The study involved four major activities in estimating the size of the farm management software market. Exhaustive secondary research has been conducted to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering farm management software have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases.

Secondary research has been conducted mainly to obtain critical information about the market’s value chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both demand- and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

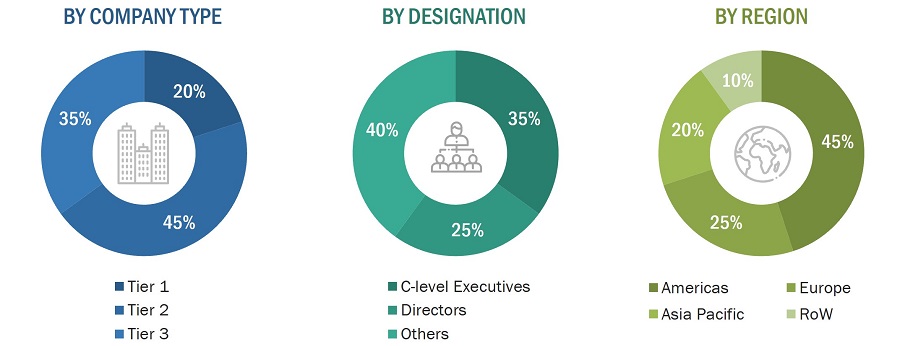

Extensive primary research has been conducted after understanding and analyzing the current scenario of the farm management software market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand and supply sides across 4 major regions: Americas, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews. questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

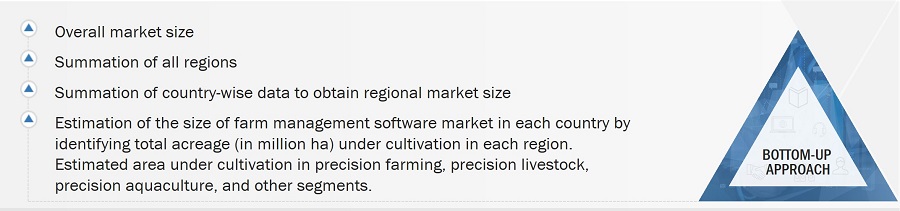

The bottom-up procedure has been employed to arrive at the overall size of the farm management software market.

-

Analyzing the agriculture technology ecosystem in each country and identifying the major companies in the market

-

Analyzing the market for farm management software for each country

-

Identifying major farm management software applications, including precision farming, precision livestock, precision aquaculture, smart greenhouses, and precision forestry, along with the types of software and services required for various applications and sub-applications.

-

Estimating the market size in each region by summation of country-wise market size

-

Tracking the ongoing and upcoming implementation projects of farm management software by various companies in each region and forecasting the market size based on these developments and other critical parameters, including ongoing recession scenario and its impact on the farm management software market

-

Arriving at the global farm management software market size through the summation of all the regions

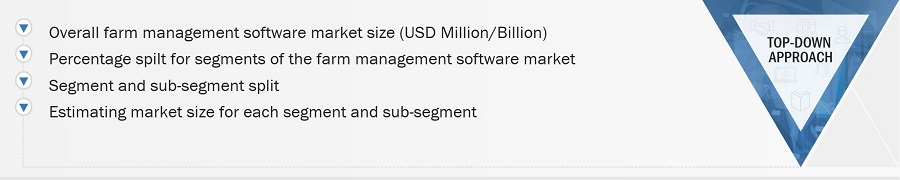

The top-down approach has been used to estimate and validate the total size of the farm management software market.

-

Initially, MarketsandMarkets focused on the top-line investment and expenditure in the ecosystems of agriculture technology, which also includes farm management software. software upgrades, and major developments in the key market area.

-

Further information was derived from the market revenue the key farm management software and service providers generated.

-

Multiple on-field discussions were conducted with key opinion leaders from each major company involved in the development of farm management software and services.

-

The geographic splits were estimated using secondary sources based on various factors, such as the number of players in a specific country and region, the level of services offered, and the type of software implemented.

Data Triangulation

After arriving at the overall size of the farm management software market through the process explained, the total market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using the top-down and bottom-up approaches.

Market Definition

Farm management is a technique to optimize and manage farm operations by automating farm activities such as record keeping, data management, crop health analysis, livestock monitoring, and aquaculture farm optimization. The software is customized to meet specific farm requirements since each farm carries out different activities. Farm management software is used for planning, implementation, assessment, and optimization of tasks performed on farms. It helps farmers improve better plan and track, save on input and labor costs, and improve yield.

The software helps enhance farm productivity and reduce input wastage. The software is integrated with hardware equipment and devices to enhance the productivity of the farmland with the help of the Global Positioning System (GPS), sensing, and communication technologies.

Key Stakeholders

-

Satellite service providers, UAVs/drone service providers, and data collection and analysis service providers

-

Electronic components (sensors, GPSs, yield monitoring systems) and device manufacturers

-

Agriculture original equipment manufacturers (OEMs)

-

Component and device suppliers, system integrators, and distributors

-

Software providers, including Software as a Service (SaaS) and Platform as a Service (SaaS) providers

-

Data analytics service providers, agricultural IoT infrastructure providers, and technology providers

-

Standardization and testing firms

-

Government bodies such as regulatory authorities, policymakers, and agricultural ministry

-

Associations, organizations, forums, and alliances related to agriculture technology

-

Research institutes and organizations

-

Market research and consulting firms

-

Agri-food companies, contract farming companies, farm-input providers, agronomists, and independent agriculture consultants

Report Objectives

-

To define, describe, segment, and forecast the size of the farm management software market, by offering, farm size, application, and farm production planning, in terms of value

-

To forecast the market size for various segments with respect to four main regions, namely, the Americas, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the farm management software market

-

To study the complete value chain and allied industry segments and perform a value chain analysis of the market landscape

-

To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

-

To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) in the farm management software market

-

To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

-

To strategically profile key players in the market and comprehensively analyze their market share/ranking and core competencies

-

To analyze competitive developments such as contracts, product launches/developments, expansions, and research & development (R&D) activities carried out by players in the farm management software market.

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Laurie

Sep, 2017

I would like to get a copy of this report for an article I am working on for our midNovember Tech issue. Laurie Bedord Advanced Technology Editor.

CK

Apr, 2019

We'd like to get informatin on global market forecast for farm management and decision making support system..

Devraj

Nov, 2017

Manufacturing companies that produces agricultural equipment is rapidly updating their products by integrating IoT devices and autonomous technology . May need to integrate with these providers in future. Looking for data for different OEM/ODM in major countries..

Junko

Mar, 2018

Since 2010, numerous companies have enetered this space as there is huge potential in leveraging agriculture prodcution with technology. Can you provide data for different hardware devices like IoT, sensors, GPS, smart cameras, and drones; used in agriculture industry..

Mathilde

Nov, 2016

I would like to know the size and the format of this report, and the degree of detail of the geographic analysis (world region, country...). Would be also interested in knowing penetration rate for different technologies. Thanks .

Steve

Feb, 2019

I am from an digital agtech company. Looking for data related to some competitor analysis (top 10 players). Can you provide up-to-date information on competitor software products, particularly indications of consumer perceptions data..

Outi

Feb, 2019

I am making a research proposal about the farm management system markets. Would be keen on understanding more about the global trends shaping the agriculture technology industry..

ethy

Oct, 2016

Hi, I am interested in this report but also would like to understand what a corporate user license will include. Thanks, Ethy.

Carlos

Jun, 2016

Mackensie Agribusiness is a brasilian company thats Works with sugar,coton, soy and corn. I would like to recieve this report to know current market trends and technological development happening in this market.. Best Regards Carlos Araujo.

Olga

Mar, 2018

Dear Sirs, I need this report for my thesis in academic research. The subject of my research is optimization model in horticulture supply chain. .

Manoj

Mar, 2019

I am looking to understand the Global smart farming and Farm management market in terms of key players and their offerings + technology future and challenges. What level of discount you can provide for a bulk deal/multiple copies ?.