Neonatal Care Equipment Market: Growth, Size, Share, and Trends

Neonatal Care Equipment Market by Product (Neonatal Incubators, Convertible Warmers & Incubators, Respiratory Care Devices (Neonatal Ventilators), Monitoring Devices (Pulse Oximeters)), End User (General and Pediatric Hospitals) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The neonatal care equipment market is driven by rising preterm birth rates, advancements in neonatal technology, and increasing government initiatives to reduce infant mortality. Growing investments in NICU infrastructure and heightened awareness about neonatal health further fuel demand for incubators, ventilators, and monitoring systems. However, market growth is restrained by high equipment costs, limited access in low-income regions, and complex regulatory requirements.

KEY TAKEAWAYS

- Asia Pacific is expected to register the highest CAGR of 8.5%.

- By Product, Neonatal Incubators segment dominated the market, with a share of 22.0% in 2024

- By End User, General Hospitals segment dominated the market with a share of 48.0% in 2024

- GE Healthcare, Dragerwerk AG & Co. KGaA, Koninklijke Philips N.V., Masimo and Fisher & Paykel Healthcare were identified as Star players in the plant-based supplements market, as they have focused on innovation and have broad industry coverage and strong operational & financial strength.

- Natus Medical, Spacelabs Healthcare, Ventec Life Systems,and Vygon Group have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy

The rise in multiple and high-risk pregnancies is significantly contributing to the growth of the neonatal care equipment market. Factors such as increased use of assisted reproductive technologies (ART), delayed maternal age, and higher rates of maternal conditions like diabetes and hypertension are driving more complex births. These high-risk pregnancies often lead to premature or low-birth-weight infants who require specialized care immediately after delivery. This has led to growing demand for neonatal equipment like incubators, ventilators, and monitors in NICUs.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The neonatal care equipment market is undergoing a significant transformation, driven by evolving clinical needs, technological advancements, and shifting healthcare delivery models. Traditional revenue sources such as basic monitoring devices, incubators, radiant warmers, and respiratory support systems are giving way to more advanced and integrated solutions. Emerging high-growth opportunities are now centered around connected NICU platforms, non-invasive monitoring technologies, portable neonatal devices, and home-based care solutions. These innovations are enabling more efficient, data-driven, and patient-centered neonatal care across diverse end-user environments—including NICUs, maternity centers, pediatric hospitals, and even home settings. This transition is disrupting customer business models, compelling healthcare providers to adopt smarter, scalable, and interoperable neonatal solutions that align with both clinical outcomes and operational efficiency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising number of preterm and low-weight births

-

Public-private initiatives to strengthen patient care

Level

-

Premium pricing of advanced neonatal care equipment

-

Growing preference for refurbished devices across emerging countries

Level

-

Development of integrated and multifunctional neonatal care equipment

-

Market opportunities in emerging markets

Level

-

Limited access in low-income regions

-

Regulatory and compliance complexities

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising number of neonatal care facilities worldwide

The rising number of neonatal care facilities worldwide is a key market driver, as it directly increases the demand for incubators, warmers, ventilators, and monitoring systems. Governments and private healthcare providers are expanding NICUs to reduce infant mortality and improve outcomes for preterm births. For instance, the Indian government has added over 900 Special Newborn Care Units (SNCUs) in recent years. This infrastructural expansion enhances equipment adoption, particularly in developing nations, fueling consistent growth in the neonatal care equipment market.

Restraint: Premium pricing of advanced neonatal care equipment

Premium pricing of advanced neonatal care equipment acts as a major market restraint, especially in low- and middle-income countries where healthcare budgets are limited. High costs of sophisticated incubators, ventilators, and monitoring systems—ranging from USD 10,000 to USD 25,000—restrict widespread adoption in public hospitals. This financial barrier limits access to critical care for premature infants and widens disparities between urban and rural healthcare facilities. As a result, many institutions opt for refurbished or basic models, slowing overall market penetration and technology advancement.

Opportunity: Market opportunities in emerging countries

Emerging countries present significant opportunities in the neonatal care equipment market due to rising birth rates, increasing healthcare investments, and government-led efforts to reduce infant mortality. As nations like India, Brazil, and Indonesia expand NICU infrastructure, demand for incubators, ventilators, and monitoring devices grows. Initiatives such as India’s Ayushman Bharat and expanded maternal care programs in Africa further drive adoption. Additionally, growing public-private partnerships and international aid funding open new markets for cost-effective, scalable neonatal solutions tailored for resource-constrained settings.

Challenge: Limited access in low-income region

Limited access to neonatal care equipment in low-income regions remains a significant market challenge due to inadequate healthcare infrastructure, high equipment costs, and inconsistent electricity and maintenance support. Many hospitals lack fully functional NICUs or trained personnel to operate advanced devices like incubators and ventilators. According to WHO, over 50% of facilities in sub-Saharan Africa lack essential neonatal equipment, directly impacting the survival rates of preterm infants. This disparity restricts market expansion and highlights the urgent need for scalable, affordable solutions in underserved areas.

Neonatal Care Equipment Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides neonatal incubators, warmers, and monitoring systems designed to stabilize and monitor premature infants in NICUs. | Offers advanced temperature control, continuous vital sign monitoring, and promotes better survival outcomes in critical neonatal care. |

|

Manufactures neonatal incubators, ventilators, and phototherapy units with integrated data connectivity for NICU environments. | Ensures precise thermoregulation and respiratory support, reduces infection risk, and improves workflow efficiency for caregivers. |

|

Offers neonatal monitoring systems and infant warmers with integrated patient data management solutions. | Enhances clinical decision-making, ensures patient safety, and enables seamless integration within hospital information systems. |

|

Develops neonatal hearing screening, brain monitoring, and jaundice management devices. | Supports early detection of developmental and neurological disorders, improving long-term infant outcomes. |

|

Produces neonatal respiratory support systems, including CPAP and humidification technologies. | Improves breathing support and patient comfort, reduces lung injury risk, and supports non-invasive respiratory management. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market ecosystem of the neonatal care equipment market comprises a dynamic network of stakeholders, including manufacturers, research institutions, regulatory authorities, healthcare providers, distributors, investors, and end users. Each participant plays a vital role in the innovation, production, approval, distribution, and utilization of life-saving equipment designed for premature and critically ill newborns. This ecosystem is shaped by clinical needs, technological advancements, policy frameworks, and funding mechanisms that collectively influence product accessibility, affordability, and adoption. Understanding the ecosystem helps identify collaboration opportunities, supply chain efficiencies, and strategic interventions to enhance neonatal outcomes across diverse healthcare settings worldwide.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Neonatal Cae Equipment Market, By Product

The neonatal care equipment market is divided into neonatal incubators, neonatal respiratory care devices, convertible warmers & incubators, neonatal phototherapy equipment, neonatal monitoring devices, neonatal diagnostic imaging components, infant warmers, and other neonatal care equipment based on product. In 2024, the neonatal incubators segment held the largest share of the global neonatal care equipment market.Neonatal incubators hold the largest market share due to their critical role in maintaining optimal thermal, humidity, and oxygen conditions for premature and low-birth-weight infants. As a fundamental component of NICUs, they are widely used across all levels of neonatal care, driving consistent demand in both developed and developing regions.

Neonatal Care Equipment Market, By End User

The neonatal cae equipment market has been categorized by end user into pediatric hospitals, general hospitals, maternity & birthing centers and other end users. General hospitals hold the largest market share in the neonatal care equipment market due to their widespread presence, comprehensive maternal and neonatal services, and integration of NICU units. They handle high patient volumes, including emergency and preterm births, making them primary purchasers of incubators, ventilators, and monitoring systems.

REGION

Asia Pacific to be fastest-growing region in global neonatal care equipment market during forecast period

Asia Pacific is expected to witness the highest growth rate in the neonatal care equipment market due to a combination of high birth and preterm birth rates, rising awareness of neonatal health, and expanding healthcare infrastructure in emerging economies such as India, China, and Indonesia. Government-led initiatives to reduce infant mortality, coupled with increasing public and private investments in NICUs, are fueling equipment demand. Technological advancements and the entry of low-cost domestic manufacturers are improving affordability and accessibility. The region’s large population base, urbanization, and rising healthcare expenditure further strengthen its position as the fastest-growing neonatal care equipment market.

Neonatal Care Equipment Market: COMPANY EVALUATION MATRIX

In the ECMO machines market, GE HEalthcare (Star) has a strong and established product portfolio and a vast geographic presence. Atom Medical (Emerging Leader) has substantial product innovations compared to its competitors. While they have broad product portfolios, they do not have a strong growth strategy for business development.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 (Value) | USD 2.06 BN |

| Revenue Forecast in 2030 (Value) | USD 2.84 BN |

| Growth Rate | 5.60% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Product: Neonatal Incubators, Neonatal Respiratory Care Devices, Convertible Warmers & Incubators, Neonatal Phototherapy Equipment, Neonatal Monitoring Devices, Neonatal Diagnostic Imaging Components, Other Neonatal Products By End User: Pediatric Hospitals, General Hospitals, Maternity & Birthing Centers and Other End User |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

WHAT IS IN IT FOR YOU: Neonatal Care Equipment Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of neonatal care equipment: Infant Warmers, Incubators, Phototherapy Equipment, Ventilators, Monitoring Devices, and Resuscitators | Analysis of technological innovations such as hybrid incubators, portable neonatal ventilators, wireless monitoring systems, and AI-driven diagnostics |

| Company Information | Profiles of key neonatal care equipment manufacturers such as GE Healthcare, Drägerwerk, Philips Healthcare, Atom Medical, Natus Medical, and Fisher & Paykel Healthcare | Market share benchmarking of top 3–5 companies across North America, Europe, Asia Pacific, and Middle East |

| Geographic Analysis | Detailed regional analysis of North America, Europe, Asia Pacific, and emerging markets (Latin America, Middle East, and Africa) | Country-level sizing and growth forecasts for high-demand countries such as the US, Germany, Japan, China, India, and Brazil |

RECENT DEVELOPMENTS

- May 2024 : Masimo received FDA clearance (510(k)) for the Stork Over-the-Counter Baby Monitoring System, enabling home monitoring of SpO2, pulse rate, and skin temperature in infants up to 18 months old, now available without prescription.

- December 2023 : Masimo received FDA clearance (510(k)) for the prescription version of the Stork Baby Monitoring System, expanding its availability for continuous home-based use in both healthy and sick infants.

- February 2023 : Time Medical?achieved FDA approval for NEONA, the world’s first dedicated neonatal MRI system, designed for NICU installation with reduced RF power and enhanced imaging speed and safety.

- January 2024 : Owlet?launched FDA-cleared BabySat, a prescription neonatal pulse oximeter (the “Dream Sock”), enabling continuous home monitoring of oxygen saturation and heart rate for infants.

Table of Contents

Methodology

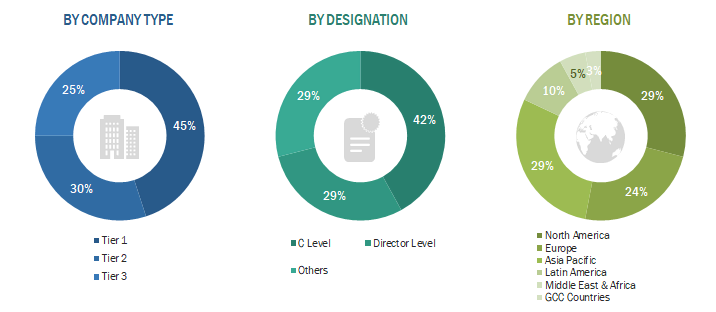

The study involved major activities in estimating the current market size for the neonatal care equipment market. Exhaustive secondary research was done to collect information on the neonatal care equipment market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the neonatal care equipment market.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, Factiva, whitepapers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the neonatal care equipment (NCE) market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends, to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply- and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the neonatal care equipment market. Primary sources from the demand side included pediatric hospitals, maternity & birthing centers, clinics, researchers, lab technicians, purchase managers, and stakeholders in corporate & government bodies.

Breakdown of Primary Interviews

Note 1: C-level primaries include CEOs, COOs, and CTOs.

Note 2: Other designations include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=< USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the neonatal care equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

The entire market was split into three segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of neonatal care equipment. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Neonatal care equipment includes medical devices designed to support and treat newborns, especially premature or ill infants. These devices help regulate temperature, provide respiratory support, monitor vital signs, and treat conditions like jaundice. Key equipment includes incubators, warmers, ventilators, and phototherapy units.

Stakeholders

- Manufacturers of Neonatal Care and Related Devices

- Suppliers and Distributors of Neonatal Care Devices

- Hospitals, Neonatal Intensive Care Units (NICUs), Diagnostic Centers, and Medical Colleges

- Maternity & Birthing Centers

- Pediatric Clinics

- Medical Device Procurement Agencies

- Government Bodies/Municipal Corporations

- Business Research and Consulting Service Providers

- Venture Capitalists

- US Food and Drug Administration (US FDA)

- European Union (EU)

Report Objectives

- To define, describe, and forecast the neonatal care equipment market based on product, indication, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall neonatal care equipment market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the neonatal care equipment market in six regions, namely, North America (US and Canada), Europe (Germany, UK, France, Spain, Italy, and Rest of Europe), the Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa, and GCC Countries

- To strategically profile the key players in the global market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as product launches, expansions, agreements, and acquisitions, of the leading players in the market

Frequently Asked Questions (FAQ)

Which are the top industry players in the global neonatal care equipment market?

The top market players include Drägerwerk AG & Co. KGaA (Germany), GE Healthcare (US), Koninklijke Philips N.V. (Netherlands), Medtronic (Ireland), Masimo (US), BD (US), Cardinal Health (US), Fisher & Paykel Healthcare (New Zealand), Utah Medical (US), and ICU Medical (US).

Which segments have been included in this report?

This report includes the following main segments: Product, End User, and Region.

Which geographical region dominates in the neonatal care equipment market?

North America dominated the neonatal care equipment market in 2024. The report also includes Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries.

Which is the leading segment in the neonatal care equipment market, by product?

The neonatal incubator segment accounted for the largest share of the neonatal care equipment market by product.

What is the CAGR of the global neonatal care equipment market?

The global neonatal care equipment market is projected to grow at a CAGR of 5.6% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Neonatal Care Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Neonatal Care Equipment Market