The study involved major activities in estimating the current industrial filtration market size. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete industrial filtration market size. Thereafter, market breakdown and data triangulation were used to estimate the industrial filtration market size of the segments and subsegments.

Secondary Research

The secondary sources referred to for this research study comprises of annual reports of companies, investor presentations of companies, press releases, white papers, certified publications, articles by recognized authors, and databases of various companies and associations. Secondary research was mainly used to obtain key information about the supply chain and to identify the key players offering industrial filtration products, market classification, and segmentation according to the offerings of the leading players, along with the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In order to gather qualitative and quantitative data for this study, a variety of primary sources from the supply and demand sides were interviewed throughout the primary research phase. Chief executive officers (CEO), vice presidents, mechanical design engineers, senior R&D engineers, sales executives, production supervisors, and related key executives from various companies and organizations operating in the industrial filtration market were among the primary sources from the supply side.

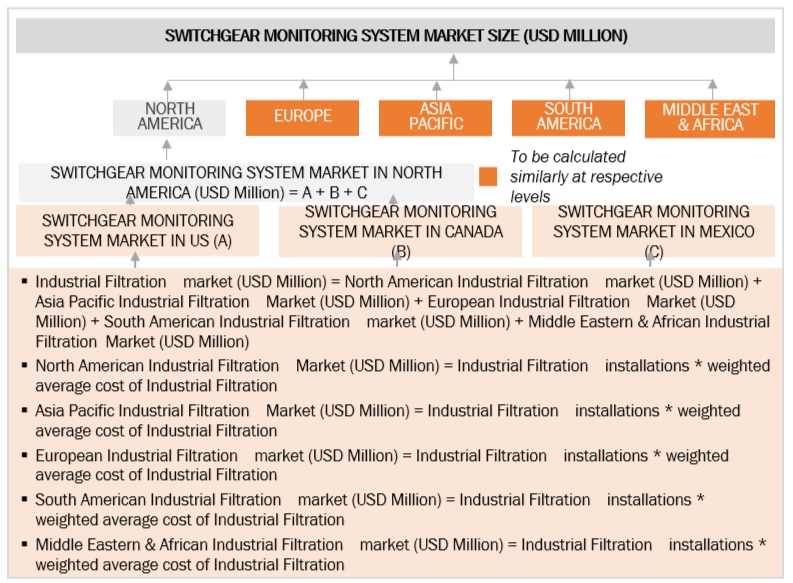

Throughout the whole market engineering process, a number of data triangulation techniques were employed in conjunction with a combination of top-down and bottom-up methodologies to generate market size estimates and projections for each of the segments and subsegments included in this study. In order to highlight important details and insights throughout the study, a thorough market engineering approach involved conducting extensive qualitative and quantitative assessments.

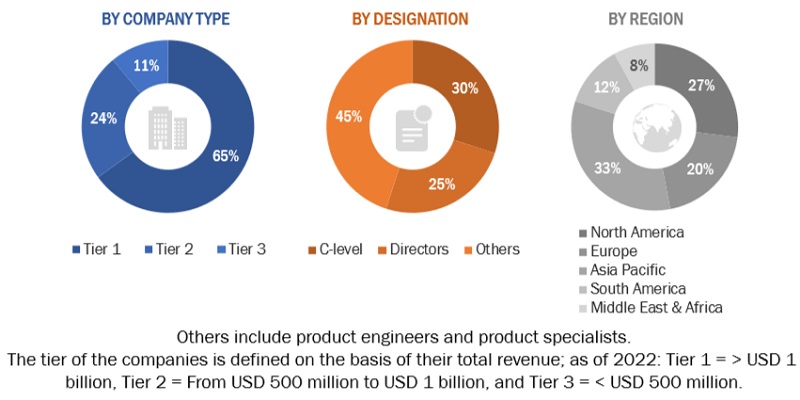

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Industrial Filtration Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the industrial filtration market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions has been determined through both secondary and primary research.

-

The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primaries.

Global Industrial Filtration Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Industrial Filtration Market Size: Bottom-Up Approach

Data Triangulation

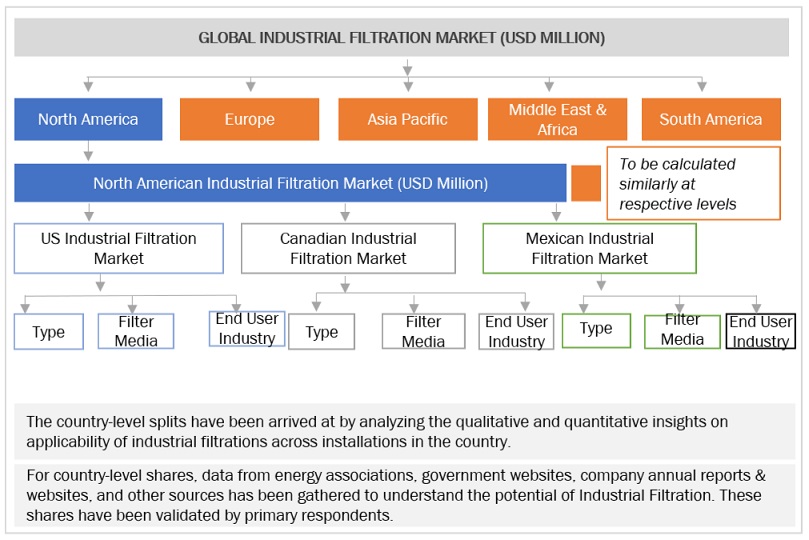

After arriving at the overall industrial filtration market size from the estimation process explained above, the total market has been split into several segments and subsegments. The complete market engineering process is done to arrive at the exact statistics for all the segments and subsegments, also data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by examining various factors and trends from both the demand- and supply sides. Along with this, the market has been validated through both the top-down and bottom-up approaches.

Market Definition

Industrial filtration is the process of removing suspended solids from liquids or air with the help of filter media. It helps in reducing emissions, preventing downtime due to failures, extending the service life of the machines, and removing clogging in pipelines. Industrial filters are used across numerous end-use industries, such as manufacturing, power generation, oil & gas, pharmaceuticals, metals & mining, and process industries.

The industrial filtration market refers to the year-on-year sales of industrial filters by key manufacturers across end-user industries. Industrial filters are used for treating both air and liquids using different filtration technologies and filter media.

Key Stakeholders

-

Chemical and pharmaceutical companies

-

Distributors

-

Filtration and environmental associations

-

Filtration technology providers

-

Government and research organizations

-

Industrial filter manufacturers

-

Industrial filter media manufacturers

-

Mining companies

-

Power generation companies

-

Raw material suppliers

-

Oil & gas operators

Objectives Of The Study

-

To define, describe, segment, and forecast the industrial filtration market based on type, product, filter media, and end user industry.

-

To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and Middle East & Africa, along with their key countries

-

To provide detailed information about the key drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

-

To analyze market opportunities for stakeholders and the competitive landscape of the market

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies

-

To analyze competitive developments, such as sales contracts, agreements, investments, expansions, new product launches, mergers, partnerships, collaborations, and acquisitions, in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

-

Further breakdown of region or country-specific analysis

Company Information

-

Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Industrial Filtration Market