The study involved four major activities in estimating the current size of the portable projector market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the portable projector market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

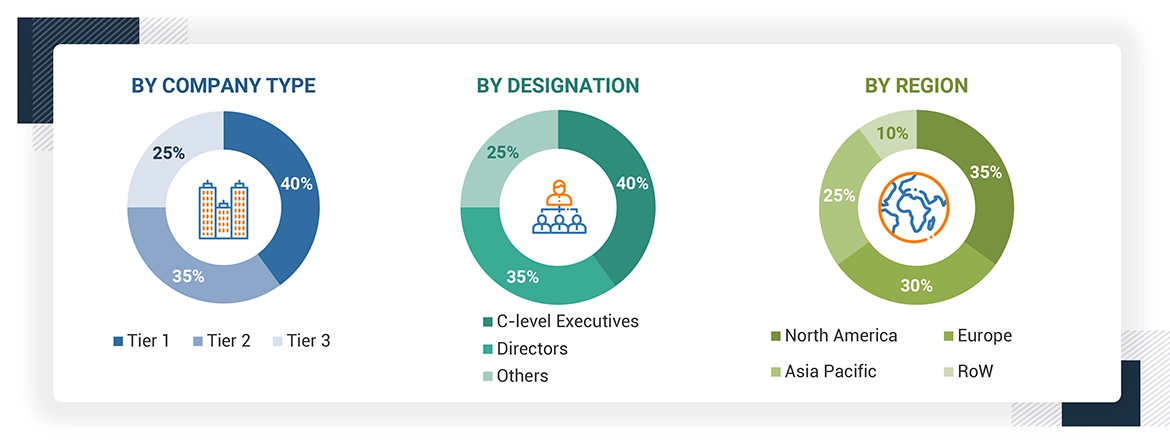

Extensive primary research was conducted after gaining knowledge about the current scenario of the portable projector market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: The three tiers of the companies are defined based on their total revenue in 2023: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the portable projector market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

-

Major players in the industry and markets have been identified through extensive secondary research.

-

The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Portable Projector Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the portable projector market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

A portable projector is a compact and lightweight device capable of projecting images or videos onto a surface. A portable projector is also known as pico or pocket projectors. It is designed to be easily carried and used in a variety of environments, such as homes, offices, classrooms, or outdoor spaces. These projectors use LED or laser light sources, which provide longer life, lower power consumption and improved color accuracy compared to traditional lamp-based projectors. A portable projector typically incorporates advanced features such as wireless connectivity, built-in smart capabilities, and high-resolution displays to provide a convenient viewing experience.

Key Stakeholders

-

Portable Projector providers

-

Raw material suppliers

-

System Integrators

-

Original Equipment Manufacturers (OEM)

-

Government organizations, forums, alliances, and associations

-

Research organizations

-

Software Developers

-

Technology standard organizations, forums, alliances, and associations

-

Technology investors

-

End-use industries (Education, Business, Consumer Electronics and Healthcare & Medical)

-

Venture capitalists, private equity firms, and startups

Report Objectives

-

To define, describe and forecast the portable projector market, in terms of technology, dimension, projected image size, lumen, resolution, end-user and region.

-

To describe and forecast the market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW) along with their respective countries

-

To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

-

To provide a detailed overview of the value chain of portable projectors.

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the portable projector market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments of the portable projector market.

-

To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

-

To analyze competitive strategies, such as product launches, expansions, mergers and acquisitions, adopted by key market players in the portable projector market.

This research report categorizes the portable projector market by technology, dimension, projected image size, lumen, resolution, end-user and region.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

-

Detailed analysis and profiling of additional market players (up to 5)

ines

Apr, 2022

for educational uses, we wanted to know-how is the market for projectors that are light weight and with technology LED. with sound functionalities as well .

Patrick

Oct, 2022

we are developing a short throw table top projection devise and are interested in finding out more about the market of compact high brightness units. .

Janet

Sep, 2022

I am working on a research project about Korean portable projectors and would like to know about the global market for projectors.