Polyimide Films & Tapes Market

Polyimide Films & Tapes Market by Application (Flexible Printed Circuits, Specialty Fabricated Products, Pressure-Sensitive Tapes, Motors/Generators, Wires & Cables), End-Use Industry (Electronics, Automotive), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The polyimide films & tapes market was estimated at USD 1.38 billion in 2024 and is projected to reach USD 2.31 billion by 2030, at a CAGR of 9.0% from 2025 to 2030. The market for polyimide films and tapes is growing rapidly due to the increasing demand for advanced electronics, electric vehicles (EVs), and flexible display applications. Polyimide materials are known for their excellent thermal stability (up to 400°C), dielectric properties, and chemical resistance. As a result, they have become the most viable option for high-temperature and high-reliability applications, quickly surpassing older substrates such as PET, PEN, and polyamide.

KEY TAKEAWAYS

-

BY TypeThe Polyimide films & tapes market comprises Colorless Polymide Films & Tapes, Colored Polymide Films & Tapes. Demand for colored and colorless polyimide films is rising as industries seek high performance, heat resistant, and flexible materials, with colored films used for insulation and protection and colorless films gaining traction in transparent and flexible electronic and display applications.

-

BY ApplicationApplication includes Flexible Printed Circuits, Specialty Fabricated Products, Pressure-sensitive Tapes, Wires & Cables, Motors/Generators. Flexible printed circuits hold the largest share in the market due to their widespread use in compact electronic devices, where polyimide films enable high reliability, flexibility, and heat resistance for advanced circuit integration.

-

By End-use IndustryEnd-use industry includes Electronics, Automotive, Aerospace, Labeling, Solar, Other End-use Industries. The electronics segment is growing at the fastest rate driven by rising demand for flexible, lightweight, and heat resistant materials used in smartphones, wearables, and next generation electronic components.

-

BY REGIONPolyimide films & tapes market covers Europe, North America, Asia Pacific, South America and Middle East and Africa. Asia Pacific holds the largest share of the polyimide films and tapes market due to its strong electronics manufacturing base, rapid expansion of electric vehicle production, and increasing investments in advanced materials and flexible electronics technologies.

The development of the flexible electronics industry is one of the primary drivers of this market, encompassing innovations such as bendable smartphones, OLED screens, and wearable devices. Colorless polyimide films serve excellently as substrates and encapsulants due to their optical clarity, mechanical flexibility, and strength. In the EV sector, polyimide tapes are used for various applications, including the insulation of batteries, wrapping high-voltage wires, and protecting battery management systems (BMS). These tapes are designed to operate safely in environments with high temperatures.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on end-user industries in the polyimide films and tapes market is driven by rapid technological advancements, evolving material performance requirements, and sustainability-focused manufacturing priorities. Rising demand for lightweight, high-temperature, and flexible materials across electronics, automotive, aerospace, and renewable energy sectors is accelerating product innovation and application diversification. End users are increasingly seeking materials that combine mechanical strength with thermal and electrical stability to enhance reliability and energy efficiency in high-performance systems. At the same time, regulatory and consumer pressure for sustainable production and recyclable materials is encouraging investment in eco-friendly processing and next-generation polymer technologies. These shifts are redefining competitive strategies, fostering cross-industry collaboration, and creating strong growth opportunities for material suppliers, converters, and technology developers within the global polyimide films and tapes landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High growth of electronics industry

-

Strong demand from automotive industry

Level

-

High manufacturing cost of polyimide films

-

Volatility in raw material prices

Level

-

Increasing use in aerospace applications

-

Preference for transparent polyimide films for flexible displays and optoelectronics

Level

-

High technical competency required for processing polyimide films

-

Lack of infrastructure for closed-loop recycling or chemical recovery

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High growth of electronics industry

The reduction in the capacity of electronic devices is a key factor driving the demand for polyimide films & tapes. As modern consumer electronics become smaller and more sophisticated, there is an increasing need for lightweight and extremely thin insulating materials that can also remain flexible. Polyimide films are ideal for compact electronic assemblies due to their exceptional thermal stability, electrical insulation, and mechanical strength. These qualities are particularly beneficial in electrical circuits that generate significant heat during operation, as polyimide films can withstand temperatures exceeding 400°C. In high-density environments, these films serve as a barrier, preventing short circuits and ensuring long-term reliability. Additionally, polyimide films are chemically resistant and maintain their dimensions, enhancing the longevity of products exposed to demanding working conditions. Polyimide tapes find applications for wiring, insulating flexible printed circuits (FPCs), and shielding sensitive components in smartphones, laptops, and other IoT devices. The performance requirements and slim profile pursued by device manufacturers have driven the shift from more traditional material options such as polyester or polyamide toward polyimide-based materials. Today, with a growing number of advanced electronics and 5G-enabled devices, the electronics sector will continue to serve as a strong growth driver for the global polyimide films & tapes market.

Restraint: High manufacturing cost of polyimide films

Despite the absence of limitations in the market for polyimide film production, the primary challenge is cost. One of the main reasons they are expensive is due to the use of costly raw materials and specific chemicals needed for polymerization and film casting. These solvents and monomers must also adhere to a stringent quality control management system to ensure that the final product meets the required thermal, mechanical, and electrical performance standards. Compliance with strict environmental and safety regulations has further increased acquisition and handling costs. The manufacturing process for polyimide films is inherently complex and requires significant investment. It involves high-temperature synthesis and curing stages, typically exceeding 300°C, which is essential for ensuring superior thermal resistance. This necessitates the use of advanced equipment and precise process controls, resulting in increased operational costs. Additionally, energy consumption is likely to rise due to these high-temperature processes. The sophisticated machinery required for coating and film orientation demands substantial initial capital investment and ongoing maintenance.

Opportunity: Preference for transparent polyimide films for flexible display and optoelectronics

There is a highly appealing opportunity in transparent polyimide (TPI) films, which are increasingly in demand for flexible displays and optoelectronics. These films can bend multiple times without failing, showcasing remarkable flexibility. They possess excellent mechanical integrity and optical clarity, making them an ideal substrate for flexible display applications, such as foldable smartphones, OLED displays, and wearables. The growing flexible electronics market is also boosting the demand for TPI films due to their transparent yet stable mechanical properties over time. Most importantly, these thin films provide electrical insulation for optoelectronic devices and prevent unwanted interactions between different electronics, reducing the risk of short circuits when multiple components come in contact. The dielectric strength and thermal stability of TPI films are particularly impressive for applications in optoelectronic sensors, light-emitting diodes (LEDs), and photodetectors. As the use of flexible displays and optoelectronics continues to expand, the acceptance of transparent polyimide films is expected to rise in these markets. Their unique combination of flexibility, transparency, and electrical insulation makes them a crucial material for the next generation of electronic applications, representing a promising growth area for manufacturers.

Challenges: Issues with the processing of polyimide films and tapes

The challenges faced in the fabrication of polyimide films & tapes can significantly impact the quality and performance of the final product. One major concern is the uniformity during processing, which can lead to inconsistencies in thickness throughout the film. If high stresses are encountered during processing, the thickness of the films may decrease to about 50–60% of the intended values. This reduction in thickness can result in potential structural weaknesses, adversely affecting the mechanical properties of the film. Another issue is poor adhesion. This can occur when polyimide films do not properly bond with other substrates, leading to a loss of reliability in high-performance applications. Adhesion difficulties may also introduce additional processing or integration challenges in complex systems, particularly in electronics and aerospace applications where stability is crucial. Furthermore, the solvents used during the production process can interact with polyimide films, impairing their performance and degrading their thermal and mechanical properties. Therefore, careful selection and control of solvents are essential to prevent contamination or degradation during processing. To address these challenges, it is vital to implement advanced processing techniques, maintain strict controls, and choose suitable materials to ensure the quality of polyimide tapes and films.

Polyimide Films and Tapes Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies high-performance polyimide films and tapes used across electronics, aerospace, and industrial insulation applications. DuPont’s Kapton series delivers exceptional thermal stability and dielectric strength, enabling reliable performance in extreme environments. | Enhances product reliability, supports high-temperature operations, and ensures long-term stability in mission-critical electronic and mechanical systems. |

|

Develops advanced polyimide films optimized for flexible printed circuits, displays, and automotive electronics. Its materials are engineered for excellent dimensional stability and low outgassing, suitable for high-precision manufacturing. | Improves device durability, ensures superior dimensional control, and reduces manufacturing defects in high-performance electronic assemblies. |

|

Produces specialty polyimide materials designed for electrical insulation, sensor components, and optical applications. UBE’s focus on resin chemistry innovation enables enhanced heat resistance and mechanical strength. | Provides high thermal endurance, improves insulation reliability, and extends component lifespan under demanding operational conditions. |

|

Specializes in advanced polyimide films designed for flexible printed circuits, display technologies, and electric vehicle batteries. The company utilizes proprietary polymer processing and coating techniques to ensure exceptional heat resistance, dimensional stability, and electrical insulation for high-reliability applications. | Enables superior heat resistance and mechanical strength in flexible electronics, enhances reliability in EV battery insulation, and supports high-yield manufacturing for next-generation electronic components. |

|

Manufactures a wide range of polyimide films for electronics, aerospace, and industrial uses, emphasizing energy-efficient production and customizable material properties. | Offers versatile film solutions, enables cost-effective production, and supports sustainable performance with strong thermal and chemical resistance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

PI Advanced Materials Co., Ltd. (South Korea), DuPont (US), Kaneka Corporation (Japan), Taimide Tech. Inc. (Taiwan), and Ube Industries Ltd. (Japan) are prominent companies in the polyimide films & tapes market. These companies are well-established, financially stable, and have a global presence in the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Polyimide films & tapes market, By End-Use Industry

The electronics segment is expected to be the fastest-growing end-use industry for polyimide films & tapes. These films are essential for electrical insulation in electric motors, particularly in high-temperature applications. They are primarily utilized for phase insulation and slot liners, ensuring that the motor winding remains properly separated to prevent short circuits and damage, even under harsh working conditions. This reliability is crucial in various fields, including automotive, industrial machinery, and home appliances. Polyimide films are also used in insulating tapes for various electrical connections and components. These insulating tapes serve as binding agents while providing excellent electrical insulation and integrity in high-temperature environments, thereby ensuring the longevity and reliability of the electrical systems involved. As electronic devices become increasingly compact, energy-efficient, and high-performance, the demand for advanced materials will rise. Polyimide films represent a key category of such materials, driving this market segment. With their superior thermal stability, chemical resistance, and electrical insulation properties, polyimide films and tapes are set to become essential for the next generation of electronics.

Polyimide films & tapes market , By Application

Flexible printed circuits (FPCs) have become a significant market driver for polyimide films in the electronic appliances industry. This rise is primarily due to the expanding range of applications for electronics. FPCs are crucial components in modern electronic devices, which often operate under high temperatures. Polyimide films exhibit excellent thermal stability, ensuring that these circuits function correctly even in extreme temperature conditions. This reliability is particularly important for devices equipped with powerful CPUs or those used in environments where overheating may occur. In addition to thermal stability, polyimide films offer strong resistance to various chemicals and solvents. This resistance helps maintain the integrity of FPCs over time, contributing to their long-term stability and reliability in electronic devices. As a result, polyimide films are valuable in many industries where devices may come into contact with hazardous chemicals or face intense manufacturing processes. Polyimide materials play a crucial role in protecting flexible printed circuits across a wide range of applications, including consumer electronics, automotive systems requiring flexibility, and industrial machinery. Their ability to resist chemical degradation enhances the durability and performance of FPCs. Consequently, the growing adoption of flexible printed circuits is expected to drive continued demand for polyimide films in this segment.

REGION

Asia Pacific region is projected to grow at a significant CAGR during the forecast period

The Asia Pacific region is projected to register the highest CAGR in terms of volume, during the forecast period. This region boasts one of the largest and fastest-growing automotive markets, leading to an increased need for polyimide materials in essential automotive components such as wire harnesses, sensors, and thermal management systems, which are crucial for performance and safety in electric vehicles and future technologies within the automotive industry. The rising demand for polyimide films & tapes beyond automotive applications is largely attributed to the growth of the electronics, aerospace, and renewable energy sectors in the Asia Pacific. In the electronics industry, polyimide sheets are valued for their insulation, flexibility, and toughness, especially in high-performance applications like flexible displays and wearable electronics. Additionally, the aviation and renewable energy sectors utilize polyimide materials for insulation, protection, and thermal management in high-stress environments. As Asia Pacific has consistently driven technological advancement and industrial growth, it is anticipated that the demand for polyimide films & tapes will continue to rise, establishing the region as a key contributor to market expansion during the forecast period.

Polyimide Films and Tapes Market: COMPANY EVALUATION MATRIX

In the polyimide films and tapes market, DuPont (Star) holds a dominant position with its extensive Kapton product line, recognized for exceptional heat resistance, dielectric strength, and dimensional stability. The company’s continuous innovation and global supply capabilities have reinforced its leadership across electronics, aerospace, and industrial sectors. 3M (Emerging Leader) is rapidly strengthening its market presence through advanced adhesive and insulation tape technologies tailored for high-temperature, flexible, and precision electronic applications. With its strong material science expertise and focus on performance optimization, 3M is expanding its reach in electric vehicles, renewable energy, and next-generation display manufacturing. Other notable players are advancing their product portfolios and production capabilities to address growing demand for durable, lightweight, and energy-efficient materials, positioning themselves to capture future growth opportunities in this dynamic market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.38 BN |

| Market Forecast in 2030 | USD 2.31 BN |

| CAGR (2025–2030) | 9.00% |

| Years considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN) |

| Report Coverage | The report defines, segments, and projects the polyimide films & tapes market based on type, application, end-use industry and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles industrial polyimide films & tapes manufacturers, comprehensively analyses their market shares and core competencies, and tracks and analyzes competitive developments they undertake in the market, such as expansions, partnerships, and new product launches. |

| Segments Covered | Type (Colorless Polymide Films & Tapes, Colored Polymide Films & Tapes) |

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Polyimide Films and Tapes Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Electronics Manufacturers | Conducted competitive benchmarking of major polyimide film and tape suppliers used in flexible circuits and semiconductor packaging. | Improves sourcing strategy and supplier visibility. |

| Automotive OEMs & Tier Suppliers | Evaluated polyimide usage trends in EV battery insulation, motor components, and electronic control systems. | Supports technology roadmaps for electrification and lightweighting initiatives. |

| Aerospace & Defense Manufacturers | Assess polyimide film performance for lightweight composites, wiring, and thermal insulation systems. | Ensures compliance with international aerospace safety standards. |

| Solar & Photovoltaic Companies | Analyze use of UV-stable and transparent polyimide films in solar encapsulation and flexible modules. | Improves material selection for higher module efficiency and lifespan. |

| Labeling & Industrial Tape Converters | Benchmark adhesive and heat-resistant polyimide tapes for industrial labeling and insulation use. | Enhances labeling durability and high-temperature resistance. |

RECENT DEVELOPMENTS

- June 2023 : Arkema acquired a 54.07% share of PI Advanced Materials Co., Ltd. to develop high-performance materials used in electronics and other industries.

- May 2022 : DuPont announced the expansion of its production of polyimide films in the US. The aim of this expansion is to enhance the properties of its Kapton polyimide films.

- March 2020 : Kaneka Corporation developed colorless polyimide films for flexible electroluminescent (EL) displays for the next-generation devices used in electronics.

Table of Contents

Methodology

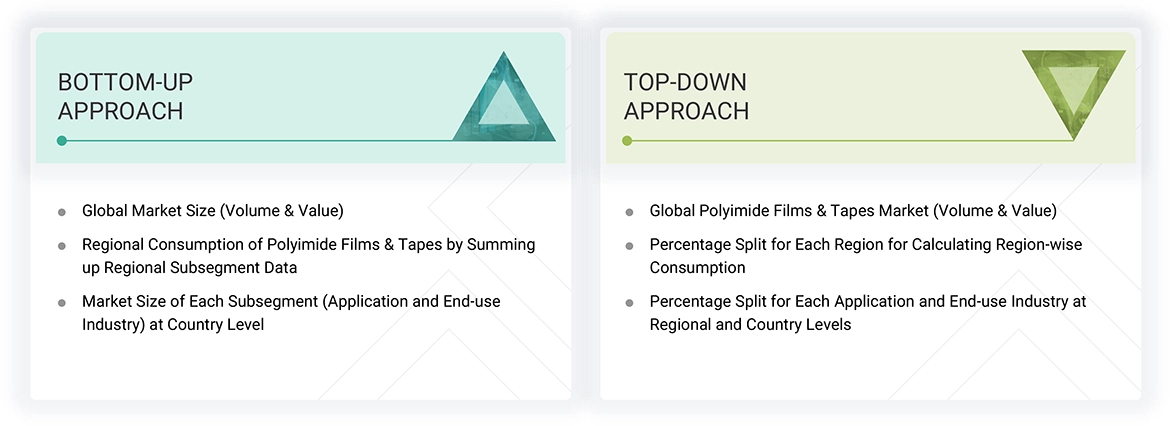

Four main activities were conducted in order to evaluate the market size for polyimide films & tapes. To compile data on the parent, peer, and market sectors, thorough secondary research was done. The next phase was verifying these results, hypotheses, and dimensions with industry experts using primary research across the polyimide films & tapes value chain. Both top-down and bottom-up approaches help one to estimate the size of the overall market. The data triangulation and market segmentation study helped to determine the sizes of the market segments and sub-segments.

Secondary Research

Starting with the gathering of revenue data from notable suppliers utilizing secondary research, the research method used to evaluate and project the market starts. Many secondary sources, including D&B Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were used in the course of the secondary research to find and synthesize materials for this study. The secondary sources included white papers, accredited publications, writings by prestigious writers, announcements from regulatory authorities, trade directories, databases, annual reports, news releases, and corporate investor presentations. Vendor offers have been taken into consideration to determine market segmentation.

Primary Research

In the supply chain, the polyimide films & tapes market includes manufacturers, suppliers, traders, associations, and regulatory bodies, among other players. The development of building, automotive, electronics, appliances, insulation, packaging, and other uses defines the demand side of this industry. Technological progress defines the supply side. To get both qualitative and quantitative data, several main sources from the supply and demand sides of the market were contacted.

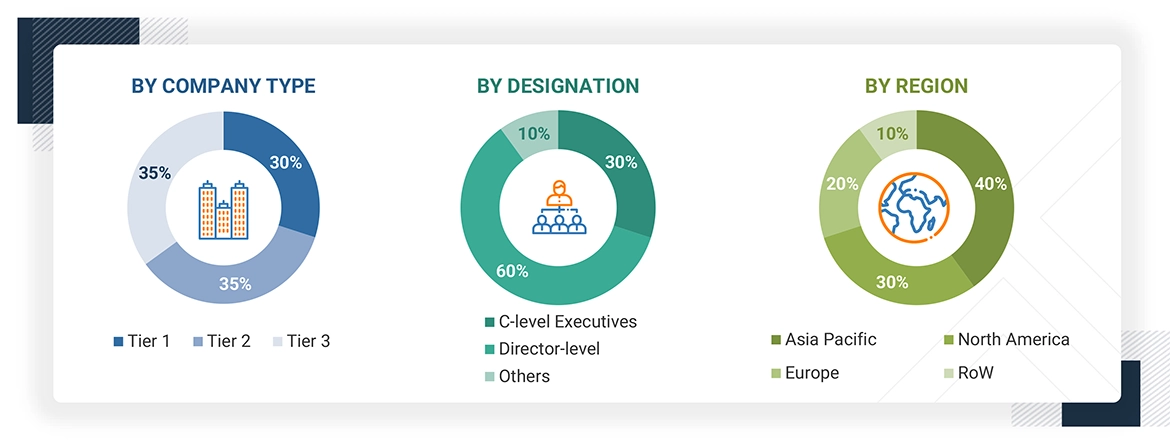

The breakdown of primary interviews has been mentioned below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the polyimide films & tapes market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research

- The value chain and market size of the polyimide films & tapes market, in terms of value, were determined through primary and secondary research

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives

Global Polyimide Films & Tapes Market Size: Bottom-up and Top-down Approaches

Data Triangulation

Following the above-described market size estimation procedures, the market was divided into segments and subsegments. Wherever relevant, data triangulation and market breakdown techniques were used to finish the whole process of market engineering and arrive at the precise statistics of each market segment and subsegment. Summing the country-level and regional-level data helped to estimate the size of the market worldwide.

Market Definition

High-performance polyimides are a class of polymers distinguished by exceptional thermal stability, electrical insulating qualities, and chemical and radiation resistance. From electronics, aerospace, automotive, and industrial sectors to flexible circuitry, insulation, and high-temperature masking, these materials find extensive use due to their unique qualities.

Stakeholders

- Raw Material Manufacturers

- Polyimide Films & Tapes Manufacturers

- Distributors and Suppliers of Polyimide Films & Tapes Goods

- Manufacturers of Automobiles, Medical Equipment, and Agricultural Equipment

- Associations and Industrial Bodies Such As Flexible Display Consortium, 60-inch Flexible OLED Consortium, Advanced Concepts for Aero-Structures with Integrated Antennas and Sensors (ACASIAS) Consortium, and Others

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the global polyimide films & tapes market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global polyimide films & tapes market

- To analyze and forecast the size of various segments (application and end-use industry) of the polyimide films & tapes market based on five major regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as expansions, product developments, agreements, and acquisitions, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Polyimide Films & Tapes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Polyimide Films & Tapes Market