Pressure Sensitive Adhesives Market

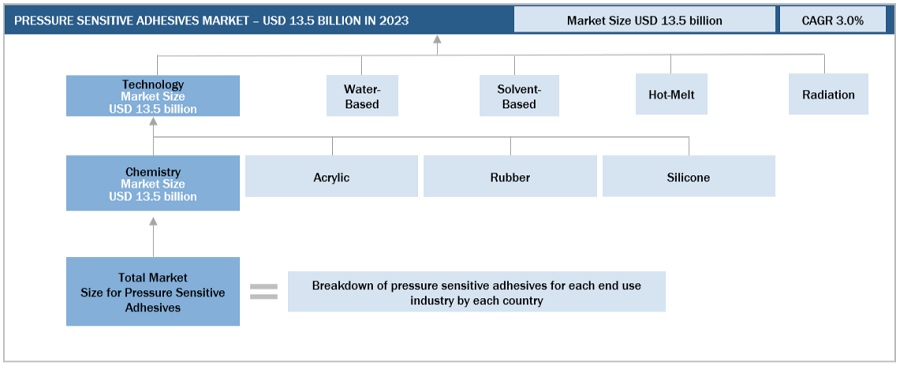

Pressure Sensitive Adhesives Market by Chemistry (Acrylic, Rubber, Silicone), Technology (Water-Based, Solvent-Based, Hot-Melt), Application (Tapes, Labels, Graphics), End-Use Industry (Packaging, Automotive), and Region - Global Forecast to 2029

Updated on : February 03, 2026

PRESSURE SENSITIVE ADHESIVES MARKET SIZE & SHARE ANALYSIS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

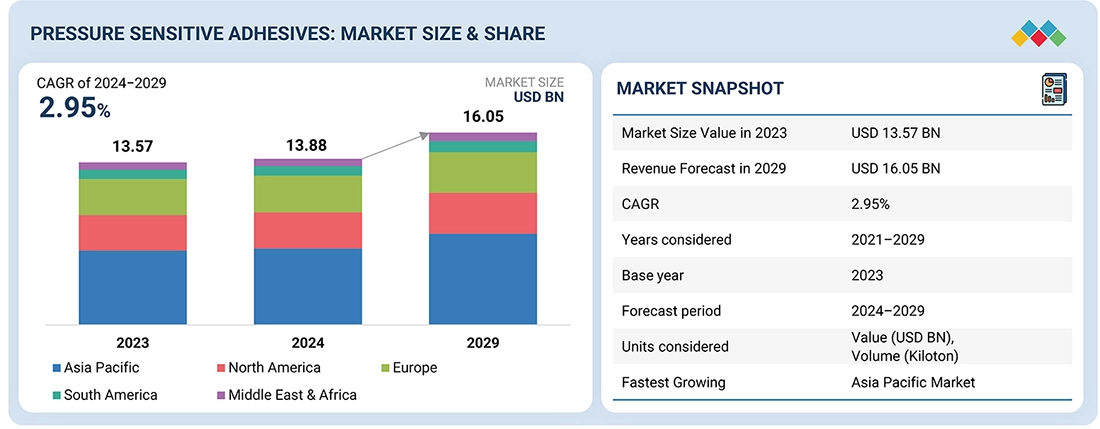

The pressure sensitive adhesives market was valued at USD 13.88 billion in 2024 and is projected to reach USD 16.05 billion by 2029, growing at a CAGR of 2.95% during the forecast period. The major factor behind market growth is increasing demand from packaging, labels, tapes, and medical applications, and this demand is further augmented by the growing end-use industries comprised of food & beverages, consumer goods, automotive, and healthcare. The demand for bonding solutions that are lightweight, flexible, and easy to apply as well as the e-commerce packaging boom are two of the factors that are inquiries together. Moreover, the continuous development of water-based and solvent-free PSA technologies along with the shift to sustainable and recyclable materials are making a positive impact on the global market scenario.

KEY TAKEAWAYS

-

BY TECHNOLOGYThe hot-melt based segment is projected to register the highest CAGR of 3.37% in terms of value during the forecast period.

-

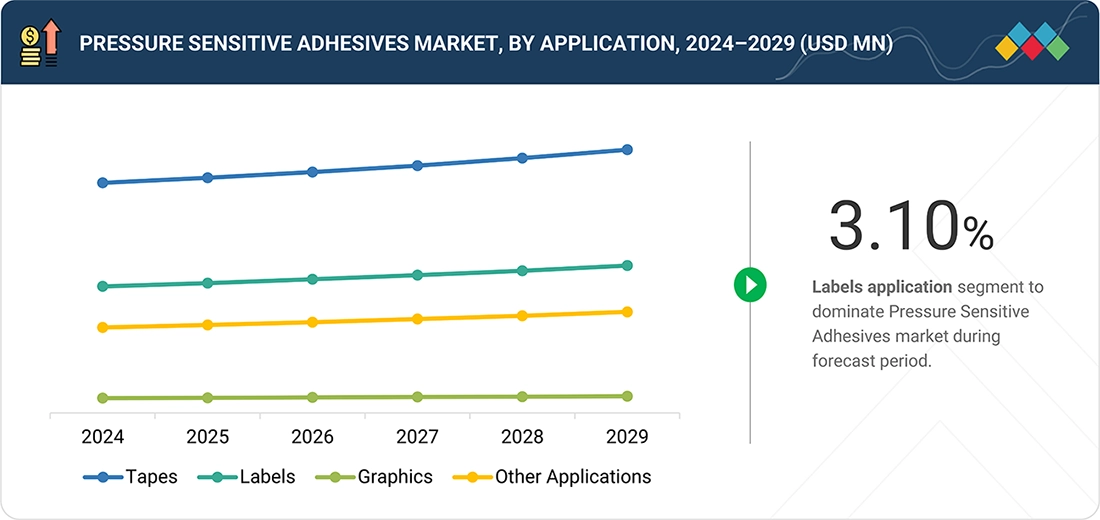

BY APPLICATIONThe tapes segment accounted for the largest share of the pressure sensitive adhesives market, in terms of value, in 2023.

-

BY CHEMISTRYThe acrylic PSA segment accounted for the largest share of the pressure sensitive adhesives market, in terms of value, in 2023.

-

BY END-USE INDUSTRYMedical & Healthcare industry is projected to register the highest CAGR of 3.77% in terms of value during the forecast period.

-

BY REGIONAsia Pacific dominated the pressure sensitive adhesives market in 2023, accounting for a share of 45.7% in terms of value.

-

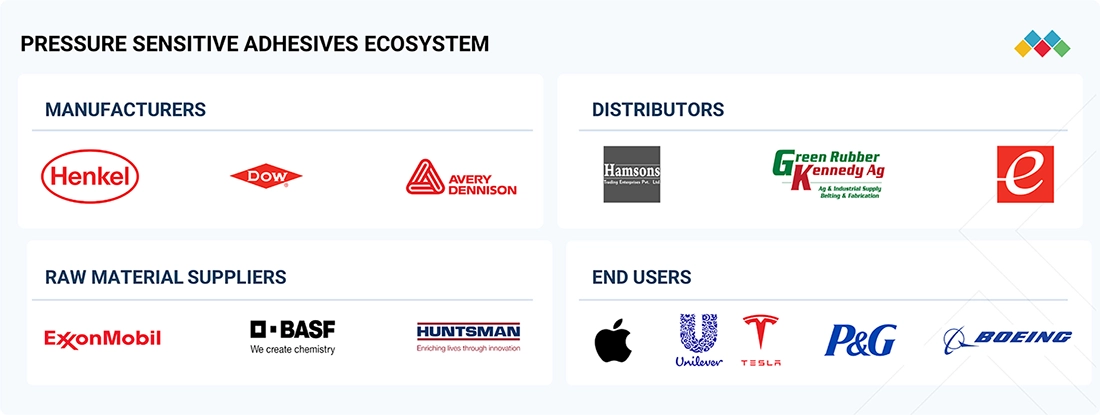

COMPETITIVE LANDSCAPE - KEY PLAYERSCompanies Henkel AG CO. & KGaA, Dow, Avery Dennison Corporation and H.B. Fuller Company were identified as key players in the global pressure sensitive adhesives market, supported by their strong market presence and extensive product portfolios.

-

COMPETITIVE LANDSCAPE - STARTUPSCompanies like Scapa Group PLC, Illinois Tool Works among other emerging players, have carved out solid positions within specialized niche segments, highlighting their potential to evolve into future market leaders.

A major reason for the pressure sensitive adhesives market being driven is the increasing focus on product performance improvement along with cost cutting throughout the assembly and processing stages in packaging, automotive, electronics, and healthcare industries. The manufacturers are increasingly adopting PSAs as they offer fast, clean, and reliable bonding even without the use of heat, water, or solvents, thus supporting high-speed production and design flexibility. The continuous use of lightweight materials and compact component designs has further increased the reliance on PSAs to provide durable and consistent adhesion. Moreover, end users are forced to use advanced PSA formulations for stable performance due to the variation in substrate surfaces and operating conditions, which in turn fuels the demand in developed and emerging markets.

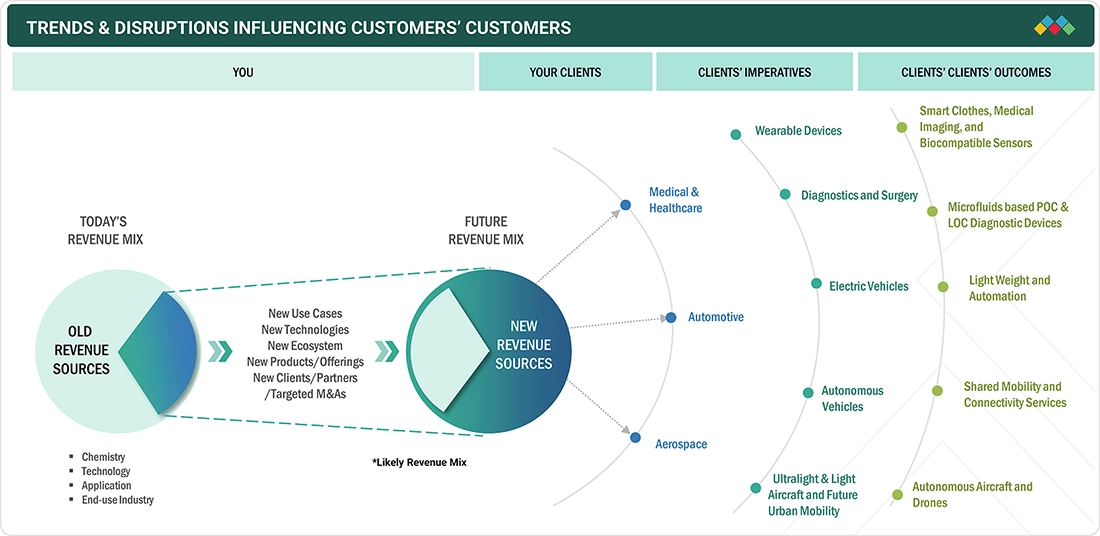

PRESSURE SENSITIVE ADHESIVES MARKET TRENDS ANALYSIS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The customers' businesses in the pressure sensitive adhesives market are being influenced by the quick transitions towards sustainability, conformity with regulations, and innovation in materials. The stricter chemical and environmental regulations implemented by the EPA are forcing the customers to shift from solvent-based adhesives to water-based, low-VOC, and recyclablesolutions which, in turn, affect the product design and procurement strategies. Moreover, the demand for lightweight materials, digital printing, and customized packaging is contributing to the need for high-performance and specialty PSAs. Disruptions in customer operations further caused by supply-chain volatility, rising raw-material costs, and pressure to support circular-economy goals are leading to an increase in collaborations with adhesive suppliers and the use of next-generation PSA technologies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing Demand for pressure sensitive adhesives from packaging industry

-

Wide use of pressure sensitive adhesives in electric vehicles

Level

-

Volatility in raw materials prices

Level

-

Potential substitutes to traditional fastening systems

-

Emergence of bio-based pressures sensitive adhesives

Level

-

Stringent regulations reshaping market

-

Substitution by mechanical fasteners

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing Demand for pressure sensitive adhesives from packaging industry

The packaging industry is the primary driver behind the increasing demand for pressure sensitive adhesives which in turn support the PSA market. The fast growth of e-commerce, food and beverage packaging, and consumer goods has raised the requirement for effective, high-speed labeling, sealing, and bundling solutions. Pressure sensitive adhesives offer easy application, strong adhesion to various substrates, and clean removability, their being perfect for modern packaging operations. More so, the trend of using lightweight, flexible, and eco-friendly packaging materials has influenced the use of sophisticated PSA formulations in the global packaging supply chains very much.

Restraint: Volatility in raw materials prices

Prices of raw materials are a major restraint that affects the market for pressure-sensitive adhesives. PSAs depend largely on inputs from the petrochemical industry like acrylic monomers, synthetic rubbers, tackifier resins, and solvents, and these prices change with the oil price, supply disruptions, and geopolitical issues. The constant price changes raise the manufacturing cost and exert pressure on the profit of all manufacturers, in particular, the small and medium-sized ones. Such a situation does not allow the adoption of any long-term pricing and contract strategies, thus, companies are forced to transfer the costs to the end-users which might have an effect on the market growth negatively.

Opportunity: Potential substitutes to traditional fastening systems

Pressure-sensitive adhesives (PSAs) are potentially able to become the main fastening method instead of screws, rivets, and welding. The adhesives selection permits joining of lighter materials, equalizing the stress of whole surface, and improving the exterior look of the products without burning or drilling. Their use is so simple that faster production and more variation in design in the automotive, electronics, construction, and industrial fields are possible. Manufacturers who want to reduce weight, control noise and vibrations and still keep fast production would certainly use PSAs instead of the conventional fastening methods.

Challenge: Stringent regulations reshaping market

The pressure-sensitive adhesive market is being transformed by strict regulations and are presenting manufacturers with a big challenge. The regulatory rules concerning VOC emissions, the use of solvents, safety of chemicals, and the ability to recycle are getting tougher and tougher in the main regions. Keeping up with the changing environmental and safety regulations implies constant reformulation, investing in R&D, and moving to water-based or solvent-free technologies. All these changes lead to higher operational costs and longer product development time. The small manufacturers might find it hard to comply with the regulations and this could result in their limited participation in the market and thus the growth of the market as a whole in the heavily regulated areas will be slow.

PRESSURE SENSITIVE ADHESIVES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses PSA tapes for bonding displays, batteries, and internal components in smartphones and wearable devices. | Enables thin designs, shock resistance, fast assembly, and improved product reliability. |

|

Applies PSA tapes for trim mounting, wire harnessing, insulation, and sealing in electric vehicles. | Reduces vehicle weight, improves noise control, and speeds up automated assembly. |

|

Uses PSA tapes in aircraft interiors for insulation fixation, panel bonding, and surface protection. | Supports lightweight structures, vibration damping, and compliance with aerospace safety standards. |

|

Uses pressure-sensitive labels on consumer goods packaging for branding and regulatory information. | Improves shelf appeal, traceability, and high-speed packaging line efficiency. |

|

Applies PSA labels on food and personal-care packaging for branding, tracking, and tamper evidence. | Enhances brand visibility, supply-chain tracking, and consumer safety assurance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of pressure-sensitive adhesives is well connected. It consists of suppliers of raw materials, producers of adhesives, distributors, and end-users of many kinds. The main players in the chemical industry, starting from the end-users, are supplying the basic components for the PSA formulations, namely, acrylic monomers, silicones, tackifiers, and specialty additives. The finest adhesive manufacturers and specialized formulators are right in between; they use those inputs to create both commodity and high-performance PSA solutions that are tailored for different applications. Distributors play very important through connecting the supply chain and maintaining availability in the area, providing technical support, and delivery of goods whenever they are needed, especially in the case of fragmented markets. On the other hand, users of the product from different industries like packaging, tapes, labels, graphics, healthcare, construction, automotive, and electronics not only keep the demand going but also become a very important source for the innovation of the products since their requirements regarding sustainability, performance, and regulatory compliance are always increasing.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

PRESSURE SENSITIVE ADHESIVES MARKET OUTLOOK & FORECAST (MARKET SEGMENTS)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pressure Sensitive Adhesives Market, By Technology

The water-based technology dominates the global PSA market due to it's friendly nature towards the environment and high applicability across end-user sectors. These types of adhesives give off small quantities of volatile organic compounds, are in line with very strict environmental regulations, and are safer to handle than their solvent-based counterparts. Adhesives of water group are widely used in the areas of packaging, labeling, tapes, and medicine due to their strong affinity, cost-effectiveness, and being compatible with paper, film, and foil substrates. Besides, constant developments in the performance characteristics such as stickiness, peel strength, and resistance to moisture, have contributed to their global acceptance.

Pressure Sensitive Adhesives Market, By Application

By application, labels holds the second largest market because of their extensive use in the packaging, logistics, food and beverage, pharmaceuticals, and consumer goods industries. Pressure-sensitive adhesive labels provide ease of application, great stickiness to different substrates, and compatibility with fast labeling lines. The continuous growth of e-commerce and retail packaging has brought about the need for strong, attractive, and informative labels more than ever. Moreover, the increasing demand for product identification, traceability, and compliance with regulations is still a factor that keeps labels in the leading position in the global PSA market.

Pressure Sensitive Adhesives Market, By Chemistry

By chemistry, silicone-based pressure sensitive adhesives are the second largest segment of the global PSA market with their chemistry being the main reason for that. They are the best among the PSAs when it comes to heat resistance, chemical stability, and adhesion of low-energy surfaces like silicone, fluoropolymer, and plastic that has been treated. These properties thus make them to be the ones highly preferred for usages in technical fields like electronics, aerospace, and medical industries besides automotive. Even though they are of higher prices than the acrylic and rubber based PSAs, the fact that they can be used in high-temperature and harsh environment conditions has led to their steady adoption across critical and high-value applications.

Pressure Sensitive Adhesives Market, By End-use Industry

Medical & Healthcare industry among the end-use industries is growing at the fastest growth rate of 3.77% CAGR per annum. Increased demand for advanced medical devices, wound care products, diagnostic tapes, and surgical drapes has contributed the most to this growth. All these products need dependable, skin-friendly, and high-performing adhesive solutions. There is a tendency to use PSAs in medical applications that is mainly due to the rising concerns about patient comfort, hygiene, and non-invasive treatments. Increasing number of old people and the progress in healthcare technology are also keeping the rapid growth of PSAs in this sector.

REGION

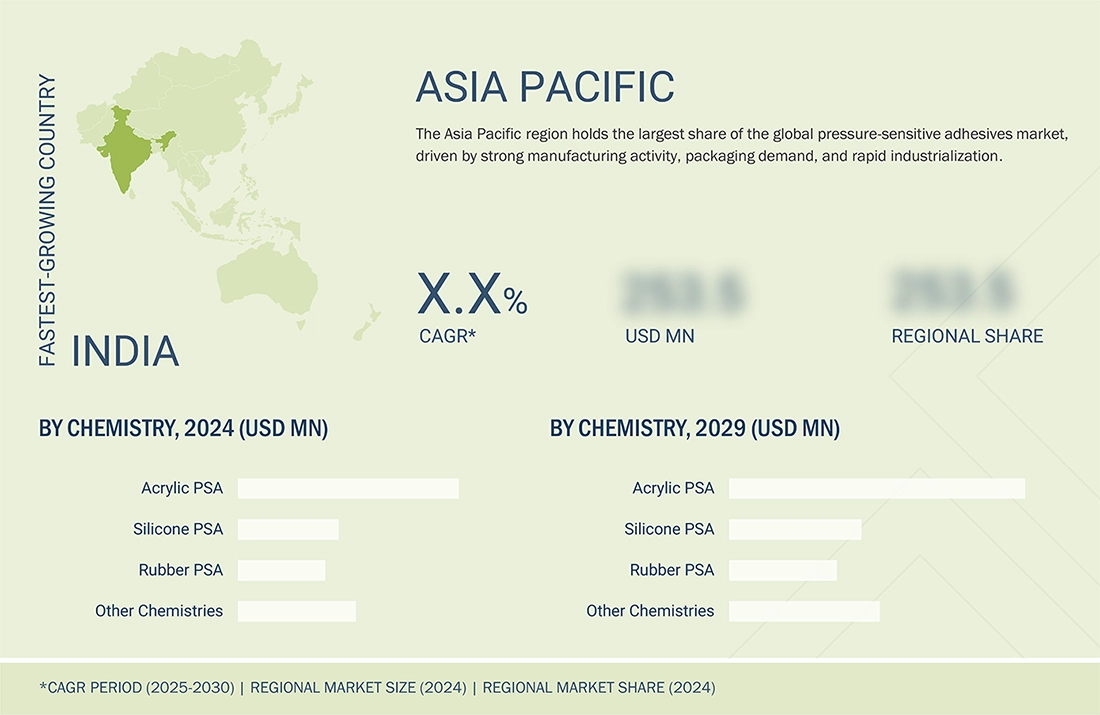

Asia Pacific held the largest share in the global pressure sensitive adhesives market in 2023

The Asia Pacific holds the largest share in pressure sensitive adhesives market the major factor behind this dominance is the manufacturer's activity, urbanization at a fast pace, and the growing use of packaging as well as the automotive and electronics industrial sectors. The demand for PSA is heightened by the region's enlarging of the manufacturing base, especially in China, India, and Southeast Asia, where several applications, including labels, tapes, and medical products, are involved. Moreover, the e-commerce and retail packaging trend is rising in the region, and this together with consuming people wanting more society friendly and innovative solutions is making Asia Pacific's hold on the global PSA market even tighter.

PRESSURE SENSITIVE ADHESIVES MARKET: COMPANY EVALUATION MATRIX

In the Pressure Sensitive Adhesives market Henkel AG CO. & KGaA is placed in the star category which is due to its strong market position, wide pressure sensitive adhesives portfolio, large manufacturing footprint, and still ongoing activities for innovative and sustainable products in global pressure sensitive adhesives market. Scapa Group PLC is classified as an Emerging Leader, backed by its increasing participation in specialty pressure sensitive adhesives, especially in packaging and industrial applications, plus the focused investments, and extending regional reach that all together make its competitive position stronger.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2023 | USD 13.57 Billion |

| Revenue Forecast in 2029 | USD 16.05 Billion |

| Growth Rate | CAGR of 2.95% from 2024−2029 |

| Actual data | 2021−2029 |

| Base year | 2023 |

| Forecast period | 2024−2029 |

| Units considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

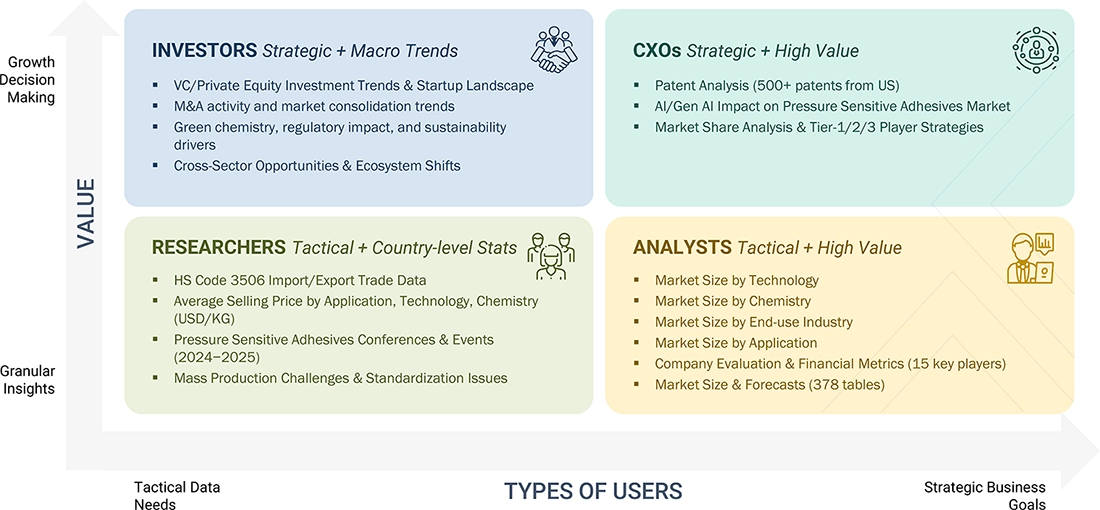

WHAT IS IN IT FOR YOU: PRESSURE SENSITIVE ADHESIVES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific-specific market and regulatory understanding | In-depth regional analysis covering regulations, sustainability trends, and key demand drivers | Enables informed strategic planning and regulatory-compliant decision-making |

| Competitive landscape and company positioning | Competitive benchmarking and company evaluation matrix for key Asia Pacific players | Strengthens market positioning, competitor monitoring, and go-to-market strategies |

RECENT DEVELOPMENTS

- May 2023 : Henkel's new Adhesives Technology Center in Bridgewater, New Jersey, spanning 70,000 square feet, serves as a dynamic hub for strategic partners and customers. Showcasing a comprehensive technology portfolio, it fosters collaboration with over 800 industry segments to create innovative solutions. The center features an interactive infinity room highlighting Henkel's latest advancements, from sustainable packaging to smart health solutions and digital maintenance innovations. This expansion reinforces Henkel's drive for innovation and sustainability in partnership with stakeholders.

- December 2022 : Henkel introduced these PSAs, which contain two components of polyurethane systems for flexible packaging due to their excellent adhesion to the metalized substrates.

- July 2021 : Dow announces capacity expansions to meet the growing demand for sustainable solutions across various end markets. In Consumer Solutions, expansions focus on silicone elastomers, polymers, sealants, and pressure-sensitive adhesives, supporting safer and more sustainable vehicle designs. Additionally, propylene glycol capacity at the Map Ta Phut facility in Thailand will be increased to 250,000 tons per year by 2024, optimizing infrastructure to serve high-value applications in Asia Pacific and India.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the pressure sensitive adhesives market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering pressure sensitive adhesives information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the pressure sensitive adhesives market, which was validated by primary respondents.

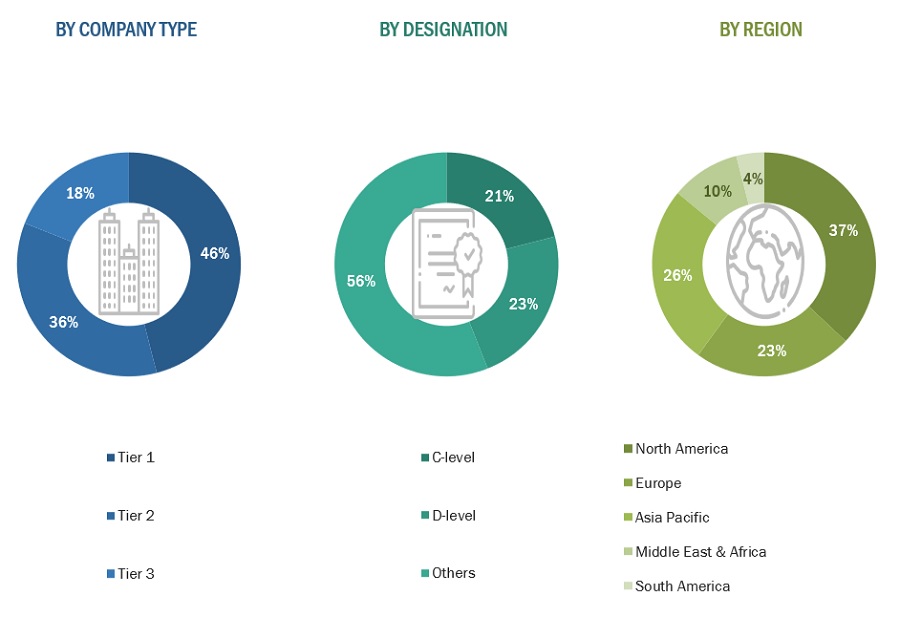

Primary Research

Extensive primary research was conducted after obtaining information regarding the pressure sensitive adhesives market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from pressure sensitive adhesives vendors; raw material suppliers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, technology, application, end use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using pressure sensitive adhesives were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of pressure sensitive adhesives and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

3M |

Director |

|

Illinois Tool Works |

Project Manager |

|

H.B. Fuller Company |

Individual Industry Expert |

|

Wacker Chemie AG |

Project Manager |

Market Size Estimation

The research methodology used to estimate the size of the pressure sensitive adhesives market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in the end-use industries at a regional level. Such procurements provide information on the demand aspects of pressure sensitive adhesives.

Global Pressure Sensitive Adhesives Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Pressure Sensitive Adhesives Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

According to the Adhesive and Sealant Council, “Pressure Sensitive Adhesives (PSAs) are adhesives with special formulations that form a bond on the application of slight pressure, and which remain tacky at room temperature without solvent or heat. These adhesives offer various properties, such as peel strength, cohesive strength, adhesive strength, shear resistance, and resistance to aging, chemicals, and humidity.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the pressure sensitive adhesives market based on chemistry, technology, application, end use industry, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the pressure sensitive adhesives market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the pressure sensitive adhesives market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the pressure sensitive adhesives Market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pressure Sensitive Adhesives Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pressure Sensitive Adhesives Market