Process Oil Market

Process Oil Market by Type (Aromatic, Paraffinic, Naphthenic, Non-Carcinogenic), Application (Tire & Rubber, Polymer, Personal Care, Textile), Function (Extender Oil, Plasticizer, Solvent, Defoamer), and Region - Global Forecast to 2030

OVERVIEW

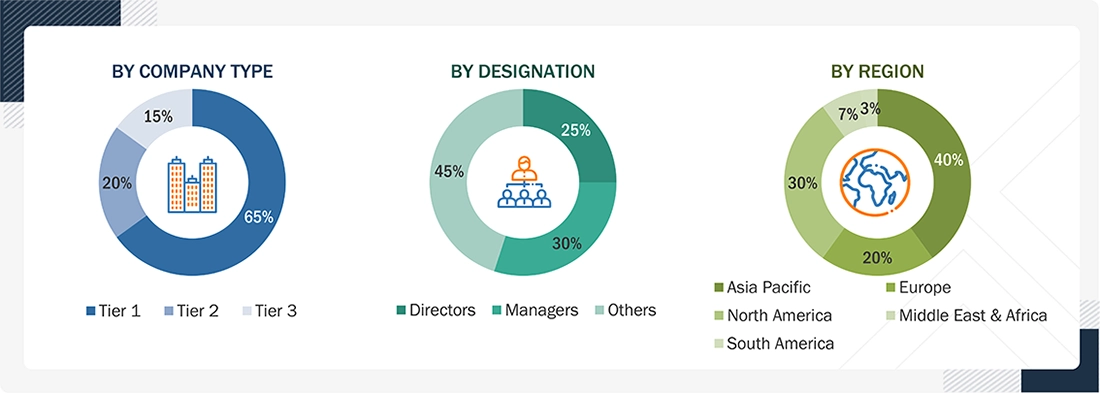

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global process oil market is projected to grow from USD 5.38 billion in 2025 to USD 6.16 billion in 2030, at a CAGR of 2.8% during the forecast period. Process oils come in a variety of forms and are made from natural and synthetic sources. The various end uses are reflected by the different applications they can be used in, such as tire, rubber, personal care, textile and many other uses. Secondary functions enabled by using process oils include extender, plasticizer, solvent, defoamer, and other functional additives that facilitate manufacturing and ensure superior product quality. By chemical, there are four types of process oils: naphthenic, paraffinic, non-carcinogenic, and aromatic oils, which are selected based on performance and regulatory compliance considerations. The technologies used to produce process oils include traditional manufacturing processes, gas-to-liquid conversion, and bio-based production. The end users of process oils include automotive, construction, manufacturing, energy, pharmaceutical, and oil and gas. Process oil manufacturing activity has seen steady increases in demand over time due to the continued expansion of the tire manufacturing and polymer processing industries, which require process oils to produce and enhance the performance of material compounds. The growth of these industries, in addition to the industries that continue to grow and require compliance or safe grades of oil, will continue to drive demand across a variety of applications.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific region is expected to register the highest CAGR (3.6%) during the forecast period.

-

BY TYPEBy type, the non-carcinogenic segment is projected to grow at the highest CAGR (4.1%) during the forecast period.

-

BY APPLICATIONBy application, the tire & rubber segment is projected to register the highest CAGR (3.4%) during the forecast period.

-

BY FUNCTIONBy function, the defoamer segment is expected to register the highest CAGR (4.9%).

-

BY PRODUCTION TECHNOLOGYBy production technology, the convention route segment is expected to dominate the market.

-

BY FEEDSTOCKBy fedstock, the petroleum segment is expected to lead the overall market during the forecast period.

-

BY END USERBy end user, the automotive segment is expected to dominate the overall market during the forecast period.

-

Competitive Landscape - Key PlayersExxon Mobil Corporation, Chevron Corporation, Shell plc, Petroliam Nasional Berhad (PETRONAS), and Idemitsu Kosan Co., Ltd. were identified as some of the leading players in the process oil market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsLODHA Petro, Cross Oil, and Eastern Petroleum, among others, have become leading startups or SMEs because they identify niche gaps early and deliver solutions that precisely match unmet customer needs. Their agility, faster decision-making, and ability to innovate continuously allow them to outperform larger, less flexible competitors.

The process oil market comprises specialty oils used to support efficient manufacturing and enhance performance across industrial applications, with segmentation defined by application, function, type, and end user. Under the application segment, demand from tire & rubber and polymer manufacturing continues to support consistent consumption, as process oils are essential for improving material flexibility, flow behavior, and compounding efficiency. From a functional perspective, their use as extender oils and plasticizers enables manufacturers to optimize formulations while maintaining desired mechanical properties and cost efficiency. In terms of type, the growing preference for non-carcinogenic, paraffinic grades reflects increasing regulatory awareness and an emphasis on safer material handling without compromising processing performance. On the end user side, industries such as automotive, construction, and manufacturing rely on process oils as critical formulation components rather than optional additives. Market growth is driven by expanding industrial activity, rising material consumption, and continuous production across these end-use sectors, which require stable, scalable process solutions. In addition, gradual formulation upgrades and replacement of traditional grades with compliant alternatives are supporting sustained demand, positioning process oils as an integral part of modern industrial manufacturing workflows.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses arises from evolving customer trends or market disruptions. Megatrends such as sustainability, and digital transformation—alongside disruptions like AI, supply chain localization, and energy transition—are significantly reshaping customer priorities and business models. Traditionally, revenue mixes were dominated by legacy products and processes focused on volume and cost. Today, customers are shifting toward high-margin, innovation-driven, and sustainable solutions to remain competitive and future-proof. This transition is prompting businesses to adapt quickly, invest in cleaner technologies, and enhance agility, with suppliers expected to deliver compliant, efficient, and tech-enabled offerings that align with evolving market demands.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in tire production and polymer-processing industries supporting steady demand for process oils

-

Industrialization and urban growth increasing the use of plastics, adhesives, and other materials that rely on process oils

Level

-

Regulations limiting high-PAH aromatic oils reducing the use of certain traditional grades

-

Increasing shift toward vegetable oils and synthetic alternatives in select applications

Level

-

Rising demand for low-PAH, hydrotreated, and eco-friendly process oils

Level

-

Crude-oil price volatility posing ongoing challenges to cost stability and production planning

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in tire production and polymer-processing industries supporting steady demand for process oils

Rising production of tires and polymer processing is influencing demand for process oils, by creating sustainable and volume driven demand across multiple applications. Process oils are used extensively in the manufacture of tires as a means for improving the processability, flexibility, and durability of rubber throughout its lifecycle and have an impact on the resulting performance characteristics of the final tire product(s). As tire production increases, so does the volume of process oils required to make tires, generating highly repeat and resilient process oil demand from the tire industry. Other industries, such as the polymer processing industry, rely extensively on process oils to improve flow, filler dispersion and the performance of plastics, elastomers and adhesives, and other materials. The continued growth of polymers used in automobile components, construction materials, consumer products, and industrial products is continuing to increase the demand for compatible process oils. Continuous development of innovative polymer formulations and rubber compounds continues to support a growing demand for the latest technology grades of process oil for a wide variety of applications. Additionally, the expansion and modernization of manufacturing capabilities in both the tire and polymer processing segments is continuing to support a consistent offtake of process oils. The scale, continuity and essential functionality of process oils in both the tire and polymer processing industries represent some of the major influencers of the long-term growth potential of the global process oil market.

Restraint: Regulations limiting high-PAH aromatic oils reducing the use of certain traditional grades

The current regulations that restrict the use of high polycyclic aromatic hydrocarbon (PAH) process oil are likely the largest deterrent to the growth of the process oil industry in general, as they are decreasing demand for some traditional process oil grades. The growing concerns about worker safety, environmental issues, and health risks associated with long-term exposure to high-PAH process oils have driven this regulatory change. Manufacturers that use PAH process oil in the production of tires, rubbers, and polymers are required to either reformulate their products or discontinue using traditional aromatic oils that are not compliant with the new regulations. This has created a number of problems for manufacturers who depend on legacy aromatic grades, resulting in decreased sales and a costly product transition. In many circumstances, substituting PAH process oils for an alternative oil will not be immediate, as the alternative oil will require formulation adjustments, testing, and changes to process conditions. Added compliance costs, such as certification, audit, and supply chain modifications, make it even more complicated for the suppliers and end users. Therefore, even though the regulations do not eliminate overall demand for process oils, they limit the market for some traditional products and slow adoption in lower-price-sensitive applications. The regulatory limitations on PAH aromatic oils, therefore, constitute a restraint on the overall growth of the process oil industry, as volume growth is constrained and the phase-out of non-compliant aromatic oil grades has accelerated.

Opportunity: Rising demand for low-PAH, hydrotreated, and eco-friendly process oils

Surging demand for low-PAH, hydrotreated, and eco-friendly process oils is increasingly a critical growth opportunity in the process oil market, fueling both product substitution and value expansion. Growing regulatory pressure and greater attention to worker safety and environmental protection are pushing end use industries toward cleaner options. These process oils pose low health and environmental risks and deliver dependable performance in tire, rubber, polymer, and personal care applications. Hydrotreated and low-PAH grades are especially appealing, as they allow formulators to remain compliant without major formulation changes. Emerging sustainability efforts and ethical sourcing pledges are also reinforcing adoption, particularly in consumer-facing and export-focused use cases. For manufacturers, this shift offers options to improve product categories and to utilize high- or advanced-refining technology to provide more valuable grades. Broader adoption of cleaner process oils across applications is enabling substitution for conventional aromatic grades and driving additional demand growth. While such products can be more costly to manufacture, their importance for regulatory compliance, sustainability alignment, and product differentiation is solidifying their market position. As a result, growing demand for low PAH and eco-friendly process oils is a great prospect underpinning the sustainable expansion of the worldwide process oil market.

Challenge: Crude-oil price volatility posing ongoing challenges to cost stability and production planning

The price fluctuations of crude oil have been disturbing the process oil industry by creating uncertainty regarding both production expenses and the ability to plan for supplies. The oil and gas industry is the source of all process oils, so naturally, the process oil market responds very closely to the increases and decreases in the pricing of crude oil in the globe. Increased crude oil prices cause increased raw material costs and decreased profit margins for manufacturers, causing manufacturers to pass along their cost increases to customers in the form of higher prices. Conversely, when crude oil prices decrease, supply contracts with suppliers may be terminated, leaving the producer unable to accurately position subsequent investments, which disrupts product stability and production. The volatility of crude oil prices is a complicating factor in budgeting, procurement, and long-term production planning for process oil manufacturers as well as downstream industries such as tire, rubber, and polymer manufacturing. Manufacturers of process oils struggle to offer customers consistent pricing while maintaining uninterrupted product supply, which ultimately weakens their competitive position in the market. Unpredictable feedstock costs can also create delays in manufacturers' capacity to expand or implement technological upgrades and therefore limit the manufacturer's growth. Manufacturers have adopted various strategies including hedging and alternative sourcing to combat the uncertainties associated with crude oil price fluctuations; nevertheless, crude oil prices remain unpredictable and will continue to be a challenging factor that will interfere with the manufacturer's ability to operate efficiently and impact their cost stability, product planning and subsequently their overall growth in the global process oil market.

PROCESS OIL MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Manufactures process oils for a wide range of applications including tire and rubber compounds, polymers, plastics, adhesives, and industrial lubricants, ensuring optimal processability and material performance. | Enhances flexibility and durability, improves processing efficiency, ensures consistent quality, and supports safer manufacturing operations |

|

Supplies paraffinic and naphthenic process oils for polymer processing, construction materials, personal care formulations, and specialty industrial applications, designed to improve flow, stability, and compatibility with additives | Improves processing efficiency, enhances product uniformity, supports long-lasting performance, and enables smoother production workflows |

|

Provides process oils for high-performance polymers, rubber, tire manufacturing, and industrial materials, with a focus on both conventional and eco-friendly grades for sustainable applications. | Supports advanced formulations, enhances mechanical and thermal stability, ensures uniform quality, and contributes to sustainability and compliance goals. |

|

Produces process oils for consumer and industrial applications such as plastics, rubbers, adhesives, and specialty formulations, supporting high-performance material requirements | Increases product consistency and reliability, improves durability, enhances formulation versatility, and strengthens end-product performance |

|

Offers process oils for specialty and high-performance industrial applications, including polymers, rubber compounds, adhesives, and automotive materials. | Improves heat resistance and flexibility, enhances wear and performance under harsh conditions, supports innovation, and enables high-value product development |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The process oil ecosystem consists of raw material suppliers (e.g., Exxon Mobil Corporation, DYM Resources), producers (e.g. Exxon Mobil Corporation, H&R Group), distributors (e.g. MEHTA PETRO REFINERIES LTD., Reliable Enterprises), and end users (e.g., CEAT, Bridgestone). Process oil is used in various applications, such as tires & rubbers, personal care, textile, and other applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Process Oil Market, By Type

The non-carcinogenic oils segment is projected to record the highest compounded annual growth rate (CAGR) among all types of process oils over the foreseeable future, largely due to manufacturers' increasing demand for cleaner, safer products in the production of their goods. Companies are making efforts to reduce the adverse effects on the environment and workers' health by implementing regulations and incentives that encourage manufacturers to use lower-toxicity oils in place of traditional aromatic-containing oils. One of the areas where this transition is felt most clearly is in tire and rubber production, where compliance with strict material specifications is required for manufacturers to access the global marketplace. In addition, as end-users continue to focus more on product performance, there is a further drive toward using these oils in the polymer processing industry as well. One of the key drivers of this increase in usage of non-carcinogenic oils in this and many other consumer applications is the increased focus by end-users on product safety, ingredient transparency, and the use of chemicals that are not classified as hazardous or dangerous. Increased development of advanced refinishing and hydroprocessing techniques by oil refiners has resulted in producing non-carcinogenic oils that are not only comparable in terms of performance to traditional grades of process oil but that also have greater consistency in terms of quality. This has enabled manufacturers that export their products to increase the pace at which they are using non-carcinogenic oils. Although these oils may carry a higher price tag than traditional grades, the benefits they provide in meeting regulatory compliance, sustainability targets, and enhancing product differentiation have resulted in these oils experiencing much faster growth in value and volume than all other process oils.

Rubber Process Oil Market, By Application

During the course of this forecast period, it is highly likely that the tire and rubber industry will witness the most robust growth rate as measured by Compound Annual Growth Rate (CAGR), mainly attributed to continued increased automobile production, continued demand for replacement tires, and increased manufacturing of rubber products over the years. In addition to the traditional automobile market, demand for tires is also being driven by the need for greater mobility and the increased use of automobile transportation among both business and private consumers, all of which has contributed to the rise in the use of process oils in tire manufacturing. Recently, in addition to the original equipment manufacturer markets, the increasing emphasis on tire maintenance and replacement has further reinforced long-term tire ownership consumption trends. The increasing production in the Industrial Rubber (e.g., hose, belt, seal, and molded component manufacturing across the Automotive, Manufacturing, and Energy sectors) is also benefiting from the advantages of using Process Oils to improve performance by enhancing durability, flexibility, and manufacturing efficiency, resulting in higher-value consumption due to the enhanced performance of Process Oils. Due to the growing emphasis by Consumer and Regulatory agencies on using "safer" raw materials, tire formulators are increasingly urged to switch to non-carcinogenic process oils in their formulations. The accumulation of past and recent tire manufacturers' innovations, along with the increasing importance to consumers and regulatory agencies of using Process Oils that do not pose a health risk, will drive market demand. As capacity expansions, modernization of rubber processing facilities and increased emphasis on consistent quality continue to be driven by the growing demand from both Regulators and Consumers, the Tire and Rubber segment will likely become the fastest growing application within the Process Oil market due to the factors mentioned above.

REGION

Asia Pacific to be fastest-growing region in global process oil market during forecast period

Asia Pacific is poised to lead growth in the process oils market. Numerous structural supply-and-demand factors are converging in this region. Multiple factors, such as sustained industrial expansion and a steady increase in manufacturing activity, are also contributing to the growth of process oils used in the tire and rubber, polymer processing, textiles, and personal care industries. Additionally, the growth of automotive production and aftermarket activity has driven demand for extender oils and plasticizers. The growing demand for continued infrastructure development has led to many applications in the polymer and construction industries, where process oils are used. Asia Pacific also has a broad and diverse manufacturing ecosystem. The region has many of the elements necessary to integrate downstream processing with refining and petrochemical operations into a single supply chain. Thus, the region’s supply of process oils is competitive and responsive to market needs. Rising awareness of product safety and environmental compliance is leading manufacturers to gradually shift to non-carcinogenic, higher-value grades of process oils. This trend has contributed to both volume and value growth in the process oils market. Growing domestic consumption, driven by improving income levels and the expansion of industrial output, is also creating strong demand for process oils across multiple end-use sectors and applications, including tire & rubber, textile, and personal care. Increasingly successful export-oriented manufacturing, along with favorable industrial policies and the ongoing expansion of production capacity, create a strong basis for continued growth in the region. Collectively, these factors create a diverse and resilient demand base that positions Asia Pacific as the fastest-growing region in the global process oils market over the forecast period.

PROCESS OIL MARKET: COMPANY EVALUATION MATRIX

In the process oil market matrix, Shell is positioned as star player due to its strong global refining presence, diversified process oil portfolio, and consistent supply capabilities. Advanced refining technologies allow Shell to offer high-quality paraffinic and non-carcinogenic process oils that meet the evolving requirements of tire, rubber, polymer, and industrial manufacturers. Its established relationships with large end users, along with reliable logistics and technical support, reinforce its position as a preferred supplier across multiple industries. Hindustan Petroleum Corporation Limited is an emerging leader in the matrix, supported by expanding refining capacity, improving product quality, and rising focus on industrial and manufacturing applications. The company benefits from strong alignment with demand from tire and polymer processors, competitive pricing, and an improving distribution network. Increasing emphasis on compliant and safer process oil grades is further strengthening its market presence. While its footprint remains more regionally focused, sustained industrial growth and capacity development are enabling Hindustan Petroleum Corporation Limited to progressively strengthen its position in the global process oil market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Shell (UK)

- Exxon Mobil Corporation (US)

- Idemitsu Kosan Co., Ltd. (Japan)

- Chevron Corporation (US)

- Petroliam Nasional Berhad (PETRONAS) (Malaysia)

- Gandhar Oil Refinery (India) Limited (India)

- Indian Oil Corporation Ltd (India)

- Repsol (Spain)

- ORGKHIM Biochemical Holding (Russia)

- Nynas AB (Sweden)

- Hindustan Petroleum Corporation Limited (India)

- HF Sinclair Corporation (US)

- ORLEN Unipetrol (Czech Republic)

- Panama Petrochem Ltd. (India)

- H&R Group (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.34 BN |

| Market Forecast in 2030 (Value) | USD 6.16 BN |

| CAGR (2025–2030) | 2.8% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2021–2030 |

| Units Considered | Value (USD Million), and Volume (Kiloton) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Segments Covered | By Type: Paraffinic, Naphthenic, Non-carcinogenic, and Aromatic |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: PROCESS OIL MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Tire and polymer manufacturer seeking guidance on selecting compliant process oil grades across multiple formulations | Comparative assessment of naphthenic, paraffinic, and non-carcinogenic process oils; application-wise suitability mapping; performance–compliance alignment framework | Improved formulation confidence; reduced reformulation risk; faster decision-making for compliant grade adoption |

| Polymer compounder evaluating process oils for cost optimization without compromising performance | Cost–performance benchmarking across extender oils and plasticizers; formulation efficiency analysis; substitution feasibility study | Optimized raw material costs; stable processing performance; improved margin control |

| Refining or petrochemical company assessing expansion into specialty and low-PAH process oils | Opportunity mapping by application and end user; regulatory readiness assessment; product portfolio gap analysis | Clear product development roadmap; prioritization of high-value segments; reduced go-to-market risk |

| Distributor or trader aiming to strengthen positioning in the process oil value chain | Supplier benchmarking; product differentiation matrix; customer application targeting model | Stronger supplier selection; improved sales effectiveness; enhanced customer engagement |

| Investor or strategy team evaluating long-term attractiveness of the process oil market | Market opportunity assessment by application, type, and production technology; value chain margin analysis; risk and sensitivity modeling | Better investment validation; improved visibility into demand drivers; clearer understanding of market resilience |

RECENT DEVELOPMENTS

- July 2025 : Shell Lubricants completed the acquisition of Raj Petro Specialities from the Brenntag Group to expand its lubricants and specialty fluids product range in India.

- March 2023 : Nynas AB introduced Nytex Bio 6200, a bio-based tire and rubber process oil designed as a sustainable drop-in alternative to conventional mineral oils. Developed using renewable ISCC PLUS-certified feedstocks, the product offers equivalent performance with a significantly reduced carbon footprint. This launch aligns with Nynas’ post-reorganization growth strategy to expand its specialty oil portfolio, focusing on sustainable solutions and emerging opportunities in the e-mobility and tire industries.

- June 2022 : Cross Oil and Ergon, Inc. entered into an offtake and marketing agreement through which process oils, a subsidiary of Ergon, Inc., will serve as the exclusive marketer and seller of Cross Oil's naphthenic base oils, including Corsol, L-Series, B-Series, CrossTrans, and Ebonite oils. This agreement can help Cross Oil strengthen its process oil products.

- May 2020 : Nynas AB launched NYTEX 8022, a process oil with multiple benefits, like stabilizing formulations of printing inks, ceramic inks, and chemical auxiliaries used in leather and textile treatments.

Table of Contents

Methodology

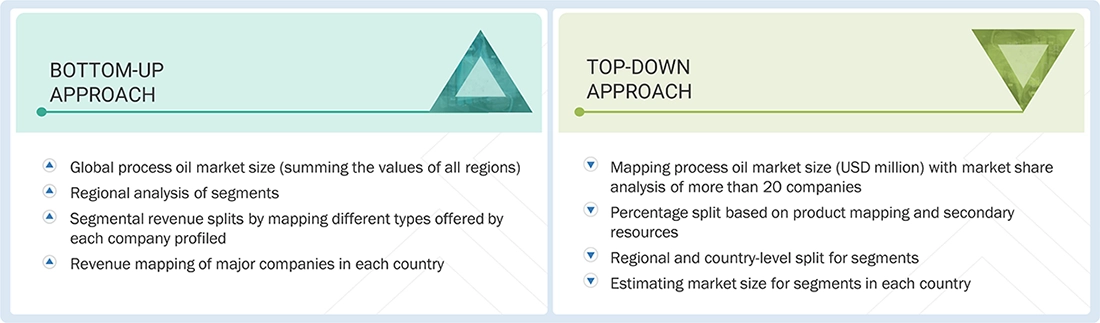

This research encompassed four primary actions to assess the current market size of process oil. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists across the oil value chain through primary research. The total market size is ascertained with both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to ascertain the dimensions of the market segments and sub-segments.

Secondary Research

The research approach employed to assess and project the process oil market initiates with the collection of revenue data from prominent suppliers using secondary research. During the secondary research, many sources, including D&B Hoover's, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were used to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations; white papers; accredited periodicals; writings by esteemed authors; announcements from regulatory agencies; trade directories; and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The process oil market comprises several stakeholders, such as manufacturers, suppliers, traders, associations, and regulatory organizations, in the supply chain. In the process oil market, the demand side includes tire manufacturers, rubber goods producers, polymer and plastic processors, textile manufacturers, personal care product manufacturers, and adhesives and sealants producers, all of which use process oils to improve processing efficiency and material performance. Demand is further supported by automotive component manufacturers, construction material producers, and other industrial manufacturers that rely on rubber- and polymer-based formulations. The supply side consists of oil refiners, petrochemical companies, integrated energy companies, and specialty oil producers that manufacture process oils from petroleum, natural gas, or coal tar feedstocks. Base oil producers, along with specialty chemical manufacturers, supply a range of conventional and compliant process oil grades, while distributors, traders, and wholesalers support market access by managing storage, logistics, and regional supply networks. Various primary sources from both the supply and demand sides of the market

were interviewed to obtain qualitative and quantitative information. The following is the breakdown of the primary respondents:

Note: Tiers of companies are based on their revenue in 2024. Tier 1: company revenue greater than USD 1 billion; Tier 2: company revenue between USD 100 million and USD 1 billion; and Tier 3: company revenue less than USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the process oil market. These methods were also widely used to determine the sizes of various market sub-segments. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the process oil market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Process Oil Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and obtain the exact statistics for each market segment and subsegment, data triangulation and market breakdown procedures were employed, as applicable. The market size was calculated globally by summing country- and regional-level data.

Market Definition

Process oil is a petroleum-derived, synthetic, or bio-based oil used as a functional additive in industrial and manufacturing processes to support efficient production and consistent product quality. It is primarily incorporated to perform roles such as extending base materials, improving flexibility and flow, acting as a plasticizing medium, serving as a solvent to enhance formulation stability, and controlling surface behavior through defoaming and related functions. Process oils are selected based on their type and production technology to match specific processing and performance requirements, and they are widely used across applications such as tire and rubber products, polymer formulations, personal care products, textiles, and other industrial uses. While not a structural component of the final product, process oil plays a critical role in enabling smooth processing, uniform ingredient dispersion, and reliable performance for end users across the automotive, construction-related manufacturing, industrial manufacturing, energy, pharmaceuticals, and oil and gas industries.

Key Stakeholders

- Process Oil Manufacturers

- Process Oil Suppliers

- Process Oil Traders, Distributors, and Suppliers

- Investment Banks and Private Equity Firms

- Raw Material Suppliers

- Government and Research Organizations

- Consulting Companies/Consultants in the Chemicals and Materials Sectors

- Industry Associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the global process oil market in terms of value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global process oil market

- To analyze and forecast the size of various segments (application, viscosity, and type) of the process oil market based on five major regions—North America, Asia Pacific, Europe, the Middle East & Africa, and South America, along with key countries in each of these regions

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the process oil market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Process Oil Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Process Oil Market

Annie

Jun, 2017

Need specific market intelligence on the Process Oil market size, future outlook, and growth drivers..

Wichai

May, 2019

Process Oil Market, .