The study involved four major activities in estimating the current size of the rice husk ash market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the Rice Husk Ash market value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; Rice Husk Ash market manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

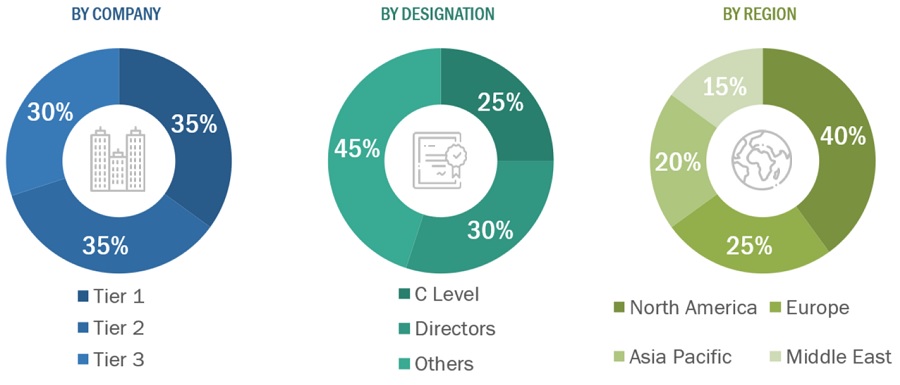

The rice husk ash market comprises several stakeholders, such as such as raw material suppliers, technology support providers, rice husk ash market manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the rice husk ash market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the Rice Husk Ash market market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

-

The key players in the market were identified through secondary research.

-

The market shares in the respective regions were identified through primary and secondary research.

-

The value chain and market size of the Rice Husk Ash market market, in terms of value, were determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Rice Husk Ash market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Rice Husk Ash Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Rice husk ash (RHA) is a natural byproduct obtained from paddy rice during the rice husk processing phase. This husk is characterized by its composition, consisting of approximately 50% cellulose, 30% lignin, and 20% silica. Through a controlled thermal decomposition process, the husk is burned, transforming it into ash that predominantly comprises amorphous silica, ranging between 89-95%. During controlled thermal decomposition, the ash undergoes a transformation, turning into a highly pozzolanic material with an exceptionally large external surface relative to its weight.

Key Stakeholders

-

Raw material manufacturers

-

Technology support providers

-

Manufacturers of Rice Husk Ash market

-

Traders, distributors, and suppliers

-

Regulatory Bodies and Government Agencies

-

Research & Development (R&D) Institutions

-

End-use Industries

-

Consulting Firms, Trade Associations, and Industry Bodies

-

Investment Banks and Private Equity Firms

Report Objectives

-

To analyze and forecast the market size of Rice Husk Ash market in terms of value and volume

-

To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

-

To analyze and forecast the global Rice Husk Ash market on the basis of Product, Silica Content, Application, Process and Region

-

To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

-

To forecast the size of various market segments based on five major regions: Asia Pacific, Europe, Middle East and Africa, South America and North America along with their respective key countries

-

To track and analyze the competitive developments, such as acquisitions, partnerships, collaborations, agreements and expansions in the market

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

-

Additional country-level analysis of the rice husk ash market

-

Profiling of additional market players (up to 5)

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company.

SS

Aug, 2018

Rice Husk Ash market.

SEHIM

Jun, 2020

Very interesting, the valorisation of a waste material as rice husk. However, I would like to know if there is any european companies who produce and sell rice husk ashes (name of the company)..

ilyas

Apr, 2017

Interested in potential of rice husk in energy generation.

ilyas

Apr, 2017

Market our technology and product is a power plant generating electricity by using rice husk as fuel and the by product of rice husk..

ilyas

Apr, 2017

Marketing of rice husk to be used as fuel.

To

Nov, 2016

Interested in this report..

Jacinta

Dec, 2017

Looking for specific information on RHA silica market in APAC. .

Rakesh

May, 2016

Want customer data base in India as well as overseas for rice husk ash.

SADASIVA

Sep, 2016

Rice & Rice Husk Ash Market.

To

Jan, 2016

Rice husk ash market report requirement.