Smart Railways Market Size, Share, Growth & Latest Trends

Smart Railways Market by Offering (Solutions (Rail Asset Management & Maintenance, Operation & Control, Communication & Networking, Security & Safety, and Rail Analytics) and Services (Professional and Managed)) Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The smart railways market is projected to grow from USD 36.49 billion in 2025 to USD 54.31 billion by 2030 at a CAGR of 8.3% during the forecast period. The market’s growth is primarily driven by the global emphasis on sustainable and efficient transportation. This shift is supported by government funding for new digital systems and the integration of IoT, AI, and big data to enhance operations

KEY TAKEAWAYS

-

BY OFFERINGThe growing demand for outsourcing the maintenance of smart railway solutions is anticipated to drive the demand for managed services

-

BY REGIONThe growth of the market in Asia Pacific can be attributed to the rapid growth of new technologies, government initiatives to boost digital infrastructure, and the need for efficient railway infrastructure

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Alstom (France), Cisco (US), Wabtec (US) and, ABB (Switzerland) have entered into a number of agreements and partnerships to cater to the growing demand for smart railways across innovative applications.

The increasing focus on passenger-centric services is driving transport operators to deploy smart ticketing solutions such as mobile-based ticketing apps, contactless payment systems, and facial recognition-based access. These systems simplify boarding, minimize queues, and generally improve the commuter experience. Smart ticketing also fits perfectly well in multimodal transport platforms, allowing for unified payment for buses, trains, metros, and shared mobility services

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are predictive maintenance with digital twins, FRMCS/5G, edge computing, AI-driven operations and autonomous train control are shifting rail from asset-centric to data- and service-driven models. Disruptions include real-time connectivity needs, OT-IT convergence and new safety/security models. End users gain via higher punctuality, lower lifecycle costs, improved safety and better passenger experience.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid urbanization, resulting in increased need for efficient railway system

-

Government initiatives ad increased number of public-private partnership projects in rail industry

Level

-

Substantial upfront investment

Level

-

Rising demand for cloud-based services

-

Increased globalization and need for advanced transportation infrastructure

Level

-

Data security and privacy issues related to IoT devices

-

Disruption in logistics and supply chain of IoT devices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid urbanization, resulting in increased need for efficient railway system

According to UN statistics, the world's population is expected to cross the 10 billion mark by 2050. Close to half of this population is expected to reside in Sub-Saharan Africa, Latin America, and Asia Pacific, where population growth is expected to be more than threefold. In these regions, railways are a well-suited means of mass transport for passengers and freight. The combination of prospective economic growth and a rise in population will encourage more than half of the world's population, which is approximately 66%, to live in cities and towns by 2050. Most of this growth is expected to occur in Africa and Asia. These two regions are projected to reach 56% and 64% urbanization by 2050, respectively. However, they would still be less urbanized than other regions of the world. On the other hand, in mature countries, private transportation, such as cars, will be discouraged to encourage public transport, such as metros and tramways. This shift is expected to be driven by economic factors and the active promotion of environmentally friendly and sustainable forms of mass transport. Urban planners and inhabitants will seek an efficient and comfortable urban transport system with seamless interchanges

Restraint: Substantial upfront investment

The high initial cost of the deployment of smart railway technologies is a major hindrance to market growth. Funding these projects can be a significant barrier to the adoption of state-of-the-art solutions by governments and private companies struggling with the existing budgetary limitations of the railway infrastructure. The adoption of smart railway systems requires a massive capital outlay in installing field-level equipment, upgrading or replacing old infrastructure, building robust communication systems, and achieving smooth integration between new and old systems within railway premises. For example, the implementation of new signaling systems, such as ERTMS (European Rail Traffic Management System) or CBTC (Communication-Based Train Control), requires huge investments in hardware, software, and engineering. Besides, railway authorities are concerned about the long-term costs of operating and maintaining advanced technologies, including software updates, system monitoring, and specialized personnel training, which create financial barriers to widespread adoption

Opportunity: Rising demand for cloud-based services

The demand for cloud-based services, analytics, and internet technologies is increasing due to their efficient IT management and reliable security environment. The big data cloud model is the biggest opportunity for rail transportation to embrace the changing structure of data and maximize its use. It offers the potential for a vast shift for all rail management companies, enabling them to enhance both rail infrastructure and operations. With the rapid increase in big data applications, the level of complexity is also expected to increase due to the increasing data, emerging technologies, and the growing need to optimize cost-efficiency. These factors would influence the growth of new analytics platforms and data storage

Challenge: Data security and privacy issues related to IoT devices

The smart railways market has significant growth potential; however, maintaining data security and privacy is a key challenge faced by players operating in this market. Smart devices and sensors continuously generate a huge amount of data; this is expected to help rail operators handle data and gain insights related to the market position of their competitors. A majority of IoT-enabled devices are connected to various connectivity networks, such as mobile connectivity, public Wi-Fi, and office Wide Area Networks (WAN). Public networks may not be as protected as they are required to be at an enterprise level. Therefore, in a large-scale deployment, privacy and security are two closely related issues for IoT devices. The business data collected in the cloud and IoT-enabled devices can be vulnerable to cyber threats and breaches

Smart Railways Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

HealthHub predictive-maintenance and fleet monitoring for rolling stock and infrastructure (continuous condition monitoring and AI analytics). | Reduced downtime, lower maintenance costs, higher asset availability. |

|

Private 5G and digital services for rail operations — telemetry, predictive maintenance and readiness for FRMCS/mission-critical apps. | Deterministic connectivity, faster troubleshooting, improved operational efficiency |

|

HMAX digital asset management / condition-based maintenance (example: Copenhagen Metro deployment) using sensors and analytics. | Shift to condition-based maintenance, fewer interventions, longer component life. |

|

5G rail corridors and mission-critical 4G/5G deployments for train-to-ground communications, passenger broadband and real-time IoT | High-capacity comms, support for FRMCS, resilient passenger/operational services. |

|

FRMCS-ready train-to-ground solutions and onboard connectivity (real-time CCTV, PTT/voice, passenger information systems) | Future-proof wireless standard support, safer operations, better passenger experience |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent players in this market include well-established, financially stable smart railways providers of platforms and services, as well as regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Alstom (France), Cisco (US), Wabtec (US), ABB (Switzerland), IBM (US), Hitachi (Japan), Huawei (China), Indra Sistemas (Spain), Siemens (Germany), Honeywell (US), Thales (France), Advantech (Taiwan), Fujitsu (Japan), Toshiba (Japan), and Alcatel-Lucent Enterprise (France) are some of the key players operating in this ecosystem

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

In-building Wireless Market, By Offering

Rail analytics systems are closely integrated with all vital railway solutions to manage the overall operations of railways through a single control panel. The major activities included in rail analytics systems are railway revenue management, demand analysis and planning, transit analysis, pricing analysis, and workforce management. With the rapid increase in passenger traffic, the level of complexity will increase due to an increase in the amount of data, emerging technologies, and the constant need to optimize costs. These factors would influence the growth of new analytical platforms and data storage. Though rail analytics systems' potential is still confined to early adopters in railway transportation, they would be highly scalable and agile to deploy and integrate. The emergence of predictive analytics is expected to create new opportunities for rail analytics solutions in the smart railways market. These analytics mainly focus on estimating the resource requirements and probable congestion patterns in route planning

REGION

Europe to be largest region in global smart railways market during forecast period

Europe’s focus on upgrading its railway infrastructure is driving tremendous growth in the smart railways market. One of the major drivers is the necessity for enhanced safety via the application of advanced technology signaling systems, such as installing automatic train protection and intelligent surveillance technologies. Countries from Western Europe, such as the UK, France, and Germany, have well-established railway infrastructure, and several regional railway operators are using some of the advanced smart railway solutions. European countries have been investing heavily in the modernization and upgrade of their rail infrastructure. Social and trade agreements among the European Union (EU) countries have promoted large-scale, cross-border trade and passenger traffic in Europe. High growth is expected in the region, especially in communication technology, as the European Telecommunications Standards Institute (ETSI) has formed a separate committee to focus on Machine-to-Machine (M2M) communication privacy standardization and high trading standards. The dynamics of the rail industry in Europe are changing rapidly with new freight and passenger management systems. Several European countries are expected to adapt to the new smart railway solutions to boost the efficiency of the existing infrastructure

Smart Railways Market: COMPANY EVALUATION MATRIX

In the In-building wireless market matrix, Huawei (Star) leads with a strong market share and extensive product footprint, driven by its offering customized solutions as per customers' requirements and adopting growth strategies to achieve advanced technology consistently. Alcatel-Lucent Enterprise (Emerging Leader) is gaining visibility with its innovative solutions to cater to future smart railway demands. While Huawei dominates through scale and a diverse portfolio, Alcatel-Lucent Enterprise shows significant potential to move toward the leaders’ quadrant as demand for smart railways continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 33.72 Billion |

| Market Forecast in 2030 (Value) | USD 54.31 Billion |

| Growth Rate | CAGR of 8.3% from 2025-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Offering: Solutions (Passenger Information System, Freight Management System, Security and Safety Solutions, Rail Communication ad Networking System, Smart Ticketing System, Rail Analytics System, Rail Asset Mangement and Maintenance Solutions, Rail Operation and Control Solutions), Services (Professional Services, Managed Services) |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: Smart Railways Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | Product Analysis: Product Matrix, which gives a detailed comparison of the product portfolio of each company | Enhanced understanding of competitive positioning and product offerings |

| Leading Service Provider (EU) | Company Information: Detailed analysis and profiling of additional market players (up to 5) | Deeper insights into market dynamics and potential strategic partnerships |

RECENT DEVELOPMENTS

- March 2025 : ABB partnered with Stadler US to supply traction converters and Pro Series Traction Batteries for Metra’s battery-powered and Caltrans’ hydrogen-powered trainsets, advancing sustainable rail transport in the US. The components will be assembled at ABB’s Virginia facility to support local manufacturing and emission reduction goals

- January 2025 : Hitachi Rail agreed to acquire Omnicom from Balfour Beatty to enhance its new HMAX digital asset management platform. Omnicom’s AI-powered rail monitoring technology will support real-time infrastructure insights, boosting predictive maintenance and operational efficiency across global rail networks

- November 2024 : Alstom and Kazakhstan Railways (KTZ) signed a partnership agreement to advance rail transport along the Middle Corridor, focusing on innovation, digitalization, and local production. Alstom will invest over USD 56.8 million in service depots and infrastructure, creating 700 jobs and strengthening Kazakhstan’s role as a regional logistics hub

- September 2024 : At InnoTrans 2024, Siemens Mobility unveiled Signaling X, a cloud-based platform integrating mainline and mass transit signaling systems to boost operational efficiency and flexibility. It also introduced new Railigent X features, including fully automated and mobile inspections, aimed at enhancing rail service, optimizing infrastructure use, and supporting digitalization for sustainable transport

- September 2024 : Schaeffler signed a strategic partnership agreement with Alstom to advance reliable and sustainable rail transport solutions. The partnership focuses on long-term collaboration, innovation, and remanufacturing to support circular economy goals and enhance rail system efficiency

Table of Contents

Methodology

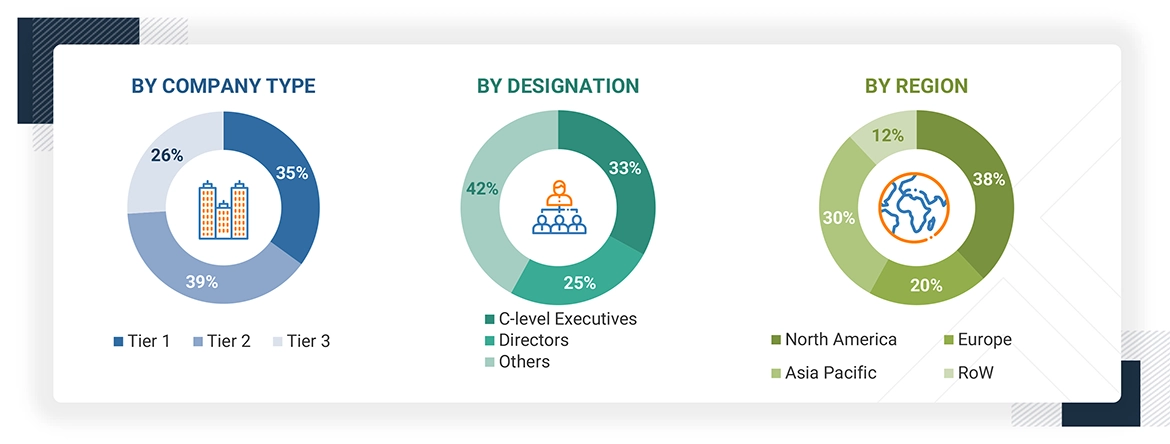

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the smart railways market. The primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market size of companies offering smart railways worldwide was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolio of major companies and rating them based on their performance and quality.

In the secondary research process, various secondary sources were referred to to identify and collect information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from the OECD, International Railway Journal, Railway Gazette International, and the US DoT. The spending by various countries in the railway sector was extracted from their respective transportation associations, such as Société Nationale Des Chemins De Fer Français (SNCF), Taiwan Railways Administration (TRA), Passenger Rail Agency of South Africa (PRASA), European Rail Freight Association, and the European Union (EU) Agency for Railways.

Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain and to identify key players through various solutions and services, market classification and segmentation according to offerings of major players, industry trends related to technologies, applications, and regions, and key developments from both market-oriented and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including chief experience officers (CXOs); vice presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from smart railways solution vendors, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as chief information officers (CIOs), chief technology officers (CTOs), chief strategy officers (CSOs), and end users using smart railways solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of smart railways solutions, which would impact the overall smart railways market.

Note: Tier 1 companies’ revenue is more than USD 1 billion; Tier 2 companies’ revenue ranges between USD

500 million and 1 billion; and Tier 3 companies’ revenue ranges between USD 100 million and 500 million. Other designations include sales

managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

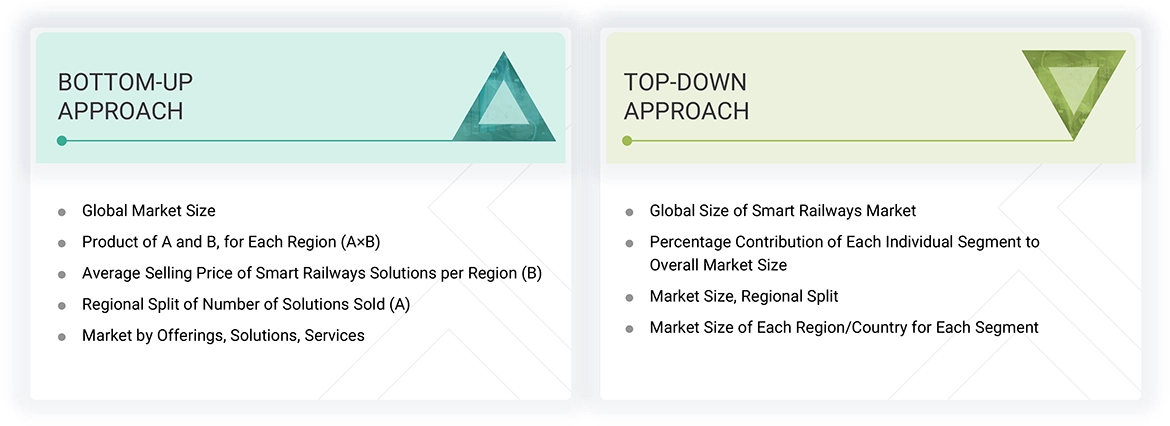

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the smart railways market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of smart railway offerings.

Top-down and bottom-up approaches were used to estimate and validate the total size of the smart railways market. These methods were also extensively used to estimate the size of various market segments. The research methodology used to evaluate the market size is listed below.

- Key players in the market were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Smart Railways Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the smart railways market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Smart railways involve the integration of advanced solutions and services that utilize Information and Communication Technology (ICT) in railway operations. This integration can transform key aspects of rail transportation, making them more focused on customer needs. By sharing data, information, and insights with supply chain partners, smart railways enhance the efficiency and effectiveness of railway services. The smart railways market is composed of various systems, associated solutions (software and applications), and services. Smart railways include passenger information systems (PIS), freight management systems, security and safety solutions, rail communication and networking systems, smart ticketing systems, rail analytics systems, rail asset management and maintenance solutions, and rail operation and control solutions. These solutions and systems optimize the performance, costs, and risks for the entire smart rail infrastructure.

Stakeholders

- Smart Railway Vendors

- Network and System Integrators (SIs)

- Cloud Service Providers

- Railway Infrastructure Providers

- Railway Support Service Providers

- National Railway Governing Authorities/Regulators/Bodies

- Railway Operators and Agencies

- Value-added Resellers (VARs) and Distributors

Report Objectives

- To determine and forecast the smart railways market by offering (solutions and services) and region

- To forecast the size of the market segments for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market’s growth

- To analyze each submarket concerning individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape

- To track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships, collaborations, and research and development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations to meet the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the definition of the smart railways market?

Smart railways involve the integration of advanced solutions and services powered by Information and Communication Technology (ICT) into railway operations. This approach can transform key aspects of rail transportation, making them more customer-centric by facilitating the sharing of data, information, and insights with supply chain partners. The smart railways market is composed of various systems, associated solutions (software and applications), and services. Smart railways include passenger information systems (PIS), freight management systems, security and safety solutions, rail communication and networking systems, smart ticketing systems, rail analytics systems, rail asset management and maintenance solutions, and rail operation and control solutions. These solutions and systems optimize the performance, costs, and risks for the entire smart rail infrastructure.

What is the market size of the smart railways market?

The smart railways market is projected to grow from USD 36.49 billion in 2025 to USD 54.31 billion by 2030 at a CAGR of 8.3% from 2025 to 2030.

What are the major drivers of the smart railways market?

The major drivers of the smart railways market include the increasing need for efficiency in rail operations, high demographic growth, hyper-urbanization, rising demand for efficient railway systems, increase in government initiatives and public-private partnerships, the adoption of IoT and other automation technologies for enhanced optimization, and technological advancements targeted toward the enhancement of customer experience.

Who are the key players operating in the smart railways market?

The key players profiled in the smart railways market include Alstom (France), Cisco (US), Wabtec (US), ABB (Switzerland), IBM (US), Hitachi (Japan), Huawei (China), Indra Sistemas (Spain), Siemens (Germany), Honeywell (US), Thales (France), Advantech (Taiwan), Fujitsu (Japan), Toshiba (Japan), Alcatel-Lucent Enterprise (France), Moxa (Taiwan), EKE-Electronics (Finland), Televic (Belgium), Uptake (US), Eurotech (Italy), Tego (US), KONUX (Germany), Aitek S.p.A (Italy), Assetic (Australia), Machines With Vision (UK), Delphisonic (US), Passio Technologies (US), CloudMoyo (US), Conduent (US), RailTel (India), and Chemito (India).

What are the key technological trends prevailing in the smart railways market?

The smart railways market is witnessing key trends like IoT for real-time data, AI for automation and optimization, and 5G for enhanced connectivity, all of which aim to improve efficiency, safety, and passenger experience.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smart Railways Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Smart Railways Market

Prabhu

Aug, 2016

Gather insights into Vendor Evaluations, Project Management Unit, Program Management, Bid Management, Project Monitoring & Auditing..