Sodium-Ion Battery Market

Sodium-ion Battery Market by Battery Type (Sodium-Sulfur and Sodium-Salt), Technology Type (Aqueous and Non-aqueous), End-use (Energy Storage, Automotive, and Industrial), and Region (Asia Pacific, Europe, and North America) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

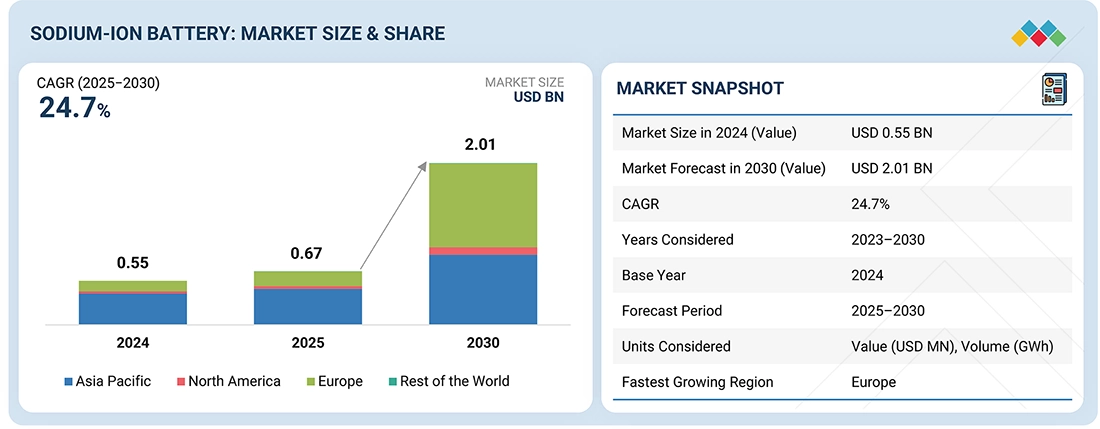

The global sodium-ion battery market is projected to grow from USD 0.67 billion in 2025 to USD 2.01 billion by 2030, at a CAGR of 24.7% during the forecast period. Sodium-ion batteries are relatively more cost-effective when compared to other batteries like lithium-ion batteries and this therefore drives the growth of the sodium-ion battery market. Sodium-ion batteries find applications in multiple industries, such as automotive, industrial, and energy storage.

KEY TAKEAWAYS

-

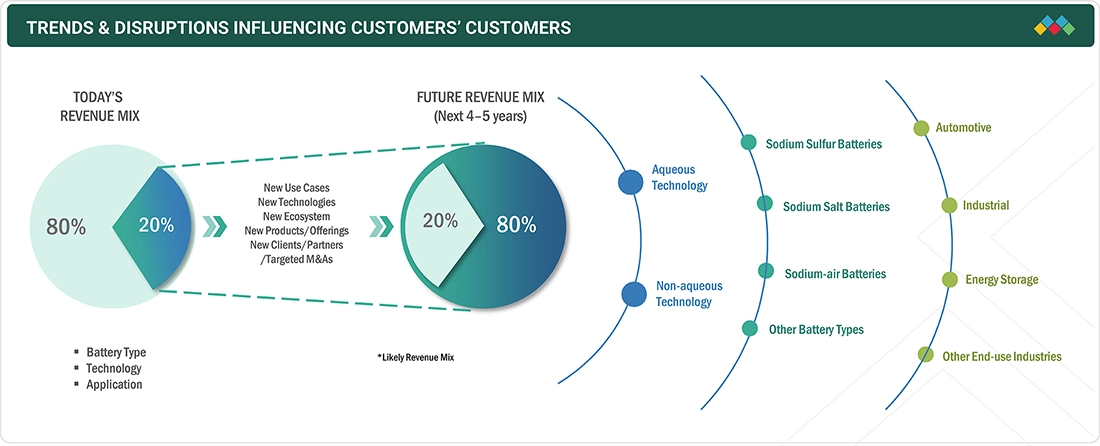

BY BATTERY TYPEThe sodium-ion battery market includes various types of batteries including Sodium Sulfur Batteries, Sodium Salt Batteries, Sodium Air Batteries, and Other Battery Types. Among the various types of sodium-ion batteries, sodium sulfur, sodium salt, sodium air, and other variants are emerging as promising contenders due to their unique characteristics and versatile applications. These batteries offer high energy density, improved safety, and cost-effectiveness, making them ideal for electric vehicles, grid energy storage, and portable electronics.

-

BY TECHNOLOGYThe sodium-ion battery market includes aqueous and nonaqueous sodium-ion batteries. Aqueous sodium-ion batteries employ water-based electrolytes, offering safety, environmental friendliness, and potential cost advantages. Nonaqueous sodium-ion batteries use nonaqueous electrolytes, offering scalability, reduced reliance on rare resources, and compatibility with large-scale applications, such as grid-level storage.

-

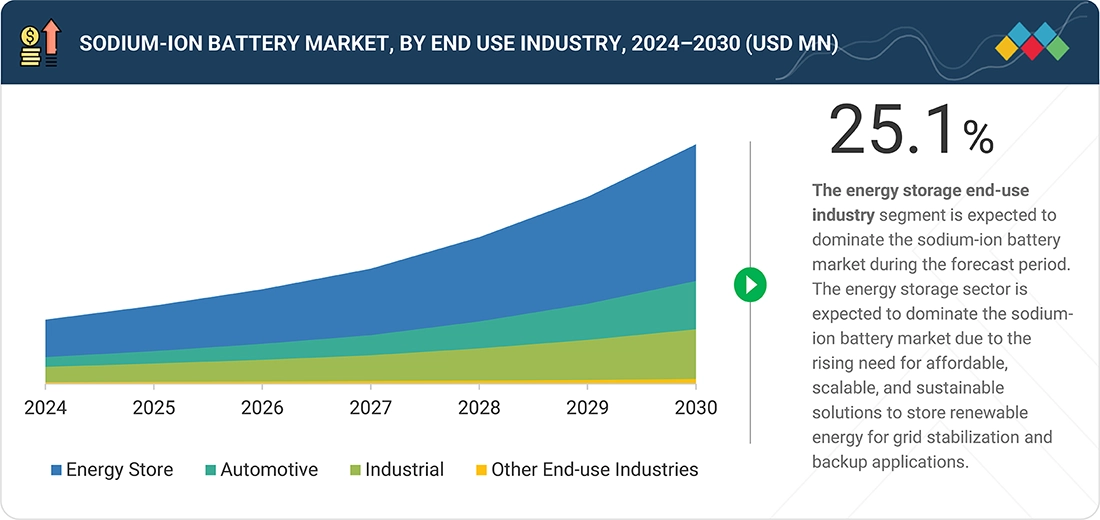

BY END-USE INDUSTRYSodium-ion batteries find usage in various sectors inluding Automotive, Industrial, Energy Storage, and Other End-use Industries. In energy storage, batteries offer a cost-effective way to store renewable energy and improve grid stability. Their potential to revolutionize automotive industries is notable, presenting a promising alternative to traditional lithium-ion batteries in electric and hybrid vehicles due to their lower cost and comparable performance. Additionally, sodium-ion batteries show great potential in industrial settings, providing reliable backup power, uninterruptible power supplies, and off-grid solutions.

-

BY REGIONThe sodium-ion batteries market covers Europe, North America, Asia Pacific, and Rest of the World. Sodium-ion batteries are becoming the preferred choice for their cost-effectiveness and sustainability, playing a vital role in the region’s transition to cleaner energy sources.

-

COMPETITIVE LANDSCAPEFaradion (UK), Contemporary Amperex Technology Co., Ltd. (China), TIAMAT Energy (France), HiNa Battery Technology Co., Ltd. (China), Jiangsu Zoolnasm Energy Technology Co., Ltd. (China), NGK Insulators Ltd. (Japan), Li-FUN Technology Corporation Limited (China), Zhejiang Natrium Energy Co., Ltd. (China), Natron Energy, Inc. (US), Jiangsu Transimage Sodium-lon Battery Technology Co., Ltd. (China) are some the leading manufacturers of sodium-ion batteries. They focus on expanding their geographic reach to meet consumer demand. These companies have adopted partnerships, acquisitions, expansions, and investments to acquire new projects, strengthen their product & service portfolios, and tap into untapped markets.

The global sodium-ion battery market is witnessing strong growth driven by the rising need for cost-effective and sustainable energy storage solutions across key end-use sectors such as automotive, industrial, and energy storage. In the automotive sector, sodium-ion batteries are gaining attention as an affordable alternative to lithium-ion batteries, particularly for electric two- and three-wheelers. The industrial segment benefits from their safety, thermal stability, and suitability for backup power and grid-support systems. Meanwhile, the energy storage sector is leading adoption due to the growing integration of renewables and the requirement for large-scale, economical storage systems. Among battery types, sodium-sulfur, sodium-salt, and sodium-air batteries are being developed to meet diverse performance needs, offering scalable, low-cost, and sustainable solutions that align with the global transition toward cleaner energy technologies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The sodium-ion battery market is undergoing rapid expansion, driven by the need for cost-effective alternatives to lithium-ion batteries. Moreover, increasing demand for sustainable energy storage solutions is also boosting this market's growth. At the same time, the abundance of sodium resources, and innovation and technological advances in sodium-ion batteries is further reinforcing market growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Need for cost-effective alternatives to lithium-ion batteries

-

Increasing demand for sustainable energy storage solutions

Level

-

Lower energy density compared to lithium-ion batteries

-

Limited cycle life of sodium-ion batteries

Level

-

Abundance of sodium resources

-

Innovation and technological advances in sodium-ion batteries

Level

-

Limited availability of high-performance materials for sodium-ion batteries

-

Wide applications of lithium-ion batteries in various industries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Need for cost-effective alternatives to lithium-ion batteries, and increasing demand for sustainable energy storage solutions

Sodium-ion batteries are a relatively cost-effective solution when compared to lithium-ion batteries. They offer significant advantages across various aspects of energy storage. Sodium-ion batteries are relatively cheaper due to the abundance and lower cost of sodium resources. This consequently reduces the overall price of sodium-ion batteries and contributes to their affordability. This cost-effectiveness of sodium-ion batteries thus leads to reduced production costs, which further escalates their attractiveness for energy storage applications. This aspect, therefore, acts as an advantage for large-scale projects such as grid storage, where cost considerations play a critical role in decision-making. Additionally, the lower price of sodium-ion batteries has a ripple effect on the electronics industry, reducing the overall cost of electronic gadgets compared to those powered by lithium-ion batteries. This cost reduction makes sodium-ion batteries not only economically appealing but also fosters their wider adoption across various consumer electronics and industrial applications, driving the shift toward more sustainable energy solutions.

Restraints: Lower energy density compared to lithium-ion batteries, and limited cycle life of sodium-ion batteries

Energy density refers to the amount of energy stored per unit of weight or volume within a battery. The lower energy density of sodium-ion batteries in comparison to that of lithium-ion batteries poses a significant challenge that impacts their suitability for various applications, such as their usage in electric vehicles (EVs). As sodium-ion batteries store less energy in comparison to lithium-ion batteries, they may fall short in meeting the demanding requirements of applications where high energy density is essential, such as EVs. When we take electric vehicles into consideration, it is imperative to, or it is desired to achieve longer driving ranges that can only be achieved by maximizing the amount of energy stored within the battery pack while keeping its weight and volume as minimal as possible. Sodium-ion batteries' lower energy density may constrain the range achievable by EVs, thereby limiting their appeal in the automotive sector. This disparity underscores the need for continued research & development efforts aimed at enhancing the energy density of sodium-ion batteries to bridge the gap with the lithium-ion technology.

Opportunity: Abundance of sodium resources, and innovation and technological advances in sodium-ion batteries

The abundance of sodium resources is a clear advantage for the sodium-ion battery technology. Unlike lithium, whose concentration is limited to specific regions and is subject to geopolitical tensions, sodium is widely distributed across the globe, with ample reserves available in various countries. This widespread availability of sodium resources mitigates supply chain risks and dependencies associated with lithium-ion batteries, offering greater resilience and stability to battery manufacturing. Sodium-ion batteries can withstand fluctuations in resource availability by reducing reliance on specific regions or suppliers for raw materials, thus ensuring a more robust and secure supply chain. Moreover, the sodium resource abundance contributes to cost stability and predictability, making sodium-ion batteries an attractive option for large-scale production and deployment. Overall, the abundant availability of sodium resources underscores the potential of the sodium-ion battery technology to offer a sustainable and reliable energy storage solution for various applications, from consumer electronics to grid-scale energy storage systems.

Challenge: Limited availability of high-performance materials for sodium-ion batteries, wide applications of lithium-ion batteries in various industries, and lack of established supply chains

The availability of high-performance materials, particularly related to sodium-ion batteries, remains a critical challenge in advancing the technology to its full potential. While materials such as Prussian white and hard carbon are promising options that can be used as cathode and anode materials, respectively, further research & development efforts are necessary to optimize their electrochemical properties, stability, and scalability for commercial production. It is imperative to ensure the long-term stability and durability of materials under various operating conditions, including extended charge-discharge cycles and high current densities, for the commercial viability of sodium-ion battery systems. Furthermore, scalability is essential to enable large-scale production of high-performance materials at an affordable cost, facilitating their integration into mass-market applications such as grid-scale energy storage and electric vehicles. Addressing the challenges associated with material availability requires interdisciplinary collaboration among researchers, engineers, and industry stakeholders to explore new synthesis methods, understand fundamental electrochemical processes, and develop innovative approaches to enhance the performance and scalability of materials for sodium-ion batteries. Through concerted efforts in research & development, high-performance materials tailored for sodium-ion batteries can be developed, paving the way for the widespread adoption of the sodium-ion battery technology.

Sodium-ion Battery Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Electric Vehicles | Strong Performance, Superior Safety, Cost-Effectiveness |

|

Electric Vehicles, and Energy Storage | Expertise in Battery Technology, Research and Development Capabilities, Supply Chain Network |

|

Electric Vehicle | High power density, enhanced safety, long lifetime, and fast charge batteries |

|

Electric Vehicles, and Energy Storage | It is cheaper when compared to lithium-ion batteries. It is also more abundant and causes lesser pollution. |

|

Electric Vehicles, and Consumer Electronics | It has a wide operating temperature range. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

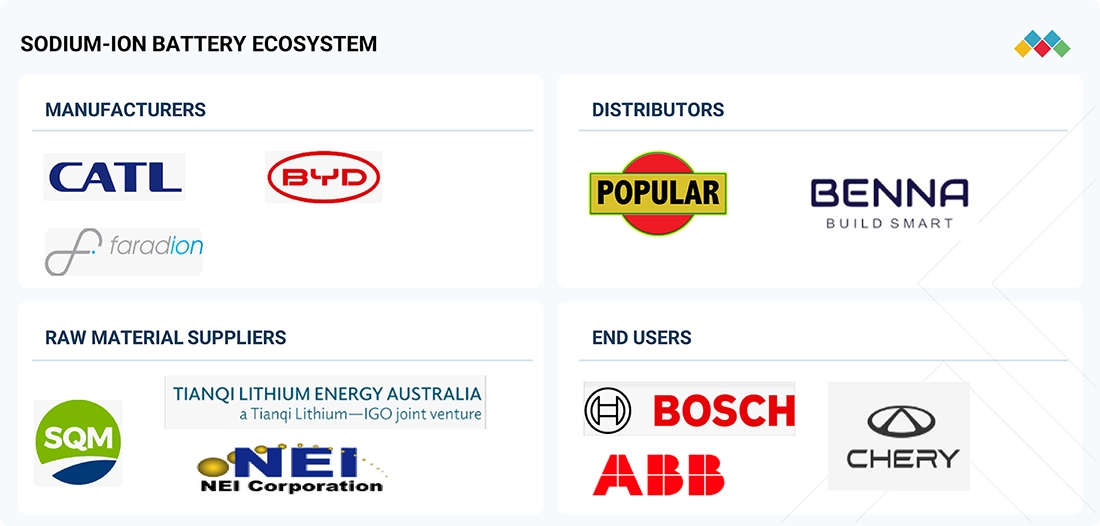

MARKET ECOSYSTEM

The sodium-ion battery market ecosystem consists of raw material suppliers, manufacturers, and end users. Prominent companies in this market include well-established and financially stable manufacturers of sodium-ion batteries. These companies have been operating in the market for several years and possess diversified product portfolios and strong global sales and marketing networks. Prominent companies in this market include Faradion (UK), Contemporary Amperex Technology Co., Ltd. (China), TIAMAT Energy (France), HiNa Battery Technology Co., Ltd. (China), and Jiangsu Zoolnasm Energy Technology Co., Ltd. (China).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Sodium-ion Battery Market, By End-use Indusry

The automotive industry is expected to grow at the fastest rate among the end-use industries of the sodium-ion battery market. The market for sodium-ion batteries is expanding at the fastest pace in the automotive sector because of the marked trend toward electric transportation. The automobile industry's growing emphasis on sustainability and clean energy technology has fueled this shift. Due to their affordability, safety features, and advantages for the environment, sodium-ion batteries have become the go-to option in this industry. Government programs supporting sustainable energy and the necessity of grid modernization have contributed to the spike in demand for sodium-ion batteries in electric vehicles. Consequently, the automotive sector has become the fastest-growing sector in the sodium-ion battery business due to its acceptance of these batteries, which has fueled their rapid expansion and domination in the market.

Sodium-ion Battery Market, By Technology

The non-aqueous sodium-ion battery segment is growing at the fastest rate in the industry, which can be attributed to their versatility and wide-ranging applications across various industries. This is because, in contrast to aqueous alternatives, non-aqueous electrolytes permit larger working voltages. Better voltages thus result in better energy densities, which are essential for long-range applications like grid storage and electric vehicles. Aqueous batteries have benefits, including cost-effectiveness and safety, but because of their lower energy density, they are better suited for stationary applications with lesser power needs.

REGION

Europe is to be fastest-growing region in global sodium-ion batery market during forecast period

The Europe region demonstrates the fastest-growing rate in the sodium-ion battery market. The increasing use of electric vehicles and renewable energy initiatives is propelling this region's growth, especially in nations like Germany, UK, and France. To reduce emissions and advance sustainable energy solutions, the need for sodium-ion batteries is growing in the transportation and power generation industries. Given the region's abundance of sodium and the growing focus on sustainability and environmental issues, sodium-ion batteries are seen as a promising technology with the potential to revolutionize the energy storage market.

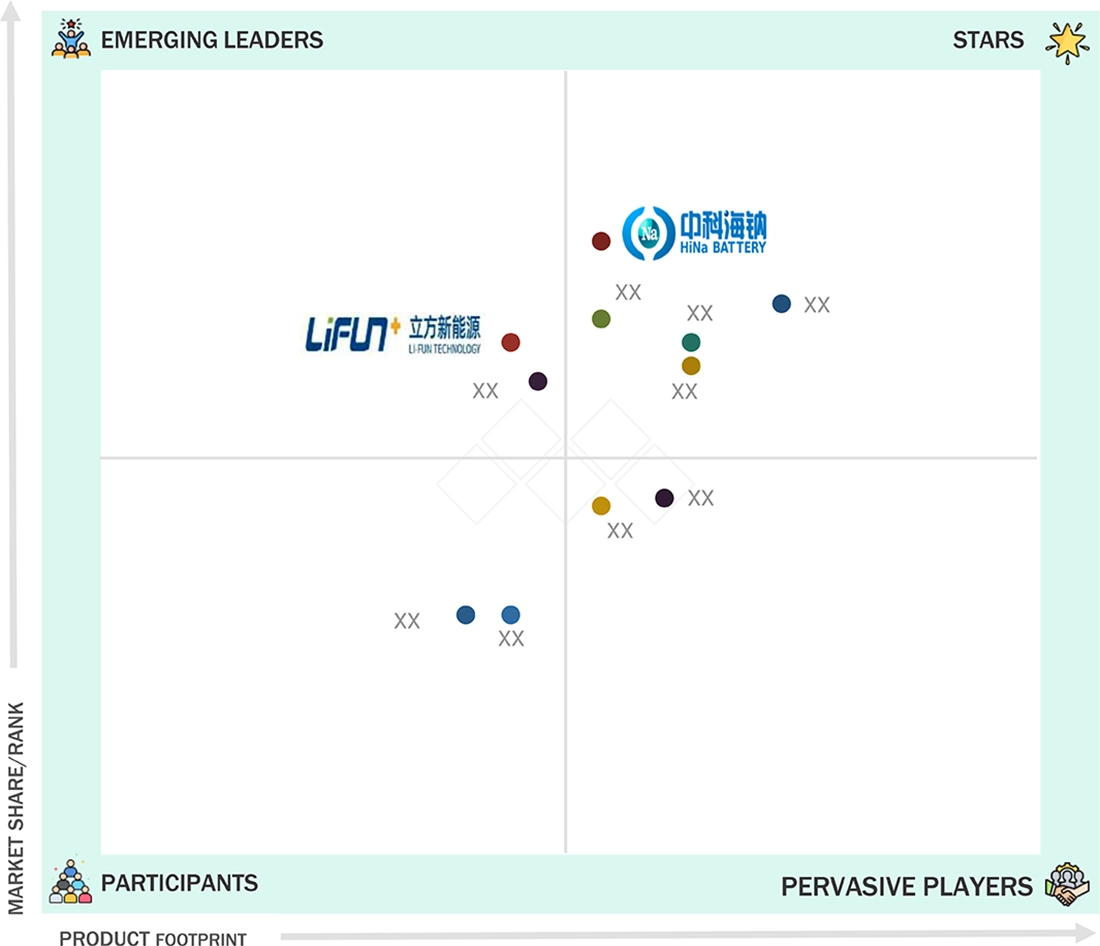

Sodium-ion Battery Market: COMPANY EVALUATION MATRIX

In the sodium-ion battery market matrix, HiNa Battery Technology Co. Ltd. With a focus on innovative technology, HiNa Battery specializes in sodium-ion battery technology, offering products with exceptional features such as extended cycle life, wide temperature range suitability, high power output, and seamless scalability for mass production. This commitment to innovation places the company at the forefront of sodium-ion battery development. Li-FUN Technology Corporation Limited, in the production and distribution of lithium-ion and sodium-ion batteries. Their diverse product line serves various sectors including industrial energy storage, electric vehicles, and household energy systems. With a focus on sodium-ion batteries, known for their cost-effectiveness, higher capacity, and superior rate performance compared to traditional lithium-ion batteries, Li-FUN has introduced two generations of sodium-ion battery technology. The company has fostered extensive research and development collaborations with prestigious international institutes like Stanford University, Oxford University, and domestic institutions such as Zhejiang University and Central South University with more than 160 R&D Engineers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.55 BN |

| Market Forecast in 2030 (value) | USD 2.01 BN |

| Growth Rate | CAGR 24.7% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD MN), Volume (GWh) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, and Rest of the World |

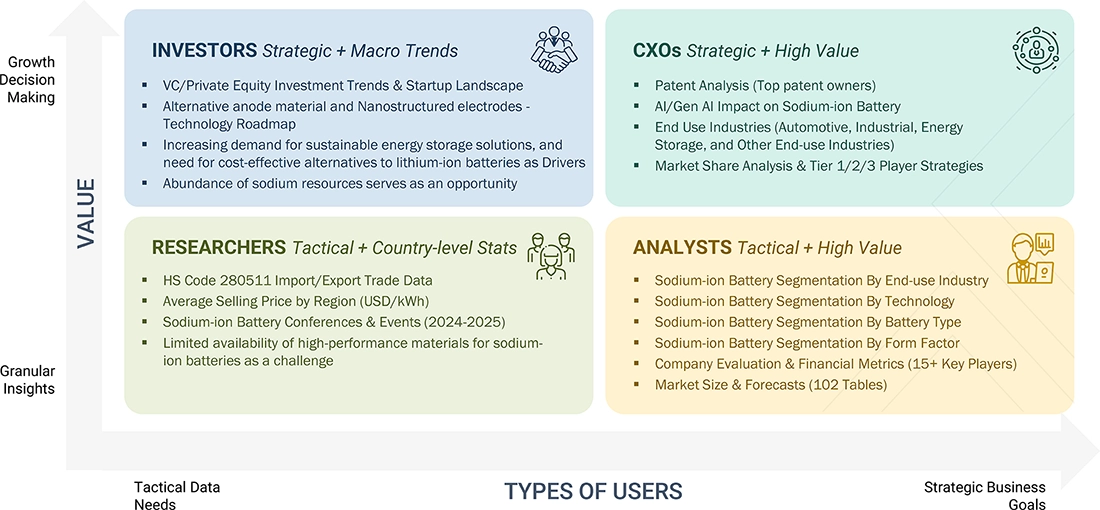

WHAT IS IN IT FOR YOU: Sodium-ion Battery Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Battery Manufacturer |

|

|

| Automotive OEM / EV Manufacturer |

|

|

| Energy Storage System (ESS) Integrator |

|

|

| Cathode/Anode Material Supplier |

|

|

| Raw Material Supplier (Sodium, Carbon, Aluminum Foil Producers) |

|

|

RECENT DEVELOPMENTS

- January 2024 : JAC Group made a groundbreaking move in the electric vehicle (EV) industry by introducing China's first mass-produced electric vehicle powered by sodium-ion batteries. This milestone delivery, part of the Yiwei brand, features cutting-edge sodium-ion cylindrical cells supplied by HiNa Battery Technology.

- February 2024 : Sodion Energy introduced India's first sodium-ion batteries, marking a significant advancement in the energy storage technology. These sodium-ion batteries are poised to revolutionize various sectors, including electric vehicles and home appliances, offering a versatile and sustainable energy storage solution.

- March 2024 : Contemporary Amperex Technology Co., Ltd. planned to establish a research & development center in Hong Kong at the Hong Kong Science Park, with an expected recruitment of approximately 500 staff members. The company's decision to set up a research base in Hong Kong is seen as strategic, leveraging the city's international hub status and talent pool while diversifying its market globally.

- April 2024 : Natron Energy commenced the first-ever commercial-scale production of sodium-ion batteries in the US at its Holland, Michigan facility. The plant, now capable of producing 600 megawatts annually, enhances the domestic battery supply chain while offering higher power density, faster recharge cycles, and improved safety compared to lithium-ion alternatives. With over USD 40 million invested in facility upgrades, this expansion supports data centers, EV fast charging, industrial mobility, and telecom applications.

- June 2024 : Altris, a Swedish developer and prototype manufacturer of sodium-ion batteries, and Stora Enso, a leading provider of renewable products in packaging, biomaterials, and wooden construction, announced a partnership. Together, the two companies will drive the adaptation of Stora Enso’s hard carbon solution Lignode as an anode material in Altris’ sodium-ion battery cells.

- October 2024 : CATL launched the Freevoy Super Hybrid Battery, a revolutionary energy solution for hybrid vehicles. This battery integrates the sodium-ion and lithium-ion technologies, ensuring exceptional performance in extreme temperatures, with a pure electric range exceeding 400 km and ultra-fast 4C charging. Designed for EREVs and PHEVs, Freevoy enhances energy efficiency, accelerates charging speeds, and improves system control precision, marking a significant advancement in sustainable mobility.

- September 2024 : Jiangsu Zoolnasm Energy Technology Co. Ltd. and Suzhou Jiaofa Baige Digital Energy Technology Co., Ltd. jointly launched Suzhou’s first sodium-ion battery charging and swapping demonstration project for two-wheeled vehicles. This initiative utilizes the sodium iron sulfate sodium-ion battery technology along with AIoT-powered intelligent charging and swapping cabinets to provide safe, efficient, and environmentally friendly battery-swapping services. The project enhances battery safety, extends lifecycle performance, and supports sustainable urban mobility solutions.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the sodium-ion battery market. Exhaustive secondary research was undertaken to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the sodium-ion battery value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; sodium-ion battery manufacturing companies, regulatory bodies, trade directories, and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The sodium-ion battery market comprises several stakeholders, such as raw material suppliers, technology support providers, sodium-ion battery manufacturers, and regulatory organizations in the supply chain. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the sodium-ion battery market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

The following is the breakdown of the interviews with experts:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, the top-down and bottom-up approaches have been used to estimate and validate the total size of the sodium-ion battery market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study:

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the sodium-ion battery market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both, quantitative and qualitative.

Global Sodium-ion Battery Market Size: Bottom-up and Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides of the oil & gas sector.

Market Definition

A sodium-ion battery is a type of rechargeable battery that uses sodium ions as the charge carriers during the electrochemical reactions that occur within the battery cell. Sodium-ion batteries store and release electrical energy through the movement of ions between the negative and positive electrodes during the charging and discharging cycles. In a sodium-ion battery, the cathode typically contains a sodium-based compound, such as sodium cobalt oxide (NaCoO2) or sodium iron phosphate (NaFePO4), while the anode is often composed of materials capable of intercalating sodium ions, such as hard carbon (graphite-like carbon) or various metal alloys.

During charging, sodium ions are extracted from the cathode and migrate through the electrolyte to the anode electrode, where they are stored within the structure of the anode material. Conversely, during discharge, the stored sodium ions move back to the cathode electrode through the electrolyte, releasing electrical energy that can be used to power electronic devices or systems.

Stakeholders

- Raw Material Manufacturers

- Technology Support Providers

- Manufacturers of Sodium-ion Batteries

- Traders, Distributors, and Suppliers

- Regulatory Bodies and Government Agencies

- Research & Development (R&D) Institutions

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

Report Objectives

- To analyze and forecast the market size of the sodium-ion battery market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the market

- To analyze and forecast the global sodium-ion battery market on the basis of battery type, technology type, end-use, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on three major regions: Asia Pacific, Europe, and North America, along with their respective key countries

- To track and analyze competitive developments, such as acquisitions, partnerships, collaborations, agreements, and expansions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Key Questions Addressed by the Report

What is the key driver for the sodium-ion battery market?

Cost-effectiveness of sodium-ion batteries in comparison to lithium-ion batteries is a force driving the sodium-ion battery market.

Which region is expected to register the highest CAGR in the sodium-ion battery market during the forecast period?

Europe is projected to register the highest CAGR during the forecast period.

What is the major source of the main component of the sodium-ion battery?

Sodium, which is widely distributed and easily accessible in nature, is the main component in sodium-ion batteries. Compared to lithium, sodium is more widely available geographically and can be obtained from a variety of substances, including sea salt (NaCl). Sodium is abundant in salt water and the earth's crust and can be easily accessed as the raw material for the manufacture of sodium-ion batteries.

Who are the major players in the sodium-ion battery market?

The key players operating in the market include Faradion (UK), Contemporary Amperex Technology Co., Ltd. (China), TIAMAT Energy (France), HiNa Battery Technology Co., Ltd. (China), and Jiangsu Zoolnasm Energy Technology Co. Ltd. (China).

At what CAGR is the sodium-ion battery market expected to grow between 2025 and 2030?

The market is expected to record a CAGR of 24.7% between 2025 and 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Sodium-ion Battery Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Sodium-ion Battery Market