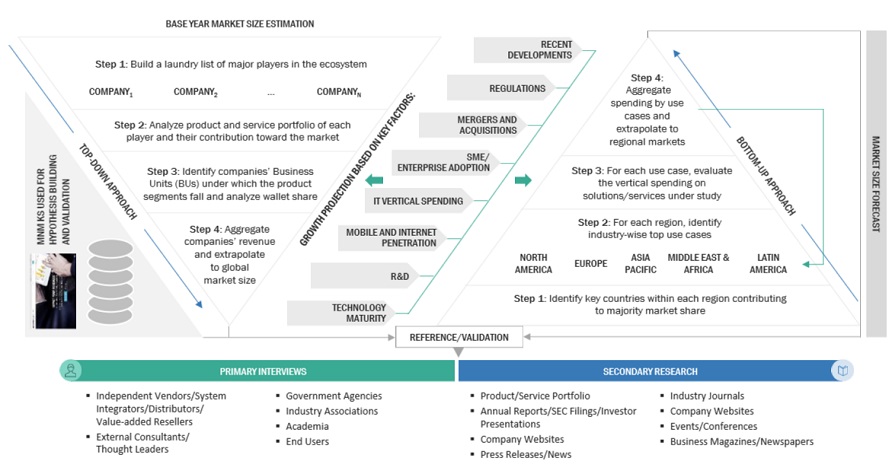

The study comprised four main activities to estimate the SDDC market size. We conducted significant secondary research to gather data on the market, the competing market, and the parent market. The following stage involved conducting primary research to confirm these conclusions and hypotheses and sizing with industry experts throughout the value chain. The overall market size was evaluated using a blend of top-down and bottom-up approach methodologies. After that, we estimated the market sizes of the various SDDC market segments using the market breakup and data triangulation techniques.

Secondary Research

We determined the size of companies offering SDDC solutions and services based on secondary data from paid and unpaid sources. We also analyzed major companies' product portfolios and rated them based on their performance and quality.

IIn the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the spending of various countries on the SDDC market was extracted from the respective sources. We used secondary research to obtain the critical information related to the industry's value chain and supply chain to identify the key players based on solutions, services, market classification, and segmentation according to components of the major players, industry trends related to components, users, and regions, and the key developments from both market- and technology-oriented perspectives.

Primary Research

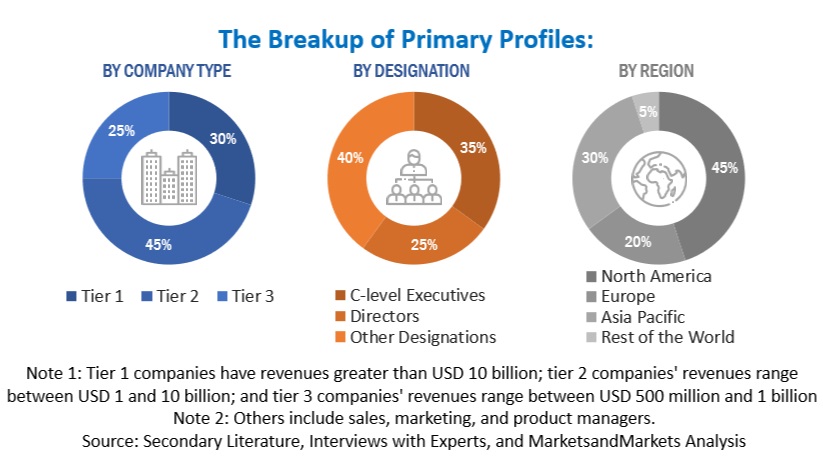

In the primary research process, we interviewed various primary sources from the supply and demand sides of the SDDC market to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from vendors providing SDDC offerings, associated service providers and is operating in the targeted countries. all possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), we conducted extensive primary research to gather information and verify and validate the critical numbers arrived at. The primary research also helped identify and validate the segmentation, industry trends, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies. In the complete market engineering process, the bottom-up approach and several data triangulation methods were extensively used to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. We conducted an extensive qualitative and quantitative analysis of the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The SDDC and related submarkets were estimated and forecasted using top-down and bottom-up methodologies. We used the bottom-up method to determine the market's overall size, using the revenues and product offerings of the major market players. This research ascertained and validated the precise value of the total parent market size through data triangulation techniques and primary interview validation. Next, using percentage splits of the market segments, we utilized the overall market size in the top-down approach to estimate the size of other individual markets.

Top Down and Bottom Up Approach of SDDC Market.

To know about the assumptions considered for the study, Request for Free Sample Report

The research methodology used to estimate the market size included the following:

-

We used primary and secondary research to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

-

Throughout the process, we obtained critical insights by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

-

We used primary sources to verify all percentage splits and breakups, which we calculated using secondary sources.

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

Considering the views of various sources and associations, a Software-Defined Data Center (SDDC) is an IT model where all infrastructure components—computing, storage, networking, and security—are virtualized and delivered as a service. The management and provisioning of these components are controlled by software rather than dependent on physical hardware.

According to IBM, the SDDC extends virtualization from computing to storage and networking resources, providing a single software toolset to manage those virtualized resources. It results from years of evolution in server virtualization.

As per HPE, SDDC refers to a data center where infrastructure is virtualized through abstraction, resource pooling, and automation to deliver Infrastructure-as-a-Service (IaaS).

Key Stakeholders

-

IT infrastructure equipment providers

-

Support infrastructure equipment providers

-

Component providers

-

Software providers

-

System integrators

-

Network service providers

-

Monitoring service providers

-

Professional service providers

-

Distributors and resellers

-

Cloud providers

-

Colocation providers

-

Enterprises

-

Government and standardization bodies

-

Telecom operators

-

Healthcare organizations

-

Financial organizations

-

Data center vendors

Report Objectives

-

To define, describe, and forecast the Software-Defined Data Center (SDDC) market based on offerings, solutions, organization size, end users, and regions

-

To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

-

To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

-

To forecast the market size concerning five central regions—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

-

To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

-

To profile the key players of the market and comprehensively analyze their market size and core competencies

-

To track and analyze the competitive developments, such as product enhancements, product launches, acquisitions, partnerships, and collaborations, in the SDDC market globally

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product analysis

-

The product matrix provides a detailed comparison of each company's portfolio.

Geographic analysis

-

Further breakup of the SDDC market

Company information

-

Detailed analysis and profiling of five additional market players

Growth opportunities and latent adjacency in Software-Defined Data Center Market