Synthetic Leather Market

Synthetic Leather Market by Type (PU based, PVC based, and Bio based), End-use Industry (Footwear, Furnishing, Automotive, Clothing, Bags, Purses, & Wallets), and Region - Global Forecast to 2029

Updated on : November 27, 2025

SYNTHETIC LEATHER MARKET

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

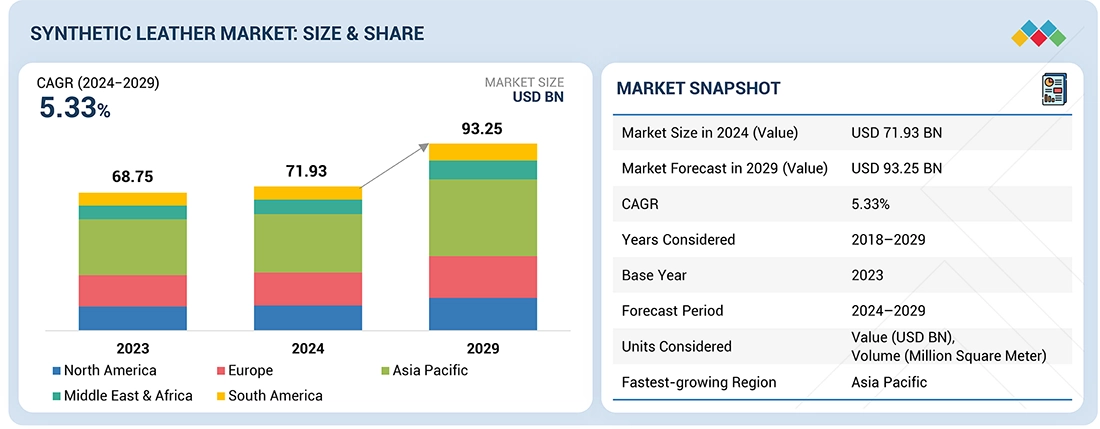

The global synthetic leather market is estimated to grow from USD 71.93 billion in 2024 to USD 93.25 billion by 2029, at a CAGR of 5.33% between 2024 to 2029. Synthetic leather, also referred to as faux leather, is an artificial fabric made mostly from polyurethane (PU) or polyvinyl chloride. This type of leather is further treated and dyed to resemble pure leather. It has several features, including durability, stain resistance, and exposure to various weather conditions. A major driver for the synthetic leather market is rising demand for eco-friendly and cruelty-free alternatives in fashion, automotive, and upholstery industries is driving synthetic leather market growth.

KEY TAKEAWAYS

-

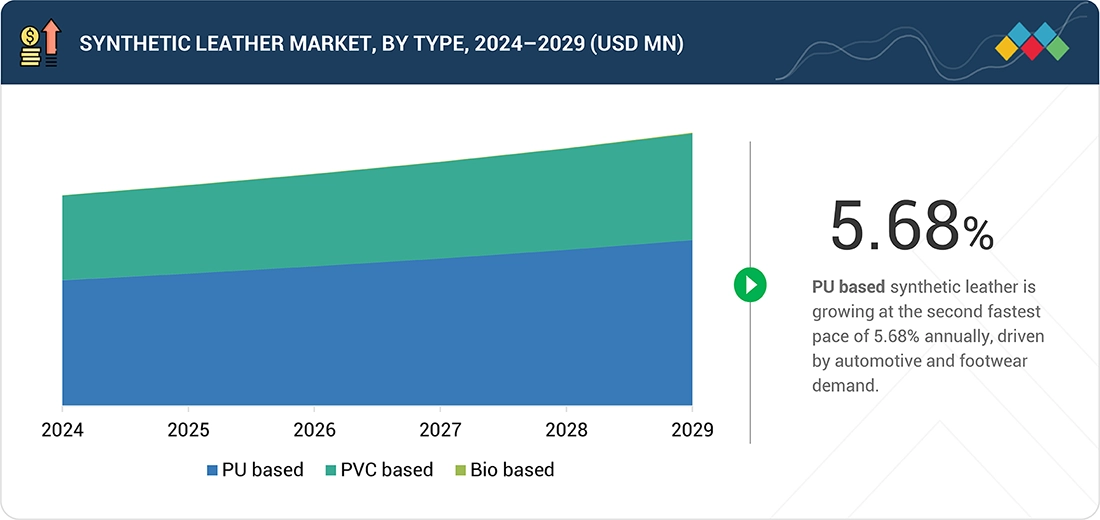

BY TYPEThe eco-friendly appeal and sustainable production practices of bio-based synthetic leather have made it one of the fastest-growing types. Bio-based synthetic leather reduces reliance on petroleum-based components often present in conventional synthetic leathers by using renewable resources for producing it, such as cork, algae, or plant-based polymers. Greener options are becoming more popular among businesses and customers alike in an environmentally concerned society. Additionally, bio-based synthetic leather has a lower carbon impact than non-bio-based synthetic leather while yet being just as gorgeous and long-lasting. Bio-based synthetic leather is becoming more and more popular as an eco-friendly alternative since more buyers are looking for sustainable furniture, fashion, and car interiors

-

BY END-USE INDUSTRYThe footwear segment of the synthetic leather market is expanding at its fastest pace due to the growing need for fashionable, long-lasting, and reasonably priced substitutes for real leather. Synthetic leather is extremely adaptable, allowing for the creation of new designs and seeming to be simply maintained with diverse textures and finishes, from which many types of footwear styles may be constructed. Eco-friendly synthetic leather, on the other hand, gained popularity as a substitute as consumers' understanding of environmental sustainability and animal welfare increased. In addition, the fact that synthetic leather is less expensive to produce than traditional leather adds to the developing global trend of employing this material in sandals, boots, and shoes.

-

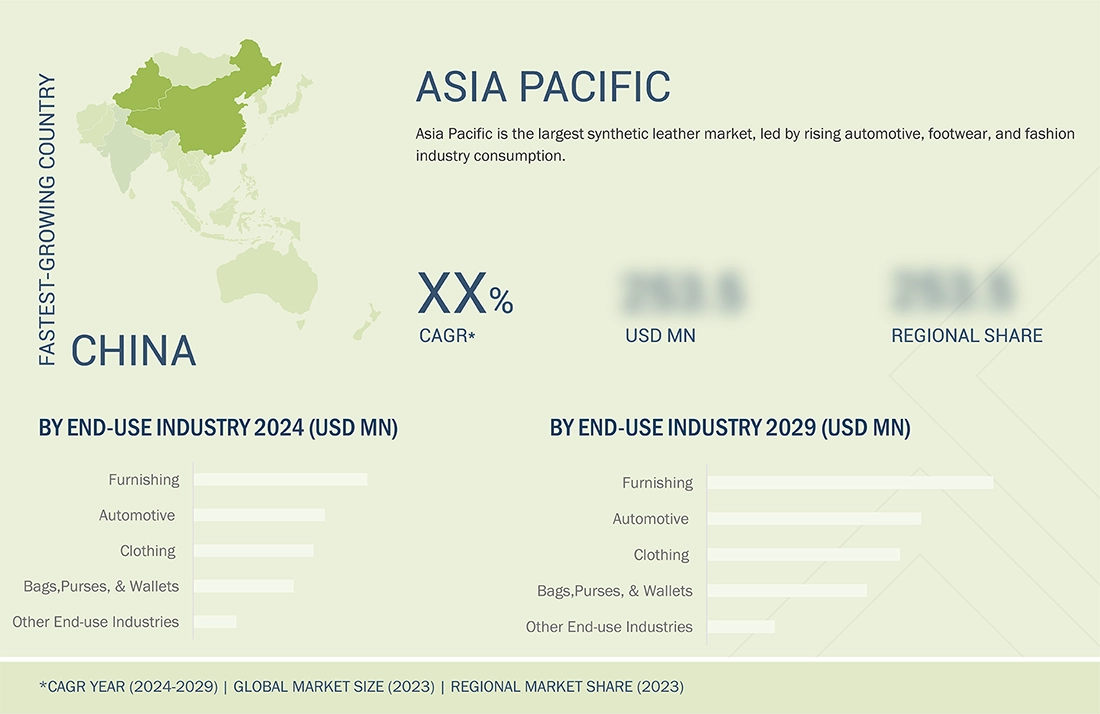

BY REGIONAsia Pacific has emerged as the fastest-growing synthetic leather market due to increased industrialization, urbanization, and rising disposable incomes. The low labor costs and extensive industrial bases in China, India, and Vietnam have made them key production hubs for synthetic leather items. In addition, customers are moving toward more economical, durable, and eco-friendly alternatives to real leather, which is driving up demand for synthetic leather in sectors including fashion, footwear, and automobiles. In addition, government sustainability initiatives and the expanding retail and e-commerce industries would enable this sector to play a major role in the expansion of the synthetic leather market.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including expansion, collaborations, partnerships, acquisitions and investments. For instance, Wanhua Chemical Group Co., Ltd. and Henkel Group signed a strategic cooperation letter for the next five years. This collaboration provided a diversified solution for consumer goods, household, and automobile customers.

Synthetic leather is made of bio-based or artificial materials such as polyurethane (PU) and polyvinyl chloride (PVC). It is highly used in the furniture, fashion, footwear, and automotive industries due to its affordability, robustness, and adaptability. Footwear and automobile companies, which seek distinctive, lightweight, affordable, and low-maintenance substitutes for genuine leather, are the major demand generators for synthetic leather. The synthetic leather market is expanding significantly with a rising focus on sustainability and demand for eco-friendly alternatives to traditional leather. The continuous improvements in the quality, appearance, and versatility of synthetic leather and advancements in manufacturing processes contribute to market growth.

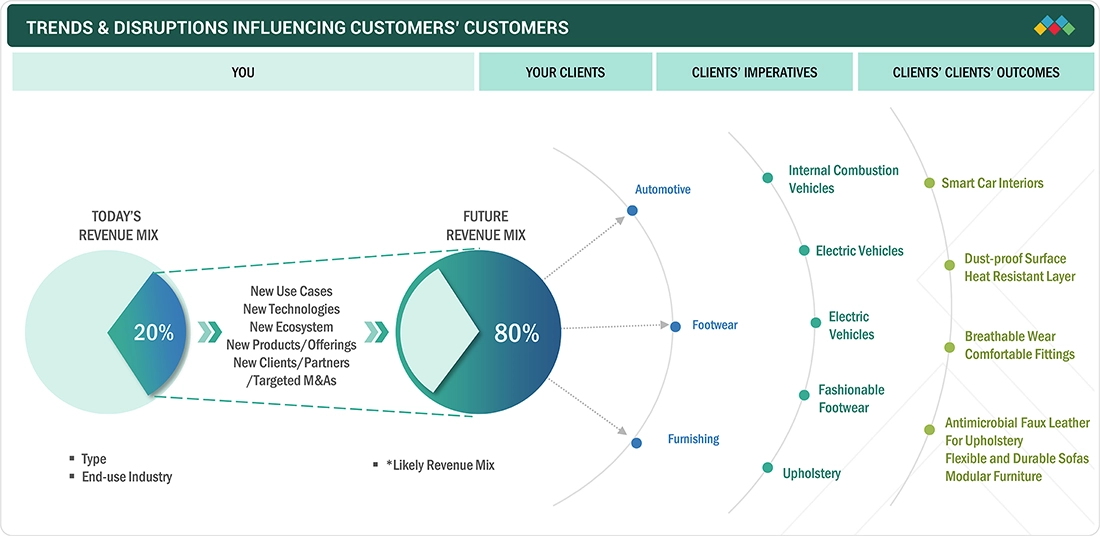

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The megatrends that include material transformation are expected to impact a company’s revenue stream. For example, smart car interiors, dustproof and heat-resistant surfaces, and luxurious cars are emerging trends in the automotive industry. These trends are pushing automobile manufacturers to use synthetic leather in automobile interiors. Similarly, the upcoming trends and advancements in the footwear and furnishing industries are leading manufacturers to produce durable, high-quality synthetic leather. Therefore, it is estimated that bio-based synthetic leather is expected to account for the largest market share in the future as compared to conventional synthetic leather due to low maintenance, better finish, and low cost

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

SYNTHETIC LEATHER MARKET DYNAMICS

Level

-

Expanding footwear and apparel industries

-

Rising concerns about animal welfare and environmental impact

Level

-

Environmental impacts related to use of PVC and PU in synthetic leather production

-

Availability of substitutes for synthetic leather in automotive industry

Level

-

Growing demand for sustainable synthetic leather solutions

Level

-

Challenges in waste management and recycling of synthetic leather

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expanding footwear and apparel industries

The expanding footwear and apparel industries mainly drive the growth of the synthetic leather market. Synthetic leather, offering low-cost, durable alternatives to genuine leather, is highly used to make shoes, bags, and clothing. The demand for synthetic leather-based products is surging as they offer a combination of style, comfort, and affordability. The rising preference for environmentally friendly materials not involving animal-based products in the fashion industry is fueling the demand for synthetic leather. Quick production and easy availability of synthetic leather have led to significant demand from fashion brands. Footwear companies, which seek distinctive, lightweight, affordable, and low-maintenance substitutes for genuine leather, are the major demand generators for synthetic leather.

Restraint: Environmental impacts related to use of PVC and PU in synthetic leather production

Environmental concerns are linked to synthetic leather production using PVC and PU. PVC based synthetic leather is non-biodegradable and releases toxic chemicals during production, polluting the environment. Although PU is safer for the environment, the methods involved in its manufacturing include chemical processing, which has negative impacts on air and water bodies. The overall sustainability of synthetic leather is limited by the environmental impacts associated with its production, disposal, and degradation. Growing consumer awareness regarding environmental safety has made people more conscious of the need for manufacturers to use environmentally friendly practices and lessen the impacts of synthetic leather production on the ecosystem.

Opportunity: Growing demand for sustainable synthetic leather solutions

The surging demand for sustainable solutions across various industries, including fashion and automotive, is creating growth opportunities for the market players. Apart from being environmentally friendly, consumers nowadays desire animal-free substitutes for traditional leather. Such changes open up many possibilities for companies to develop synthetic leather made from bio-based or recycled materials that are biodegradable or more sustainable. Manufacturers will have a competitive edge to attract environmentally concerned consumers and industries looking for solutions to reduce their carbon footprints while increasing their business revenues.

Challenge: Challenges in waste management and recycling of synthetic leather

The recycling and waste management of synthetic leather products are two major challenges the market players face. Most synthetic leather types are non-biodegradable and are thus disposed of in landfills, leading to environmental contamination. The complicated structure and chemical treatment used in product manufacturing makes recycling such materials challenging. A significant amount of waste is generated as the development of efficient recycling solutions continues. To reduce the impact on the environment and cater to consumer complaints about waste, producers must investigate ways to improve the recycling of synthetic leather.

Synthetic Leather Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Footwear manufacturing (Air Force 1, Air Max) | Reduces carbon footprint using 50% recycled leather and 50% recycled polyester. |

|

Electric vehicle interiors (vegan interiors) | Supports ethical consumerism and reduces environmental impact. |

|

Footwear using Mirum, a plant-based leather | Eliminates harmful chemicals and enhances sustainability in production. |

|

High-fashion apparel and accessories | Aligns with luxury demand for cruelty-free and eco-friendly products. |

|

Lab-grown leather alternatives for fashion | Reduces reliance on animal products and minimizes environmental impact. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

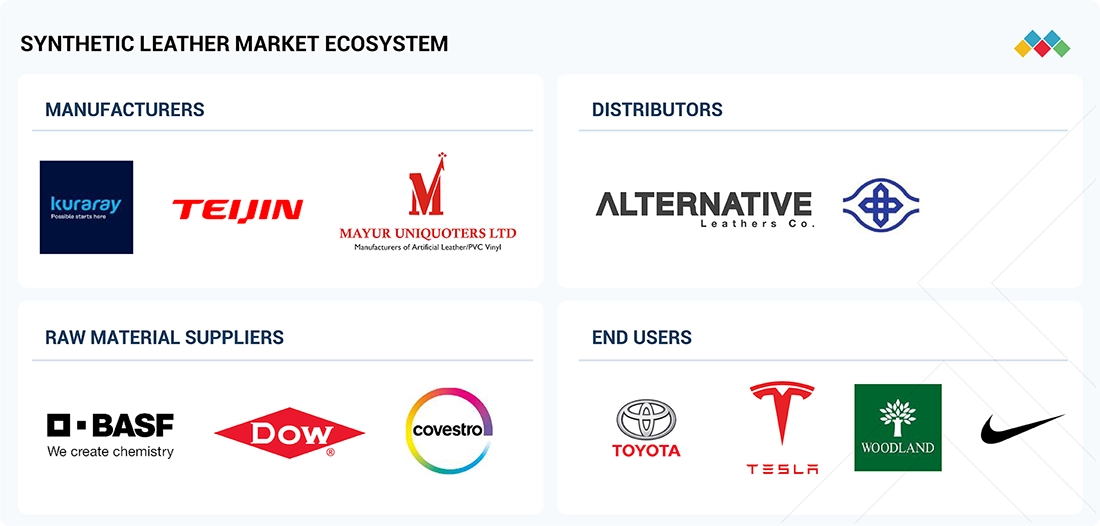

SYNTHETIC LEATHER MARKET ECOSYSTEM

The synthetic leather market ecosystem includes distributors, manufacturers, raw material suppliers, and end-use industries. Raw materials suppliers provide the essential components needed to make synthetic leather, including PVC, PU, bio based polymers, and additives. Manufacturers turn these materials into synthetic leather, guaranteeing excellence, functionality, and creative designs for various industries. Distributors guarantee product distribution via channels such as wholesalers, retailers, and major producers, bridging the gap between manufacturers and end users. End-use industries include automotive, fashion, footwear, and furniture. These industries generate a high demand for synthetic leather.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

SYNTHETIC LEATHER MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Synthetic Leather Market, By Type

The PU based synthetic leather segment is expected to hold the largest market share because of its exceptional qualities, including flexibility, durability, and superior production techniques that have less environmental impact than PVC based synthetic leather. These features make it an ideal material for the fashion, automotive, and footwear industries. Besides, it is lightweight, breathable, and has an excellent appearance. PU based synthetic leather is gaining popularity for environmentally friendly applications because of the growing customer desire for sustainable substitutes for genuine leather. PU synthetic leather is the most widely used type in the market in terms of volume due to its versatility and ability to substitute genuine leather.

Synthetic Leather Market, By End-use Industries

The footwear industry is expected to hold the highest share of the synthetic leather market, owing to rising demand for affordable, trendy, and durable footwear. Synthetic leather is gaining popularity as an alternative to conventional leather due to its adaptability, ease of care, reduced cost, and equal performance compared to genuine leather. Most companies are using synthetic leather to make shoes, boots, and sandals with the rising trend of environmentally friendly materials. Alongside consumer trends toward sustainability and fashion, emerging economies have witnessed rapid expansion of the footwear industry, fueling the growth of the synthetic leather market.

REGION

Asia Pacific to be largest and fastest-growing synthetic leather market during forecast period

Asia Pacific will likely be the largest and fastest-growing synthetic leather market during the review period. The presence of a strong manufacturing base in China, India, and Vietnam, low labor costs, high production capacities, and the expansion of the e-commerce and retail industries are driving the regional market growth. Besides, the rising middle-class population, increasing disposable income, and growing preference for eco-friendly products that do not involve animal-based materials are fueling the demand for durable synthetic leather-based products over genuine leather-based products in the region.

Synthetic Leather Market: COMPANY EVALUATION MATRIX

In the synthetic leather market matrix, Nan Ya Plastics Corporation (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across industries. Filwel Co., Ltd. (Emerging Leader) is gaining traction due to its diversified product portfolio and continuous investment in R&D. While Nan Ya Plastics Corporation dominates with scale, Filwel Co., Ltd. shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

SYNTHETIC LEATHER MARKET PLAYERS

SYNTHETIC LEATHER MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 71.93 BN |

| Revenue Forecast in 2029 | USD 93.25 BN |

| Growth Rate | CAGR of 5.33% from 2024-2029 |

| Actual data | 2018−2029 |

| Base year | 2023 |

| Forecast period | 2024−2029 |

| Units considered | Value (USD Billion) and Volume (Million Square Meter) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

| Leading Segment | PU based synthetic leather growing at 5.68% CAGR |

| Leading Region | Asia Pacific |

| Market Driver | Expanding Footwear and apparel industries |

| Market Constraint | Environmental impacts related to use of PU and PVC in synthetic leather production |

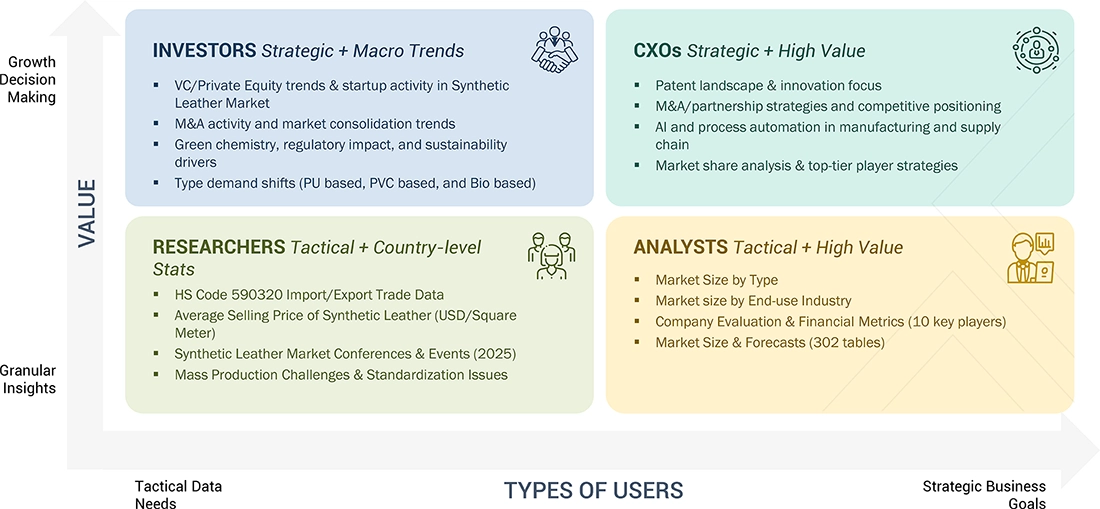

WHAT IS IN IT FOR YOU: Synthetic Leather Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe -based Synthetic Leather Manufacturer | • Detailed Europe based company profiles of competitors (financials, product portfolio) • Customer landscape mapping by application sector • Partnership ecosystem analysis | • Identify interconnections and supply chain blind spots • Detect customer migration trends across the industry • Highlight untapped customer clusters for market entry |

| Asia Pacific-based Synthetic Leather Manufacturer | • Global & regional production capacity benchmarking • Customer base profiling across the end-use industries | • Strengthen forward integration strategy • Identify high-demand customers for long-term supply contracts • Assess supply-demand gaps for competitive advantage |

RECENT DEVELOPMENTS

- June 2023 : Wanhua Chemical Group Co., Ltd. and Henkel Group signed a strategic cooperation letter for the next five years. This collaboration provided a diversified solution for consumer goods, household, and automobile customers

- May 2023 : San Fang Chemical Industry announced that it would develop a new synthetic leather for footwear. The new product is expected to be more breathable and comfortable than traditional synthetic leather

- April 2023 : Wanhua Chemical Group Co., Ltd. and KUKA Home Furnishing Co., Ltd. jointly established an innovation laboratory in Hangzhou

Table of Contents

Methodology

The study involved four major activities in order to estimating the current size of the synthetic leather market. Exhaustive secondary research conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva; and publications and databases from associations, including The Fiber Society, CIRFS European Man-Made Fibres Association, American Fiber Manufacturers Association (AFMA), Synthetic Yarn and Fabric Association, The Fibre Optic Association Producers Association of Synthetic Leather.

Primary Research

Extensive primary research was carried out after gathering information about synthetic leather market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the synthetic leather market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to type, end use industry, and region.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| LG Chem | Sumitomo Corporation | |

| Resonac Corporation (Showa Denko K.K.) | Toray International, Inc. | |

| Nanocyl SA | Cabot Corporation | |

Market Size Estimation

The following information is part of the research methodology used to estimate the size of the synthetic leather market. The market sizing of the synthetic leather market was undertaken from the demand side. The market size was estimated based on market size for synthetic leather in various type.

Global Synthetic Leather Market Size: Bottom-Up Approach and Top-Down Approach

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Synthetic leather, also referred to as faux leather, is an artificial fabric made mostly from polyurethane (PU) or polyvinyl chloride. This type of leather is further treated and dyed to resemble pure leather. It has several features, including durability, stain resistance, and exposure to various weather conditions.

However, the International Journal of Advance Research, Ideas, and Innovations in Technology defines faux leather as the substance used to make leather clothes, furniture, and even automotive interiors. The term "faux" is derived from French and means fake or not real. The use of imitation leather instead of actual leather is to

Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the synthetic leather market based on type, end use industry, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the synthetic leather market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Synthetic Leather Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Synthetic Leather Market