Thermoplastic Elastomers Market

Thermoplastic Elastomers Market by Type (SBC, TPU, TPO, TPV, COPE, PEBA), End-use Industry (Automotive, Building & Construction, Footwear, Wire & Cable, Medical, Engineering), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

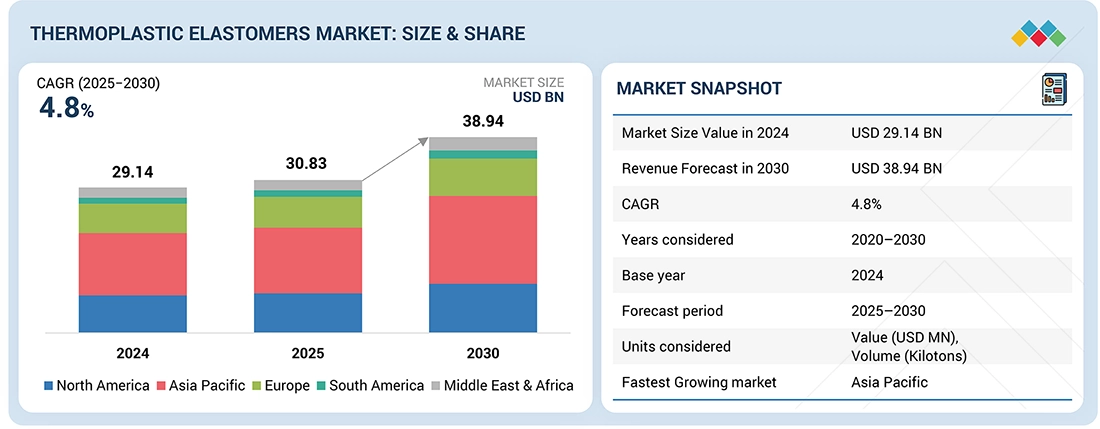

The thermoplastic elastomers market is expected to reach USD 38.94 billion by 2030 from USD 30.83 billion in 2025, at a CAGR of 4.8% during the forecast period. Thermoplastic elastomers (TPEs) are versatile polymers that combine rubber-like elasticity with plastic-like processability. They are durable, flexible, and easy to mold. They are ideal for automotive, medical, and consumer products. The market for thermoplastic elastomers is experiencing impressive growth, fueled by increasing demand in various sectors like automotive, consumer goods, medical, construction, and electronics. Thermoplastic elastomers blend the easy processing of plastics with the flexibility of rubber, offering outstanding durability, chemical resistance, and lightweight characteristics. Sustainability trends and the regulatory initiatives of organizations like the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are enabling thermoplastic elastomers’ transition to recyclable and eco-friendly materials, further driving their adoption.

KEY TAKEAWAYS

-

BY TYPEThe Thermoplastic Elastomers market by type includes SBC, TPU, TPO, TPV, COPE, and PEBA.Dry Laid, Spunbond, Wet Laid, and Other Technologies. Styrenic block copolymers (SBCs) are expected to be one of the fastest-growing segments in the thermoplastic elastomers market during the forecast period.

-

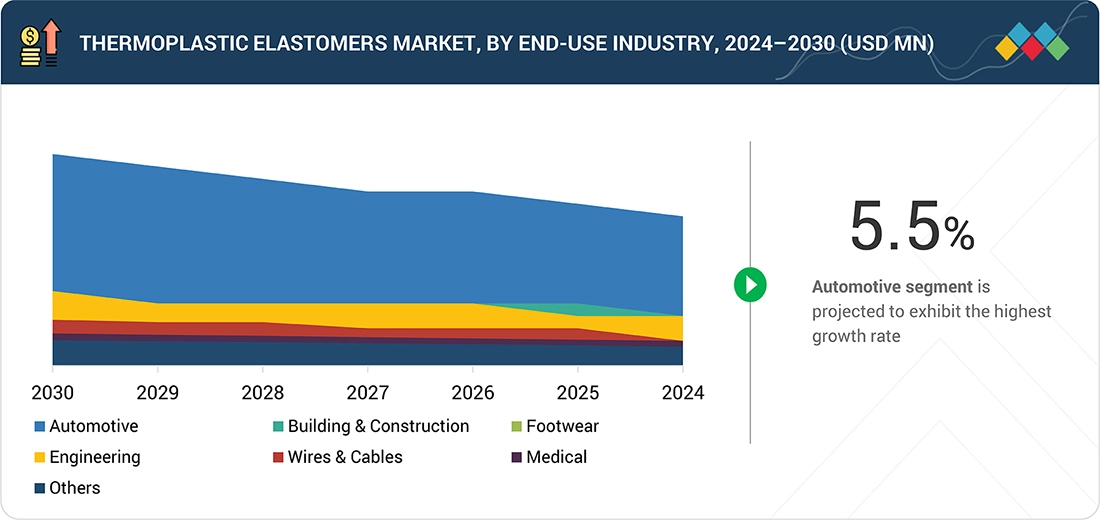

BY END-USE INDUSTRYThe Thermoplastic Elastomers market by end-use industry includes Automotive, Building & Construction, Footwear, Wire & Cable, Medical, Engineering, and others. The automotive industry is expected to register the fastest growth in the use of thermoplastic elastomers during the forecast period.

-

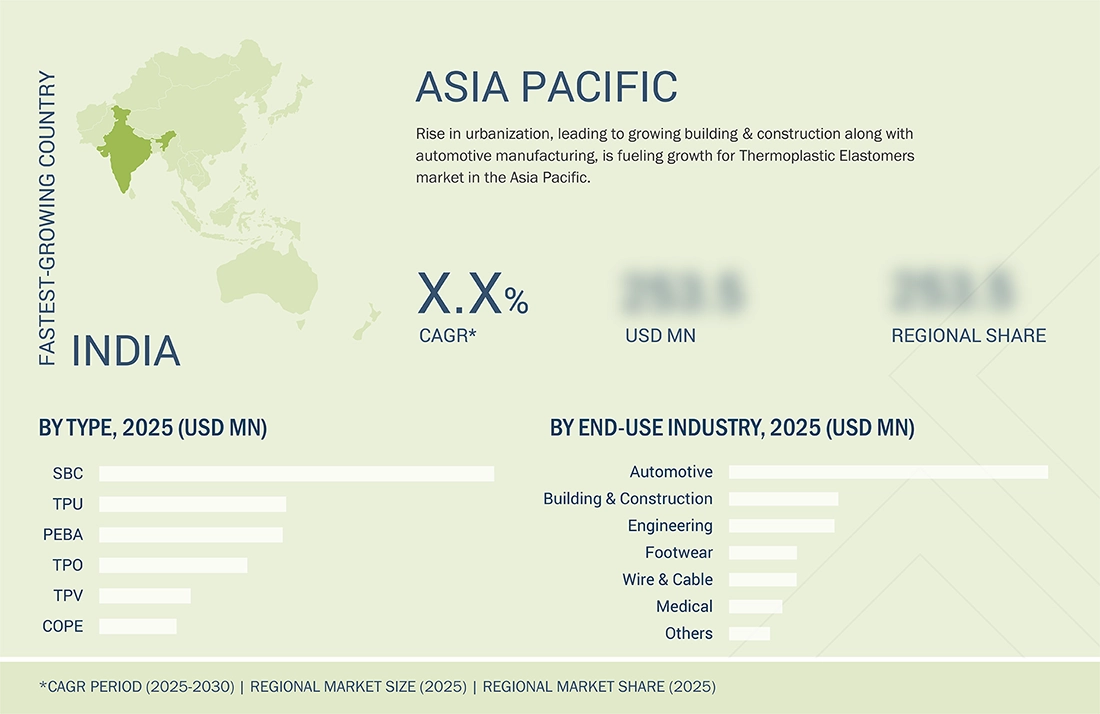

BY REGIONThe Asia Pacific region emerged as the largest segment within the Thermoplastic Elastomers marketin 2024, driven by rapid industrialization, a large growing population, and an increasing demand from automotive and Building & Consruction end-use indutries.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic product launches, collaborations, acquisitions, and expansions from leading players such as Arkema SA (France), Asahi Kasei Corporation (Japan), BASF SE (Germany), The Dow Chemical Company (The U.S), Covestro AG (Germany), Huntsman Corporation (US), Exxon Mobil Corporation (US), Lubrizol Corporation (US), Mitsubishi Chemical Company (Japan), and DuPont de Nemours, Inc. (US). These companies are strong in their home regions and are exploring geographic diversification options to grow their businesses.

Increasing demand for lightweight, durable, and flexible materials from the automotive, medical, consumer goods, and electronics industries steers the growth of the thermoplastic elastomers market. Thermoplastic elastomers give a unique mix of rubber-like elasticity and the processing ease of plastics that permit design flexibility and recyclability. They hold up to extreme temperature variations and chemical resistance and have top fatigue resistance for high performance. Being in line with stringent regulatory and sustainability directions and simultaneously reducing manufacturing costs with enhanced product life cycles in different end-use sectors earns the market for these properties.

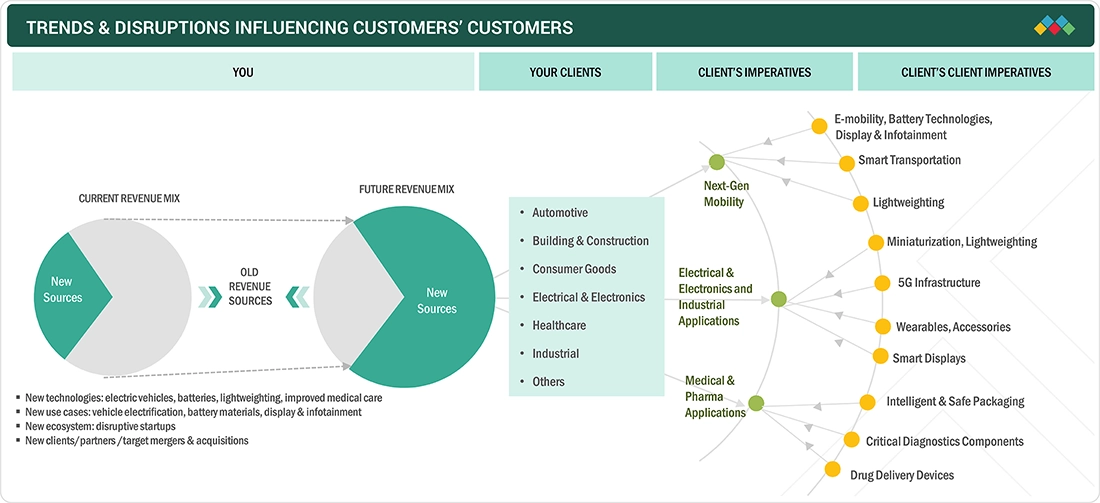

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Thermoplastic Elastomers (TPE) market is undergoing transformation driven by evolving consumer preferences, sustainability mandates, and technological innovation. Demand is increasing for lightweight, recyclable, and high-performance materials across automotive, medical, and consumer goods sectors. Key trends include bio-based and recycled feedstocks, specialty TPEs with enhanced chemical and thermal resistance, and advanced processing techniques for efficiency and cost reduction. Disruptions such as raw material price fluctuations, stricter environmental regulations, and the shift toward circular economy models are reshaping supply chains and driving manufacturers to innovate. These dynamics foster competitive differentiation and create opportunities for niche, high-value applications, challenging traditional TPE formulations and production practices.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Recovery of automotive industry and growing penetration of electric vehicles

-

Stringent emission regulations and standards in developed countries

Level

-

Higher cost of thermoplastic elastomers and increasing raw material prices

Level

-

Emerging market for bio-based thermoplastic elastomers

Level

-

Intra thermoplastic elastomer segment replacement

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Recovery of automotive industry and growing penetration of electric vehicles

The demand for thermoplastic elastomers (TPEs) is strongly driven by the automotive sector, with their importance further amplified by the growing adoption of electric vehicles (EVs). In conventional vehicles, thermoplastic elastomers are increasingly used as lightweight alternatives to heavier plastics and traditional materials, contributing to overall vehicle weight reduction and improved fuel efficiency. Thermoplastic elastomers play a critical role in sealing and gasket applications, ensuring structural integrity, leak prevention, and protection against environmental exposure. Additionally, they offer excellent vibration damping and acoustic insulation, enhancing ride quality and interior comfort.

Restraint: Higher cost of thermoplastic elastomers and increasing raw material prices

The classic appeal of thermoplastic elastomers (TPEs) as a budget-friendly alternative to materials like rubber is starting to fade due to their rising costs, which is becoming a significant issue for various industries. The main driver behind this price hike is the increasing expense of essential raw materials needed to produce thermoplastic elastomers, including styrene, ethylene, and benzene. These commodities have witnessed price fluctuation as a result of various reasons, among them volatile world demand from industries downstream, supply chain disruptions due to delayed deliveries, and curtailed production activities. For example, the lack of regional consistency in demand has put a strain on supply chains, while transportation bottlenecks and a lack of manufacturing capacity have further pushed prices upward. According to market projections, the problem will worsen as raw material prices continue to rise.

Opportunity: Emerging market for bio-based thermoplastic elastomers

Biobased thermoplastic elastomers, derived from renewable feedstocks such as vegetable oils, fatty acids, and starches, are emerging as high-performance alternatives to conventional thermoplastic elastomers. These materials offer comparable—if not superior—properties for use in industries such as electronics, sporting goods, and footwear, while also addressing growing environmental concerns. The development of biobased thermoplastic elastomers enhances biodegradability and significantly reduces dependence on fossil-based resources. Their commercialization is opening new market opportunities, driven by increasing demand for sustainable and eco-friendly materials. Leading manufacturers, including BASF and Lubrizol, have already introduced biobased thermoplastic polyurethanes (TPUs) targeted at applications in footwear, automotive, electronics, industrial equipment, and textiles.

Challenge: Intra thermoplastic elastomer segment replacement

Thermoplastic elastomers (TPEs) are increasingly recognized for their versatility, ease of processing, and broad applicability across diverse industries. Despite these advantages, they face intensifying competition from alternative materials that challenge their adoption in specific high-performance or niche applications. Traditional vulcanized rubber remains a strong competitor, owing to its proven performance in demanding environments and decades of industry use. Similarly, thermoset elastomers retain a distinct advantage in applications requiring superior chemical resistance, thermal stability, and long-term mechanical durability—areas where current thermoplastic elastomer formulations may encounter performance limitations.

Thermoplastic Elastomers Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Liberty used ESTANE® VSN TPU in its eyewear frames to enable novel shapes, color-change effects, and scratch-healing capabilities for premium optical applications. | Delivers lightweight, durable, self-healing frames with stable dimensions and excellent aesthetic flexibility. |

|

FRESH 32, a producer of oral care products, collaborated with Covestro to develop replaceable toothbrush heads using Desmopan® TPU grades 9385A and 9392A GMP, combined with a reusable metal handle for a more circular design. | Enables 100% recyclable, long-lasting toothbrush heads with high abrasion resistance, microbial protection, and excellent durability for sustainable oral care solutions. |

|

Hamee Corp, a leading smartphone accessories manufacturer, partnered with BASF to produce its HIGHER series of MagSafe-compatible phone covers using Elastollan N, a bio-based TPU containing about 53% renewable content. | Provides durable, transparent, and UV-resistant covers with reduced yellowing while lowering fossil resource dependence for more sustainable smartphone accessories. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The thermoplastic elastomers market ecosystem includes raw material suppliers, thermoplastic elastomer manufacturers, distributors, and end users. Raw material suppliers offer a variety of thermoplastic elastomer chemistries, such as styrenic block copolymers, thermoplastic polyurethanes, or olefin blends, which manufacturers use to create thermoplastic elastomer compounds. Thermoplastic elastomer manufacturers produce different types to meet the needs of numerous end-use industries without compromising regulatory requirements. Distributors bring market access through a proper supply chain. The automotive, medical, consumer goods, construction, electronics, and industrial sectors utilize thermoplastic elastomers for different applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Thermoplastic Elastomers Market, By Type

Styrenic block copolymers (SBCs) are expected to be one of the fastest-growing segments in the thermoplastic elastomers market during the forecast period. This growth is mainly because SBCs offer a great balance of flexibility, strength, and ease of use. They are often used in several products we encounter in our day-to-day lives, including shoe soles, adhesives, sealants, soft-touch grips, and medical and personal care products. One of the main benefits of SBCs is that they are easily processed using standard plastic manufacturing techniques such as injection molding and extrusion, making them cheap to produce in bulk. SBCs are light-weight and soft; many of the soft products that you will find are made from SBCs because they are very comfortable, or flexibly soft. SBCs are the preferred materials in the packaging industry, in the case of hygiene and medical products, they reflect their safe use and lack of irritation. Their eligibility for recycling and coming from lower-energy impact traditions make SBCs popular, especially as more industries look to sustainability. The developing countries continue to create demand in the automotive, consumer goods, and health care sectors; SBC usage is expected to grow rapidly, creating additional demand in a market that is firmly based for the future.

Thermoplastic Elastomers Market, By End-use industry

The automotive industry is expected to register the fastest growth in the use of thermoplastic elastomers during the forecast period. This is because car manufacturers are looking for materials that are lightweight, durable, and easy to mold into different shapes. Thermoplastic elastomers are a perfect fit as they help reduce the overall weight of vehicles, which improves fuel efficiency and lowers emissions—an important goal for the auto industry, especially with stricter environmental rules. PEs are also used in many parts of a vehicle, such as door seals, bumpers, interior panels, grips, and under-the-hood components. They offer excellent flexibility, resistance to heat and chemicals, and long-lasting performance, making them ideal for these applications. In electric vehicles (EVs), thermoplastic elastomers are becoming even more important because they help in noise and vibration control and can be used in flexible cables and charging parts. As more people are purchasing vehicles, especially in developing countries such as China and India, better and more efficient materials are becoming more desirable. Thermoplastic elastomers have a competitive advantage due to the automakers' commitment to using recyclable and eco-friendly materials. All of these factors are speeding the adoption of thermoplastic elastomers into the automotive market.

REGION

Asia Pacific to be the major regional segment in global Thermoplastic Elastomers market

Thermoplastic elastomers are expected to grow at the fastest rate in Asia Pacific over the next several years. The region's thriving consumer goods, electronics, healthcare, automotive, and construction industries are all responsible for this quick expansion. The manufacturing boom in nations like China, India, Japan, and South Korea is increasing demand for flexible, high-performance materials like thermoplastic elastomers. The growth of population, continued urbanization, and increased disposable incomes are demanding more products made with TPEs that are used in a number of different applications, from clothing, automotive parts, medical devices, household products, and electronic devices. Thermoplastic elastomers make sense for these industries because they are lightweight, easy to process, and recyclable, providing manufacturers with high-quality, sustainable, flexible, lightweight products. The market and the Asia Pacific region have different government-created regulations and bodies to support the thermoplastic elastomers market. For example, China's Ministry of Ecology and Environment and India’s Central Pollution Control Board encourage the use of eco-friendly and recyclable materials. Related regulations regarding emissions for vehicles and the federal regulations for products offer manufacturers incentives to replace traditional materials with better options or consider the use of thermoplastic elastomers.

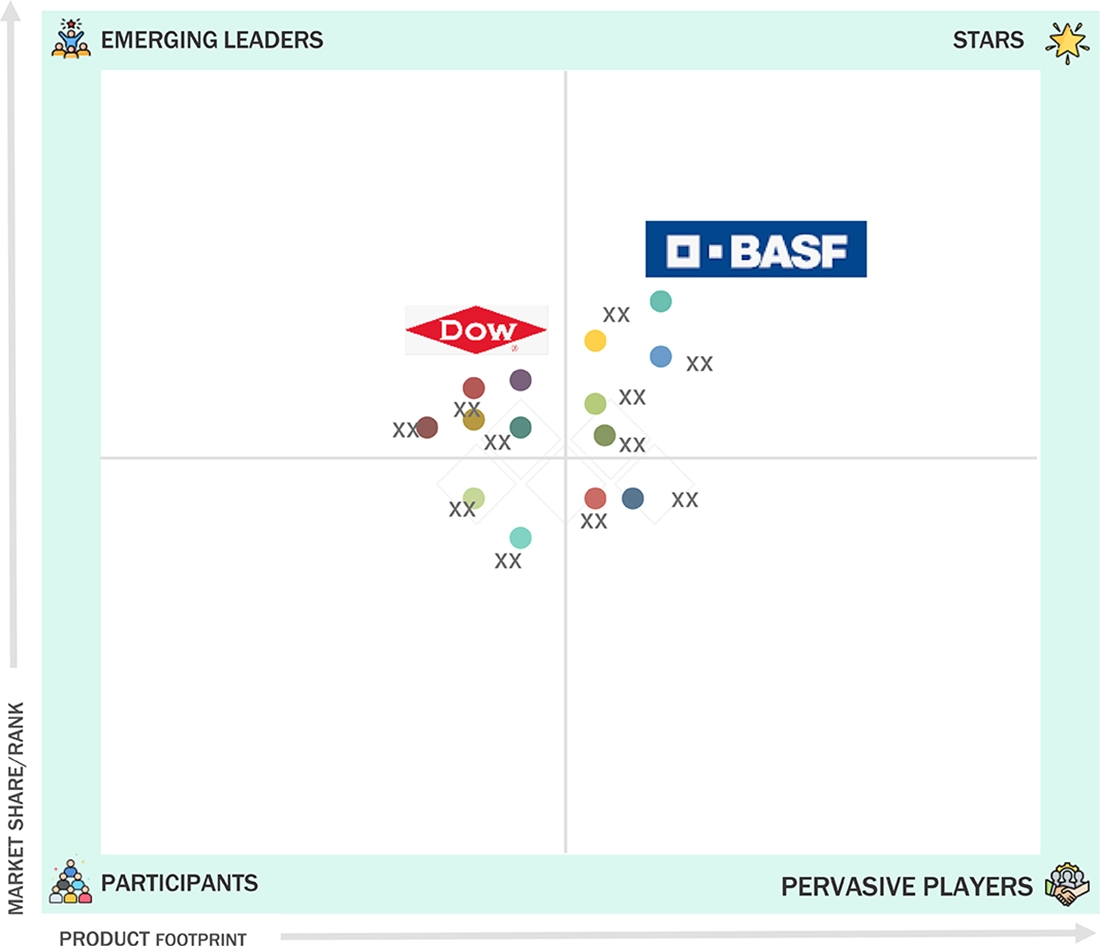

Thermoplastic Elastomers Market: COMPANY EVALUATION MATRIX

BASF is a star player in the TPE market, recognized for its broad portfolio, innovation in specialty elastomers, and strong global presence. Dow is an emerging leader, gaining traction through sustainable solutions, advanced TPE grades, and expanding applications across key end-use industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 29.14 Billion |

| Market Forecast in 2030 (Value) | USD 38.94 Billion |

| Growth Rate | CAGR of 4.8% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, the Middle East & Africa |

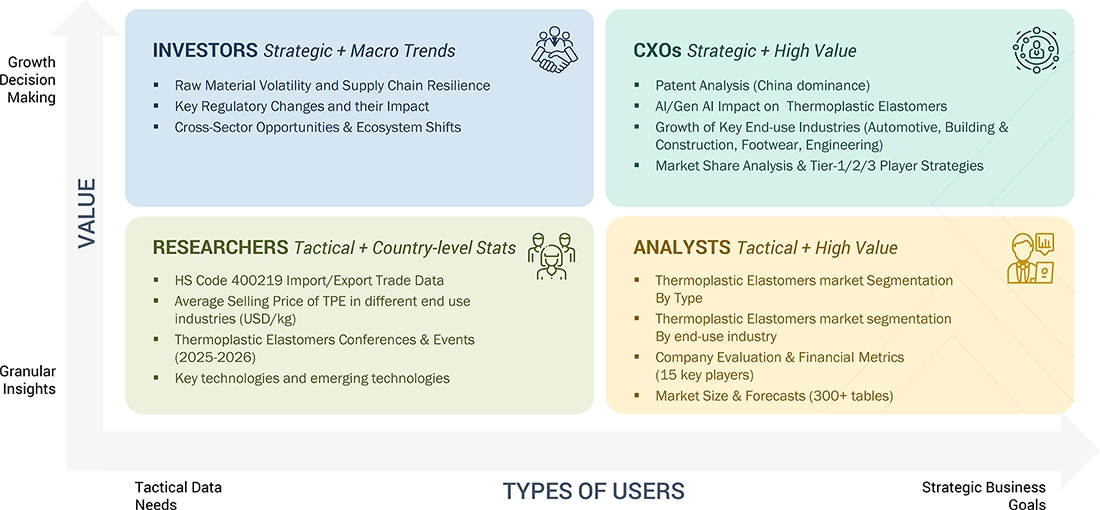

WHAT IS IN IT FOR YOU: Thermoplastic Elastomers Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Detailed Thermoplastic Elastomers Market Analysis for APAC Countries | Market sizing and demand forecasting for Thermoplastic Elastomers across major APAC countries, segmented by type and end-use industry. | Provided country-specific insights on required end-use industries; analyzed regulatory policies, capacity expansions, and sustainability initiatives driving regional demand. |

RECENT DEVELOPMENTS

- September 2023 : The Dow Chemical Company began operations at its MDI distillation and prepolymers facility in Freeport, Texas.

- August 2023 : Covestro AG started production in its new plant for polyurethane elastomer systems at its integrated site in Shanghai, China.

- March 2023 : Arkema SA and Engie SA entered into an agreement in France for the supply of 300 GWh per year of renewable biomethane, aiming to lower the carbon footprint of Arkema’s 3D printing materials.

- February 2023 : Covestro AG established its largest thermoplastic polyurethane facility in Zhuhai, China, investing in Solutions & Specialties.

- January 2022 : Arkema SA expanded its global manufacturing capacity of Pebax Elastomer by 25% through an investment at its Serquigny plant in France.

Table of Contents

Methodology

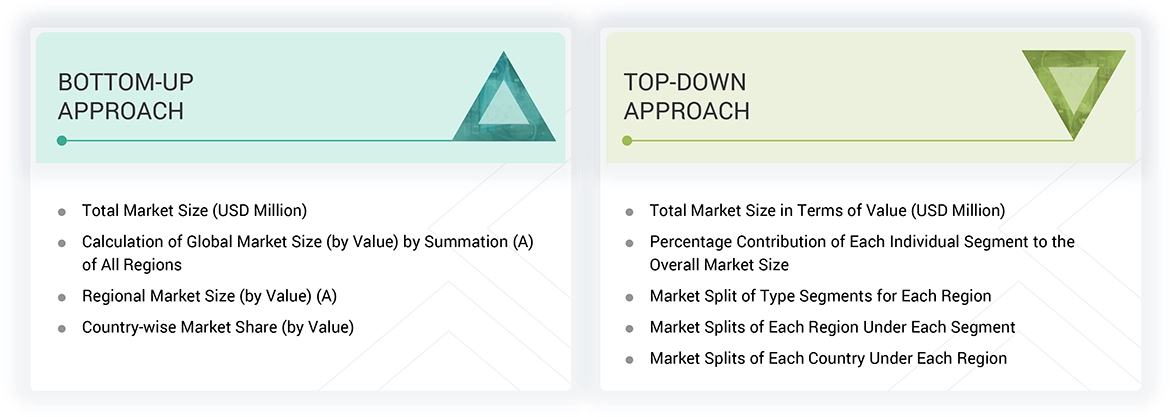

The study involved four major activities to estimate the current size of the global thermoplastic elastomers market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of thermoplastic elastomers through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the thermoplastic elastomers market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

The market for the companies offering thermoplastic elastomers is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the thermoplastic elastomers market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of thermoplastic elastomer vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

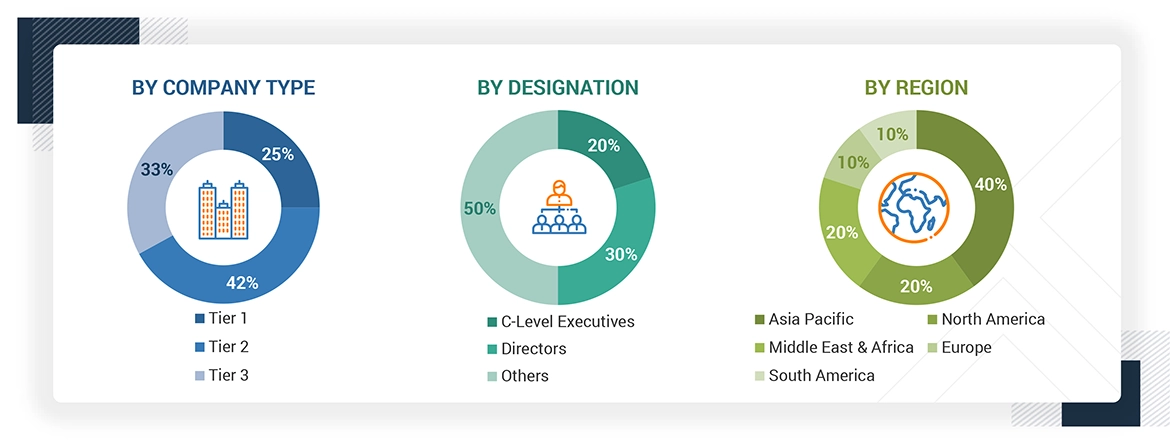

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the thermoplastic elastomers market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of thermoplastic elastomers offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global thermoplastic elastomers market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Thermoplastic elastomers (TPEs) are a diverse class of polymers that incorporate the elasticity of rubber with the thermoplastic character of ease of processing. In contrast to conventional rubber, which is subjected to vulcanization, thermoplastic elastomers may be melted and remolded repeatedly without causing much degradation, making them suitable for effective manufacturing and recycling. Thermoplastic elastomers offer the elasticity of rubber with the ease of processing of thermoplastics. Thermoplastic elastomers are flexible, resilient, and durable, which makes them suitable for applications that need soft touch, impact survival, and chemical resistance. Thermoplastic elastomers are used in many applications in many different industries, including automotive, medical, consumer products, electronics, and construction. Their moldability to intricate shapes and suitability for different additives make it possible to tailor properties such as hardness, color, and resistance. Increasing environmental consciousness and the need for eco-friendly materials also contribute to increasing the demand for thermoplastic elastomers worldwide.

Stakeholders

- Thermoplastic elastomers manufacturers

- Raw material suppliers

- Converters & processors

- Distributors and traders

- Industry associations and regulatory bodies

- End users

Report Objectives

- To define, describe, and forecast the size of the global thermoplastic elastomers market based on type, end-use industry, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as product launches, acquisitions, expansions, partnerships, and agreements in the thermoplastic elastomers market

- To provide the impact of AI/Gen AI on the market.

Key Questions Addressed by the Report

What is the major driver influencing the growth of the thermoplastic elastomers market?

The major drivers include the recovery of the automotive industry, growing penetration of electric vehicles, increasing demand for medical elastomers, and stringent emission regulations and standards in developed countries.

What are the major challenges to the growth of the thermoplastic elastomers market?

Intra-thermoplastic elastomer segment replacement is the major challenge impacting the market's growth.

What are the major opportunities in the thermoplastic elastomers market?

The emerging market for bio-based thermoplastic elastomers presents lucrative opportunities for market players in the coming years.

What are the major factors restraining the growth of the thermoplastic elastomers market?

Higher material costs and rising raw material prices are the key factors restraining market growth.

Who are the major players in the thermoplastic elastomers market?

Major players include Arkema SA (France), Asahi Kasei Corporation (Japan), BASF SE (Germany), The Dow Chemical Company (US), and Covestro AG (Germany).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Thermoplastic Elastomers Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Thermoplastic Elastomers Market

Biswajit

Aug, 2014

Interested in Thermoplastic Elastomers market.

Biswajit

Aug, 2014

% replacement of syenthetic elastomers by thermoplastic elastomers in mechanical rubber goods application in the next 5-10 years..

Karl

Jan, 2018

Requires a copy of Research Methodology and sources.

Ayadi

Nov, 2014

Interested in market of thermoplastic elastomers.

Ayadi

Nov, 2014

Inforamtion on Thermoplastic Elastomers, especially for TPVs.

Cindy

May, 2013

Specific interest on TPE market in food indusrty.

Darryl

Feb, 2014

Report needed for Thermoplastic Elastomers Marke.

ivy

Sep, 2015

Just an extract of TPE for medical market .

Oksana

Apr, 2015

Thermoplastic Elastomers market report.

KS

Dec, 2018

Interested in updated version of report.

Beatrice

Dec, 2014

General information on TPO,TPV market.

VIKRAM

Dec, 2016

Information on Thermoplastic Elastomer market .

Agusti

Aug, 2017

Interested in TPES market report.

Agusti

Aug, 2017

TPES market by type, by Application, trend and players profile .