The study used a holistic approach, using a wide range of primary and secondary sources to examine the factors affecting the industry. This methodology included market segmentation analysis, identification of industry trends, profiling key players, analyzing the competitive landscape, assessing key market dynamics, and evaluating the strategies implemented by leading companies.

Secondary Research

This secondary research utilized D&B Hoovers, Bloomberg Businessweek, Factiva, white papers, annual reports, company filings, investor presentations, and SEC filings to create an extensive database of key industry participants. The database includes the most important data on leading companies, multi-level market segmentation, industry trends by segment, significant mergers and acquisitions, and the impact of technological developments in the ultrasound market.

Primary Research

The main research has been conducted both qualitatively and quantitatively in the form of in-depth interviews with the participants both from the demand and supply side of the market. With the supply side, interviews have been conducted with high-level executives, including CEOs, VPs, marketing and sales directors, regional sales managers, and technology and innovation directors from leading companies and organizations that operate in product therapy markets. On the demand side, the professionals interviewed were clinicians, procurement managers, purchase managers, department heads, and experts from hospitals, diagnostic centers, pharmaceutical and biotechnological firms, and research and academic institutes. This research offered insights into market segmentation, key players, and the trends and dynamics driving market growth

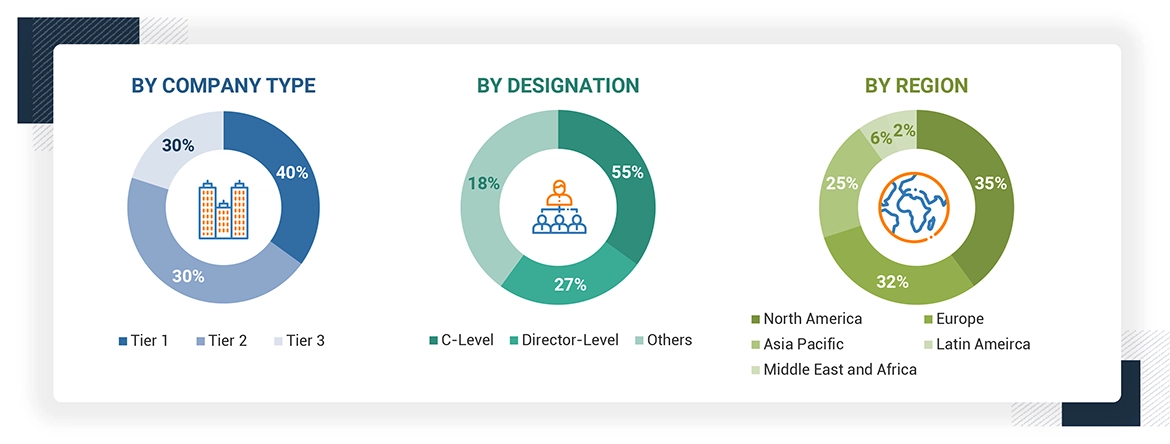

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 1 billion, Tier 2 = < USD 500 million, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report compiles a comprehensive analysis about the ultrasound market. These players are identified using both primary and secondary research. All of the secondary research relied upon annual and financial reports of the leading market players, while primary research carried out in-depth interviews involving key opinion leaders like CEOs, directors, and senior marketing executives.

A segment-based approach was used to estimate the global market value, involving collecting revenue data from major solution and service providers. This process includes:

-

Key players in the global ultrasound market.

-

Analyzing their reported annual revenues, either specific to ultrasound or to their overall business units/products.

-

The data was then projected to arrive at the overall value for the ultrasound market.

Global Ultrasound Market: Bottom-Up Approach

Data Triangulation

The research methodology adopted involved segmentation of the global ultrasound market into different categories and subcategories. The data triangulation and segmentation processes ensured availability of accurate data for all market segments. Several analyses were carried out to understand the demand and supply sides of the market. A thorough integration between the top-down and bottom-up approach provided an in-depth understanding of the ultrasound market.

Market Definition

The ultrasound market is another industry that specializes in developing and producing ultrasound devices used by medical professionals for medical imagery and diagnostic purposes. Technology that uses high-frequency sounds to create images of the internal structure that appear in real time assists in the diagnosis and monitoring by doctors of a large quantity of medical conditions. This market includes applications such as obstetrics and gynecology, cardiology, musculoskeletal imaging, and vascular diagnostics, among others. The ultrasound market also encompasses the innovation of portable devices, point-of-care diagnostics, and artificial intelligence and 3D/4D imaging, all of which increase the accuracy of diagnosis and patient care.

Stakeholders

-

Healthcare institutions (Hospitals and Home care)

-

Healthcare institutions (Hospitals)

-

Research institutions

-

Clinical research organizations

-

Academic medical centers and universities

-

Reference laboratories

-

Accountable Care Organizations (ACOs)

-

Research and consulting firms

-

Contract research organizations (CROs) and contract manufacturing organizations (CMOs)

-

Academic medical centers and universities

-

Market research and consulting firms

-

Group Purchasing Organizations (GPOs)

-

Medical Research Laboratories

-

Academic Medical Centers and Universities

Report Objectives

-

Market analysis can be made on various dimensions like technology, display, portability, component, applications, end-users, and regional areas.

-

Explore the opportunities for stakeholders and analysis of the competitive landscape to be provided with key players.

-

Provide insights into the key drivers influencing market growth.

-

Analyze the growth trends of individual players and their potential impact on micro-markets.

-

Analyze the competitive strategies of new product launches, approvals, agreements, partnerships, expansions, acquisitions, and collaborations in the ultrasound market.

Growth opportunities and latent adjacency in Ultrasound Market