Video Processing Platform Market

Video Processing Platform Market by Offering (Video Encoding & Transcoding, Video Management), Content Type (VOD, Short Form Video), Application (Video Ingest & Capture, Video Delivery & Distribution, Video Editing & Enhancement) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Video Processing Platform market is projected to grow from USD 7.50 billion in 2025 to USD 12.40 billion by 2030, registering a CAGR of 10.6%. This growth is driven by the accelerated adoption of cloud-native video processing, AI-powered transcoding, adaptive bitrate streaming, and real-time video analytics across media, entertainment, education, and enterprise communication sectors. Vendors are increasingly leveraging machine learning, edge computing, and computer vision to enable low-latency live streaming, automated content optimization, multi-device delivery, and immersive video experiences. As demand for high-quality, interactive, and personalized video content rises, platforms are positioning AI-enhanced video enhancement, automated workflows, and scalable cloud infrastructures as strategic enablers of real-time engagement, operational efficiency, and global content distribution. The integration of these technologies is reshaping workflow automation, viewer experience, and enabling competitive differentiation across the evolving digital media ecosystem.

KEY TAKEAWAYS

- North America dominates the Video Processing platform market by 32.8% market share in 2025.

- By platform, content management tools segment is expected to be the fastest growing segment, with CAGR of 14.9%, during the forecast period.

- By degree of customization, the preset avatars segment dominates the market, with market share of 41.8% in 2025.

- By deployment mode, the on-premises segment is expected to grow the fastest, during the forecast period.

- By application, the video analytics & QoE monitoring segment is projected to dominate the market.

- By end user, the marketing & advertising agencies segment is expected to be the fastest growing segment, during the forecast period.

- Akamai Technologies, MediaKind (Ericcson) and Harmonic are identified as some of the star players in the Video Processing platform market, given their strong market share and product footprint.

- Haivision, Synthesia and Wistia, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging leaders.

The Video Processing Platform market is witnessing strong momentum, fueled by the surge in OTT consumption, enterprise streaming, e-learning, and digital advertising. Enterprises and content providers are increasingly adopting AI- and cloud-based video processing solutions to automate encoding, transcoding, and streaming workflows. These platforms enable efficient bandwidth utilization, adaptive bitrate streaming, and low-latency delivery across devices, while AI-powered analytics and integrations with CMS, CDN, and marketing tools enhance content personalization and operational scalability.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Video Processing Platform market is rapidly evolving as media companies, OTT providers, and enterprises increasingly adopt AI-powered solutions for real-time video enhancement, adaptive streaming, and immersive content delivery. This growth is driven by demand for ultra-low latency streaming, multi-codec support, cloud-native video processing, and scalable infrastructure that optimize viewer engagement across devices. Platforms leverage AI for intelligent frame-by-frame correction, automated transcoding, bandwidth optimization, and live content personalization. Integration with content management systems (CMS), marketing automation, and analytics tools enables seamless workflows and data-driven performance insights. Security, privacy, and compliance remain crucial as video processing adoption expands across entertainment, education, healthcare, and enterprise communications sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

OTT expansion drives the global video consumption and viewer engagement

-

Rise of short-form and platform-specific video content

Level

-

Intense competition limits differentiation and scalability

Level

-

AI-powered real-time video enhancement enables superior live experiences

-

Growing adoption of edge computing infrastructure for real-time data processing

Level

-

Complex integration with existing enterprise systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: OTT expansion driving global video consumption and engagement

The rapid growth of Over-The-Top (OTT) platforms is fueling demand for video processing platforms, driven by rising consumer preference for on-demand, multi-device content experiences. Providers are investing in localized and original content to boost subscriber retention and engagement, as seen with Netflix’s Money Heist and Amazon Prime Video’s genre-specific originals. The proliferation of smartphones—accounting for over 70% of global streaming, and 5G deployment is enhancing accessibility and quality of video content, highlighting the need for scalable video encoding, transcoding, and adaptive streaming solutions to optimize viewer experience across devices.

Restraint: Intense competition limits differentiation and scalability

The video processing platform market faces increasing competitive pressure, with numerous global and emerging vendors offering overlapping services. Standardization of core technologies such as encoding, decoding, compression, and transcoding has intensified pricing pressures and compressed profit margins. These conditions challenge smaller players in achieving differentiation and scaling operations. Buyers are increasingly prioritizing cost over innovation, slowing investments in areas like AI-driven video enhancement, ultra-low latency streaming, and bandwidth optimization. To remain competitive, vendors must focus on operational efficiency, strategic partnerships, and delivering high-performance, scalable video processing solutions.

Opportunity: AI-powered real-time video enhancement enables superior live experiences

AI-driven real-time video processing is a high-growth opportunity for the market, supporting seamless live, mobile, and interactive content delivery. Advanced AI models enable frame-by-frame adjustments of exposure, color balance, noise reduction, stabilization, and upscaling, ensuring consistent visual quality without increasing latency. Industries such as media, education, healthcare, and enterprise communications are increasingly adopting these solutions to enhance live streaming, virtual events, and interactive training. Platform providers integrating AI-based real-time enhancement can differentiate through low-latency, high-quality video delivery, unlocking new value across immersive and distributed content applications.

Challenge: Complex integration with existing enterprise systems

Integrating video processing platforms into existing enterprise ecosystems, comprising CMS, marketing automation, cloud storage, and analytics tools; remains a major challenge. Custom API development and alignment with third-party solutions are often required to maintain workflow automation. Poor integration can delay performance insights and impede data-driven decision-making, while compliance and security requirements in regulated sectors add further complexity. Adopting standards-based, flexible video platforms with robust integration capabilities is critical for enterprises to streamline operations, maximize ROI, and maintain scalable, seamless video-driven workflows across content, marketing, and training applications.

Video Processing Platform Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Taghos leveraged Akamai’s EdgeWorkers and global CDN to combat illegal streaming, secure broadcaster revenues, and deliver high-quality, reliable video content across Brazil, including rural regions. | Akamai enabled Taghos to block piracy and protect revenues while ensuring scalable, high-definition, buffer-free streaming experiences nationwide. |

|

CFA Institute adopted Brightcove’s video marketing solution to expand global brand awareness and engagement, delivering live and on-demand video campaigns tailored for diverse audiences across 73 markets. | Brightcove tripled CFA Institute’s engagement scores and enhanced global visibility through localized, analytics-driven campaigns optimized for different audience segments. |

|

Insight Global utilized Synthesia’s AI-powered video platform to rapidly create multilingual training videos for internationally educated nurses, improving onboarding speed, accessibility, and engagement across diverse healthcare environments. | Synthesia enabled 10× faster training content production and simplified updates, ensuring engaging, accessible, and up-to-date nurse training for improved learning outcomes. |

|

The University of Dundee implemented Panopto’s comprehensive video management platform to improve lecture capture, accessibility, and system reliability, enhancing digital learning experiences for its global student community. | Panopto ensured stable, accessible, and integrated lecture delivery with accurate captioning and seamless LMS integration, improving efficiency and learning accessibility campus-wide. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The video processing platform market ecosystem comprises diverse offerings. The ecosystem includes platform providers and service providers. The platform categories include video encoding & transcoding software, video management software, content management tools, workflow automation & orchestration software, and live production tools. These platforms optimize video workflows by automating processes, and supporting seamless content creation, and monetization across live and on-demand experiences.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Video Processing Platform Market, By Offering

Content management tools are emerging as one of the fastest-growing offerings in the Video Processing Platform market. These platforms leverage AI and ML to automate video cataloging, metadata tagging, content indexing, and workflow optimization. By integrating cloud-based storage, adaptive streaming, and automated video analytics, content management tools enhance operational efficiency, streamline distribution, and improve content discoverability. Media houses, OTT platforms, and social media companies increasingly adopt these tools to manage large-scale video libraries, ensure consistent quality, and deliver personalized viewing experiences, positioning this segment as a high-growth, revenue-driving offering globally.

Video Processing Platform Market, By Content Type

Short-form video and social media content are driving rapid growth in the Video Processing Platform market. Platforms leverage AI-powered video editing, automated clipping, and real-time optimization to create engaging, mobile-friendly content optimized for platforms like TikTok, Instagram, and YouTube. Features such as auto-captioning, scene recognition, and personalized recommendations enhance viewer engagement and content virality. Brands, content creators, and digital marketers increasingly adopt short-form video solutions to maximize reach, boost social interaction, and generate targeted advertising opportunities, making this content type a critical driver of adoption and market expansion.

Video Processing Platform Market, By Application

Video personalization and recommendation engines are gaining significant traction as a key application in the Video Processing Platform market. Leveraging AI and ML algorithms, these platforms analyze viewer behavior, content preferences, and engagement patterns to deliver tailored recommendations and adaptive streaming experiences. Personalized video feeds, dynamic ad insertion, and contextual content suggestions enhance user retention and engagement across OTT, social media, and e-learning platforms. Increasing demand for individualized viewing experiences and monetization opportunities drives adoption, positioning video personalization and recommendation engines as a high-growth application segment shaping the future of digital content delivery.

Video Processing Platform Market, By Enterprise End user

Marketing and advertising agencies represent a rapidly growing enterprise end-user segment in the Video Processing Platform market. These organizations leverage AI-driven video editing, automated content optimization, and personalized ad placement tools to create highly engaging campaigns across digital channels. By integrating real-time analytics, social media insights, and programmatic advertising solutions, agencies improve targeting accuracy, campaign performance, and audience engagement. The rising demand for interactive, data-driven video marketing and social media campaigns positions marketing and advertising agencies as primary adopters, driving innovation, technology adoption, and revenue growth in the global video processing ecosystem.

REGION

Asia Pacific to be the fastest-growing region in the Video Processing Platform market during the forecast period

Asia Pacific is witnessing rapid growth in the Video Processing Platform market, driven by AI- and ML-powered video transcoding, content recognition, quality enhancement, and recommendation systems. The expansion of high-speed broadband, 4G/5G networks, and cloud-based streaming infrastructure is enabling seamless delivery of live and on-demand video across media, e-learning, gaming, and social platforms. Countries like China, Japan, South Korea, and India are advancing AI research, while initiatives such as South Korea’s Digital New Deal promote digital transformation, broadband expansion, and startup support. These factors collectively accelerate adoption, enhance content creation and distribution, and position the region as a hub for innovative video processing solutions.

Video Processing Platform Market: COMPANY EVALUATION MATRIX

In the Video Processing Platform market matrix, Akamai Technologies (Star) leads with a robust global CDN infrastructure and advanced edge computing capabilities, delivering exceptional video quality, low-latency streaming, and scalable content delivery. Its AI-powered adaptive bitrate streaming, dynamic caching, and media optimization tools enable seamless live and on-demand video experiences across devices and regions, supporting large-scale deployments in media, entertainment, and OTT platforms. CyberLink (Emerging Leader) is gaining momentum with its AI-driven video editing, facial recognition, and content enhancement solutions, empowering creators and enterprises with intelligent video analytics, real-time rendering, and automated post-production workflows. While Akamai dominates through performance, scale, and network reach, CyberLink showcases strong innovation and growth potential in AI-enhanced video processing and creative automation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.72 Billion |

| Market Forecast in 2030 | USD 12.40 Billion |

| Growth Rate | CAGR of 10.6% during 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Video Processing Platform Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | Delivered competitive profiling of additional vendors, brand comparative analysis, and a drill-down of country-level segmentation across key markets. | Enabled competitive positioning insights, product differentiation clarity, and multi-country market intelligence, supporting go-to-market strategy refinement and stakeholder alignment. |

| Leading Solution Provider (Europe) | Provided competitive profiling, brand benchmarking, and segmentation analysis across additional geographies. | Delivered in-depth market insights, comparative brand positioning, and segment-level intelligence, empowering strategic decision-making and regional growth planning. |

RECENT DEVELOPMENTS

- April 2025 : Synamedia and MTN Group partnered to launch a new streaming platform for Africa, targeting mobile and broadband users. Leveraging Synamedia’s cloud-based technology, the service will offer linear TV, video-on-demand, and ad-supported content, with personalized recommendations and local content strategies, aiming to boost digital inclusion across the continent.

- March 2025 : Harmonic and TAG Video Systems partnered to integrate TAG’s Realtime Media Platform with Harmonic’s VOS360 Media SaaS, showcased at the 2025 NAB Show. This collaboration empowers broadcasters and content creators with real-time monitoring, advanced multi-viewing, and latency measurement across streaming workflows. The joint solution ensures exceptional video quality, and flexible cloud or hybrid deployment for efficient, reliable streaming.

- December 2024 : Akamai Technologies completed the acquisition of select assets from Edgio, including certain customer contracts related to content delivery and security, as well as non-exclusive license rights to patents in Edgio’s portfolio. This transaction enables Akamai to offer new customers a seamless migration path to its services, ensuring continued support and reliability.

- October 2024 : MediaKind partnered with Skreens to launch an advanced Multiview live event streaming solution, integrating Skreens’ content compositing technology with the MK.IO platform. This enables broadcasters and OTT providers to deliver multiple live video feeds, allowing viewers to seamlessly switch between camera angles and streams for a personalized, interactive experience across devices, while offering flexible, cost-effective deployment for live event coverage.

- October 2024 : Avid entered into a definitive agreement to acquire Wolftech Broadcast Solutions, a leader in cloud-based multiplatform newsroom planning and publishing. This acquisition has combined Avid’s end-to-end media solutions with Wolftech’s story-centric workflow expertise, empowering news organizations to deliver stories faster, enhance collaboration, and streamline production across digital and broadcast platforms with advanced, integrated tools.

Table of Contents

Methodology

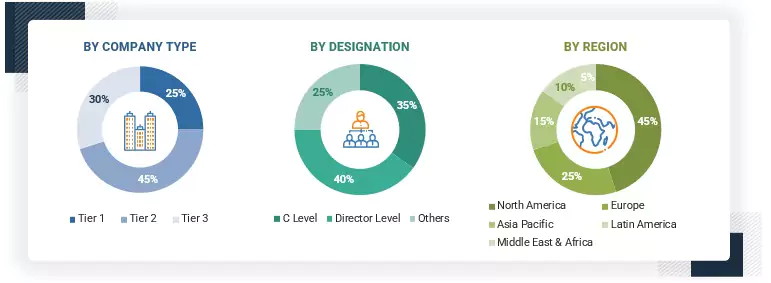

This comprehensive market research study on the web content management market involved the use of extensive secondary sources, directories, as well as several journals and magazines, such as WCM Journal, Institute of Electrical and Electronics Engineers (IEEE) journals and magazines, and journals/forums for Machine Learning (ML), WCM India magazine, and other magazines. The primary sources were mainly industry experts from the core and related industries, preferred web content management product providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information, as well as assess the prospects.

Secondary Research

The market size of companies across the globe offering WCM products was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The WCM spending of various countries was extracted from respective sources. Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify key players based on products; services; market classification and segmentation according to offerings of major players; industry trends related to product types, deployment mode, architecture, end user and regions; and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from the business development department, marketing experts, product development/innovation n teams, and related key executives from web content management product vendors, SIs, professional service providers, industry associations, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the solutions, and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Strategy Officers (CSOs), and installation teams of the governments/end users using web content management products were interviewed to understand the buyers’ perspective on the suppliers, products, and service providers; and their current usage of web content management products and how it would affect the overall web content management market.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

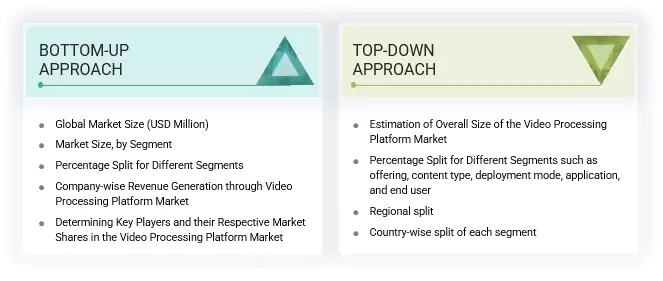

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the web content management market. The first approach involves estimating the market size by companies’ revenue generated through the sale of WCM products.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering products in the WCM market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of product type, deployment mode, architecture, and end user. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of web content management products among different verticals in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of WCM products among enterprises, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the WCM market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major web content management providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall web content management market size and segments’ size were determined and confirmed using the study.

Video Processing Platform Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to OpenText, WCM is a software application that enables enterprises to easily manage and publish digital content. WCM systems include various capabilities, including site design, content authoring, editing, and personalization. A robust WCM would enable organizations to manage multiple websites, support more than one language, as well as deliver omnichannel customer experiences.

According to Sitecore, WCM is a software application that allows users to collaborate in the creation, editing, and production of digital content: web pages and blog posts to manage the overall digital experience. WCM helps users upload or write content, format it, add headlines and images, and perform a number of backstage tasks such as Search Engine Optimization (SEO).

Stakeholders

- WCM product and service providers

- Independent Software Vendors (ISVs)

- Investors and Venture Capitalists (VCs)

- Managed service providers

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Value-Added Resellers (VARs) and distributors

Report Objectives

- To define, describe, and predict the Video Processing Platform Market, by product type, deployment mode, architecture, end user and region.

- To describe and forecast the Video Processing Platform Market, in terms of value, by region—North America, Europe, Asia Pacific, Middle East & Africa and Latin America

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall Video Processing Platform Market.

- To profile key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders.

- To analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and ongoing research and development (R&D) in the Video Processing Platform Market.

- To provide the illustrative segmentation, analysis, and projection of the main regional markets.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American Video Processing Platform Market

- Further breakup of the European Market

- Further breakup of the Asia Pacific Market

- Further breakup of the Middle East & Africa Market

- Further breakup of the Latin American Video Processing Platform Market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is a Video Processing Platform?

According to EMB Global, video processing is the technology and set of techniques used to enhance, compress, and manage video content, making it better, smaller, and easier to store or share. It is essential in editing, broadcasting, surveillance, and streaming, helping maintain high quality while efficiently managing high-resolution videos for various applications.

Which are the key end users adopting video processing platform market?

Key end users adopting video processing platform include enterprise users such as media & entertainment, retail & e-commerce, advertising & marketing agencies, healthcare & life sciences, education, BFSI, manufacturing, travel & hospitality, and other enterprise users (IT & Telecom, real estate, government & defense) and individual users such as content creators, freelancers, educators, and small-scale influencers.

What are the major factors driving the growth of the video processing platform market?

The key drivers supporting the growth of the video processing platform market include rapid growth in live streaming and real-time video applications, OTT expansion driving global video consumption, and rapid adoption of cloud-based video processing solutions for scalability and cost efficiency.

What challenges are hindering the widespread adoption of video processing platforms?

The video processing platform market faces key challenges, such as ensuring robust content protection against unauthorized access, overcoming integration complexities with diverse APIs and third-party systems, and maintaining seamless, high-quality user experience across devices and platforms. These software-centric issues hinder platform reliability, adaptability, and user satisfaction, limiting growth in competitive and rapidly evolving digital media environments.

Who are the key vendors in the video processing platform market?

The key vendors in the global video processing platform market include Akamai Technologies (US), MediaKind (US), Harmonic (US), Synamedia (UK), Avid Technology (US), Brightcove (US), Kaltura (US), Adobe (US), IBM (US), Microsoft (US), Vimeo (US), Ateme (France), Amagi (India), CyberLink (Taiwan), AWS (US), Google (US), Wondershare (China), Haivision (US), Telestream (US), Wowza Media Systems (US), SeaChange (US), Mux (US), Bitmovin (US), Panopto (US), Wistia (US), MediaMelon (US), Vantrix (Canada), M2A Media (London), Pixelpower (UK), Kapwing (US), Beamr (Israel), Lightcast.com (US), Base Media Cloud (UK), Village Talkies (Australia), Synthesia (UK), TechSmith (US), VideoVerse (US), and Animaker (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Video Processing Platform Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Video Processing Platform Market