Welding Equipment, Accessories, and Consumables Market

Welding Equipment, Accessories, and Consumables Market by Equipment (Electrode & Filler Metal Equipment, Oxy-Fuel Gas Equipment), Accessory (Fume Extraction Equipment, Gas Flow Meter, Protective Gear), Consumable (Electrodes & Filler Materials, Fluxes & Wires Gases), Technology (Arc Welding, Oxy-Fuel Welding), End-use Industry (General Fabrication, Automotive, Construction), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Welding Equipment, Accessories, & Consumables market is projected to reach USD 42.14 billion by 2030 from USD 25.84 billion in 2025, at a CAGR of 3.29% from 2025 to 2030. The demand for welding equipment, accessories, and consumables is expected to grow due to various factors. Expanding steel use, automotive innovation, and EV growth, advancements in welding technologies that improve precision and efficiency, and increasing demand from other end-use industries are all likely to drive the market.

KEY TAKEAWAYS

-

BY EQUIPMENTThe Welding Equipment, Accessories, & Consumables market is segmented by type into Electrodes & Filler Metal Equipment, Oxy-fuel Gas Equipment, and Other Equipment. Electrode and filler material equipment hold the largest market share, driven by their wide demand across several application areas, including heavy manufacturing and construction.

-

BY CONSUMABLESThe Welding Equipment, Accessories, & Consumables market is segmented by application into Electrodes & Filler Materials, Gases, and Fluxes & Wires. Electrodes and filler materials dominate the welding market because they are vital in producing strong, high-quality joints in construction, manufacturing, and repair. Welding electrodes transfer current to the base metal, generating heat to melt the materials. Different electrode types suit welding methods like stick, TIG, or MIG. Filler materials fill gaps, strengthen joints, and improve longevity, with options tailored to base metal characteristics. Overall, these materials are crucial for modern welding across industries.

-

BY ACCESSORIESThe Welding Equipment, Accessories, & Consumables market is segmented by accessories into Protective Gear, Gas Manifolds, Flow Controllers, Gas Panels, Gas Flow Meters, Gas Regulators, Gas Cabinets, Gas Filters, and Check Valves. The rising demand for helmets, flame-resistant clothing, respiratory protection, and other aspects of PPE in construction and other areas has propelled the growth of the protective gear segment.

-

BY TECHNOLOGYThe Welding Equipment, Accessories, & Consumables market is segmented by technology into Arc Welding, Oxy-fuel Welding, and Others. The arc welding segment accounted for the largest market share due to its low cost and applicability to a wide range of metals.

-

BY END-USE INDUSTRYThe Welding Equipment, Accessories, & Consumables market by end-use industry is segmented into Heavy Equipment/Earth Moving Equipment, Truck & Trailer, General Manufacturing, Automotive, Rail, Tank & Pressure Vessels, Aerospace, Marine & Shipbuilding, Construction & Infrastructure, Oil & Gas, Power Generation, Pipeline, and Maintenance & Repair. The use of equipment has seen significant growth with infrastructural development, technological advancement, and automobile production in recent years.

-

BY REGIONThe market covers North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Nations like China, India, Japan, and South Korea are experiencing rapid urban growth and major infrastructure projects, making the APAC the largest market. This includes building highways, bridges, railways, and smart urban areas.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including acquisitions and product launches. For instance, Lincoln Electric Holdings, Inc. (US), ESAB (US), Illinois Tool Works Inc. (US), Fronius International GmbH (Austria), Kemppi Oy (Finland), Panasonic Holdings Corporation (Japan), DAIHEN Corporation (Japan), Air Liquide (France), voestalpine AG (Austria), and Shenzhen Megmeet Electric Co., Ltd. (China), have entered into several agreements and partnerships to cater the growing demand for equipment, accessories, and consumables across various end-use industries, and have also launched new products to meet evolving customer demand.

Welding is the process of joining two materials through mechanical force, friction, or through heat using the sparks or fluxes produced by a torch tip. There are three basic types of welding processes: gas welding, arc welding, and oxy-fuel welding. Machines, jigs, and other devices required for the fabrication of welding articles from semi-finished stock to final products are termed welding equipment. The growth of the welding equipment, accessories & consumables market is expected to be driven by increasing demand from various end-use industries like construction, automotive, and general manufacturing.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of suppliers and manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Expanding utilization of steel for welding-intensive industries

-

•Innovation in automotive and expansion of EV sector

Level

-

•High running and maintenance costs

-

•Environmental impact of welding

Level

-

•Developments in Asia Pacific and Middle East & Africa offer opportunities

-

•Digitalization and IoT integration

Level

-

•Shortage of skilled labor and occupational health risks

-

•Intense competition

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

DRIVER: Innovation in automotive and expansion of EV sector

The use of welding equipment, accessories, and consumables is increasing across various end-use industries, such as automotive, and the adoption of EVs. First, the recent shift toward producing lighter vehicles requires new welding technologies capable of bonding delicate steels, aluminum, and other lightweight materials to improve fuel efficiency and maximize the driving range of electric vehicles. Second, EV manufacturing is experiencing a rapid growth in production volume, necessitating specialized welding technologies to handle battery packs, electrical components, and structural assemblies, where precision, durability, and safety are critically important. Third, the adoption of automation and robotic welding in automotive manufacturing is already accelerating the consumption of welding consumables and equipment, as companies recognize the potential for higher production rates, consistent weld quality, and lower manufacturing costs.

RESTRAINT: Environmental impact of welding

Fumes generated during welding release gases and tiny particles that can pollute the air we breathe. These pollutants can stay in the atmosphere, causing air pollution and contributing to issues like smog. Besides worsening climate change, certain hazardous gases released during welding can form ground-level ozone. Welding fumes may contain heavy metals such as chromium and nickel, damaging soil and water and impacting plants, animals, and overall biodiversity. These contaminants can affect the soil and water balance, potentially causing acid rain and disrupting ecosystems. The high energy use in welding also increases carbon dioxide levels and other greenhouse gases that fuel global warming. The steel industry, which depends heavily on welding, is a major source of these emissions. Furthermore, welding fumes pose serious health risks to workers, making it essential to use systems that capture and filter these fumes.

OPPORTUNITY: Digitalization and IoT integration

Digitalization and IoT integration offer a significant opportunity for welding consumables, equipment, and accessories because they fundamentally change how welding operations are managed, monitored, and optimized. With IoT-enabled welding equipment, manufacturers can track welding parameters like heat input, arc stability, and gas flow. This data-driven approach improves quality control, reduces rework, and makes better use of consumables. By cutting down on the waste of electrodes, wires, and shielding gases, IoT boosts cost efficiency and helps extend the lifespan of accessories.

CHALLENGE: Shortage of skilled labor and occupational health risks

The scarcity of skilled workers and occupational health hazards pose significant challenges to the welding consumables, equipment, and accessories market. The welding process requires skilled labor, and without it, productivity decreases, weld quality becomes inconsistent, and more materials are wasted, especially consumables like electrodes, wires, and shielding gases. Additionally, due to occupational health risks such as fumes, heat, and radiation, companies are compelled to invest more in safety equipment, accessories, and fume collection systems, which increase operational costs. These trends put pressure on manufacturers of robotic and automated welding systems to develop cost-effective, innovative solutions for manufacturers.

Welding Equipment, Accessories, and Consumables Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Lou-Rich deployed a series of automated robotic welding cells at its fabrication facilities to streamline its welding operations. The cells integrate robotic arms, precision positioners, automated wire feeders, and motion control to weld repetitive assemblies (such as structural frames, chassis components, and sheet-metal subassemblies). This mechanized setup enables continuous operation across shifts and ensures consistent weld quality across high volume runs. | The robotic welding cells enabled Lou-Rich to achieve higher throughput through continuous, unattended operation. They ensured uniform weld quality and reduced variability across production batches. By automating repetitive welds, the company reduced dependency on skilled manual welders, addressed labor shortages, and minimized scrap and rework. Overall, the solution improved production efficiency while delivering long-term cost savings and return on investment. |

|

Kawasaki Motors Manufacturing (KMM) implemented multiple robotic arc welding systems across its ATV and utility vehicle frame production lines. These included dedicated cells handling small to large components and feeding into a centralized robotic welding station. The goal was maintaining high production volumes while enhancing consistency and minimizing reliance on manual welding. | By automating approximately 80% of its arc welding operations, KMM significantly reduced weld inconsistency and frame distortion. The robots delivered high repeatability, enabling precise and consistent welds without requiring advanced vision systems. The cells' flexibility allowed the company to handle different part geometries with minimal setup changes. This improved product quality and allowed skilled welders to shift focus to critical inspections and complex welds, improving overall workflow efficiency. |

|

McCorvey Sheet Metal evaluated WeldComputer’s adaptive welding control system by integrating it into existing resistance seam welders. This temporary, noninvasive installation enabled real-world testing of the technology's impact on performance and energy efficiency within the company’s production environment. | The evaluation showed significant improvements in electrical efficiency, with power factor consistently maintained between 85–90% and peak energy demand reduced by up to 74%. The RMS current draw dropped significantly, cutting overall energy consumption. In addition to energy savings, the adaptive controls enhanced weld consistency and stability, improving product quality. The low-risk evaluation approach allowed McCorvey to validate the technology's benefits before committing to a full-scale rollout. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

An ecosystem map visually illustrates the network of companies operating within the welding equipment, accessories, and consumables market. It highlights key players, including raw material suppliers, manufacturers, distributors, and end users across industries. Each entity in the ecosystem interacts with others, influencing and being influenced by supply chain dynamics, market demand, and technological advancements. The diagram below presents the major entities in the welding equipment, accessories, and consumables market and their respective roles within the ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Welding Equipment, Accessories, and Consumables Market, by Equipment

The growth of electrode and filler material equipment in welding consumables, equipment, and accessories is driven by various structural and technological factors across industries, especially automotive, construction, and heavy manufacturing. Electrodes and filler materials are the primary consumables in welding processes, and their demand is increasing with the expanded use of welding in infrastructure projects, shipbuilding, energy, and automotive manufacturing. The shift to high-strength steels, alloys, and lightweight materials in automotive and EV production has created a need for specialized filler materials and advanced electrode types that ensure durability, corrosion resistance, and precise joining. Additionally, in construction and heavy fabrication, the demand for stronger and longer-lasting structures is boosting reliance on electrodes and filler materials with enhanced performance features.

Welding Equipment, Accessories, and Consumables Market, by Accessories

Protective gear is experiencing steady growth as a key segment within welding consumables, equipment, and accessories, mainly due to increased focus on worker safety, stricter regulations, and automation-driven demand for skilled operators. Helmets, gloves, goggles, flame-resistant clothing, and respiratory protection are all crucial parts of personal protective equipment (PPE) because welding involves risks like heat, sparks, fumes, molten metal, and UV radiation. High-quality protective gear has become mandatory at manufacturing and construction sites due to strict occupational health and safety regulations enforced by governments and industry bodies such as OSHA in the US, EU workplace safety directives, and similar standards worldwide.

Welding Equipment, Accessories, and Consumables Market, by Consumables

Electrodes and filler materials dominate the welding market because they are vital in producing strong, high-quality joints in construction, manufacturing, and repair. Welding electrodes transfer current to the base metal, generating heat to melt the materials. Different electrode types suit welding methods like stick, TIG, or MIG. Filler materials fill gaps, strengthen joints, and improve longevity, with options tailored to base metal characteristics. Overall, these materials are crucial for modern welding across industries.

Welding Equipment, Accessories, and Consumables Market, by Technology

During the forecast period, the arc welding segment is expected to lead the market for welding equipment, accessories, and consumables. This welding technique is defined by the creation of an electric arc between the electrode and the workpiece, generating focused and intense heat. This high temperature is essential because it effectively melts the surfaces of metals, enabling strong fusion. One of the key advantages of arc welding is its ability to produce consistent and controlled metal deposition. This not only boosts overall efficiency during welding but also enhances the strength of the welded joints. Additionally, arc welding equipment, accessories, and consumables demonstrate excellent corrosion resistance, making them suitable for harsh environments.

Welding Equipment, Accessories, and Consumables Market, by End-use Industry

The construction segment is expected to grow fastest and hold the largest market share, driven by infrastructure projects, urbanization, and modernization efforts. The surge in global infrastructure—bridges, railways, airports, and smart cities—relies heavily on welding for structural steel. As steel use rises, so does demand for welding consumables and advanced equipment. Modern welding technologies are encouraged by the need for durable, high-quality joints in high-rise urban buildings. Prefabrication and modular construction, which depend on welding, are also expanding. Government investments in infrastructure and housing further boost the demand, making construction a primary growth driver for the welding market, reliant on reliable consumables, equipment, and accessories.

REGION

Asia Pacific to register strong growth supported by industrialization, infrastructural development, and rising end-use demand

Countries like China, India, Japan, and South Korea are experiencing rapid urban growth and infrastructure development, including highways, bridges, railways, and smart urban areas. India’s National Infrastructure Pipeline involves large investments, boosting welding supply demand. The Asia Pacific region is a key manufacturing hub for automotive, shipbuilding, and heavy industries, which require extensive welding materials. The rise of electric vehicle (EV) manufacturing in these countries also increases demand for specialized welding tools, accessories, and consumables for batteries and light chassis. Overall, infrastructure projects, industrial expansion, renewable energy, EV production, and welding tech advances drive the need for welding supplies in Asia Pacific.

Welding Equipment, Accessories, and Consumables Market: COMPANY EVALUATION MATRIX

The market matrix shows Lincoln Electric (Star) as a leader in arc welding, automated joining, and brazing alloys, expanding through acquisitions and innovation. Repsol S.A. and voestalpine AG (Emerging Leaders) pursue growth strategies, with Repsol operating 500 companies worldwide and voestalpine gaining strength in emerging markets like China, India, Africa, and the Middle East. While Lincoln maintains a strong position with global manufacturing and product diversity, voestalpine demonstrates growth potential and differentiation, positioning it as a potential leader.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 34.72 Billion |

| Market Forecast in 2030 (Value) | USD 42.14 Billion |

| Growth Rate | CAGR of 3.29% from 2025-2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Welding Equipment, Accessories, and Consumables Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Deep Dive into US Welding Equipment, Accessories, and Consumables Market | Detailed breakdown of the US welding equipment, accessories, and consumables market into the Midwest, Southwest, Southeast, West, and Northeast | Insights into each region of the US and potential market for different welding equipment, accessories, and consumables |

RECENT DEVELOPMENTS

- June 2025 : ESAB signed an agreement to acquire Germany-based EWM GmbH for approximately USD 317.06 million (€275 million), aiming to complete the deal in the second half of 2025. This transaction addresses ESAB’s product gaps in heavy industrial welding equipment, enhances technological capabilities, and is expected to be profitable from year one, while expanding the company’s global market presence.

- March 2025 : Linde Engineering, a subsidiary of the global company Linde plc, collaborated to develop specialized welding wire techniques to improve speed and precision in ammonia tank construction, addressing Stress Corrosion Cracking for safer, more efficient storage.

- February 2025 : Air?Liquide announced that it will build, own, and operate a large-scale air separation unit (ASU) on Naoshima Island, Japan, expected to start operations in 2027. The facility will be capable of producing up to 1,400 tons per day of oxygen and nitrogen to support increasing demand driven by semiconductor manufacturing, transportation equipment manufacturing, and construction work. Argon and neon will also be produced to meet the needs of semiconductor manufacturing and welding applications.

- July 2024 : Lincoln Electric acquired Vanair Manufacturing, a leading US provider of mobile power solutions such as vehicle-mounted compressors, generators, welders, and electrified equipment. This acquisition broadens Lincoln Electric’s capabilities in the rapidly growing maintenance and repair service truck market and enhances ongoing joint development efforts..

- April 2024 : DAIHEN Corporation announced the acquisition of Rolan Robotics BV, a Netherlands-based systems integrator specializing in robotization and welding automation. This acquisition strengthened Daihen’s presence in the European robotics and welding market, especially in the Benelux countries, and improved technological integration within the Daihen group.

Table of Contents

Methodology

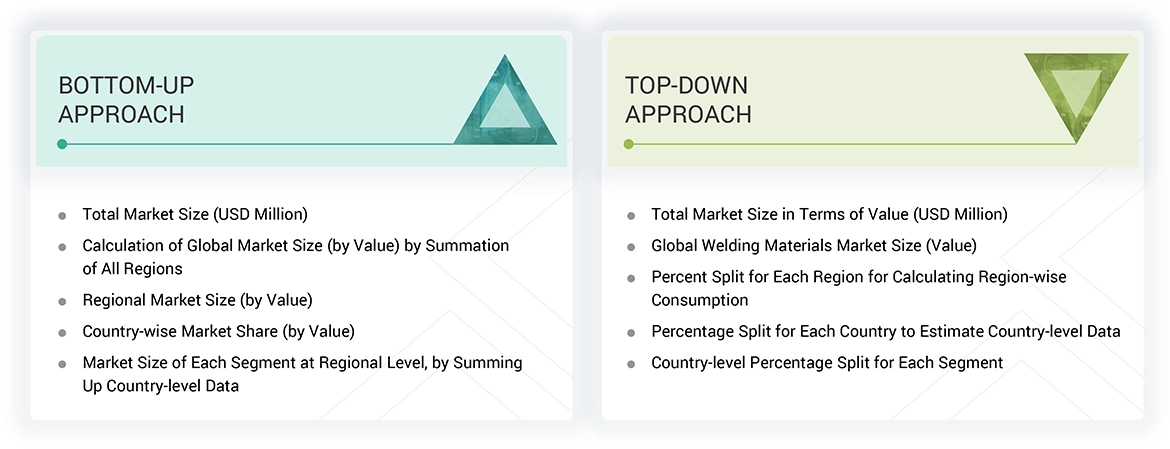

The study involved four main activities to estimate the current size of the global market for welding equipment, accessories, and consumables. Comprehensive secondary research was conducted to gather information on the market, the related product markets, and the parent product group market. The next step was to validate these findings, assumptions, and estimates with industry experts across the value chain of welding equipment, accessories, and consumables through primary research. Both top-down and bottom-up approaches were used to determine the overall market size. Subsequently, market breakdown and data triangulation procedures helped identify the sizes of various segments and sub-segments of the market.

Secondary Research

The market for companies offering welding equipment, accessories, and consumables is determined using secondary data from both paid and unpaid sources. This involves analyzing the product portfolios of major companies in the industry and rating them based on their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were consulted to gather information for this study on the welding equipment, accessories, and consumables market. Multiple sources were reviewed during the secondary research process to collect relevant data. These sources included annual reports, press releases, investor presentations from welding manufacturers, forums, certified publications, and whitepapers. This secondary research provided essential information on the industry’s value chain, the key players, market classifications, and segmentation from both market and technology perspectives.

Primary Research

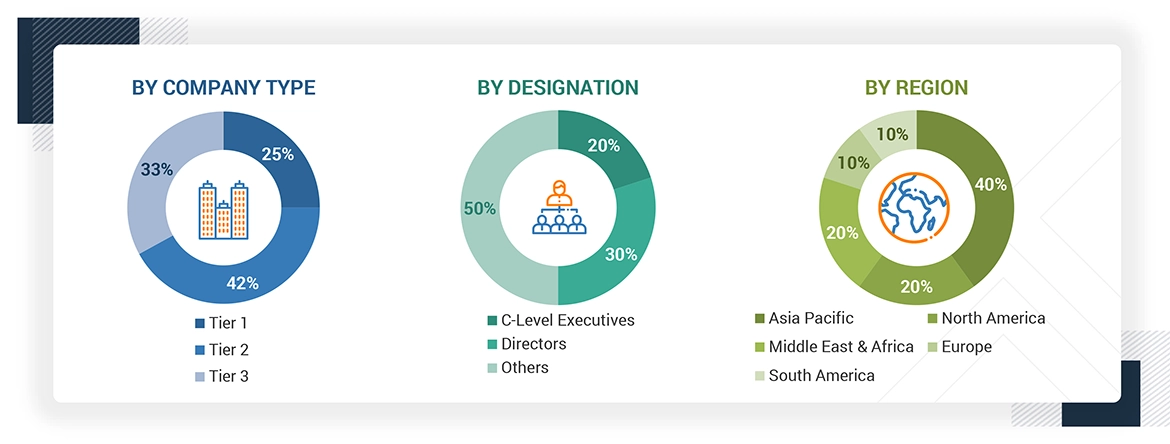

During the primary research process, various primary sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. The supply-side sources included industry experts such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and other key executives from several leading companies and organizations operating in the welding equipment, accessories, and consumables market. After completing the market engineering calculations—covering market statistics, market breakdown, size estimations, forecasting, and data triangulation—extensive primary research was conducted to verify and validate the critical data points. This research also aimed to identify segmentation types, industry trends, the competitive landscape of welding equipment, accessories, and consumables offered by various market players, as well as key market dynamics like drivers, restraints, opportunities, challenges, industry trends, and strategies of major players. Throughout the entire market engineering process, top-down and bottom-up approaches and multiple data triangulation methods were extensively employed to perform market estimations and forecasts for the overall market segments and subsegments outlined in this report. A comprehensive blend of qualitative and quantitative analysis was conducted to generate key insights and information throughout the report.

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the global welding equipment, accessories, and consumables market. size These approaches were also extensively used to estimate the size of various related market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After estimating the overall market size using the appropriate processes, the market was divided into various segments and subsegments. Data triangulation and market breakup methods were used, where applicable, to complete the entire market analysis and obtain accurate statistics for each segment and subsegment. The data was triangulated by examining different factors and trends from both the demand and supply sides.

Market Definition

Welding is the process of joining two materials through mechanical force, friction, or heat caused by sparks or fluxes produced by a torch tip. There are three basic types of welding processes — gas welding, arc welding, and oxy-fuel welding. Machines, jigs, and other devices are called welding equipment for fabricating welding articles from semi-finished stock to final products.

Stakeholders

- Welding equipment, accessory, and consumable manufacturers

- Raw material suppliers

- Traders and distributors

- Industry associations

- Research organizations, trade associations, and government agencies

- R&D institutes

- Regulatory bodies

- End-use industries

Report Objectives

- To define, describe, and forecast the size of the global welding equipment, accessories, and consumables market based on equipment, consumable, accessory, technology, end-use industry, and region in terms of value

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To forecast the market size of segments and subsegments for North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments such as product launches, acquisitions, expansions, partnerships, and agreements in the welding equipment, accessories, and consumables market

- To provide the impact of AI/Gen AI on the market

Key Questions Addressed by the Report

What are the major drivers driving the growth of the welding equipment, accessories, and consumables market?

Expanding steel utilization; automotive innovation and EV expansion; advancements in welding technologies that improve precision and efficiency; and increasing demand from other end-use industries.

What are the major challenges in the welding equipment, accessories, and consumables market?

Shortage of skilled labor, occupational health risks, and fierce competition.

What are the restraining factors in the welding equipment, accessories, and consumables market?

High operating and maintenance costs, and the environmental impact of welding.

What is the key opportunity for welding equipment, accessories, and consumables?

Market developments in Asia Pacific and the Middle East & Africa; digitalization; IoT integration; and growth of wind energy infrastructure.

What are the end-use industries of welding equipment, accessories, and consumables?

Heavy equipment/earthmoving equipment, trucks and trailers, general manufacturing, automotive, rail, tank & pressure vessels, aerospace, marine & shipbuilding, construction & infrastructure, oil & gas, power generation, pipeline, and maintenance & repair.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Welding Equipment, Accessories, and Consumables Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Welding Equipment, Accessories, and Consumables Market