1,6-Hexanediol Market by Application (Polyurethanes, Coatings, Acrylates, Adhesives, Polyester Resins, and Plasticizers), and Region (Europe, APAC, North America, South America, and Middle East & Africa) - Global Forecast to 2025

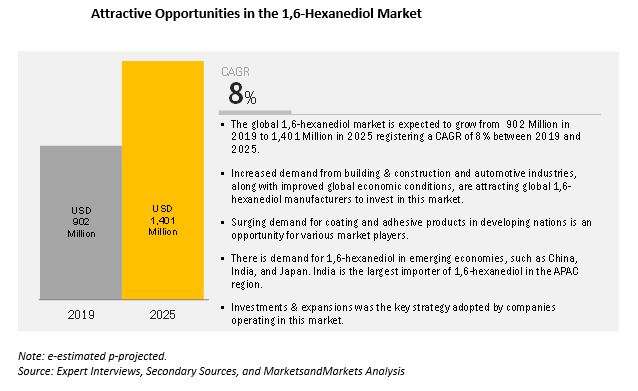

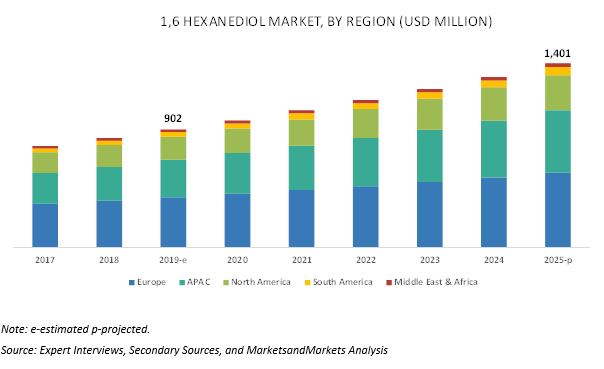

The 1,6-hexanediol market is projected to reach USD 1,401 million by 2025, at a CAGR of 8%. The demand for 1,6-hexanediol has improved in the recent years due to its increased consumption in the APAC region. In addition, the increasing usage of 1,6-hexanediol in varied applications, such as coatings, PU, acrylates, and polyester resins, has further contributed to the growth of this market. As PU is the largest end user of 1,6-hexanediol, it is used as a chain extender in the PU and other resins application segments. It converts the PU into a modified PU with substantially high corrosion resistance. It permeates different properties in PU, such as high mechanical strength, low glass transition temperature, and high heat resistance.

Polyurethane is expected to be the largest application during the forecast period.

The polyurethanes segment is the largest application segment of the global 1,6-hexanediol market, in terms of value and volume. A principal factor for growth of polyurethanes is the demand for its sub-applications or derivatives, such as thermoplastic polyurethanes elastomers, coatings, and foams, across varied regions. The APAC region with the rising demand for polyurethanes further propels the growth of the global 1,6-hexanediol market. In addition, emerging countries in the APAC region, such as China, Korea, India, and Vietnam have witnessed an increase in the polyurethane production. Thus, increasing demand for polyurethanes across varied industry verticals has contributed to the growth of the polyurethanes segment.

APAC to record the highest growth rate during the forecast period.

The APAC 1,6-hexanediol market is projected to register the highest CAGR during the forecast period, due to the rising demand for 1,6-hexanediol from Japan, India, China, and South Korea. China is expected to lead the demand for 1,6-hexanediol due to the increase in the production of polyurethane and coatings due to increase in construction activities.The construction industry is expected to witness significant growth in the next five years, owing to huge investments in new infrastructure developments, new housing projects, and renovation/repaint of residential and commercial buildings in the US, China, India, and Brazil. The demand for coatings in the APAC region has increased significantly, and this trend is expected to continue in the near future. The coatings industry is moving towards consolidation as top coating players are acquiring other local and foreign players.

Market Dynamics

The global market of 1,6-Hexanediol is estimated to witness steady growth in developing nations of APAC, including Japan. Increasing penetration of new players and a substantial presence of Chinese manufacturers in the 1,6-Hexanediol market are acting as prime factors impacting the overall production rate in the region. The polyurethane industry is expected to grow in the APAC region, owing to the rise in R&D, government regulations, cost advantage, low-cost workforce, and better manufacturing facilities, thereby driving the consumption rate in the 1,6-Hexanediol market. A major factor responsible for the growth of polyurethanes is the demand for its sub-applications or derivatives, such as thermoplastic polyurethane elastomers, coatings, and foams, across varied regions. Owing to the rising demand for polyurethanes in APAC, the region is further expected to propel the growth of the global 1,6-Hexanediol market. In addition, the emerging countries in the APAC region, such as China, South Korea, India, and Vietnam, have witnessed an increase in the polyurethane production since 2017. Thus, the increasing demand for polyurethanes across varied industry verticals has contributed to the growth of the polyurethanes segment in the region.

However, Storage and transportation is a major challenge for 1,6-Hexanediol as it is highly hygroscopic in nature, and measures need to be taken to minimize its exposure to air or moisture. The temperature of the product should be maintained between 55°C and 70°C at all times to optimize its utility. 1,6-Hexanediol has been found to exhibit low toxicity, and proper precautions need to be undertaken while handling the chemical. It causes eye irritation and diffuses opacity of cornea upon contact with the eyes. Vapors or dust of 1,6-Hexanediol also causes respiratory tract irritation. Furthermore, proper protective garments are required to be worn by people handling the substance to minimize skin contact.

1,6-Hexanediol Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019–2025 |

|

Base year |

2018 |

|

Forecast period |

2019–2025 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

Application and Region |

|

Regions |

APAC, North America, Europe, South America, and Middle East & Africa |

|

Companies |

BASF SE (Germany), Lanxess Aktiengesellschaft (Germany), Linshui Nanming Chemical Co., Ltd (China), Perstorp AB (Sweden), Ube Industries, Ltd. (Japan). |

This research report categorizes the 1,6-hexanediol market based on application and region.

On the basis of application, the 1,6-hexanediol market is segmented as follows:

- Polyurethane

- Coatings

- Acrylates

- Adhesives

- Polyester Resins

- Plasticizers

- Others resins (alkyd and epoxy)

On the basis of region, the 1,6-hexanediol market is segmented as follows:

- APAC

- North America

- Europe

- South America

- Middle East & Africa

Leading Players in 1,6-Hexanediol Market

BASF SE is a leading chemical company that offers a wide range of chemicals and intermediate solutions. The company operates through five business segments, namely, chemicals, performance products, functional materials & solutions, agricultural solutions, and oil & gas. It offers 1,6-Hexanediol through its chemicals business segment within the monomers division. The company has a strong customer base and operates in Europe, APAC, North America, South America, Africa, and the Middle East. The company has six production sites globally, the largest of which is in Ludwigshafen.

LANXESS, a specialty chemicals company, develops, manufactures, and markets chemical intermediates, specialty chemicals, and plastics, worldwide. It operates in five segments; advanced intermediates, specialty additives, performance chemicals, engineering materials, and Arlanxeo. The company offers 1,6-Hexanediol through its engineering materials segment under its high-performance materials business unit. The company operates through a total of 75 production sites and is present in 25 countries.

Recent Developments

- In September 2018, BASF SE announced to increase the production capacity of 1,6-Hexanediol at its Ludwigshafen Verbund site by more than 50% after the start-up in 2021. After this expansion, the production capacity of 1,6-Hexanediol will be more than 70,000 metric tons per year. 1,6-Hexanediol produced from the facility will be used in high growth sectors such as automotive, furniture, and packaging.

- In April 2017, Lanxess invested USD 111.96 million for the expansion of intermediates production. Advanced Industrial Intermediates, the business segment of Lanxess is expanding its production facility and is expected to complete by 2020. Around USD 44.78 million is expected to be invested in the Leverkusen and Krefeld-Uerdingen sites. At the Krefeld-Uerdingen site, the company plans to expand the production facility of trimethylolpropane, hexanediol, benzylalcohol, and menthols to meet the demand of the global market.

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of a specific country based on application

Company Information:

Detailed analysis and profiling of top ten market players

Frequently Asked Questions (FAQ):

What are the factors Influencing the growth of 1,6 Hexanediol?

What are the advantages of 1,6 Hexanediol?

What are the major applications of 1,6 Hexanediol?

1,6 Hexanediol has various applications such as Polyurethane, Coatings, Acrylates, Adhesives, Polyester Resins, and Plasticizers among others.

Which are the available substitutes for 1,6 Hexanediol?

Which application is estimated to register the highest demand for 1,6 Hexanediol?

Who are the major manufacturers?

What is the biggest restraint for 1,6 Hexanediol?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

2.3.2 Key Industry Insights

2.3.3 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Data Triangulation

2.6 Assumptions and Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 24)

3.1 Introduction

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the 1,6-Hexanediol Market

4.2 1,6-Hexanediol Market, By Application

4.3 APAC 1,6-Hexanediol Market, By Application and Country

4.4 1,6-Hexanediol Market, Developed Vs. Developing Countries

4.5 1,6-Hexanediol Market: Major Countries

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Demand for 1,6-Hexanediol in the Polyurethanes Application From APAC

5.2.1.2 Growth of Coatings Application From Various End-Use Industries

5.2.1.3 New Technological Advancements and Development of Bio-Based Raw Materials

5.2.2 Restraints

5.2.2.1 Storage and Transportation is a Major Restraint

5.2.3 Opportunities

5.2.3.1 R&D Investment and Capacity Expansion, Globally

5.2.3.2 Growing Automotive Industry in APAC and the Middle East

5.2.4 Challenges

5.2.4.1 Availability of Substitutes, Such as 1,4-Butanediol and 1,5-Pentanediol

5.3 Porter’s Five Forces Analysis

5.3.1 Intensity of Competitive Rivalry

5.3.2 Bargaining Power of Buyers

5.3.3 Bargaining Power of Suppliers

5.3.4 Threat of Substitutes

5.3.5 Threat of New Entrants

5.4 Relative Comparison of Competitive Diols

5.4.1 End User Analysis

5.5 Macroeconomic Overview and Key Trends

5.5.1 Introduction

5.5.2 Trends and Forecast of GDP

5.5.3 Trends in Automotive Industry

5.5.4 Construction Industry Spending Worldwide, 2017–2025

6 1,6-Hexanediol Market, By Application (Page No. - 41)

6.1 Introduction

6.2 Polyurethanes

6.2.1 High Demand From Thermoplastic Polyurethanes Elastomers, Foams to Drive the Polyurethanes Market

6.3 Coatings

6.3.1 1,6-Hexanediol Provides Excellent Surface Hardness and Flexibility That Enhances Impact Resistance in Coatings

6.4 Acrylates

6.4.1 Increasing Demand for Molecular Building Blocks, Textile Adhesive Resins, and Surface Coatings to Drive the Demand for Acrylates, Globally

6.5 Adhesives

6.5.1 Growing Automobiles, Construction, Sports & Leisure, Footwear, Furniture, and Electronic End-Use Industries to Drive the Market, Globally

6.6 Polyester Resin

6.6.1 Demand From Composite Industry Will Drive Polyester Resin Application

6.7 Plasticizers

6.7.1 Positive Growth in the Construction and Electronics Industries in APAC and Middle East & Africa Driving the Market

6.8 Others

7 1,6-Hexanediol Market, By Region (Page No. - 51)

7.1 Introduction

7.2 Europe

7.2.1 Germany

7.2.1.1 Thriving Demand for Coatings, Adhesives, and Polymeric Materials From the Construction Industry

7.2.2 France

7.2.2.1 Gradual Growth of Automotive Industry is Expected to Drive the 1,6-Hexanediol Market

7.2.3 UK

7.2.3.1 Stringent Regulatory Framework in the Country is Affecting the 1,6-Hexanediol Market

7.2.4 Italy

7.2.4.1 Increasing Demand for 1,6-Hexanediol in Polyurethanes and Coatings Applications is Expected to Drive the Market

7.2.5 Russia

7.2.5.1 1,6-Hexanediol Market is Expected to Grow at a Moderate Rate

7.2.6 The Netherlands

7.2.7 Turkey

7.2.8 Belgium

7.2.9 Spain

7.2.10 Rest of Europe

7.3 APAC

7.3.1 China

7.3.1.1 The Country is One of the Largest 1,6-Hexanediol Manufacturers

7.3.2 Japan

7.3.2.1 Growing Automotive and Electronics Industries to Drive the Demand for 1,6-Hexanediol

7.3.3 India

7.3.3.1 Construction and Automotive Industries to Drive the Growth of 1,6-Hexanediol Market

7.3.4 South Korea

7.3.5 Singapore

7.3.6 Malaysia

7.3.7 Thailand

7.3.8 Indonesia

7.3.9 Rest of APAC

7.4 North America

7.4.1 US

7.4.1.1 Increasing Demand From Polyurethanes, Coatings, and Adhesives Will Drive the 1,6-Hexanediol Market

7.4.2 Canada

7.4.2.1 Automotive End-Use Industry to Drive the 1,6-Hexanediol Market

7.4.3 Mexico

7.4.3.1 Polyester Resins, Which are Widely Used in the Manufacturing of Kayaks, Powerboats, Sailboats, and a Number of Automobile Parts to Drive the 1,6-Hexanediol Market

7.5 South America

7.5.1 Brazil

7.5.1.1 The Country is an Attractive Market for 1,6-Hexanediol Production Due to the Easy Availability of Its Raw Materials

7.5.2 Argentina

7.5.2.1 Vehicle Sales is Expected to Increase During the Forecast Period, Thereby Driving the 1,6-H Exanediol Market

7.5.3 Colombia

7.5.3.1 Automotive End-Use Industry to Drive the 1,6-Hexanediol Market

7.5.4 Rest of South America

7.6 Middle East & Africa

7.6.1 South Africa

7.6.1.1 the Demand for 1,6-Hexanediol is Increasing Due to the Rapid Expansion of the Construction Industry

7.6.2 Saudi Arabia

7.6.2.1 Construction Industry to Drive the Market in Polyurethanes and Coatings Applications

7.6.3 UAE

7.6.3.1 the Demand for 1,6-Hexanediol is Increasing Due to the Rapid Expansion of the Construction Industry

7.6.4 Iran

7.6.4.1 Vehicle Sales is Expected to Increase During the Forecast Period, Thereby Driving the 1,6-Hexanediol Market

7.6.5 Rest of Middle East & Africa

8 Competitive Landscape (Page No. - 84)

8.1 Overview

8.2 Competitive Scenario

8.2.1 Investment & Expansion

9 Company Profiles (Page No. - 85)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

9.1 BASF SE

9.2 Fushun Tianfu Chemicals Co. Ltd

9.3 LANXESS

9.4 Linshui Nanming Chemical Co., Ltd

9.5 Perstorp Holding AB

9.6 UBE Industries, Ltd

9.7 Shandong Yuanli Science and Technology Co., Ltd.

9.8 Prasol Chemical Ltd

9.9 Hefei TNJ Chemical Industry Co., Ltd

9.10 Zhengzhou Meiya Chemical Products Co., Ltd

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not be Captured in Case of Unlisted Companies.

10 Appendix (Page No. - 101)

10.1 Discussion Guide

10.2 Knowledge Store: Marketsandmarkets Subscription Portal

10.3 Available Customizations

10.4 Related Reports

10.5 Author Details

List of Tables

Table 1 1,6-Hexanediol Market Snapshot

Table 2 Major Players Profiled in This Report

Table 3 APAC Automobile Production in 2018

Table 4 Effect Assessment of 1,5-Pentanediol

Table 5 Relative Comparison of Competitive Diols

Table 6 End User Analysis

Table 7 GDP Annual Percentage Change

Table 8 Automotive Production Trends, Million Units (2014–2018)

Table 9 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 10 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 11 1,6-Hexanediol Market Size in Polyurethanes, By Region, 2015–2025 (USD Million)

Table 12 1,6-Hexanediol Market Size in Polyurethanes, By Region, 2015–2025 (Kiloton)

Table 13 1,6-Hexanediol Market Size in Coatings, By Region, 2015–2025 (USD Million)

Table 14 1,6-Hexanediol Market Size in Coatings, By Region, 2015–2025 (Kiloton)

Table 15 1,6-Hexanediol Market Size in Acrylates, By Region, 2015–2025 (USD Million)

Table 16 1,6-Hexanediol Market Size in Acrylates, By Region, 2015–2025 (Kiloton)

Table 17 1,6-Hexanediol Market Size in Adhesives, By Region, 2015–2025 (USD Million)

Table 18 1,6-Hexanediol Market Size in Adhesives, By Region, 2015–2025 (Kiloton)

Table 19 1,6-Hexanediol Market Size in Polyester Resin, By Region, 2015–2025 (USD Million)

Table 20 1,6-Hexanediol Market Size in Polyester Resin, By Region, 2015–2025 (Kiloton)

Table 21 Advantages of 1,6-Hexanediol-Based Polyester Resin in the Construction Industry

Table 22 1,6-Hexanediol Market Size in Plasticizers, By Region, 2015–2025 (USD Million)

Table 23 1,6-Hexanediol Market Size in Plasticizers, By Region, 2015–2025 (Kiloton)

Table 24 1,6-Hexanediol Market Size in Other Applications, By Region, 2015–2025 (USD Million)

Table 25 1,6-Hexanediol Market Size in Other Applications, By Region, 2015–2025 (Kiloton)

Table 26 1,6-Hexanediol Market Size, By Region, 2015–2025 (USD Million)

Table 27 1,6-Hexanediol Market Size, By Region, 2015–2025 (Kiloton)

Table 28 Europe: 1,6-Hexanediol Market Size, By Country, 2015–2025 (USD Million)

Table 29 Europe: 1,6-Hexanediol Market Size, By Country, 2015–2025 (Kiloton)

Table 30 Europe: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 31 Europe: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 32 Germany: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 33 Germany: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 34 France: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 35 France: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 36 UK: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 37 UK: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 38 Italy: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 39 Italy: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 40 Russia: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 41 Russia: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 42 The Netherlands: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 43 The Netherlands: 1,6-Hexanediol Market Size, 2015–2025 (Kiloton)

Table 44 Turkey: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 45 Turkey: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 46 Belgium: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 47 Belgium: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 48 Spain: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 49 Spain: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 50 Rest of Europe: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 51 Rest of Europe: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 52 APAC: 1,6-Hexanediol Market Size, By Country, 2015–2025 (USD Million)

Table 53 APAC: 1,6-Hexanediol Market Size, By Country, 2015–2025 (Kiloton)

Table 54 APAC: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 55 APAC: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 56 China: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 57 China: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 58 Japan: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 59 Japan: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 60 India: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 61 India: 1,6-Hexanediol Market Size, By Application, 2019–2025 (Kiloton)

Table 62 South Korea: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 63 South Korea: 1,6-Hexanediol Market Size, 2019–2025 (Kiloton)

Table 64 Singapore: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 65 Singapore: 1,6-Hexanediol Market Size, 2019–2025 (Kiloton)

Table 66 Malaysia: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 67 Malaysia: 1,6-Hexanediol Market Size, 2019–2025 (Kiloton)

Table 68 Thailand: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 69 Thailand: 1,6-Hexanediol Market Size, 2019–2025 (Kiloton)

Table 70 Indonesia: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 71 Indonesia: 1,6-Hexanediol Market Size, 2019–2025 (Kiloton)

Table 72 Rest of APAC: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 73 Rest of APAC: 1,6-Hexanediol Market Size, 2019–2025 (Kiloton)

Table 74 North America: 1,6-Hexanediol Market Size, By Country, 2015–2025 (USD Million)

Table 75 North America: 1,6-Hexanediol Market Size, By Country, 2015–2025 (Kiloton)

Table 76 North America: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 77 North America: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 78 US: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 79 US: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 80 Canada: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 81 Canada: 1,6-Hexanediol Market Size, 2015–2025 (Kiloton)

Table 82 Mexico: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 83 Mexico: 1,6-Hexanediol Market Size, 2015–2025 (Kiloton)

Table 84 South America: 1,6-Hexanediol Market Size, By Country, 2015–2025 (USD Million)

Table 85 South America: 1,6-Hexanediol Market Size, By Country, 2015–2025 (Kiloton)

Table 86 South America: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 87 South America: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 88 Brazil: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 89 Brazil: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 90 Argentina: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 91 Argentina: 1,6-Hexanediol Market Size, 2015–2025 (Kiloton)

Table 92 Colombia: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 93 Colombia: 1,6-Hexanediol Market Size, 2015–2025 (Kiloton)

Table 94 Rest of South America: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 95 Rest of South America: 1,6-Hexanediol Market Size, 2015–2025 (Kiloton)

Table 96 Middle East & Africa: 1,6-Hexanediol Market Size, By Country, 2015–2025 (USD Million)

Table 97 Middle East & Africa: 1,6-Hexanediol Market Size, By Country, 2015–2025 (Kiloton)

Table 98 Middle East & Africa: 1,6-Hexanediol Market Size, By Application, 2015–2025 (USD Million)

Table 99 Middle East & Africa: 1,6-Hexanediol Market Size, By Application, 2015–2025 (Kiloton)

Table 100 South Africa: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 101 South Africa: 1,6-Hexanediol Market Size, 2015–2025 (Kiloton)

Table 102 Saudi Arabia: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 103 Saudi Arabia: 1,6-Hexanediol Market Size, 2015–2025 (Kiloton)

Table 104 UAE: 1,6-Hexanediol Market Size, By 2015–2025 (USD Million)

Table 105 UAE: 1,6-Hexanediol Market Size, By 2015–2025 (Kiloton)

Table 106 Iran: 1,6-Hexanediol Market Size, By 2015–2025 (USD Million)

Table 107 Iran: 1,6-Hexanediol Market Size, 2015–2025 (Kiloton)

Table 108 Rest of Middle East & Africa: 1,6-Hexanediol Market Size, 2015–2025 (USD Million)

Table 109 Rest of Middle East & Africa: 1,6-Hexanediol Market Size, 2015–2025 (Kiloton)

Table 110 Investments & Expansions, 2016–2019

List of Figures (31 Figures)

Figure 1 1,6-Hexanediol Market Segmentation

Figure 2 1,6-Hexanediol Market: Research Design

Figure 3 1,6-Hexanediol Market: Bottom-Up Approach

Figure 4 1,6-Hexanediol Market: Top-Down Approach

Figure 5 1,6-Hexanediol Market: Data Triangulation

Figure 6 APAC to be the Fastest Growing 1,6-Hexanediol Market

Figure 7 Coatings to be the Most Attractive Application of 1,6-Hexanediol

Figure 8 Emerging Economies Offer Attractive Opportunities to the Market

Figure 9 Polyurethanes Segment Led the Market in 2018

Figure 10 Polyurethanes Application and China Accounted for the Largest Shares

Figure 11 1,6-Hexanediol Market to Grow Faster in Developing Countries

Figure 12 India to be the Fastest-Growing Market

Figure 13 Drivers, Restraints, Opportunities, and Challenges in the 1,6-Hexanediol Market

Figure 14 1,4-Butanediol and 1,5-Pentanediol are the Closest Substitutes in the 1,6-Hexanediol Market

Figure 15 Global Spending in Construction Industry, 2017–2025

Figure 16 Rising Demand for Polyurethanes in Various Industries to Drive the Market Between 2019 and 2025

Figure 17 India to Register the Highest CAGR During the Forecast Period

Figure 18 Europe: 1,6-Hexanediol Market Snapshot

Figure 19 APAC: 1,6-Hexanediol Market Snapshot

Figure 20 North America: 1,6-Hexanediol Market Snapshot

Figure 21 South America: 1,6-Hexanediol Market Snapshot

Figure 22 Middle East & Africa: 1,6 Hexanediol Market Snapshot

Figure 23 BASF SE: Company Snapshot

Figure 24 BASF SE: SWOT Analysis

Figure 25 Fushun Tianfu Chemicals Co. Ltd: SWOT Analysis

Figure 26 LANXESS: Company Snapshot

Figure 27 LANXESS: SWOT Analysis

Figure 28 Linshui Nanming Chemical Co., Ltd: SWOT Analysis

Figure 29 Perstorp Holding AB: Company Snapshot

Figure 30 Perstorp Holding AB: SWOT Analysis

Figure 31 UBE Industries, Ltd: Company Snapshot

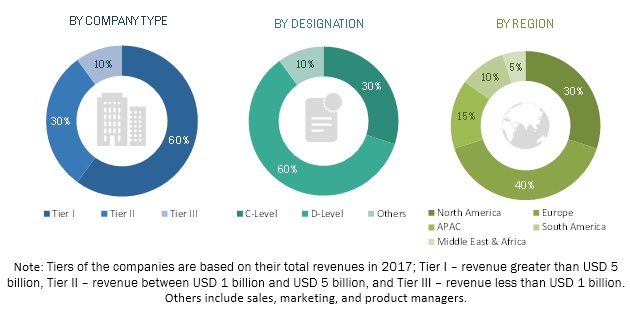

The study involved four major activities in estimating the current market size of 1,6-hexanediol. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation methods were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg, and BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The 1,6-hexanediol market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side for this market is characterized by the development of construction and automotive manufacturers, and applications, such as polyurethane, coatings, adhesives, polyester resin, plasticizers and others. The supply side is characterized by advancements in functions, technologies, and diverse end-use industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the overall size of the 1,6-hexanediol market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global 1,6-hexanediol market, in terms of value and volume

- To provide information about the factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze and forecast the 1,6-hexanediol market based on application

- To analyze and forecast the market size, with respect to five main regions (along with their respective key countries), namely, North America, Europe, APAC, the Middle East & Africa, and South America

- To strategically analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze competitive developments, for instance, investment & expansion, in the market

- To analyze opportunities in the market for stakeholders and provide details of a competitive landscape of the market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of a specific country based on application

Company Information:

- Detailed analysis and profiling of top ten market players

Growth opportunities and latent adjacency in 1,6-Hexanediol Market

Interested in purchase of report along with additional customization