Adaptive Security Market by Component (Solution, Services), Application (Network Security, Endpoint Security, Application Security, Cloud Security, Others), Deployment Mode, Organization Size, Vertical, Region - Global Forecast to 2021

[160 pages Report] The adaptive security market size is expected to grow from USD 3526.5 million in 2016 to USD 7,065.4 million by 2021, at a CAGR of 14.9% during the forecast period. Adaptive security is a set of technologies and processes designed to secure organization’s critical network infrastructure from advanced cyber threats. The need to defend against advanced cyber-attacks, limitations of traditional security solutions, and need for security compliances and regulations have led to growth of the market. The growth of the adaptive security market is also propelled by the need to combat with advanced threats and vulnerabilities, and secure the enterprise cloud. Cyber-attacks are increasing at an alarming rate and this has necessitated the organizations worldwide to adopt adaptive security components to address the attacks in the continuously evolving threat landscape. The base year for the study is 2016 and the forecast period is considered to be 2016 to 2021.

Adaptive Security Market Dynamics

Drivers

- Need to defend against advanced cyber-attacks

- Limitations of traditional security solutions

- Need for security compliances and regulations

Restraints

- High cost of innovation and budget constraints

- Lack of visibility across IT infrastructure

Opportunities

- Rise in demand for intelligence-driven and multi-layered security solutions

- Rise in adoption of cloud-based security technologies across organizations

Challenges

- Aggregating and analyzing large volumes of data

- Shortage of skilled cybersecurity professionals

Need to defend against advanced cyber-attacks is driving the global adaptive security market

Organizations globally are under constant assault from sophisticated threats such as Advanced Persistent Threats (APT), zero-day malwares, and other targeted attacks. These modern day cyber-attacks are dynamic and well organized to exploit the security loopholes in the organization’s traditional defense. Cybercriminals are adopting various hacking techniques to penetrate into an organization’s IT infrastructure, to gain access to such business critical information, which might cause damages and result in huge financial and data losses. As a result, defending against these advanced cyber-attacks requires a strategy that moves beyond traditional defense. The adaptive security practices strive to take advantage of existing security infrastructure to ensure a strong security posture within the organization. Both large enterprise as well as small and medium enterprises (SMEs) are looking forward to deploy security solutions, which are adaptive to evolving threats, to safeguard their networks, endpoints, data, and users against such malicious attacks.

The following are the major objectives of the study

- To define, describe, and forecast the adaptive security market on the basis of components (solutions and services), application, deployment mode, organization size, verticals, and regions

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to the individual growth trends, future prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

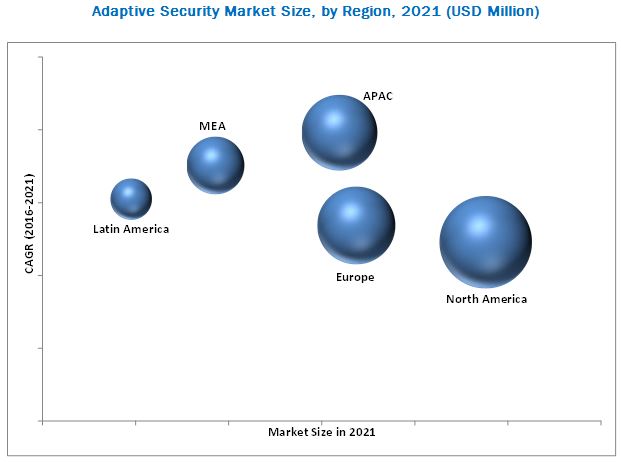

- To forecast the market size of the segments with respect to five main regions, namely North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players in the market and comprehensively analyze their market size and core competencies2

- To track and analyze competitive developments, such as new product launches, mergers and acquisitions, and partnerships, agreements, and collaborations in the global market

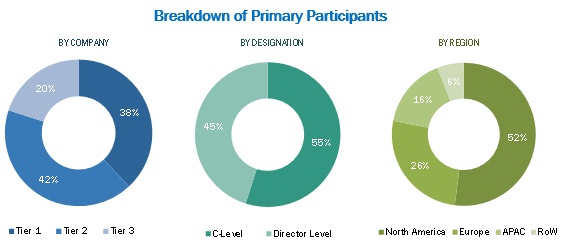

The research methodology used to estimate and forecast the adaptive security market begins with collection and analysis of data on key vendor revenues through secondary sources such as company website, press releases, annual reports, the SANS Institute, SC Magazine, and Cloud Security Alliance (CSA). The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the total market size of the global market from the revenue of the key players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of the primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The adaptive security market comprises key vendors, such as Cisco Systems, Inc. (California, US), Juniper Networks (California, US), Trend Micro, Inc. (Tokyo, Japan), FireEye, Inc. (California, US), Rapid7, Inc. (Massachusetts, US), Panda Security (Bilbao, Spain), Illumio (California, US), EMC RSA (Massachusetts, US), Aruba Networks (California, US), and Cloudwick. (California, US). These vendors sell market to end-users to cater to their unique business requirements and security needs.

Major Market Developments

- In August 2016, Cisco acquired CloudLock, Inc., a privately held cloud security company for USD 293 million to enhance its cloud security and security everywhere strategy. Acquisition took place for 293 USD.

- In March 2016, Trend Micro acquired Tipping point for USD 300 million for enhancing its security portfolio.

- In January 2016, FireEye and Parsons partnered to offer advanced cybersecurity to critical infrastructure and IT environment.

Key Target Audience for Adaptive Security Market

- Adaptive security vendors

- Government agencies

- Network solution providers

- Independent software vendors

- Consulting firms

- System integrators

- Value-Added Resellers (VARs)

- Managed Security Service Providers (MSSPs)

- Government agencies

“Study answers several questions for the stakeholders, primarily which market segments to focus in the next 2–5 years for prioritizing the efforts and investments”.

Scope of the Market

The research report segments the adaptive security market into the following submarkets:

By Component

- Solution

- Service

- Professional Service

- Consulting

- Support and Maintenance

- Training and Education

- Managed Service

- Professional Service

Adaptive Security Market Research By Application

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others (database security and web security)

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Vertical

- Government and Defense

- Banking, Financial Services, and Insurance (BFSI)

- Retail

- IT and Telecom

- Healthcare

- Energy and Utilities

- Manufacturing

- Education

- Others (media and entertainment, hospitality, and automotive)

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Critical questions which the report answers

- What are new application areas which the adaptive security companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America market

- Further breakdown of the Europe market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players

The adaptive security market size is expected to grow from USD 3,526.5 million in 2016 to USD 7,065.4 million by 2021, at a CAGR of 14.9% during the forecast period. The major growth drivers of the market include need to defend against advanced cyber-attacks, limitations of traditional security solutions, and need for security compliances and regulations.

Adaptive security is a real-time information security approach that helps to protect the network from cyber-attacks, advanced threats, and vulnerabilities. It offers comprehensive adaptive protection process with improved predictive, preventive, detective and response capabilities to safeguards networks, endpoints, applications, and data from real time behavioral anomalies and advanced threats. With the suitable adaptive security architecture, an enterprise can prevent security breaches and enhance its information security infrastructure across complex IT environment. The sophistication level in the cyber-attacks is increasing and creating demands for more comprehensive adaptive security solutions that would protect enterprises from advanced cyber threats.

The adaptive security market by component has been segmented, on the basis of solution and services. The market for services segment is expected to grow at the highest CAGR between 2016 and 2021. The high adoption of adaptive security solutions and services by the global organizations contribute to the rapid growth of the market.

The adaptive security market by application has been segmented into network security, endpoint security, application security, cloud security, and others. The network security segment is expected to have the largest market size in market by application by 2021. As the vulnerabilities have become more complex and sophisticated, the demand for network security products is expected to increase for countering against the growing challenges posed by the threats. The application security segment is expected to grow at the highest CAGR during the forecast period in the market due to the increasing need to protect applications from cyber-attacks. With more and more companies ready to adapt Interactive Application Security Testing (IAST) and other hybrid analysis methodologies for application security, the market for application security is growing.

The telecom and IT vertical is the fastest-growing vertical in the adaptive security market. Adaptive security is to be embedded in every micro and macro component of information systems of BFSI sector with the increase in smart banking, internet banking, and mobile banking. The convergence of various security solutions to design an integrated environment for secure and faster access to information, whenever and wherever required, is the demand of the employees and customers in the financial institution. The retail vertical is expected to grow at a significant rate during the forecast period owing to their adherence to various compliance mandates and regulatory standards.

Need to defend against advanced cyber-attacks drive the growth of adaptive security market

Banking Financial Services, and Insurance (BFSI)

Banks, insurance companies, and other financial institutions are upgrading physical and adaptive security solutions to protect the industry’s employees, customers, assets, offices, branches, operations and to optimize against internal and external threats. The industry is continuously looking out for improved business operations which attract attackers and other sensitive information at run time. Adaptive security is to be embedded in every micro and macro component of information systems of BFSI sector with the increase in smart banking, internet banking, and mobile banking. The convergence of various security solutions to design an integrated environment for secure and faster access to information, whenever and wherever required, is the demand of the employees and customers in the financial institutions. Thus, banks need a multilayered security approach to deliver authenticated and authorized experience to customers

Government and Defense

Due to large number of breaches observed in government and defense sector, adaptive security has become a necessity to combat advanced threats in government and defense sector. Adaptive security solutions provide high performance security, control, and visibility over on-premise data and cloud data and help in protecting government and defense critical information. Adaptive solutions and services prevent advanced persistent threats, DOS attacks, ransomwares, malwares, virus, phishing mails, and also find out about the back entries. Masquerading, passive monitoring of data is detected with real time analysis at run time.

The concept of e-governance has led the government to focus more on adaptive security threats. Moreover, as organizations are shifting toward real-time communication, threats from web browsing, email correspondence, peer to peer traffic, and file exchange have considerably increased. Adaptive security countermeasures are developed and implemented to protect the systems from next generation attacks which bypasses the traditional firewalls send by terrorists and hackers.

Telecom and IT

Telecom companies are among the largest industries hit by cyber-attacks. These attacks could stop the telecom service to reach customers, breakdown the businesses, and even shutdown the government organizations. The increased integration of Information and Communication Technology (ICT) into daily activities of industries, government, families, and consumers along with the rising sophistication levels of cyber-attacks have led the IT and telecom sector to focus more on their adaptive security activities. Telecom organizations typically store personal data, such as name, address, and financial data, which is a compelling target for cyber-criminals or insiders. Rise in cloud computing, IoT, and BYOD has raised concerns over the security to be adopted in Telecom industries. Telecom organizations and IT service providers are boosting up the adaptive security budgets significantly, aligning business strategy with adaptive security plans, and creating cyber awareness programs for employees and customers. Global Information Society Project Program on Telecommunication Policy and strict telecom and regulatory policies has been introduced to regulate telecom and IT cyber threats.

Healthcare

Healthcare attacks are very attractive target to the attackers as the healthcare data records contain valuable sensitive information. Stealing financial data has always been the primary target of cyber-attackers, but these days medical data is also becoming one of the major targets. Healthcare organizations face several challenges such as maintaining the privacy of Electronic Health Record (EHR) and meeting various compliances set by HIPAA. Moreover, due to highly proliferated digital medical devices, network management has become essential to save devices from malicious attacks. Social security numbers, insurance IDs, addresses, credit card information, and medical details are at risk for cyber threats because they usually contain valuable data. Other than these, security solutions are required to control email spam, monitoring, reporting, remote login, and overall management, which include secure remote access, backup & recovery, and secure wireless connection. Ransomware attacks, cloud deployments, incident response, application vulnerability, and increase in IoT and BYOD trends are major issues, which can trigger the attacks in healthcare organizations.

Critical questions the report answers

- Where will all these developments take the industry in the mid to long term?

- What are the applications areas of adaptive security?

High cost of innovation and budget constraints is a major challenge in the growth of the market. As the frequency of advanced cyber-attacks has increased over the past five years, organizations have increased their IT security investments to protect against advanced threats, zero-day malwares, Trojans, and other targeted threats. However, for many enterprises, including SMEs, these investment costs are a matter of concern. Furthermore, for strong and advanced security, the cost of innovation is still high and many organizations view budgetary constraints as a barrier for growth in the adaptive security market. This lack of adequate budget continues to be an important concern for security professionals to effectively carry out their IT security operations. IT security budgets in SMEs are not sufficient to fulfill every security need, and therefore, organizations have to understand which information assets are most important to curb evolving security threats. Companies have to think twice about investing in regions with developing economies, such as Latin America and MEA, due to lower security defense budgets in these regions.

The key players in adaptive security market include Cisco Systems, Inc. (California, US), Juniper Networks (California, US), Trend Micro, Inc. (Tokyo, Japan), FireEye, Inc. (California, US), Rapid7, Inc. (Massachusetts, US), Panda Security (Bilbao, Spain), Illumio (California, US), EMC RSA (Massachusetts, US), Aruba Networks (California, US), and Cloudwick. (California, US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities

4.2 Adaptive Security Market, By Component

4.3 Global Adaptive Security Market

4.4 Lifecycle Analysis, By Region 2016

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Component

5.3.2 By Application

5.3.3 By Deployment Mode

5.3.4 By Organization Type

5.3.5 By Vertical

5.3.6 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Need to Defend Against Advanced Cyber-Attacks

5.4.1.2 Limitations of Traditional Security Solutions

5.4.1.3 Need for Security Compliances and Regulations

5.4.2 Restraints

5.4.2.1 High Cost of Innovation and Budget Constraints

5.4.2.2 Lack of Visibility Across IT Infrastructure

5.4.3 Opportunities

5.4.3.1 Rise in Demand for Intelligence-Driven and Multi-Layered Security Solutions

5.4.3.2 Rise in Adoption of Cloud-Based Security Technologies Across Organizations

5.4.4 Challenges

5.4.4.1 Aggregating and Analyzing Large Volumes of Data

5.4.4.2 Shortage of Skilled Cybersecurity Professionals

5.5 Regulatory Implications

5.5.1 Payment Card Industry Data Security Standard (PCI–DSS)

5.5.2 Health Insurance Portability and Accountability Act (HIPAA)

5.5.3 Federal Information Security Management Act (FISMA)

5.5.4 Gramm-Leach-Bliley Act (GLB Act)

5.5.5 Sarbanes-Oxley Act (SOX)

5.5.6 The International Organization for Standardization (Iso) Standard 27001

5.6 Innovation Spotlight

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Key Trends in Adaptive Security

6.3.1 The Upsurge in Ransomeware

6.3.2 Internet of Things and Rise of Advanced Persistent Threats

6.3.3 Upswing in Cloud Computing

6.3.4 Innovation in Security Intelligence

6.4 Strategic Benchmarking

6.4.1 Strategic Benchmarking: Technology Integration and Product Enhancement

7 Adaptive Security Market Analysis, By Component (Page No. - 48)

7.1 Introduction

7.2 Solution

7.3 Services

7.3.1 Professional Services

7.3.1.1 Consulting

7.3.1.2 Support and Maintenance

7.3.1.3 Training and Education

7.3.2 Managed Services

8 Market Analysis, By Application (Page No. - 58)

8.1 Introduction

8.2 Network Security

8.3 Endpoint Security

8.4 Application Security

8.5 Cloud Security

8.6 Others

9 Adaptive Security Market Analysis, By Deployment Mode (Page No. - 66)

9.1 Introduction

9.2 Cloud

9.3 On-Premises

10 Market Analysis, By Organization Size (Page No. - 70)

10.1 Introduction

10.2 Small and Medium Enterprises (SMES)

10.3 Large Enterprises

11 Adaptive Security Market Analysis, By Vertical (Page No. - 74)

11.1 Introduction

11.2 Government and Defense

11.3 Banking, Financial Services, and Insurance (BFSI)

11.4 Retail

11.5 IT and Telecom

11.6 Healthcare

11.7 Energy and Utilities

11.8 Manufacturing

11.9 Education

11.10 Others

12 Adaptive Security Market Analysis, By Region (Page No. - 85)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific (APAC)

12.5 Middle East and Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 110)

13.1 Overview

13.2 Competitive Situation & Trends

13.2.1 Agreements, Partnerships, and Collaborations

13.2.2 Mergers and Acquisitions

13.2.3 New Product Launches and Enhancements

13.2.4 Business Expansions

14 Company Profiles (Page No. - 116)

14.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

14.2 Cisco Systems, Inc.

14.3 Juniper Networks

14.4 Trend Micro, Inc.

14.5 Fireeye, Inc.

14.6 Rapid7

14.7 Panda Security

14.8 Illumio

14.9 EMC RSA

14.10 Aruba Networks, A Hewlett Packard Enterprise Company

14.11 Cloudwick

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

15 Key Innovators (Page No. - 149)

15.1 Logrhythm

15.2 Assuria Ltd

15.3 Lightcyber

15.4 Blueliv

16 Appendix (Page No. - 151)

16.1 Other Developments

16.1.1 Other Developments: Partnerships, Agreements, and Collaborations

16.1.2 Other Developments: Mergers and Acquisitions

16.1.3 Other Developments: New Product Launches

16.2 Industry Experts

16.3 Discussion Guide

16.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.5 Introduction RT: Real-Time Market Intelligence

16.6 Available Customizations

16.7 Related Reports

List of Tables (77 Tables)

Table 1 Adaptive Security Market Size and Growth Rate, 2014–2021 (USD Million, Y-O-Y %)

Table 2 Innovation Spotlight: Latest Adaptive Security Innovations

Table 3 Market Size, By Component, 2014–2021 (USD Million)

Table 4 Solution: Market Size, By Region, 2014–2021 (USD Million)

Table 5 Services: Market Size, By Region, 2014–2021 (USD Million)

Table 6 Market Size, By Services, 2014–2021 (USD Million)

Table 7 Professional Services: Market Size, By Region, 2014–2021 (USD Million)

Table 8 Professional Services: Market Size, By Type, 2014–2021 (USD Million)

Table 9 Consulting: Market Size, By Region, 2014–2021 (USD Million)

Table 10 Support and Maintenance: Market Size, By Region, 2014–2021 (USD Million)

Table 11 Training and Education: Market Size, By Region, 2014–2021 (USD Million)

Table 12 Managed Services: Market Size, By Region, 2014–2021 (USD Million)

Table 13 Adaptive Security Market Size, By Application, 2014–2021 (USD Million)

Table 14 Network Security: Market Size, By Region, 2014–2021 (USD Million)

Table 15 Endpoint Security: Market Size, By Region, 2014–2021 (USD Million)

Table 16 Application Security: Market Size, By Region, 2014–2021 (USD Million)

Table 17 Cloud Security: Market Size, By Region, 2014–2021 (USD Million)

Table 18 Others: Market Size, By Region, 2014–2021 (USD Million)

Table 19 Market Size, By Deployment Mode, 2014–2021 (USD Million)

Table 20 Cloud: Market Size, By Region, 2014–2021 (USD Million)

Table 21 On-Premises: Market Size, By Region, 2014–2021 (USD Million)

Table 22 Adaptive Security Market Size, By Organization Size, 2014–2021 (USD Million)

Table 23 Small and Medium Enterprises: Market Size, By Region, 2014–2021 (USD Million)

Table 24 Large Enterprises: Market Size, By Region, 2014–2021 (USD Million)

Table 25 Market Size, By Vertical, 2014–2021 (USD Million)

Table 26 Government and Defense: Market Size, By Region, 2014–2021 (USD Million)

Table 27 Banking, Financial Services, and Insurance: Market Size, By Region, 2014–2021 (USD Million)

Table 28 Retail: Adaptive Security Market Size, By Region, 2014–2021 (USD Million)

Table 29 IT and Telecom: Market Size, By Region, 2014–2021 (USD Million)

Table 30 Healthcare: Market Size, By Region, 2014–2021 (USD Million)

Table 31 Energy and Utilities: Market Size, By Region, 2014–2021 (USD Million)

Table 32 Manufacturing: Market Size, By Region, 2014–2021 (USD Million)

Table 33 Education: Market Size, By Region, 2014–2021 (USD Million)

Table 34 Others: Market Size, By Region, 2014–2021 (USD Million)

Table 35 Adaptive Security Market Size, By Region, 2014–2021 (USD Million)

Table 36 North America: Market Size, By Component, 2014–2021 (USD Million)

Table 37 North America: Market Size, By Application, 2014–2021 (USD Million)

Table 38 North America: Market Size, By Service, 2014–2021 (USD Million)

Table 39 North America: Market Size, By Professional Service, 2014–2021 (USD Million)

Table 40 North America: Market Size, By Deployment Mode, 2014–2021 (USD Million)

Table 41 North America: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 42 North America: Market Size, By Vertical, 2014–2021 (USD Million)

Table 43 Europe: Adaptive Security Market Size, By Component, 2014–2021 (USD Million)

Table 44 Europe: Market Size, By Application, 2014–2021 (USD Million)

Table 45 Europe: Market Size, By Service, 2014–2021 (USD Million)

Table 46 Europe: Market Size, By Professional Service, 2014–2021 (USD Million)

Table 47 Europe: Market Size, By Deployment Mode, 2014–2021 (USD Million)

Table 48 Europe: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 49 Europe: Market Size, By Vertical, 2014–2021 (USD Million)

Table 50 Asia-Pacific: Adaptive Security Market Size, By Component, 2014–2021 (USD Million)

Table 51 Asia-Pacific: Market Size, By Application, 2014–2021 (USD Million)

Table 52 Asia-Pacific: Market Size, By Service, 2014–2021 (USD Million)

Table 53 Asia-Pacific: Market Size, By Professional Service, 2014–2021 (USD Million)

Table 54 Asia-Pacific: Market Size, By Deployment Mode, 2014–2021 (USD Million)

Table 55 Asia-Pacific: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 56 Asia-Pacific: Market Size, By Vertical, 2014–2021 (USD Million)

Table 57 Middle East and Africa: Adaptive Security Market Size, By Component, 2014–2021 (USD Million)

Table 58 Middle East and Africa: Market Size, By Application, 2014–2021 (USD Million)

Table 59 Middle East and Africa: Market Size, By Service, 2014–2021 (USD Million)

Table 60 Middle East and Africa: Market Size, By Professional Service, 2014–2021 (USD Million)

Table 61 Middle East and Africa: Market Size, By Deployment Mode, 2014–2021 (USD Million)

Table 62 Middle East and Africa: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 63 Middle East and Africa: Market Size, By Vertical, 2014–2021 (USD Million)

Table 64 Latin America: Adaptive Security Market Size, By Component, 2014–2021 (USD Million)

Table 65 Latin America: Market Size, By Application, 2014–2021 (USD Million)

Table 66 Latin America: Market Size, By Service, 2014–2021 (USD Million)

Table 67 Latin America: Market Size, By Professional Service, 2014–2021 (USD Million)

Table 68 Latin America: Market Size, By Deployment Mode, 2014–2021 (USD Million)

Table 69 Latin America: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 70 Latin America: Market Size, By Vertical, 2014–2021 (USD Million)

Table 71 Agreements, Partnerships, and Collaborations, 2015-2016

Table 72 Mergers and Acquisitions, 2015-2016

Table 73 New Product Launches and Enhancements, 2015-2016

Table 74 Business Expansions, 2015

Table 75 Other Developments: Partnerships, Agreements, and Collaborations, 2014-2015

Table 76 Other Developments: Mergers and Acquisitions, 2013-2014

Table 77 Other Developments: New Product Launches, 2014-2015

List of Figures (49 Figures)

Figure 1 Global Adaptive Security Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 7 Application Security is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 8 Managed Services Segment Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 Cloud Deployment Mode is Expected to Grow at the Highest CAGR From 2016 to 2021

Figure 10 Banking, Financial Services, and Insurance Vertical to Grow at the Highest CAGR From 2016 to 2021

Figure 11 North America Estimated to Hold the Largest Market Share of the Market in 2016

Figure 12 Need for Defense Against Advanced Cyber-Attacks is Expected to Boost the Market

Figure 13 Services Segment Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Government and Defense Vertical Expected to Hold the Largest Share in the Adaptive Security Market in 2016

Figure 15 APAC has Immense Opportunities for the Growth of Market, Followed By the Middle East and Africa

Figure 16 Evolution of the Adaptive Security Market

Figure 17 Market: By Component

Figure 18 Market: By Application

Figure 19 Market: By Deployment Mode

Figure 20 Market: By Organization Type

Figure 21 Market: By Vertical

Figure 22 Market: By Region

Figure 23 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 24 Adaptive Security Market: Value Chain

Figure 25 Strategic Benchmarking: Technology Integration and Product Enhancement (2014 - 2016)

Figure 26 Services Segment to Grow at the Highest CAGR During the Forecast Period

Figure 27 Managed Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Application Security Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Cloud-Based Deployment Mode is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Small and Medium Enterprises Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 31 Banking, Financial Services, and Insurance Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Asia-Pacific Region is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 33 Regional Snapshot: Asia-Pacific is the Emerging Region in the Adaptive Security Market

Figure 34 North America Market Snapshot

Figure 35 Asia-Pacific Market Snapshot

Figure 36 Top Companies Adopted Partnerships/Agreements/Collaborations as the Key Growth Strategy During the Period 2014-2016

Figure 37 Battle for Market Share: Partnerships, Agreements, and Collaborations Was the Key Strategy

Figure 38 Market Evaluation Framework: Significant Number of New Product Launches has Fueled the Growth of the Market From 2014-2016

Figure 39 Geographic Revenue Mix of Top Players

Figure 40 Cisco Systems, Inc.: Company Snapshot

Figure 41 Cisco Systems, Inc.: SWOT Analysis

Figure 42 Juniper Networks: Company Snapshot

Figure 43 Juniper Networks: SWOT Analysis

Figure 44 Trend Micro, Inc.: Company Snapshot

Figure 45 Trend Micro, Inc.: SWOT Analysis

Figure 46 Fireeye, Inc.: Company Snapshot

Figure 47 Fireeye, Inc.: SWOT Analysis

Figure 48 Rapid7 : Company Snapshot

Figure 49 Rapid7 : SWOT Analysis

Growth opportunities and latent adjacency in Adaptive Security Market