Advanced Ceramics Market

Advanced Ceramics Market by Material (Alumina, Zirconia, Titanate, Silicon Carbide, Piezo Ceramic), Application (Monolithic Ceramics, Ceramic Matrix Composites, Ceramic Coatings, Ceramic Filters), End-Use Industry - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The advanced ceramics market represents a specialized and technology-driven segment of the materials industry focused on high-value, precision ceramic products. This market is driven by innovative technologies, increasing performance demands, and the growing substitution of traditional materials. It includes a wide range of materials, product forms, and customized components developed to meet strict technical and quality standards. Market growth is supported by long qualification cycles, strong supplier–customer relationships, and high entry barriers. Manufacturing consistency, material purity, and process control play a critical role in competitiveness. The market is also influenced by regional production strengths, evolving regulations, and investment in research and development. As demand for reliable and long-life components increases, the advanced ceramics market continues to expand in both volume and technological advancement.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific dominated the market with a share of 38.3% in 2024.

-

By MaterialAlumina held the largest share of 47.3% of the market in 2024.

-

By Product TypeBy product type, the ceramic coatings segment is expected to register the highest CAGR of 6.0%.

-

By End-use IndustryBy end-use industry, the electrical & electronics segment is projected to grow at the fastest rate from 2025 to 2030.

-

Competitive Landscape- Key PlayersKYOCERA Corporation and CeramTec GmbH were identified as Star players in the market, as they have focused on innovation and have broad industry coverage and strong operational & financial strength.

-

Competitive Landscape- StartupsNishimura Advanced Ceramics Co., Ltd. has distinguished itself as a progressive company among startups and SMEs due to its strong product portfolio and business strategy.

The demand for advanced ceramics is increasing as industries look for materials that can perform reliably in extreme and demanding conditions. Their resistance to heat, wear, corrosion, and electrical stress supports wider adoption. Growing requirements for precision, durability, and long service life are strengthening usage. Expanding applications across electrical & electronics, transportation, medical, and chemical industries are contributing to steady demand growth. Improvements in manufacturing accuracy and quality control have made advanced ceramics more accessible. Furthermore, the rising focus on efficiency, safety, and performance enhancement is encouraging the replacement of conventional materials with advanced ceramic solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The advanced ceramics market is making rapid innovations in materials and manufacturing processes. The expanding use of additive manufacturing allows for increasingly complex ceramic designs with increased precision and less material waste. The development of high-purity, nano-structured, and functionalized ceramics further improves performance and reliability. Increasing emphasis on developing light-weight and energy-efficient ceramics is also shaping product development. Environmental protection measures are increasing the application of ceramic filters, membranes, and high-purity, lightweight, and corrosion-resistant ceramic materials. All these factors are redefining cost structures, performance standards, and competitive positioning across the advanced ceramics market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Miniaturization and Performance Escalation in Electronics and Semiconductor Devices

-

Growth of Electric Vehicles and Power Electronics

Level

-

Complex and Capital-Intensive Manufacturing Processes

-

Limited Design Flexibility Compared to Metals and Polymers

Level

-

Global Expansion of Semiconductor Fabrication Capacity and the Energy Transition Toward Clean Technologies

-

Increasing Adoption in Medical and Dental Applications

Level

-

Raw Material Purity and Supply Consistency

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth of Electric Vehicles and Power Electronics

The growth of electric vehicles and power electronics has greatly increased the demand for advanced ceramics due to their capability for high temperature, voltage, and power density handling. Electric vehicle powertrains, inverters, and onboard chargers require materials that provide excellent electrical insulation while efficiently managing heat. Advanced ceramics support compact and lightweight component design, which is critical for improving vehicle efficiency and driving range. In power electronics, advanced ceramics enable stable performance in high-frequency and high-voltage environments. They contribute to enhanced system safety by preventing electrical leakage and overheating. As electric vehicles increase in power and charging speed, performance requirements continually rise, driving the adoption of advanced ceramic substrates, insulating components, and thermal management solutions throughout EV and power electronic applications.

Restraint: Complex and Capital-Intensive Manufacturing Processes

Complex and large-scale manufacturing processes limit the demand for advanced ceramics. Production requires high-purity raw materials and controlled manufacturing process conditions. Specialized machinery like high-temperature furnaces and controlled forming equipment requires large capital. Small fluctuations in manufacturing process conditions can cause defects or cracking. This increases rejection rates and material waste. Quality testing and inspection add more time and expense. Production cycles are often long and difficult to scale. Customization further multiplies manufacturing complexities and associated manufacturing costs for advanced ceramics. Small-scale manufacturers find such manufacturing a barrier to entry, as large-scale capital investment is required. This restricts adoption in cost-sensitive markets. It also slows broader market penetration despite strong performance benefits.

Opportunity: Increasing Adoption in Medical and Dental Applications

Increasing adoption in medical and dental applications presents a strong opportunity for advanced ceramics due to their biocompatibility and long-term stability. These materials do not react with body fluids and tissues. This makes them suitable for implants and prosthetics. Advanced ceramics offer high wear resistance and low friction. This improves implant lifespan and patient comfort. Their strength and fracture resistance support load-bearing applications. Precision manufacturing allows complex and customized designs. This meets patient-specific clinical needs. The growing demand for minimally invasive procedures supports the use of smaller, more durable components. Aging populations are increasing the demand for joint replacements and dental restorations. Regulatory approval and clinical acceptance of ceramic materials continue to expand. As healthcare technology advances, advanced ceramics gain wider use. This creates long-term growth opportunities across medical and dental segments.

Challenge: Raw Material Purity and Supply Consistency

Raw material purity and supply consistency pose major challenges to the demand for advanced ceramics. Advanced ceramic production depends on extremely high-purity powders to achieve reliable performance. Even minor impurities can affect strength, thermal stability, and electrical properties. This increases the risk of defects and product failure. Maintaining consistent purity across batches is technically difficult and costly. Supply disruptions or quality variations can slow production and increase rejection rates. Limited availability of high-grade raw materials also restricts large-scale manufacturing. Producers often rely on a small number of qualified suppliers. This reduces supply flexibility. Quality testing and certification add time and cost to procurement. These factors increase overall production expenses. This challenges broader adoption despite strong performance advantages.

ADVANCED CERAMICS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

CoorsTek manufactures advanced ceramic materials, including alumina, zirconia, silicon nitride, and aluminum nitride, for high-performance structural and functional applications. These materials are used in components requiring high strength, thermal stability, and wear resistance. CoorsTek supplies powders, engineered parts, and custom ceramic components for demanding operating conditions. | CoorsTek offers high material purity, consistent performance, and long service life. Its broad material portfolio supports tailored solutions. Global manufacturing capabilities ensure reliable supply and scalability. |

|

CeramTec produces advanced ceramic components, including alumina, zirconia, and mixed oxide ceramics, for precision parts and high-stress environments. The company supports applications requiring dimensional accuracy, thermal resistance, and chemical stability. It also provides advanced machining and custom fabrication services. | CeramTec delivers excellent mechanical stability, thermal performance, and corrosion resistance. Its precision manufacturing reduces material loss and improves component reliability. Custom capabilities support faster development cycles. |

|

Morgan Advanced Materials supplies engineered advanced ceramics such as alumina, silicon nitride, boron nitride, and aluminum nitride. These materials are designed for high-temperature, high-wear, and electrically demanding environments. The company focuses on both structural and functional ceramic solutions. | Morgan’s ceramics enhance durability, thermal control, and electrical insulation. Strong engineering support enables smooth integration. A global production network ensures consistent quality and dependable delivery. |

|

KYOCERA manufactures advanced ceramic materials, including alumina, silicon carbide, and zirconia, for precision-engineered components. These materials are used where high strength, thermal stability, and dimensional accuracy are required. KYOCERA supports both standard and customized ceramic solutions. | KYOCERA provides high-performance materials with excellent thermal and mechanical properties. High-volume manufacturing ensures cost efficiency. Custom engineering improves component lifespan and performance consistency. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The advanced ceramics market necessitates a well-coordinated value chain among the raw material suppliers, ceramic manufacturers, processing and finishing companies, and the distribution channels. Raw material suppliers for advanced ceramics provide high-purity materials like alumina, zirconia, and silicon carbide. The manufacturers process these in the form of forming, sintering, and finishing to create advanced ceramic products in desired forms and grades. Distributors and specialized suppliers support market reach by managing logistics and application-specific delivery requirements. End-use industries include electrical & electronics, transportation, medical, defense & security, environmental, and chemical sectors that rely on advanced ceramics for high-performance and precision applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Advanced Ceramics Market, by Material

Alumina ceramics account for the largest share in the advanced ceramics market because of their excellent combination of performance, reliability, and affordability. They provide high hardness and wear resistance, making them suitable for applications where durability is critical. Alumina also has strong thermal stability, allowing it to perform effectively in high-temperature environments. It has very good electrical insulation properties, making it suitable for electronic and electrical components. The raw materials needed to produce alumina are abundant and cost-effective, enabling large-scale production. It is chemically stable and resistant to corrosion, which expands its use in industrial and chemical applications.

Advanced Ceramics Market, by Product Type

Monolithic ceramics account for the largest share of the advanced ceramics market due to their reliable performance and highly efficient material structure. They are manufactured from a single ceramic composition that guarantees uniform properties and predictable behavior during use. Such uniformity enhances the mechanical strength, thermal resistance, and wear performance of monolithic ceramics. Monolithic ceramics are also easier to design and produce compared to composite or coated systems, which decreases manufacturing complexity and cost. They enable high-volume manufacturing with stable quality control. The ability of monolithic ceramics to support high temperatures, pressure, and corrosive atmospheres enables their wide industrial adoption.

Advanced Ceramics Market, by End-use Industry

The electrical and electronics end-use industry accounts for the largest share in the advanced ceramics market because of the critical role ceramics play in modern electronic systems. Advanced ceramics exhibit excellent electrical insulation with very good thermal conductivity, making heat management in compact devices possible. They provide dimensional stability and reliability at high voltage and frequencies. These properties support their applications in substrates, capacitors, sensors, and semiconductor equipment. Continuous miniaturization of electronic components increases the need for materials that can perform consistently at smaller scales. Advanced ceramics also resist heat, moisture, and chemical exposure, improving device lifespan and safety. Growth in power electronics, energy-efficient systems, and high-performance computing further increases material demand.

REGION

Asia Pacific to be largest region in advanced ceramics market during forecast period

The Asia Pacific accounts for the largest share of the advanced ceramics market because of its strong production capabilities and expanding technology-driven industries. This region possesses an advanced manufacturing infrastructure to support the massive production of ceramics at lower production costs. The presence of major electronics and industrial equipment producers creates a continuous demand for advanced ceramic components. Many countries in the Asia Pacific region focus significantly on investing in material science, automation, and precision manufacturing. Access to natural resources helps in reducing production lead times. The Asia Pacific also benefits from a growing base of skilled engineers. These combined factors allow Asia Pacific to maintain leadership in both volume and value within the global advanced ceramics market.

ADVANCED CERAMICS MARKET: COMPANY EVALUATION MATRIX

The advanced ceramics market is characterized by a mix of emerging leaders, participants, pervasive players, and stars. The chart highlights KYOCERA Corporation (Star) as a strong market leader in terms of both market share and product footprint. MARUWA Co., Ltd. (Emerging Leaders) exhibits a broad product presence but a relatively moderate market share. Several smaller players cluster in the "Participants" and "Pervasive Players" zones, reflecting niche positioning or early-stage growth potential. Overall, market dynamics suggest strong competition, with global giants driving innovation while smaller companies strive for differentiation and market penetration.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- KYOCERA Corporation (Japan)

- CeramTec GmbH (Germany)

- CoorsTek (US)

- Materion Corporation (US)

- AGC Inc. (Japan)

- Morgan Advanced Materials (UK)

- MARUWA Co., Ltd. (Japan)

- Saint-Gobain Performance Ceramics & Refractories (France)

- 3M (US)

- Ferrotec Corporation (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12.15 Billion |

| Market Forecast in 2030 (Value) | USD 17.24 Billion |

| Growth Rate | CAGR of 6.0% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kilotons) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, South America |

WHAT IS IN IT FOR YOU: ADVANCED CERAMICS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-level Breakdown | Instead of regional-level insights, the report provides country-specific analysis for major advanced ceramics markets such as the US, China, Japan, Germany, and South Korea. It includes national production capacity, material demand trends, manufacturing clusters, import–export flows, key producers, and government policies related to advanced manufacturing, electronics, defense, and sustainability. | Helps clients identify high-growth countries, assess local manufacturing and sourcing opportunities, understand policy-driven demand, and plan market entry, expansion, or localization strategies. |

| Material-specific Deep Dive | Detailed segmentation and analysis by ceramic material including alumina, zirconia, titanate, silicon carbide, piezo ceramics, and others. Covers performance characteristics, processing complexity, cost structure, supply availability, and application suitability. Includes material-level demand trends and technology developments. | Enables stakeholders to focus on high-demand materials, optimize product portfolios, manage raw material sourcing, and align R&D investments with performance and cost requirements. |

| End-use Industry Customization | Comparative assessment across electrical & electronics, transportation, medical, defense & security, environmental, chemical, and other industries. Includes application mapping, volume demand, performance requirements, adoption barriers, and regulatory considerations. | Supports manufacturers and suppliers in targeting high-value industries, developing application-specific solutions, improving customer alignment, and prioritizing sectors with strong growth and margin potential. |

RECENT DEVELOPMENTS

- September 2025 : KYOCERA Corporation and KYOTO FUSIONEERING LTD. have entered into a joint development agreement to co-create advanced ceramic materials for use in next-generation fusion energy plants. The collaboration brings together Kyocera’s deep expertise in advanced ceramics and materials engineering with Kyoto Fusioneering’s specialized fusion energy technologies.

- April 2024 : Morgan Advanced Materials and Penn State University signed a five-year Memorandum of Understanding (MOU) to conduct research and development in silicon carbide (SiC) crystal growth in the semiconductor industry.

- February 2024 : ESK-SIC GmbH and KYOCERA Fineceramics Europe GmbH (subsidiary of KYOCERA Corporation) entered a strategic partnership to advance the sustainable production of silicon carbide ceramics.

- October 2023 : MATERION CORPORATION entered into a purchase agreement to supply beryllium and beryllium oxide products (which are advanced ceramics) for the US Department of Energy’s MARVEL microreactor project being developed by Idaho National Laboratory. This supports clean energy research and microreactor technology.

- February 2021 : CoorsTek expanded its manufacturing footprint in Southeast Asia. The US-based company was constructed on the first phase of a 400,000 sq. ft. engineered ceramics manufacturing facility in the province of Rayong, Thailand.

Table of Contents

Methodology

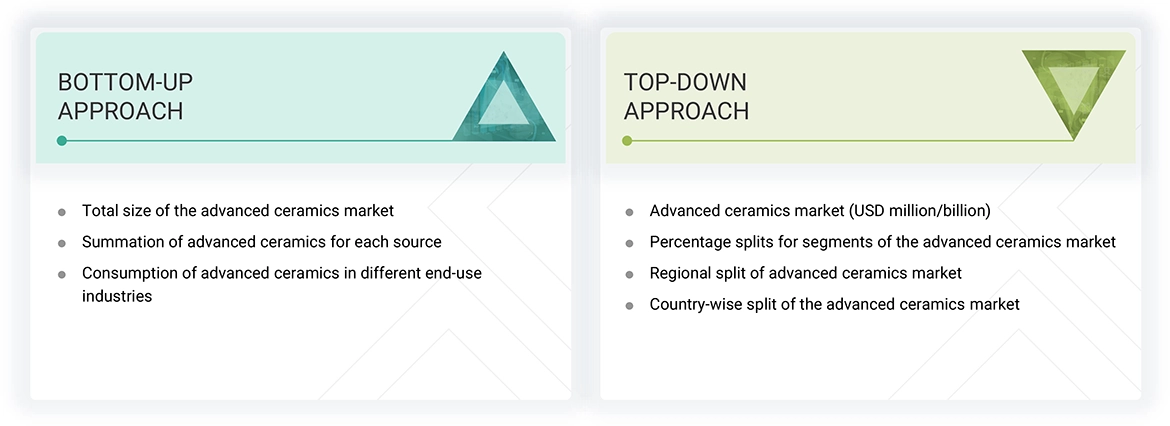

The study involved four major activities for estimating the current size of the global advanced ceramics market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of advanced ceramics through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the advanced ceramics market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study on the advanced ceramics market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The advanced ceramics market comprises several stakeholders in the supply chain, which include raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the advanced ceramics market. Primary sources from the supply side include associations and institutions involved in the advanced ceramics market, key opinion leaders, and processing players.

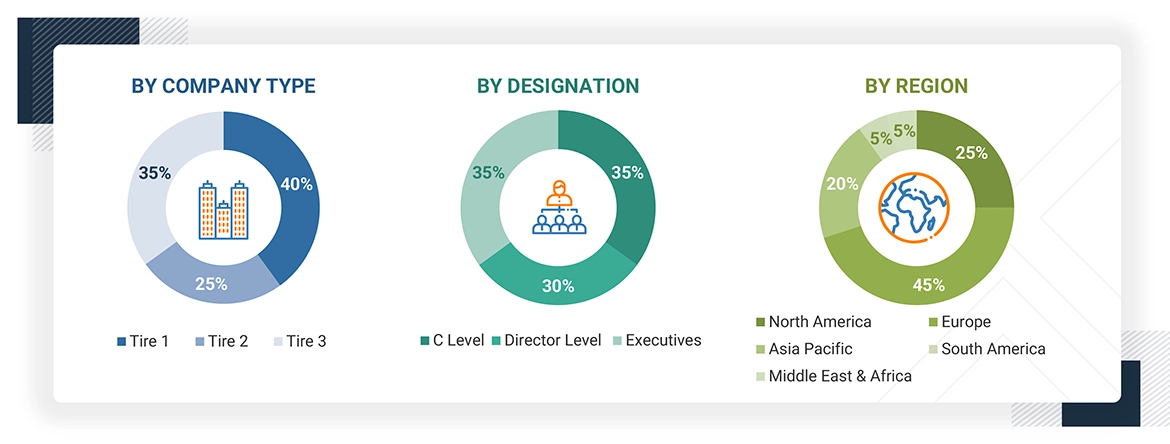

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the advanced ceramics market by material, application, end-use industry, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the advanced ceramics market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Advanced ceramics are a group of engineered ceramic materials with high strength, thermal resistance, electrical conductivity, and chemical stability. They are generally manufactured using advanced processing methods and are intended for high-performance applications in the aerospace, automotive, electronics, healthcare, and defense industries. Advanced ceramics comprise alumina, zirconia, and silicon carbide, which are applied in electronic substrates, medical equipment, cutting tools, and armor systems. The advanced ceramics market is fueled by continuous technological improvements, miniaturization needs, and the demand for high-performance, long-life materials in hostile environments.

Stakeholders

- Advanced Ceramics Manufacturers

- Raw Material Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-Use Industries

- Associations and Industrial Bodies

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the advanced ceramics market in terms of value and volume.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To forecast the market size based on material, application, end-use industry, and region.

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa (MEA),—along with their key countries.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders.

- To strategically profile leading players and comprehensively analyze their key developments such as new product launches, expansions, and deals in the advanced ceramics market.

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook.

Key Questions Addressed by the Report

- Integration of nanotechnology in advanced ceramic materials.

- Increasing use in aerospace and defense industries.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Advanced Ceramics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Advanced Ceramics Market