Aerospace Coatings Market by Resin Type (Polyurethanes, Epoxy), Technology (Liquid, Powder), User Type (MRO, OEM), End User (Commercial, Military, General Aviation), Application (Exterior, Interior), and Region - Global Forecast to 2022

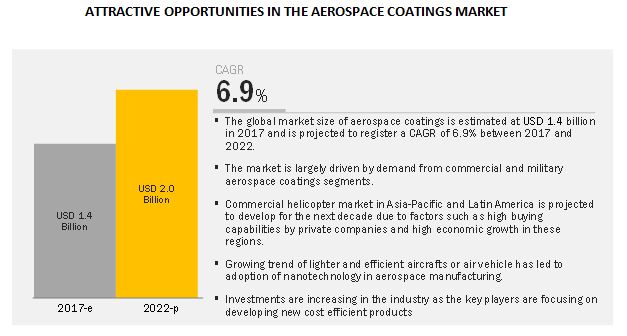

[296 Pages Report] The aerospace coatings market is projected to reach USD 2.0 billion by 2022 rom USD 1.4 billion in 2017, at a CAGR 6.9% between 2017 and 2022. A coating is a covering that is applied to the surface of an object, usually referred to as a substrate. The purpose of applying the coating may be decorative, functional, or both. The aerospace coatings market is largely driven by increased demand for aerospace coatings from various end users, such as commercial aviation, military aviation, and general aviation. Growing trend of lighter and efficient aircrafts has led to adoption of nanotechnology in aerospace manufacturing. Nanostructure metals are used in aircraft manufacturing, as nano structure metals have better properties than larger grain structures. Nano-Structure metals offers tensile strength, corrosion resistance, and low density along with lighter material. This light weight of aircraft construction leads to less fuel consumption and low carbon footprint.

The Polyurethane resin based coating segment is expected to grow at the highest CAGR of the overall aerospace coatings market during the forecast period.

Polyurethane resin types are preferred over other coatings as they offer resistance to abrasion, staining, and chemicals. They have a high degree of natural resistance to the damaging effects of ultraviolet rays from the sun. The polyurethanes resin type segment of the aerospace coatings market is projected to grow at the highest CAGR during the forecast period.

The aerospace coatings market in the exterior application is expected to witness the highest CAGR during the forecast period.

The exterior application segment is leading the aerospace coatings market and is projected grow at the highest CAGR during the forecast period, 2017 to 2022. The growth of the exterior segment of the aerospace coatings market is due to increased use of aerospace coatings to coat exterior parts of aircraft to protect their surface from deterioration, erosion, and cracking.

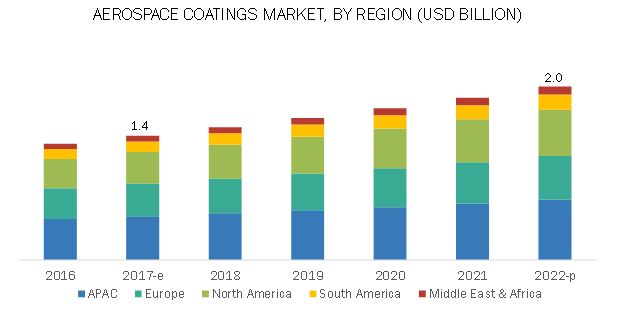

North America aerospace coatings market is estimated to be the largest during the forecast period.

In terms of volume and value, the North American region is the largest market for aerospace coatings, as the key manufacturers of aerospace coatings are based in this region. In addition, the introduction of various new aircraft, such as A320neo and A350 by Airbus, and 737 MAX and 787 by Boeing have driven the demand for aerospace coatings, thereby leading to the growth of the North America aerospace coatings market. Companies such as Akzo Nobel N.V. (Netherlands), Mankiewicz Gebr. & Co., and BASF SE (Germany), among others, are the key manufacturers of aerospace coatings that have expanded their presence across the European region as well and enhanced their production capacities to cater to the increased demand for aerospace coatings from the European region.

Market Dynamics

Drivers

Increasing air travel demand due to affordable carriers in the emerging regions

The global aerospace industry is experiencing an increase in the passenger air travel segment. Low-cost carriers (LCCs) have proved to be strong competitors in the market, particularly in the developing economies of APAC, Middle East & Africa, and South America. More travelers are anticipated to fly more often in these regions. Aircraft carriers such as Emirates (UAE), Qatar Airways (Qatar), and Etihad Airways (UAE) are among the largest players of the commercial aviation in the Middle East region. These carriers are also involved in most of the passenger travel between Europe and APAC. The highest growth is in the short-haul market in the APAC region. Despite LCCs opting for predominantly wide-body aircraft, Boeing and Airbus both forecast that the demand for single-aisle aircraft in the emerging regions is expected to increase in the coming years. The number of people using air transport is increasing, in turn driving the demand for larger airplanes. This demand is anticipated to fuel the growth of aerospace coatings.

Restraint

Reduced defense spending in developed economies

The global defense expenditure is declining due to defense budget reductions by key defense spending nations. Major reasons for the reduction in the defense budgets are the end of the long conflicts in Iraq and Afghanistan along with the affordability of the war expenses incurred by the active military nations. However, defense expenditure in several areas is witnessing a slight increase due to increased expenditure by China, India, the Middle East, Japan, Brazil, and Russia. Some of these countries are spending to modernize their military whereas some of them are spending to safeguard their borders. However, the defense market is impacted mainly by the reductions in the defense spending by the U.S., which is the highest spending nation in the world, accounting for nearly 40.0% of the global defense expenditure. The declaration of reduction in the defense spending till 2022 by the U.S. government has impacted the global defense equipment manufacturer’s market, especially the military aircraft manufacturing market. This factor may adversely the affect the demand for aerospace coatings for military end-use industry.

Opportunity

Growing demand for commercial aircraft

The affordable commercial air traffic is emerging as a feasible option in developing economies, providing travelers a broad access to an array of locations. Customers in emerging economies are inclined toward the affordable choice of air travel that provides speed and convenience rather than the traditional modes of transportation. Lightweight and efficient aircraft have initiated short route operations in emerging economies to challenge the lengthier routes which are ideally ruled by the overseas carriers. Modern lightweight airplanes exhibit a long range of travel and low cost of operations, which are assisting the beginning of long distant low-budget business models. These business models are, in turn, benefitting the connected city air travels of the carriers and the convenience of passengers. Therefore, the increased passenger travel coupled with the economic growth of the emerging countries is likely to enhance the commercial aircraft production globally.

Challenge

Stringent and time-consuming regulatory policies

The coated aircraft needs to be approved or cleared by various regulatory bodies, as the coatings are not approved separately. The coated aircraft needs to undergo design verification tests to demonstrate if they meet the specifications. However, some coating manufacturers perform tests on their coatings to maintain high quality. Major coating manufacturers in the market also maintain a Master File that shows all the proprietary ingredients and processes involved in making the product. This may lead to saving time on its approval. The approval time of the aircraft varies largely according to their types. On an average, regulatory bodies take several months to approve a coated aircraft. Also, any change in regulations affects the timeline that coating manufacturers have to adhere and hence eventually creating backlogs in the aerospace industry. There is also a possibility that the regulations will become more complicated and expensive. Hence, the stringent and time-consuming regulatory policies pose a challenge to the coating manufacturers.

Scope of The Report

|

Report Metric |

Details |

|

Years considered for the study |

2015–2022 |

|

Base year |

2016 |

|

Forecast period |

2017–2022 |

|

Units considered |

Value (USD Million) and Volume (Kiloton) |

|

Segments |

Resin type, technology, user type, end user, and application |

|

Regions |

APAC, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

PPG Industries, AkzoNobel N.V., Mankiewicz Gebr. & Co., Hentzen Coatings, Inc., Sherwin Williams. |

This research report categorizes the aerospace coatings market on the basis of resin type, technology, user type, end user, application, and region.

Aerospace Coatings Market, by Resin Type:

- Polyurethanes

- Epoxy

- Others (Silicone, Polyester and Acrylic)

Aerospace Coatings Market, by Technology:

-

Liquid Coating-based

- Solvent-based

- Water-based

- Powder Coating-based

- Others

Aerospace Coatings Market, by User Type:

- MRO

- OEM

Aerospace Coatings Market, by End User:

- Commercial Aviation

- Military Aviation

- General Aviation

-

Others

- Space

- Business Aircrafts

- Helicopters

Aerospace Coatings Market, by Application:

- Exterior

- Interior

Aerospace Coatings Market, by Product Type:

- Top-coat

- Primer

- Others

Aerospace Coatings Market, by Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

The market is further analyzed for key countries in each of these regions.

Key Market Players

Leading players in the aerospace coatings market, which include PPG Industries, Inc. (U.S.), Akzo Nobel N.V. (Netherlands), Henkel AG & Co. KGaA (Germany), Mankiewicz Gebr. & Co. (Germany), Hentzen Coatings, Inc., (U.S.), BASF SE (Germany), IHI Ionbond AG (Switzerland), The Sherwin-Williams Company (U.S.), and Zircotec Ltd. (U.K.), among others, have been profiled in this report.

Major strategies identified in the global market include the following:

- Expansions

- New product launches

- Acquisitions

- Agreements

Key Questions Addressed by the Report

- Who are the major market players in the aerospace coatings market?

- What are the regional growth trends and the largest revenue-generating regions for the aerospace coatings market?

- Which are the significant regions for different industries that are projected to witness remarkable growth for the aerospace coatings market?

- What are the major types of aerospace coatings that are projected to gain maximum market revenue and share during the forecast period?

- Which is the major application where aerospace coatings are used that will be accounting for the majority of the revenue over the forecast period?

Recent Developments

- In 2016 PPG Industries, Inc. (U.S.) expanded development and technical-service capabilities for aerospace and military coatings at its Shildon (U.K.) facility with an investment of USD 2 million. This development supported the installation of advanced-technology equipment for evaluating paint characteristics.

- In 2015 AkzoNobel N.V. (Netherlands) expanded its performance coatings research facility in Houston (U.S.) with an investment of USD 3.4 million. The upgraded facility will support the company’s aerospace coatings, marine coatings, and specialty coatings businesses. This expansion mainly focused on technology and product innovation and provides technical support for customers, globally.

- In 2016 PPG Industries, Inc. (U.S.) launched Aerocon e-coat primer pilot system in France for the aerospace industry. This system will help address queries of customers regarding aerospace coatings in the region.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of product portfolio of each company

Country-wise Analysis

- Further breakdown of Rest of APAC countries into Thailand, Vietnam, Singapore, the Philippines, Myanmar, Australia, and New Zealand.

- Further breakdown of Rest of Europe into the Netherlands, Switzerland, Greece, Hungary, Romania, Croatia, Bulgaria, Denmark, Finland, Austria, Norway, and Ukraine.

- Further breakdown of Rest of the Middle East & Africa into the Algeria, Egypt, Iraq, Nigeria, Kenya, and Morocco

- Further breakdown of Rest of South America into Chile, Uruguay, Ecuador, and Paraguay.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stake Holders

2 Research Methodology

2.1 Aerospace Coatings: Research Data

2.2 Breakdown of Primary Interviews

2.3 Key Industry Insights

2.4 Market Size Estimation: Top-Down Approach

2.5 Market Size Estimation: Bottom-Up Approach

2.6 Aerospace Coatings Market: Data Triangulation

2.7 Assumption

3 Executive Summary

3.1 Overview

4 Premium Insights

4.1 Opportunities in the Aerospace Coatings Market

4.2 Aerospace Coatings Market Attractiveness

4.3 Aerospace Coatings Market, Developing vs Developed Countries

5 Market Overview

5.1 Overview

5.2 Market Segmentation

5.3 Market Dynamics

6 Industry Trends

6.1 Value Chain Anallysis

6.2 Porter’s Five Forces Anallysis

7 Macroeconomic Indicator

7.1 Market Trend

7.2 Nano Technology in Aerospace Coatings Industry is Driving the Market

8 Aerospace Coatings Patents Details

8.1 Introduction

8.2 Patents Details

9 Aerospace Coatings Market, By Resin Type

9.1 Introduction

9.2 Key Findings

9.3 Polyurethane

9.4 Epoxy

9.5 Others (Silicone,Polyester and Acrylic)

10 Aerospace Coatings Market, By Technology

10.1 Key Findings

10.2 Introduction

10.3 Liquid Coatings

10.3.1 Solvent-Based

10.3.1 Water-Based

10.4 Powder Coating

11 Aerospace Coatings Market, By User Type

11.1 Key Findings

11.2 Introduction

11.3 MRO

11.4 OEM

12 Aerospace Coatings Market, By End-User Industry

12.1 Key Findings

12.2 Introduction

12.3 Commercial Aviation

12.4 Military Aviation

12.5 General Aviation

13 Aerospace Coatings Market, By Application

13.1 Key Findings

13.2 Introduction

13.3 Exterior

13.3.1 Sub-Application Under Exterior Application of Aerospace Coatings

13.4 Interior

13.4.1 Sub-Application Under Interior Application of Aerospace Coatings

14 Aerospace Coatings Market, By Region

14.1 Key Findings

14.2 Introduction

14.3 North America

14.3.1 Introduction

14.3.2 U.S.

14.3.3 Canada

14.3.4 Mexico

14.4 Europe

14.4.1 Introduction

14.4.2 Russia

14.4.3 Germany

14.4.4 France

14.4.5 U.K

14.4.6 Spain

14.4.7 Italy

14.4.8 Turkey

14.4.9 Other European Countries

14.5 Asia-Pacific

14.5.1 Introduction

14.5.2 China

14.5.3 Japan

14.5.4 India

14.5.5 Singapore

14.5.6 South Korea

14.5.7 Taiwan

14.5.8 Thailand

14.5.9 Vietnam

14.5.10 Rest of Asia Pacific

14.6 Middle East & Africa

14.6.1 Introduction

14.6.2 South Africa

14.6.3 Saudi Arabia

14.6.4 Rest of Middle-East & Africa

14.7 South America

14.7.1 Introduction

14.7.2 Brazil

14.7.3 Argentina

14.7.4 Other South American Countries

15 Competitive Landscape

15.1 Overview

15.2 Battle for Developmental Market Share

15.3 Market Share Analysis

15.4 Competitive Situation & Trends

16 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

16.1 PPG Industries, Inc.

16.2 Akzonobel N.V.,

16.3 Mankiewicz Gebr. & Co

16.4 The Sherwin-Williams Company

16.5 BASF SE

16.6 Henkel AG & Co. KGaA

16.7 Hentzen Coatings, Inc.

16.8 IHI Ionbond AG

16.9 Zircotec Ltd.

16.10 Mapaero

16.11 Other Key Players

16.11.1 Argosy International

16.11.2 Hohman Plating & Manufacturing LLC

16.11.3 Brycoat.Inc

16.11.4 AHC Oberflächentechnik GmbH

16.11.5 Asahi Kinzoku Kogyo Inc.

16.11.6 Zodiac Aerospace

16.11.7 Merck Performance Materials

16.11.8 Cheaerospacel

16.11.9 NVSC Speciality Coatings

16.11.10 International Aerospace Coatings Holdings Lp

*Details Might Not Be Captured in Case of Unlisted Companies.

17 Appendix

17.1 Discussion Guide

17.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

17.3 Marketsandmarkets Knowledge Store: Snapshot

17.4 Introducing RT: Real Time Market Intelligence

17.5 Related Reports

17.6 Authors Details

List of Table (146 Tables)

Table 1 Global Aerospace Coatings Market Overview (2017–2022)

Table 2 Aerospace Coatings Market, By Resin Type

Table 3 Aerospace Coatings Market, By Technology

Table 4 Aerospace Coatings Market, By User Type

Table 5 Aerospace Coatings Market, By End Use Industry

Table 6 Aerospace Coatings Market, By Application

Table 7 Trends and Forecast of GDP, USD Billion

Table 8 Growth Indicators of Aerospace Coatings Industry, 2015–2033

Table 9 Growth Indicators of Aerospace Coatings Industry, By Region, 2015–2033

Table 10 New Airplane Deliveries, By Region, 2015–2033

Table 11 Indicators Encouraging the Aerospace Industry

Table 12 Aerospace Coatings Market Size, By Resin, 2015–2022 (Million Gallon)

Table 13 Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 14 Aerospace Coatings Market Size in Polyurethane Resin, By Region, 2015–2022 (Million Gallon)

Table 15 Aerospace Coatings Market Size in Polyurethane Resin, By Region, 2015–2022 (USD Million)

Table 16 Aerospace Coatings Market Size in Epoxy Resin, By Region, 2015–2022 (Million Gallon)

Table 17 Aerospace Coatings Market Size in Epoxy Resin, By Region, 2015–2022 (USD Million)

Table 18 Aerospace Coatings Market Size in Other Resins, By Region, 2015–2022 (Million Gallon)

Table 19 Aerospace Coatings Market Size in Other Resins, By Region, 2015–2022 (USD Million)

Table 20 Aerospace Coatings Market Size, By Technology, 2015–2022 (Million Gallon)

Table 21 Aerospace Coatings Market Size, By Technology, 2015–2022 (Million Gallon)

Table 22 Aerospace Coatings Market Size in Liquid Technology, By Region, 2015–2022 (Million Gallon)

Table 23 Aerospace Coatings Market Size in Liquid Technology , By Region, 2015–2022 (USD Million)

Table 24 Aerospace Coatings Market Size in Solvent-Based Technology, By Region, 2015–2022 (Million Gallon)

Table 25 Aerospace Coatings Market Size in Solvent-Based Technology , By Region, 2015–2022 (USD Million)

Table 26 Aerospace Coatings Market Size in Water-Based Technology, By Region, 2015–2022 (Million Gallon)

Table 27 Aerospace Coatings Market Size in Water-Based Technology , By Region, 2015–2022 (USD Million)

Table 28 Aerospace Coatings Market Size in Powder-Based Technology, By Region, 2015–2022 (Million Gallon)

Table 29 Aerospace Coatings Market Size in Powder-Based Technology , By Region, 2015–2022 (USD Million)

Table 30 Aerospace Coatings Market Size, By User Type, 2015–2022 (Million Gallon)

Table 31 Aerospace Coatings Market Size, By User Type, 2015–2022 (USD Million)

Table 32 Aerospace Coatings Market Size in MRO User Type, By Region, 2015–2022 (Million Gallon)

Table 33 Aerospace Coatings Market Size in MRO User Type , By Region, 2015–2022 (USD Million)

Table 34 Aerospace Coatings Market Size in OEM User Type, By Region, 2017–2022 (Million Gallon)

Table 35 Aerospace Coatings Market Size in OEM User Type , By Region, 2017–2022 (USD Million)

Table 36 Aerospace Coatings Market Size, By End-Use Industry, 2015–2022 (Million Gallon)

Table 37 Aerospace Coatings Market Size, End-Use Industry, 2015–2022(USD Million)

Table 38 Aerospace Coatings Market Size in Commercial Aviation, By Region, 2015–2022 (Million Gallon)

Table 39 Aerospace Coatings Market Size in Commercial Aviation , By Region, 2015–2022 (USD Million)

Table 40 Aerospace Coatings Market Size in Military Aviation, By Region, 2015–2022 (Million Gallon)

Table 41 Aerospace Coatings Market Size in Military Aviation, By Region, 2015–2022 (USD Million)

Table 42 Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 43 Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 44 Aerospace Coatings Market Size in Exterior Application, By Region, 2015–2022 (Million Gallon)

Table 45 Aerospace Coatings Market Size in Exterior Application , By Region, 2015–2022 (USD Million)

Table 46 Aerospace Coatings Market Size in Interior Application, By Region, 2015–2022 (Million Gallon)

Table 47 Aerospace Coatings Market Size in Interior Application , By Region, 2015–2022 (USD Million)

Table 48 Top Economies in Terms of GDP (Ppp), 2010 and 2020

Table 49 North America: Aerospace Coatings Market Size, By Country, 2015–2022 (Million Gallon)

Table 50 North America: Aerospace Coatings Market Size, By Country, 2015–2022 (USD Million)

Table 51 North America: Aerospace Coatings Market Size, By Resin Type, 2015–2022 (Million Gallon

Table 52 North America: Aerospace Coatings Market Size, By Resin Type, 2015–2022 (USD Million)

Table 53 North America: Aerospace Coatings Market Size, By Technology, 2015–2022 (Million Gallon

Table 54 North America: Aerospace Coatings Market Size, By Technology, 2015–2022 (USD Million)

Table 55 North America: Aerospace Coatings Market Size, By User Type, 2015–2022 (Million Gallon

Table 56 North America: Aerospace Coatings Market Size, By User Type, 2015–2022 (USD Million)

Table 57 North America: Aerospace Coatings Market Size, By End-Use Industry, 2015–2022 (Million Gallon)

Table 58 North America : Aerospace Coatings Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 59 North America: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 60 North America: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 61 U.S.: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 62 U.S.: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 63 Canada: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 64 Canada: Aerospace Coatings Market Size, By Application, 2015–2021 (USD Million)

Table 65 Mexico: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 66 Mexico: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 67 Europe: Aerospace Coatings Market Size, By Country, 2015–2022 (Million Gallon)

Table 68 Europe: Aerospace Coatings Market Size, By Country, 2015–2022 (USD Million)

Table 69 Europe: Aerospace Coatings Market Size, By Resin Type, 2015–2022 (Million Gallon)

Table 70 Europe : Aerospace Coatings Market Size, By Resin Type, 2015–2022 (USD Million)

Table 71 Europe : Aerospace Coatings Market Size, By Technology, 2015–2022 (Million Gallon)

Table 72 Europe : Aerospace Coatings Market Size, By Technology, 2015–2022 (USD Million)

Table 73 Europe: Aerospace Coatings Market Size, By User Type, 2015–2022 (Million Gallon)

Table 74 Europe: Aerospace Coatings Market Size, By User Type, 2015–2022 (USD Million)

Table 75 Europe: Aerospace Coatings Market Size, By End-Use Industry, 2015–2022 (Million Gallon)

Table 76 Europe: Aerospace Coatings Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 77 Europe : Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 78 Europe: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 79 Russia: Aerospace Coatings Market Size, By Application, 2015–2021 (Million Gallon)

Table 80 Russia: Aerospace Coatings Market Size, By Application, 2015–2021 (USD Million)

Table 81 Germany: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 82 Germany: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 83 France: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 84 France: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 85 U.K.: Aerospace Coatings Market Size, By Application, 2015–2022 (Million)

Table 86 U.K.: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 87 Italy: Aerospace Coatings Market Size, By Application, 2015–2022 (Million)

Table 88 Italy: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 89 Asia-Pacific: Aerospace Coatings Market Size, By Country, 2015–2022 (Million Gallon)

Table 90 Asia-Pacific: Aerospace Coatings Market Size, By Country, 2015–2022 (USD Million)

Table 91 Asia-Pacific: Aerospace Coatings Market Size, By Resin Type , 2015–2022 (Million Gallon)

Table 92 Asia-Pacific: Aerospace Coatings Market Size, By Resin Type, 2015–2022 (USD Million)

Table 93 Asia-Pacific: Aerospace Coatings Market Size, By Technology , 2015–2022 (Million Gallon)

Table 94 Asia-Pacific: Aerospace Coatings Market Size, By Technology, 2015–2022 (USD Million)

Table 95 Asia-Pacific: Aerospace Coatings Market Size, By User Type, 2015–2022 (Million Gallon)

Table 96 Asia-Pacific: Aerospace Coatings Market Size, By User Type, 2015–2022 (USD Million)

Table 97 Asia-Pacific: Aerospace Coatings Market Size, By End-Use Industry, 2015–2022 (Million Gallon)

Table 98 Asia-Pacific: Aerospace Coatings Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 99 Asia-Pacific: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 100 Asia-Pacific: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 101 China: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 102 China: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 103 Japan: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 104 Japan: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 105 India: Aerospace Coatings Market Size, By Application, 2015–2022 (Million)

Table 106 India: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 107 Singapore: Aerospace Coatings Market Size, By Application, 2015–2022 (Million)

Table 108 Singapore: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 109 South Korea: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 110 South Korea: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 111 Middle East & Africa: Aerospace Coatings Market Size, By Country, 2015–2022 (Million Gallon)

Table 112 Middle East & Africa: Aerospace Coatings Market Size, By Country, 2015–2022 (USD Million)

Table 113 Middle East & Africa: Aerospace Coatings Market Size, By Resin Type , 2015–2022 (Million Gallon)

Table 114 Middle East & Africa : Aerospace Coatings Market Size, By Resin Type, 2015–2022 (USD Million)

Table 115 Middle East & Africa : Aerospace Coatings Market Size, By Technology , 2015–2022 (Million Gallon)

Table 116 Middle East & Africa : Aerospace Coatings Market Size, By Technology, 2015–2022 (USD Million)

Table 117 Middle East & Africa : Aerospace Coatings Market Size, By User Type, 2015–2022 (Million Gallon)

Table 118 Middle East & Africa : Aerospace Coatings Market Size, By User Type, 2015–2022 (USD Million)

Table 119 Middle East & Africa: Aerospace Coatings Market Size, By End-Use Industry, 2015–2022 (Million Gallon)

Table 120 Middle East & Africa : Aerospace Coatings Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 121 Middle East & Africa: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 122 Middle East & Africa : Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 123 South Africa : Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 124 South Africa : Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 125 Saudi Arabia : Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 126 Saudi Arabia : Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 127 South America: Aerospace Coatings Market, By Country, 2015–2022 (Million Gallon)

Table 128 South America: Aerospace Coatings Market, By Country, 2015–2022 (USD Million)

Table 129 South America: Aerospace Coatings Market Size, By Resin Type , 2015–2022 (Million Gallon)

Table 130 South America : Aerospace Coatings Market Size, By Resin Type, 2015–2022 (USD Million)

Table 131 South America : Aerospace Coatings Market Size, By Technology , 2015–2022 (Million Gallon)

Table 132 South America : Aerospace Coatings Market Size, By Technology, 2015–2022 (USD Million)

Table 133 South America: Aerospace Coatings Market Size, By User Type, 2015–2022 (Million Gallon)

Table 134 South America : Aerospace Coatings Market Size, By User Type, 2015–2022 (USD Million)

Table 135 South America: Aerospace Coatings Market Size, By End-Use Industry, 2015–2022 (Million Gallon)

Table 136 South America: Aerospace Coatings Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 137 South America: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 138 South America : Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 139 Brazil: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 140 Brazil: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 141 Argentina: Aerospace Coatings Market Size, By Application, 2015–2022 (Million Gallon)

Table 142 Argentina: Aerospace Coatings Market Size, By Application, 2015–2022 (USD Million)

Table 143 Investment & Expansion, 2012–2016

Table 144 New Product Launch, 2012–2016

Table 145 Acquisition, 2012–2016

Table 146 Agreement, 2012–2016

Table of Figure (45 Figures)

Figure 1 Primary Interviews

Figure 2 Asia-Pacific Market to Register the Highest CAGR Between 2017 and 2022

Figure 3 Aerospace Coating Market in Polyurethane Resin to Register the Highest CAGR Between 2017 and 2022

Figure 4 Aerospace Coating Market in Liquid Coating Technology to Register the Highest CAGR Between 2017 and 2022

Figure 5 Market in MRO User Type to Register the Highest CAGR Between 2017 and 2022

Figure 6 Market in the Commercial Aviation End Use Industry to Register Highest CAGR Between 2017 and 2022

Figure 7 Aerospace Coatings Market in Polyurethane Application to Register the Highest CAGR (2017–2022)

Figure 8 Attractive Opportunities in Asia-Pacific Market

Figure 9 Aerospace Coatings Market to Register High Growth in Developing Countries Between 2017 and 2022

Figure 10 Market in India to Register the Highest CAGR Between 2017 and 2022

Figure 11 Aerospace Coatings Market, By Region

Figure 12 Drivers, Restraints, Opportunities, and Challenges in the Aerospace Coatings Market

Figure 13 Value Chain Analysis

Figure 14 Porter’s Five Forces Analysis

Figure 15 World Fleet Production, By Manufacturer

Figure 16 Airplanes in Service, 2014–2034

Figure 17 Deliveries By Airplane Size and Region

Figure 18 Airplanes in Service, 2014–2034

Figure 19 Germany Filed the Highest Number of Patents Between 2010 and 2016

Figure 20 Kansai Paints Co Ltd Filed the Highest Numbers of Patents Between 2010 and 2016

Figure 21 Polyurethane Resin to Register the Highest CAGR in Aerospace Coatings Market Between 2017 and 2022

Figure 22 Aerospace Coatings Market in Liquid Coatings Technology to Register the Highest CAGR (2017–2022)

Figure 23 Aerospace Coating Market in MRO User Type to Register the Highest CAGR (2017–2022)

Figure 24 Aerospace Coatings Market in Commercial Aviation to Register the Highest CAGR (2017–2022)

Figure 25 The Market in Exterior Application to Register the Highest CAGR (2017–2022)

Figure 26 Aerospace Coatings Market Share, By Region, 2016

Figure 27 Asia-Pacific to Lead the Aerospace Coatings Market Between 2017 and 2022

Figure 28 Aerospace Coatings Market, By Resin Type and Region

Figure 29 Aerospace Coatings Market, By Technology and Region

Figure 30 Aerospace Coatings Market, By User Type and Region

Figure 31 Aerospace Coatings Market, By End-Use Industry and Region

Figure 32 Aerospace Coatings Market, By Application and Region

Figure 33 North America: Aerospace Coatings Market Snapshot

Figure 34 U.S. Dominates the Aerospace Coatings Market in North America

Figure 35 Europe: Aerospace Coatings Market Share, By Application

Figure 36 Russia Led the Aerospace Coatings Market in Europe

Figure 37 Asia-Pacific: Aerospace Coatings Market Snapshot

Figure 38 China to Lead the Aerospace Coatings Market Between 2017 and 2022

Figure 39 Middle East & Africa: Aerospace Coatings Market Size, By Application

Figure 40 South Africa to Lead the Aerospace Coatings Market in Middle East & Africa

Figure 41 South America: Aerospace Coatings Market Size, By Application

Figure 42 Brazil to Lead the Aerospace Coatings Market in South America

Figure 43 Investment & Expansion Was the Key Strategy Adopted By Leading Companies Between 2012 and 2016

Figure 44 Investment & Expansion Accounted for Major Share of All Growth Strategies Adopted Between 2012 and 2016

Figure 45 PPG Industries, Inc., Accounted for the Largest Market Share in 2015"

Growth opportunities and latent adjacency in Aerospace Coatings Market

Information on ererging technology on cast nylon manfacturing

Deepdive intelligence on Aerospace Coatings consumption in the US Defense industry.

Interest on structural coatings for interior and exterior applications.

Interested in surface treament (coatings) reports

Military coatings growth by technology and resin chemistry

Market analysis on Aerospace Coatings market by Region