Agricultural Robots Market

Agricultural Robots Market by Robot Type (Unmanned Aerial Vehicles, Milking Robots), Application (Harvest Management, Dairy & Livestock Management), Offering (Hardware, Software), End Use, Farming Environment, Farm Size, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

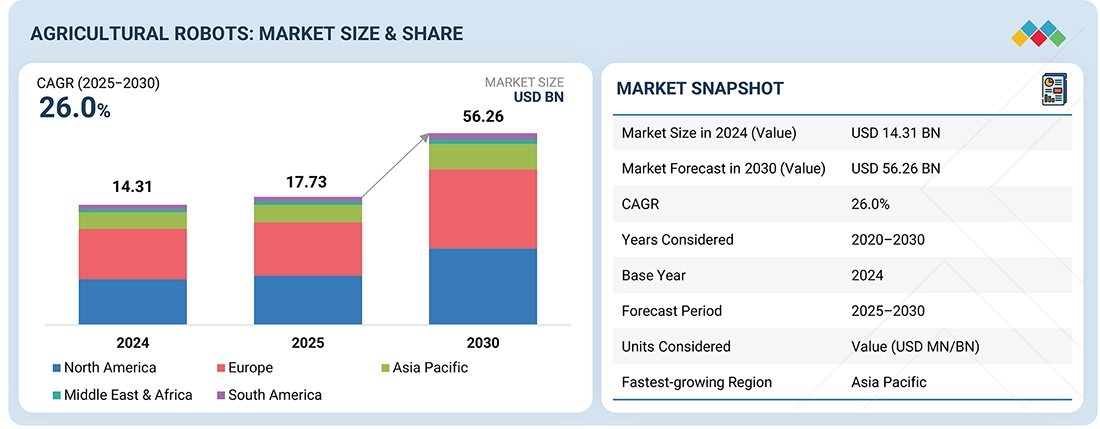

The global agricultural robots market is projected to expand from USD 17.73 billion in 2025 to reach USD 56.26 billion by 2030, at a CAGR of 26.0% during the forecast period. The agriculture robot market is expanding rapidly, fueled by advances in automation, artificial intelligence, and precision farming solutions. Key applications include autonomous tractors, drones, robotic harvesters, and weeding machines, all designed to improve efficiency, reduce labor costs, and enhance crop yields. North America and Europe are leading adopters, while Asia-Pacific shows emerging potential. Startups, technology collaborations, and product innovations are accelerating market growth, transforming traditional farming practices globally.

KEY TAKEAWAYS

-

BY ROBOT TYPEThe agricultural robots market encompasses unmanned aerial vehicles/drones, milking robots for automated livestock management, driverless tractors for autonomous field operations, and automated harvesting robots for efficient crop collection. These robot types enhance operational precision, optimize labor utilization, and improve productivity, supporting broad-scale adoption worldwide.

-

BY APPICATIONThe agricultural robots market by application includes harvest management for efficient crop collection, field & crop management with autonomous tractors and weeding robots, dairy and livestock management through milking and feeding systems, inventory & supply chain management for tracking resources, and soil and irrigation management via smart sensors and irrigation solutions, all enhancing efficiency, precision, and productivity, and weather tracking & forecasting while supporting sustainable and data-driven farming practices.

-

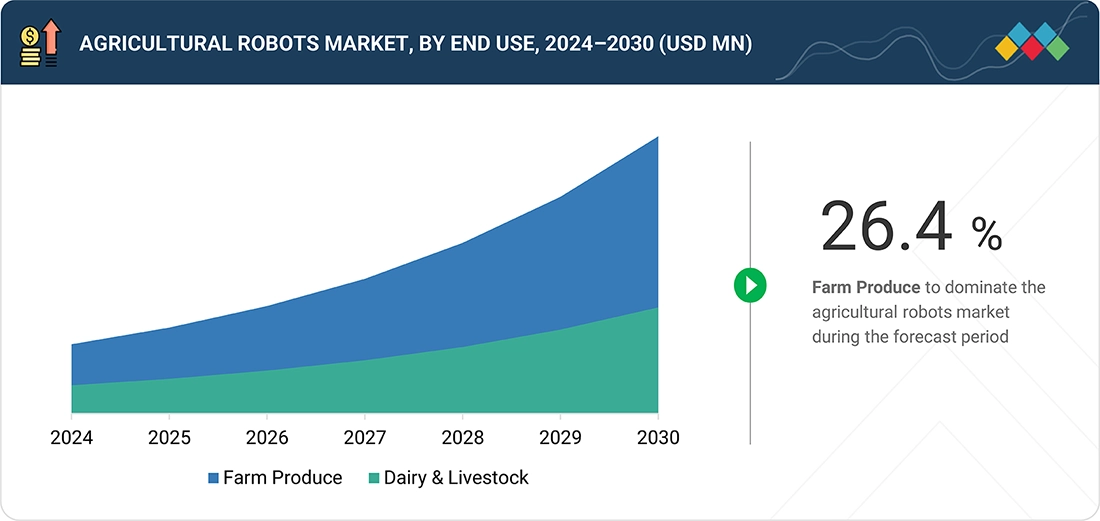

BY END USEThe agricultural robots market is divided by end-use into farm produce and dairy & livestock. The farm produce segment focuses on robotic solutions for planting, harvesting, and field operations, improving crop yield and efficiency. The dairy & livestock segment includes automated milking, feeding, and health monitoring systems, enhancing animal welfare, productivity, and labor optimization.

-

BY FARMING ENVIRONMENTThe farming environment refers to outdoor and indoor farming. Outdoor farming utilizes autonomous tractors, drones, and field robots for planting, harvesting, and crop monitoring in open fields, whereas indoor farming employs robotics in greenhouses and vertical farms for precise planting, harvesting, and controlled crop management.

-

BY OFFERINGThe agricultural robots market is segmented by offering into hardware, software, and services. Hardware includes tractors, harvesters, drones, and sensors that enable automation and precision. Software encompasses AI, farm management, and analytics platforms that facilitate data-driven decisions. Services encompass installation, maintenance, training, and support, ensuring smooth deployment and operation of robotic systems.

-

BY FARM SIZEThe agricultural robots market is segmented by farm size, ranging from small to large farms. Small farms use cost-effective or semi-autonomous robots, mid-sized farms adopt entry-level autonomous systems, and large farms utilize fully autonomous, AI-integrated solutions for maximum efficiency and yield. They deploy autonomous tractors and drones.

-

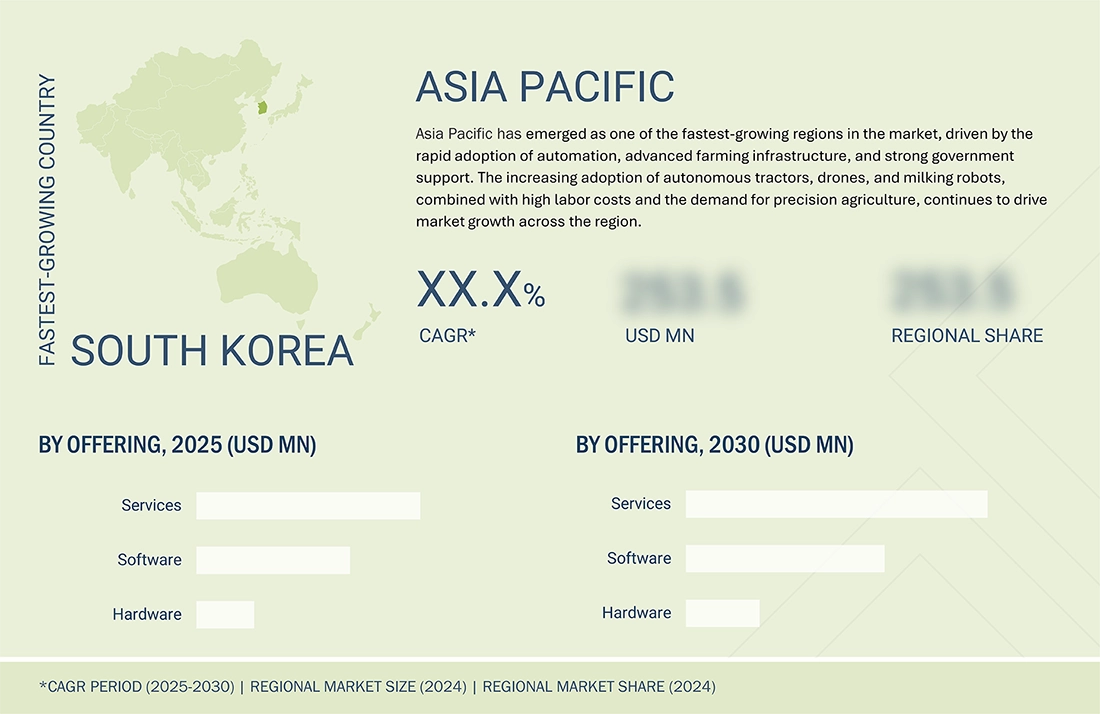

BY REGIONThe Asia Pacific region is expected to be the fastest-growing market for agricultural robots during the forecast period, driven by technological advancements, labor shortages, and increasing demand for sustainable farming practices.

-

COMPETITIVE LANDSCAPEThe agricultural robots market is highly competitive and fragmented, comprising global OEMs, ag-tech firms, and innovative startups. Major players, including Deere & Company, CNH Industrial, Trimble, DJI, Lely, and DeLaval, compete on the basis of technology, performance, integration, and service. Competition focuses on automation reliability, data connectivity, and ROI-driven adoption. Partnerships, acquisitions, and regional collaborations are common strategies, with established companies leveraging scale and distribution networks, while startups drive innovation in AI, sensing, and autonomous operations.

The agricultural robots market is experiencing significant growth as producers adopt automated solutions for planting, harvesting, monitoring, and crop management. Advanced robotics and AI enable precision operations, provide real-time data insights, and reduce labor dependency. Key segments include field robots, drones, and autonomous machinery. Increasing demand for efficiency, sustainable practices, and higher yields is driving innovation, with established players and startups collaborating to deliver scalable, cost-effective solutions globally.

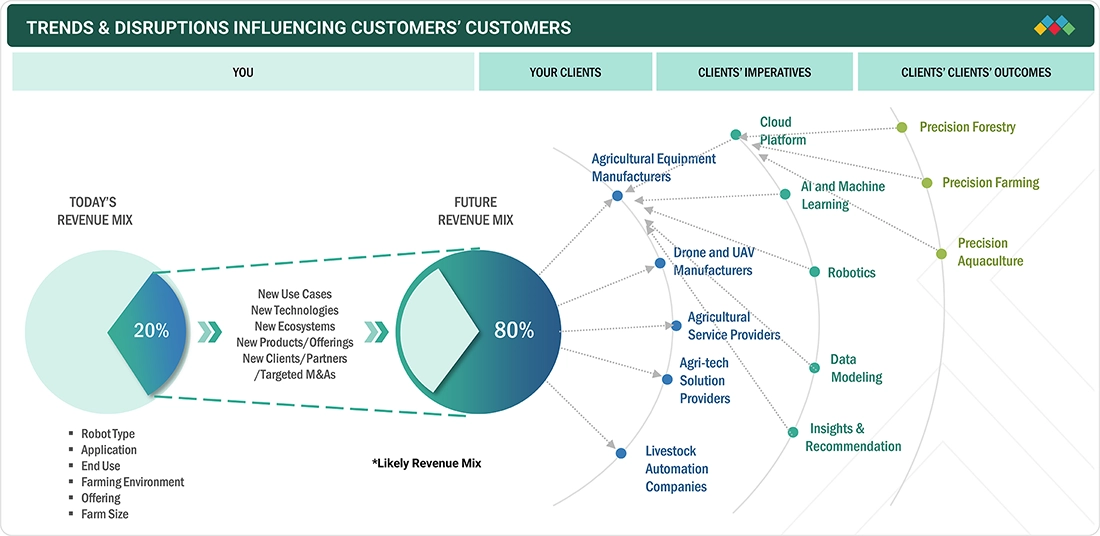

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The agricultural robots market is undergoing significant trend-driven disruption, fueled by advancements in AI, machine learning, IoT, and computer vision. These technologies enable smarter, data-driven decision-making and greater automation across farming operations. The shift toward precision and sustainable agriculture is accelerating the adoption of autonomous tractors, drones, and robotic harvesters. Additionally, labor shortages, rising input costs, and environmental pressures are pushing farmers to adopt robotic solutions for efficiency and productivity. Collaboration between tech firms and agri-equipment manufacturers is reshaping the competitive landscape, driving continuous innovation and transforming traditional farming into a connected, automated ecosystem.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Incease in IoT devices connected with farm management to analyze data on various factors

-

Demand for optimizing farm management using agricultural drones and robots

Level

-

High cost of automation for small farmers

-

Technological barrier pertaining to fully autonomous robots

Level

-

Untapped market potential and scope for automation in agriculture

-

Use of real-time multi modal robots

Level

-

Lack of standardization of agriculture robot technologies

-

High cost and complexity of fully autonomous robots

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Incease in IoT devices connected with farm management to analyze data on various factors

A major growth driver in the agriculture robotics market is the rising integration of IoT-enabled devices with farm management systems, enabling real-time data collection and analysis on key parameters such as soil conditions, weather patterns, crop health, and equipment performance. This connectivity enhances operational efficiency, supports data-driven decision-making, and enables predictive maintenance, ultimately optimizing resource utilization and accelerating the adoption of advanced robotic solutions across modern farming operations.

Restraint: High cost of automation for small farmers

A major restraint in the agriculture robotics market is the high capital investment required for automation technologies, which limits adoption among small and medium-sized farmers. The significant upfront costs of robotic equipment, coupled with ongoing expenses for maintenance, software, and operator training, increase total ownership costs. This financial burden restricts accessibility, slowing adoption and widening the technology gap between large-scale and smallholder farming operations.

Opportunity: Untapped market potential and scope for automation in agriculture

A significant opportunity in the agriculture robotics market lies in the untapped potential and growing scope for automation across global farming sectors. Emerging economies present substantial growth prospects as farmers increasingly recognize the benefits of precision, efficiency, and sustainability. Advancements in cost-effective robotic technologies, along with supportive government initiatives and digitalization in agriculture, are expected to accelerate adoption, creating new opportunities for market expansion and strategic investments.

Challenge: Lack of standardization of agriculture robot technologies

A major challenge in the agriculture robotics market is the absence of global standardization for robotic technologies and interoperability protocols. Differences in hardware, software platforms, and communication interfaces limit seamless integration and scalability across systems. Coupled with varying regional regulatory frameworks, this fragmentation slows adoption. Establishing unified standards is critical to ensure reliability, compatibility, and broader market acceptance.

Agricultural Robots Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of autonomous tractors and planters for row crops | Increases operational efficiency, reduces labor costs, and improves precision planting |

|

Use of robotic harvesters and crop pickers in cereals and vegetables | Minimizes crop loss, reduces reliance on seasonal labor, and enables faster harvest cycles |

|

Autonomous weed control robots for large-scale cereal and vegetable farms | Reduces herbicide usage, lowers environmental impact, and ensures precise weed management |

|

Drone-based crop monitoring and spraying for high-value fruits and vegetables | Enables targeted nutrient and pesticide application, improves yield, and reduces chemical wastage |

|

Greenhouse and indoor robotic solutions for seeding, transplanting, and harvesting | Increases planting and harvesting precision, reduces labor, and optimizes crop growth conditions |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The agricultural robots market ecosystem comprises OEMs producing autonomous machinery, technology, and component providers supplying sensors, AI, and IoT platforms, startups developing specialized solutions, and distributors/dealers offering equipment, service, and training. End users, including farms and agribusinesses, implement these technologies, which are supported by research institutions and government agencies that drive R&D, standardization, and adoption.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Agricultural Robots Market, By Robot Type

As of 2024, the agricultural robot market is segmented into unmanned aerial vehicles (UAVs)/drones, milking robots, driverless tractors, and automated harvesting systems. UAVs are further classified by type—fixed-wing for large-area coverage and multirotor for detailed inspections—and by components such as sensors, cameras, GPS, and sprayers, primarily used for crop monitoring and precision agriculture. Milking robots automate the milking process using sensors and cameras, enhancing efficiency and animal welfare. Driverless tractors perform plowing, seeding, and tilling autonomously, reducing labor requirements on large farms. Automated harvesting systems identify and harvest ripe crops efficiently, minimizing waste and labor.

Agricultural Robots Market, By Appication

As of 2024, the agricultural robots market is segmented by application into harvest management, field & crop management, dairy & livestock management, soil & irrigation management, weather tracking & forecasting, and inventory & supply chain management. Harvest management robots automate crop collection, enhancing efficiency and reducing labor requirements. Field farming robots handle planting, monitoring, spraying, and weeding for optimized production. Dairy and livestock robots assist with milking, feeding, and health monitoring. Soil and irrigation robots manage soil health and automate watering, while inventory robots track seeds, fertilizers, and produce, enhancing supply chain efficiency. These applications collectively drive market growth and productivity.

Agricultural Robots Market, By End Use

As of 2024, the agricultural robots market is segmented by end use into farm produce and dairy & livestock. Farm produce robots are deployed for activities such as planting, crop monitoring, spraying, and harvesting, enhancing yield and operational efficiency. Dairy & livestock robots focus on milking, feeding, health monitoring, and overall animal management, improving productivity, welfare, and labor efficiency on farms. This segmentation highlights how robotics solutions are tailored to specific agricultural needs, driving adoption across crop and livestock operations.

Agricultural Robots Market, By Farming Environment

As of 2024, the agricultural robots market is segmented by farming environment into outdoor and indoor. Outdoor robots are designed for open-field operations such as planting, spraying, monitoring, and harvesting, where they navigate varying terrains and weather conditions. Indoor robots are utilized in controlled environments, such as greenhouses and vertical farms, to manage tasks like planting, irrigation, crop monitoring, and harvesting under regulated conditions.

Agricultural Robots Market, By Offering

Offerings include hardware, software, and services. Hardware includes autonomous tractors, harvesters, drones, and milking robots, enabling automation of planting, harvesting, spraying, and monitoring while reducing labor and improving efficiency. Software encompasses AI and farm management platforms for navigation, crop monitoring, and predictive analytics, optimizing input use and enhancing decision-making. Services cover installation, maintenance, training, and support, ensuring smooth operation, minimizing downtime, and aiding adoption. Together, these segments form a complete ecosystem that drives precision, efficiency, and productivity in modern agriculture.

Agricultural Robots Market, By Farm Size

As of 2024, the agricultural robots market, by farm size, includes small, mid-sized, and large-sized farms. Small farms (<100 ha) typically adopt cost-effective or semi-autonomous robots to reduce labor, while mid-sized farms (100–500 ha) increasingly use semi- or entry-level autonomous systems for planting, spraying, and harvesting. Large farms (more than 500 ha) rely on autonomous tractors, harvesters, and drones for full-field operations.

REGION

Asia Pacific to be fastest-growing region in agricultural robots market during forecast period

The Asia Pacific region is expected to be the fastest-growing market for agricultural robots during the forecast period, driven by technological advancements, labor shortages, and rising demand for sustainable farming. Countries like China, India, Japan, and South Korea are integrating AI, IoT, and robotics into agriculture, while government initiatives promote mechanization and smart farming. Strategic investments and adoption of autonomous tractors, drones, and robotic harvesters further accelerate growth, positioning Asia Pacific as a leading hub for agricultural robotics innovation.

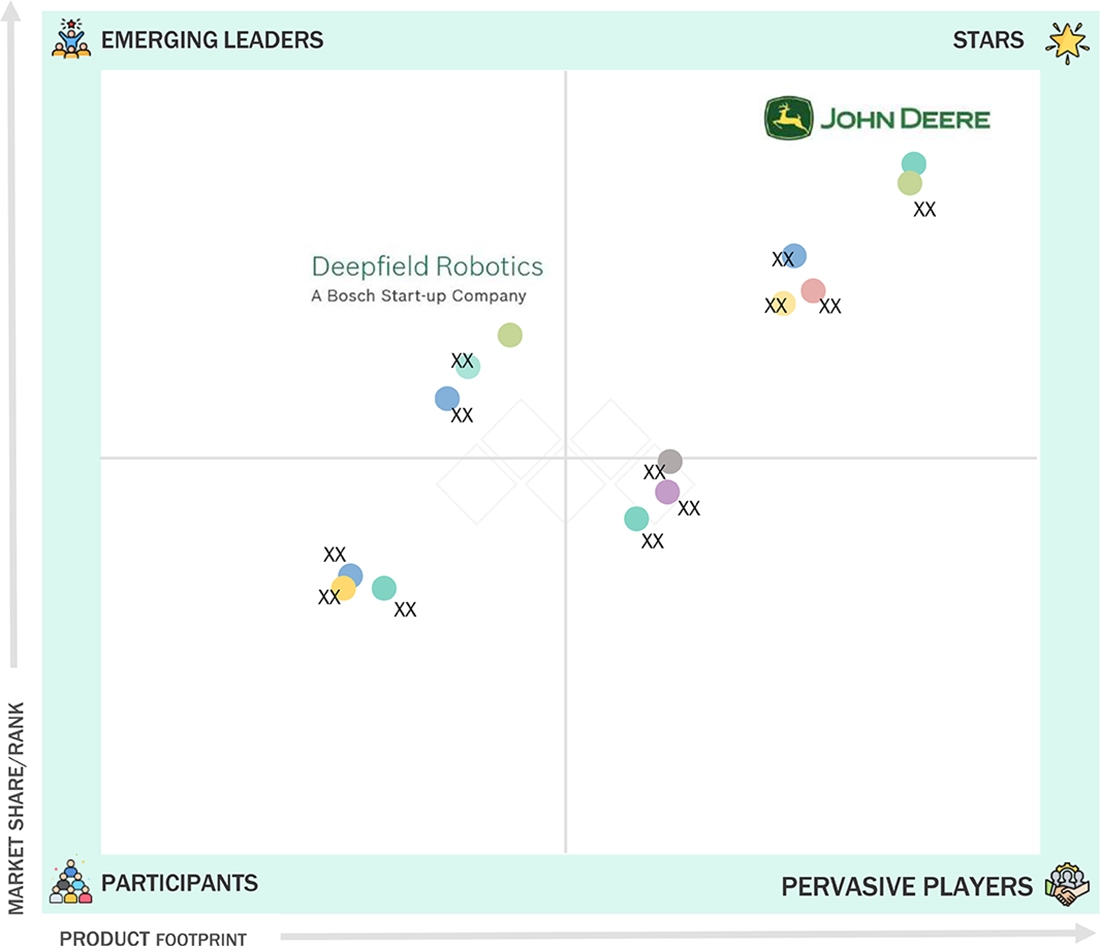

Agricultural Robots Market: COMPANY EVALUATION MATRIX

The agricultural robots market is highly competitive, with companies evaluated based on technology innovation, product portfolio, market presence, and strategic partnerships. John Deere (Key Player), is recognized for its autonomous tractors, precision planting systems, and advanced field robots, leveraging decades of agricultural expertise to drive large-scale adoption globally. In contrast, Deepfield Robotics (Emerging Player), an emerging player, focuses on AI-powered robotic systems for seeding, weeding, and crop monitoring, targeting precision agriculture and niche applications. Established players benefit from a brand reputation and established distribution networks, while emerging firms gain agility, a focus on innovation, and potential for rapid market penetration.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 14.31 Billion |

| Market Forecast in 2030 (Value) | USD 56.26 Billion |

| Growth Rate | CAGR of 26.0% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

| Leading Segments | By End Use, farm produce to dominate the agricultural robots market at 26.4% CAGR. |

| Leading Region | Asia Pacific to be fastest-growing region in agricultural robots market during forecast period. |

| Driver | Increase in IoT devices connected with farm management to analyze data on various factors |

| Constraints | High cost of automation for small farmers |

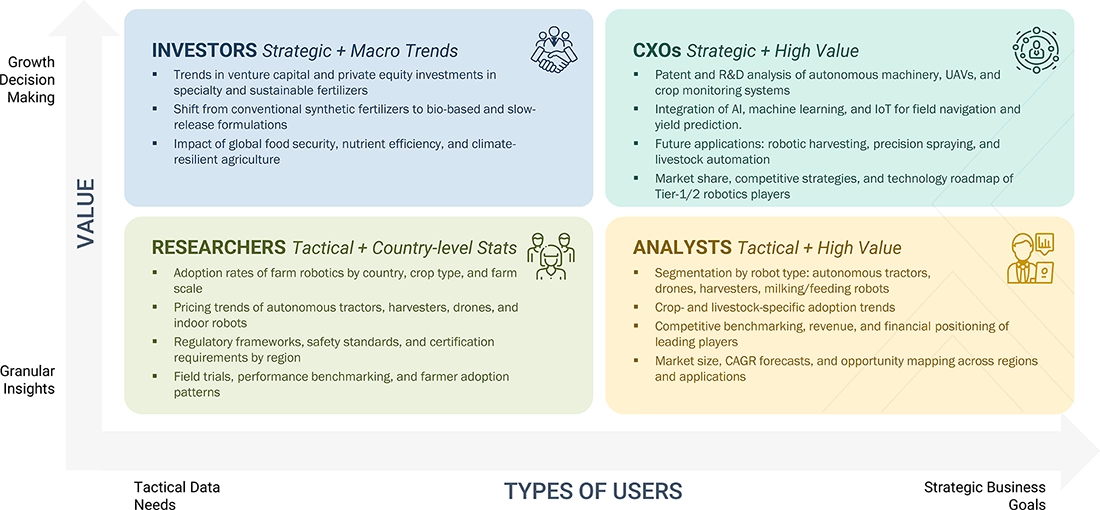

WHAT IS IN IT FOR YOU: Agricultural Robots Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| North America–based Agri-Robot Manufacturer |

|

|

| European Agri-Robotics Company |

|

|

| APAC-based Agritech Firm |

|

|

| Global Agri-Robot Distributor |

|

|

| Investor / Private Equity Firm |

|

|

RECENT DEVELOPMENTS

- June 2025 : CNH Industrial launched SenseApply, an AI-powered sprayer technology across Case IH, New Holland, and Miller brands. It uses machine learning and camera sensing for real-time crop and weed detection, enabling precise input application, reducing chemical use, enhancing sustainability, and improving farm efficiency and yields.

- April 2025 : DJI launched the Agras T50 and T25 drones for precision agriculture. The T50 handles large-scale spraying with advanced navigation, while the T25 is compact for smaller farms. Both use the SmartFarm App for monitoring, mission planning, and data analysis, improving efficiency and reducing labor.

- February 2025 : Ecorobotix has launched the ARA Ultra-High Precision Field Sprayer, featuring AI-based Plant-by-Plant technology for targeted spraying, resulting in up to a 95% reduction in chemical use. Equipped with vision systems and crop-specific algorithms, it enhances sustainability, efficiency, and compliance with regulations, marking a significant step forward in precision and autonomous crop care technology.

- January 2024 : At CES 2024, Kubota launched the New Agri Concept, a fully electric, autonomous agricultural vehicle equipped with six independent drive motors. It performs tasks such as tilling and mowing, supports rapid charging, integrates AI for data collection and automation, and addresses labor shortages while promoting sustainable and efficient farming practices.

- October 2024 : Clearpath Robotics launched the Husky A300, a rugged mobile robot with a 100?kg payload, 12-hour runtime, and flexible sensor integration. The Husky AMP version offers turnkey autonomous deployment with navigation software, simplifying outdoor operations.

Table of Contents

Methodology

The study employed two primary approaches to estimate the current size of the agricultural robots market. Exhaustive secondary research was conducted to gather information on the market, peer markets, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Following this, market breakdown and data triangulation were employed to determine the market size of each segment and its subsegments.

Secondary Research

This research study extensively utilized secondary sources, including directories and databases such as Bloomberg Businessweek and Factiva, to identify and collect information relevant to a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources, including annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles by recognized authors, directories, and databases, were consulted to identify and collect information.

Secondary research was primarily used to gather key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends, down to the most granular level, including regional markets and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the agricultural robots market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as CXOs, VPs, Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights, including market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to agricultural robot technology, applications, end uses, farming environments, offerings, farm sizes, and regions. Stakeholders from the demand side, including research institutions and universities, agrochemical distributors and retailers, and food processing companies, were interviewed to understand the buyer’s perspective on suppliers, products, and their current usage of agricultural robots, as well as their outlook for the business, which will impact the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2022 or 2023, as per the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = Revenue = USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Deere & Company (US) |

General Manager |

|

DJI (China) |

Sales Manager |

|

CNH Industries NV (US) |

Manager |

|

AGCO Corporation (US) |

Sales Manager |

|

Delaval (Sweden) |

Marketing Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the agricultural robots market. These approaches were also used extensively to determine the size of various market segments. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Agricultural Robots Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the estimation process explained above, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall agricultural robots market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

The agricultural robots market refers to the market for automated and robotic technologies designed to perform agricultural tasks with minimal human intervention. It encompasses a wide range of equipment and systems, including autonomous tractors, drones (UAVs), robotic harvesters, milking robots, planting and seeding machines, weeding robots, and soil and irrigation monitoring systems. These technologies aim to enhance productivity, efficiency, and precision in farming operations while reducing labor dependency and operational costs. The market also includes software platforms, AI-driven analytics, and IoT-enabled solutions that support decision-making, resource optimization, and sustainable agricultural practices across crop farming, livestock management, and greenhouse operations.

Stakeholders

- Farmers and agribusinesses that adopt robots to boost productivity and reduce labor costs

- Equipment manufacturers that produce autonomous tractors, drones, and robotic harvesters

- Traders, distributors, and suppliers in the agricultural robots market

- Technology providers delivering AI, IoT, GPS, sensors, and farm software

- Government bodies promoting adoption through policies, subsidies, and initiatives

- Investors funding agritech startups and robotics innovations

- Research institutions developing robotic and precision farming technologies

Report Objectives

- To determine and project the size of the agricultural robots market with respect to the robot type, application, end use, farming environment, offering, farm size, and region in terms of value over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the agricultural robots market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of each company's product portfolio.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the market in the Rest of Europe, by country

- Further breakdown of the market in the Rest of the Asia Pacific, by country

- Further breakdown of the market in the Rest of South America, by country

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Agricultural Robots Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Agricultural Robots Market

Adetunji

Apr, 2017

Does your report includes these equipment and system like Driverless Tractors, Food Processing systems, Pulverizer and capsules Filing machines, Green Leave Dryers, and Softwares . .

Evgeniy

Apr, 2022

Хочу посмотреть что происходит на рынке робототехники и самое главное перспективы.

Michael

May, 2019

Looking for agriculture robots market historical data and future trends for camera technology. Specially for polarisation, hyperspectral, tof, video in uhd, FHD... .

Holly

Jun, 2019

I am looking for major analysis you have provided for different agriculture robots and their adoption trends in major agriculture country. .