Aircraft Fuel Cells Market by Fuel Type (Hydrogen, Hydrocarbon, Others), Power Output (0-100kW, 100 kW- 1MW, 1MW & Above), Aircraft Type (Fixed-Wing, Rotary Wing, UAVs, AAMs) and Region - Global Forecast to 2035

Update: 10/22/2024

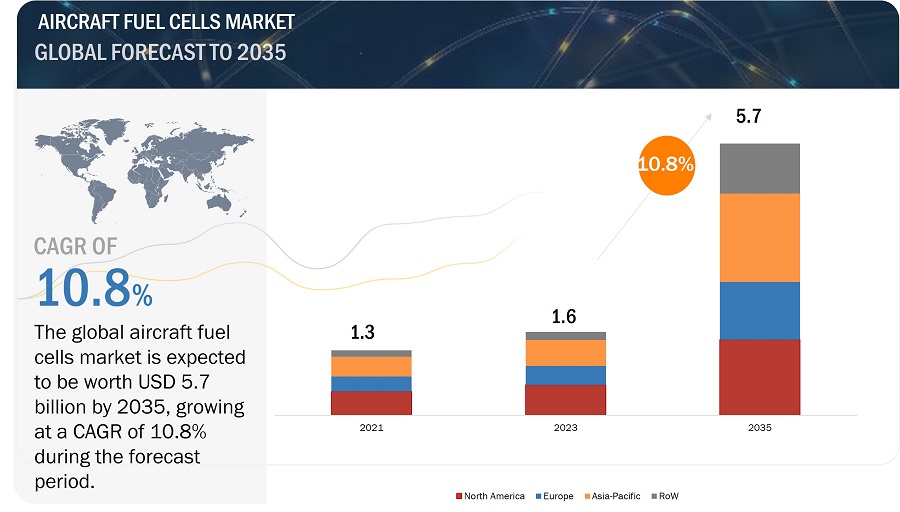

The Aircraft Fuel Cell Market size is projected to grow from USD 1.6 Billion in 2023 to USD 5.7 Billion by 2035, at a CAGR of 10.8% from 2023 to 2035. Aircraft fuel cells serve a vital function in the aviation industry by providing efficient and clean power generation for various applications. Fuel cells convert the chemical energy of fuels, like hydrogen or hydrocarbon, into electricity through an electrochemical process. In Aircraft Fuel Cell Industry, these are utilized for propulsion systems, enabling more efficient and environmentally friendly aircraft engines. They also find application as auxiliary power units (APUs), supplying electricity for aircraft systems during ground operations and reducing reliance on traditional engine-based power generation. Additionally, fuel cells are used as backup power sources in emergency situations, ensuring uninterrupted operation of critical systems. By powering essential equipment and systems, such as communication, navigation, and safety devices, fuel cells enhance aircraft safety and reliability.

Aircraft Fuel Cells Market Forecast to 2035

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Fuel Cell Market Dynamics.

Driver: Fuel Cell Innovation and Cost Efficiency Propel the Growth in the Aircraft Industry

Innovation in fuel cell technology is a catalyst for market growth. Ongoing research and development efforts focus on enhancing fuel cell performance, durability, and efficiency. Innovations in materials, design, and manufacturing processes have led to higher energy conversion rates, improved power output, and extended fuel cell lifespan. Additionally, advancements in system integration and control technologies contribute to the reliability and adaptability of fuel cell systems. Cost efficiency is a critical factor in driving the adoption of fuel cell technology in the aircraft industry. Over the years, significant progress has been made in reducing the cost of fuel cell systems. Innovations in manufacturing processes, economies of scale, and increased market competition have resulted in cost reductions. As fuel cell costs become more competitive with conventional power sources, the business case for adopting fuel cell technology in aircraft becomes stronger. The potential for long-term cost savings in fuel consumption, maintenance, and operational efficiency further drives the market growth. These factors are expected to drive the fuel cell market in the future.

Restraint: Hydrogen storage and cooling

One of the primary challenges in fuel cell technology is the storage of hydrogen, the fuel used in fuel cells. Hydrogen has a low energy density and requires large storage tanks or complex systems for compression or liquefaction. These storage solutions can add weight and volume to the aircraft, impacting fuel efficiency and payload capacity. Moreover, ensuring the safe handling and storage of hydrogen is crucial due to its flammability. These factors pose technical and logistical challenges that need to be overcome to enable efficient and practical hydrogen storage for aircraft fuel cells. Fuel cells generate heat during operation, requiring effective cooling systems to maintain optimal performance and prevent overheating. Cooling systems in aircraft fuel cells must be efficient, lightweight, and capable of handling high heat loads. Designing and integrating effective cooling systems can be complex and expensive, impacting the overall cost and complexity of the fuel cell system. Failure to properly manage heat dissipation can lead to reduced fuel cell efficiency and potential damage to the system, necessitating careful design considerations and advanced thermal management solutions. These factors act as a restraint to the market growth.

Opportunity: Innovation in HPTEM technology to increase the adoption of aircraft fuel cells

Innovation in HPTEM technology brings the prospect of enhanced fuel cell performance. HPTEMs have the potential to exhibit higher proton conductivity, allowing for more efficient ion transport within the fuel cell. This, in turn, can lead to improved power output, energy conversion efficiency, and overall system performance. The ability of HPTEMs to operate under a wide range of temperatures also makes them adaptable to different aircraft operating conditions, enhancing their reliability and effectiveness. HPTEM technology offers the opportunity to enhance the durability of fuel cell systems. Innovations in HPTEM materials and manufacturing processes can lead to increased resistance to degradation from factors such as high temperatures, fuel impurities, and system cycling. By improving the durability of fuel cells, HPTEM technology can contribute to longer lifespan, reduced maintenance requirements, and increased overall reliability of fuel cell systems in aircraft applications. Innovations in HPTEM technology have the potential to improve cost-effectiveness in the aircraft fuel cell market. HPTEM materials can be manufactured using cost-efficient methods, such as roll-to-roll processing, allowing for large-scale production at lower costs. Moreover, the enhanced durability of HPTEMs can reduce the need for frequent replacements or repairs, leading to cost savings in terms of maintenance and system downtime. These cost advantages make HPTEM-based fuel cell systems more economically viable, creating opportunities for wider adoption in the aviation industry.

Challenge: Enhancing heat removal capabilities of LPTEM fuel cells

Ensuring effective heat removal for the integration of Low-Platinum Thin-Film Electrolyte Membrane (LPTEM) fuel cells presents a significant challenge for the aircraft fuel cell industry. LPTEM fuel cells generate heat during operation, necessitating efficient thermal management to maintain optimal performance and prevent overheating. The compact design requirements of aircraft impose limitations on the available space for integrating cooling systems. Thus, lightweight and efficient cooling mechanisms must be developed to dissipate heat without compromising other critical components or adding excessive weight. Moreover, the integration of heat removal systems must be carefully engineered to minimize aerodynamic impacts and maintain optimal aircraft performance. Overcoming these challenges calls for ongoing research and development efforts to design and implement advanced cooling systems that strike a balance between space constraints, weight considerations, aerodynamic requirements, and efficient heat dissipation. By addressing these challenges, the aircraft fuel cell industry can optimize LPTEM fuel cell integration, ensuring reliable operation, enhanced performance, and extended longevity in aircraft applications.

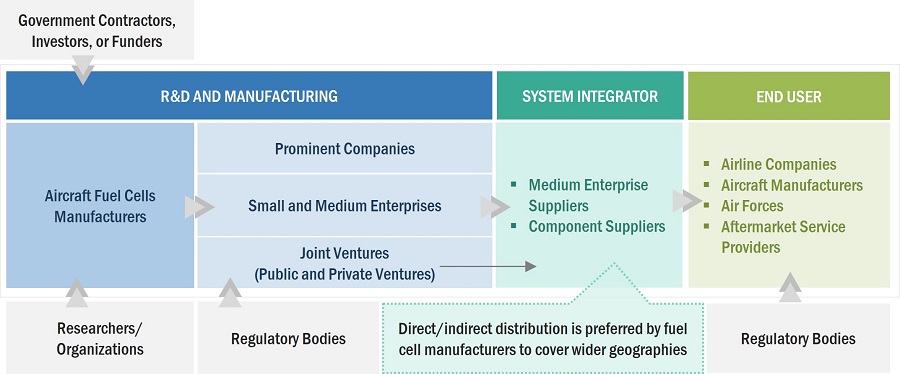

Aircraft Fuel Cell Market Ecosystem

Several significant companies that specialize in designing and manufacturing high-quality fuel cells for the aerospace industry serve the aircraft fuel cell market. These organisations have established themselves as leaders due to their wide product portfolios, technological expertise, and strong client ties. They cater to a wide range of aircraft applications, providing fuel cells that fulfill strict industry standards for performance, dependability, and safety. Furthermore, these companies are always investing in research and development to create innovative sealing systems that answer the changing needs of the aviation sector. The prominent companies are ZeroAvia Inc. (US), Intelligent Energy Limited (UK), Piasecki Aircraft Corporation (US), Doosan Mobility Innovation (South Korea), and H3 Dynamics (Singapore), among others.

The UAV segment accounts for the largest market size during the forecast period.

Based on Aircraft Type, the market has been segmented into fixed-wing, rotary-wing, UAVs, and AAM in the aircraft fuel cell market.

The UAV (Unmanned Aerial Vehicle) segment holds the highest market share in the aircraft fuel cell market for several key reasons. Firstly, UAVs are increasingly being adopted for various applications, including surveillance, remote sensing, delivery services, and more. These unmanned aircraft require efficient and lightweight power solutions, making fuel cells an attractive choice due to their high energy density and longer flight durations compared to traditional batteries. Secondly, fuel cells offer advantages such as quiet operation, reduced vibration, and low heat signature, which are highly beneficial for UAV applications. These characteristics enable UAVs to operate stealthily and with minimal detection, making them ideal for military, surveillance, and security purposes. Additionally, UAVs often require long endurance and extended flight range, which can be achieved with fuel cells. Fuel cells provide a continuous and reliable source of power, enabling UAVs to stay airborne for extended periods, covering larger distances without the need for frequent refueling or recharging.

The 0-100 kW segment is projected to have a greater market share during the forecast period.

Based on the Power Output, the aircraft fuel cell market has been segmented into 0-100 kW, 100 kW- 1MW, 1 MW & above. The 0-100 kW segment holds a significant market share due to its compatibility with emerging trends in electric aviation, such as electric vertical take-off and landing (eVTOL) aircraft. These aircraft, often used for urban air mobility and air taxis, rely on compact and efficient power systems within the 0-100 kW power range. Additionally, advancements in fuel cell technology have made the 0-100 kW segment more attractive. These advancements have led to improved energy conversion efficiency, enhanced durability, and reduced costs, making fuel cells within this power range more viable and competitive compared to other power sources. The increasing adoption of smaller aircraft and UAVs in various industries is driving the demand for fuel cells within this power range. These aircraft often require compact and lightweight power solutions to meet their specific requirements. The 0-100 kW segment addresses these needs effectively, offering efficient and reliable power generation for smaller aircraft.

Asia Pacific is projected to grow at the highest CAGR during the forecast period.

Asia Pacific is projected to be the fastest-growing region in the aircraft fuel cell market during the forecast period, owing to a number of variables that support the region's growth potential. The region has witnessed significant economic development, which has resulted in greater air travel demand and a rising commercial aviation sector. The rising emphasis on sustainable aviation practices and the emergence of urban air mobility and advanced air mobility solutions will drive the demand for aircraft fuel cells. Numerous growing economies, like China and India, have made significant investments in their aerospace sectors in Asia Pacific. The presence of important aircraft manufacturers and suppliers in the region has contributed to Asia-Pacific's market leadership in aircraft fuel cells.

Asia Pacific is projected to hold the highest market share during the forecast period.

Aircraft Fuel Cells Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Aircraft Fuel Cells Industry Companies: Top Key Market Players

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 1.6 Billion in 2023

|

|

Projected Market Size

|

USD 5.7 Billion by 2035

|

|

Growth Rate

|

CAGR of 10.8%

|

|

Market size available for years |

2019-2035 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2035 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Fuel Type, Power Output, Aircraft Type, and Region |

|

Geographies Covered |

North America, Europe, Asia-Pacific, and Rest of the World |

|

Companies Covered |

ZeroAvia Inc. (US), Intelligent Energy Limited (UK), Piasecki Aircraft Corporation (US), Doosan Mobility Innovation (South Korea), and H3 Dynamics (Singapore), among others. |

Aircraft Fuel Cells Market Highlights

This research report categorizes the Aircraft Fuel cells market based on Fuel Type, Power Output, Aircraft Type, and Region.

|

Segment |

Subsegment |

|

By Fuel Type |

|

|

By Power Output |

|

|

By Aircraft Type |

|

Recent Developments

- Airbus, the renowned French aviation company, has recently unveiled its plans to develop a hydrogen-powered fuel cell engine and conduct testing on an unprecedented scale. The engine will be installed in a modified A380 superjumbo, positioned between the wings and tail of the aircraft. This significant milestone is part of Airbus' ambitious ZEROe initiative, aimed at introducing a zero-emission aircraft by 2035. Test flights for this hydrogen-powered engine are anticipated to commence in 2026.

- PowerCell, a leading fuel cell technology company, has achieved a groundbreaking milestone by signing a historic contract with ZeroAvia, a pioneering zero-emission aviation company. This contract marks the world's first-ever agreement for the serial delivery of hydrogen fuel stacks to the aviation industry. The agreement, valued at up to SEK 1.51 billion, is contingent on ZeroAvia obtaining the necessary certifications and entails the supply of 5,000 hydrogen fuel cell stacks. The deliveries are scheduled to commence in 2024. ZeroAvia, known for its focus on hydrogen-electric aviation solutions, aims to launch a 19-seat aircraft with a range of 300 miles by 2025.

- ZeroAvia, a pioneering company specializing in zero-emission solutions for commercial aviation, has achieved a significant milestone in its pursuit of delivering hydrogen-electric engines for regional jets through an expanded agreement with MHI RJ Aviation Group (MHIRJ). The collaboration entails MHIRJ providing valuable engineering services and aircraft integration expertise and leveraging its renowned OEM experience to facilitate the certification of ZeroAvia's hydrogen-electric powertrain for retrofitting onto airframes in the regional jet markets.

Frequently Asked Questions (FAQ):

What is the current size of the aircraft fuel cell market?

The aircraft fuel cell market size is projected to grow from USD 1.6 Billion in 2023 to USD 5.4 Billion by 2035, at a CAGR of 10.3% from 2023 to 2035.

Who are the winners in the aircraft fuel cell market?

ZeroAvia Inc. (US), Intelligent Energy Limited (UK), Piasecki Aircraft Corporation (US), Doosan Mobility Innovation (South Korea), and H3 Dynamics (Singapore), among others. Are some of the winners in the market.

What are some of the technological advancements in the aircraft fuel cell market?

The aircraft fuel cell market has experienced significant technological advancements, driving its growth and development. These advancements include the development of high-temperature fuel cells like Solid Oxide Fuel Cells (SOFCs), which offer greater efficiency and power output. Lightweight and compact designs have been achieved through material and manufacturing innovations, making fuel cells more suitable for aircraft integration. Improvements in durability and longevity have resulted in enhanced performance and reduced maintenance requirements. Advancements in hydrogen infrastructure and storage technologies ensure a reliable supply of hydrogen fuel. The emergence of hybrid systems, combining fuel cells with other power sources, provides flexibility and improved performance.

What are the factors driving the growth of the aircraft fuel cell market?

The increasing emphasis on sustainable aviation practices, fuel cell innovation, and cost efficiency of operation, along with rising prices of conventional fuels and technological advancements in material and manufacturing technologies, are some of the factors driving the growth of the aircraft fuel cell market.

What are the growth opportunities in the aircraft fuel cell market?

The aircraft fuel cell market offers several prospects for expansion to players. Market expansion is being driven by innovation in fuel cell technologies, and the advent of new aircraft programs and systems to power the future of smaller aircraft and electric flight.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising conventional fuel prices- Rising focus on sustainable aviation- Technological advancements and cost reductions in aircraft fuel cellsRESTRAINTS- Hydrogen storage and cooling- Premium charge for fuel cells hinders widespread adoptionOPPORTUNITIES- Innovation in HTPEM technology- Reduced noise levels- Leveraging fuel cell technology to power smaller aircraftCHALLENGES- Overcoming commercial feasibility challenges of hydrogen for fuel cell adoption- Overcoming architectural challenges for fuel cell integration in larger aircraft- Improving heat removal capabilities of LTPEM fuel cells for effective integration in aircraft systems

- 5.3 PRICING ANALYSIS

- 5.4 VALUE CHAIN

-

5.5 AIRCRAFT FUEL CELL MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.6 TRADE DATA STATISTICS

-

5.7 TECHNOLOGY TRENDS IN AIRCRAFT FUEL CELL MARKETADVANCEMENTS IN FUEL CELL TECHNOLOGYFUEL CELL HYBRID SYSTEMSUTILIZATION OF ALTERNATIVE FUELS

-

5.8 CASE STUDY ANALYSISZEROAVIA: HYDROGEN-ELECTRIC AIRCRAFTBOEING: FUEL-CELL POWERED UAVAIRBUS: E-FAN X HYBRID-ELECTRIC AIRCRAFT

-

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRCRAFT FUEL CELL PRODUCT AND SOLUTION MANUFACTURERS

-

5.10 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS IN 2023–2024

- 5.13 TARIFF AND REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGICAL ADVANCEMENTS IN AIRCRAFT FUEL CELLSHIGH POWER DENSITY OFFERED BY SOLID-OXIDE FUEL CELLS TO EXPAND OPPORTUNITIES IN FUTURISTIC AIR MOBILITY SOLUTIONSBLOCKCHAINHYDROGEN INFRASTRUCTURE DEVELOPMENTLOW-TEMPERATURE PROTON EXCHANGE MEMBRANE FUEL CELLS

-

6.3 EMERGING TRENDS IN AIRCRAFT FUEL CELL MANUFACTURING3D PRINTINGBIG DATAPREDICTIVE MAINTENANCE

- 6.4 SUPPLY CHAIN ANALYSIS

-

6.5 USE CASESAIRBUS DEVELOPS HYBRID COMMERCIAL AIRLINERS RUN BY FUEL CELLSHYPOINT AND PIASECKI AIRCRAFT CORPORATION: COLLABORATION ON ZERO CARBON-EMISSION HYDROGEN FUEL CELL SYSTEMS FOR EVTOLSZEROAVIA AND ALASKA AIRLINES: COLLABORATION ON HYDROGEN-ELECTRIC POWERTRAIN FOR REGIONAL AIRCRAFT

-

6.6 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 HYDROGEN FUEL CELLSPROTON EXCHANGE MEMBRANE FUEL CELLS- Favorable characteristics to drive demand for PEM Fuel CellsSOLID OXIDE FUEL CELLS- Potential applications of SOFC in aircraft fuel cells to drive marketOTHERS

-

7.3 HYDROCARBON FUEL CELLSVERSATILITY AND EASE OF USE WITH ADVANCEMENTS IN TECHNOLOGY TO DRIVE DEMAND

- 7.4 OTHERS

- 8.1 INTRODUCTION

-

8.2 10 KW–100 KWINCREASING DEMAND FOR FUEL CELL SYSTEMS FOR SMALL AIRCRAFT TO DRIVE SEGMENT

-

8.3 100 KW–1 MWREQUIREMENT FOR FUEL CELL SYSTEMS FOR LARGER AIRCRAFT TO DRIVE SEGMENT

-

8.4 1 MW & ABOVETECHNOLOGICAL ADVANCEMENTS AND HIGH-POWER OUTPUT REQUIREMENTS TO DRIVE DEMAND

- 9.1 INTRODUCTION

-

9.2 FIXED-WINGONGOING DEVELOPMENTS TO DRIVE FIXED-WING SEGMENT

-

9.3 ROTARY-WINGUNDERDEVELOPMENT PROJECTS, ONCE COMPLETED, TO DRIVE ROTARY-WING SEGMENT

-

9.4 UNMANNED AERIAL VEHICLEEXPANDING CAPABILITIES TO DRIVE DEMAND FOR UNMANNED AERIAL VEHICLES

-

9.5 ADVANCED AIR MOBILITYINTEGRATION OF FUEL CELL TECHNOLOGY TO DRIVE MARKET FOR ADVANCED AIR MOBILITY

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Presence of leading aircraft fuel cell manufacturers to drive marketCANADA- Investments in R&D of new materials to drive market

-

10.3 EUROPEPESTLE ANALYSIS: EUROPEUK- Increase in air travel to drive marketFRANCE- Considerable investments in aerospace systems and components to drive marketGERMANY- Growing investment in aerospace technology and air connectivity to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: PESTLE ANALYSISCHINA- Large-scale domestic manufacturing to boost marketINDIA- Rising government focus on military and defense to propel marketJAPAN- Increased demand from air force to support market growthAUSTRALIA- Increasing demand from airlines to boost marketSOUTH KOREA- Rising security concerns from neighboring countries to drive marketREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDPESTLE ANALYSIS: REST OF THE WORLDMIDDLE EAST- New start-ups to drive marketAFRICA- Government support to drive marketLATIN AMERICA- Growing focus on sustainability to drive market

- 11.1 INTRODUCTION

- 11.2 RANKING OF LEADING PLAYERS, 2023

- 11.3 MARKET SHARE ANALYSIS, 2023

- 11.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2023

- 11.5 COMPETITIVE OVERVIEW

-

11.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.8 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.9 COMPETITIVE SCENARIODEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSDOOSAN MOBILITY INNOVATION- Business overview- Products offered- Recent developments- MnM viewZEROAVIA, INC.- Business overview- Products offered- Recent developments- MnM viewAIRBUS- Business overview- Products offered- Recent developments- MnM viewAEROVIRONMENT, INC.- Business overview- Products offered- Recent developments- MnM viewPOWERCELL SWEDEN AB- Business overview- Products offered- Recent developmentsAPUS GROUP- Business overview- Products offered- Recent developmentsUNIVERSAL HYDROGEN CO.- Business overview- Products offered- Recent developmentsINTELLIGENT ENERGY LIMITED- Business overview- Products offered- Recent developmentsEMBRAER- Business overview- Products offered- Recent developmentsGKN AEROSPACE SERVICES LIMITED- Business overview- Products offered- Recent developmentsHYPOINT INC.- Business overview- Products offered- Recent developmentsPIASECKI AIRCRAFT CORPORATION- Business overview- Products offered- Recent developmentsH3 DYNAMICS- Business overview- Products offered- Recent developmentsPLUG POWER INC.- Business overview- Products offered- Recent developmentsAVIO AERO- Business overview- Products offered- Recent developments

-

12.2 OTHER PLAYERSFUEL CELL STOREFLYKAHONEYWELL INTERNATIONAL INC.SHANGHAI PEARL HYDROGEN ENERGY TECHNOLOGY CO., LTD.URBAN AERONAUTICS LTD.PIPISTREL D.O.O.ALAKA’I TECHNOLOGIESAERODELFTACCELERASFC ENERGY AG

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE

- TABLE 3 AVERAGE SELLING PRICE RANGE: AIRCRAFT FUEL CELLS, BY TYPE (USD)

- TABLE 4 AIRCRAFT FUEL CELL MARKET ECOSYSTEM MAP

- TABLE 5 TRADE DATA TABLE FOR AIRCRAFT FUEL CELLS

- TABLE 6 AIRCRAFT FUEL CELL MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT FUEL CELL PRODUCTS AND SYSTEMS (%)

- TABLE 8 KEY BUYING CRITERIA FOR AIRCRAFT FUEL CELL PRODUCTS AND SYSTEMS

- TABLE 9 AIRCRAFT FUEL CELL MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 15 AIRCRAFT FUEL CELL MARKET FOR HYDROGEN FUEL CELLS, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 16 AIRCRAFT FUEL CELL MARKET FOR HYDROGEN FUEL CELLS, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 17 AIRCRAFT FUEL CELL MARKET, BY POWER OUTPUT, 2019–2022 (USD MILLION)

- TABLE 18 AIRCRAFT FUEL CELL MARKET, BY POWER OUTPUT, 2023–2035 (USD MILLION)

- TABLE 19 AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 20 AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 21 FIXED-WING: AIRCRAFT FUEL CELL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 22 FIXED-WING: AIRCRAFT FUEL CELL MARKET, BY TYPE, 2023–2035 (USD MILLION)

- TABLE 23 ROTARY-WING: AIRCRAFT FUEL CELL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 24 ROTARY-WING: AIRCRAFT FUEL CELL MARKET, BY TYPE, 2023–2035 (USD MILLION)

- TABLE 25 ADVANCED AIR MOBILITY: AIRCRAFT FUEL CELL MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 ADVANCED AIR MOBILITY: AIRCRAFT FUEL CELL MARKET, BY TYPE, 2023–2035 (USD MILLION)

- TABLE 27 AIRCRAFT FUEL CELL MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 AIRCRAFT FUEL CELL MARKET, BY REGION, 2023–2035 (USD MILLION)

- TABLE 29 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 30 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET, BY COUNTRY, 2023–2035 (USD MILLION)

- TABLE 31 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET, BY HYDROGEN FUEL CELL TYPE, 2019–2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET, BY HYDROGEN FUEL CELL TYPE, 2023–2035 (USD MILLION)

- TABLE 33 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 35 US: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 36 US: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 37 US: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 38 US: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 39 CANADA: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 40 CANADA: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 41 CANADA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 42 CANADA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 43 EUROPE: AIRCRAFT FUEL CELL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 44 EUROPE: AIRCRAFT FUEL CELL MARKET, BY COUNTRY, 2023–2035 (USD MILLION)

- TABLE 45 EUROPE: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 46 EUROPE: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 47 EUROPE: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 48 EUROPE: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 49 UK: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 50 UK: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 51 UK: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 52 UK: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 53 FRANCE: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 54 FRANCE: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 55 FRANCE: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 56 FRANCE: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 57 GERMANY: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 58 GERMANY: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 59 GERMANY: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 60 GERMANY: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 61 REST OF EUROPE: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 62 REST OF EUROPE: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 63 REST OF EUROPE: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 64 REST OF EUROPE: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 65 ASIA PACIFIC: AIRCRAFT FUEL CELL MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 66 ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY COUNTRY, 2023–2035 (USD MILLION)

- TABLE 67 ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 68 ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 69 ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 70 ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 71 CHINA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 72 CHINA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 73 CHINA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 74 CHINA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 75 INDIA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 76 INDIA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 77 INDIA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 78 INDIA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 79 JAPAN: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 80 JAPAN: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 81 JAPAN: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 82 JAPAN: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 83 AUSTRALIA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 84 AUSTRALIA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 85 AUSTRALIA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 86 AUSTRALIA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 87 SOUTH KOREA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 88 SOUTH KOREA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 89 SOUTH KOREA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 90 SOUTH KOREA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 95 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET, BY REGION, 2023–2035 (USD MILLION)

- TABLE 97 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 98 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 99 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 100 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 101 MIDDLE EAST: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 102 MIDDLE EAST: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 103 MIDDLE EAST: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 104 MIDDLE EAST: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 105 AFRICA: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 106 AFRICA: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 107 AFRICA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 108 AFRICA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 109 LATIN AMERICA: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019–2022 (USD MILLION)

- TABLE 110 LATIN AMERICA: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- TABLE 111 LATIN AMERICA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019–2022 (USD MILLION)

- TABLE 112 LATIN AMERICA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- TABLE 113 KEY DEVELOPMENTS BY LEADING PLAYERS IN AIRCRAFT FUEL CELL MARKET BETWEEN 2021 AND 2023

- TABLE 114 COMPANY AIRCRAFT TYPE FOOTPRINT

- TABLE 115 COMPANY REGION FOOTPRINT

- TABLE 116 COMPANY FOOTPRINT

- TABLE 117 AIRCRAFT FUEL CELL MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 118 AIRCRAFT FUEL CELL MARKET: DEALS, 2021–2023

- TABLE 119 AIRCRAFT FUEL CELL MARKET: OTHER DEVELOPMENTS, 2021–2023

- TABLE 120 DOOSAN MOBILITY INNOVATION: COMPANY OVERVIEW

- TABLE 121 DOOSAN MOBILITY INNOVATION: PRODUCTS OFFERED?

- TABLE 122 DOOSAN MOBILITY INNOVATION: DEALS

- TABLE 123 ZEROAVIA, INC.: COMPANY OVERVIEW

- TABLE 124 ZEROAVIA, INC.: PRODUCTS OFFERED?

- TABLE 125 ZEROAVIA, INC.: DEALS

- TABLE 126 AIRBUS: COMPANY OVERVIEW

- TABLE 127 AIRBUS: PRODUCTS OFFERED?

- TABLE 128 AIRBUS: DEALS

- TABLE 129 AEROVIRONMENT, INC.: COMPANY OVERVIEW

- TABLE 130 AEROVIRONMENT, INC.: PRODUCTS OFFERED?

- TABLE 131 AEROVIRONMENT, INC.: DEALS

- TABLE 132 POWERCELL SWEDEN AB: COMPANY OVERVIEW

- TABLE 133 POWERCELL SWEDEN AB: PRODUCTS OFFERED?

- TABLE 134 POWERCELL SWEDEN AB: DEALS

- TABLE 135 APUS GROUP: COMPANY OVERVIEW

- TABLE 136 APUS GROUP: PRODUCTS OFFERED?

- TABLE 137 UNIVERSAL HYDROGEN CO.: COMPANY OVERVIEW

- TABLE 138 UNIVERSAL HYDROGEN CO.: PRODUCTS OFFERED?

- TABLE 139 UNIVERSAL HYDROGEN CO.: DEALS

- TABLE 140 INTELLIGENT ENERGY LIMITED: COMPANY OVERVIEW

- TABLE 141 INTELLIGENT ENERGY LIMITED: PRODUCTS OFFERED?

- TABLE 142 INTELLIGENT ENERGY LIMITED: DEALS

- TABLE 143 EMBRAER: COMPANY OVERVIEW

- TABLE 144 EMBRAER: PRODUCTS OFFERED?

- TABLE 145 EMBRAER: DEALS

- TABLE 146 GKN AEROSPACE SERVICES LIMITED: COMPANY OVERVIEW

- TABLE 147 GKN AEROSPACE SERVICES LIMITED: PRODUCTS OFFERED?

- TABLE 148 GKN AEROSPACE SERVICES LIMITED: DEALS

- TABLE 149 HYPOINT INC.: COMPANY OVERVIEW

- TABLE 150 HYPOINT INC.: PRODUCTS OFFERED?

- TABLE 151 HYPOINT INC.: DEALS

- TABLE 152 PIASECKI AIRCRAFT CORPORATION: COMPANY OVERVIEW

- TABLE 153 PIASECKI AIRCRAFT CORPORATION: PRODUCTS OFFERED?

- TABLE 154 PIASECKI AIRCRAFT CORPORATION: DEALS

- TABLE 155 H3 DYNAMICS: COMPANY OVERVIEW

- TABLE 156 H3 DYNAMICS: PRODUCTS OFFERED?

- TABLE 157 H3 DYNAMICS: DEALS

- TABLE 158 PLUG POWER INC.: COMPANY OVERVIEW

- TABLE 159 PLUG POWER INC.: PRODUCTS OFFERED?

- TABLE 160 AVIO AERO: COMPANY OVERVIEW

- TABLE 161 AVIO AERO: PRODUCTS OFFERED?

- FIGURE 1 REPORT PROCESS FLOW

- FIGURE 2 AIRCRAFT FUEL CELL MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 PEMFC SEGMENT TO HAVE LARGEST MARKET SHARE FROM 2023 TO 2035

- FIGURE 7 10 KW–100 KW SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 9 INCREASE IN RETROFITTING OF FUEL CELLS IN AIRCRAFT TO DRIVE MARKET

- FIGURE 10 UAV SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 CANADA TO REGISTER HIGHEST CAGR FROM 2023 TO 2035

- FIGURE 12 AIRCRAFT FUEL CELL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 13 AIRCRAFT FUEL CELL MARKET: VALUE CHAIN ANALYSIS

- FIGURE 14 AIRCRAFT FUEL CELL MARKET ECOSYSTEM

- FIGURE 15 REVENUE SHIFT IN AIRCRAFT FUEL CELL MARKET

- FIGURE 16 AIRCRAFT FUEL CELL MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT FUEL CELL PRODUCTS AND SYSTEMS

- FIGURE 18 KEY BUYING CRITERIA FOR AIRCRAFT FUEL CELL PRODUCTS AND SYSTEMS

- FIGURE 19 SUPPLY CHAIN ANALYSIS

- FIGURE 20 AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023–2035 (USD MILLION)

- FIGURE 21 AIRCRAFT FUEL CELL MARKET, BY POWER OUTPUT, 2023–2035 (USD MILLION)

- FIGURE 22 AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023–2035 (USD MILLION)

- FIGURE 23 AIRCRAFT FUEL CELL MARKET: REGIONAL SNAPSHOT

- FIGURE 24 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET SNAPSHOT

- FIGURE 25 EUROPE: AIRCRAFT FUEL CELL MARKET SNAPSHOT

- FIGURE 26 ASIA PACIFIC: AIRCRAFT FUEL CELL MARKET SNAPSHOT

- FIGURE 27 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET SNAPSHOT

- FIGURE 28 MARKET RANKING OF LEADING PLAYERS IN AIRCRAFT FUEL CELL MARKET, 2023

- FIGURE 29 MARKET SHARE OF TOP PLAYERS IN AIRCRAFT FUEL CELL MARKET, 2023

- FIGURE 30 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS IN AIRCRAFT FUEL CELLS MARKET

- FIGURE 31 AIRCRAFT FUEL CELL MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 32 AIRCRAFT FUEL CELL MARKET: START-UP/SME EVALUATION MATRIX, 2023

- FIGURE 33 AIRBUS: COMPANY SNAPSHOT

- FIGURE 34 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

- FIGURE 35 POWERCELL SWEDEN AB: COMPANY SNAPSHOT

- FIGURE 36 EMBRAER: COMPANY SNAPSHOT

- FIGURE 37 PLUG POWER INC.: COMPANY SNAPSHOT

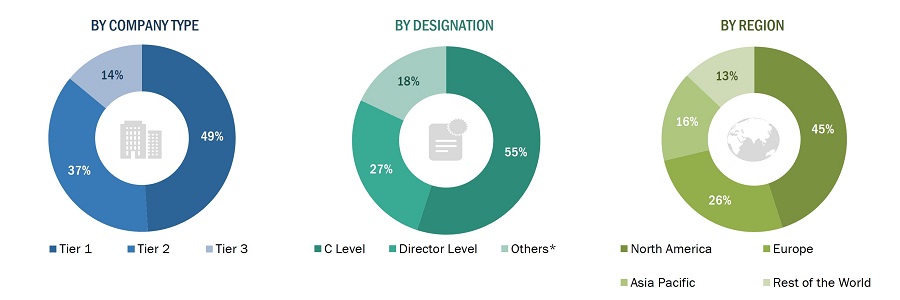

The study involved four major activities in estimating the current market size for the Aircraft fuel cells market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, Dow Jones Factiva, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases. Secondary sources referred for this research study included General Aviation Manufacturers Association (GAMA); International Air Transport Association (IATA) publications, corporate filings (such as annual reports, investor presentations, and financial statements); Federal Aviation Administration (FAA) and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

The Aircraft fuel cells market comprises several stakeholders, such as raw material providers, Aircraft fuel cell manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in materials and types. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

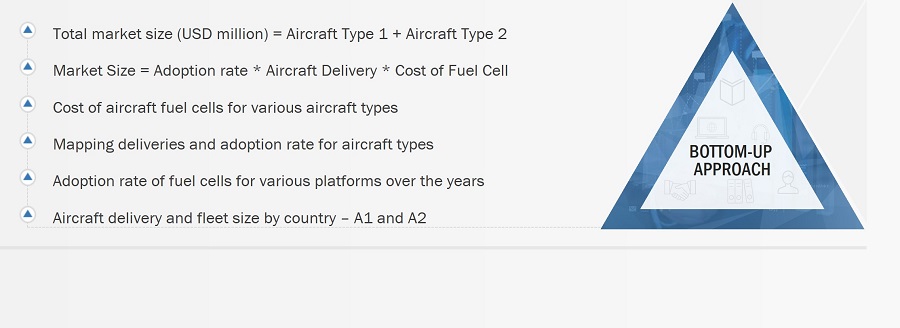

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the aircraft fuel cells market. The research methodology used to estimate the size of the market includes the following details.

The key players in the aircraft fuel cells market were identified through secondary research, and their market shares were determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the aircraft fuel cells market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the aircraft fuel cells market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the aircraft fuel cells market. The market size estimation method is delineated below:

The study focuses on two types of aircraft deliveries: (1) aircraft that will be running completely on hydrogen fuel cells, with adoption expected in later years, and (2) aircraft utilizing fuel cells for applications such as auxiliary power units (APUs) and emergency power.

a. Hydrogen Fuel Cell Aircraft:

Collect data on projected deliveries of aircraft that will run completely on hydrogen fuel cells for future years.

Estimate the market size based on the number of hydrogen fuel cell-powered aircraft expected to be delivered each year.

Calculate the potential market value by considering the average price of hydrogen fuel cell systems for aircraft and estimated demand.

b. Fuel Cell Applications in Existing Aircraft:

Gather data on the number of existing aircraft utilizing fuel cells for applications such as APUs and emergency power.

Estimate the market size by considering the number of aircraft equipped with fuel cell systems for these applications.

Determine the market value by analyzing the average price of fuel cell systems for APUs and emergency power.

- Aircraft Fuel cells Market = Aircraft Type 1 + Aircraft Type 2

Aircraft fuel cells market for Aircraft Type 1

|

Step 1 |

Mapping deliveries of all types of aircraft |

Mapped the operating fleet size of all types of aircraft from 2019 to 2035 based on historical data and projects announced by OEMs during the forecast period |

|

Step 2 |

Identifying the rate of adoption of aircraft fuel cells in each type of aircraft |

The rate of adoption of each aircraft model type by aircraft manufacturers was identified; the penetration of aircraft fuel cells cost is varied |

|

Step 3 |

Identifying the cost of aircraft fuel cells solutions |

Identified the cost of aircraft fuel cells solutions in various types of aircraft |

|

Step 4 |

Arriving at the OEM aircraft fuel cells market size |

Aircraft Fuel cells OEM Market = Sum [(Aircraft Type 1 Deliveries * Rate of Adoption * Cost of aircraft fuel cell), (Aircraft Type 2 deliveries * Rate of Adoption * Cost of FUEL CELL), (Aircraft Type 3 deliveries * Rate of Adoption * Cost of FUEL CELL), ……(Aircraft Type Deliveries * Rate of Adoption * Cost of FUEL CELL)] |

Aircraft fuel cells market for Aircraft Type 2

|

Step 1 |

Mapping the fleet of aircraft |

Mapped deliveries of all types of aircraft from 2019 to 2023 and projections for years till 2035 |

|

Step 2 |

Mapping retrofit contracts |

Contracts associated with retrofitting across regions were mapped from 2018 to identify trends |

|

Step 3 |

Identifying the rate of adoption |

The adoption of aircraft fuel cells across platforms was identified by mapping the historical data; the rate of adoption at the regional level was arrived at. |

|

Step 4 |

Cost of Aircraft fuel cell and application |

ASP of aircraft fuel cells was identified for various platforms. |

|

Step 5 |

Arriving at the aftermarket size |

Aircraft Fuel cells Aftermarket = (Operating Aircraft * Application Type * Aircraft Fuel Cell Cost for Platform) |

In the bottom-up approach, the size of the aircraft fuel cells market was arrived at by calculating the country-level data. In the top-down approach, the market size was derived by estimating the revenues of key companies operating in the market and validating the data acquired from primary research.

Market size estimation methodology: Bottom-up Approach

Top-Down Approach

In the top-down approach, aircraft fuel cell solution providers were identified. Their revenue specific to the aircraft fuel cells market was identified. The base market number for each player was arrived at by assigning weightage to aircraft fuel cell contracts.

Market Size Estimation Methodology: Top-Down Approach

Data Triangulation

After arriving at the overall size of the aircraft fuel cells market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Market Definition & Key Stakeholders

The aircraft fuel cells market encompasses the development, manufacturing, and implementation of specialized fuel cell systems designed for aircraft applications. These fuel cells, utilizing hydrogen or hydrogen-rich fuels, provide cleaner and more efficient power generation compared to traditional combustion engines. Key stakeholders in this market include aircraft manufacturers, fuel cell technology providers, airlines, research institutions, and regulatory authorities. Collaboratively, they drive innovation, ensure safety standards, and facilitate the integration of sustainable power generation into aircraft propulsion and auxiliary systems. The aircraft fuel cells market represents a transformative opportunity to reduce carbon emissions, enhance the energy efficiency, and promote the overall sustainability of the aviation industry.

Key Stakeholders

- Aircraft Manufacturers

- Fuel Cell Technology providers

- Airlines

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Aircraft fuel cells market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for four regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 6)

Growth opportunities and latent adjacency in Aircraft Fuel Cells Market