Americas Structural Adhesives Market by Type (Acrylic, Epoxy, Methacrylate, Polyurethane), Application (Automotive & Transportation, Building & Construction, Marine, Wind), Region (North America, South America) - Forecasts to 2026

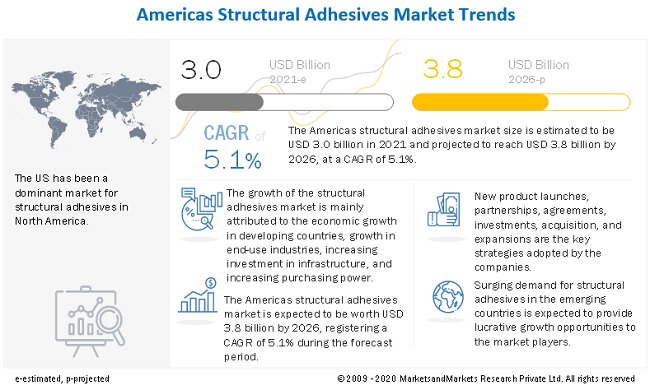

[205 Pages Report] The market size for Americas Structural Adhesives is projected to grow from USD 3.0 billion in 2021 to USD 3.8 billion by 2026, at a CAGR of 5.1%. The growth of the structural adhesives market is primarily driven by the increasing use of modified epoxies and polyurethane adhesives, along with increasing penetration of methyl methacrylate adhesives in wind energy, marine, building & construction, and automotive applications.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Americas Structural Adhesives Market

COVID-19 has posed many challenges for the construction sector. Major economies worldwide, such as the US and Brazil, are among the severely affected countries by the pandemic. Social distancing measures, supply chain disruptions, and workforce dislocation have led to the suspension of construction activities in most countries. Construction companies with high debts and lower cash reserves have faced a liquidity crisis. However, the construction of temporary hospitals and quarantine centers has increased during the pandemic.

The outbreak of COVID-19 and resulting economic uncertainty may reduce consumer demand in the short term. This would possibly hamper new vehicle sales and delay spending on non-essential maintenance. In the long run, these factors could influence consumer preferences. As soon as businesses resume operations, it is expected that the demand may surge in the automotive industry. Some manufacturers are opting for digital solutions to overcome the situation.

Americas Structural Adhesives Market Dynamics

Driver: Growing trend for lightweight and low carbon-emitting vehicles

The automotive industry is one of the major end-use industries for structural adhesives. Adhesives play an important role in enhancing the aesthetics and performance of automobiles. Weight reduction of vehicles is the key to improving fuel efficiency and limiting emission of pollutants. Historically, adhesives were used for laminating, bonding, and assembling automotive interior components. Modern-day adhesives are playing a decisive role in supporting original equipment manufacturers in automobile weight reduction strategies and complying with stringent environmental regulations by keeping carbon emissions at a minimum. This has presented a new growth opportunity for adhesives manufacturers.

Restraint: Stringent environmental regulations in North American countries

With growing environmental concerns and increasingly stringent regulatory policies, various countries are using eco-friendly products in various applications. Manufacturers of structural adhesives are focusing on ensuring safety and avoiding health issues associated with VOCs emissions from chemical products. Due to increased industrialization and urbanization, there has been a rapid increase in air pollution. Many countries, both developed and developing, have to comply with policies and standards fixed by international and domestic regulatory bodies on VOC emission to control air pollution. This is affecting the structural adhesives production capacities of manufacturers in North American regions.

Opportunity: Increasing demand for non-hazardous, green, and sustainable structural adhesives

Owing to the rising demand for eco-friendly or green products in various applications, the demand for green adhesives or those with low VOC is increasing. Stringent regulations by the USEPA (the United States Environmental Protection Association), Europes REACH (Registration, Evaluation, Authorization, and Restrictions of Chemicals), Leadership in Energy and Environmental Design (LEED), and other regional regulatory authorities have forced manufacturers to make eco-friendly adhesives with low VOC levels. In light of these regulatory policies, there is a growing trend in the structural adhesives market for environment-friendly or green buildings, which provides an opportunity for the development of green and sustainable adhesive solutions. Such green adhesive solutions are made from renewable, recycled, remanufactured, or biodegradable materials.

Challenge: Changing regulatory policies and standards

The adhesive industry is going through many changes in standards and rules, which poses a serious threat to structural adhesive manufacturers. The Construction Products Regulation (CPR) is formulating new regulations, which is compelling manufacturers to formulate and develop adhesives accordingly. With the implementation of new regulations, adhesive manufacturers have to bear additional burden in terms of additional external test costs, labeling, and paperwork to demonstrate compliance. Additional substance alerts occurring on a regular basis focus on biocides and waste packaging, which leads to frequent changes in standards. The manufacturers in the adhesives industry have to abide by the rules and changing standards for commercializing their products and ensure acceptance among customers.

To know about the assumptions considered for the study, download the pdf brochure

The epoxy segment accounted for the largest share of the Americas Structural Adhesives market.

Epoxy segment accounts for the largest share in the Americas Structural Adhesives market. Epoxy adhesives are significantly used in the structural adhesives market owing to their excellent chemical resistance, low shrinkage value, and less volatile compounds produced during curing. These adhesives are formulated according to the end-application requirements. For aerospace, high-performance epoxy adhesives are formulated with different epoxy resins and hardeners in comparison to the ones used in the construction industry.

Wind energy is projected to witness the fastest growth of Americas Structural Adhesives market during the forecast period.

Wind energy is projected to witness the fastest growth of the Americas Structural Adhesives market during the forecast period, in terms of volume Wind energy has become an integral part of the worlds energy production. It is one of the fastest-growing green energy sources globally. The demand for wind energy is increasing due to its environmental benefits. It reduces dependence on fossil fuels for our energy requirements. The wind energy industry also offers the benefits of reducing greenhouse gases emission and enables the reduction of costs of power generation as compared to energy derived from nuclear or thermal power.

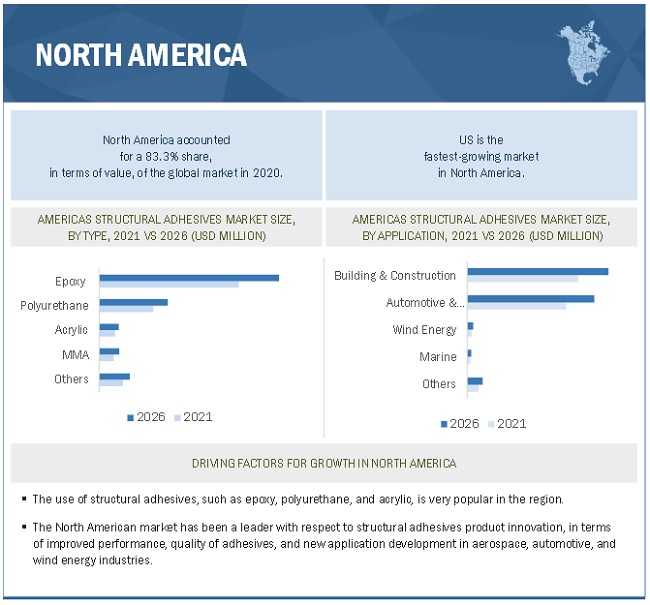

North America is the largest Americas Structural Adhesives market in the forecast period

North America has emerged as one of the leading producers as well as consumers of Americas Structural Adhesives. The demand for structural adhesives is expected to be driven by the performance of the construction and automotive industries in North America. The high growth of the automotive market in Mexico, which is becoming the preferred manufacturing hub for companies, is a vital driver of the demand from the automotive sector. Exports from North America to other countries have increased multiple times owing to the free trade treaties between North American countries. This is projected to lead to the growth of the structural adhesives market in the region.

The countries of North America are among the most affected ones by the pandemic. After originating in Wuhan, China, the virus rapidly spread across the globe and soon reached the US, which is the worst affected by the pandemic. As the virus expanded, countries across North America went into lockdown to control the spread of the virus and ensure minimum damage to lives and businesses. However, over the past few months, numerous people got infected and died, millions lost their jobs, and businesses across the region were forced to shut down. As the rate of infections across the region is slowing, industries are expected to revive, and economic growth is expected to gain pace.

The US has recorded the highest number of COVID-19 positive cases in the world, which has impacted the structural adhesives market. The impact of COVID-19 is not as severe in Canada and Mexico due to the comparatively less number of positive cases and functioning of end-use industries. The market in the US witnessed very little growth in 2020 as the country was under lockdown, and only a few industries for essential services were functioning. End-use industries such as transportation, oil & gas, automotive, and chemicals are the most affected industries in the region.

Key Market Players

The key players operating in the market are Henkel AG (Germany), H.B. Fuller (US), Dow Inc. (US), 3M (US), and Arkema (Bostik SA) (France).

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2017-2026 |

|

Base year |

2020 |

|

Forecast period |

20212026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Type |

|

Regions covered |

North America and South America |

|

Companies profiled |

The major market players Henkel AG (Germany), H.B. Fuller (US), Dow Inc. (US), 3M (US), and Arkema (Bostik SA) (France). (Total of 20 companies) |

This research report categorizes the Americas Structural Adhesives market based on type, application, and region.

By Type:

- Epoxy

- Polyurethane

- Methyl Methacrylate (MMA)

- Acrylic

- Others

By Application:

- Building & construction

- Automotive & transportation

- Marine

- Wind energy

- Others

By Region:

- North America

- South America

Recent Developments

- In April 2021, Sika recently acquired DriTac, a US-based floor covering adhesives company. According to Sika, the acquisition will contribute to its presence among floor covering installers and distributors while accelerating its expansion in the interior finishing market in the US. In 2020, the acquired business generated sales of CHF 20 million (approximately USD 21.2 million).

- In May 2021, Henkel, in line with its sustainability priorities, announces the development and commercial availability of LOCTITE HHD 3544F, the industrys first bio-based polyurethane reactive (PUR) hot melt designed for consumer electronics assembly; approximately two-thirds of its content is sourced from renewable, plant-based feedstocks. This is Henkels first consumer electronics-specific, bio-based PUR hot melt adhesive.

Frequently Asked Questions (FAQ):

What is the current size of the Americas Structural Adhesives market?

The Americas Structural Adhesives market is estimated to be USD 3.0 billion n 2021 and projected to reach USD 3.8 billion by 2026, at a CAGR of 5.1%

Who are the major players of the Americas Structural Adhesives market?

Companies such as Henkel AG (Germany), H.B. Fuller (US), Dow Inc. (US), 3M (US), Arkema (Bostik SA) (France), Sika AG (Switzerland), Huntsman International LLC (US), Illinois Tool Works Inc. (US), Parker Hannifin (US), and Ashland Global Holdings (US) are the major players in the market.

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including new product launches, acquisitions, investments, expansions, partnerships, and agreements are expected to help the market grow. New product launches is the key strategy adopted by companies operating in this market.

Which segment has the potential to register the highest market share for Americas Structural Adhesives?

The building & construction segment was the leading application of Americas Structural Adhesives in 2020. In the building & construction application, adhesives are used to bond different substrates in flooring, tiling, waterproofing, carpet laying, wall covering, insulation, and roofing. Adhesives are a substantial part of the construction industry and are used in bonding, renovation, maintenance, and repairs in residential, commercial, and civil engineering applications. Floors, roofing, tiling, and HVAC in hospitals, schools, and public buildings bear heavy loads. Thus, the adhesives used in these applications should be durable and capable of bearing the load and resisting cracks.

Which is the fastest-growing region in the market?

South America is the fastest market for Americas Structural Adhesives. South America is a developing region that provides high growth opportunities for global adhesive manufacturers to expand and generate considerable demand in the future. The regions construction and manufacturing sectors hold growth potential for the structural adhesives market. The construction sector is likely to record moderate growth during the forecast period, while commercial construction is active and is growing at a high rate in South America with the rise in the middle-class population and improving standards of living in the region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS

1.2.2 MARKET EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 MARKETS SEGMENTATION

FIGURE 2 AMERICAS STRUCTURAL ADHESIVES MARKET: GEOGRAPHICAL BREAKUP

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY AND PRICING

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 3 AMERICAS STRUCTURAL ADHESIVES MARKET: RESEARCH DESIGN

2.2 SECONDARY DATA

2.2.1 KEY DATA FROM SECONDARY SOURCES

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Key industry insights

2.2.2.3 Breakdown of primary interviews

2.2.2.4 Primary data sources

2.3 MARKET SIZE ESTIMATION

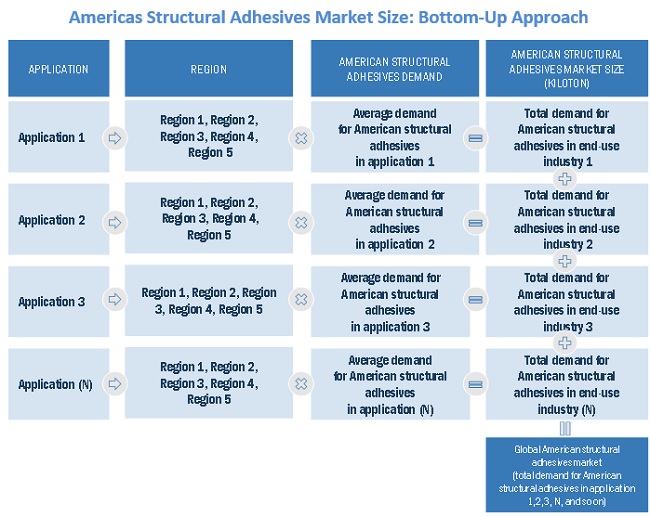

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

FIGURE 7 LIMITATIONS OF THE RESEARCH STUDY

2.6 RISK ANALYSIS

2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 1 STRUCTURAL ADHESIVES MARKET IN AMERICAS 20212026

FIGURE 8 BUILDING & CONSTRUCTION LEADS OVERALL STRUCTURAL ADHESIVES MARKET

FIGURE 9 EPOXY RESIN ADHESIVE TO LEAD AMERICAS STRUCTURAL ADHESIVES MARKET DURING FORECAST PERIOD

FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGER SHARE OF AMERICAS STRUCTURAL ADHESIVES MARKET, 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN AMERICAS STRUCTURAL ADHESIVES MARKET

FIGURE 11 STRUCTURAL ADHESIVES MARKET IN AMERICAS TO REGISTER ROBUST GROWTH BETWEEN 2021 AND 2026

4.2 STRUCTURAL ADHESIVES MARKET IN AMERICAS, BY TYPE

FIGURE 12 MMA CHEMISTRY TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

4.3 AMERICAS STRUCTURAL ADHESIVES MARKET, BY END-USE INDUSTRY

FIGURE 13 AUTOMOTIVE & TRANSPORTATION SEGMENT TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

4.4 NORTH AMERICA: AMERICAS STRUCTURAL ADHESIVES MARKET, BY TYPE AND BY APPLICATION

FIGURE 14 EPOXY SEGMENT DOMINATED MARKET IN 2020

4.5 AMERICAS STRUCTURAL ADHESIVES MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 15 DEVELOPING COUNTRIES TO GROW FASTER THAN DEVELOPED COUNTRIES

4.6 AMERICAS STRUCTURAL ADHESIVES MARKET, BY COUNTRY

FIGURE 16 BRAZIL TO REGISTER HIGHEST CAGR IN AMERICAS STRUCTURAL ADHESIVES MARKET

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR STRUCTURAL ADHESIVES MARKET IN THE AMERICAS

5.2.1 DRIVERS

5.2.1.1 Growing trend for lightweight and low carbon-emitting vehicles

5.2.1.2 Increasing demand for structural adhesives in aerospace industry

5.2.1.3 High demand for adhesives in building & construction and wind energy applications

5.2.2 RESTRAINTS

5.2.2.1 Stringent environmental regulations in North American countries

5.2.2.2 Different characteristic limitations of various adhesives

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for non-hazardous, green, and sustainable structural adhesives

5.2.4 CHALLENGES

5.2.4.1 Changing regulatory policies and standards

5.3 PORTERS FIVE FORCES ANALYSIS

TABLE 2 AMERICAS STRUCTURAL ADHESIVES MARKET: PORTERS FIVE FORCES ANALYSIS

FIGURE 18 PORTERS FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 DEGREE OF COMPETITION

5.4 MACROECONOMIC INDICATORS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECASTS OF GDP

TABLE 3 GDP TRENDS AND FORECASTS, USD BILLION (20192026)

5.4.3 TRENDS AND FORECASTS FOR AMERICAN AUTOMOTIVE INDUSTRY

TABLE 4 AUTOMOTIVE INDUSTRY PRODUCTION (20192020)

5.4.4 TRENDS AND FORECASTS OF AMERICAS CONSTRUCTION INDUSTRY

5.4.5 TRENDS IN AEROSPACE INDUSTRY

TABLE 5 GROWTH INDICATORS FOR AEROSPACE INDUSTRY, 20152033

TABLE 6 GROWTH INDICATORS FOR AEROSPACE INDUSTRY, BY REGION, 20152033

5.5 COVID-19 IMPACT

5.6 COVID-19 ECONOMIC ASSESSMENT

FIGURE 19 ECONOMIC OUTLOOK FOR MAJOR COUNTRIES

5.7 IMPACT OF COVID-19 ON END-USE INDUSTRIES

FIGURE 20 PRE-COVID AND POST-COVID MARKET SCENARIOS: STRUCTURAL ADHESIVES MARKET

5.7.1 IMPACT ON CONSTRUCTION INDUSTRY

5.7.2 IMPACT ON AUTOMOTIVE INDUSTRY

5.8 IMPACT OF COVID-19 ON REGIONS

5.8.1 IMPACT OF COVID-19 ON NORTH AMERICA

5.8.2 IMPACT OF COVID-19 ON SOUTH AMERICA

5.9 VALUE-CHAIN ANALYSIS

FIGURE 21 VALUE-CHAIN ANALYSIS

5.10 AVERAGE SELLING PRICE ANALYSIS

FIGURE 22 AVERAGE SELLING PRICE OF STRUCTURAL ADHESIVES, BY REGION

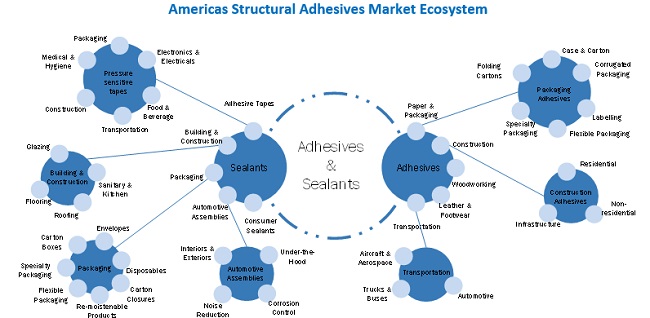

5.11 ECOSYSTEM/MARKET MAP

TABLE 7 STRUCTURAL ADHESIVES MARKET: ECOSYSTEM

FIGURE 23 ADHESIVES & SEALANTS MARKET: ECOSYSTEM

5.12 REVENUE SHIFT AND NEW REVENUE POCKETS FOR STRUCTURAL ADHESIVE MANUFACTURERS

FIGURE 24 REVENUE SHIFT IN STRUCTURAL ADHESIVES MARKET

5.13 EXPORT-IMPORT TRADE STATISTICS FOR ADHESIVES

TABLE 8 COUNTRY-WISE EXPORT DATA FOR ADHESIVES, 20192020

TABLE 9 COUNTRY-WISE IMPORT DATA FOR ADHESIVES, 20192020

5.14 PATENTS ANALYSIS

5.14.1 METHODOLOGY

5.14.2 PUBLICATION TRENDS

FIGURE 25 NUMBER OF PATENTS PUBLISHED, 20152021

5.14.3 PATENTS ANALYSIS BY JURISDICTION

FIGURE 26 PATENTS PUBLISHED IN MAJOR JURISDICTIONS, 20152021

5.14.4 TOP APPLICANTS

FIGURE 27 PATENTS PUBLISHED BY MAJOR APPLICANTS, 20152021

TABLE 10 PATENTS BY TOP 20 OWNERS

5.15 REGULATIONS

5.15.1 EMISSION STANDARDS FOR ADHESIVES

TABLE 11 VOC CONTENT LIMITS: ADHESIVES

TABLE 12 VOC CONTENT LIMITS: ADHESIVE PRIMERS

TABLE 13 VOC CONTENT LIMITS: ADHESIVES APPLIED TO THE LISTED SUBSTRATE

5.16 CASE STUDY ANALYSIS

5.17 TECHNOLOGY ANALYSIS

6 AMERICAS STRUCTURAL ADHESIVES MARKET, BY TYPE (Page No. - 76)

6.1 INTRODUCTION

FIGURE 28 EPOXY ADHESIVE SEGMENT LEADS STRUCTURAL ADHESIVES MARKET IN AMERICAS

TABLE 14 AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (USD MILLION)

TABLE 15 AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

TABLE 16 AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (KILOTON)

TABLE 17 AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (KILOTON)

6.2 EPOXY

6.2.1 EPOXY-BASED STRUCTURAL ADHESIVES MOST COMMONLY USED IN INDUSTRIAL, AUTOMOTIVE, CONSTRUCTION, AND AEROSPACE

TABLE 18 EPOXY: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 19 EPOXY: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 20 EPOXY: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 21 EPOXY: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (KILOTON)

6.3 POLYURETHANE (PU)

6.3.1 PU-BASED STRUCTURAL ADHESIVES EXTENSIVELY USED IN AUTOMOTIVE & TRANSPORTATION

6.3.2 REACTIVE ADHESIVES

6.3.2.1 One-component adhesives

6.3.2.2 Two-component adhesives

TABLE 22 POLYURETHANE: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 23 POLYURETHANE: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 24 POLYURETHANE: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 25 POLYURETHANE: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (KILOTON)

6.4 METHYL METHACRYLATE (MMA)

6.4.1 MMA-BASED STRUCTURAL ADHESIVES HAVE ABILITY TO BOND VARIETY OF DISSIMILAR SUBSTRATES

TABLE 26 MMA: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 27 MMA: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 28 MMA: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 29 MMA: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (KILOTON)

6.5 ACRYLIC

6.5.1 ACRYLIC-BASED STRUCTURAL ADHESIVES CAN EASILY JOIN OR BOND DISSIMILAR SUBSTRATES

TABLE 30 ACRYLIC: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 31 ACRYLIC: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 32 ACRYLIC: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 33 ACRYLIC: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (KILOTON)

6.6 OTHERS

TABLE 34 OTHERS: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 35 OTHERS: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 36 OTHERS: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 37 OTHERS: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (KILOTON)

7 AMERICAS STRUCTURAL ADHESIVES MARKET, BY APPLICATION (Page No. - 89)

7.1 INTRODUCTION

FIGURE 29 WIND ENERGY SEGMENT TO WITNESS HIGHEST CAGR, BY APPLICATION, 2021 VS. 2026

TABLE 38 AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (USD MILLION)

TABLE 39 AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 40 AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (KILOTON)

TABLE 41 AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (KILOTON)

7.2 BUILDING & CONSTRUCTION

7.2.1 STRENGTH, EXCELLENT QUALITY OF FINISH, AND AESTHETICS OF STRUCTURAL ADHESIVES USEFUL IN THIS APPLICATION

TABLE 42 BUILDING & CONSTRUCTION: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 43 BUILDING & CONSTRUCTION: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 44 BUILDING & CONSTRUCTION: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 45 BUILDING & CONSTRUCTION: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (KILOTON)

7.3 AUTOMOTIVE & TRANSPORTATION

7.3.1 USE OF STRUCTURAL ADHESIVES HELPS IN LIGHT-WEIGHTING AND IMPROVING IMPACT RESISTANCE OF VEHICLES

TABLE 46 AUTOMOTIVE & TRANSPORTATION: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 47 AUTOMOTIVE & TRANSPORTATION: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 48 AUTOMOTIVE & TRANSPORTATION: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 49 AUTOMOTIVE & TRANSPORTATION: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (KILOTON)

7.4 MARINE

7.4.1 INCREASING USE OF PLASTIC AND COMPOSITES IN FABRICATING BOATS IS BOOSTING THE DEMAND

TABLE 50 MARINE: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 51 MARINE: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 52 MARINE: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 53 MARINE: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (KILOTON)

7.5 WIND ENERGY

7.5.1 INCREASING FOCUS ON GREEN ENERGY SOURCES EXPECTED TO DRIVE THE DEMAND

TABLE 54 WIND ENERGY: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 55 WIND ENERGY: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 56 WIND ENERGY: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 57 WIND ENERGY: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (KILOTON)

7.6 OTHERS

TABLE 58 OTHER APPLICATIONS: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 59 OTHER APPLICATIONS: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 60 OTHER APPLICATIONS: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 61 OTHER APPLICATIONS: AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (KILOTON)

8 STRUCTURAL ADHESIVES MARKET, BY REGION (Page No. - 101)

8.1 INTRODUCTION

FIGURE 30 NORTH AMERICA TO LEAD THE AMERICAS STRUCTURAL ADHESIVES MARKET

TABLE 62 AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (USD MILLION)

TABLE 63 AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 64 AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20172020 (KILOTON)

TABLE 65 AMERICAS STRUCTURAL ADHESIVES MARKET SIZE, BY REGION, 20212026 (KILOTON)

8.2 NORTH AMERICA

TABLE 66 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY COUNTRY, 20172020 (USD MILLION)

TABLE 67 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

TABLE 68 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY COUNTRY, 20172020 (KILOTON)

TABLE 69 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY COUNTRY, 20212026 (KILOTON)

TABLE 70 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (USD MILLION)

TABLE 71 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

TABLE 72 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (KILOTON)

TABLE 73 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (KILOTON)

TABLE 74 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (USD MILLION)

TABLE 75 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 76 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (KILOTON)

TABLE 77 NORTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (KILOTON)

8.2.1 US

8.2.1.1 Automotive and electronics industries expected to fuel demand for structural adhesives

TABLE 78 US: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (USD MILLION)

TABLE 79 US: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

TABLE 80 US: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (KILOTON)

TABLE 81 US: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (KILOTON)

TABLE 82 US: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (USD MILLION)

TABLE 83 US: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 84 US: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (KILOTON)

TABLE 85 US: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (KILOTON)

8.2.2 CANADA

8.2.2.1 Growth in automotive industry to boost demand for structural adhesives

TABLE 86 CANADA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (USD MILLION)

TABLE 87 CANADA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

TABLE 88 CANADA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (KILOTON)

TABLE 89 CANADA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (KILOTON)

TABLE 90 CANADA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (USD MILLION)

TABLE 91 CANADA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 92 CANADA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (KILOTON)

TABLE 93 CANADA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (KILOTON)

8.2.3 MEXICO

8.2.3.1 Growth of construction industry expected to drive the market

TABLE 94 MEXICO: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (USD MILLION)

TABLE 95 MEXICO: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

TABLE 96 MEXICO: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (KILOTON)

TABLE 97 MEXICO: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (KILOTON)

TABLE 98 MEXICO: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (USD MILLION)

TABLE 99 MEXICO: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 100 MEXICO: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (KILOTON)

TABLE 101 MEXICO: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (KILOTON)

8.3 SOUTH AMERICA

TABLE 102 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY COUNTRY, 20172020 (USD MILLION)

TABLE 103 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY COUNTRY, 20212026 (USD MILLION)

TABLE 104 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY COUNTRY, 20172020 (KILOTON)

TABLE 105 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY COUNTRY, 20212026 (KILOTON)

TABLE 106 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (USD MILLION)

TABLE 107 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

TABLE 108 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (KILOTON)

TABLE 109 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (KILOTON)

TABLE 110 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (USD MILLION)

TABLE 111 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 112 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (KILOTON)

TABLE 113 SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (KILOTON)

8.3.1 BRAZIL

8.3.1.1 New investments in construction industry to boost the market for structural adhesives

TABLE 114 BRAZIL: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (USD MILLION)

TABLE 115 BRAZIL: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

TABLE 116 BRAZIL: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (KILOTON)

TABLE 117 BRAZIL: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (KILOTON)

TABLE 118 BRAZIL: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (USD MILLION)

TABLE 119 BRAZIL: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 120 BRAZIL: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (KILOTON)

TABLE 121 BRAZIL: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (KILOTON)

8.3.2 ARGENTINA

8.3.2.1 Government investments in infrastructure will enhance sales of structural adhesives

TABLE 122 ARGENTINA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (USD MILLION)

TABLE 123 ARGENTINA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

TABLE 124 ARGENTINA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (KILOTON)

TABLE 125 ARGENTINA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (KILOTON)

TABLE 126 ARGENTINA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (USD MILLION)

TABLE 127 ARGENTINA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 128 ARGENTINA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (KILOTON)

TABLE 129 ARGENTINA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (KILOTON)

8.3.3 REST OF SOUTH AMERICA

TABLE 130 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (USD MILLION)

TABLE 131 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

TABLE 132 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20172020 (KILOTON)

TABLE 133 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY TYPE, 20212026 (KILOTON)

TABLE 134 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (USD MILLION)

TABLE 135 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

TABLE 136 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20172020 (KILOTON)

TABLE 137 REST OF SOUTH AMERICA: STRUCTURAL ADHESIVES MARKET SIZE, BY APPLICATION, 20212026 (KILOTON)

9 COMPETITIVE LANDSCAPE (Page No. - 132)

9.1 OVERVIEW

9.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY STRUCTURAL ADHESIVE PLAYERS IN AMERICAS

9.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITION AND METHODOLOGY, 2020

9.2.1 STAR

9.2.2 EMERGING LEADERS

9.2.3 PERVASIVE

9.2.4 EMERGING COMPANIES

FIGURE 31 STRUCTURAL ADHESIVES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

9.2.5 PRODUCT FOOTPRINT

9.3 COMPANY EVALUATION MATRIX

TABLE 138 PRODUCT FOOTPRINT OF COMPANIES

TABLE 139 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 140 REGION FOOTPRINT OF COMPANIES

9.3.1 STRATEGIC DEVELOPMENTS MATRIX

TABLE 141 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 142 MOST FOLLOWED STRATEGIES

TABLE 143 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

9.4 SME MATRIX, 2020

9.4.1 RESPONSIVE COMPANIES

9.4.2 PROGRESSIVE COMPANIES

9.4.3 STARTING BLOCKS

9.4.4 DYNAMIC COMPANIES

FIGURE 32 AMERICAS STRUCTURAL ADHESIVES MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2020

9.5 AMERICAS STRUCTURAL ADHESIVES MARKET SHARE SCENARIO

TABLE 144 AMERICAS STRUCTURAL ADHESIVES MARKET SHARE SCENARIO, 2020

9.6 REVENUE ANALYSIS

FIGURE 33 REVENUE ANALYSIS OF TOP 5 PLAYERS, 20162020

9.6.1 HENKEL AG

9.6.2 3M

9.6.3 H.B. FULLER

9.6.4 DOW INC.

9.6.5 ARKEMA (BOSTIK SA)

9.7 MARKET RANKING ANALYSIS

TABLE 145 MARKET RANKING ANALYSIS, 2020

9.8 COMPETITIVE SITUATION AND TRENDS

TABLE 146 STRUCTURAL ADHESIVES MARKET: PRODUCT LAUNCHES, 20162021

TABLE 147 STRUCTURAL ADHESIVES MARKET: DEALS, 20162021

10 COMPANY PROFILES (Page No. - 152)

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

10.1 HENKEL AG & CO. KGAA

TABLE 148 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

FIGURE 34 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

TABLE 149 HENKEL: PRODUCT LAUNCHES

TABLE 150 HENKEL: DEALS

10.2 SIKA AG

TABLE 151 SIKA: COMPANY OVERVIEW

FIGURE 35 SIKA AG: COMPANY SNAPSHOT

TABLE 152 SIKA AG: PRODUCT LAUNCHES

TABLE 153 SIKA AG: DEALS

10.3 ARKEMA (BOSTIK SA)

TABLE 154 ARKEMA (BOSTIK SA): COMPANY OVERVIEW

FIGURE 36 ARKEMA (BOSTIK SA): COMPANY SNAPSHOT

TABLE 155 ARKEMA (BOSTIK SA): PRODUCT LAUNCHES

TABLE 156 ARKEMA (BOSTIK SA): DEALS

10.4 3M COMPANY

TABLE 157 3M COMPANY: COMPANY OVERVIEW

FIGURE 37 3M COMPANY: COMPANY SNAPSHOT

TABLE 158 3M COMPANY: PRODUCT LAUNCHES

10.5 H.B. FULLER

TABLE 159 H.B. FULLER: COMPANY OVERVIEW

FIGURE 38 H.B. FULLER: COMPANY SNAPSHOT

TABLE 160 H.B. FULLER: PRODUCT LAUNCHES

TABLE 161 H.B. FULLER: DEALS

10.6 ILLINOIS TOOL WORKS

TABLE 162 ILLINOIS TOOL WORKS: COMPANY OVERVIEW

FIGURE 39 ILLINOIS TOOL WORKS: COMPANY SNAPSHOT

10.7 HUNTSMAN INTERNATIONAL LLC

TABLE 163 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

FIGURE 40 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

TABLE 164 HUNTSMAN INTERNATIONAL LLC: PRODUCT LAUNCHES

TABLE 165 HUNTSMAN INTERNATIONAL LLC: DEALS

10.8 PARKER HANNIFIN

TABLE 166 PARKER HANNIFIN: BUSINESS OVERVIEW

FIGURE 41 LORD CORPORATION: COMPANY SNAPSHOT

TABLE 167 PARKER HANNIFIN: DEALS

10.9 ASHLAND GLOBAL HOLDINGS

TABLE 168 ASHLAND GLOBAL HOLDINGS: COMPANY OVERVIEW

FIGURE 42 ASHLAND INC.: COMPANY SNAPSHOT

10.10 DOW INC.

TABLE 169 DOW INC.: COMPANY OVERVIEW

FIGURE 43 DOW INC.: COMPANY SNAPSHOT

TABLE 170 DOW INC.: PRODUCT LAUNCHES

10.11 OTHER COMPANIES

TABLE 171 SCIGRIP ADHESIVES: BUSINESS OVERVIEW

TABLE 172 SCIGRIP ADHESIVES: DEALS

10.11.2 PERMABOND LLC.

TABLE 173 PERMABOND LLC.: BUSINESS OVERVIEW

TABLE 174 PERMABOND LLC.: PRODUCT LAUNCHES

10.11.3 MASTER BOND

TABLE 175 MASTER BOND: BUSINESS OVERVIEW

10.11.4 DYMAX CORPORATION

TABLE 176 DYMAX CORPORATION: BUSINESS OVERVIEW

TABLE 177 DYMAX CORPORATION: PRODUCT LAUNCHES

10.11.5 DELO INDUSTRIE KLEBSTOFFE GMBH & CO. KGAA

TABLE 178 DELO INDUSTRIE KLEBSTOFFE GMBH & CO. KGAA: BUSINESS OVERVIEW

TABLE 179 DELO INDUSTRIE KLEBSTOFFE GMBH & CO. KGAA: PRODUCT LAUNCHES

10.11.6 SCOTT BADER COMPANY LTD.

TABLE 180 SCOTT BADER COMPANY LTD.: BUSINESS OVERVIEW

TABLE 181 SCOTT BADER COMPANY LTD.: PRODUCT LAUNCHES

10.11.7 MAPEI S.P.A.

TABLE 182 MAPEI S.P.A.: BUSINESS OVERVIEW

10.11.8 PARSON ADHESIVES, INC.

TABLE 183 PARSON ADHESIVES, INC.: BUSINESS OVERVIEW

10.11.9 HERNON MANUFACTURING INC.

TABLE 184 HERNON MANUFACTURING INC.: BUSINESS OVERVIEW

10.11.10 UNISEAL INC.

TABLE 185 UNISEAL INC.: BUSINESS OVERVIEW

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11 APPENDIX (Page No. - 199)

11.1 INSIGHTS FROM INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHORS DETAILS

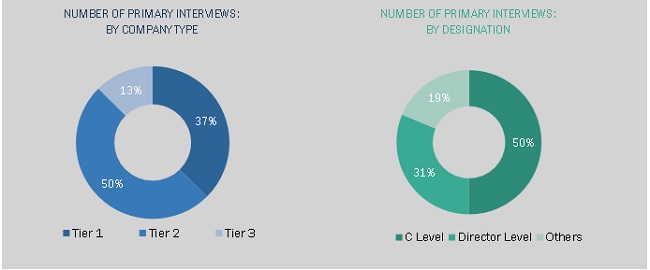

The study involves four major activities in estimating the current market size of Americas Structural Adhesives. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The Americas Structural Adhesives market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in applications, such as building & construction, automotive & transportation, marine, wind energy and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Americas Structural Adhesives market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the structural adhesives market in the Americas on the basis of type, application, and region

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To forecast the market size of the segments, in terms of value and volume, with respect to the Americas

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the Americas structural adhesives market

- To strategically profile the key players and comprehensively analyze their core competencies2

Note: 1. Micromarkets are defined as the sub-segments of the structural adhesives market in the Americas mentioned in the report.

2. Core competencies of the companies are captured in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Americas Structural Adhesives market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Americas Structural Adhesives Market