Automation-as-a-Service Market by Component (Solution and Services), Type (Rule-Based and Knowledge-Based), Business Function, Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Organization Size, Industry, and Region - Global Forecast to 2022

[192 Pages Report] Automation-as-a-service enables organizations to mechanize the business processes by capturing and interpreting data from existing applications. It enables organizations to shift from slow manual processes to reliable, fast automation across the organization in a matter of hours or even minutes. The automation-as-a-service market size is expected to grow from USD 1.56 Billion in 2016 to USD 6.23 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 28.1%. 2016 is considered to be the base year, while the forecast period is 20172022.

Following are the objectives of the Automation-as-a-service Market report:

- To describe and forecast the automation-as-a-service market on the basis of components (solution and services), business functions, types, deployment models, organization sizes, industries, and regions

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the subsegments with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide the details of a competitive landscape for the major players

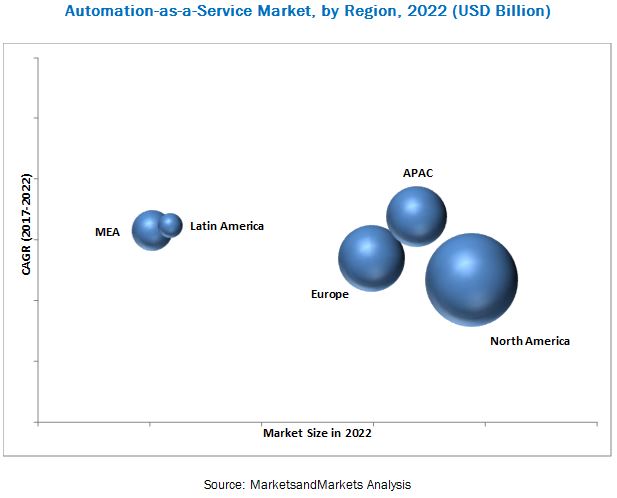

- To forecast the revenue of market segments with respect to all the major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To profile the key players and comprehensively analyze their recent developments and positioning

- To analyze competitive developments, such as partnerships, collaborations, agreements, acquisitions, new product launches, product upgradations, and R&D activities in the market

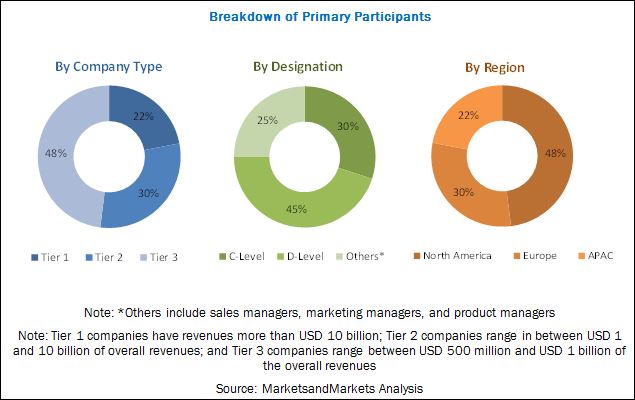

The research methodology used to estimate and forecast the automation-as-a-service market began with capturing the data on key vendors revenues through secondary research sources, such as companies websites, Factiva, and Hoovers. The other secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; and articles from recognized authors, directories, and databases. The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global automation-as-a-service market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with the key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of the primary is depicted in the below figure.

To know about the assumptions considered for the study, download the pdf brochure

The automation-as-a-service ecosystem comprises vendors, such as Automation Anywhere, Inc. (US), Blue Prism Group plc (UK), International Business Machines Corporation (US), Microsoft Corporation (US), UiPath (US), HCL Technologies Limited (India), Hewlett Packard Enterprise Development LP (US), Kofax Inc. (US), NICE Ltd. (Israel), and Pegasystems Inc.(US). The other stakeholders in the automation-as-a-service market include automation service providers, consulting service providers, Information Technology (IT) service providers, resellers, enterprise users, and technology providers.

The target audience of the automation-as-a-service market report are:

- Solution vendors

- Original Equipment Manufacturers (OEMs)

- System integrators

- Advisory firms

- National regulatory authorities

- Venture capitalists

- Private equity groups

- Investment houses

- Equity research firms

The study answers several questions for the stakeholders, primarily, which market segments to focus in the next 2-5 years for prioritizing the efforts and investments.

Scope of the Report

The research report categorizes the automation-as-a-service market to forecast the revenues and analyze the trends in each of the following subsegments:

By Component

- Solution

- Services

By Service

- Managed Services

- Professional Services

- Consulting Services

- Deployment and Integration

- Support and Training

By Business Function

- Information Technology (IT)

- Sales and Marketing

- Operations

- Finance

- Human Resources (HR)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Type

- Rule-based Automation

- Knowledge-based Automation

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

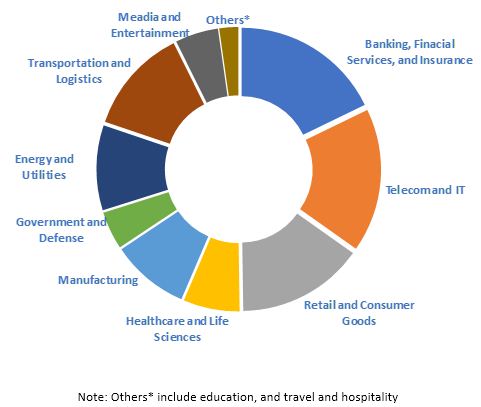

By Industry

- Banking, Financial Services, and Insurance (BFSI)

- Telecom and IT

- Retail and Consumer goods

- Healthcare and Life Sciences

- Manufacturing

- Government and Defense

- Energy and Utilities

- Media and Entertainment

- Transportation and Logistics

- Others (travel and hospitality, and education)

By Region

- North America

- Europe

- APAC

- Latin America

- MEA

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American automation-as-a-service market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

Increasing demand for automation across business processes and adoption of the cloud technology to drive the global automation-as-a-service analytics market to USD 6.23 billion by 2022

Automation involves mechanizing a series of operations by capturing and interpreting the existing repetitive and high-volume business processes. Automation deals with triggering responses, manipulating data, and communicating with other digital systems, which usually calls for tremendous labour and monotony. Automation implemented as a subscription-based service and delivered via the cloud is referred to as automation-as-a-service. Moreover, the automation-as-a-service model enables organizations to shift from slow manual processes to reliable, fast automation across the organization in a matter of hours or even minutes.

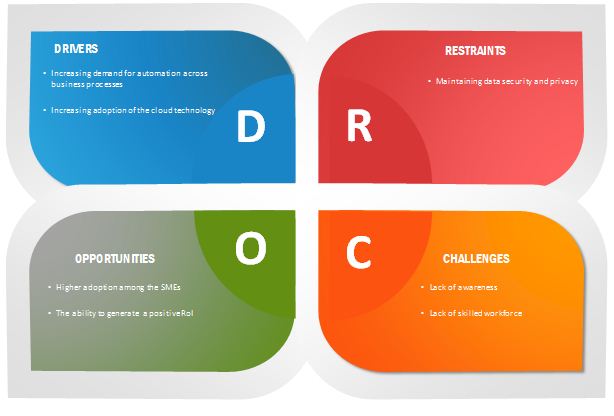

The increasing demand for automation and the increasing adoption of cloud technology are expected to be the major drivers for the growth of the automation-as-a-service market. Business functions such as IT, finance, marketing and sales, operations, and HR are currently experiencing a rapid growth. Thus, there is an enormous market potential for automation across numerous business verticals, owing to its ability to perform the mundane or error-prone parts efficiently. Automation is highly useful in industries, such as BFSI, healthcare, and telecommunications and IT, as these industries follow defined, repeated, and rule-based processes. Automation reduces inconsistencies in the business environment and eradicates errors created by manual work, thereby enabling effective business processes.

Higher adoption among the Small and Medium-sized Enterprises (SMEs) present major opportunity in the market

SMEs hold a major role in defining the worlds economy. SMEs, as defined by the European Commission (EC), are organizations that have than 250 employees, with an annual turnover of up to USD 60 million (approximately EUR 50 million). SMEs comprise 99% of the overall companies in the European Union (EU) alone. Most often, large organizations outsource their services to SMEs. SMEs adaptive capabilities provide a backbone to define the global economic structures. Earlier, it was believed that only large organizations can benefit from the automation of processes. Eventually, technology has become an integral part of everything a business does, and so, SMEs can also reap great benefits by automating their IT, finance, HR, operations, and marketing and sales processes. SMEs are reluctant to invest in automation-as-a-service, due to the fear of not gaining any RoI. Automation solutions provided on the cloud can be valuable for the SMEs, as they do not have enough resources to invest in manpower. Moreover, investing in these solutions can streamline the business processes, thereby making the business more profitable. As the advantages of automation-as-a-service are recognized, more SMEs may adopt these solutions; and the wide adoption of automation-as-a-service among the SMEs is expected to boost the growth of the market.

Market Dynamics

The automation-as-a-service market is expected to grow from USD 1.80 Billion in 2017 to USD 6.23 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 28.1%. The major growth drivers of the market include the increasing demand for automation and the increasing adoption of cloud technology.

The market is segmented by solution and services. The services segment is expected to grow at the highest CAGR during the forecast period, out of which, deployment and integration services in the professional services segment is projected to witness the highest demand, due to the growing need of automation-as-a-service solutions across organizations.

The Banking, Financial Services, and Insurance (BFSI) industry is expected to hold the largest share of the automation-as-a-service market in 2017. The growth is fueled by the growing need to simplify the workload related to security and the increasing dependence on workers, for monitoring every financial transaction. The healthcare and life sciences industry is expected to grow at the highest CAGR during the forecast period, due to the increasing need to store and manage data coming from various patients and medical devices and medical record systems, used across healthcare organizations.

The major business functions for which the automation-as-a-service is deployed include the IT, sales and marketing, operations, finance, and Human Resources (HR). The adoption of automation-as-a-service for sales and marketing is expected to increase significantly in the coming years because of the increasing need to automate repetitive tasks and streamline the business process across industries.

Organizations are deploying automation-as-a-service solutions either on the public, private, or hybrid cloud. The demand for hybrid automation-as-a-service solutions is expected to grow, due to its cost-effective and scalable features; its growth is expected to be high, particularly in the Small and Medium-sized Enterprises (SMEs), where low-cost solutions along with high data privacy are largely required.

Organizations are opting for rule-based or knowledge-based automation. The demand for knowledge-based automation solutions is expected to grow, due to its ability to deal with the increasing amount of unstructured data across all organizations with greater efficiency and lesser dependency on manual handling.

The global market has been segmented on the basis of regions into North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA). The North American region, followed by Europe, is expected to continue as the largest revenue-generating region for the automation-as-a-service vendors, for the next 5 years. This is mainly because, in the developed economies of the US and Canada, there is a high focus on innovations obtained from Research and Development (R&D) and technologies. The APAC region is expected to be the fastest-growing region in the automation-as-a-service market because of the increasing adoption of automation and cloud technologies, and various other government initiatives, such as smart cities across the APAC countries, including China and India.

The automation-as-a-service market faces challenges, such as maintaining data security and privacy, and lack of skilled workforce. Factors such as lack of awareness of automation-as-a-service is expected to limit the market growth.

The major vendors that offer automation-as-a-service software and services globally are Automation Anywhere, Inc. (US), Blue Prism Group plc (UK), International Business Machines Corporation (US), Microsoft Corporation (US), UiPath (US), HCL Technologies Limited (India), Hewlett Packard Enterprise Development LP (US), Kofax Inc. (US), NICE Ltd. (Israel), and Pegasystems Inc. (US). These vendors have adopted different types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships, collaborations, agreements, and acquisitions, to expand their offerings in the automation-as-a-service market.

The growth of automation-as-a-service market is depending on the factors such as demand for automation across business processes and adoption of cloud technology, which in turn has fuelled the demand for effective automation-as-a-service solutions.

Various industries are adopting automation-as-a-service to streamline their workflows and automate the repetitive tasks, significantly increasing the productivity of the businesses

Banking, financial services, and insurance

In the BFSI industry, multiple systems are linked with each other by interfaces to enable the flow of transaction-related data. Automation solutions control and monitor these interfaces to ensure seamless execution of transactions and fix bottlenecks in workflows. These solutions improve the accuracy and efficiency of various processes in the industry, and help in regulatory and compliance reporting by collating data from multiple systems and conducting a host of validation checks to prepare information for detailed analysis.

Telecom and IT

The telecom and IT industry is increasingly adopting automation to reduce its operating cost and improve the operational efficiency and customer satisfaction. The benefits of automation for this industry include centralization and consolidation of request management systems for enhanced efficiency, improved transparency, and visibility for service functions; automation of Service-Level Agreement (SLA) reporting; and reduction of manual efforts, thereby helping in reducing errors and operational costs through process automation.

Retail and consumer goods

Automation solutions, adopted across the entire value chain in the retail and consumer goods industry, effectively reduce the workload and provide process optimization opportunities to retailers and marketers. Benefits of adopting automation-as-a-service solutions include real-time communication with customers, increase in brand loyalty, handling warranty and replacement of products, and increase in sales.

Healthcare and life sciences

The healthcare and life sciences industry industry struggles with paper-intensive workflows, such as patients medical records, customer care records, patients credentials, processing of claims, and revenue cycle management. Demand for document management, need to enhance patient care, and competitive landscape in the industry fuel the demand for automation solutions that can significantly increase the productivity of organizations, operating in the industry, despite the growing pressure of regulatory and compliance requirements.

Manufacturing

The manufacturing industry is increasingly adopting automation-as-a-service for various workflows, such as vendor management, purchase order management, request for quotation, and inventory management. Automation enables manufacturers to automate and monitor their manufacturing activities by tracking day-to-day workflows. It results in increased productivity and reduced operational cost by eliminating routine manual and clerical tasks, thereby minimizing the manufacturing lead time.

Government and defense

Increased budgetary constraints, for instance, reinforce government agencies to look for low-cost technology solutions that meet their diverse requirements while adhering to their strict regulatory and compliance framework. Automation-as-a-service solutions are increasingly adopted by organizations in this industry, given the low-cost benefits of cloud-based solutions and other advantages, leading to the growth of the automation-as-a-service market during the forecast period.

Energy and utility

? The energy and utilities industry is rapidly adopting advanced technologies to gain an edge in the competitive market. The automation-as-a-service solution can benefit energy solution providers by enabling them to consolidate their data sources in the cloud, and by analyzing individual consumers and targeted segments in real time. It leads to a faster collection of overdue invoices and unbilled income, forecast demand and revenue accurately, and process automation, thereby providing real-time benefits.

Transportation and logistics

The transportation and logistics industry deploy automation solutions across various phases of its value chain, from supply chain to customer experience management. Automation-as-a-service enables better management of all transportation activities throughout an enterprises supply chain, thus helping reduce freight costs, optimize service levels, and automate processes. It simplifies various workflows in the logistics industry, such as order collaboration, communication and network-wide transportation management, and supply chain from shipper to carrier to customer.

Media and entertainment

The media and entertainment industry is benefiting from automation-as-a-service significantly. The automation-as-a-service solution enables companies to virtualize their supply chain, automate workflows, and eliminate the use of multiple disparate systems across various departments and regions. Virtualization through automation-as-a-service enables the companies to provide centralized access to their resources and reallocate human resources to better-suited tasks, thus enhancing efficiency, reducing costs, and boosting monetization.

Key questions

- Which are the substitute products and how big is the threat from them?

- Which are the top use cases where automation-as-a-service can be implemented for revenue generation through new advancements such as AI and cloud computing?

- What are the potential opportunities in the adjacent markets, such as robotics process automation and workflow automation?

- What should be your go-to-market strategy to expand the reach into developing countries across APAC, MEA, and Latin America?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Research Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities in the Automation-as-a-Service Market

4.2 Automation-as-a-Service Market: Market Share Across Various Regions

4.3 Market By Industry and Region

4.4 Market Professional Services, By Region

5 Market Overview and Industry Trends (Page No. - 38)

5.1 Market Overview

5.1.1 Introduction

5.1.2 Market Dynamics

5.1.2.1 Drivers

5.1.2.1.1 Increasing Demand for Automation Across Business Processes

5.1.2.1.2 Increasing Adoption of the Cloud Technology

5.1.2.2 Restraints

5.1.2.2.1 Maintaining Data Security and Privacy

5.1.2.3 Opportunities

5.1.2.3.1 Higher Adoption Among the Smes

5.1.2.3.2 The Ability to Generate A Positive Roi

5.1.2.4 Challenges

5.1.2.4.1 Lack of Awareness

5.1.2.4.2 Lack of Skilled Workforce

5.2 Industry Trends

5.2.1 Automation-as-a-Service: Top Trends

5.2.1.1 Automation and AI

5.2.1.2 Automation and IoT

5.2.1.3 Automation and Cybersecurity

5.2.1.4 Automation and Chatbots Devops

5.2.2 Automation-as-a-Service Market: Use Cases

5.2.2.1 Introduction

5.2.2.2 Use Case 1: IT Service Desk Automation From Ipsoft

5.2.2.3 Use Case 2: Test Automation From Applitools

5.2.2.4 Use Case 3: Data Reconciliation and Reporting in Retail From Workfusion

5.2.2.5 Use Case 4: Workflow and Process Automation in Legal Operations From Thinksmart

6 Automation-as-a-Service Market, By Component (Page No. - 51)

6.1 Introduction

6.2 Solution

6.3 Services

6.3.1 Professional Services

6.3.1.1 Deployment and Integration

6.3.1.2 Support and Training

6.3.1.3 Consulting Services

6.3.2 Managed Services

7 Market By Type (Page No. - 60)

7.1 Introduction

7.2 Rule-Based Automation

7.3 Knowledge-Based Automation

8 Automation-as-a-Service Market, By Business Function (Page No. - 64)

8.1 Introduction

8.2 Information Technology

8.3 Finance

8.4 Human Resources

8.5 Sales and Marketing

8.6 Operations

9 Market By Deployment Model (Page No. - 70)

9.1 Introduction

9.2 Public Cloud

9.3 Private Cloud

9.4 Hybrid Cloud

10 Automation-as-a-Service Market, By Organization Size (Page No. - 75)

10.1 Introduction

10.2 Large Enterprises

10.3 Small and Medium-Sized Enterprises

11 Market By Industry (Page No. - 79)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.3 Telecom and IT

11.4 Retail and Consumer Goods

11.5 Healthcare and Life Sciences

11.6 Manufacturing

11.7 Government and Defense

11.8 Energy and Utilities

11.9 Transportation and Logistics

11.10 Media and Entertainment

11.11 Others

12 Automation-as-a-Service Market, By Region (Page No. - 88)

12.1 Introduction

12.2 North America

12.2.1 By Component

12.2.2 By Service

12.2.3 By Professional Service

12.2.4 By Type

12.2.5 By Business Function

12.2.6 By Deployment Model

12.2.7 By Organization Size

12.2.8 By Industry

12.3 Europe

12.3.1 By Component

12.3.2 By Service

12.3.3 By Professional Service

12.3.4 By Type

12.3.5 By Business Function

12.3.6 By Deployment Model

12.3.7 By Organization Size

12.3.8 By Industry

12.4 Asia Pacific

12.4.1 By Component

12.4.2 By Service

12.4.3 By Professional Service

12.4.4 By Type

12.4.5 By Business Function

12.4.6 By Deployment Model

12.4.7 By Organization Size

12.4.8 By Industry

12.5 Latin America

12.5.1 By Component

12.5.2 By Service

12.5.3 By Professional Service

12.5.4 By Type

12.5.5 By Business Function

12.5.6 By Deployment Model

12.5.7 By Organization Size

12.5.8 By Industry

12.6 Middle East and Africa

12.6.1 By Component

12.6.2 By Service

12.6.3 By Professional Service

12.6.4 By Type

12.6.5 By Business Function

12.6.6 By Deployment Model

12.6.7 By Organization Size

12.6.8 By Industry

13 Competitive Landscape (Page No. - 113)

13.1 Overview

13.2 Competitive Scenerio

13.2.1 New Product Launches and Product Upgradations

13.2.2 Partnerships, Collaborations, and Agreements

13.2.3 Acquisitions

13.2.4 Business Expansions

13.3 Automation-as-a-Service Market: Prominent Players

14 Company Profiles (Page No. - 141)

14.1 Automation Anywhere

14.1.1 Business Overview

14.1.2 Solutions and Services Offered

14.1.3 Recent Developments

14.1.4 SWOT Analysis

14.1.5 MnM View

14.2 Blue Prism

14.2.1 Business Overview

14.2.2 Solutions and Services Offered

14.2.3 Recent Developments

14.2.4 SWOT Analysis

14.2.5 MnM View

14.3 IBM

14.3.1 Business Overview

14.3.2 Solutions and Services Offered

14.3.3 Recent Developments

14.3.4 SWOT Analysis

14.3.5 MnM View

14.4 Microsoft

14.4.1 Business Overview

14.4.2 Solutions and Services Offered

14.4.3 Recent Developments

14.4.4 SWOT Analysis

14.4.5 MnM View

14.5 Uipath

14.5.1 Business Overview

14.5.2 Solutions and Services Offered

14.5.3 Recent Developments

14.5.4 SWOT Analysis

14.5.5 MnM View

14.6 HCL Technologies

14.6.1 Business Overview

14.6.2 Solutions and Services Offered

14.6.3 Recent Developments

14.6.4 MnM View

14.7 HPE

14.7.1 Business Overview

14.7.2 Solutions Offered

14.7.3 Recent Developments

14.7.4 MnM View

14.8 Kofax

14.8.1 Business Overview

14.8.2 Solutions and Services Offered

14.8.3 Recent Developments

14.8.4 MnM View

14.9 Nice Ltd.

14.9.1 Business Overview

14.9.2 Solutions and Services Offered

14.9.3 Recent Developments

14.9.4 MnM View

14.1 Pegasystems

14.10.1 Business Overview

14.10.2 Solutions and Services Offered

14.10.3 Recent Developments

14.10.4 MnM View

15 Key Innovators (Page No. - 177)

15.1 Kryon Systems

15.2 Softomotive

15.3 Workfusion

16 Appendix (Page No. - 181)

16.1 Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets Subscription Portal

16.4 Introducing RT: Real-Time Market Intelligence

16.5 Available Customization

16.6 Related Reports

List of Tables (84 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Automation-as-a-Service Market Size, By Component, 20152022 (USD Million)

Table 3 Solution: Market Size, By Region, 20152022(USD Million)

Table 4 Services: Market Size, By Type, 20152022 (USD Million)

Table 5 Services: Market Size, By Region, 20152022 (USD Million)

Table 6 Professional Services Market Size, By Type, 20152022 (USD Million)

Table 7 Professional Services Market Size, By Region, 20152022 (USD Million)

Table 8 Deployment and Integration Market Size, By Region, 20152022 (USD Million)

Table 9 Support and Training Market Size, By Region, 20152022 (USD Million)

Table 10 Consulting Services Market Size, By Region, 20152022 (USD Million)

Table 11 Managed Services Market Size, By Region, 20152022 (USD Million)

Table 12 Automation-as-a-Service Market Size, By Type, 20152022 (USD Million)

Table 13 Rule-Based Automation: Market Size, By Region, 20152022 (USD Million)

Table 14 Knowledge-Based Automation: Market Size, By Region, 20152022 (USD Million)

Table 15 Automation-as-a-Service Market Size, By Business Function, 20152022 (USD Million)

Table 16 Information Technology: Market Size, By Region, 20152022 (USD Million)

Table 17 Finance: Market Size, By Region, 20152022 (USD Million)

Table 18 Human Resources: Market Size, By Region, 20152022 (USD Million)

Table 19 Sales and Marketing: Market Size, By Region, 20152022 (USD Million)

Table 20 Operations: Market Size, By Region, 20152022 (USD Million)

Table 21 Automation-as-a-Service Market Size, By Deployment Model, 20152022 (USD Million)

Table 22 Public Cloud: Market Size, By Region, 20152022 (USD Million)

Table 23 Private Cloud: Market Size, By Region, 20152022 (USD Million)

Table 24 Hybrid Cloud: Market Size, By Region, 20152022 (USD Million)

Table 25 Automation-as-a-Service Market Size, By Organization Size, 20152022 (USD Million)

Table 26 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 27 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 28 Automation-as-a-Service Market Size, By Industry, 20152022 (USD Million)

Table 29 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 30 Telecom and IT: Market Size, By Region, 20152022 (USD Million)

Table 31 Retail and Consumer Goods: Market Size, By Region, 20152022 (USD Million)

Table 32 Healthcare and Life Sciences: Market Size, By Region, 20152022 (USD Million)

Table 33 Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 34 Government and Defense: Market Size, By Region, 20152022 (USD Million)

Table 35 Energy and Utilities: Market Size, By Region, 20152022 (USD Million)

Table 36 Transportation and Logistics: Market Size, By Region, 20152022 (USD Million)

Table 37 Media and Entertainment: Market Size, By Region, 20152022 (USD Million)

Table 38 Others: Market Size, By Region, 20152022 (USD Million)

Table 39 Automation-as-a-Service Market Size, By Region, 20152022 (USD Million)

Table 40 North America: Market Size, By Component, 20152022 (USD Million)

Table 41 North America: Market Size, By Service, 20152022 (USD Million)

Table 42 North America: Market Size, By Professional Service, 20152022 (USD Million)

Table 43 North America: Market Size, By Type, 20152022 (USD Million)

Table 44 North America: Market Size, By Business Function, 20152022 (USD Million)

Table 45 North America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 46 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 47 North America: Market Size, By Industry, 20152022 (USD Million)

Table 48 Europe: Automation-as-a-Service Market Size, By Component, 20152022 (USD Million)

Table 49 Europe: Market Size, By Service, 20152022 (USD Million)

Table 50 Europe: Market Size, By Professional Service, 20152022 (USD Million)

Table 51 Europe: Market Size, By Type, 20152022 (USD Million)

Table 52 Europe: Market Size, By Business Function, 20152022 (USD Million)

Table 53 Europe: Market Size, By Deployment Model, 20152022 (USD Million)

Table 54 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 55 Europe: Market Size, By Industry, 20152022 (USD Million)

Table 56 Asia Pacific: Automation-as-a-Service Market Size, By Component, 20152022 (USD Million)

Table 57 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 58 Asia Pacific: Market Size, By Professional Service, 20152022 (USD Million)

Table 59 Asia Pacific: Market Size, By Type, 20152022 (USD Million)

Table 60 Asia Pacific: Market Size, By Business Function, 20152022 (USD Million)

Table 61 Asia Pacific: Market Size, By Deployment Model, 20152022 (USD Million)

Table 62 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 63 Asia Pacific: Market Size, By Industry, 20152022 (USD Million)

Table 64 Latin America: Automation-as-a-Service Market Size, By Component, 20152022 (USD Million)

Table 65 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 66 Latin America: Market Size, By Professional Service, 20152022 (USD Million)

Table 67 Latin America: Market Size, By Type, 20152022 (USD Million)

Table 68 Latin America: Market Size, By Business Function, 20152022 (USD Million)

Table 69 Latin America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 70 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 71 Latin America: Market Size, By Industry, 20152022 (USD Million)

Table 72 Middle East and Africa: Automation-as-a-Service Market Size, By Component, 20152022 (USD Million)

Table 73 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 74 Middle East and Africa: Market Size, By Professional Service, 20152022 (USD Million)

Table 75 Middle East and Africa: Market Size, By Type, 20152022 (USD Million)

Table 76 Middle East and Africa: Market Size, By Business Function, 20152022 (USD Million)

Table 77 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 79 Middle East and Africa: Market Size, By Industry, 20152022 (USD Million)

Table 80 New Product Launches and Product Upgradations, 2017

Table 81 Partnerships, Collaborations, and Agreements, 2017

Table 82 Acquisitions, 20162017

Table 83 Business Expansions, 2017

Table 84 Prominent Players in the Automation-as-a-Service Market

List of Figures (45 Figures)

Figure 1 Automation-as-a-Service Market: Market Segmentation

Figure 2 Market Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Automation-as-a-Service Market: Assumptions

Figure 7 Market is Expected to Witness Substantial Growth During the Forecast Period

Figure 8 Market By Component (2017 vs 2022)

Figure 9 Market By Service (2017)

Figure 10 Market By Professional Service (2017)

Figure 11 Market By Business Function (2017)

Figure 12 Market By Type (2017)

Figure 13 Market By Deployment Model (2017)

Figure 14 Market By Organization Size (2017)

Figure 15 Market By Industry (2017 vs 2022)

Figure 16 Increasing Need for Automation Across Industries is Expected to Be One of the Major Factors Contributing to the Growth of the Automation-as-a-Service Market

Figure 17 North America is Estimated to Have the Largest Market Share in 2017

Figure 18 Banking, Financial Services, and Insurance Industry, and North America are Estimated to Have the Largest Market Shares in 2017

Figure 19 Support and Training Segment is Estimated to Hold the Largest Market Share Across the Globe, Except in Asia Pacific, in 2017

Figure 20 Automation-as-a-Service Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 Services Segment is Expected to Have A Higher CAGR During the Forecast Period

Figure 22 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 23 Deployment and Integration Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 Knowledge-Based Automation Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Sales and Marketing Business Function is Expected to Have the Highest CAGR During the Forecast Period

Figure 26 Hybrid Cloud Deployment Model is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 Small and Medium-Sized Enterprises Segment is Expected to Adopt the Automation-as-a-Service Solution at A Higher CAGR During the Forecast Period

Figure 28 Healthcare and Life Sciences Industry is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 31 North America: Market Snapshot

Figure 32 Asia Pacific: Market Snapshot

Figure 33 Key Developments By the Leading Companies in the Automation-as-a-Service Market

Figure 34 Automation Anywhere: SWOT Analysis

Figure 35 Blue Prism: Company Snapshot

Figure 36 Blue Prism: SWOT Analysis

Figure 37 IBM: Company Snapshot

Figure 38 IBM: SWOT Analysis

Figure 39 Microsoft: Company Snapshot

Figure 40 Microsoft: SWOT Analysis

Figure 41 Uipath: SWOT Analysis

Figure 42 HCL Technologies: Company Snapshot

Figure 43 HPE: Company Snapshot

Figure 44 Nice Ltd.: Company Snapshot

Figure 45 Pegasystems: Company Snapshot

Growth opportunities and latent adjacency in Automation-as-a-Service Market