Automotive Steering System Market by Technology (HPS, EHPS, EPS), EPS Type (R-EPS, C-EPS, P-EPS), Pinion (Single, Dual), Mechanism (Collapsible, Rigid), Components (OE, Aftermarket), Vehicle (PC, LCV, HCV, EV, OHV) and Region - Global Forecast to 2027

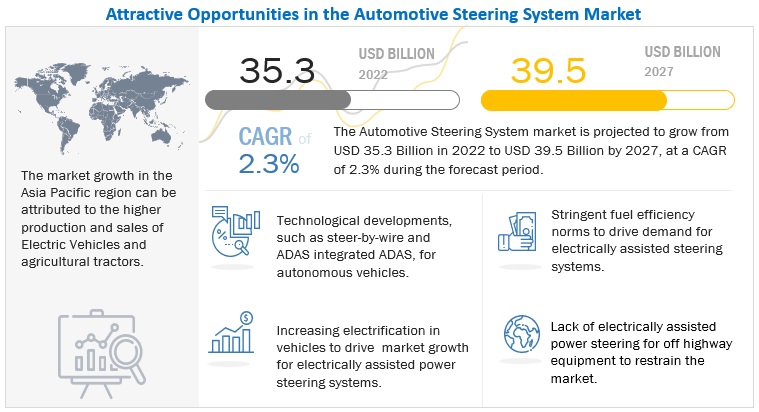

The automotive steering system market was valued at USD 35.3 billion in 2022 and is expected to reach USD 39.5 billion by 2027, at a CAGR of 2.3% over the forecast period 2022-2027. With emissions standards becoming more stringent automotive electrification is imminent. The rapid adoption of Electric Vehicles (EVs) worldwide creates a huge demand for Electrical Power Steering (EPS) and steer-by-wire steering systems. OEMs in the passenger car segment have almost entirely moved to EPS systems, with EPS systems for commercial vehicles at a very nascent stage. As more commercial EVs are introduced in the market, the demand for EPS in these vehicles will witness significant growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Steering System Market Dynamics

Driver: Increasing demand for Electrically assisted Hydraulic Power Steering (E-HPS) in commercial vehicles

Light and heavy commercial vehicles have been using hydraulic power steering for a long time. Commercial vehicles usually carry large volumes of goods for long distances in trailers and trucks. The long-distance hauling of goods often causes fatigue to drivers. Power steering helps to reduce driver fatigue by reducing the effort required to turn the heavy vehicle. This reduction in fatigue provides more comfort to drivers, enabling them to drive on long-haul freight routes. Lately, the hydraulic power steering systems have been upgraded by adding electronic components, thus leading to Electrically assisted Hydraulic Power Steering (E-HPS). The linking of the steering system with other electric components, such as sensors, brakes, batteries, and the vehicle control unit, enables innovative driver assistance systems to be implemented for increased safety and more comfort. In E-HPS, an oil circuit and a power cylinder provide hydraulic steering assistance for the steering wheel motions of the driver. The electric motor and worm gear give an additional turning moment to the input shaft parallel to the steering wheel's moment. Hence, the manual force needed for steering varies depending on the driving situation. The electric control unit receives the steering wheel signal, is applied by a sensor, and precisely provides the corresponding steering assist. The electronic system can learn from the driver’s driving pattern and add or subtract steering assist as required, thus increasing safety for heavy commercial vehicles. An indirect advantage of having improved safety in commercial vehicles is lower vehicle insurance costs, which can reduce the total overall ownership cost of the vehicle. Adding electric components and motors minimizes the load on the vehicle engine for the steering system operation, thus reducing fuel requirements and CO2 emissions. According to Infineon Technologies AG (Germany), E-HPS can reduce CO2 emissions ranging from 6 gm CO2/km to 11 gm CO2/km while increasing fuel efficiency by 0.9 to 1.2%. Thus, the combined advantage of reduced CO2 emissions, increased fuel efficiency, better driver comfort, and improved safety will likely drive the demand for E-HPS in commercial vehicles globally.

Restraint: Lack of electrically assisted power steering for the construction and mining equipment market

Most construction and mining equipment use articulated steering mechanisms, such as articulated dump trucks, motor graders, and wheeled loaders. In an articulated steering mechanism, the vehicle is divided into two parts and connected by a hydraulic mechanism that allows either car’s parts to turn while steering. Depending on the size, such as wheeled loaders, some equipment uses traditional steering mechanisms involving rack and pinions for steering functionality. Power steering in this equipment is normally provided via a hydraulic system where double-acting cylinders are used to move the vehicle's body. They usually come with an active self-compensating design. Electrically assisted hydraulic systems help reduce the engine load, thus reducing fuel requirements for the car and improving fuel efficiency. No electrically assisted steering mechanisms are available for construction and mining equipment. The forces required to turn construction or mining equipment range from 50kN to 100kN. These forces are challenging to achieve with an electric motor. This is restraining the automotive steering market, as any advancement in electrifying the steering mechanisms of construction and mining equipment will unlock a huge demand for automotive steering system OEMs.

Opportunities: Retreading of tires

Electric Power Steering (EPS) has become one of the key enablers of the Advanced Driver Assistance Systems (ADAS) that are now being rapidly adopted across vehicle segments globally. With the proliferation of ADAS, new and improved features related to steering assistance and steering safety can now be integrated into the EPS to enhance its reliability and functionality. Features such as parallel parking can help drivers to efficiently park their vehicles eliminating the hassle of parking through judgment. This feature will save fuel and time for the vehicle owner. Lane-keeping assist and Highway assist features can help the driver experience better driving on highways and make them feel more secure. Lane Keep Assist (LKA) feature takes data of the surroundings from sensors placed in the vehicle. It inputs them into the steering central computing chip, where the information is translated to the mechanical movement of the steering mechanism, which responds and corrects the lane position of the driver. ADAS systems can be developed to adapt to the driver’s driving pattern by taking inputs from the driver’s behavior of turning the steering wheel. They can potentially optimize steering designs on frequent routes to improve fuel efficiency and reduce time traveled from point A to point B. ADAS, coupled with EPS, will play a critical role in applications in autonomous mobility and connected cars.

Challenges: Low customer confidence in the adoption of steer-by-wire technology for autonomous mobility

Steer-by-Wire (SbW) technology is the next step in steering system innovation. In SbW, there are no mechanical linkages like the steering column, steering gear, and tie rods; instead, sensors and electric motors replace them to turn the vehicle's wheels during steering. When the driver turns the steering, the sensors and actuators assess the signal and turn the wheel accordingly. This elimination of mechanical linkage has raised a few concerns among customers regarding having control over the vehicle. In case of an emergency turn or swerving, the mechanical linkage is advantageous as the driver can maneuver the vehicle to safety. Any failure in electrical components or software assessment of the situation will put the driver at risk. When such incidents are looked at from an autonomous mobility lens, it becomes even more critical that there should not be room for error in the steering system components. Steer-by-wire steering systems are especially prone to cyber-attacks as they don’t have any physical linkages between the steering wheel and the turning mechanism, allowing hackers to take control of the vehicle and leave the driver stranded. Thus, including fail-safe mechanisms and high-reliability measures in the SbW becomes critical and challenging for steering system OEMs to instill confidence in customers willing to adopt autonomous vehicles.

Electronic components observe the fastest growth rate due to wide EPS adoption.

The steering wheel speed sensors are projected to register the highest CAGR. All the requirements of a modern car, like driving dynamics, driving safety, driving comfort, lower fuel consumption, and lower emissions, are based on the speed sensors data. The growth of this segment can be attributed to the increasing adoption of electronics in vehicles. The torque sensor is integrated with the steering angle sensor for better data accuracy fed to the ECU. The higher the quality of the data, the better the steering control. Since this sensor is sophisticated, it is mostly adopted in higher-end premium vehicle segments. Asia Pacific is expected to be the largest and fastest-growing region due to increased demand for SUVs and luxury cars in the emerging economies in the region. The demand for EPS and EHPS (electrically assisted hydraulic power steering) systems is influenced by the demand for electric motors since both these steering systems use electric motors. Thus, the demand for related electronics components will rise as more EPS is adopted.

Dual pinion segment to hold a majority share in the automotive steering system

The dual-pinion segment is estimated to lead the market by providing better fuel economy and steering feel. Dual pinion provides additional design flexibility to locate the motor and controller and assists the mechanism opposite the driver's side, reducing risks of leg injury in case of a collision. In addition, the increasing penetration of C and D vehicle segments is expected to drive the growth of the dual-pinion segment. Asia Pacific is estimated to be the largest market for dual-pinion steering systems. Dual pinion provides about 4 percent more fuel savings than conventional hydraulic steering systems. The growth of the dual-pinion segment can be attributed to the shift in customers' preference from compact cars to compact SUVs in countries such as China, Japan, and India. The strong presence of dual pinion manufacturers, such as JTEKT Corporation, NSK Ltd, and Showa Corporation, is also further expected to drive the market growth for dual pinion in this region.

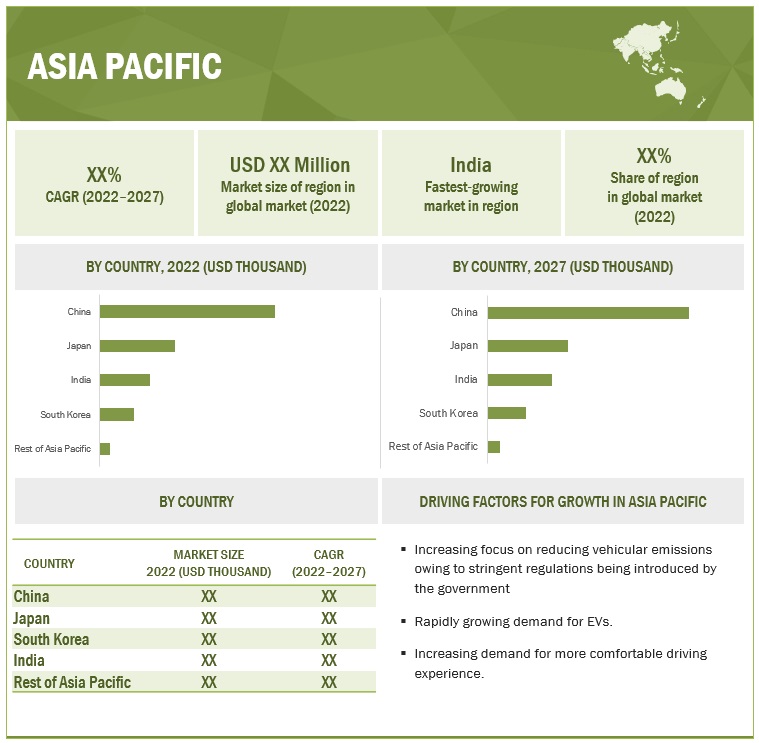

Asia Pacific region to dominate the global Automotive Steering Systems market amongst other regions

The rapid adoption of EPS technology, especially in passenger cars and light commercial vehicles, owing to enhanced driving comfort and better fuel efficiency, is expected to drive automotive steering sensor market growth in China. China, an electronics manufacturing hub, has the advantage of faster adoption of EPS. In recent years, the Indian government has been focusing on emission norms and safety regulations, for example, the BS-VI emissions standards. This has pushed OEMs to opt for EPS technology over traditional Hydraulic Power Steering (HPS) technology. India is also witnessing high demand for EVs, boosting EPS systems' demand. The agricultural tractors segment will witness higher adoption of HPS over traditional manual steering, driving the demand for HPS in this sector. Japan has a high rate of automobile electrification owing to the innovative automotive companies moving towards lower-emission vehicles. The adoption of EPS in passenger cars and EHPS in commercial vehicles has witnessed high growth in recent years.

Asia Pacific is expected to be less affected by the recession when compared to their western counterparts. Due to the diminishing global production of vehicles due to the economic turndown, the growth rate in this region is expected to fall for the automotive steering system market.

Asia pacific: Automotive Steering System Market

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

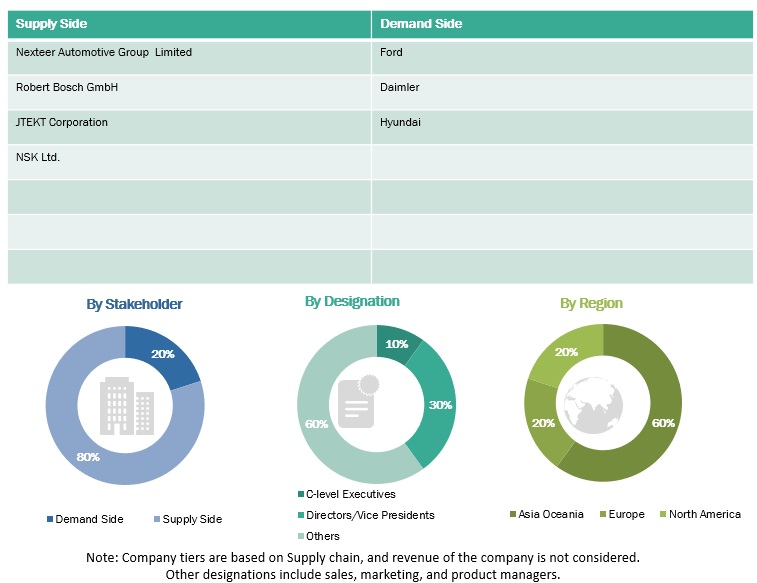

The Automotive Steering System Market is consolidated, with the presence of five major players JTEKT Corporation (Japan), Nexteer (US), Robert Bosch (Germany), Hyundai Mobis (South Korea), and NSK Ltd. (Japan).

Scope of the Report

|

Report Metric |

Details |

|

Base Year for Estimation |

2021 |

|

Forecast Period |

2022–2027 |

|

Market Growth and Revenue Forecast |

USD (Million/Billion) |

|

Top Players |

|

|

Fastest Growing Market |

By EV Type, BEV |

|

Largest Market |

Asia Pacific |

|

Segments Covered |

|

|

By Technology |

Hydraulic Power Steering, Electrically assisted Hydraulic Power Steering, Electric Power Steering |

|

By Component |

Sensors, Steering Column, Mechanical Rack and Pinion, Electric Motor, ECU, Hydraulic Pump |

|

By Off-Highway |

Agricultural Tractors, Construction Equipment |

|

By Electric Motor Type |

Brushless, Brushed |

|

By Application |

PCs, LCVs, HCVs |

|

By Electric Vehicle |

BEV, PHEV, FCEV |

|

By EPS Type |

C-EPS, P-EPS, R-EPS |

|

By EPS Mechanism |

Collapsible, Rigid |

|

By Pinion |

Single, Dual |

|

Aftermarket by component |

Hydraulic pump, electric motor, steering column |

|

By Region |

Asia Pacific (China, India, Japan, South Korea), Europe (Germany, UK, France, Spain, Italy, Turkey, Russia, and Rest of Europe), North America (US, Canada, and Mexico), and Rest of the World (Brazil, South Africa) |

|

Additional Customization to be offered |

|

Recent Developments

- In October 2022, Nexteer introduced a new EPS product with a platform design and an expandable electronic control system; mCEPS meets customers’ needs for an advanced, customizable, and cost-effective steering system that is flexible to customer packaging and other requirements.

- In September 2022, Hyundai Mobis launched the Dual Actuator Rear Wheel Steering System. The system can reduce the turning radius by up to 25% and improve stability and comfort when the vehicle turns at high speed. It is expected to be useful, particularly on narrow roads and without parking spaces. Furthermore, the demand for rear-wheel steering systems is increasing in electric vehicles with an enlarged wheelbase.

- In May 2022, NSK Ltd. and ThyssenKrupp AG signed a memorandum of understanding to explore a joint venture between NSK Steering and ThyssenKrupp Automotive. The steering businesses of both companies are highly complementary and synergetic in terms of product competencies, geographic footprints, and customer groups. It is expected the combined technological capabilities will enable the joint venture to meet the broad and highly technological needs better

Frequently Asked Questions (FAQ):

What is the current size of the Automotive Steering System market?

The global Automotive Steering System market is projected to grow from USD 35.3 Billion in 2022 to USD 39.5 Billion by 2027, at a CAGR of 2.3% over the forecast period.

Who are the top key players in the Automotive Steering System market?

The Automotive Steering System industry is dominated by global players and comprises several regional players, JTEKT Corporation (Japan), Nexteer (US), Robert Bosch (Germany), Hyundai Mobis (South Korea), and NSK Ltd. (Japan).

What are the trends in the Automotive Steering System market?

Increasing electrification in vehicles to drive market growth for electrically assisted power steering systems.

Technological developments, such as steer-by-wire and ADAS, for autonomous vehicles.

The fall of hydraulic power steering system in passenger cars and the rise of electrically assisted steering systems in LCVs.

Which are the most prominent factors driving the Automotive Steering System market?

Stringent fuel efficiency norms.

Increasing consumer preference for driving comfort and technologically advanced vehicles.

How would EVs impact the automotive steering system market?

EVs have a large battery pack from which the power for propulsion is drawn. This large reservoir of electrical energy is perfectly suited for EPS technology that utilizes electric motors to assist the steering mechanism. As the market share for EVs grow, so will the adoption of EPS owing to its excellent compatibility with EVs. They will likely skew the market share towards EPS technology in both passenger and commercial vehicle segments.

What is the impact of R&D in autonomous vehicle space on the steering system industry?

Steer-by-Wire (SbW) technology has been at the heart of the global steering system innovation ecosystem. The development of SbW has completely changed the way steering systems work. SbW has no mechanical linkage between the steering wheel and the mechanism turning the wheels, allowing for overall weight reduction of the vehicle and thus improving efficiency. SbW also allows for integrating software features such as ADAS for connected cars, paving the way for autonomous mobility. Companies such as Nexteer Automotive, ZF Friedrichshafen AG, and Bosch lead the R&D in SbW technology.

What would be the Revenue shift in the steering industry?

With the electrification of steering systems in passenger cars and LCVs, the revenue will likely shift towards EPS technology. As a result, the revenue generated from Hydraulic Power Steering (HPS) is likely to reduce. HPS can witness growth in the agricultural tractor segment as HPS is now becoming a standard feature in tractors across the power segment.

By components, the revenue will shift away from the sales of hydraulic pumps towards more sales of ECUs, sensors, and electric motors used in EPS. A similar trend is to be witnessed in the aftermarket as well. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Stringent fuel emission norms and demand for lightweight systems- Increasing demand for driving comfort in commercial vehiclesRESTRAINTS- Limited load-bearing capacity of EPS systems- Lack of electrically assisted power steering for construction and mining equipmentOPPORTUNITIES- Adoption of steer-by-wire technology- Integrating EPS with ADASCHALLENGES- Cybersecurity concerns in EPS for connected cars- Low customer confidence in adopting steer-by-wire technology for autonomous mobility

-

5.3 TRADE ANALYSISIMPORT DATA- US- Germany- Mexico- UK- ChinaEXPORT DATA- UK- China- Canada- US- Germany

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRYPORTER’S FIVE FORCES ANALYSIS

-

5.5 RECESSION IMPACT ON ECONOMYINTRODUCTIONREGIONAL MACRO-ECONOMIC OVERVIEWANALYSIS OF KEY ECONOMIC INDICATORSECONOMIC STAGFLATION (SLOWDOWN) VS. ECONOMIC RECESSION- Europe- Asia Pacific- AmericasECONOMIC OUTLOOK/PROJECTIONS

-

5.6 RECESSION IMPACT ON AUTOMOTIVE SECTORANALYSIS OF AUTOMOTIVE VEHICLE SALES- Europe- Asia Pacific- AmericasAUTOMOTIVE SALES OUTLOOK

- 5.7 VALUE CHAIN: MARKET

- 5.8 SUPPLY CHAIN ANALYSIS

-

5.9 AUTOMOTIVE STEERING SYSTEM MARKET ECOSYSTEM

-

5.10 ROLE OF COMPANIES IN AUTOMOTIVE STEERING SYSTEM MARKET ECOSYSTEMAUTOMOTIVE STEERING SYSTEM MARKET: SUPPLY CHAIN

- 5.11 AVERAGE SELLING PRICE TREND

-

5.12 PATENT ANALYSISAPPLICATIONS AND PATENTS GRANTED, 2019–2022

- 5.13 REVENUE SHIFT FOR AUTOMOTIVE STEERING SYSTEM MANUFACTURERS

-

5.14 TECHNOLOGY ANALYSISSTOWABLE COLUMNS FOR AUTOMATED DRIVING AND ADDITIONAL COMFORTNEW STEERING TECHNOLOGY PROVIDING INTUITIVE DRIVINGADVANCED STEERING TECHNOLOGIES FOR SOFTWARE-DEFINED VEHICLES

-

5.15 CASE STUDY ANALYSISFUTURE-PROOFING VEHICLE STEERING SYSTEMSPREDICT IN-VEHICLE E-POWER STEERING SOUND & VIBRATION PERFORMANCE

-

5.16 KEY CONFERENCES AND EVENTS IN 2023BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 6.1 ASIA PACIFIC TO BE KEY MARKET FOR AUTOMOTIVE STEERING SYSTEMS

- 6.2 ELECTRICALLY ASSISTED POWER STEERING FOR HEAVY COMMERCIAL VEHICLES - KEY FOCUS AREA

- 6.3 CONCLUSION

-

7.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

- 7.2 HYDRAULIC POWER STEERING (HPS)

- 7.3 ELECTRICALLY ASSISTED HYDRAULIC POWER STEERING (EHPS)

- 7.4 ELECTRIC POWER STEERING (EPS)

-

8.1 INTRODUCTIONRESEARCH METHODOLOGYINDUSTRY INSIGHTSASSUMPTIONS

- 8.2 PASSENGER CARS

- 8.3 LIGHT COMMERCIAL VEHICLES (LCVS)

- 8.4 HEAVY COMMERCIAL VEHICLES (HCVS)

-

9.1 INTRODUCTIONRESEARCH METHODOLOGYPRIMARY INDUSTRY INSIGHTSASSUMPTIONS

- 9.2 AGRICULTURAL TRACTORS

- 9.3 CONSTRUCTION EQUIPMENT

-

10.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

-

10.2 HYDRAULIC PUMPSHYDRAULIC PUMPS TO WITNESS DECLINING DEMAND OWING TO WIDER EPS ADOPTION

-

10.3 STEERING COLUMNSASIA PACIFIC TO BE LARGEST MARKET DUE TO INCREASED POWER STEERING ADOPTION

-

10.4 STEERING ANGLE SENSORSGROWING ADOPTION OF EHPS AND EPS TO DRIVE STEERING ANGLE SENSOR DEMAND

-

10.5 TORQUE SENSORSGROWING PREMIUM VEHICLE SEGMENT TO DRIVE TORQUE SENSOR DEMAND

-

10.6 ELECTRONIC CONTROL UNITSRAPID ADOPTION OF ELECTRIC POWER STEERING TO DRIVE DEMAND FOR ELECTRONIC CONTROL UNITS

-

10.7 ELECTRIC MOTORSELECTRIFICATION OF STEERING SYSTEMS TO DRIVE DEMAND FOR ELECTRIC MOTORS

-

10.8 MECHANICAL RACKS AND PINIONSEUROPE TO BE SECOND-LARGEST MARKET FOR STEERING RACK AND PINION ASSEMBLY

-

10.9 BEARINGSDEMAND FOR BEARINGS TO BE HIGHEST IN ASIA PACIFIC

-

11.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

- 11.2 COLUMN-EPS (C-EPS)

- 11.3 PINION-EPS (P-EPS)

- 11.4 RACK-EPS (R-EPS)

-

12.1 INTRODUCTIONRESEARCH METHODOLOGYPRIMARY INDUSTRY INSIGHTSASSUMPTIONS

- 12.2 ASIA PACIFIC

- 12.3 EUROPE

- 12.4 NORTH AMERICA

- 12.5 BATTERY ELECTRIC VEHICLE (BEV)

- 12.6 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 12.7 FUEL CELL ELECTRIC VEHICLE (FCEV)

-

13.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONS

- 13.2 BRUSHED DC MOTOR

- 13.3 BRUSHLESS DC MOTOR

-

14.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

- 14.2 COLLAPSIBLE EPS

- 14.3 RIGID EPS

-

15.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

- 15.2 SINGLE PINION

- 15.3 DUAL PINION

-

16.1 INTRODUCTIONRESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

- 16.2 HYDRAULIC PUMPS

- 16.3 STEERING COLUMNS

- 16.4 ELECTRIC MOTORS

-

17.1 RESEARCH METHODOLOGYASSUMPTIONSINDUSTRY INSIGHTS

- 17.2 INTRODUCTION

-

17.3 ASIA PACIFICRECESSION IMPACTCHINA- Rapid adoption of EVs to boost demand for EPS and EHPS across vehicle segmentsINDIA- EPS to be dominant technology in passenger carsJAPAN- Electrification of automotive vehicles to increase demand for EPS and EHPS systemsSOUTH KOREA- Growing electric vehicle sales in mid-level segment to drive demand for EPS technologyREST OF ASIA PACIFIC

-

17.4 EUROPERECESSION IMPACTGERMANY- EPS to be standard steering technology across passenger car segmentFRANCE- Increased penetration of luxury MPVs to drive demand for EPS technologyUK- Growing EV sales to drive demand for EHPS and EPS systemsITALY- Increased manufacturing of premium and luxury vehicles to boost demand for EHPS and EPS systemsSPAIN- Growing LCV and MPV sales to drive demand for EPS technologyTURKEY- Growing LCV sales to drive demand for EHPS systems

-

17.5 NORTH AMERICARECESSION IMPACTUS- Ease in steering effort to drive EPS demand in LCVs and HCVsCANADA- LCVs to shift from EHPS to EPS technology in CanadaMEXICO- Growing economy and rising income levels to drive demand for EPS technology

-

17.6 REST OF THE WORLDRECESSION IMPACTBRAZIL- Fuel efficiency to drive demand for EPS in passenger carsRUSSIA- HPS to witness slower demand from passenger car segmentSOUTH AFRICA- EPS to be fastest-growing steering technology in South Africa

- 18.1 OVERVIEW

- 18.2 AUTOMOTIVE STEERING SYSTEM MARKET SHARE ANALYSIS, 2021

-

18.3 MARKET SHARE ANALYSIS OF STEERING SYSTEM COMPONENTSAUTOMOTIVE STEERING SYSTEM MARKET SHARE ANALYSIS, 2021- Japan: Steering system market share analysis, 2021- China: Steering system market share analysis, 2021- Americas: Steering system market share analysis, 2021- ASEAN, India, South Korea: Steering system market share analysis, 2021STEERING COLUMNS/SHAFTS- Japan: Steering columns/shafts market share analysis, 2021- ASEAN, India, South Korea: Steering columns/shafts market share analysis, 2021STEERING KNUCKLES- Japan: Steering knuckles market share analysis, 2021- Thailand: Steering knuckles market share analysis, 2021STEERING WHEELS- Global: Steering wheels market share analysis, 2021

-

18.4 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

18.5 COMPETITIVE SCENARIONEW PRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS, 2019–2022

- 18.6 RIGHT TO WIN

- 18.7 COMPETITIVE BENCHMARKING

-

19.1 KEY PLAYERSJTEKT CORPORATION- Business overview- Products offered- Recent developments- MnM viewNEXTEER AUTOMOTIVE- Business overview- Products offered- Recent developments- MnM viewZF FRIEDRICHSHAFEN AG- Business overview- Products offered- Recent developments- MnM viewROBERT BOSCH- Business overview- Products offered- MnM viewNSK LTD.- Business overview- Products offered- Recent developments- MnM viewHYUNDAI MOBIS- Business overview- Products offered- Recent developments- Recent developmentsHITACHI ASTEMO- Business overview- Products offeredTHYSSENKRUPP- Business overview- Products offered- Recent developmentsMITSUBISHI ELECTRIC- Business overview- Products offeredKYB CORPORATION- Business overview- Products offeredMANDO CORPORATION- Business overview- Products offered- Recent developmentsHYCET TECHNOLOGY CO., LTD.- Business overview- Products offered

-

19.2 OTHER PLAYERSMAVAL INDUSTRIESTENNECOGSS STEERING SYSTEMS LLCHELLA GMBH & CO. KGAAYUBEI POWER STEERING SYSTEM CO., LTD.HUHEI HENGLONG AUTO SYSTEM GROUPBORGWARNERDENSO CORPORATION

- 20.1 INSIGHTS FROM INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS

- TABLE 1 STEERING RACK FORCE LIMIT, BY PASSENGER CAR SEGMENT

- TABLE 2 US: IMPORT SHARE, BY COUNTRY, VALUE (%)

- TABLE 3 GERMANY: IMPORT SHARE, BY COUNTRY, VALUE (%)

- TABLE 4 MEXICO: IMPORT SHARE, BY COUNTRY, VALUE (%)

- TABLE 5 UK: IMPORT SHARE, BY COUNTRY, VALUE (%)

- TABLE 6 CHINA: IMPORT SHARE, BY COUNTRY, VALUE (%)

- TABLE 7 UK: EXPORT SHARE, BY COUNTRY, VALUE (%)

- TABLE 8 CHINA: EXPORT SHARE, BY COUNTRY, VALUE (%)

- TABLE 9 CANADA: EXPORT SHARE, BY COUNTRY, VALUE (%)

- TABLE 10 US: EXPORT SHARE, BY COUNTRY, VALUE (%)

- TABLE 11 GERMANY: EXPORT SHARE, BY COUNTRY, VALUE (%)

- TABLE 12 KEY ECONOMIC INDICATORS FOR SELECT COUNTRIES, 2021–2022

- TABLE 13 EUROPE: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 14 ASIA PACIFIC: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 15 AMERICAS: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 16 GDP GROWTH PROJECTIONS FOR KEY COUNTRIES, 2024–2027 (% GROWTH)

- TABLE 17 AVERAGE REGIONAL PRICE TREND: AUTOMOTIVE STEERING SYSTEM MARKET (USD/UNIT), 2022

- TABLE 18 AVERAGE GLOBAL PRICE TREND: AUTOMOTIVE STEERING SYSTEM MARKET, BY TYPE (USD/UNIT), 2022

- TABLE 19 KEY BUYING CRITERIA FOR STEERING SYSTEM TECHNOLOGIES

- TABLE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR AUTOMOTIVE STEERING SYSTEM TECHNOLOGIES (%)

- TABLE 21 AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 22 AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 23 AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 24 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 25 HYDRAULIC POWER STEERING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 26 HYDRAULIC POWER STEERING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 27 HYDRAULIC POWER STEERING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 28 HYDRAULIC POWER STEERING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 ELECTRICALLY ASSISTED HYDRAULIC POWER STEERING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 30 ELECTRICALLY ASSISTED HYDRAULIC POWER STEERING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 31 ELECTRICALLY ASSISTED HYDRAULIC POWER STEERING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 32 ELECTRICALLY ASSISTED HYDRAULIC POWER STEERING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 ELECTRIC POWER STEERING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 34 ELECTRIC POWER STEERING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 35 ELECTRIC POWER STEERING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 36 ELECTRIC POWER STEERING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

- TABLE 38 MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

- TABLE 39 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 40 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

- TABLE 41 PASSENGER CARS STEERING SYSTEM MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 42 PASSENGER CARS STEERING SYSTEM MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 43 PASSENGER CARS STEERING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 44 PASSENGER CARS STEERING SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 LIGHT COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 46 LIGHT COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 47 LIGHT COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 48 LIGHT COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 HEAVY COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 50 HEAVY COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 51 HEAVY COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 52 HEAVY COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 53 OFF-HIGHWAY STEERING SYSTEM MARKET, BY EQUIPMENT TYPE, 2018–2021 (THOUSAND UNITS)

- TABLE 54 OFF-HIGHWAY STEERING SYSTEM MARKET, BY EQUIPMENT TYPE, 2022–2027 (THOUSAND UNITS)

- TABLE 55 OFF-HIGHWAY STEERING SYSTEM MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD MILLION)

- TABLE 56 OFF-HIGHWAY STEERING SYSTEM MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 57 AGRICULTURAL TRACTORS: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 58 AGRICULTURAL TRACTORS: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 59 AGRICULTURAL TRACTORS: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 60 AGRICULTURAL TRACTORS: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 61 CONSTRUCTION EQUIPMENT: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 62 CONSTRUCTION EQUIPMENT: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 63 CONSTRUCTION EQUIPMENT: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 64 CONSTRUCTION EQUIPMENT: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 65 MARKET, BY COMPONENT, 2018–2021 (THOUSAND UNITS)

- TABLE 66 MARKET, BY COMPONENT, 2022–2027 (THOUSAND UNITS)

- TABLE 67 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 68 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 69 HYDRAULIC PUMPS: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 70 HYDRAULIC PUMPS: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 71 HYDRAULIC PUMPS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 72 HYDRAULIC PUMPS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 73 STEERING COLUMNS: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 74 STEERING COLUMNS: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 75 STEERING COLUMNS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 76 STEERING COLUMNS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 77 STEERING ANGLE SENSORS: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 78 STEERING ANGLE SENSORS: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 79 STEERING ANGLE SENSORS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 80 STEERING ANGLE SENSORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 81 TORQUE SENSORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 82 TORQUE SENSORS: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 83 TORQUE SENSORS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 84 TORQUE SENSORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 85 ELECTRONIC CONTROL UNITS: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 86 ELECTRONIC CONTROL UNITS: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 87 ELECTRONIC CONTROL UNITS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 88 ELECTRONIC CONTROL UNITS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 89 ELECTRIC MOTORS: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 90 ELECTRIC MOTORS: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 91 ELECTRIC MOTORS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 92 ELECTRIC MOTORS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 93 MECHANICAL RACKS AND PINIONS: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 94 MECHANICAL RACKS AND PINIONS: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 95 MECHANICAL RACKS AND PINIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 96 MECHANICAL RACKS AND PINIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 97 BEARINGS: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 98 BEARINGS: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 99 BEARINGS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 100 BEARINGS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 101 ELECTRIC POWER STEERING MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

- TABLE 102 ELECTRIC POWER STEERING MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

- TABLE 103 ELECTRIC POWER STEERING MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 104 ELECTRIC POWER STEERING MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 105 COLUMN-EPS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 106 COLUMN-EPS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 107 COLUMN-EPS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 108 COLUMN-EPS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 109 PINION-EPS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 110 PINION-EPS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 111 PINION-EPS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 112 PINION-EPS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 113 RACK-EPS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 114 RACK-EPS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 115 RACK-EPS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 116 RACK-EPS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 117 ELECTRIC POWER STEERING MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

- TABLE 118 ELECTRIC POWER STEERING MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

- TABLE 119 ELECTRIC POWER STEERING MARKET, BY ELECTRIC VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 120 ELECTRIC POWER STEERING MARKET, BY ELECTRIC VEHICLE TYPE, 2022–2027 (USD MILLION)

- TABLE 121 BEV STEERING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 122 BEV STEERING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 123 BEV STEERING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 124 BEV STEERING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 125 PHEV STEERING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 126 PHEV STEERING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 127 PHEV STEERING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 128 PHEV STEERING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 129 FCEV STEERING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 130 FCEV STEERING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 131 FCEV STEERING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 132 FCEV STEERING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 133 MARKET, BY ELECTRIC MOTOR TYPE, 2018–2021 (THOUSAND UNITS)

- TABLE 134 MARKET, BY ELECTRIC MOTOR TYPE, 2022–2027 (THOUSAND UNITS)

- TABLE 135 MARKET, BY ELECTRIC MOTOR TYPE, 2018–2021 (USD MILLION)

- TABLE 136 MARKET, BY ELECTRIC MOTOR TYPE, 2022–2027 (USD MILLION)

- TABLE 137 BRUSHED DC MOTOR: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 138 BRUSHED DC MOTOR: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 139 BRUSHED DC MOTOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 140 BRUSHED DC MOTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 141 BRUSHLESS DC MOTOR: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 142 BRUSHLESS DC MOTOR: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 143 BRUSHLESS DC MOTOR: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 144 BRUSHLESS DC MOTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 145 ELECTRIC POWER STEERING SYSTEM MARKET, BY MECHANISM, 2018–2021 (THOUSAND UNITS)

- TABLE 146 ELECTRIC POWER STEERING SYSTEM MARKET, BY MECHANISM, 2022–2027 (THOUSAND UNITS)

- TABLE 147 ELECTRIC POWER STEERING SYSTEM MARKET, BY MECHANISM, 2018–2021 (USD MILLION)

- TABLE 148 ELECTRIC POWER STEERING SYSTEM MARKET, BY MECHANISM, 2022–2027 (USD MILLION)

- TABLE 149 COLLAPSIBLE EPS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 150 COLLAPSIBLE EPS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 151 COLLAPSIBLE EPS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 152 COLLAPSIBLE EPS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 153 RIGID EPS MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 154 RIGID EPS MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 155 RIGID EPS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 156 RIGID EPS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 157 MARKET, BY PINION TYPE, 2018–2021 (THOUSAND UNITS)

- TABLE 158 MARKET, BY PINION TYPE, 2022–2027 (THOUSAND UNITS)

- TABLE 159 MARKET, BY PINION TYPE, 2018–2021 (USD MILLION)

- TABLE 160 MARKET, BY PINION TYPE, 2022–2027 (USD MILLION)

- TABLE 161 SINGLE PINION: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 162 SINGLE PINION: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 163 SINGLE PINION: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 164 SINGLE PINION: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 165 DUAL PINION: MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 166 DUAL PINION: MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 167 DUAL PINION: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 168 DUAL PINION: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 169 AUTOMOTIVE STEERING SYSTEM AFTERMARKET, BY COMPONENT, 2018–2021 (MILLION UNITS)

- TABLE 170 AUTOMOTIVE STEERING SYSTEM AFTERMARKET, BY COMPONENT, 2022–2027 (MILLION UNITS)

- TABLE 171 AUTOMOTIVE STEERING SYSTEM AFTERMARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 172 AUTOMOTIVE STEERING SYSTEM AFTERMARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 173 HYDRAULIC PUMPS AFTERMARKET, BY REGION, 2018–2021 (MILLION UNITS)

- TABLE 174 HYDRAULIC PUMPS AFTERMARKET, BY REGION, 2022–2027 (MILLION UNITS)

- TABLE 175 HYDRAULIC PUMPS AFTERMARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 176 HYDRAULIC PUMPS AFTERMARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 177 STEERING COLUMNS AFTERMARKET, BY REGION, 2018–2021 (MILLION UNITS)

- TABLE 178 STEERING COLUMNS AFTERMARKET, BY REGION, 2022–2027 (MILLION UNITS)

- TABLE 179 STEERING COLUMNS AFTERMARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 180 STEERING COLUMNS AFTERMARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 181 ELECTRIC MOTORS AFTERMARKET, BY REGION, 2018–2021 (MILLION UNITS)

- TABLE 182 ELECTRIC MOTORS AFTERMARKET, BY REGION, 2022–2027 (MILLION UNITS)

- TABLE 183 ELECTRIC MOTORS AFTERMARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 184 ELECTRIC MOTORS AFTERMARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 185 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 186 MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

- TABLE 187 MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 188 MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 189 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

- TABLE 190 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

- TABLE 191 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 192 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 193 CHINA: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 194 CHINA: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 195 CHINA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 196 CHINA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 197 INDIA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 198 INDIA: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 199 INDIA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 200 INDIA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 201 JAPAN: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 202 JAPAN: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 203 JAPAN: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 204 JAPAN: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 205 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 206 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 207 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 208 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 210 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 211 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 213 EUROPE: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

- TABLE 214 EUROPE: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

- TABLE 215 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 216 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 217 GERMANY: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 218 GERMANY: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 219 GERMANY: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 220 GERMANY: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 221 FRANCE: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 222 FRANCE: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 223 FRANCE: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 224 FRANCE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 225 UK: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 226 UK: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 227 UK: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 228 UK: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 229 ITALY: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 230 ITALY: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 231 ITALY: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 232 ITALY: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 233 SPAIN: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 234 SPAIN: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 235 SPAIN: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 236 SPAIN: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 237 TURKEY: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 238 TURKEY: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 239 TURKEY: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 240 TURKEY: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 241 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

- TABLE 242 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

- TABLE 243 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 244 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 245 US: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 246 US: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 247 US: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 248 US: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 249 CANADA: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 250 CANADA: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 251 CANADA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 252 CANADA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 253 MEXICO: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 254 MEXICO: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 255 MEXICO: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 256 MEXICO: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 257 REST OF THE WORLD: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

- TABLE 258 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (THOUSAND UNITS)

- TABLE 259 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 260 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 261 BRAZIL: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 262 BRAZIL: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 263 BRAZIL: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 264 BRAZIL: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 265 RUSSIA: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 266 RUSSIA: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 267 RUSSIA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 268 RUSSIA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 269 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2018–2021 (THOUSAND UNITS)

- TABLE 270 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2022–2027 (THOUSAND UNITS)

- TABLE 271 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 272 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 273 MARKET SHARE ANALYSIS, 2021

- TABLE 274 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2019–2022

- TABLE 275 PRODUCT LAUNCHES, 2019–2022

- TABLE 276 DEALS, 2019–2022

- TABLE 277 OTHER DEVELOPMENTS, 2019–2022

- TABLE 278 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS, PARTNERSHIPS, AND SUPPLY CONTRACTS AS KEY GROWTH STRATEGIES FROM 2019 TO 2022

- TABLE 279 MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 280 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 281 JTEKT CORPORATION: BUSINESS OVERVIEW

- TABLE 282 JTEKT CORPORATION: PRODUCTS OFFERED

- TABLE 283 JTEKT CORPORATION: DEALS

- TABLE 284 JTEKT CORPORATION: OTHER DEVELOPMENTS

- TABLE 285 NEXTEER AUTOMOTIVE: BUSINESS OVERVIEW

- TABLE 286 NEXTEER AUTOMOTIVE: PRODUCTS OFFERED

- TABLE 287 NEXTEER AUTOMOTIVE: NEW PRODUCT DEVELOPMENTS

- TABLE 288 NEXTEER AUTOMOTIVE: OTHER DEVELOPMENTS

- TABLE 289 ZF FRIEDRICHSHAFEN AG: BUSINESS OVERVIEW

- TABLE 290 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

- TABLE 291 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 292 ROBERT BOSCH: BUSINESS OVERVIEW

- TABLE 293 ROBERT BOSCH: PRODUCTS OFFERED

- TABLE 294 NSK LTD.: BUSINESS OVERVIEW

- TABLE 295 NSK LTD.: PRODUCTS OFFERED

- TABLE 296 NSK LTD.: NEW PRODUCT DEVELOPMENTS

- TABLE 297 NSK LTD.: DEALS

- TABLE 298 HYUNDAI MOBIS: BUSINESS OVERVIEW

- TABLE 299 HYUNDAI MOBIS: PRODUCTS OFFERED

- TABLE 300 HYUNDAI MOBIS: NEW PRODUCT DEVELOPMENTS

- TABLE 301 HYUNDAI MOBIS: DEALS

- TABLE 302 HITACHI ASTEMO: BUSINESS OVERVIEW

- TABLE 303 HITACHI ASTEMO: PRODUCTS OFFERED

- TABLE 304 THYSSENKRUPP: BUSINESS OVERVIEW

- TABLE 305 THYSSENKRUPP: PRODUCTS OFFERED

- TABLE 306 THYSSENKRUPP: OTHER DEVELOPMENTS

- TABLE 307 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

- TABLE 308 MITSUBISHI ELECTRIC: PRODUCTS OFFERED

- TABLE 309 KYB CORPORATION: BUSINESS OVERVIEW

- TABLE 310 KYB CORPORATION: PRODUCTS OFFERED

- TABLE 311 MANDO CORPORATION: BUSINESS OVERVIEW

- TABLE 312 MANDO CORPORATION: PRODUCTS OFFERED

- TABLE 313 MANDO CORPORATION: DEALS

- TABLE 314 MANDO CORPORATION: OTHER DEVELOPMENTS

- TABLE 315 HYCET TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 316 HYCET TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 317 MAVAL INDUSTRIES: BUSINESS OVERVIEW

- TABLE 318 TENNECO: BUSINESS OVERVIEW

- TABLE 319 GSS STEERING SYSTEMS LLC: BUSINESS OVERVIEW

- TABLE 320 HELLA GMBH & CO. KGAA: BUSINESS OVERVIEW

- TABLE 321 YUBEI POWER STEERING SYSTEM CO., LTD.: BUSINESS OVERVIEW

- TABLE 322 HUHEI HENGLONG AUTO SYSTEM GROUP: BUSINESS OVERVIEW

- TABLE 323 BORGWARNER: BUSINESS OVERVIEW

- TABLE 324 DENSO CORPORATION: BUSINESS OVERVIEW

- FIGURE 1 MARKET SEGMENTATION: AUTOMOTIVE STEERING SYSTEM MARKET

- FIGURE 2 AUTOMOTIVE STEERING SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MARKET: BOTTOM-UP APPROACH

- FIGURE 7 MARKET BY TYPE: TOP-DOWN APPROACH

- FIGURE 8 MARKET: RESEARCH DESIGN AND METHODOLOGY

- FIGURE 9 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 10 PRE- & POST-RECESSION SCENARIO: MARKET, 2018–2027 (USD MILLION)

- FIGURE 11 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 INCREASING CONSUMER PREFERENCE FOR DRIVING COMFORT TO DRIVE MARKET

- FIGURE 13 MECHANICAL RACK & PINIONS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 EPS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 PASSENGER CARS TO SHOWCASE LARGEST DEMAND FOR STEERING SYSTEMS OVER NEXT FIVE YEARS

- FIGURE 16 C-EPS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 ELECTRIC MOTORS SEGMENT TO LEAD AUTOMOTIVE STEERING SYSTEM AFTERMARKET DURING FORECAST PERIOD

- FIGURE 18 BRUSHLESS DC MOTOR OFFERS SIGNIFICANTLY HIGHER EFFICIENCY AND BETTER PERFORMANCE THAN BRUSHED DC MOTOR

- FIGURE 19 INCREASING FOCUS ON DRIVER SAFETY LEADS TO INCREASED DEMAND FOR COLLAPSIBLE EPS

- FIGURE 20 DUAL PINION STEERING SYSTEMS OFFER OPTIMIZED DRIVING EXPERIENCE AND DESIGN FLEXIBILITY

- FIGURE 21 INCREASING EV SALES TO DRIVE DEMAND FOR EPS BY EV TYPE

- FIGURE 22 HYDRAULIC STEERING INCREASES FUEL EFFICIENCY IN OFF-HIGHWAY SEGMENT

- FIGURE 23 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 24 MARKET: MARKET DYNAMICS

- FIGURE 25 GLOBAL EMISSION REGULATIONS FOR LIGHT DUTY VEHICLES, BY COUNTRY, 2014–2025

- FIGURE 26 ILLUSTRATIVE MODEL OF STEER-BY-WIRE TECHNOLOGY

- FIGURE 27 PROS AND CONS OF STEER-BY-WIRE SYSTEMS

- FIGURE 28 PORTER’S FIVE FORCES ANALYSIS: PRESENCE OF ESTABLISHED GLOBAL PLAYERS INCREASES DEGREE OF COMPETITION

- FIGURE 29 EUROPE: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022 (UNITS)

- FIGURE 30 ASIA PACIFIC: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022 (UNITS)

- FIGURE 31 AMERICAS: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022 (UNITS)

- FIGURE 32 EUROPE: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2027 (‘000 UNITS)

- FIGURE 33 ASIA PACIFIC: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2027 (‘000 UNITS)

- FIGURE 34 NORTH AMERICA: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2027 (‘000 UNITS)

- FIGURE 35 VALUE CHAIN: MARKET

- FIGURE 36 MARKET: ECOSYSTEM

- FIGURE 37 SHIFT OF FOCUS TOWARD ELECTRICALLY ASSISTED STEERING SYSTEMS

- FIGURE 38 KEY BUYING CRITERIA FOR DIFFERENT STEERING SYSTEM TECHNOLOGIES

- FIGURE 39 MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- FIGURE 40 MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 41 OFF-HIGHWAY STEERING SYSTEM MARKET, BY EQUIPMENT TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 42 MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

- FIGURE 43 ELECTRIC POWER STEERING MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 44 ELECTRIC POWER STEERING MARKET, BY ELECTRIC VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 45 MARKET, BY ELECTRIC MOTOR TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 46 ELECTRIC POWER STEERING SYSTEM MARKET, BY MECHANISM, 2022 VS. 2027 (USD MILLION)

- FIGURE 47 MARKET, BY PINION TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 48 AUTOMOTIVE STEERING SYSTEM AFTERMARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

- FIGURE 49 MARKET, BY REGION, 2022 (USD MILLION)

- FIGURE 50 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 51 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- FIGURE 52 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 53 MARKET SHARE ANALYSIS, 2021

- FIGURE 54 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- FIGURE 55 COMPETITIVE EVALUATION MATRIX (AUTOMOTIVE STEERING SYSTEM MANUFACTURERS), 2021

- FIGURE 56 COMPANY SNAPSHOT: JTEKT CORPORATION

- FIGURE 57 COMPANY SNAPSHOT: NEXTEER AUTOMOTIVE

- FIGURE 58 COMPANY SNAPSHOT: ZF FRIEDRICHSHAFEN AG

- FIGURE 59 COMPANY SNAPSHOT: ROBERT BOSCH

- FIGURE 60 COMPANY SNAPSHOT: NSK LTD.

- FIGURE 61 COMPANY SNAPSHOT: HYUNDAI MOBIS

- FIGURE 62 COMPANY SNAPSHOT: HITACHI ASTEMO

- FIGURE 63 COMPANY SNAPSHOT: THYSSENKRUPP

- FIGURE 64 COMPANY SNAPSHOT: MITSUBISHI ELECTRIC

- FIGURE 65 COMPANY SNAPSHOT: KYB CORPORATION

- FIGURE 66 COMPANY SNAPSHOT: MANDO CORPORATION

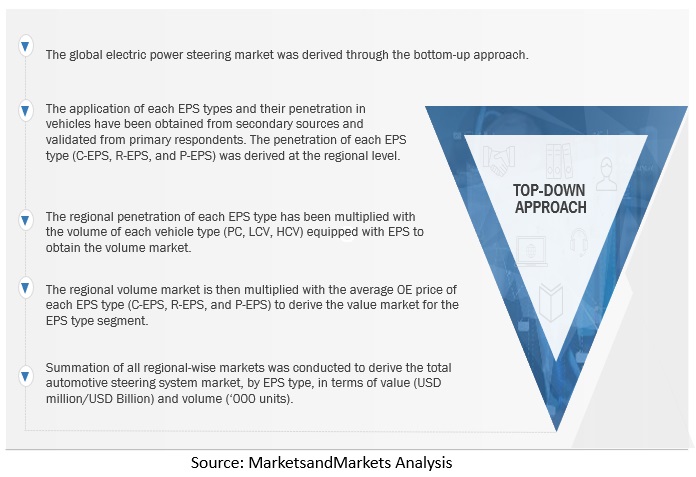

The study involves four main activities to estimate the current size of the Automotive Steering System market.

- Exhaustive secondary research was done to collect information on the market, such as components, EPS, By EV type, vehicle type, aftermarket, off-highway vehicles, technology, and region.

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

- Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered under this study.

- Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include auto industry organizations (such as AEM); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the automotive steering system market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (OEMs) and supply (automotive steering systems manufacturers) sides across the globe. Approximately 20% and 80%, respectively, of primary interviews were conducted from both the demand and supply sides. Primary data was collected through questionnaires, e-mails, and telephonic interviews.

After interacting with industry participants, brief sessions were also conducted with highly experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject-matter experts’ opinions, has led to the findings as described in the remainder of the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the automotive steering system market and other dependent submarkets, as mentioned below:

- Key players in the automotive steering market were identified through secondary research, and their market share was determined through primary and secondary research.

- The research methodology included the study of annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights.

- All application-level penetration rates, percentage shares, splits, and breakdowns for the automotive steering system market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Automotive Steering System Market Size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Steering System Market Size: Top-Down Approach ( RIM Size)

Report Objectives

- To define, describe, and forecast the off-the-road (OTR) tires and retreading market with respect to individual growth trends and prospects and determine the contribution of each segment to the total market.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with Porter’s five forces analysis, trade analysis, trends/disruptions impacting buyers, case studies, patent analysis, supply chain analysis, market ecosystem, regulatory analysis, technology trend, and the COVID-19 impact on the Automotive Steering System market.

- To analyze the impact of COVID-19 on the market.

- To analyze the market share of leading players in the market and evaluate competitive leadership mapping.

- To strategically analyze the key player strategies/right to win and company revenue analysis.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To provide an analysis of recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the global Automotive Steering System market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs

With the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Country Information

- Vehicle Type segment at country level

- EPS- Type segment at country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Pricing Analysis

- Detailed pricing analysis for each type of steering type

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Steering System Market

We are interested in Automotive Steering System Market by technology electric power steering (EPS), electrically assisted hydraulic power steering (EHPS), and hydraulic power steering (HPS).

I need more details on how global key players are dominating the Automotive Steering System Market