Rubber Molding Market for Automotive Components & Sub-Components (Rings, Weather-strips, Gaskets, Seals, Hoses, Grommets, & Bellows), Material (EPDM, NR, SBR & Others), Vehicle Type (Passenger car, LCV & HCV) & Region - Global Trends & Forecast to 2020

[273 Pages Report] The automotive rubber molded components market is driven by increased adoption of lightweight materials in automobiles and the increasingly stringent emission, safety, and fuel economy norms. The automotive rubber molded components market, in terms of value, is projected to grow at a CAGR of 5.20% from 2015 to 2020, to reach a market size of USD 40.5 Billion by 2020. The study segments the automotive rubber molded components market on the basis of components, material type, vehicle type, and region.

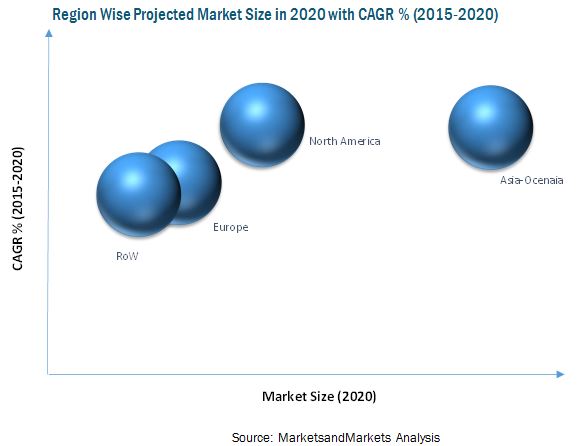

The rubber molded components market is driven by technological advancements. These include the formula developed by Ford Motor Co.'s biomaterial researchers, which enables renewable soy oil to be used to improve rubber car parts and make them more eco-friendly. The use of this soy oil as a 25% replacement for petroleum oil doubles the rubber's stretch ability and reduces its environmental impact. Asia-Oceania is estimated to be the largest market, while China is estimated to be one of the largest markets for automotive rubber molded components in Asia-Oceania. The sizeable population and low production cost in the country have resulted in a high demand for vehicles. Asia-Oceania is known for producing compact and cost-effective cars. Given the low production costs, easy availability of economical labor, lenient emission and safety norms, and government initiatives for FDIs, the region has witnessed higher growth than the matured markets of Europe and North America.

The research methodology used in the report involves various secondary sources including paid databases and directories. Experts from related industries and suppliers have been interviewed to understand the future trends of the automotive rubber molded components market. The bottom-up approach has been used to estimate the market size, in which country-wise vehicle production statistics has been taken into account for each vehicle type.

In order to arrive at the market size, in terms of volume, for automotive rubber molded components, the average number of molded components that go into each vehicle category has been identified and multiplied by vehicle production numbers to get the country-level rubber molded components volume. This country-wise market size, in terms of volume, of rubber molded components for each vehicle type is then multiplied with the country-wise average OE price (AOP) of rubber molded components required for each application. This results in the country-wise market size, in terms of value. The summation of the country-wise market gives the regional market and further summation of the regional market provides the global automotive rubber molded components market.

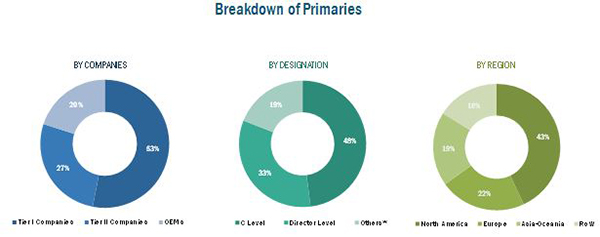

Figure below shows the break-up of profile of industry experts who participated in primary discussions.

Industry Ecosystem

Some of the key industry players which comprise the ecosystem of Rubber Molded Components market are given below:

- OEMs (Original Equipment Manufacturers) : General Motors Company, Ford Motor Company, Toyota Motor Corporation, Volkswagen AG, Daimler AG, BMW Group, PSA Peugeot Citroλn & Others

- Rubber Molded Components Suppliers: Continental AG (Germany), Federal Mogul Corporation (U.S.), Cooper Standard Holdings Inc. (U.S.), Sumitomo Riko Co., Ltd. (Japan), Freudenberg & Co. KG (Germany) & Others

The automotive rubber molded components ecosystems consists of manufacturers such as Continental AG (Germany), Federal Mogul Corporation (U.S.) & Sumitomo Riko Co., Ltd. (Japan), automotive original equipment manufacturers (OEM) such as Toyota Motor Corporation (Japan), Volkswagen AG (Germany) & Ford Motor Company (U.S.), research institutes such as The Automotive Research Association of India (ARAI), European automotive research partners association (EARPA), & The United States Council for Automotive Research (USCAR) and regional automobile associations such as China Association of Automobile Manufacturers (CAAM), Japan Automobile Manufacturers Association (JAMA), & European Automobile Manufacturers Association (ACEA), among others.

Target Audience

- Raw material suppliers of the materials

- Original Equipment Manufacturers (OEMs)

- Dealers

- Distributors of automotive rubber molded components

- Industry Associations

- Private Equity Firms

Scope of the Report

This report segments the automotive rubber molded components market as follows:

- By Components: Seals (O-Ring Seals, Rotary Seals, Lip Seals, and Mechanical Seals), Weather-strips (Door Weather-strips, Window Weather-strips, Trunk Weather-strips, and Hood Weather-strips), Gaskets (Intake Manifold Gaskets, Exhaust Manifold Gaskets, Oil Pan Gaskets, and Valve Cover Gaskets), Hoses, Grommets, and Bellows

- By Vehicle Type (Passenger Car, LCV, and HCV)

- By Material (EPDM (Ethylene Propylene Diene Terpolymer), NR (Natural Rubber), SBR (Styrene-Butadiene Rubber), and Others)

- By Region (North America, Asia-Oceania, Europe, and RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

- Automotive Rubber Molding Market, By OE, Additional Applications

- Hoses

- Hydraulic Clutch

- Transmission Oil Cooler

- HVAC Hoses

- Gaskets

- Cylinder Head Gaskets

- Cooling System Gaskets

- Water Pump Gaskets

- Fuel Pump Gaskets

- Diaphragm

- Vibration Damping

- Brake

- EGR

- Bellows

- Fuel Nozzle Bellows

- Valve Shaft Seal Bellows

- Hoses

- Automotive Rubber Molding Market, By Aftermarket

- Seals

- O-Ring Seals

- Rotary Seals

- Lip Seals

- Mechanical Seals

- Weather-strips

- Door Weather-strips

- Window Weather-strips

- Trunk Weather-strips

- Hood Weather-strips

- Gaskets

- Intake Manifold Gaskets

- Valve Cover Gaskets

- Hoses

- Diaphragms

- Bellows

- Seals

The automotive rubber molded components market, in terms of value, is projected to grow at a CAGR of 5.20% from 2015 to 2020, to reach a market size of USD 40.5 Billion by 2020. This growth can be attributed to factors such as the increasing adoption of lightweight materials, government regulations, fluctuating oil prices, environmental concerns, limited number of suppliers, and technological advances.

Asia-Oceania is estimated to occupy the largest share in the automotive rubber molded components market in 2015. With regard to material type, ethylene propylene diene terpolymer (EPDM) is estimated to dominate the market in 2015, followed by styrene-butadiene rubber (SBR). The increasing demand for comfort and safety creates promising growth opportunities for driver assistance systems, which incorporate automotive rubber molded components, and would consequently boost the demand for the same. Moreover, rubber molding materials such as EPDM or natural rubber (NR) provide better flexibility and are lighter than conventional metal parts. This results in an overall reduction in the vehicle weight, which in turn, helps to increase fuel efficiency. The replacement of conventional metal parts with rubber molded components will therefore help in meeting the stringent fuel economy and emission norms in regions such as North America and Europe.

The different types of components considered in the study are seals (O-ring, rotary, lip, and mechanical seals), weather-strips (door, window, trunk, and hood weather-strips), gaskets (intake manifold, exhaust manifold, oil pan, and valve cover gaskets), hoses, and bellows. The key material types identified in this study are EPDM, NR, SBR, and others. Additionally, the market is segmented by vehicle type (passenger car, light commercial vehicle, and heavy commercial vehicle) and by region (Asia-Oceania, North America, Europe, and RoW)

Increasing vehicle electrification (with systems such as start/stop system, electric power steering (EPS), liquid heater PTC, electric air-conditioner compressor, electric vacuum pump, electric oil pump, and electric water pump) and progressively stringent emission, safety, and fuel economy standards are driving the market for automotive rubber molded components. The growing demand for advanced driver assistance systems (ADAS) and safety features represent attractive opportunities for automotive rubber molded components.

Rising raw material prices pose a serious threat to the growth of this market. For instance, EPDM is one of the most versatile and fastest-growing rubber molding materials, and provides excellent resistance to heat, oxidation, ozone, and weather withstanding capacity. However, owing to its high cost, its use in the automotive market is restricted to high-end vehicles. The global automotive rubber molded components market is dominated by major players such as Continental AG (Germany), Federal-Mogul Corporation (U.S.), and Sumitomo Riko Co., Ltd. (Japan), among others. Continental AG is currently the market leader, and has adopted new product development and expansion as key strategies to gain traction in the market.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.2.1 Impact of GDP on Commercial Vehicle Sales

2.4.2.2 Vehicle Production Increasing in Developing Countries

2.4.2.3 Urbanization vs Passenger Cars Per 1,000 People

2.4.2.4 Infrastructure: Roadways

2.4.3 Supply Side Analysis

2.4.4 Technological Advancements

2.4.5 Influence of Other Factors

2.5 Market Estimation

2.5.1 Bottom-Up Approach

2.5.2 Data Triangulation

2.5.3 Assumptions

2.5.4 Other Assumptions

3 Executive Summary

4 Premium Insights

4.1 Opportunities in the Rubber Molding Components Market

4.2 Automotive Rubber Molded Components Regional Market Share and Growth Rate

4.3 Hose Segment to Dominate the Rubber Molding Components Market

4.4 EPDM to Be the Largest Segment, By Material

4.5 Life Cycle Analysis of Rubber Molding Process

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.2.1 Rubber Molding Components Market Segmentation: By Material

5.2.2 Rubber Molding Components Market Segmentation: By Component

5.2.3 Rubber Molding Components Market Segmentation: By Region

5.2.4 Rubber Molding Components Market Segmentation: By Vehicle Type

5.3 Technological Roadmap

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increased Adoption of Lightweight Materials in Automobiles

5.4.2 Restraints

5.4.2.1 Regulatory Issues

5.4.2.2 Price Volatility

5.4.3 Opportunities

5.4.3.1 Demand for Alternate Fuel Vehicles

5.4.4 Challenges

5.4.4.1 Extended Warranty and Increase in Average Life of Vehicles

5.4.5 Burning Issue

5.4.5.1 Counterfeiting

5.5 Porters Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Buyers

5.5.4 Bargaining Power of Suppliers

5.5.5 Intensity of Competitive Rivalry

5.6 Who Supplies to Whom

5.7 ASP (Average Selling Price) Analysis

5.8 Value Chain

6 Rubber Molding Components Market, By Region, Vehicle Type, & Component

6.1 Introduction

6.1.1 Seals

6.1.1.1 O-Rings

6.1.1.2 Rotary Seals

6.1.1.3 Lip Seals

6.1.1.4 Mechanical Seals

6.1.2 Weather-Strips

6.1.2.1 Door Weather-Strips

6.1.2.2 Window Weather-Strips

6.1.2.3 Trunk Weather-Strips

6.1.2.4 Hood Weather-Strips

6.1.3 Gaskets

6.1.3.1 Intake Manifold Gaskets

6.1.3.2 Exhaust Manifold Gaskets

6.1.3.3 Valve Cover Gaskets

6.1.3.4 Oil Pan Gaskets

6.1.4 Hoses

6.1.5 Diaphragms

6.1.6 Bellows

6.2 Asia-Oceania

6.2.1 Asia-Oceania: Rubber Molding Components Market, By Component Type

6.2.2 Asia-Oceania: O-Rings Market, By Country & Vehicle Type

6.2.3 Asia-Oceania: Rotary Seals Market, By Country & Vehicle Type

6.2.4 Asia-Oceania: Lip Seals Market, By Country and Vehicle Type

6.2.5 Asia-Oceania: Mechanical Seals Market, By Country & Vehicle Type

6.2.6 Asia-Oceania: Door Weather-Strips Market, By Country & Vehicle Type

6.2.7 Asia-Oceania: Window Weather-Strips Market, By Country & Vehicle Type

6.2.8 Asia-Oceania: Trunk Weather-Strips Market, By Country & Vehicle Type

6.2.9 Asia-Oceania: Hood Weather-Strips Market, By Country & Vehicle Type

6.2.10 Asia-Oceania: Intake Manifold Gasket Market, By Country & Vehicle Type

6.2.11 Asia-Oceania: Valve Cover Gasket Market, By Country & Vehicle Type

6.2.12 Asia-Oceania: Exhaust Manifold Gasket Market, By Country & Vehicle Type

6.2.13 Asia-Oceania: Oil Pan Gasket Market, By Country & Vehicle Type

6.2.14 Asia-Oceania: Hoses Market, By Country & Vehicle Type

6.2.15 Asia-Oceania: Diaphragm Market, By Country & Vehicle Type

6.2.16 Asia-Oceania: Bellows Market, By Country & Vehicle Type

6.3 Asia-Oceania Pest Analysis

6.3.1 Political Factors

6.3.2 Economic Factors

6.3.3 Social Factors

6.3.4 Technological Factors

6.4 Europe

6.4.1 Europe: Rubber Molding Components Market, By Component Type

6.4.2 Europe: O-Rings Market, By Country & Vehicle Type

6.4.3 Europe: Rotary Seals Market, By Country & Vehicle Type

6.4.4 Europe: Lip Seals Market, By Country & Vehicle Type

6.4.5 Europe: Mechanical Seals Market, By Country & Vehicle Type

6.4.6 Europe: Door Weather-Strips Market, By Country & Vehicle Type

6.4.7 Europe: Window Weather-Strips Market, By Country & Vehicle Type

6.4.8 Europe: Trunk Weather-Strips Market, By Country & Vehicle Type

6.4.9 Europe: Hood Weather-Strips Market, By Country & Vehicle Type

6.4.10 Europe: Intake Manifold Gasket Market, By Country & Vehicle Type

6.4.11 Europe: Valve Cover Gasket Market, By Country & Vehicle Type

6.4.12 Europe: Exhaust Manifold Gasket Market, By Country & Vehicle Type

6.4.13 Europe: Oil Pan Gasket Market, By Country & Vehicle Type

6.4.14 Europe: Hoses Market, By Country & Vehicle Type

6.4.15 Europe: Diaphragms Market, By Country & Vehicle Type

6.4.16 Europe: Bellows Market, By Country & Vehicle Type

6.5 Europe Pest Analysis

6.5.1 Political Factors

6.5.2 Economic Factors

6.5.3 Social Factors

6.5.4 Technological Factors

6.6 North America

6.6.1 North America: Rubber Molding Components Market, By Component Type

6.6.2 North America: O-Rings Market, By Country and Vehicle Type

6.6.3 North America: Rotary Seals Market, By Country & Vehicle Type

6.6.4 North America: Lip Seals Market, By Country & Vehicle Type

6.6.5 North America: Mechanical Seals Market, By Country & Vehicle Type

6.6.6 North America: Door Weather-Strips Market, By Country & Vehicle Type

6.6.7 North America: Window Weather-Strips Market, By Country & Vehicle Type

6.6.8 North America: Trunk Weather-Strips Market, By Country & Vehicle Type

6.6.9 North America: Hood Weather-Strips Market, By Country & Vehicle Type

6.6.10 North America: Intake Manifold Gasket Market, By Country & Vehicle Type

6.6.11 North America: Valve Cover Gasket Market, By Country & Vehicle Type

6.6.12 North America: Exhaust Manifold Gasket Market, By Country & Vehicle Type

6.6.13 North America: Oil Pan Gasket Market, By Country & Vehicle Type

6.6.14 North America: Hoses Market, By Country & Vehicle Type

6.6.15 North America: Diaphragms Market, By Country & Vehicle Type

6.6.16 North America: Bellows Market, By Country & Vehicle Type

6.7 North America Pest Analysis

6.7.1 Political Factors

6.7.2 Economic Factors

6.7.3 Social Factors

6.7.4 Technological Factors

6.8 RoW

6.8.1 RoW: Rubber Molding Components Market, By Component Type

6.8.2 RoW: O-Rings Market, By Country & Vehicle Type

6.8.3 RoW: Rotary Seals Market, By Country & Vehicle Type

6.8.4 RoW: Lip Seals Market, By Country & Vehicle Type

6.8.5 RoW: Mechanical Seals Market, By Country & Vehicle Type

6.8.6 RoW: Door Weather-Strips Market, By Country & Vehicle Type

6.8.7 RoW: Window Weather-Strips Market, By Country & Vehicle Type

6.8.8 RoW: Trunk Weather-Strips Market, By Country & Vehicle Type

6.8.9 RoW: Hood Weather-Strips Market, By Country & Vehicle Type

6.8.10 RoW: Intake Manifold Gasket Market, By Country & Vehicle Type

6.8.11 RoW: Valve Cover Gasket Market, By Country & Vehicle Type

6.8.12 RoW: Exhaust Manifold Gasket Market, By Country & Vehicle Type

6.8.13 RoW: Oil Pan Gasket Market, By Country & Vehicle Type

6.8.14 RoW: Hoses Market, By Country & Vehicle Type

6.8.15 RoW: Diaphragms Market, By Country & Vehicle Type

6.8.16 RoW: Bellows Market, By Country & Vehicle Type

6.9 RoW Pest Analysis

6.9.1 Political Factors

6.9.2 Economic Factors

6.9.3 Social Factors

6.9.4 Technological Factors

7 Rubber Molding Components Market, By Material

7.1 Introduction

7.2 Ethylene Propylene Diene Monomer (EPDM)

7.2.1 Ethylene Propylene Diene Monomer (EPDM) Market, By Region

7.3 Natural Rubber (NR)

7.3.1 Natural Rubber (NR) Market, By Region

7.4 Styrene-Butadiene Rubber (SBR)

7.4.1 Styrene-Butadiene Rubber (SBR) Market, By Region

8 Competitive Landscape

8.1 Market Share Analysis, Rubber Molding Components Market

8.2 Competitive Situation & Trends

8.3 New Product Launches

8.4 Expansions

8.5 Mergers & Acquisitions & Other Developments

8.6 Agreements/Joint Ventures/Supply Contracts/Partnerships

9 Company Profiles

9.1 Introduction

9.2 Continental AG

9.2.1 Business Overview

9.2.2 Products & Services

9.2.3 MnM View

9.2.4 Recent Developments

9.2.5 SWOT Analysis

9.3 Dana Holding Corporation

9.3.1 Business Overview

9.3.2 Products & Services

9.3.3 MnM View

9.3.4 Recent Developments

9.4 Federal-Mogul Corporation

9.4.1 Business Overview

9.4.2 Products Offered

9.4.3 MnM View

9.4.4 Recent Developments

9.4.5 SWOT Analysis

9.5 Hutchinson SA

9.5.1 Business Overview

9.5.2 Products Offered

9.5.3 MnM View

9.5.4 Recent Developments

9.6 Cooper-Standard Holdings Inc.

9.6.1 Business Overview

9.6.2 Products Offered

9.6.3 MnM View

9.6.4 Recent Developments

9.6.5 SWOT Analysis

9.7 Toyoda Gosei Co., Ltd.

9.7.1 Business Overview

9.7.2 Products Offered

9.7.3 MnM View

9.7.4 Recent Developments

9.7.5 SWOT Analysis

9.8 Sumitomo Riko Co., Ltd.

9.8.1 Business Overview

9.8.2 Products Offered

9.8.3 MnM View

9.8.4 Recent Developments

9.8.5 SWOT Analysis

9.9 AB SKF

9.9.1 Business Overview

9.9.2 Products Offered

9.9.3 MnM View

9.9.4 Recent Developments

9.10 Freudenberg and Co. Kg

9.10.1 Business Overview

9.10.2 Products Offered

9.10.3 MnM View

9.10.4 Recent Developments

9.11 Trelleborg AB

9.11.1 Business Overview

9.11.2 Products Offered

9.11.3 MnM View

9.11.4 Recent Developments

9.12 NOK Corporation

9.12.1 Business Overview

9.12.2 Products Offered

9.12.3 MnM View

9.12.4 Recent Developments

10 Appendix

10.1 Insights of Industry Experts

10.2 Discussion Guide

10.3 Introducing RT: Real Time Market Intelligence

10.4 Available Customizations

10.4.1 Rubber Molding Components Market, By Application

10.4.1.1 Radiator

10.4.1.2 Heater

10.4.1.3 Turbocharger

10.4.1.4 Braking

10.4.1.5 Steering

10.4.1.6 Wiper

10.4.1.7 Ac System

10.4.1.8 Fuel Delivery System

10.4.1.9 Camshaft

10.4.1.10 Crankshaft

10.4.1.11 Fuel Pump

10.4.1.12 Oil Pump

10.4.2 Rubber Molding Components Market, By Aftermarket

10.4.2.1 Seals

10.4.2.2 Weather-Strips

10.4.2.3 Hoses

10.4.2.4 Diaphragms

10.4.2.5 Bellows

10.4.3 Rubber Molding Components Market for Alternate Fuel Vehicles, By Region

List of Tables (146 Tables)

Table 1 Assumptions for Rubber Molded Components, By Vehicle Type

Table 2 Assumptions for Market By Vehicle Type & Material

Table 3 Assumptions for Rubber Material, By Vehicle Type

Table 4 ASP Analysis of Rubber Molded Components Market, By Material, 2014 (USD/Ton)

Table 5 Rubber Molding Components Market Size, By Region, 20132020 (000 Units)

Table 6 Rubber Molding Components Market Size, By Region, 20132020 (USD Million)

Table 7 Asia-Oceania: Rubber Molding Components Market Size, By Component, 20132020 (000 Units)

Table 8 Asia-Oceania: Rubber Molding Components Market Size, By Component, 20132020 (USD Million)

Table 9 Asia-Oceania: Automotive O-Rings Market Size, 20132020 (000 Units)

Table 10 Asia-Oceania: Automotive O-Rings Market Size, 20132020 (USD Million)

Table 11 Asia-Oceania: Automotive Rotary Seals Market Size, 20132020 (000 Units)

Table 12 Asia-Oceania: Automotive Rotary Seals Market Size, 20132020 (USD Million)

Table 13 Asia-Oceania: Automotive Lip Seals Market Size, 20132020 (000 Units)

Table 14 Asia-Oceania: Automotive Lip Seals Market Size, 20132020 (USD Million)

Table 15 Asia-Oceania: Automotive Mechanical Seals Market Size, 20132020 (000 Units)

Table 16 Asia-Oceania: Automotive Mechanical Seals Market Size, 20132020 (USD Million)

Table 17 Asia-Oceania: Automotive Door Weather-Strips Market Size, 20132020 (000 Units)

Table 18 Asia-Oceania: Automotive Door Weather-Strips Market Size, 20132020 (USD Million)

Table 19 Asia-Oceania: Automotive Window Weather-Strips Market Size, 20132020 (000 Units)

Table 20 Asia-Oceania: Automotive Window Weather-Strips Market Size, 20132020 (USD Million)

Table 21 Asia-Oceania: Automotive Trunk Weather-Strips Market Size, 20132020 (000 Units)

Table 22 Asia-Oceania: Automotive Trunk Weather-Strips Market Size, 20132020 (USD Million)

Table 23 Asia-Oceania: Automotive Hood Weather-Strips Market Size, 20132020 (000 Units)

Table 24 Asia-Oceania: Automotive Hood Weather-Strips Market Size, 20132020 (USD Million)

Table 25 Asia-Oceania: Automotive Intake Manifold Gasket Market Size, 20132020 (000 Units)

Table 26 Asia-Oceania: Automotive Intake Manifold Gasket Market Size, 20132020 (USD Million)

Table 27 Asia-Oceania: Automotive Valve Cover Gasket Market Size, 20132020 (000 Units)

Table 28 Asia-Oceania: Automotive Valve Cover Gasket Market Size, 20132020 (USD Million)

Table 29 Asia-Oceania: Automotive Exhaust Manifold Gasket Market Size, 20132020 (000 Units)

Table 30 Asia-Oceania: Automotive Exhaust Manifold Gasket Market Size, 20132020 (USD Million)

Table 31 Asia-Oceania: Automotive Oil Pan Gasket Market Size, 20132020 (000 Units)

Table 32 Asia-Oceania: Automotive Oil Pan Gasket Market Size, 20132020 (USD Million)

Table 33 Asia-Oceania: Automotive Hoses Market Size, 20132020 (000 Units)

Table 34 Asia-Oceania: Automotive Hoses Market Size, 20132020 (USD Million)

Table 35 Asia-Oceania: Automotive Diaphragms Market Size, 20132020 (000 Units)

Table 36 Asia-Oceania: Automotive Diaphragms Market Size, 20132020 (USD Million)

Table 37 Asia-Oceania: Automotive Bellows Market Size, 20132020 (000 Units)

Table 38 Asia-Oceania: Automotive Bellows Market Size, 20132020 (USD Million)

Table 39 Europe: Rubber Molding Components Market Size, By Component, 20132020 (000 Units)

Table 40 Europe: Rubber Molding Components Market Size, By Component, 20132020 (USD Million)

Table 41 Europe: Automotive O-Rings Market Size, 20132020 (000 Units)

Table 42 Europe: Automotive O-Rings Market Size, 20132020 (USD Million)

Table 43 Europe: Automotive Rotary Seals Market Size, 20132020 (000 Units)

Table 44 Europe: Automotive Rotary Seals Market Size, 20132020 (USD Million)

Table 45 Europe: Automotive Lip Seals Market Size, 20132020 (000 Units)

Table 46 Europe: Automotive Lip Seals Market Size, 20132020 (USD Million)

Table 47 Europe: Automotive Mechanical Seals Market Size, 20132020 (000 Units)

Table 48 Europe: Automotive Mechanical Seals Market Size, 20132020 (USD Million)

Table 49 Europe: Automotive Door Weather-Strips Market Size, 20132020 (000 Units)

Table 50 Europe: Automotive Door Weather-Strips Market Size, 20132020 (USD Million)

Table 51 Europe: Automotive Window Weather-Strips Market Size, 20132020 (000 Units)

Table 52 Europe: Automotive Window Weather-Strips Market Size, 20132020 (USD Million)

Table 53 Europe: Automotive Trunk Weather-Strips Market Size, 20132020 (000 Units)

Table 54 Europe: Automotive Trunk Weather-Strips Market Size, 20132020 (USD Million)

Table 55 Europe: Automotive Hood Weather-Strips Market Size, 20132020 (000 Units)

Table 56 Europe: Automotive Hood Weather-Strips Market Size, 20132020 (USD Million)

Table 57 Europe: Automotive Intake Manifold Gasket Market Size, 20132020 (000 Units)

Table 58 Europe: Automotive Intake Manifold Gasket Market Size, 20132020 (USD Million)

Table 59 Europe: Automotive Valve Cover Gasket Market Size, 20132020 (000 Units)

Table 60 Europe: Automotive Valve Cover Gasket Market Size, 20132020 (USD Million)

Table 61 Europe: Automotive Exhaust Manifold Gasket Market Size, 20132020 (000 Units)

Table 62 Europe: Automotive Exhaust Manifold Gasket Market Size, 20132020 (USD Million)

Table 63 Europe: Automotive Oil Pan Gasket Market Size, 20132020 (000 Units)

Table 64 Europe: Automotive Oil Pan Gasket Market Size, 20132020 (USD Million)

Table 65 Europe: Automotive Hoses Market Size, 20132020 (000 Units)

Table 66 Europe: Automotive Hoses Market Size, 20132020 (USD Million)

Table 67 Europe: Automotive Diaphragms Market Size, 20132020 (000 Units)

Table 68 Europe: Automotive Diaphragms Market Size, 20132020 (USD Million)

Table 69 Europe: Automotive Bellows Market Size, 20132020 (000 Units)

Table 70 Europe: Automotive Bellows Market Size, 20132020 (USD Million)

Table 71 North America: Rubber Molding Components Market Size, By Component, 20132020 (000 Units)

Table 72 North America: Rubber Molding Components Market Size, By Component, 20132020 (USD Million)

Table 73 North America: Automotive O-Rings Market Size, 20132020 (000 Units)

Table 74 North America: Automotive O-Rings Market Size, 20132020 (USD Million)

Table 75 North America: Automotive Rotary Seals Market Size, 20132020 (000 Units)

Table 76 North America: Automotive Rotary Seals Market Size, 20132020 (USD Million)

Table 77 North America: Automotive Lip Seals Market Size, 20132020 (000 Units)

Table 78 North America: Automotive Lip Seals Market Size, 20132020 (USD Million)

Table 79 North America: Automotive Mechanical Seals Market Size, 20132020 (000 Units)

Table 80 North America: Automotive Mechanical Seals Market Size, 20132020 (USD Million)

Table 81 North America: Automotive Door Weather-Strips Market Size, 20132020 (000 Units)

Table 82 North America: Automotive Door Weather-Strips Market Size, 20132020 (USD Million)

Table 83 North America: Automotive Window Weather-Strips Market Size, 20132020 (000 Units)

Table 84 North America: Automotive Window Weather-Strips Market Size, 20132020 (USD Million)

Table 85 North America: Automotive Trunk Weather-Strips Market Size, 20132020 (000 Units)

Table 86 North America: Automotive Trunk Weather-Strips Market Size, 20132020 (USD Million)

Table 87 North America: Automotive Hood Weather-Strips Market Size, 20132020 (000 Units)

Table 88 North America: Automotive Hood Weather-Strips Market Size, 20132020 (USD Million)

Table 89 North America: Automotive Intake Manifold Gasket Market Size, 20132020 (000 Units)

Table 90 North America: Automotive Intake Manifold Gasket Market Size, 20132020 (USD Million)

Table 91 North America: Automotive Valve Cover Gasket Market Size, 20132020 (000 Units)

Table 92 North America: Automotive Valve Cover Gasket Market Size, 20132020 (USD Million)

Table 93 North America: Automotive Exhaust Manifold Gasket Market Size, 20132020 (000 Units)

Table 94 North America: Automotive Exhaust Manifold Gasket Market Size, 20132020 (USD Million)

Table 95 North America: Automotive Oil Pan Gasket Market Size, 20132020 (000 Units)

Table 96 North America: Automotive Oil Pan Gasket Market Size, 20132020 (USD Million)

Table 97 North America: Automotive Hoses Market Size, 20132020 (000 Units)

Table 98 North America: Automotive Hoses Market Size, 20132020 (USD Million)

Table 99 North America: Automotive Diaphragms Market Size, 20132020 (000 Units)

Table 100 North America: Automotive Diaphragms Market Size, 20132020 (USD Million)

Table 101 North America: Automotive Bellows Market Size, 20132020 (000 Units)

Table 102 North America: Automotive Bellows Market Size, 20132020 (USD Million)

Table 103 RoW: Rubber Molding Components Market Size, By Component, 20132020 (000 Units)

Table 104 RoW: Rubber Molding Components Market Size, By Component, 20132020 (USD Million)

Table 105 RoW: Automotive O-Rings Market Size, 20132020 (000 Units)

Table 106 RoW: Automotive O-Rings Market Size, 20132020 (USD Million)

Table 107 RoW: Automotive Rotary Seals Market Size, 20132020 (000 Units)

Table 108 RoW: Automotive Rotary Seals Market Size, 20132020 (USD Million)

Table 109 RoW: Automotive Lip Seals Market Size, 20132020 (000 Units)

Table 110 RoW: Automotive Lip Seals Market Size, 20132020 (USD Million)

Table 111 RoW: Automotive Mechanical Seals Market Size, 20132020 (000 Units)

Table 112 RoW: Automotive Mechanical Seals Market Size, 20132020 (USD Million)

Table 113 RoW: Automotive Door Weather-Strips Market Size, 20132020 (000 Units)

Table 114 RoW: Automotive Door Weather-Strips Market Size, 20132020 (USD Million)

Table 115 RoW: Automotive Window Weather-Strips Market Size, 20132020 (000 Units)

Table 116 RoW: Automotive Window Weather-Strips Market Size, 20132020 (USD Million)

Table 117 RoW: Automotive Trunk Weather-Strips Market Size, 20132020 (000 Units)

Table 118 RoW: Automotive Trunk Weather-Strips Market Size, 20132020 (USD Million)

Table 119 RoW: Automotive Hood Weather-Strips Market Size, 20132020 (000 Units)

Table 120 RoW: Automotive Hood Weather-Strips Market Size, 20132020 (USD Million)

Table 121 RoW: Automotive Intake Manifold Gasket Market Size, 20132020 (000 Units)

Table 122 RoW: Automotive Intake Manifold Gasket Market Size, 20132020 (USD Million)

Table 123 RoW: Automotive Valve Cover Gasket Market Size, 20132020 (000 Units)

Table 124 RoW: Automotive Valve Cover Gasket Market Size, 20132020 (USD Million)

Table 125 RoW: Automotive Exhaust Manifold Gasket Market Size, 20132020 (000 Units)

Table 126 RoW: Automotive Exhaust Manifold Gasket Market Size, 20132020 (USD Million)

Table 127 RoW: Automotive Oil Pan Gasket Market Size, 20132020 (000 Units)

Table 128 RoW: Automotive Oil Pan Gasket Market Size, 20132020 (000 Units)

Table 129 RoW: Automotive Hoses Market Size, 20132020 (000 Units)

Table 130 RoW: Automotive Hoses Market Size, 20132020 (USD Million)

Table 131 RoW: Automotive Diaphragms Market Size, 20132020 (000 Units)

Table 132 RoW: Automotive Diaphragms Market Size, 20132020 (USD Million)

Table 133 RoW: Automotive Bellows Market Size, 20132020 (000 Units)

Table 134 RoW: Automotive Bellows Market Size, 20132020 (USD Million)

Table 135 Rubber Molding Components Market Size, By Material, 20132020 (000 Tons)

Table 136 Rubber Molding Components Market Size, By Material, 201 32020 (USD Million)

Table 137 EPDM Rubber Molding Components Market Size, 20132020 (000 Tons)

Table 138 EPDM Rubber Molding Components Market Size, 20132020 (USD Million)

Table 139 NR Rubber Molding Components Market Size, 20132020 (000 Tons)

Table 140 NR Rubber Molding Components Market Size, 20132020 (USD Million)

Table 141 SBR Rubber Molding Components Market Size, 20132020 (000 Tons)

Table 142 SBR Rubber Molding Components Market Size, 20132020 (USD Million)

Table 143 New Product Launches, 20142015

Table 144 Expansions, 20142015

Table 145 Mergers & Acquisitions & Other Developments, 20142015

Table 146 Agreements/Joint Ventures/Supply Contracts/Partnerships, 20142015

List of Figures (49 Figures)

Figure 1 Global Rubber Molding Components Market

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Gross Domestic Product vs Total Vehicle Sales, 2013 & 2014

Figure 6 Vehicle Production for Developing Countries, 2009 vs 2014

Figure 7 Urbanization vs Passenger Cars Per 1,000 People, 2010 vs 2014

Figure 8 Road Network vs Total Vehicle Sales, 2012 vs 2013

Figure 9 Micro & Macro Factor Analysis

Figure 10 Market Size Estimation Methodology: Bottom-Up Approach

Figure 11 Data Triangulation

Figure 12 Asia-Oceania to Hold the Largest Market Share, By Volume (000 Units), in the Rubber Molding Components Market, 2015

Figure 13 Rubber Molding Components Market, By Value, 2015 vs 2020 (USD Million)

Figure 14 EPDM Material to Hold the Largest Share in the Rubber Molding Components Market, 2015 vs 2020

Figure 15 Rubber Molding Components Market: Asia-Oceania Projected to Be the Fastest-Growing Market During the Forecast Period (000 Units)

Figure 16 Attractive Opportunities in the Rubber Molding Components Market, By Value, 2015 vs 2020

Figure 17 Rubber Molding Components Market, By Region (USD Million), 2015

Figure 18 Hoses to Dominate the Rubber Molding Components Market, 2015 vs 2020 (USD Million)

Figure 19 EPDM to Constitute the Largest Segment of the Automotive Rubber Molded Components Material Market, By Value, 2015 vs 2020 (USD Million)

Figure 20 Life Cycle Analysis, By Rubber Molding Process, 2015

Figure 21 Evolution of Automotive Rubber Molding, 19901998

Figure 22 Automotive Rubber Molded Components Market Dynamics

Figure 23 Porters Five Forces Analysis: Rubber Molding Components Market

Figure 24 Rubber Molding Components Market: Value Chain Analysis

Figure 25 Rubber Molding Components Market: Asia-Oceania Estimated to Be the Largest Market, 2015 vs 2020

Figure 26 Asia-Oceania Rubber Molding Components Market: Regional Snapshot (2015)

Figure 27 European Rubber Molding Components Market: Regional Snapshot (2015)

Figure 28 Rubber Molding Components Market Size, By Material, 2015 vs 2020

Figure 29 Companies Adopted Expansion as the Key Growth Strategy

Figure 30 Sumitomo Riko Co., Ltd. Registered the Highest Growth Rate From 2010 to 2014

Figure 31 Market Evaluation Framework: Expansions Have Fueled the Demand for Automotive Rubber Molded Components From 2012 to 2015

Figure 32 Battle for Market Share: Expansion Was the Key Strategy

Figure 33 Region-Wise Revenue Mix of Five Major Players

Figure 34 Continental AG.: Company Snapshot

Figure 35 SWOT Analysis: Continental AG

Figure 36 Dana Holding Corporation: Company Snapshot

Figure 37 Federal-Mogul Corporation: Company Snapshot

Figure 38 SWOT Analysis: Federal-Mogul Corporation

Figure 39 Hutchinson SA: Company Snapshot

Figure 40 Cooper-Standard Holdings Inc.: Company Snapshot

Figure 41 SWOT Analysis: Cooper Standard Holdings Inc.

Figure 42 Toyoda Gosei Co., Ltd.: Company Snapshot

Figure 43 SWOT Analysis: Toyoda Gosei Co., Ltd.

Figure 44 Sumitomo Riko Co., Ltd.: Company Snapshot

Figure 45 SWOT Analysis: Sumitomo Riko Co., Ltd.

Figure 46 AB SKF: Company Snapshot

Figure 47 Freudenberg and Co. Kg: Company Snapshot

Figure 48 Trelleborg AB: Company Snapshot

Figure 49 NOK Corporation: Company Snapshot

Growth opportunities and latent adjacency in Rubber Molding Market