The study involves four main activities to estimate the current size of the automotive transmission market.

-

Exhaustive secondary research and country-wise model mapping to collect the information on such as transmission type, vehicle type, number of forward gears, fuel type, hybrid electric transmissions and two-wheeler transmissions.

-

The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

-

Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered in this study.

-

After that, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of manufacturers; white papers, certified publications; articles from recognized authors, directories, industry databases; and articles from recognized associations and government publishing sources.

Secondary research was used to obtain critical information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

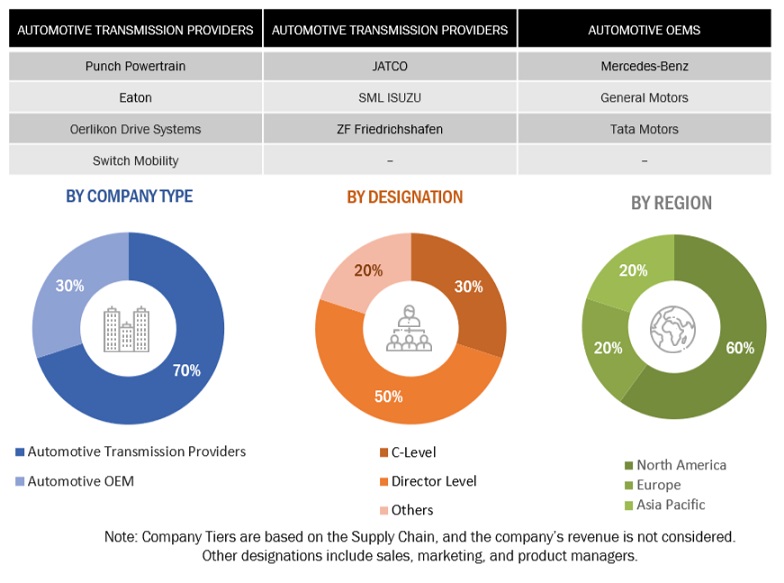

After understanding the automotive transmission market scenario, extensive primary research was conducted. Several industry experts from automotive transmission providers, component/system providers, and end-user organizations across three major regions: North America, Europe, and Asia Pacific were reached out to for the primary interviews. Most of the interviews were conducted from the supply side and some from OEMs. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administration, were contacted to provide a holistic viewpoint in the report while canvassing primaries. After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This and the opinions of in-house subject matter experts led to the conclusions delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value and volume of the automotive transmission market and other dependent submarkets, as mentioned below:

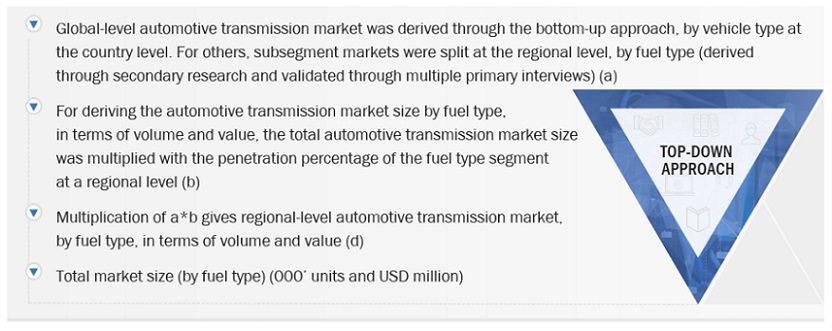

The top-down approach was used to estimate and validate the size of the market by fuel type, number of forward gears, and two-wheeler transmission type by volume and value. For others, subsegment markets were split at the regional level by fuel type (derived through secondary research and validated through multiple primary interviews)

The region-level market by transmission type by volume is multiplied by the region-level average selling price (ASP) for each application to get the market for each transmission by value.

The summation of the region-level market would give the global automotive transmission market by transmission type (Automatic Transmission, Automated Manual Transmission, Dual-Clutch Transmission, Continuously Variable Transmission, Manual Transmission). The total value of each region was then summed up to derive the total value of the market by transmission type.

All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Automotive Transmission Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach was used to estimate and validate the market size of automotive transmission by fuel type, number of forward gears, and two-wheeler transmission type by volume and value. The global market size in terms of volume and value was divided into diesel and gasoline using the percentage split to derive the market size of fuel type. The global market was further segmented at the regional level. A similar approach was used to derive the market size of the number of forward gears and two-wheeler transmission type segments in terms of volume and value.

Market Definition:

Automotive transmission is the system that extracts the maximum torque from an engine and delivers it to the wheels. The evolution of automatic transmission and its integration with electronic controls have allowed for more significant progress in automobile technologies in recent years. Modern automatic transmission helps achieve better fuel economy, reduced engine emissions, more excellent shift system reliability, improved shift feel and speed, and improved vehicle handling. There are five major types of automotive transmission: manual transmission, automatic transmission, automated manual transmission, dual-clutch transmission, and continuously variable transmission.

Stakeholders:

-

Automobile Manufacturers (OEMs)

-

Automotive Transmission Manufacturers

-

Automotive Electronic Hardware Suppliers & integrators

-

Automotive SoC and ECU Manufacturers

-

Automotive Transmission Component Suppliers

-

Government & Research Organizations

-

Traders, Distributors, and Suppliers of Automotive Transmission Components

-

Automobile Organizations/Associations

Report Objectives

-

To define, describe, and forecast the automotive transmission market size by volume (thousand units) and value (USD million) based on:

-

Transmission type [manual transmission (MT), automatic transmission (AT), continuously variable transmission (CVT), automated manual transmission (AMT), and dual-clutch transmission (DCT)]

-

Hybrid electric vehicle type by region (Asia Pacific, Europe, and North America)

-

Fuel type (diesel, gasoline, and alternate fuel)

-

Number of forward gears (CVT, up to 5, 6 to 8, 9 to 10, and above 10)

-

Vehicle type (passenger cars, light commercial vehicles, trucks, and buses)

-

Two-wheeler transmission type (manual transmission and automatic transmission)

-

Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa)

-

To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To strategically analyze the key player strategies/right to win

-

To study the market with supply chain analysis, ecosystem analysis, trade analysis, case study analysis, pricing analysis, patent analysis, trends/disruptions impacting buyers, technology trends, regulatory analysis, and recession impact analysis

-

To analyze the competitive leadership mapping of the global automotive transmission manufacturers and automotive transmission component suppliers in the market and understand their market position with the help of a company evaluation matrix.

-

To track and analyze competitive developments, such as joint ventures, collaborations, partnerships, mergers & acquisitions, new product developments, and expansions, in the automotive transmission market

Available customizations

Along with the given market data, MarketsandMarkets offers customizations to a company’s specific needs

-

Automotive transmission market, by Fuel Type & Country

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Rest of Asia Pacific

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

Rest of Europe

-

North America

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Middle East & South Africa

-

Iran

-

Rest of Middle East & Africa

Danial

Jun, 2022

Who are the top vendors in the Automotive Transmission Market? What is the competitive scenario among them?.

User

Nov, 2019

Pls send TOC and can it be customised for 2W AMT market for India and for ASEAN region including after market requirement for 2W AMT for a Bolt on design of AMT for 2W.

User

Nov, 2019

I am looking for commercial vehicle transmission data at a global level with deep dive into India, China, Brazil, Russia and South Africa. In this database, I am looking for Tier-1 and Tier-2 transmission suppliers mapping by different OEMs and models for the mentioned countries..

User

Nov, 2019

I am interested in new technologies relevance in commercial vehicles in developing countries context. Request if you can send me the free sample report portion relevant to only commercial vehicle regions covering other than Europe and North America.

User

Nov, 2019

I am interested to know just in the Automotive Transmission Market by vehicle and transmission type just in Mexico..

User

Nov, 2019

Looking for opportunities to exploit new technologies in the automotive industry in particular for smaller engines and related industries..

User

Nov, 2019

Ideally would like to see Program and/or Platform included. Also EVT/Reduction breakouts if possible..

User

Nov, 2019

Market share, past, present, forecast (2008-2018) with splits for: Supplier OEM Vehicle Class Technology Type Global Region.

User

Nov, 2019

LOW CARBON TRANSPORT – 16.67 Co2e g/km Transport, Automotive, Rail, Ship, Missile, JET Plane. Technology: Double Speed, 1/3 Fuel for same Ton-HP-Vehicle. 6 x kmpl; 16.67 Co2e g/km; g/t-km. .

User

Aug, 2019

Architecture,Transmission,Motor Output,final drive,Drive Type, Power Electronics, Vehicle type, Region-Global Forecast to 2025.