Automotive Drivetrain Market by Drive Type (AWD, RWD, FWD), Vehicle Type (Passenger car, LCV, Buses and Trucks), Electric Vehicle Drive type (BEV, PHEV, HEV), and Region - Global Forecast to 2021

[140 Pages Report] The global automotive drivetrain market is projected to grow at a CAGR of 6.18% during the forecast period, to reach USD 278.57 Billion by 2021 from an estimated USD 206.43 Billion in 2016.

As drivetrain is an essential part of a vehicle, the growth of the drivetrain market is primarily triggered by the increasing production of automobiles. Other factors attributing to the growth of this market are wide acceptance of technologically advanced drivetrain systems offering beneficial features such as increased fuel economy and improved vehicle performance. However, factors such as high cost of the AWD systems and increasing prices of fuel are restraining the growth of the market. The report segments the market by vehicle type, region, drive type, and electric vehicle type.

Automotive Drivetrain Market Dynamics

Drivers

- Growing Demand for Comfort & Safety in Vehicles

- Increasing Need for Better Acceleration, Traction, & Towing Capabilities in Vehicles

- Better Vehicle Control in Unfavorable Terrains

- Growing Demand for Lightweight Driveshaft

Restraints

- High Initial & Maintenance Cost of Vehicles Equipped With AWD

- Fluctuations in Raw Material Prices

Opportunities

- Emerging Markets for SUVs & Premium Cars with AWD Systems

- Integration of Electronics in Drivetrains

Challenges

- Cost Reduction of Drivetrains

- Light & Efficient Drivetrains

The following are the major objectives of the study.

- To define, describe, and forecast the global market size for automotive drivetrain on the basis of vehicle type, product type, drive type, location, and region in terms of volume (thousand) and value (USD billion)

- To provide detailed information about the major factors influencing the growth of this market (drivers, restraints, opportunities, industry-specific challenges, and burning issues)

- To analyze opportunities for stakeholders and details of the competitive landscape of market leaders

- To strategically analyze sub segments (vehicle type, drive type, and location) with respect to individual growth trends, future prospects, and contribution to the total market

- To forecast the size of market segments with respect to four main regions (along with key countries), namely, Asia-Pacific, North America, Europe, and Rest of the World (RoW)

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development in the global automotive drivetrain market

Research Methodology

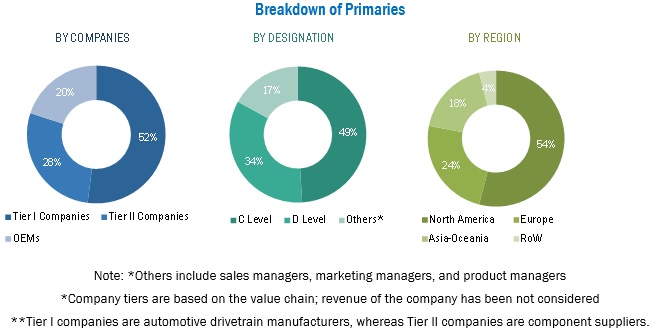

The research methodology used in the report involves primary and secondary sources. Secondary sources include associations such as the Society of Indian Automobile Manufacturers (SIAM), Korea Automobile Manufacturers Association (KAMA), International Energy Agency (IEA), and China Association of Automobile Manufacturers (CAAM) and directories such as Factiva and Bloomberg. In the primary research stage, experts from related industries, manufacturers, and suppliers have been interviewed to understand the present situation and future trends of the market. The automotive drivetrain market, in terms of volume (‘000 units) and value (USD million/billion), for various regions, vehicle types, and drive types has been derived. The OEM prices of drivetrain components have been verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

The automotive drivetrain market ecosystem consists of drivetrain component suppliers such as Aisin Seki Co., Ltd. (Japan) and American Axle & Manufacturing, Inc. (U.S.), which supply drivetrains to automotive OEMs such as Nissan (Japan), Tata Motors (India), Chevrolet (U.S.), and Volkswagen AG (Germany).

Major Market Developments

- In June 2016, ZF Friedrichshafen has opened a new plant, ZF Pars SSK, in Iran to improve its competitive position and to meet the increased demand for commercial vehicle transmission systems in the Middle Eastern region.

- In April 2015, Aisin Seiki announced plans to build a new office for its R&D affiliate Aisin (Nantong) Technical Center of China Co., Ltd in China. This would help Aisin Seiki to fully integrate different stages of product development such as design, development, and assessment, thereby improving the quality of the products and services offered to customers.

- In March 2016, American Axle & Manufacturing Holdings, Inc. announced the launch of new driveline technologies at the 2016 Winter Test Activities event in Michigan (U.S.). The company is set to launch e-AAM hybrid and electric driveline systems and QUANTUM lightweight axles and drive units. These technologies will decrease carbon dioxide emissions and increase fuel economy.

Automotive Drivetrain Market Target Audience

- Automotive drivetrain manufacturers

- Automotive drivetrain component suppliers

- Raw material suppliers

- Automobile organizations/associations

- Traders and distributors of drivetrain systems

- Automotive Original Equipment Manufacturers (OEMs)

Scope of the Report

-

Automotive Drivetrain Market for Alternate Fuel Passenger Cars, By Vehicle Type

- Passenger car

- LCV

-

HCV

- Trucks

- Buses

-

Automotive Drivetrain Market for Alternate Fuel Passenger Cars, By Electric Vehicle Type

- BEV

- HEV

- PHEV

-

Automotive Drivetrain Market, By Drive Type

- AWD

- FWD

- RWD

-

Automotive Drivetrain Market, By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations

-

Automotive Drivetrain Market, By Transmission Type

- Manual Transmission (MT)

- Automatic Transmission (AT)

- Continuous Variable Transmission (CVT)

- Dual-Clutch Transmission (DCT)

- Automated Manual Transmission (AMT)

-

Automotive Drivetrain Market, By Engine location

- Front engine

- Rear engine

The global automotive drivetrain market is projected to grow at a CAGR of 6.18% during the forecast period, to reach USD 278.57 Billion by 2021 from an estimated USD 206.43 Billion in 2016. As drivetrain is an essential part of a vehicle, the growth of the drivetrain market is primarily triggered by the increasing production of automobiles. Other factors attributing to the growth of this market are wide acceptance of technologically advanced drivetrain systems offering beneficial features such as increased fuel economy and improved vehicle performance. However, factors such as high cost of the AWD systems and increasing prices of fuel are restraining the growth of the market.

The automotive drivetrain market has been classified into Drive Type (AWD, RWD, FWD), Vehicle Type (Passenger car, LCV, Buses and Trucks), Electric Vehicle Drive type (BEV, PHEV, HEV), and Region.

FWDs have the engine, transmission, final drive gears, and differential, all in a single unit. FWD vehicles are usually lighter, on an average, than either of their counterparts. Most modern-day sedans, particularly those in the medium and lower price ranges, feature FWD, as FWD cars are generally lighter and have the most weight over the front wheels. This provides a good balance for reliable traction. It also helps with braking. Additionally, superior traction makes them use fuel more effectively, regardless of the engine size. FWD also has larger space for passengers and cargo. The drivetrain market size for FWD vehicles is estimated to be 58872.11 thousand units in 2016, and is projected to reach 73834.09 thousand units by 2021, growing at a promising CAGR of 4.63% from 2016 to 2021. The Asia-Pacific drivetrain market for FWD vehicles is poised to grow at the highest CAGR of 5.35%

The shift towards electrification is one of the biggest changes the automotive sector has seen during its century-long history. Battery electric vehicles, or BEVs, use electricity stored in a battery pack to power an electric motor and turn the wheels. When driven, BEVs don’t produce tailpipe pollution they don’t even have a tailpipe. Battery electric cars are does not use any kind of fossil fuel which makes them affordable than conventional vehicles. The market of battery electric vehicle in 2016 is estimated to be at 462.57 thousand units which is expected to reach at 1647.16 thousand units by 2021. The BEV market is growing with the CAGR of 28.92% for the forecasted period. This growth is attributed to the stringent emission norms, which has led to the higher adoption of electric vehicles.

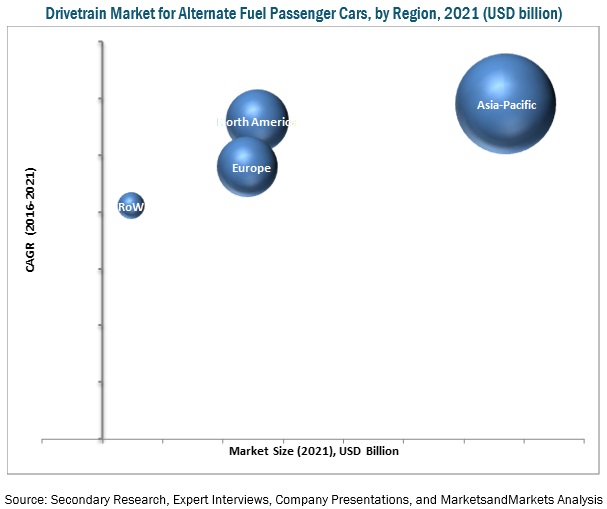

The Asia-Pacific region is estimated to hold the largest share of 51.83% of the overall automotive drivetrain market in 2016. In terms of value it is projected to grow at a CAGR of 6.52% during the forecast period, to reach USD 146.71 billion by 2021. The North American market is projected to grow at a CAGR of 6.22% during the forecast period, from USD 47.86 billion in 2016 to USD 64.71 million by 2021. The U.S. market is estimated to grow at the highest CAGR of 6.57% from 2016 to 2021.

The Front Wheel Drive segment is estimated to lead the automotive drivetrain market, in terms of value, and is projected to reach USD 140.01 billion in 2021

Front Wheel Drive

FWDs have the engine, transmission, final drive gears, and differential, all in a single unit. FWD vehicles are usually lighter, on an average, than either of their counterparts. Most modern-day sedans, particularly those in the medium and lower price ranges, feature FWD, as FWD cars are generally lighter and have the most weight over the front wheels. This provides a good balance for reliable traction. It also helps with braking. Additionally, superior traction makes them use fuel more effectively, regardless of the engine size. FWD also has larger space for passengers and cargo. The FWD segment of the automotive drivetrain market is estimated to be USD 111.31 billion in 2016, and is projected to reach USD 140.01 billion by 2021, growing at a CAGR of 4.69% from 2016 to 2021. The Asia-Pacific market is poised to grow at the highest CAGR of 5.37%.

Rear Wheel Drive

Rear wheel drive cars use a driveshaft (connected to the transmission) to send power to the back wheels. RWD system transfers power from the engine to the rear wheels to push the car forward. The front wheels do not receive any power and are free to manoeuvre the vehicle. Due to the weight of a RWD vehicle being more evenly spread than a FWD vehicle, it creates a better balance of weight. The disadvantage of a RWD vehicle is that they do not perform well in poor weather conditions such as rain or snow because they are more prone to loss of traction on slick roads. The overall market for automotive drivetrain used in RWD vehicles is estimated to grow from USD 45.02 billion in 2016 to USD 56.95 billion by 2021, at a CAGR of 4.81% during the forecast period.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- Who are the major players dominating the drivetrain market?

Cost reduction will be a challenge in this market. A drivetrain includes expensive components, such as transmissions, clutch/torque convertors, and differentials. In case of transmissions, AT is very expensive and reducing their cost is a huge challenge for Tier 1 suppliers. The cost reduction of these systems is largely based on new technology and innovations for cheaper products and the actions of stakeholders, such as the car industry, governments, and consumers. Considering all these facts, reducing the cost of a drivetrain is a challenge for automobile manufacturers.

The automotive drivetrain market ecosystem consists of drivetrain component suppliers such as Aisin Seki Co., Ltd. (Japan) and American Axle & Manufacturing, Inc. (U.S.), which supply drivetrains to automotive OEMs such as Nissan (Japan), Tata Motors (India), Chevrolet (U.S.), and Volkswagen AG (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Data From Secondary Sources

2.4 Primary Data

2.4.1 Sampling Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Demand-Side Analysis

2.5.2.1 Infrastructure: Roadways

2.5.2.2 Increasing Population in Developing Countries

2.5.2.3 Impact of Gdp on Commercial Vehicle Sales

2.5.3 Supply-Side Analysis

2.5.3.1 Rising Demand for Hybrid and Electric Vehicles

2.6 Market Size Estimation

2.7 Data Triangulation

2.8 Assumptions

3 Executive Summary (Page No. - 27)

3.1 Introduction

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Automotive Drivetrain Market

4.2 FWD Segment to Lead the Global Market in 2016

4.3 Region-Wise Market Share of the Market, 2016 vs 2021

4.4 Market, By Drivetype Type

4.5 Market, By Vehicle Type

4.6 Electric Vehicle Drivetrain Market, By Drive Type

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Automotive Drivetrain Market Segmentation

5.2.2 By Drive Type

5.2.3 By Region

5.2.4 Electric Vehicle Drivetrain

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Demand for Comfort & Safety in Vehicles

5.3.1.2 Increasing Need for Better Acceleration, Traction, & Towing Capabilities in Vehicles

5.3.1.3 Better Vehicle Control in Unfavorable Terrains

5.3.1.4 Growing Demand for Lightweight Driveshaft

5.3.2 Restraints

5.3.2.1 High Initial & Maintenance Cost of Vehicles Equipped With AWD

5.3.2.2 Fluctuations in Raw Material Prices

5.3.3 Opportunities

5.3.3.1 Emerging Markets for Suvs & Premium Cars With AWD Systems

5.3.3.2 Integration of Electronics in Drivetrains

5.3.4 Challenges

5.3.4.1 Cost Reduction of Drivetrains

5.3.4.2 Light & Efficient Drivetrains

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

6 Automotive Drivetrain Market, By Region (Page No. - 50)

6.1 Introduction

6.2 North America

6.2.1 U.S.

6.2.2 Canada

6.2.3 Mexico

6.3 Europe

6.3.1 Germany

6.3.2 France

6.3.3 U.K.

6.3.4 Spain

6.3.5 Rest of Europe

6.4 Asia-Pacific

6.4.1 China

6.4.2 India

6.4.3 Japan

6.4.4 South Korea

6.5 Rest of the World

6.5.1 Brazil

6.5.2 South Africa

6.5.3 Others

7 Automotive Drivetrain Market, By Vehicle Type (Page No. - 78)

7.1 Introduction

7.1.1 Passenger Car

7.1.2 Light Commercial Vehicles

7.1.3 Heavy Commercial Vehicles

7.1.4 Heavy Commercial Vehicles: Trucks

7.1.5 Heavy Commercial Vehicles: Buses

8 Automotive Drivetrain Market, By Drive Type (Page No. - 85)

8.1 Introduction

8.1.1 Front Wheel Drive

8.1.2 Rear Wheel Drive

8.1.3 All-Wheel Drive

9 Automotive Drivetrain Market, By Electric Vehicle Type (Page No. - 92)

9.1 Introduction

9.1.1 Battery Electric Vehicles

9.1.2 Plug-In Hybrid Electric Vehicles

9.1.3 Hybrid Electric Vehicles

10 Competitive Landscape (Page No. - 97)

10.1 Competitive Situation & Trends

10.2 Expansion

10.3 New Product Launches

10.4 Joint Ventures/Supply Contracts/Partnerships

10.5 Mergers & Acquisitions

11 Company Profiles (Page No. - 103)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Introduction

11.2 Aisin Seiki Co., Ltd.

11.3 American Axle & Manufacturing, Inc.

11.4 Borgwarner Inc.

11.5 GKN PLC

11.6 ZF Friedrichshafen AG

11.7 Magna International Inc.

11.8 Dana Holding Corporation

11.9 JTEKT Corporation

11.10 Showa Corporation

11.11 Schaeffler Group

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 133)

12.1 Key Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (69 Tables)

Table 1 Commodity Prices, 2015 (USD /MT)

Table 2 Automotive Drivetrain Market Size, By Region, 2014–2021 (USD Billion)

Table 3 Market Size, By Region, 2014–2021 (Million Units)

Table 4 North America: Market Size, By Country, 2014–2021 (USD Billion)

Table 5 North America: Market Size, By Country, 2014–2021 (‘000 Units)

Table 6 U.S.: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 7 U.S.: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 8 Canada: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 9 Canada: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 10 Mexico: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 11 Mexico: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 12 Europe: Market Size, By Country, 2014–2021 (USD Billion)

Table 13 Europe: Automotive Drivetrain Market Size, By Country, 2014–2021 (‘000 Units)

Table 14 Germany: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 15 Germany: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 16 France: Market Size, By Product Type, 2014–2021 (USD Million)

Table 17 France: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 18 U.K.: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 19 U.K.: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 20 Spain: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 21 Spain: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 22 Rest of Europe: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 23 Rest of Europe: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 24 Asia-Pacific: Market Size, By Country, 2014–2021 (USD Billion)

Table 25 Asia-Pacific: Market Size, By Country, 2014–2021 (‘000 Units)

Table 26 China: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 27 China: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 28 India: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 29 India: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 30 Japan: Automotive Drivetrain Market Size, By Product Type, 2014 -2021 (USD Billion)

Table 31 Japan: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 32 South Korea: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 33 South Korea: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 34 Rest of Asia-Pacific: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 35 Rest of Asia-Pacific: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 36 Rest of the World: Market Size, By Country, 2014–2021 (USD Billion)

Table 37 Rest of the World: Market Size, By Country, 2014–2021 (‘000 Units)

Table 38 Brazil: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 39 Brazil: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 40 South Africa: Market Size, By Product Type, 2014–2021 (USD Billion)

Table 41 South Africa: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 42 Others: Automotive Drivetrain Market Size, By Product Type, 2014–2021 (USD Billion)

Table 43 Others: Market Size, By Product Type, 2014–2021 (‘000 Units)

Table 44 Market Size, By Vehicle Type, 2014–2021 (USD Billion)

Table 45 Market Size, By Vehicle Type, 2014–2021 (‘000 Units)

Table 46 Passenger Car: Market Size, By Drive Type, 2014–2021 (USD Billion)

Table 47 Passenger Car: Market Size,By Drive Type, 2014–2021 (‘000 Units)

Table 48 Light Commercial Vehicle: Market Size,By Drive Type, 2014–2021 (USD Billion)

Table 49 Light Commercial Vehicle: Market Size, By Drive Type, 2014–2021 (‘000 Units)

Table 50 Heavy Commercial Vehicle (Trucks): Market Size, By Drive Type, 2014–2021 (USD Billion)

Table 51 Heavy Commercial Vehicle (Trucks): Market Size,By Drive Type, 2014–2021 (‘000 Units)

Table 52 Heavy Commercial Vehicle (Buses): Market Size, By Drive Type, 2014–2021 (USD Billion)

Table 53 Heavy Commercial Vehicle (Buses): Automotive Drivetrain Market Size, By Drive Type, 2014–2021 (‘000 Units)

Table 54 Automotive Drivetrain Market Size, By Drive Type, 2014–2021 (USD Billion)

Table 55 Market Size, By Drive Type, 2014–2021 (‘000 Units)

Table 56 Front Wheel Drive: Market Size, By Drivetype, 2014–2021 (USD Billion)

Table 57 Front Wheel Drive: Market Size,By Region, 2014–2021 (Thousand Units)

Table 58 Rear Wheel Drive: Market Size, By Region, 2014–2021 (USD Billion)

Table 59 Rear Wheel Drive: Market Size,By Region, 2014–2021 (‘000 Units)

Table 60 All-Wheel Drive: Market Size, By Region, 2014–2021 (USD Billion)

Table 61 All-Wheel Drive: Market Size, By Region, 2014–2021 (‘000 Units)

Table 62 Automotive Drivetrain Market Size, By Electric Vehicle Type, 2014–2021 (USD Billion)

Table 63 Battery Electric Vehicles: Market Size, By Region, 2014–2021 (‘000 Units)

Table 64 Plug-In Hybrid Electric Vehicles: Market Size, By Region, 2014–2021 (‘000 Units)

Table 65 Hybrid Electric Vehicles: Market Size,By Region, 2014–2021 (‘000 Units)

Table 66 Expansions, 2015–2016

Table 67 New Product Launches, 2016

Table 68 Agreement/Joint Ventures/Supply Contracts/Partnerships, 2010–2015

Table 69 Mergers & Acquisitions, 2015

List of Figures (49 Figures)

Figure 1 Research Design

Figure 2 Research Design Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Roadways Infrastructure: Road Network (Km), By Country, 2011

Figure 5 Production Statistics for the Year 2004 vs 2014

Figure 6 Automotive Drivetrain Market, By Type: Bottom-Up Approach

Figure 7 Asia-Pacific is Estimated to Be the Largest Market for Automotive Drivetrain, 2016 vs 2021 (USD Billion)

Figure 8 FWD Segment to Dominate the Market in 2016

Figure 9 Asia-Pacific is Estimated to Be the Largest Market for Automotive Drivetrain 2016 vs 2021

Figure 10 BEV is Estimated to Be the Largest Market for Elevtric Vehicle Drivetrain 2016 vs 2021

Figure 11 Growing Demand for Comfort and Safety in Vehicles is Driving the Market, 2016-2021

Figure 12 Market Share, By Drivetype & Region, 2016

Figure 13 Asia-Pacific Holds the Largest Market Share, By Value, 2016–2021

Figure 14 FWD Segment to Lead the Global Market, By Product, 2016 vs 2021

Figure 15 Passenger Car Segment to Lead the Market, 2016–2021

Figure 16 HEV to Hold the Largest Market Share, 2016-2021 (‘000 Units)

Figure 17 Market Segmentation

Figure 18 Automotive Drivetrain Market, By Drive Type

Figure 19 Market, By Region

Figure 20 Market, By Electric Vehicle Drivetrain

Figure 21 Market Dynamics

Figure 22 Increase in Vehicle Production Across the Globe, 2009 vs 2015

Figure 23 Porter’s Five Forces Analysis

Figure 24 Regional Snapshot (2016): China, Germany and U.S. are Emerging as New Hotspots

Figure 25 North American Market Snapshot: Demand to Be Driven By Increasing Rate of Vehicle Production

Figure 26 European Automotive Drivetrain Market, 2016 vs 2021

Figure 27 Asia-Pacific Market Snapshot: China to Dominate the Market in 2016

Figure 28 Rest of the World Market, 2016 vs 2021

Figure 29 Passenger Cars : Estimated to Be the Fastest Growing Vehicle Segment in the Automotive Drivetrain Market

Figure 30 All Wheel Drive Estimated to Be the Fastest Growing Vehicle Segment in the Automotive Drivetrain Market (2016-2021)

Figure 31 Hybrid Electric Vehicle : Estimated to Be the Fastest Growing Electric Vehicle Segment in the Automotive Drivetrain Market

Figure 32 Companies Adopted Expansion as the Key Growth Strategy From 2012 to 2016

Figure 33 Market Evaluation Framework: Expansions Fuelled Market Growth From 2013–2016

Figure 34 Battle for Market Share: Agreements/Joint Ventures/Supply Contracts/Partnerships Was the Key Strategy

Figure 35 Aisin Seiki Co., Ltd.: Company Snapshot

Figure 36 Aisin Seiki Co. Ltd.: SWOT Analysis

Figure 37 American Axle & Manufacturing, Inc.: Company Snapshot

Figure 38 American Axle & Manufacturing, Inc.: SWOT Analysis

Figure 39 Borgwarner Inc.: Company Snapshot

Figure 40 Borgwarner Inc.: SWOT Analysis

Figure 41 GKN PLC: Company Snapshot

Figure 42 GKN PLC: SWOT Analysis

Figure 43 ZF Friedrichshafen AG: Company Snapshot

Figure 44 ZF Friedrichshafen AG: SWOT Analysis

Figure 45 Magna International Inc.: Company Snapshot

Figure 46 Dana Holding Corporation: Company Snapshot

Figure 47 JTEKT Corporation: Company Snapshot

Figure 48 Showa Corporation: Company Snapshot

Figure 49 Schaeffler Group: Company Snapshot

Growth opportunities and latent adjacency in Automotive Drivetrain Market

We are looking for share of the AWD trucks in the global truck industry; GVW 18t> and we are also looking for the key trends in segment of GVW 14 – 18 tons