Aviation Test Equipment Market by Segments (Electrical, Hydraulic, Pneumatic, Power), by Application (Military and Commercial), & by Geography (North America, Latin America, Asia-Pacific, Europe, the Middle East, Africa & ROW) - Global Forecasts & Analysis 2034

The aviation test equipment market continues to evolve as aircraft become more electric, connected, and digitally monitored.

Global market valuation is estimated at USD 8.1 billion in 2024. It is projected to reach approximately USD 11.9 billion by 2034, registering a steady compound annual growth rate (CAGR) of 3.5 % during the forecast period. This study covers detailed insights into product-level trends, emerging technologies, key regulations, and vendor strategies shaping the global ecosystem. It extends one year beyond comparable industry forecasts to offer a more current perspective for OEMs, maintenance service providers, and investors evaluating long-term opportunities.

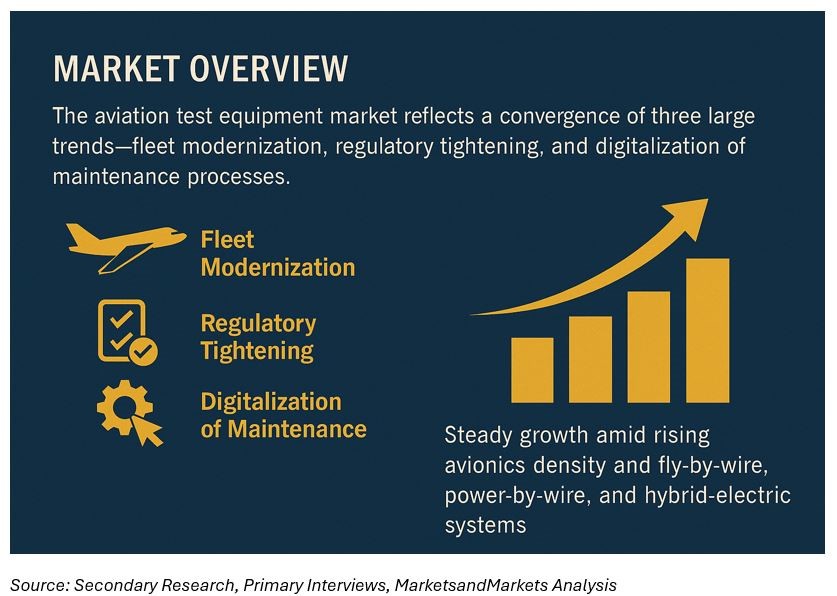

Market Overview

The aviation test equipment market reflects a convergence of three significant trends—fleet modernization, regulatory tightening, and digitalization of maintenance processes. Over the last decade, the increasing density of avionics and the adoption of fly-by-wire, power-by-wire, and hybrid-electric systems have transformed test equipment requirements.

Modern aircraft platforms now rely on comprehensive electrical, hydraulic, and pneumatic verification, driving demand for multi-function test benches and portable diagnostic systems. In parallel, commercial and defense operators are under pressure to minimize aircraft downtime. This has accelerated the shift from legacy bench-top testing toward automated, software-integrated, and IoT-enabled systems capable of on-wing diagnostics.

Meanwhile, aviation regulators such as the Federal Aviation Administration (FAA), European Union Aviation Safety Agency (EASA), and Transport Canada Civil Aviation (TCCA) are enforcing tighter calibration and traceability mandates. These policies sustain continuous demand for certified test platforms and frequent recertification services.

Market Dynamics

Key Growth Drivers

- Fleet expansion and modernization: More than 25,000 commercial aircraft are expected to enter service globally by 2035, prompting extensive testing demand across assembly lines, maintenance bases, and defense depots.

- Technological advancement in avionics: Integrated modular avionics (IMA), radar altimetry, fly-by-wire flight controls, and next-generation propulsion systems require high-precision testing and calibration tools.

- Regulatory compliance and safety mandates: Continuous airworthiness management systems (CAMS) and air-safety directives increase the testing frequency of electrical and hydraulic systems.

- Digital transformation of MRO operations: Predictive maintenance and data analytics encourage the use of portable, sensor-embedded test units for faster turnaround.

Restraints

The high initial cost of advanced test equipment, the lack of skilled calibration engineers, and recurring certification expenses limit adoption among small and medium-sized MROs. Additionally, the pace of avionics innovation risks rendering older test systems obsolete sooner than expected.

Opportunities

- Adoption of AI-assisted diagnostics and cloud-based calibration management offers new revenue models such as test-as-a-service.

- Increasing participation of unmanned and hybrid-electric aircraft expands application scope into emerging aviation niches.

- Ongoing defense fleet renewals in the U.S., Europe, India, and Japan will further elevate procurement of ruggedized test systems.

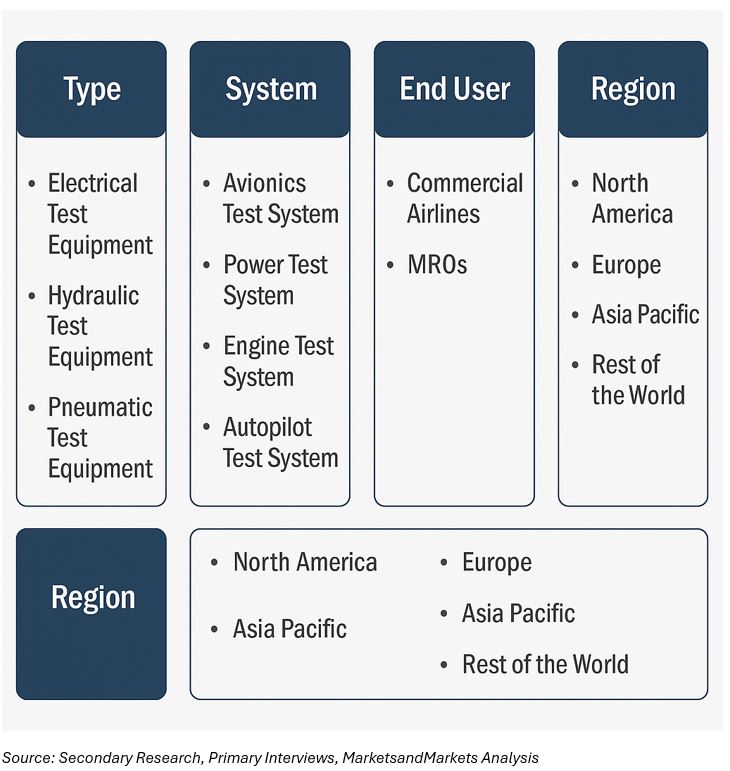

Market Segmentation

By Product Type

- Electrical/Electronic Test Equipment – including automatic test systems, power-supply analyzers, and avionics test sets. This category represents the largest share owing to electric-propulsion trends and integrated flight-deck electronics.

- Hydraulic Test Equipment is used to validate actuator, pump, and valve performance in line and base maintenance.

- Pneumatic Test Equipment – critical for environmental control and braking systems testing.

- Power System Test Equipment – including battery, generator, and converter test stands supporting the “more-electric aircraft” concept.

- Others – specialized optical, fuel, and communication test modules.

By Aircraft Type

- Fixed-Wing Commercial Aircraft – narrow-body, wide-body, and regional jets.

- Rotary-Wing Aircraft – helicopters used for defense, emergency, and offshore operations.

- Unmanned Aerial Systems (UAS) – the fastest-growing segment, requiring lightweight portable testers for propulsion and payload diagnostics.

By End User

- OEMs (Original Equipment Manufacturers) – employ test rigs during assembly, integration, and certification phases.

- MRO Facilities (Maintenance, Repair & Overhaul) – the largest operational consumers due to recurring testing and calibration cycles.

- Airlines and Operators – deploy portable testers for on-wing health monitoring and flight-line verification.

- Defense Organizations – adopt ruggedized and mobile testers for military aircraft and UAV fleets.

By Region

|

Region |

Key Highlights |

|

North America |

Largest share (~33 % in 2024) supported by a mature OEM base, FAA regulations, and strong defense procurement. |

|

Europe |

A robust avionics supply chain and EASA standards drive steady upgrades to the test infrastructure. |

|

Asia Pacific |

Fastest growth through 2034 is expected due to fleet expansion in China, India, Indonesia, and Vietnam; emerging local MRO hubs are also intensifying demand. |

|

Middle East & Africa |

Growth led by Gulf-based carriers, modernizing fleets, and increasing in-house maintenance capacity. |

|

Latin America |

Moderate but rising adoption of digital test systems in Brazil and Mexico, primarily within OEM tier-2 supplier networks. |

Competitive Landscape

The market exhibits a mix of established aerospace conglomerates and specialized instrumentation firms. Leading participants include:

Honeywell International Inc., Boeing Company, Rolls-Royce Holdings plc, RTX Corporation (Raytheon Technologies), 3M Company, Teradyne Inc., Moog Inc., SPHEREA Test & Services SAS, Testek Solutions, Rockwell Collins (An RTX Company), and Airbus Defence & Space.

These players emphasize R&D toward automation, interoperability with digital maintenance ecosystems, and lifecycle support. Recent strategic developments highlight this trend:

- 2024: Honeywell introduced an AI-enabled avionics test suite integrating predictive failure analytics.

- 2023: SPHEREA and Airbus Helicopters launched a portable ATEC Plug bench optimized for rotary-wing diagnostics.

- 2022: Moog expanded its hydraulic test-system production line to address electric-actuator qualification for eVTOL platforms.

Partnerships with airlines and defense ministries are increasingly common, ensuring calibration compliance and data integration across maintenance records.

Regulatory and Standards Environment

Testing and calibration activities must conform to international frameworks such as RTCA/DO-160, DO-178C, DO-254, MIL-STD-810, and ISO 17025. These define environmental, software, and hardware assurance levels for airborne equipment. Additionally, region-specific quality systems (e.g., AS9100D) are also applicable to calibration laboratories and supplier networks.

The rising emphasis on traceability—supported by digital certificates and blockchain-based calibration logs—is influencing how vendors design next-generation test platforms. Compliance complexity increases entry barriers, favoring established, certified suppliers.

Sustainability and ESG Perspective

The aviation test equipment market is gradually aligning with sustainability imperatives. Manufacturers are redesigning benches for lower power consumption and adopting modular hardware to extend service life. Remote diagnostics and virtual calibration reduce technician travel, cutting indirect emissions.

Leading vendors have begun publishing lifecycle emission metrics and adopting ISO 14001 environmental management standards. For airlines and MROs pursuing Scope 3 emission reductions, procurement of energy-efficient test systems forms part of their ESG disclosures. This alignment between operational efficiency and sustainability creates a subtle but essential growth catalyst through the next decade.

Regional Outlook

North America

The region’s dominance will persist, anchored by the presence of Boeing, Honeywell, and GE Aerospace. Fleet renewal of narrow-body aircraft and strong defense modernization programs will ensure the continuous procurement of advanced test equipment.

Europe

European growth is supported by EASA’s evolving maintenance regulations and investments in electric-propulsion demonstrators. Countries such as France, Germany, and the UK are expanding calibration-lab infrastructure for both commercial and military use.

Asia Pacific

The Asia Pacific remains the fastest-growing market, projected to record a CAGR of more than 5% during 2024-2034. Indigenous manufacturing in India (Make in India initiative) and China’s COMAC C919 program are stimulating localized test-equipment demand.

Middle East & Africa

Aircraft fleet expansion by Gulf carriers, together with investments in regional MRO hubs (Dubai South, Abu Dhabi, Jeddah), will accelerate test-system imports and regional assembly partnerships.

Latin America

Growth is modest but consistent. Brazil’s Embraer and regional suppliers are upgrading ground-test facilities to align with global certification norms.

Forecast Summary

|

Year |

Market Size (USD Billion) |

CAGR (2024–2034) |

|

2024 (Base) |

8.1 |

XX% |

|

2029 (5-year |

9.8 |

XX% |

|

2034 (10 years |

11.9 |

3.5 % |

Overall, the aviation test equipment market is expected to demonstrate stable, technology-driven growth over the next decade. The transition toward more-electric aircraft, coupled with rigorous regulatory oversight and sustainability imperatives, will sustain long-term demand. The ecosystem is moving from hardware-centric manufacturing to service-enabled, data-driven solutions. For stakeholders—OEMs, system suppliers, and MROs—competitive advantage will hinge on digital integration, calibration efficiency, and alignment with ESG principles.

Frequently Asked Questions

Q1. What is the size of the aviation test equipment market in 2024?

The global aviation test equipment market is valued at approximately USD 8.1 billion in 2024.

Q2. What is the forecast for 2034?

It is projected to reach around USD 11.9 billion by 2034, growing at a CAGR of 3.5 %.

Q3. Which product segment dominates?

Electrical and electronic test equipment leads due to growing avionics complexity and the electrification of aircraft systems.

Q4. Which region is expected to record the fastest growth?

The Asia Pacific is set to expand at the fastest rate, supported by fleet growth and indigenous aircraft manufacturing in China and India.

Q5. Who are the key players in the aviation test equipment market?

Honeywell International Inc., Boeing Company, Rolls-Royce Holdings plc, RTX Corporation, 3M Company, Teradyne Inc., Moog Inc., SPHEREA Test & Services SAS, Testek Solutions, and Airbus Defence & Space.

Table Of Contents

1 Introduction (Page No. - 18)

1.1 Key Take-Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

2 Executive Summary (Page No. - 23)

3 Market Overview (Page No. - 25)

3.1 Introduction

3.2 Market Segmentation

3.2.1 By Segments

3.2.2 By Geographic Region

3.3 Market Definition

3.4 Market Dynamics

3.4.1 Drivers

3.4.1.1 Increasing Trends Towards Software-Adaptable Solutions

3.4.1.2 Testing of Advanced Capabilities; Dircm& Digital Rf

3.4.1.3 Multi-Use Test Systems For Multiple Weapons Platform

3.4.1.4 Configurable and Scalable Testers

3.4.1.5 Uas Testers in Battlefield and National Airspace

3.4.2 Restraints

3.4.2.1 Sustainment of Legacy Platforms

3.4.2.2 Diminutive Life Cycle of Avionics Module

3.4.3 Opportunities

3.4.3.1 New Standards and Synthetic Instrumentation

3.4.3.2 Future Airborne Capability Environment Consortium

3.4.3.3 Updating Legacy Equipment

4 Trend Analysis (Page No. - 33)

4.1 Test Equipment Gaining Intelligence

4.2 Aviation Test Equipment, Then, Now, and in The Future

5 Global Aviation Test Equipment Market (Page No. - 36)

5.1 Global Aviation Test Equipment Spending

5.1.1 Global Revenue Analysis

5.2 Revenue Analysis, By Type of Segments

5.2.1 Electrical Test Equipment Revenue Forecast

5.2.2 Hydraulic Aviation Test Equipment Revenue Forecast

5.2.3 Pneumatic Aviation Test Equipment Revenue Forecast

5.2.4 Power Aviation Test Equipment Revenue Forecast

6 Global Revenue Analysis, By Geography (Page No. - 42)

6.1 Aviation Test Equipment Market, Regional Analysis

6.1.1 North America Revenue Forecast

6.1.1.1 North America Revenue Forecast, By Segments of Test Equipment

6.1.2 Asia Pacific Revenue Forecast

6.1.2.1 Asia Pacific Revenue Forecast, By Segments ofTest Equipment

6.1.3 Middle East Revenue Forecast

6.1.3.1 Middle East Revenue Forecast, By Segments ofTest Equipment

6.1.4 Latin America Revenue Forecast

6.1.4.1 Latin America Revenue Forecast, By Segments of Test Equipment

6.1.5 Europe Revenue Forecast

6.1.5.1 Europe Revenue Forecast, By Segments ofTest Equipment

6.1.6 Africa Revenue Forecast

6.1.6.1 Africa Revenue Forecast, By Segments ofTest Equipment

6.2 Aviation Test Equipment Market, Country Analysis

6.2.1 United States Revenue Forecast

6.2.1.1 United States Revenue Forecast, By Segments of Test Equipment

6.2.2 Canada Revenue Forecast

6.2.2.1 Canada Revenue Forecast, By Segments ofTest Equipment

6.2.3 Brazil Revenue Forecast

6.2.3.1 Brazil Revenue Forecast, By Segments of Test Equipment

6.2.4 China Revenue Forecast

6.2.4.1 China Revenue Forecast, By Segments of Test Equipment

6.2.5 Singapore Revenue Forecast

6.2.5.1 Singapore Revenue Forecast, By Segments of Test Equipment

6.2.6 Malaysia Revenue Forecast

6.2.6.1 Malaysia Revenue Forecast, By Segments of Test Equipment

6.2.7 Indonesia Revenue Forecast

6.2.7.1 Indonesia Revenue Forecast, By Segments of Test Equipment

6.2.8 United Kingdom Revenue Forecast

6.2.9 France Revenue Forecast

6.2.9.1 France Revenue Forecast, By Segments of Test Equipment

6.2.10 Germany Revenue Forecast

6.2.10.1 Germany Revenue Forecast, By Segments of Test Equipment

6.2.11 Russia Revenue Forecast

6.2.11.1 Russia Revenue Forecast, By Segments of Test Equipment

6.2.12 Turkey Revenue Forecast

6.2.12.1 Turkey Revenue Forecast, By Segments of Test Equipment

6.2.13 UAE Revenue Forecast

6.2.13.1 UAE Revenue Forecast, By Segments of Test Equipment

6.2.14 South Africa Revenue Forecast

6.2.14.1 South Africa Revenue Forecast, By Segments of Test Equipment

7 Competitive Landscape (Page No. - 100)

7.1 Overview

7.2 Market Share Analysis, By Segments

7.3 Market Share Analysis, By Country

7.4 Industry Key Players

7.5 Recent Industry Developments

7.5.1 New Product Developments & Announcements

7.5.2 Contacts and Agreements

7.5.3 Acquisitions, Collaborations, and Joint Ventures

7.5.4 Awards and Others

8 Company Profiles (Page No.- 109)

8.1 Honeywell International Inc.

8.2 Boeing

8.3 Airbus

8.4 Rockwell Collins

8.5 General Electric Co.

8.6 3M

8.7 Moog, Inc.

8.8 Rolls Royce Holdings Plc

8.9 Teradyne Inc.

List of Tables (94 Tables)

Table 1 Global Aviation Test Equipment Market 2014 – 2020 ($Billion)

Table 2 Impact Analysis: Drivers

Table 3 Impact Analysis: Restraints

Table 4 Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 5 Market Value, 2014-2020 ($Billion)

Table 6 Electrical Aviation Test Equipment Market Value, 2014-2020 ($Billion)

Table 7 Hydraulic Aviation Test Equipment Market Value, 2014-2020 ($Billion)

Table 8 Pneumatic Aviation Test Equipment Market Value, 2014-2020 ($Billion)

Table 9 Power Aviation Test Equipment Market Value, 2014-2020 ($Billion)

Table 10 North America: Aviation Test Equipment Market Value, 2014-2020 ($Billion)

Table 11 North America: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 12 North America: Military Aviation Market Value, 2014-2020 ($Billion)

Table 13 North America: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 14 Asia Pacific: Aviation Test Equipment Market Value, 2014-2020 ($Billion)

Table 15 Asia-Pacific: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 16 Asia-Pacific: Military Aviation Market Value, 2014-2020 ($Billion)

Table 17 Asia-Pacific: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 18 Middle East: Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 19 Middle East: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 20 Middle East: Military Aviation Market Value, 2014-2020 ($Billion)

Table 21 Middle East: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 22 Latin America: Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 23 Latin America: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 24 Latin America: Military Aviation Market Value, 2014-2020 ($Billion)

Table 25 Latin America: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 26 Europe: Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 27 Europe: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 28 Europe: Military Aviation Market Value, 2014-2020 ($Billion)

Table 29 Europe: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 30 Africa: Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 31 Africa: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 32 Africa: Military Aviation Market Value, 2014-2020 ($Billion)

Table 33 Africa: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 34 United States Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 35 United States: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 36 United States: Military Aviation Market Value, 2014-2020 ($Billion)

Table 37 United States: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 38 Canadian Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 39 Canada: Segments, Revenue Forecast, 2014-2020 ($Billion)

Table 40 Canada: Military Aviation Market Value, 2014-2020 ($Billion)

Table 41 Canada: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 42 Brazilian Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 43 Brazil: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 44 Brazil: Military Aviation Market Value, 2014-2020 ($Billion)

Table 45 Brazil: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 46 China Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 47 China: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 48 China: Military Aviation Market Value, 2014-2020 ($Billion)

Table 49 China: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 50 Singapore Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 51 Singapore: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 52 Singapore: Military Aviation Market Value, 2014-2020 ($Billion)

Table 53 Singapore: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 54 Malaysia’s Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 55 Malaysia: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 56 Malaysia: Military Aviation Market Value, 2014-2020 ($Billion)

Table 57 Malaysia: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 58 Indonesia’s Aviation, 2014-2020 ($Billion)

Table 59 Indonesia: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 60 Indonesia: Military Aviation Market Value, 2014-2020 ($Billion)

Table 61 Indonesia: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 62 United Kingdom Aviation Test Equipment Market Value, 2014-2020 ($Billion)

Table 63 United Kingdom: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 64 United Kingdom: Military Aviation Market Value, 2014-2020 ($Billion)

Table 65 United Kingdom: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 66 France Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 67 France: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 68 France: Military Aviation Market Value, 2014-2020 ($Billion)

Table 69 France: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 70 Germany Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 71 Germany: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 72 Germany: Military Aviation Market Value, 2014-2020 ($Billion)

Table 73 Germany: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 74 Russia Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 75 Russia: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 76 Russia: Military Aviation Market Value, 2014-2020 ($Billion)

Table 77 Russia: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 78 Turkey Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 79 Turkey: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 80 Turkey: Military Aviation Market Value, 2014-2020 ($Billion)

Table 81 Turkey: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 82 UAE Aviation Test Equip Market Value, 2014-2020 ($Billion)

Table 83 UAE: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 84 UAE: Military Aviation Market Value, 2014-2020 ($Billion)

Table 85 UAE: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 86 South Africa Aviation Test Equipment Market Value, 2014-2020 ($Billion)

Table 87 South Africa: Test Equipment Segments Market Value, 2014-2020 ($Billion)

Table 88 South Africa: Military Aviation Market Value, 2014-2020 ($Billion)

Table 89 South Africa: Commercial Aviation Market Value, 2014-2020 ($Billion)

Table 90 Top Five Players in The Aviation Test Equipment Market, 2014-2020

Table 91 New Product Developments and Announcements in Market

Table 92 Contracts and Agreements in Market

Table 93 Acquisitions, Collaborations, and Joint Ventures in Market

Table 94 Awards, Expansions and Testing in Market

List of Figures (35 Figures)

Figure 1 Global Aviation Test Equipment Market

Figure 2 Marketing Collateral

Figure 3 Research Methodology

Figure 4 Data Triangulation Methodology

Figure 5 Impact Analysis: Drivers & Restraints

Figure 6 Impact Analysis of Drivers & Restraints During Forecast Period

Figure 7 North America: Regional Split, 2014-2020 (%)

Figure 8 Asia-Pacific: Regional Split, 2014-2020 (%)

Figure 9 Middle East: Regional Split 2014-2020 (%)

Figure 10 Latin America: Regional Split, 2014-2020 (%)

Figure 11 Europe: Regional Split, 2014 - 2020 (%)

Figure 12 Africa: Regional Split, 2014-2020 (%)

Figure 13 Market Share Analysis, By Segments

Figure 14 Market Share Analysis, By Country

Figure 15 Honeywell: Company Snapshot

Figure 16 Honeywell: SWOT Analysis

Figure 17 Boeing: Company Snapshot

Figure 18 Boeing: SWOT Analysis

Figure 19 Airbus: Company Snapshot

Figure 20 Airbus: SWOT Analysis

Figure 21 Rockwell Collins: Company Snapshot

Figure 22 Rockwell Collins: SWOT Analysis

Figure 23 General Electric Co. : Company Snapshot

Figure 24 General Electric Co.: Product offerings

Figure 25 General Electric Co.: SWOT Analysis

Figure 26 3M: Company Snapshot

Figure 27 3M: Product offerings

Figure 28 3M: SWOT Analysis

Figure 29 Moog Inc.: Company Snapshot

Figure 30 Moog, Inc.: SWOT Analysis

Figure 31 Rolls Royce Holdings Plc : Company Snapshot

Figure 32 Rolls Royce Holdings Plc: Product offerings

Figure 33 Rolls Royce Holdings Plc: SWOT Analysis

Figure 34 Teradyne Inc. : Company Snapshot

Figure 35 Teradyne: SWOT Analysis

Growth opportunities and latent adjacency in Aviation Test Equipment Market