Blister Packaging Market by Material (Paper & Paperboard, Plastic, Aluminum), Type (Carded, Clamshell), Technology (Thermoforming, Cold Forming), End-use Sector (Healthcare, Consumer Goods Industrial Goods, Food), and Region - Global Forecast to 2025

Updated on : August 25, 2025

Blister Packaging Market

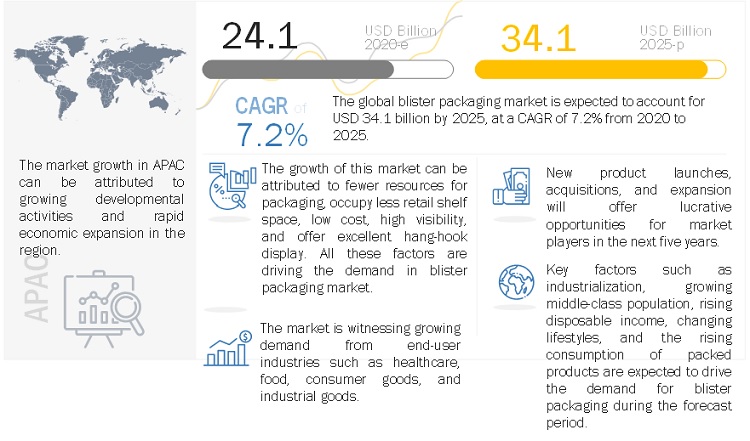

The global blister packaging market was valued at USD 24.1 billion in 2020 and is projected to reach USD 34.1 billion by 2025, growing at 7.2% cagr from 2020 to 2025. Several properties such as cost-effectiveness and tamper-evident design for product protection will drive the growth of the blister packaging market in several end-use industries such as healthcare, food, consumer goods, and industrial goods.

Global Blister Packaging Market Trends

Note: e - estimated, p - projected

To know about the assumptions considered for the study, Request for Free Sample Report

Blister Packaging Market Dynamics

Driver: Cost-effectiveness

The rapid shift of consumer preference from traditional bottles for pharmaceutical products to blister packaging, which is unit-dose packaging. In the healthcare industry, blister packaging is used in drugs and medical devices. These packaging are highly used in consumer goods, industrial goods, and food industries. Also, blister packaging requires fewer resources for packaging, occupies minimum retail shelf space, and provides an excellent hang-hook display. Hence, the cost of blister packs is less as compared to other packaging formats, such as rigid bottles, making them cost-effective.

Restraint: Not suitable for packaging heavy items

Blister packaging is mainly used for the purpose of protecting lightweight items and extending the shelf life of the products. However, it is not an ideal solution for the packaging of heavy-weight products. Heavy products tend to put more strain on the paperboard backing or the plastic film in which they are packed. This, in turn, breaks packages during handling, storing, and transporting of the product, which also results in additional cost and loss of the product. Blister packaging is also not advisable for costly and fragile products it could break or damage the product and cause loss to the owner.

Opportunity: Emerging economies offer high growth potential

Blister packaging is projected to witness much growth in emerging economies such as BRIC (Brazil, Russia, India, and China) and CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa) in upcoming years, owing to the growing favourable demographics, rising household incomes, changing lifestyles of consumers, and encouraging a rising preference for on-the-go products. These factors promote changes in lifestyle and will drive the demand for convenience in terms of packaging and use.

Challenges: Compliance with stringent regulations

Stringent regulations imposed on blister packaging, especially in the healthcare industry, come across as a challenge to the blister packaging market. Compliance with regulations specific to the smallest defect in packaging may destroy the product which will also negatively impact the manufacturer’s profit. According to the FDA, a blister cell label must include the proprietary and established name, strength, lot number, expiration date, bar code, and manufacturer name must appear over each blister cell. Complying with such regulations requires extra effort, resulting in additional costs, time, and resources, which becomes a challenge to the blister packaging market manufacturers.

Thermoforming is the largest technology segment of the blister packaging market

The blister packaging market is segmented on the basis of technology i.e thermoforming and cold forming. Owing to its large number of applications in the end-use sector such as healthcare and food, thermoforming holds the largest market share in the global blister packaging market. Thermoforming technology also requires low-cost initial tools and equipment as compared to cold forming.

Carded is the largest type segment of the blister packaging market

The blister packaging market is segmented on the basis of type including carded and clamshell. Carded blister packaging is the largest and faster-growing segment of the global blister packging market owing to its ability to form different shapes, stack many products, easy handling and excellent damage control properties. Additionally, the rising demand from food packaging and e-commerce industries will support the growth of carded blister packaging.

Plastic films are the largest material segment of the blister packaging market

The blister packaging market is classified on the basis of material into plastic films, paper & paperboard, and aluminium. Plastic films are projected to be the largest and fastest-growing segment during the forecast period. Several characteristics such as excellent visibility and security of the product, security, and attractive packaging, will drive the segment growth in the forecast period.

Healthcare is the largest end-use sector segment of the blister packaging market

The blister packaging market is classified on the basis of the end-use sector into healthcare, consumer goods, industrial goods, and food. The healthcare segment dominated the blister packaging market followed by the consumer goods end-use segment. In the healthcare industry blister packaging of products reduces product contamination and protects healthcare products from moisture, gas, light, and temperature. All these factors are driving the demand for blister packaging in the healthcare end-use sector.

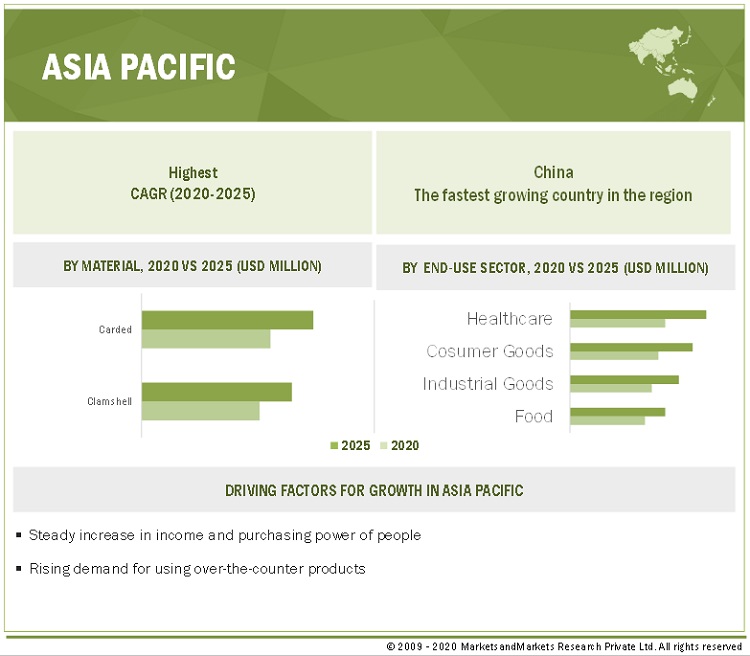

APAC is the fastest-growing market for blister packaging market

APAC is expected to register the highest CAGR during the forecasted period. The rapid expansion of end-use sectors such as healthcare, food, and consumer & industrial goods sectors will support the growth of the blister packaging market in the APAC region. Moreover, factors such as rising disposable income, growing middle-class population, rising consumption of high-visibility products, and the growing healthcare industry will drive the demand for the blister packaging market over the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Blister Packaging Market Players

Amcor Plc (Switzerland), DOW (US), WestRock Company (US), Sonoco Products Company (US), Constantia Flexibles (Austria), Klockner Pentaplast Group (Germany), E.I. du Pont de Nemours and Company (US), Honeywell International Inc. (US), Tekni-Plex (US), and Display Pack (US) are the key players operating in the blister packaging market. These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for blister packaging from emerging economies.

Blister Packaging Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

Technology, Material, Type, End-Use Sector, and Region |

|

Regions |

APAC, Europe, North America, the Middle East & Africa, and South America |

|

Companies |

Amcor Plc (Switzerland), DOW (US), WestRock Company (US), Sonoco Products Company (US), Constantia Flexibles (Austrai), Klockner Pentaplast Group (Germany), E.I. du Pont de Nemours and Company (US), Honeywell International Inc. (US), Tekni-Plex (US), Display Pack (US), and others. |

This research report categorizes the blister packaging market based on chemistry, type, application, and region.

Blister Packaging Market, By Technology:

- Thermoforming

- Cold Forming

Blister Packaging Market By Type:

- Carded

- Clamshell

Blister Packaging Market, By Material:

- Paper & Paperboard

- Plastics Films

- Aluminium

Blister Packaging Market, By End-Use Sector:

- Healthcare

- Consumer Goods

- Indstrial Goods

- Food

Blister Packaging Market, By Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2021, Sonoco Products Company entered into partnership with Integrated Systems, Inc. (US). This partnership will help the company to enhance its automation activities and increase efficiency in global manufacturing operations.

- In September 2020, Amcor Plc developed first recyclable retort flexible packaging with improved environmental footprint of packaging to 60% (approximately). This will allow recycling of high-performance packaging such as wet pet food, ready-meals, baby foods, and pre-cooked soups.

- In August 2020, Sonoco Products Company acquired Can Packaging (France). This acquisition will add two manufacturing facilities, and a R&D facility to the company’s existing assets and fortify its market position in Europe region.

- In July 2020, Dow launched INNATE TF an extension to INNATE precision packaging family. It is a polyethylene resin for tenter frame biaxial orientation films. These are high performance, recyclable, and consumer convenience films.

- In May 2020, Constantia Flexibles acquired TT print (Russia). This acquisition will add pharmaceutical packaging production plant to the company’s asset and will strengthen its pharma division.

- In May 2020, Constantia Flexibles started world’s first sustainable packaging dedicated manufacturing plant in India. With this new manufacturing facility focused on the production of environmental friendly packaging EcoLamb, it aims to cater to growing demand of sustainable and recyclable packaging.

- In January 2020, Amcor Plc signed partnership with Moda Vacuum Packaging System (New Zealand) to provide innovative packaging solution. With the synergy of Amcor’s rollstock film and shrink bag for cheese & meat with Moda’s packaging system, producers can drive total cost saving and operational efficiency.

- In September 2019, Amcor Plc started two e-commerce testing laboratories in Michigan, US and Ghent, Belgium. This expansion will help the company to harness significant online sales growth by providing convenient and sustainable packaging materials.

- In Septmeber 2019, WestRock Company launch recyclable polyethylene flexible packaging under the brand name EnviroFlex PE. It can be used in variety of retail products and cater to the growing need for sustainable & recyclable packaging.

- In January 2017, WestRock Company signs definite agreement to acquire Multi Packaging Solutions International Limited (US). This growth strategy will help the company to increase cash inflow, addition of packaging products, and extend its presence in 59 locations across APAC, North America, and Europe.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the blister packaging market?

Emerging economies such as BRIC (Brazil, Russia, India, and China) and CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa) offer high growth potential for blister packaging market. Growth in is mainly driven by the favorable demographics, rising household incomes, and changing lifestyles of consumers, encouraging a rising preference for on-the-go products.

What are the market dynamics for the different materials of blister packaging?

The blister packaging market is segmented on the basis of material into plastic films, paper & paperboard, and aluminum. Plastic films is projected to be the largest abd fastest growing material segment during the forecast period. This is attributed to its excellent visibility to the product and secure & attractive packaging.

What are the market dynamics for the different end-use industry of blister packaging?

The blister packaging market is segmented on the basis of end-use sector into healthcare, consumer goods, industrial goods, and food. The healthcare segment dominated the market followed by consumer goods segment. Blister packaging of healthcare products reduces the possibility of product contamination and protects healthcare products from moisture, gas, light, and temperature. This is driving the demand for blister packaging in healthcare end-use sector.

Who are the major manufacturers of blister packaging market?

Amcor Plc (Switzerland), DOW (US), WestRock Company (US), Sonoco Products Company (US), Constantia Flexibles (Austrai), Klockner Pentaplast Group (Germany), E.I. du Pont de Nemours and Company (US), Honeywell International Inc. (US), Tekni-Plex (US), and Display Pack (US)) are the key manufacturers in the blister packaging market.

What are the major factors which will impact market growth during the forecast period?

The blister packaging market is witnessing high growth owing to demand from end-use industries such as healthcare, food, consumer goods, and industrial goods. Its growth is attributed to cost-effectiveness and tamper-evident design for product protection.

What are the effects of COVID-19 on blister packaging market?

The demand for blister packaging has increased on account of the increase in demand for pharmaceutical and medical products during this pandemic. Certain drugs were approved for use as an interim medicine to control COVID-19 by international regulatory organizations such as FDA. The establishment of new hospitals and COVID-19 centers across the world has increased the demand for medical devices. These factors have been attributed to the increase in demand for blister packaging. Blister packaging is also used in industrial goods, consumer goods, and food products. The demand for this packaging in industrial and consumer goods declined, whereas a sharp increase in food products is presented to the manufacturers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

1.5 UNITS CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH – 1

2.2.2 SUPPLY-SIDE APPROACH – 2

2.2.3 SUPPLY-SIDE APPROACH – 3

2.2.4 DEMAND-SIDE APPROACH – 1

2.3 FACTOR ANALYSIS

2.3.1 INTRODUCTION

2.3.2 DEMAND-SIDE ANALYSIS

2.3.3 SUPPLY-SIDE ANALYSIS

2.4 MARKET SIZE ESTIMATION

2.5 DATA TRIANGULATION

2.6 MARKET SHARE ESTIMATION

2.7 RESEARCH ASSUMPTIONS & LIMITATIONS

2.7.1 ASSUMPTIONS MADE FOR THIS STUDY

3 EXECUTIVE SUMMARY (Page No. - 37)

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 DEVELOPING ECONOMIES TO WITNESS HIGH DEMAND FOR BLISTER PACKAGING

4.2 BLISTER PACKAGING MARKET, BY MATERIAL

4.3 BLISTER PACKAGING MARKET, BY TYPE

4.4 BLISTER PACKAGING MARKET, BY TECHNOLOGY

4.5 NORTH AMERICA: BLISTER PACKAGING MARKET

4.6 BLISTER PACKAGING MARKET: BY KEY COUNTRIES

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 EVOLUTION OF THE BLISTER PACKAGING MARKET

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Cost-effectiveness

5.3.1.2 Growing demand from end-use industry

5.3.1.3 Rising disposable income

5.3.1.4 Tamper-evident design for product protection

5.3.1.5 Downsizing of packaging

5.3.2 RESTRAINTS

5.3.2.1 Not suitable for packaging heavy items

5.3.3 OPPORTUNITIES

5.3.3.1 Emerging economies offer high growth potential

5.3.3.2 Investment in R&D activities

5.3.4 CHALLENGES

5.3.4.1 Compliance with stringent regulations

5.4 IMPACT ANALYSIS OF DRIVERS AND RESTRAINTS

5.5 PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 TRADE ANALYSIS

5.6.1 IMPORT-EXPORT SCENARIO OF BLISTER PACKAGING INDUSTRY

5.7 REGULATORY LANDSCAPE

5.8 VALUE CHAIN ANALYSIS

5.9 PATENT ANALYSIS

5.9.1 METHODOLOGY

5.9.2 DOCUMENT TYPE

5.9.3 PATENT PUBLICATION TRENDS

5.9.4 INSIGHT

5.9.5 JURISDICTION ANALYSIS

5.9.6 TOP PATENT APPLICANTS

5.10 MACROECONOMIC INDICATORS

5.10.1 INTRODUCTION

5.10.2 RISING POPULATION

5.10.3 INCREASE IN MIDDLE-CLASS POPULATION,2009-2030

5.10.4 DEVELOPING ECONOMICS, GDP (PURCHASING POWER PARITY), 2019

5.10.5 TREND AND FORECAST OF PHARMACEUTICAL INDUSTRY, BY REGION

6 BLISTER PACKAGING MARKET, BY TECHNOLOGY (Page No. - 61)

6.1 INTRODUCTION

6.2 THERMOFORMING

6.2.1 THIS PROCESS ENSURES OPTIMUM DISPLAY OF THE PRODUCT

6.3 COLD FORMING

6.3.1 IT IS USED IN BLISTER PACKS, WHICH USE FOIL/FOIL LAMINATION

7 BLISTER PACKAGING MARKET, BY TYPE (Page No. - 64)

7.1 INTRODUCTION

7.1.1 CARDED

7.1.1.1 Allows printing of high-quality, glossy graphics on packaging

7.1.2 CLAMSHELL

7.1.2.1 Provide necessary protection against harmful light, dirt, and wear & tear

8 BLISTER PACKAGING MARKET, BY MATERIAL (Page No. - 67)

8.1 INTRODUCTION

8.2 PLASTICS FILMS

8.2.1 PVC

8.2.1.1 Provides oxygen and water barrier and extends the shelf-life of the product

8.2.2 RIGID PVC

8.2.2.1 Provides chemical resistance and allows low permeability to oils and fats

8.2.3 POLYETHYLENE TEREPHTHALATE (PET)

8.2.3.1 It is used for packaging soft-gel packaging

8.2.4 PE

8.2.4.1 Provides moisture barrier but lacks oxygen barrier

8.2.5 OTHERS

8.2.5.1 These materials are lightweight and provide insulation properties to blister packaging

8.3 PAPER & PAPERBOARD

8.3.1 SBS

8.3.1.1 It is used as a base substrate in blister packaging

8.3.2 WLC

8.3.2.1 It is used for frozen or chilled food and toys packaging

8.3.3 OTHERS

8.3.3.1 These are used for dry food, electronics, and healthcare products packaging

8.4 ALUMINUM

9 BLISTER PACKAGING MARKET, BY END-USE SECTOR (Page No. - 73)

9.1 INTRODUCTION

9.1.1 HEALTHCARE

9.1.1.1 Blister packaging for healthcare products reduces possibility of product contamination

9.1.2 CONSUMER GOODS

9.1.2.1 Blister packaging protects electronic products from dust and moisture during transit

9.1.3 INDUSTRIAL GOODS

9.1.3.1 Blister packaging offers cost-effective packaging option for industrial goods

9.1.4 FOOD

9.1.4.1 Blister packaging increases shelf life of food product

10 BLISTER PACKAGING, BY REGION (Page No. - 78)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: BLISTER PACKAGING MARKET, BY COUNTRY

10.2.2 NORTH AMERICA: BLISTER PACKAGING MARKET, BY TYPE

10.2.3 NORTH AMERICA: BLISTER PACKAGING MARKET, BY END-USE SECTOR

10.2.4 US

10.2.4.1 Strong and growing healthcare industry to support growth of the market

10.2.4.2 US: Blister packaging market, by type

10.2.4.3 US: Blister packaging market, by end-use sector

10.2.5 CANADA

10.2.5.1 Growth of medical & pharmaceutical industry to drive demand for blister packaging

10.2.5.2 Canada: Blister packaging market, by type

10.2.5.3 Canada: Blister packaging market, by end-use sector

10.2.6 MEXICO

10.2.6.1 Growing exports will drive the demand for blister packaging

10.2.6.2 Mexico: Blister packaging market, by type

10.2.6.3 Mexico: Blister packaging market, by end-use sector

10.3 EUROPE

10.3.1 EUROPE: BLISTER PACKAGING MARKET, BY COUNTRY

10.3.2 EUROPE: BLISTER PACKAGING MARKET, BY TYPE

10.3.3 EUROPE: BLISTER PACKAGING MARKET, BY END-USE SECTOR

10.3.4 UK

10.3.4.1 Growing healthcare and food end-use sectors to support the market

10.3.4.2 UK: Blister packaging market, by type

10.3.4.3 UK: Blister packaging market, by end-use sector

10.3.5 GERMANY

10.3.5.1 Largest market for blister packaging in Europe

10.3.5.2 Germany: Blister packaging market, by type

10.3.5.3 Germany: Blister packaging market, by end-use sector

10.3.6 FRANCE

10.3.6.1 Increasing exports of food products will support the market

10.3.6.2 France: Blister packaging market, by type

10.3.6.3 France: Blister packaging Market, by end-use sector

10.3.7 SPAIN

10.3.7.1 Increase in demand from the pharmaceutical and food & beverage industries will support the growth of the market

10.3.7.2 Spain: Blister packaging market, by type

10.3.7.3 Spain: Blister packaging market, by end-use sector

10.3.8 ITALY

10.3.8.1 Growing healthcare and consumer goods industry will drive the demand

10.3.8.2 Italy: Blister packaging market, by type

10.3.8.3 Italy: Blister packaging market, by end-use sector

10.3.9 REST OF EUROPE

10.3.9.1 Growing healthcare awareness and high disposable income will drive the demand

10.3.9.2 Rest of Europe: Blister packaging market, by type

10.3.9.3 Rest of Europe: Blister packaging market, by end-use sector

10.4 APAC

10.4.1 APAC: BLISTER PACKAGING MARKET, BY COUNTRY

10.4.2 APAC: BLISTER PACKAGING MARKET, BY TYPE

10.4.3 APAC: BLISTER PACKAGING MARKET, BY END-USE SECTOR

10.4.4 CHINA

10.4.4.1 Rising consumer spending and growing population will boost the demand for consumer goods

10.4.4.2 China: Blister packaging market, by type

10.4.4.3 China: Blister packaging market, by end-use sector

10.4.5 JAPAN

10.4.5.1 Heavy investment in production capacity witnessed to meet domestic and overseas demand

10.4.5.2 Japan: Blister packaging market, by type

10.4.5.3 Japan: Blister packaging market, by end-use sector

10.4.6 AUSTRALIA

10.4.6.1 Growth of blister packaging market supported by innovation in packaging techniques

10.4.6.2 Australia: Blister packaging market, by type

10.4.6.3 Australia: Blister packaging market, by end-use sector

10.4.7 INDIA

10.4.7.1 Continuous influx of multinational companies likely to trigger demand for blister packaging

10.4.7.2 India: Blister packaging market, by type

10.4.7.3 India: Blister packaging market, by end-use sector

10.4.8 INDONESIA

10.4.8.1 Rapid industrialization, rising consumer spending, and growing healthcare industry to drive demand

10.4.8.2 Indonesia: Blister packaging market, by type

10.4.8.3 Indonesia: Blister packaging market, by end-use sector

10.4.9 REST OF APAC

10.4.9.1 Growth in organized retail sector leading to demand for blister packaging

10.4.9.2 Rest of APAC: Blister packaging market, by type

10.4.9.3 Rest of APAC: Blister packaging market, by end-use sector

10.5 MIDDLE EAST & AFRICA (MEA)

10.5.1 MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET, BY COUNTRY

10.5.2 MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET, BY TYPE

10.5.3 MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET, BY END-USE SECTOR

10.5.4 TURKEY

10.5.4.1 Growing demand for FMCG products will drive demand for blister packaging

10.5.4.2 Turkey: Blister packaging market, by type

10.5.4.3 Turkey: Blister packaging market, by end-use sector

10.5.5 UAE

10.5.5.1 Growing healthcare sector will drive the demand for blister packaging

10.5.5.2 UAE: Blister packaging market, by type

10.5.5.3 UAE: Blister packaging market, by end-use sector

10.5.6 SAUDI ARABIA

10.5.6.1 Increasing spending on convenience packaging will drive demand for blister packaging

10.5.6.2 Saudi Arabia: Blister packaging market, by type

10.5.6.3 Saudi Arabia: Blister packaging market, by end-use sector

10.5.7 SOUTH AFRICA

10.5.7.1 Growth in packaging industry to drive demand for blister packaging

10.5.7.2 South Africa: Blister packaging market, by type

10.5.7.3 South Africa: Blister packaging market, by end-use sector

10.5.8 REST OF MIDDLE EAST & AFRICA

10.5.8.1 Increase in demand for blister packaging witnessed in healthcare, food, and consumer goods sectors

10.5.8.2 Rest of Middle East & Africa: Blister packaging market, by type

10.5.8.3 Rest of Middle East & Africa: Blister packaging market, by end-use sector

10.6 SOUTH AMERICA

10.6.1 SOUTH AMERICA: BLISTER PACKAGING MARKET, BY COUNTRY

10.6.2 SOUTH AMERICA: BLISTER PACKAGING MARKET, BY TYPE

10.6.3 SOUTH AMERICA: BLISTER PACKAGING MARKET, BY END-USE SECTOR

10.6.4 BRAZIL

10.6.4.1 Government initiatives to support growth of blister packaging market

10.6.4.2 Brazil: Blister packaging market, by type

10.6.4.3 Brazil: Blister packaging market, by end-use sector

10.6.5 ARGENTINA

10.6.5.1 Rising foreign demand and improvement in business confidence of investors support growth of the market

10.6.5.2 Argentina: Blister packaging market, by type

10.6.5.3 Argentina: Blister packaging market, by end-use sector

10.6.6 REST OF SOUTH AMERICA

10.6.6.1 Rising disposable income and improving economy expected to support demand for blister packaging

10.6.6.2 Rest of South America: Blister packaging market, by type

10.6.6.3 Rest of South America: Blister packaging market, by end-use sector

11 IMPACT OF COVID-19 PANDEMIC (Page No. - 135)

11.1 INTRODUCTION

11.2 COVID-19 IMPACT ON THE BLISTER PACKAGING MARKET

12 COMPETITIVE LANDSCAPE (Page No. - 137)

12.1 INTRODUCTION

12.2 MARKET RANKING OF KEY PLAYERS

12.3 COMPETITIVE LEADERSHIP MAPPING

12.3.1 DYNAMIC

12.3.2 INNOVATOR

12.3.3 VANGUARDS

12.3.4 EMERGING

12.4 COMPETITIVE BENCHMARKING

12.4.1 PRODUCT OFFERING (FOR ALL 25 PLAYERS)

12.4.2 BUSINESS STRATEGY (FOR ALL 25 PLAYERS)

12.5 COMPETITIVE SCENARIO

12.5.1 NEW PRODUCT LAUNCHES

12.5.2 PARTNERSHIPS/AGREEMENTS

12.5.3 EXPANSIONS

12.5.4 MERGERS & ACQUISITIONS

13 COMPANY PROFILES (Page No. - 151)

13.1 AMCOR PLC

13.1.1 BUSINESS OVERVIEW

13.1.2 PRODUCTS OFFERED

13.1.3 RECENT DEVELOPMENTS

13.1.4 SWOT ANALYSIS

13.1.5 WINNING IMPERATIVES

13.1.6 CURRENT FOCUS AND STRATEGIES

13.1.7 THREAT FROM COMPETITION

13.1.8 RIGHT TO WIN

13.2 DOW

13.2.1 BUSINESS OVERVIEW

13.2.2 PRODUCTS OFFERED

13.2.3 RECENT DEVELOPMENTS

13.2.4 SWOT ANALYSIS

13.2.5 WINNING IMPERATIVES

13.2.6 CURRENT FOCUS AND STRATEGIES

13.2.7 THREAT FROM COMPETITION

13.2.8 RIGHT TO WIN

13.3 WESTROCK COMPANY

13.3.1 BUSINESS OVERVIEW

13.3.2 PRODUCTS OFFERED

13.3.3 RECENT DEVELOPMENTS

13.3.4 SWOT ANALYSIS

13.3.5 WINNING IMPERATIVES

13.3.6 CURRENT FOCUS AND STRATEGIES

13.3.7 THREAT FROM COMPETITION

13.3.8 RIGHT TO WIN

13.4 SONOCO PRODUCTS COMPANY

13.4.1 BUSINESS OVERVIEW

13.4.2 PRODUCTS OFFERED

13.4.3 RECENT DEVELOPMENTS

13.4.4 SWOT ANALYSIS

13.4.5 WINNING IMPERATIVES

13.4.6 CURRENT FOCUS AND STRATEGIES

13.4.7 THREAT FROM COMPETITION

13.4.8 RIGHT TO WIN

13.5 CONSTANTIA FLEXIBLES

13.5.1 BUSINESS OVERVIEW

13.5.2 PRODUCTS OFFERED

13.5.3 RECENT DEVELOPMENTS

13.5.4 SWOT ANALYSIS

13.5.5 WINNING IMPERATIVES

13.5.6 CURRENT FOCUS AND STRATEGIES

13.5.7 THREAT FROM COMPETITION

13.5.8 RIGHT TO WIN

13.6 KLOCKNER PENTAPLAST GROUP

13.6.1 BUSINESS OVERVIEW

13.6.2 PRODUCTS & SERVICES OFFERED

13.6.3 RECENT DEVELOPMENTS

13.7 E.I. DU PONT DE NEMOURS AND COMPANY

13.7.1 BUSINESS OVERVIEW

13.7.2 PRODUCTS OFFERED

13.7.3 RECENT DEVELOPMENTS

13.8 HONEYWELL INTERNATIONAL INC.

13.8.1 BUSINESS OVERVIEW

13.8.2 PRODUCTS OFFERED

13.8.3 RECENT DEVELOPMENTS

13.9 TEKNI-PLEX

13.9.1 BUSINESS OVERVIEW

13.9.2 PRODUCTS OFFERED

13.9.3 RECENT DEVELOPMENTS

13.10 DISPLAY PACK

13.10.1 BUSINESS OVERVIEW

13.10.2 PRODUCTS OFFERED

13.10.3 RECENT DEVELOPMENTS

13.11 ADDITIONAL COMPANIES

13.11.1 PHARMA PACKAGING SOLUTIONS

13.11.2 BLISTERPAK, INC.

13.11.3 SINCLAIR & RUSH, INC.

13.11.4 STERIPACK

13.11.5 MISTER BLISTER LIMITED

13.11.6 THOMAS PACKAGING, LLC.

13.11.7 ZED INDUSTRIES, INC.

13.11.8 CAMPAK, INC.

13.11.9 BROOKDALE PLASTICS

13.11.10 CHADPAK CO, INC.

13.11.11 FORMPAKS INTERNATIONAL CO. LTD

13.11.12 UHLMANN GROUP

13.11.13 HAMER PACKAGING TECHNOLOGY

13.11.14 WISSER VERPACKUNGEN GMBH

13.11.15 WINPAK LTD.

14 ADJACENT MARKETS: PROTECTIVE PACKAGING MARKET (Page No. - 186)

14.1 INTRODUCTION

14.2 PROTECTIVE PACKAGING MARKET, BY MATERIAL

14.3 PROTECTIVE PACKAGING MARKET, BY TYPE

14.4 PROTECTIVE PACKAGING MARKET, BY FUNCTION

14.5 PROTECTIVE PACKAGING MARKET, BY APPLICATION

14.6 PROTECTIVE PACKAGING MARKET, BY REGION

15 ADJACENT MARKETS: THERMOFORM PACKAGING MARKET (Page No. - 190)

15.1 INTRODUCTION

15.2 THERMOFORM PACKAGING MARKET, BY MATERIAL

15.3 THERMOFORM PACKAGING MARKET, BY HEAT SEAL COATING

15.4 THERMOFORM PACKAGING MARKET, BY TYPE

15.5 THERMOFORM PACKAGING MARKET, BY END-USE INDUSTRY

15.6 THERMOFORM PACKAGING MARKET, BY REGION

16 ADJACENT MARKETS: SKIN PACKAGING MARKET (Page No. - 194)

16.1 INTRODUCTION

16.2 SKIN PACKAGING MARKET, BY TYPE

16.3 SKIN PACKAGING MARKET, BY BASE MATERIAL

16.4 SKIN PACKAGING MARKET, BY HEAT SEAL COATING

16.5 SKIN PACKAGING MARKET, BY APPLICATION

16.6 SKIN PACKAGING MARKET, BY REGION

17 APPENDIX (Page No. - 198)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

LIST OF TABLES (188 TABLES)

TABLE 1 BLISTER PACKAGING: MARKET DEFINITION

TABLE 2 IMPORT-EXPORT TRADE DATA FOR SELECT COUNTRIES, 2019

TABLE 3 COUNTRY-WISE CERTIFICATION OR APPROVING AUTHORITIES FOR FOOD PACKAGING

TABLE 4 BLISTER PACKAGING MARKET: REGISTERED PATENTS

TABLE 5 BLISTER PACKAGING MARKET SIZE: LIST OF PATENTS, BY CKD CORPORATION

TABLE 6 BLISTER PACKAGING MARKET SIZE: LIST OF PATENTS, BY COOPERVISION INT HOLDING CO LP.

TABLE 7 BLISTER PACKAGING MARKET SIZE: LIST OF PATENTS, BY ZHEJIANG FUTURE MACHINERY CO., LTD.

TABLE 8 BLISTER PACKAGING MARKET SIZE: LIST OF PATENTS, BY BLISSPACK CO., LTD.

TABLE 9 BLISTER PACKAGING MARKET SIZE: LIST OF PATENTS, BY MANREX PTY LIMITED

TABLE 10 CONTRIBUTION OF PHARMACEUTICAL INDUSTRY IN PACKAGING, BY REGION, 2017–2024 (USD MILLION)

TABLE 11 BLISTER PACKAGING MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 12 BLISTER PACKAGING MARKET SIZE, BY TECHNOLOGY, 2018–2025 (KILOTON)

TABLE 13 BLISTER PACKAGING MARKET, BY TYPE, 2018-2025 (USD MILLION)

TABLE 14 BLISTER PACKAGING MARKET, BY TYPE, 2018-2025 (KILOTON)

TABLE 15 BLISTER PACKAGING MARKET SIZE, BY MATERIAL, 2018-2025 (USD MILLION)

TABLE 16 BLISTER PACKAGING MARKET SIZE, BY MATERIAL, 2018-2025 (KILOTON)

TABLE 17 BLISTER PACKAGING MARKET SIZE, BY PLASTIC FILM, 2018-2025 (USD MILLION)

TABLE 18 BLISTER PACKAGING MARKET SIZE, BY PLASTIC FILM, 2018-2025 (KILOTON)

TABLE 19 BLISTER PACKAGING MARKET SIZE, BY PAPER & PAPERBOARD, 2018-2025 (USD MILLION)

TABLE 20 BLISTER PACKAGING MARKET SIZE, BY PAPER & PAPERBOARD, 2018-2025 (KILOTON)

TABLE 21 BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 22 BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 23 BLISTER PACKAGING MARKET SIZE IN HEALTHCARE, 2018-2025 (USD MILLION)

TABLE 24 BLISTER PACKAGING MARKET SIZE IN HEALTHCARE, 2018-2025 (KILOTON)

TABLE 25 BLISTER PACKAGING MARKET SIZE IN CONSUMER GOODS, 2018-2025 (USD MILLION)

TABLE 26 BLISTER PACKAGING MARKET SIZE IN CONSUMER GOODS, 2018-2025 (KILOTON)

TABLE 27 BLISTER PACKAGING MARKET SIZE IN INDUSTRIAL GOODS, 2018-2025 (USD MILLION)

TABLE 28 BLISTER PACKAGING MARKET SIZE IN INDUSTRIAL GOODS, 2018-2025 (KILOTON)

TABLE 29 BLISTER PACKAGING MARKET SIZE IN FOOD, 2018-2025 (USD MILLION)

TABLE 30 BLISTER PACKAGING MARKET SIZE IN FOOD, 2018-2025 (KILOTON)

TABLE 31 BLISTER PACKAGING MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 32 BLISTER PACKAGING MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 33 NORTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 34 NORTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 35 NORTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 36 NORTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 37 NORTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 38 NORTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 39 US: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 40 US: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 41 US: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 42 US: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 43 CANADA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 44 CANADA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 45 CANADA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 46 CANADA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 47 MEXICO: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 48 MEXICO: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 49 MEXICO: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 50 MEXICO: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 51 EUROPE: BLISTER PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 52 EUROPE: BLISTER PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 53 EUROPE: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 54 EUROPE: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 55 EUROPE: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 56 EUROPE: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 57 UK: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 58 UK: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 59 UK: BLISTER PACKAGING MARKET, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 60 UK: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 61 GERMANY: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 62 GERMANY: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 63 GERMANY: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 64 GERMANY: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 65 FRANCE: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 66 FRANCE: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 67 FRANCE: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 68 FRANCE: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 69 SPAIN: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 70 SPAIN: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTONS)

TABLE 71 SPAIN: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 72 SPAIN: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 73 ITALY: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 74 ITALY: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 75 ITALY: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 76 ITALY: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 77 REST OF EUROPE: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 78 REST OF EUROPE: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 79 REST OF EUROPE: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 80 REST OF EUROPE: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 81 APAC: BLISTER PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 82 APAC: BLISTER PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 83 APAC: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 84 APAC: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 85 APAC: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 86 APAC: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 87 CHINA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 88 CHINA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 89 CHINA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 90 CHINA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 91 JAPAN: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 92 JAPAN: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 93 JAPAN: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 94 JAPAN: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 95 AUSTRALIA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 96 AUSTRALIA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 97 AUSTRALIA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 98 AUSTRALIA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 99 INDIA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 100 INDIA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 101 INDIA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 102 INDIA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 103 INDONESIA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 104 INDONESIA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 105 INDONESIA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 106 INDONESIA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 107 REST OF APAC: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 108 REST OF APAC: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 109 REST OF APAC: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 110 REST OF APAC: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 111 MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 112 MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 113 MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 114 MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 115 MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 117 TURKEY: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 118 TURKEY: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 119 TURKEY: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 120 TURKEY: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 121 UAE: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 122 UAE: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 123 UAE: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 124 UAE: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 125 SAUDI ARABIA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 126 SAUDI ARABIA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 127 SAUDI ARABIA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 128 SAUDI ARABIA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 129 SOUTH AFRICA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 130 SOUTH AFRICA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 131 SOUTH AFRICA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 132 SOUTH AFRICA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 133 REST OF MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 134 REST OF MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 135 REST OF MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST & AFRICA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 137 SOUTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 138 SOUTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY COUNTRY, 2018-2025 (KT)

TABLE 139 SOUTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 140 SOUTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 141 SOUTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 142 SOUTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 143 BRAZIL: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 144 BRAZIL: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 145 BRAZIL: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 146 BRAZIL: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 147 ARGENTINA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 148 ARGENTINA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 149 ARGENTINA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 150 ARGENTINA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 151 REST OF SOUTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 152 REST OF SOUTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY TYPE, 2018-2025 (KILOTON)

TABLE 153 REST OF SOUTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (USD MILLION)

TABLE 154 REST OF SOUTH AMERICA: BLISTER PACKAGING MARKET SIZE, BY END-USE SECTOR, 2018-2025 (KILOTON)

TABLE 155 NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2014–2021

TABLE 156 PARTNERSHIPS/AGREEMENTS/JOINT VENTURES, 2014–2021

TABLE 157 EXPANSIONS, 2014–2021

TABLE 158 MERGERS & ACQUISITIONS, 2014–2021

TABLE 159 PROTECTIVE PACKAGING MARKET SIZE, BY MATERIAL, 2015–2022 (USD MILLION)

TABLE 160 PROTECTIVE PACKAGING MARKET SIZE, BY MATERIAL, 2015–2022 (KILOTON)

TABLE 161 PROTECTIVE PACKAGING MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

TABLE 162 PROTECTIVE PACKAGING MARKET SIZE, BY TYPE, 2015–2022 (KILOTON)

TABLE 163 PROTECTIVE PACKAGING MARKET SIZE, BY FUNCTION, 2015–2022 (USD MILLION)

TABLE 164 PROTECTIVE PACKAGING MARKET SIZE, BY FUNCTION, 2015–2022 (KILOTON)

TABLE 165 PROTECTIVE PACKAGING MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

TABLE 166 PROTECTIVE PACKAGING MARKET SIZE, BY APPLICATION, 2015–2022 (KILOTON)

TABLE 167 PROTECTIVE PACKAGING MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 168 PROTECTIVE PACKAGING MARKET SIZE, BY REGION, 2015-2022 (KILOTON)

TABLE 169 THERMOFORM PACKAGING MARKET SIZE, BY MATERIAL, 2014–2021 (USD MILLION)

TABLE 170 THERMOFORM PACKAGING MARKET SIZE, BY MATERIAL, 2014–2021 (KILOTON)

TABLE 171 THERMOFORM PACKAGING MARKET SIZE, BY HEAT SEAL COATING, 2014–2021 (USD MILLION)

TABLE 172 THERMOFORM PACKAGING MARKET SIZE, BY HEAT SEAL COATING, 2014–2021 (KILOTON)

TABLE 173 THERMOFORM PACKAGING MARKET SIZE, BY TYPE, 2014–2021 (USD MILLION)

TABLE 174 THERMOFORM PACKAGING MARKET SIZE, BY TYPE, 2014–2020 (KILOTON)

TABLE 175 THERMOFORM PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 2014–2021 (USD MILLION)

TABLE 176 THERMOFORM PACKAGING MARKET SIZE, BY END-USE INDUSTRY, 2014–2021 (KILOTON)

TABLE 177 THERMOFORM PACKAGING MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 178 THERMOFORM PACKAGING MARKET SIZE, BY REGION, 2014–2021 (KILOTON)

TABLE 179 SKIN PACKAGING MARKET SIZE, BY TYPE, 2013–2020 (USD MILLION)

TABLE 180 SKIN PACKAGING MARKET SIZE, BY TYPE, 2013–2020 (KILOTON)

TABLE 181 SKIN PACKAGING MARKET SIZE, BY BASE MATERIAL, 2013–2020 (USD MILLION)

TABLE 182 SKIN PACKAGING MARKET SIZE, BY BASE MATERIAL, 2013–2020 (KILOTON)

TABLE 183 SKIN PACKAGING MARKET SIZE, BY HEAT SEAL COATING, 2013–2020 (USD MILLION)

TABLE 184 SKIN PACKAGING MARKET SIZE, BY HEAT SEAL COATING, 2013–2020 (KILOTON)

TABLE 185 SKIN PACKAGING MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION)

TABLE 186 SKIN PACKAGING MARKET SIZE, BY APPLICATION, 2013–2020 (KILOTON)

TABLE 187 SKIN PACKAGING MARKET SIZE, BY REGION, 2013–2020 (USD MILLION)

TABLE 188 SKIN PACKAGING MARKET SIZE, BY REGION, 2013–2020 (KILOTON)

LIST OF FIGURES (63 FIGURES)

FIGURE 1 BLISTER PACKAGING MARKET, BY REGION

FIGURE 2 BLISTER PACKAGING MARKET: RESEARCH DESIGN

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 4 BLISTER PACKAGING MARKET: SUPPLY-SIDE APPROACH - 1

FIGURE 5 BLISTER PACKAGING MARKET: SUPPLY-SIDE APPROACH - 2

FIGURE 6 BLISTER PACKAGING MARKET: SUPPLY-SIDE APPROACH – 3

FIGURE 7 BLISTER PACKAGING MARKET: DEMAND-SIDE APPROACH – 1

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 10 BLISTER PACKAGING: DATA TRIANGULATION

FIGURE 11 PLASTIC FILMS TO REMAIN THE LARGEST MATERIAL SEGMENT THROUGH 2025

FIGURE 12 CARDED SEGMENT TO BE THE LARGER SEGMENT THROUGH 2025

FIGURE 13 THERMOFORMING TO BE LARGER THAN COLD FORMING TECHNOLOGY THROUGH 2025

FIGURE 14 HEALTHCARE SEGMENT TO LEAD THE MARKET FOR BLISTER PACKAGING THROUGH 2025

FIGURE 15 NORTH AMERICA WAS THE LARGEST MARKET FOR BLISTER PACKAGING IN 2019

FIGURE 16 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES TO THE BLISTER PACKAGING MARKET

FIGURE 17 PLASTIC FILMS SEGMENT TO LEAD THE MARKET THROUGH 2025

FIGURE 18 CARDED SEGMENT TO GROW AT A RELATIVELY HIGHER RATE DURING THE FORECAST PERIOD

FIGURE 19 THERMOFORMING SEGMENT TO GROW AT A COMPARATIVELY HIGHER RATE DURING THE FORECAST PERIOD

FIGURE 20 THE HEALTHCARE SEGMENT CAPTURED THE LARGEST SHARE IN THE NORTH AMERICAN MARKET, IN 2019

FIGURE 21 MARKET IN CHINA TO GROW AT THE HIGHEST RATE FROM 2020 TO 2025

FIGURE 22 BLISTER PACKAGING HAS EVOLVED SIGNIFICANTLY SINCE THE EARLY 1800S

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE BLISTER PACKAGING MARKET

FIGURE 24 RISE IN URBAN POPULATION PERCENTAGE IN EMERGING COUNTRIES POSITIVELY IMPACTS THE BLISTER PACKAGING MARKET

FIGURE 25 BLISTER PACKAGING MARKET: IMPACT ANALYSIS OF DRIVERS AND RESTRAINTS

FIGURE 26 BLISTER PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

FIGURE 27 BLISTER PACKAGING: VALUE CHAIN ANALYSIS

FIGURE 28 BLISTER PACKAGING MARKET: REGISTERED PATENTS

FIGURE 29 BLISTER PACKAGING MARKET: PATENT PUBLICATION TRENDS, 2015-2020

FIGURE 30 BLISTER PACKAGING MARKET: JURISDICTION ANALYSIS

FIGURE 31 BLISTER PACKAGING MARKET: TOP PATENT APPLICANTS

FIGURE 32 GDP PER CAPITA, BY COUNTRY

FIGURE 33 THERMOFORMING SEGMENT TO GROW AT A HIGHER RATE THROUGH 2025

FIGURE 34 CARDED SEGMENT PROJECTED TO REGISTER HIGHER GROWTH RATE THROUGH 2025

FIGURE 35 PLASTIC FILMS TO DOMINATE THE BLISTER PACKAGING MARKET BY 2025

FIGURE 36 HEALTHCARE SEGMENT PROJECTED TO EXPERIENCE THE HIGHEST GROWTH FROM 2020 TO 2025

FIGURE 37 REGIONAL SNAPSHOT (2018-2025): MARKET IN CHINA PROJECTED TO GROW AT THE HIGHEST RATE, IN TERMS OF VALUE

FIGURE 38 NORTH AMERICAN BLISTER PACKAGING MARKET SNAPSHOT: US PROJECTED TO BE FASTEST-GROWING MARKET BETWEEN 2020 & 2025

FIGURE 39 EUROPE: BLISTER PACKAGING MARKET SNAPSHOT

FIGURE 40 APAC BLISTER PACKAGING MARKET SNAPSHOT: CHINA PROJECTED TO BE FASTEST-GROWING MARKET

FIGURE 41 MIDDLE EAST & AFRICA BLISTER PACKAGING MARKET SNAPSHOT: UAE PROJECTED TO BE FASTEST-GROWING MARKET

FIGURE 42 SOUTH AMERICA BLISTER PACKAGING MARKET SNAPSHOT: BRAZIL PROJECTED TO BE FASTEST-GROWING MARKET

FIGURE 43 COMPANIES ADOPTED ACQUISITION AS THE KEY GROWTH STRATEGY, 2014–2021

FIGURE 44 BLISTER PACKAGING MARKET SHARE, BY COMPANY, 2019

FIGURE 45 MARKET RANKING

FIGURE 46 DIVE CHART

FIGURE 47 AMCOR PLC: COMPANY SNAPSHOT

FIGURE 48 AMCOR PLC: SWOT ANALYSIS

FIGURE 49 AMCOR PLC: WINNING IMPERATIVES

FIGURE 50 DOW: COMPANY SNAPSHOT

FIGURE 51 DOW: SWOT ANALYSIS

FIGURE 52 DOW: WINNING IMPERATIVES

FIGURE 53 WESTROCK COMPANY.: COMPANY SNAPSHOT

FIGURE 54 WESTROCK COMPANY: SWOT ANALYSIS

FIGURE 55 WESTROCK COMPANY: WINNING IMPERATIVES

FIGURE 56 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

FIGURE 57 SONOCO PRODUCTS COMPANY: SWOT ANALYSIS

FIGURE 58 SONOCO PRODUCTS COMPANY: WINNING IMPERATIVES

FIGURE 59 CONSTANTIA FLEXIBLES: SWOT ANALYSIS

FIGURE 60 CONSTANTIA FLEXIBLES: WINNING IMPERATIVES

FIGURE 61 KLOCKNER PENTAPLAST GROUP: COMPANY SNAPSHOT

FIGURE 62 E.I. DU PONT DE NEMOURS AND COMPANY: COMPANY SNAPSHOT

FIGURE 63 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

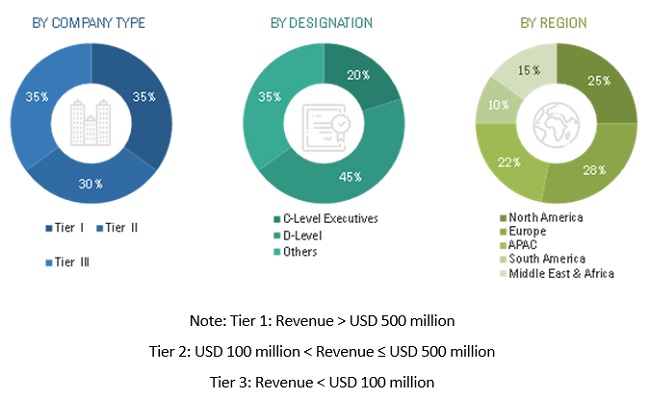

The study involved four major activities in estimating the current market size for the blister packaging market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

The blister packaging comprises of several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The blister packaging market is witnessing high growth owing to cost-effectiveness, growing demand from end-use sector, and tamper-evident design for product protection. Growth in the market is also backed by the growing consumer preference on packed & processed food, rising per-capita income, and development of end-use sector. The supply side is characterized by market consolidation activities undertaken by raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

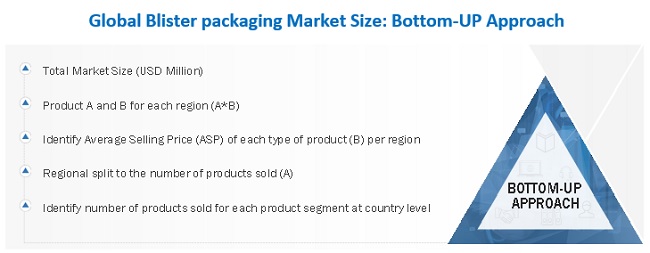

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of blister packaging market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the global blister packaging market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the blister packaging market based on technology, type, material and end-use sector

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisition, collaboration, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blister Packaging Market