Bluetooth Smart and Smart Ready Market by Technology (Bluetooth Smart, Smart Ready, and Bluetooth 5.0), Application (Automotive, Consumer Electronics, Wearable Electronics, Healthcare, Building & Retail), and Geography - Global Forecast to 2023

Bluetooth smart and smart ready market was valued at USD 4.55 billion in 2016 and is expected to reach USD 5.34 billion by 2023, at a CAGR of 2.23% during the forecast period. The growth in IoT applications and the rising demand for consumer electronics such as smart phones and PC peripherals are the factors driving the market. The major applications of the Bluetooth smart and smart ready market include consumer electronics, automotive, wearable electronics, appcessories, and healthcare. Among all the applications, the market for the appcessories segment is expected to grow at the highest CAGR during the forecast period. Presently, many start-ups are developing new apps that can control a specific device. The market of apps is ever increasing and is triggered by the demand for smartphones and these apps; this is driving the market for appcessories.

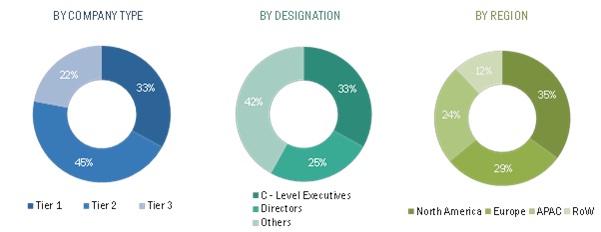

Note 1: Others include sales, marketing, and product managers.

Note 2: Tier1 = USD 1 billion; Tier 2 = USD 0.5 billion to USD 1.0 billion; and Tier 3 = < USD 0.5 billion

These are hardware devices that interact with an app on smartphones or tablets through Bluetooth to perform a specific function. BLE has become the connectivity standard for these devices. Bluetooth smart and smart ready solutions are prominently used in many appcessories such as weight scales, toys, camera triggers, basketballs, and child proximity sensors. Currently, many start-ups are emerging with new apps that can control a specific device. The market of apps is ever increasing and is triggered by the demand for smartphones and these apps. Thus, the market for appcessories is expected to reach at the highest rate during the forecast period.

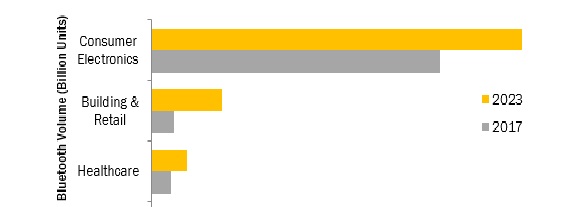

Consumer electronics is the biggest market for the Bluetooth technology with a multitude of Bluetooth Smart Ready devices. Different technologies, such as ZigBee, Wi-Fi, NFC, ANT+, and Bluetooth, are used by consumers to connect their devices, such as smartphones, tablets, and desktops. Among these technologies, BLE is the most widely used technology that consumers use every day as it is simple, secure, and has low power consumption. Thus, the demand to maintain high efficiency of the electronic devices is expected to fuel the growth of the Bluetooth smart and smart ready market.

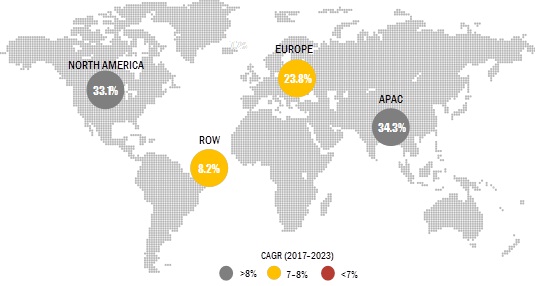

North America is expected to hold the largest share of Bluetooth smart and smart ready market by 2023, and it holds a tremendous potential for the market in the coming future due to its large number of smartphone, tablet, and desktop users. APAC is expected to hold the largest share of Bluetooth smart and smart ready market by 2023. It holds a tremendous potential for the market in the coming future due to the developing economies such as China and India, which have a huge potential for the application of IoT, one of the key growth sectors for the Bluetooth Smart technology. Also, increasing demand for smartphones and PC peripherals, coupled with the realization of huge benefits of improved lifestyle, is driving the BLE market in APAC. Moreover, the APAC region is accounted for the largest number of smartphone, tablet, and desktop users in the world, with India being the fastest-growing country.

Market Dynamics

Drivers: Increase in adoption of smart wireless devices

Developments in various connectivity technologies, such as ZigBee, BLE, Z-Wave, and EnOcean, are empowering the rapid deployment of these wireless sensors around homes and offices. From the everyday sensors in homes to the high-end precision sensors in industries and laboratories, sensors are finding applications everywhere. Thus, this growing demand for low-cost, smart wireless sensors is also expected to drive the BLE market as it offers ease of compatibility with Smart Ready devices.

Restraint: Stubby data streaming limits the growth

BLE has a very low data payload throughput compared with the Classic Bluetooth technology. This makes BLE unsuitable for not only high- but also medium-bandwidth streaming (audio or video) as it is designed for the transfer of few and small data packets with large sleeping time in between. It reduces the amount of picojoules per bit for data packets compared with other competing technologies. Other technologies consume more power not because they have less efficient radios, but because the receiver is constantly powered up even when there are more pauses in radio traffic, along with the fact that a significant portion of the transferred bits is not payload but overhead—protocol headers, checksums, and even just blanking spaces.

Opportunities: Use of Bluetooth Smart and Smart Ready in real time monitoring applications

Wearable electronics are gaining traction in sports and fitness sensor devices. These devices are used everywhere—joggers with polar heart rate sensors keep track of a target heart rate and cyclists with sensors on their bike wheels measure speed and pace. Even the executive wears his FitBit on his pocket so that his motion is monitored in real time. The latest Bluetooth specification—ultralow-power consumption—presents an opportunity for companies to bring everyday products such as heart rate monitors, toothbrushes, and running shoes into the connected world. Thus, all the emerging connecting technologies are expected to make use of Bluetooth Smart and Smart Ready owing to its exceptional features and competence.

Challenges: Concerns in the privacy of the data

The BLE technology forms an essential part of the IoT ecosystem. IoT constitutes a network of interconnected devices, known as smart devices, which are all finally connected to the Internet. These connected devices exchange data with the help of Bluetooth Smart technology. , security of data and other information stored on the devices connected in the IoT ecosystem is an area of concern as it involves ubiquitous data collection, unexpected use of consumer data, and heightened security risks.

Scope of the Report

|

Report Metric |

Details |

|

Report Name |

Bluetooth Smart and Smart Ready Market |

|

Base year considered |

2016 |

|

Forecast period |

2017–2023 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

Technology, Application & Geography |

|

Geographies covered |

North America, Europe, APAC, RoW |

|

Companies covered |

Qualcomm Inc. (US), Broadcom Corporation (Singapore), Cypress Semiconductor Corporation (US), Dialog Semiconductor PLC (UK), Marvell Technology Group, Ltd. (Bermuda), Mediatek, Inc. (Taiwan), Nordic Semiconductor ASA (Norway), Bluegiga Technologies (Finland), Texas Instruments Incorporated (US), Fanstel Corporation (US), Toshiba Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), Renesas Electronics Corporation (Japan), Microchip Technology Inc. (US), and CEVA, Inc. (US). |

The research report categorizes the Bluetooth smart and smart ready market to forecast the revenues and analyze the trends in each of the following sub-segments:

Bluetooth smart and smart ready Market, by Technology:

- Bluetooth Smart

- Bluetooth Smart Ready

- Bluetooth 5.0

Bluetooth smart and smart ready Market, by Application:

- Automotive

- Building & Retail

- Wearable Electronics

- Healthcare

- Appcessories

- Industrial Measurement and Diagnostics

Bluetooth smart and smart ready Market, by Geography:

- Americas

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Netherlands

- Rest of Europe

- APAC

- China

- Japan

- India

- Rest of APAC

- RoW

- South America

- Middle East and Africa

Key Market Players

Key players in the market include Qualcomm Inc. (US), Broadcom Corporation (Singapore)- , Cypress Semiconductor Corporation (US), Dialog Semiconductor PLC (UK), Marvell Technology Group, Ltd. (Bermuda), Mediatek, Inc (Taiwan).

Qualcomm Incorporated (US) is a key market player in the digital communications technology, mainly code division multiple access (CDMA), and is also involved extensively in the development and commercialization of orthogonal frequency division multiple access (OFDMA). The company also develops and commercializes key technologies that are currently being used in handsets and tablets—LAN, GPS, and short-range communication functionalities, including NFC and Bluetooth.

Recent Developments

- Bluegiga Technologies was acquired by Silicon Laboratories (US) in 2015. Silicon Laboratories (US) is a leading provider of microcontroller, wireless connectivity, and analog and sensor solutions for the Internet of Things (IoT). This acquisition has helped expand Silicon Labs’ wireless hardware and software solutions for IoT, thus addressing a broader range of market opportunities and customer needs.

- In February 2017, Siemens Ltd. and Siemens Rail Automation Spain have jointly won an order to supply state-of-the-art signaling technology for the first 2 metro lines of the Nagpur Metro, i.e., the North–South and the East–West Corridors.

- Dialog Semiconductor (UK) will showcase its new connectivity products including theSmartBond DA14681, a wearable development kit. The company will also showcase DA14585 and DA14586, the systems enabled the Bluetooth 5, emphasizing the capabilities of IoT SoCs as part of a voice command demonstration for its Remote Control Unit (RCU) reference designs.

- Nordic Semiconductor launched the Switchmate voice-activated smart lighting device, which is connected to BLE wireless device (Bluetooth 4.0). This product can be

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Study Objectives

1.2 Market Definition

1.3 Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Growth Opportunities in the Bluetooth Smart and Smart Ready Market

4.2 Bluetooth Smart and Smart Ready, By Application

4.3 Bluetooth Smart and Smart Ready, By Application and Region

4.4 Bluetooth Smart and Smart Ready, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Investments in the Iot Technology

5.2.1.2 Rise in Applications of Smart Wireless Sensors

5.2.1.3 Cost-Efficient Bluetooth Smart and Smart Ready Devices With Low Power Consumption

5.2.1.4 Growth of Wearable Devices and Appcessories

5.2.2 Restraints

5.2.2.1 Low Data Streaming Capacity Can Limit the Growth of Bluetooth Smart and Smart Ready

5.2.3 Opportunities

5.2.3.1 Faster IP Connectivity With Enhanced Privacy

5.2.3.2 Use of Bluetooth Smart and Smart Ready in State-Of-The-Art Technologies

5.2.4 Challenges

5.2.4.1 Increasing Security and Surveillance Concerns in the Age of Iot

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Model

6.4 Bluetooth Smart and Smart Ready Standards and Regulations

6.4.1 Codes and Standards Related to Bluetooth Smart and Smart Ready

6.5 Start-Up Scenario

7 Bluetooth Smart and Smart Ready, By Technology (Page No. - 54)

7.1 Introduction

7.2 Bluetooth Smart

7.3 Bluetooth Smart Ready

7.4 Bluetooth 5.0

8 Bluetooth Smart and Smart Ready, By Application (Page No. - 57)

8.1 Introduction

8.2 Automotive

8.2.1 Driver Health and Wellness Monitoring

8.2.1.1 Ecg and Respiration Monitoring

8.2.1.2 Drowsiness Detection

8.2.2 Remote Control Via Smartphones

8.2.2.1 Keyless Entry Systems (KES)

8.2.2.2 Driver/Vehicle Identification (Traffic Monitoring) Solutions

8.2.2.3 Infotainment Control Systems

8.2.2.4 Others

8.3 Consumer Electronics

8.3.1 Smartphones

8.3.2 Tablets

8.3.3 Laptops

8.3.4 PC Peripherals

8.3.5 Smart TV Consoles

8.4 Healthcare

8.4.1 Wireless Portable Medical Devices (WPMDS)

8.4.1.1 Blood Glucose Monitors

8.4.1.2 Cholesterol Monitors

8.4.1.3 Blood Pressure Monitors

8.5 Building and Retail

8.5.1 Smart Locks

8.5.2 Smart Homes

8.5.3 Beacons

8.6 Appcessories

8.7 Wearable Electronics

8.7.1 Consumer Wearable Devices

8.7.1.1 Smart Glasses

8.7.1.2 Smartwatches

8.7.1.3 Activity Trackers

8.7.1.4 Wearable Cameras

8.7.1.5 3D Motion Trackers

8.7.2 Medical Wearable Devices

8.7.2.1 Holter Monitors

8.7.2.2 Heart Rate Monitors

8.7.2.3 Sleep Apnea Monitors

8.7.2.4 Wearable Injectors

8.7.2.5 Continuous Glucose Monitors

8.7.2.6 Multiparameter Monitors

8.8 Industrial Measurement and Diagnostics

8.8.1 Wireless Sensor Networks

8.8.2 Configuration and Maintenance

9 Geographic Analysis (Page No. - 113)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 UK

9.3.2 Germany

9.3.3 France

9.3.4 RoE

9.4 APAC

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 RoAPAC

9.5 RoW

9.5.1 South America and Mea

10 Competitive Landscape (Page No. - 131)

10.1 Overview

10.2 Key Players in Bluetooth Smart and Smart Ready

10.3 Dive Chart Analysis

10.3.1 Vanguard

10.3.2 Dynamic

10.3.3 Innovator

10.3.4 Emerging

10.4 Product Portfolio Analysis of the Major Players in the Bluetooth Smart & Smart Ready Market (25 Companies)

10.5 Business Strategies Adopted By Major Players in the Bluetooth Smart & Smart Ready Market (25 Companies)

*Top Companies Analyzed for This Study are – Avnet, Inc. (US); Afero, Inc. (US); Cassia Networks, Inc. (US); Avi-On Labs, Inc. (US); Qualcomm Incorporated (US); Texas Instruments Incorporated (US); Broadcom Corporation (Singapore); Cypress Semiconductor Corporation (US); Dialog Semiconductor PLC (UK); Marvell Technology Group, Ltd. (Bermuda); Laird PLC (UK); Bluegiga Technologies (Finland); Mediatek, Inc. (Taiwan); Nordic Semiconductor Asa (Norway); Rfsister (China); Swatch Group (Switzerland); Toshiba Corporation (Japan); Murata Manufacturing Co., Ltd. (Japan); Renesas Electronics Corporation (Japan); Microchip Technology, Inc. (US); Rohm Semiconductor (Japan); Ceva, Inc. (US); Samsung Corporation (South Korea); Panasonic Corporation (Japan); Fanstel Corporation (US)

10.6 Competitive Situations and Trends

11 Company Profiles (Page No. - 139)

11.1 Introduction

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

11.2 Bluegiga Technologies

11.3 Broadcom Corporation

11.4 Qualcomm Incorporated

11.5 Cypress Semiconductor Corporation

11.6 Marvell Technology Group Ltd.

11.7 Mediatek Inc.

11.8 Texas Instruments Incorporated

11.9 Toshiba Corporation

11.10 Murata Manufacturing Co., Ltd.

11.11 Renesas Electronics Corporation

11.12 Microchip Technology Incorporated

11.13 Dialog Semiconductor PLC

11.14 Nordic Semiconductors Asa

11.15 Ceva, Inc.

11.16 Laird PLC

11.17 Fanstel Corporation

11.18 Key Innovators

11.18.1 Afero, Inc.

11.18.2 Revogi Innovation Co., Ltd.

11.18.3 Virscient Limited

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 199)

12.1 Insights of Industry Experts

12.2 Questionnaire for Bluetooth Smart and Smart Ready Market

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (112 Tables)

Table 1 Bluetooth Technology Features

Table 2 Start-Up Companies and Investors Scenario

Table 3 Bluetooth Smart and Smart Ready Market, 2015–2023

Table 4 Bluetooth Smart and Smart Ready, By Technology, 2015–2023 (Million Units)

Table 5 Bluetooth Technology Differentiation

Table 6 Bluetooth Smart and Smart Ready, By Application, 2015–2023 (USD Million)

Table 7 Bluetooth Smart and Smart Ready, By Application, 2015–2023 (Million Units)

Table 8 Bluetooth Smart and Smart Ready for Automotive, 2015–2023 (Million Units)

Table 9 Bluetooth Smart and Smart Ready for Automotive, By Region, 2015–2023 (USD Million)

Table 10 Bluetooth Smart and Smart Ready for Automotive, By Region, 2015–2023 (Million Units)

Table 11 Bluetooth Smart and Smart Ready for Driver Health and Wellness Monitoring, 2015–2023 (Million Units)

Table 12 Bluetooth Smart and Smart Ready for Driver Health and Wellness Monitoring, By Region, 2015–2023 (USD Million)

Table 13 Market for Driver Health and Wellness Monitoring, By Region, 2015–2023 (Million Units)

Table 14 Market for Remote Control Via Smartphones, 2015–2023 (Million Units)

Table 15 Market for Remote Control Via Smartphones, By Region, 2015–2023 (USD Thousand)

Table 16 Market for Remote Control Via Smartphones, By Region, 2015–2023 (Thousand Units)

Table 17 Market for Consumer Electronics, 2015–2023 (Million Units)

Table 18 Market for Consumer Electronics, By Region, 2015–2023 (USD Million)

Table 19 Market for Consumer Electronics, By Region, 2015–2023 (Million Units)

Table 20 Market for Smartphones, 2015–2023 (Million Units)

Table 21 Market for Smartphones, By Region, 2015–2023 (USD Million)

Table 22 Market for Smartphones, By Region, 2015–2023 (Million Units)

Table 23 Market for Tablets, 2015–2023 (Million Units)

Table 24 Market for Tablets, By Region, 2015–2023 (USD Million)

Table 25 Market for Tablets, By Region, 2015–2023 (Million Units)

Table 26 Market for Laptops, 2015–2023 (Million Units)

Table 27 Market for Laptops, By Region, 2015–2023 (USD Million)

Table 28 Market for Laptops, By Region, 2015–2023 (Million Units)

Table 29 Market for PC Peripherals, 2015–2023 (Thousand Units)

Table 30 Market for PC Peripherals, By Region, 2015–2023 (USD Thousand)

Table 31 Market for PC Peripherals, By Region, 2015–2023 (Thousand Units)

Table 32 Market for Smart TV Consoles, 2015–2023 (Thousand Units)

Table 33 Market for Smart TV Consoles, By Region, 2015–2023 (USD Thousand)

Table 34 Market for Smart TV Consoles, By Region, 2015–2023 (Thousand Units)

Table 35 Market for Healthcare, 2015–2023 (Million Units)

Table 36 Market for Healthcare, By Region, 2015–2023 (USD Million)

Table 37 Market for Healthcare, By Region, 2015–2023 (Million Units)

Table 38 Market for Wireless Portable Medical Devices, 2015–2023 (USD Million)

Table 39 Market for Wireless Portable Medical Devices, 2015–2023 (Million Units)

Table 40 Market for Building and Retail, 2015–2023 (Million Units)

Table 41 Market for Building and Retail, By Region, 2015–2023 (USD Million)

Table 42 Market for Building and Retail, By Region, 2015–2023 (Million Units)

Table 43 Bluetooth Smart and Smart Ready for Smart Locks, 2015–2023 (Million Units)

Table 44 Bluetooth Smart and Smart Ready for Smart Locks, By Region, 2015–2023 (USD Thousand)

Table 45 Market for Smart Locks, By Region, 2015–2023 (Thousand Units)

Table 46 Bluetooth Smart and Smart Ready for Smart Homes, 2015–2023 (Million Units)

Table 47 Bluetooth Smart and Smart Ready for Smart Homes, By Region, 2015–2023 (USD Million)

Table 48 Market for Smart Homes, By Region, 2015–2023 (Million Units)

Table 49 Bluetooth Smart and Smart Ready for Beacons, 2015–2023 (Million Units)

Table 50 Bluetooth Smart and Smart Ready for Beacons, By Region, 2015–2023 (USD Thousand)

Table 51 Market for Beacons, By Region, 2015–2023 (Thousand Units)

Table 52 Bluetooth Smart and Smart Ready for Appcessories, 2015–2023 (Million Units)

Table 53 Market for Appcessories, By Region, 2015–2023 (USD Million)

Table 54 Bluetooth Smart and Smart Ready for Appcessories, By Region, 2015–2023 (Million Units)

Table 55 Market for Wearable Electronics, 2015–2023 (Million Units)

Table 56 Bluetooth Smart and Smart Ready for Wearable Electronics, By Region, 2015–2023 (USD Million)

Table 57 Bluetooth Smart and Smart Ready for Wearable Electronics, By Region, 2015–2023 (Million Units)

Table 58 Market for Smart Glasses, 2015–2023 (Million Units)

Table 59 Bluetooth Smart and Smart Ready for Smart Glasses, By Region, 2015–2023 (USD Million)

Table 60 Market for Smart Glasses, By Region, 2015–2023 (Million Units)

Table 61 Market for Smartwatches, 2015–2023 (Million Units)

Table 62 Bluetooth Smart and Smart Ready for Smartwatches, By Region, 2015–2023 (USD Million)

Table 63 Market for Smartwatches, By Region, 2015–2023 (Million Units)

Table 64 Market for Activity Trackers, 2015–2023 (Million Units)

Table 65 Bluetooth Smart and Smart Ready for Activity Trackers, By Region, 2015–2023 (USD Million)

Table 66 Market for Activity Trackers, By Region, 2015–2023 (Million Units)

Table 67 Bluetooth Smart and Smart Ready for Wearable Cameras, 2015–2023 (Million Units)

Table 68 Market for Wearable Cameras, By Region, 2015–2023 (USD Thousand)

Table 69 Market for Wearable Cameras, By Region, 2015–2023 (Thousand Units)

Table 70 Bluetooth Smart and Smart Ready for 3D Motion Trackers, 2015–2023 (Million Units)

Table 71 Market for 3D Motion Trackers, By Region, 2015–2023 (USD Thousand)

Table 72 Bluetooth Smart and Smart Ready for 3D Motion Trackers, By Region, 2015–2023 (Thousand Units)

Table 73 Market for Holter Monitors, 2015–2023 (Million Units)

Table 74 Market for Holter Monitors, By Region, 2015–2023 (USD Million)

Table 75 Bluetooth Smart and Smart Ready for Holter Monitors, By Region, 2015–2023 (Million Units)

Table 76 Market for Heart Rate Monitors, 2015–2023 (Thousand Units)

Table 77 Market for Heart Rate Monitors, By Region, 2015–2023 (USD Thousand)

Table 78 Market for Heart Rate Monitors, By Region, 2015–2023 (Thousand Units)

Table 79 Bluetooth Smart and Smart Ready for Sleep Apnea Monitors, 2015–2023 (Thousand Units)

Table 80 Market for Sleep Apnea Monitors, By Region, 2015–2023 (USD Thousand)

Table 81 Market for Sleep Apnea Monitors, By Region, 2015–2023 (Thousand Units)

Table 82 Bluetooth Smart and Smart Ready for Wearable Injectors, 2015–2023 (Thousand Units)

Table 83 Market for Wearable Injectors, By Region, 2015–2023 (USD Thousand)

Table 84 Market for Wearable Injectors, By Region, 2015–2023 (Thousand Units)

Table 85 Bluetooth Smart and Smart Ready for Continuous Glucose Monitors, 2015–2023 (Thousand Units)

Table 86 Market for Continuous Glucose Monitors, By Region, 2015–2023 (USD Thousand)

Table 87 Market for Continuous Glucose Monitors, By Region (Thousand Units)

Table 88 Bluetooth Smart and Smart Ready for Multiparameter Monitors, 2015–2023 (Thousand Units)

Table 89 Market for Multiparameter Monitors, By Region, 2015–2023 (USD Thousand)

Table 90 Bluetooth Smart and Smart Ready Market for Multiparameter Monitors, By Region, 2015–2023 (Thousand Units)

Table 91 Market for Industrial Measurement and Diagnostics, 2015–2023 (Million Units)

Table 92 Bluetooth Smart and Smart Ready for Industrial Measurement and Diagnostics, By Region, 2015–2023 (USD Million)

Table 93 Market for Industrial Measurement and Diagnostics, By Region, 2015–2023 (Million Units)

Table 94 Market, By Region, 2015–2023 (USD Million)

Table 95 Bluetooth Smart and Smart Ready, By Region, 2015–2023 (Million Units)

Table 96 Market in North America, By Application, 2015–2023 (USD Million)

Table 97 Bluetooth Smart and Smart Ready in North America, By Application, 2015–2023 (Million Units)

Table 98 North American Market, By Country, 2015–2023 (Million Units)

Table 99 North American Market, By Country, 2015–2023 (USD Million)

Table 100 Market in Europe, By Application, 2015–2023 (USD Million)

Table 101 Market in Europe, By Application, 2015–2023 (Million Units)

Table 102 European Market, By Country, 2015–2023 (Million Units)

Table 103 European Market, By Country, 2015–2023 (USD Million)

Table 104 Market in APAC, By Application, 2015–2023 (USD Million)

Table 105 Market in APAC, By Application, 2015–2023 (Million Units)

Table 106 Market in APAC, By Country, 2015–2023 (Million Units)

Table 107 Market in APAC, By Country, 2015–2023 (USD Million)

Table 108 Market in RoW, By Application, 2015–2023 (USD Million)

Table 109 Market in RoW, By Application, 2015–2023 (Million Units)

Table 110 Market in RoW, By Region, 2015–2023 (Million Units)

Table 111 Market in RoW, By Region, 2015–2023 (USD Million)

Table 112 Market: Company Ranking Analysis

List of Figures (61 Figure)

Figure 1 Market Segmentation

Figure 2 Bluetooth Smart and Smart Ready Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Consumer Electronics Application Expected to Hold the Largest Volume of the Market in 2023

Figure 7 Consumer Electronics Application Expected to Hold the Largest Share of the Market in 2017

Figure 8 APAC Expected to Hold the Largest Size of the Market Till 2023

Figure 9 APAC Expected to Hold the Largest Share of the Market in 2017

Figure 10 Market in APAC Expected to Witness the Highest Growth During the Forecast Period

Figure 11 Consumer Electronics Application Expected to Hold the Largest Size of the Market By 2023

Figure 12 Consumer Electronics Application Expected to Hold the Largest Share of the Market By 2023

Figure 13 APAC Expected to Hold the Largest Volume of the Market in 2017

Figure 14 Increasing Investments in the IoT Technology and Growing Applications of Smart Wireless Sensors Fuel Growth of the Bluetooth Smart and Smart Ready Market

Figure 15 Value Chain Analysis of the Market

Figure 16 Porter’s Five Forces Analysis: Market

Figure 17 Porter’s Analysis: Market, 2016

Figure 18 Impact of Threat of New Entrants

Figure 19 Impact of Threat of Substitutes

Figure 20 Impact of Bargaining Power of Suppliers

Figure 21 Impact of Bargaining Power of Buyers

Figure 22 Impact of Intensity of Competitive Rivalry

Figure 23 Total Investment Raised By Start-Ups (2010–2014)

Figure 24 Bluetooth Smart and Smart Ready, By Application

Figure 25 Bluetooth Smart and Smart Ready for Automotive, 2017 and 2023

Figure 26 Bluetooth Smart and Smart Ready for Driver Health and Wellness Monitoring, 2017 and 2023

Figure 27 Bluetooth Smart and Smart Ready for Consumer Electronics, 2017 and 2023

Figure 28 Bluetooth Smart and Smart Ready Penetration in Smartphones, 2017 and 2023

Figure 29 Bluetooth Smart Ready Penetration in Tablets, 2017 and 2023

Figure 30 Bluetooth Smart Penetration in PC Peripherals, 2017 and 2023

Figure 31 Market for Healthcare, 2017 and 2023

Figure 32 Bluetooth Smart and Smart Ready for Building and Retail, 2017 and 2023

Figure 33 Market for Beacons, 2017 and 2023

Figure 34 Bluetooth Smart and Smart Ready for Wearable Electronics, 2017 and 2023

Figure 35 Market for Smartwatches, 2017 and 2023

Figure 36 Bluetooth Smart and Smart Ready for 3D Motion Trackers, 2017 and 2023

Figure 37 North America Expected to Dominate the Market for Heart Rate Monitors Globally

Figure 38 Market for Wearable Injectors, 2017 and 2023

Figure 39 Bluetooth Smart and Smart Ready for Multiparameter Monitors, 2017 and 2023

Figure 40 Bluetooth Smart and Smart Ready : APAC Expected to Be the Fastest-Growing Region Over the Next 6 Years

Figure 41 Market Snapshot: North America, 2017

Figure 42 Market Snapshot: Europe, 2017

Figure 43 Market Snapshot: APAC, 2017

Figure 44 Dive Chart

Figure 45 Market Evolution Framework: Product Launches and Developments is the Major Strategy Adopted By Market Players

Figure 46 Battle for Market Share: Product Launches and Developments Was the Key Growth Strategy

Figure 47 Bluegiga Technologies (Silicon Labs): Company Snapshot

Figure 48 Broadcom Corporation: Business Overview

Figure 49 Qualcomm Incorporated: Business Overview

Figure 50 Cypress Semiconductor Corporation: Business Overview

Figure 51 Marvell Technology Group Ltd.: Business Overview

Figure 52 Mediatek Inc.: Company Snapshot

Figure 53 Texas Instruments Incorporated: Business Overview

Figure 54 Toshiba Corporation: Business Overview

Figure 55 Murata Manufacturing Co., Ltd.: Business Overview

Figure 56 Renesas Electronics Corporation: Company Snapshot

Figure 57 Microchip Technology Incorporated: Company Snapshot

Figure 58 Dialog Semiconductor PLC: Company Snapshot

Figure 59 Nordic Semiconductors ASA: Company Snapshot

Figure 60 Ceva, Inc.: Company Snapshot

Figure 61 Laird PLC: Company Snapshot

Growth opportunities and latent adjacency in Bluetooth Smart and Smart Ready Market