Cannula Market by Product (Nasal, Arterial, Arthroscopy, Ophthalmic, Cardioplegia, Suction, Femoral, Injector, Infusion, Venous, Microcannula), Material (Plastic, Metal) & End User (Hospitals, Ambulatory Surgical Centers) - Global Forecast to 2020

The cannula market is estimated to grow at a CAGR of 5.6% from 2015 to 2020 to reach $135.5 million by 2020.The report segments the global cannula market by product, by material, by application, by end-users and region.

On the basis of material, the market is divided into plastic, metal and silicone. The silicone material is estimated to be the fastest growing segment during the forecast period. On the basis of end users, the cannula market is divided into hospitals, ambulatory surgical centers, and others (blood banks and home healthcare facilities). Hospitals segment accounted the largest share of the cannula market as compared to ambulatory surgical centers, and others. This can be attributed to the growing number of patients and increasing healthcare awareness.

In application segment, the cannula market is segregated into cardiovascular surgery, oxygen therapy, general surgery, cosmetic/plastic surgery, orthopedic surgery, and others (diabetes treatment, ophthalmic surgery, gynecology and neurology). The cosmetic/plastic surgery segment is expected to be the fastest-growing segment owing to increasing health consciousness and growing number of obesity cases, leading to increasing number of cosmetic surgeries.

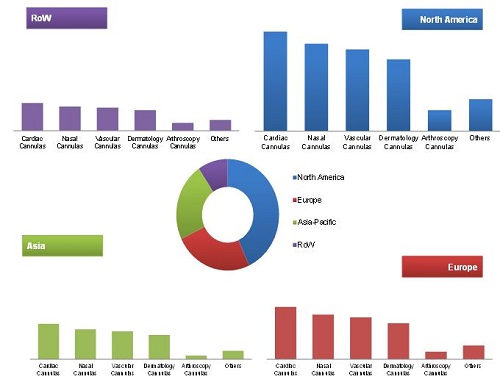

Based on type of product, the global cannula market is segmented into cardiac, vascular, nasal, arthroscopy cannula, dermatology cannulas and others (floating spinal cannulas, vitreoretinal cannulas, and hysterosalpingography cannulas). The dermatology cannula segment is expected to be the fastest-growing market by 2020.

The major driving factors of this market are increasing number of surgeries, advancement in the healthcare facilities, increased investment in R&D, large pool of patients, and rising government funding. Increasing minimally invasive surgery (MIS) procedures is also one of the key drivers of this market. However, uncertain regulatory framework in medical devices industry is limiting the growth of this market.

The key players in cannula market include Medtronic plc (U.S.), Edward Lifesciences Corp. (U.S.), Terumo Corporation (Japan), Sorin Group (Italy), and Maquet Holding B.V. & Co. KG (Germany).

Cannula Market : Scope of the Report

Particular |

Scope |

|

Region |

|

|

Historical Years |

20132014 |

|

Base Year |

2014 |

|

Projected Year |

2015 |

|

Forecast Period |

20152020 |

|

Revenue Currency |

USD ($) |

Market Segmentation

This research report categorizes the cannula market on the basis of products, application, material, end users and regions.

By Product

- Cardiac Cannulas

- Vascular Cannulas

- Nasal Cannulas

- Arthoscopy Cannulas

- Dermatology Cannulas

- Others (Floating Spinal Cannulas, Vitreoretinal Cannulas, and Hysterosalpingography Cannulas)

By Application

- Cardiovascular Surgery

- Oxygen Therapy

- General Surgery

- Cosmetic/Plastic Surgery

- Orthopedic Surgery&

- Others (diabetes treatment, ophthalmology, gynecology, and neurology.)

By Material

- Plastic

- Metal

- Silicone

By End Users

- Hospitals

- Ambulatory Surgical Centers

- Others (Blood Banks and Home Healthcare Facilities)

By Region

- North America

- U.S.

- Canada

- Europe

- Asia-Pacific

- China

- India

- Rest of the World (RoW)

The global cannula market is expected to grow at a CAGR of 5.6% from 2015 to 2020 to reach $135.5 million by 2020 from $97.6 million in 2014.The market is expected to grow in the forecast period owing to increased investment in R&D, growing demand of minimally invasive surgery (MIS) procedures, large pool of patients, and increasing number of surgeries. However uncertain regulatory framework is hindering the growth of cannula market.

On the basis of products, the market is divided into the global cannula market is segmented into cardiac, vascular, nasal, arthroscopy, dermatology cannula and others (floating spinal cannulas, vitreoretinal cannulas, hysterosalpingography cannulas). On the basis of end users, the market is divided into hospitals, ambulatory surgical centers, and others (blood banks and home healthcare facilities). Hospitals segment accounted the largest share of the cannula market as compared to ambulatory surgical centers, and others. On the basis of material, the market is divided into plastic, silicone, and metal. Silicone is expected to be the fastest-growing segment, owing to the increasing usage of silicone-based cannula in oxygen therapies to provide continuous oxygen supply to the elderly population and patients suffering from respiratory disorders.

Geographically, the cannula market is dominated by North America, followed by Europe. However, the Asia-Pacific region is expected to be the fastest growing region in cannula market during the forecast period. Increasing awareness about MIS techniques in countries such as China, India, and Japan, increasing purchasing power of the middle class population are augmenting the growth of this market in Asia-Pacific region.

The key players in cannula market include Medtronic plc (U.S.), Edward Lifesciences Corp. (U.S.), Terumo Corporation (Japan), Sorin Group (Italy), and Maquet Holding B.V. & Co. KG (Germany).

Global Cannula Market, by Product,2014

MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Market Size Estimation

2.2 Market Breakdown and Data Triangulation

2.2.1 Key Data From Secondary Sources

2.2.2 Key Data From Primary Sources

2.2.2.1 Key Industry Insights

2.2.3 Assumptions for the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Market Overview for Cannula

4.2 Geographic Snapshot: Cannula Market, By Application

4.3 Cannula Market, By Product

4.4 Geographic Snapshot of the Cannula Market

4.5 Cannula Market, By End User

4.6 Cannula Market, By Material

4.7 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction of Cannula

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Number of Surgeries Among the Aging Population

5.2.1.2 Increased Patient Preference for Minimally Invasive Surgeries

5.2.2 Restraints

5.2.2.1 Uncertain Regulatory Framework in the Medical Device Industry

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Growing Obesity Rate

5.2.3.3 Increasing Demand of Cannula in Home Healthcare

5.2.4 Challenges

5.2.5 Winning Imperatives

6 Industry Insights (Page No. - 42)

6.1 Introduction

6.2 Porters Five Forces Analysis

6.3 Supply Chain Analysis

6.4 Industry Insights

6.5 Strategic Benchmarking

7 Cannula Market, By Application (Page No. - 47)

7.1 Introduction

7.2 Cardiovascular Surgery

7.3 Oxygen Therapy

7.4 General Surgery

7.5 Cosmetic/Plastic Surgery

7.6 Orthopedic Surgery

7.7 Others (Diabetes Treatment, Opthalmology, Gynecology, and Neurology)

8 Cannula Market, By Product (Page No. - 58)

8.1 Introduction

8.1.1 Cardiac Cannulas

8.1.2 Nasal Cannulas

8.1.3 Vascular Cannulas

8.1.4 Dermatology Cannulas

8.1.5 Arthroscopy Cannulas

8.1.6 Other Cannulas

9 Global Cannula Market, By Material (Page No. - 69)

9.1 Introduction

9.2 Plastic (PVC) Cannulas

9.3 Silicone Cannulas

9.4 Metal Cannulas (Stainless Steel)

10 Global Cannula Market, By End User (Page No. - 78)

10.1 Introduction

10.1 Hospitals

10.2 Ambulatory Surgical Centers (ASC)

10.3 Other End Users (Blood Banks and Home Healthcare Facilities)

11 Cannula Market, By Region (Page No. - 87)

11.1Introduction

11.2 North America

11.3 U.S.

11.4 Canada

11.5 Europe

11.6 Asia-Pacific

11.7 China

11.8 India

11.8.1 Rest of Asia-Pacific

11.9 Rest of the World

12 Competitive Landscape (Page No. - 119)

12.1 Overview

12.1.1 New Product Launch

12.1.2 New Product Launches, 20122015

12.1.3 Acquisitions

12.1.4 Acquisitions, 20122015

12.1.5 Partnerships, Collaborations and Agreements

12.1.6 Other Developments

12.1.7 Other Developments, 20112014

13 Company Profiles (Page No. - 125)

13.1 Introduction

13.2 Medtronic PLC.

13.2.1 Business Overview

13.2.2 Product Portfolio

13.2.4 Key Strategy

13.2.5 Recent Developments

13.3 Edward Lifescience Corporation

13.3.1 Business Overview

13.3.2 Product Portfolio

13.3.3 Key Strategy

13.4 Terumo Corporation

13.4.1 Business Overview

13.4.2 Product Portfolio

13.4.3 Key Strategy

13.5 Sorin Group

13.5.1 Business Overview

13.5.2 Product Portfolio

13.5.3 Key Strategy

13.5.4 Recent Developments

13.6 Smith & Nephew PLC.

13.6.1 Business Overview

13.6.2 Product Portfolio

13.6.3 Key Strategy

13.6.4 Recent Development

13.7 Conmed Corporation

13.7.1 Business Overview

13.7.2 Product Portfolio

13.7.3 Key Strategy

13.7.4 Recent Developments

13.8 Smiths Medical

13.8.1 Business Overview

13.8.2 Product Portfolio

13.8.3 Key Strategy

13.8.4 Recent Developments

13.9 Teleflex Incorporated

13.9.1 Business Overview

13.9.2 Product Portfolio

13.9.3 Key Strategy

13.9.4 Recent Developments

13.10 Maquet Holding B.V. & Co. KG.

13.10.1 Business Overview

13.10.2 Product Portfolio

13.10.3 Key Strategy

13.10.4 Recent Developments

13.11 Boston Scientific Corporation

13.11.1 Business Overview

13.11.2 Product Portfolio

13.11.3 Key Strategy

13.11.4 Recent Developments

14 Appendix (Page No. - 150)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

Table of Content (AVAILABLE CUSTOMIZATION)

1. Cannula Market, By Product (Volume)

1.1. Introduction

1.2. Cardiac

1.3. Nasal

1.4. Vascular

1.5. Dermatology

1.6. Arthroscopy

2. Cannula Market, By Product (Others)

2.1. Introduction

2.2. Diabetes

2.3. Ophthalmology

2.4.Gynaecology

3. Cannula Market, By Product

3.1.Introduction

3.2.Vascular (U.S.,Canada,China)

3.3.Dermatology (U.S.,Canada,China)

4. Cannula Market, By Region

4.1. Europe

4.1.1. Germany

4.1.2. U.K.

4.1.3. Spain

4.1.4. France

4.1.5. Italy

4.1.6. Rest Of Europe (Roe )

4.2 Rest Of The World

4.2.1Brazil

5. Company Profiles

(Additional Information Of 5 Players Would Be Provided Who Have Substantial Market Share In The Cannula Market)

List of Tables (86 Tables)

Table 1 Increased Patient Preference for Minimally Invasive Surgeries Likely to Drive the Cannula Market

Table 2 Uncertain Regulatory Framework to Restrain the Cannula Market

Table 3 Emerging Countries Provide Significant Growth Opportunities for the Cannula Market

Table 4 Maintaining the Quality of Cannula is A Major Market

Table 5 Cannulas Market Size, By Application, 20132020 ($Million)

Table 6 Cannulas Market Size for Cardiovascular Surgery, By Region, 20132020 ($Million)

Table 7 North America: Cannula Market Size for Cardiovascular Surgery, By Country, 20132020 ($Million)

Table 8 Asia-Pacific: Cannula Market Size for Cardiovascular Surgery, By Country, 20132020 ($Million)

Table 9 Cannulas Market Size for Oxygen Therapy, By Region, 20132020 ($Million)

Table 10 North America: Cannula Market Size for Oxygen Therapy, By Country, 20132020 ($Million)

Table 11 Asia-Pacific: Cannula Market Size for Oxygen Therapy, By Country, 20132020 ($Million)

Table 12 Cannula Market Size for General Surgery, By Region, 20132020 ($Million)

Table 13 Cannulas Market Size for Cosmetic/Plastic Surgery, By Region, 20132020 ($Million)

Table 14 Market Size for Orthopedic Surgery, By Region, 20132020 ($Million)

Table 15 Market Size for Other Applications, By Region, 20132020 ($Million)

Table 16 Cannula Market Size, By Product, 20132020 ($Million)

Table 17 Cardiac Cannulas Market Size, By Region, 20132020 ($Million)

Table 18 North America: Cardiac Cannula Market Size, By Country, 20132020 ($Million)

Table 19 Asia-Pacific: Cardiac Cannula Market Size, By Country, 20132020 ($Million)

Table 20 Nasal Cannula Market Size, By Region, 20132020 ($Million)

Table 21 North America: Nasal Cannula Market Size, By Country, 20132020 ($Million)

Table 22 Asia-Pacific: Nasal Cannula Market Size, By Country, 20132020 ($Million)

Table 23 Vascular Cannula Market Size, By Region, 20132020 ($Million)

Table 24 Dermatology Cannula Market Size, By Region, 20132020 ($Million)

Table 25 Arthroscopy Cannula Market Size, By Region, 20132020 ($Million)

Table 26 Other Cannulas Market Size, By Region, 20132020 ($Million)

Table 27 Cannula Market Size, By Material, 20132020 ($Million)

Table 28 Plastic Cannulas Market Size, By Region, 20132020 ($Million)

Table 29 North America: Plastic Cannula Market Size, By Country, 20132020 ($Million)

Table 30 Asia-Pacific: Plastic Cannula Market Size, By Country, 20132020 ($Million)

Table 31 Silicone Cannula Market Size, By Region, 20132020 ($Million)

Table 32 North America: Silicone Cannula Market Size, By Country, 20132020 ($Million)

Table 33 Asia-Pacific: Silicone Cannula Market Size, By Country, 20132020 ($Million)

Table 34 Metal Cannula Market Size, By Region, 20132020 ($Million)

Table 35 North America: Metal Cannula Market Size, By Country, 20132020 ($Million)

Table 36 Asia-Pacific: Metal Cannula Market Size, By Country, 20132020 ($Million)

Table 37 Cannula Market Size, By End User, 20132020 ($Million)

Table 38 Cannula Market Size for Hospitals, By Region, 20132020 ($Million)

Table 39 North America: Cannula Market Size for Hospitals, By Country, 20132020 ($Million)

Table 40 APAC: Cannula Market Size for Hospitals, By Country, 20132020 ($Million)

Table 41 Cannula Market Size for Ambulatory Surgical Centers, By Region, 20132020 ($Million)

Table 42 North America: Cannula Market Size for Ambulatory Surgical Centers, By Country, 20132020 ($Million)

Table 43 APAC: Cannula Market Size for Ambulatory Surgical Centers, By Country, 20132020 ($Million)

Table 44 Cannula Market Size for Other End Users, By Region, 20132020 ($Million)

Table 45 North America: Cannulas Market Size for Other End Users, By Country, 20132020 ($Million)

Table 46 APAC: Cannula Market Size for Other End Users, By Country, 20132020 ($Million)

Table 47 Cannula Market Size, By Region, 20132020 ($Million)

Table 48 North America: Cannulas Market Size, By Country, 20132020 ($Million)

Table 49 North America: Cannula Market Size, By Product, 20132020 ($Million)

Table 50 North America: Market Size, By Application, 20132020 ($Million)

Table 51 North America: Market Size, By End User, 20132020 ($Million)

Table 52 North America: Market Size, By Material, 20132020 ($Million)

Table 53 U.S.: Cannula Market Size, By Product, 20132020 ($Million)

Table 54 U.S.: Cannula Market Size, By Application, 20132020 ($Million)

Table 55 U.S.: Market Size, By End User, 20132020 ($Million)

Table 56 U.S.: Market Size, By Material, 20132020 ($Million)

Table 57 Canada: Cannulas Market Size, By Product, 20132020 ($Million)

Table 58 Canada: Cannula Market Size, By Application, 20132020 ($Million)

Table 59 Canada: Market Size, By End User, 20132020 ($Million)

Table 60 Canada: Market Size, By Material, 20132020 ($Million)

Table 61 Europe: Cannulas Market Size, By Product, 20132020 ($Million)

Table 62 Europe: Cannula Market Size, By Application, 20132020 ($Million)

Table 63 Europe: Market Size, By End User, 20132020 ($Million)

Table 64 Europe: Market Size, By Material, 20132020 ($Million)

Table 65 Asia-Pacific: Cannulas Market Size, By Country, 20132020 ($Million)

Table 66 Asia-Pacific: Cannula Market Size, By Product, 20132020 ($Million)

Table 67 Asia-Pacific: Market Size, By Application, 20132020 ($Million)

Table 68 Asia-Pacific: Market Size, By End User, 20132020 ($Million)

Table 69 Asia-Pacific: Market Size, By Material, 20132020 ($Million)

Table 70 China: Cannula Market Size, By Product, 20132020 ($Million)

Table 71 China: Cannulas Market Size, By Application, 20132020 ($Million)

Table 72 China: Market Size, By End User, 20132020 ($Million)

Table 73 China: Market Size, By Material, 20132020 ($Million)

Table 74 India: Cannula Market Size, By Product, 20132020 ($Million)

Table 75 India: Cannula Market Size, By Application, 20132020 ($Million)

Table 76 India: Market Size, By End User, 20132020 ($Million)

Table 77 India: Market Size, By Material, 20132020 ($Million)

Table 78 ROAPAC: Cannula Market Size, By Product, 20132020 ($Million)

Table 79 ROAPAC: Cannulas Market Size, By Application, 20132020 ($Million)

Table 80 ROAPAC: Market Size, By End User, 20132020 ($Million)

Table 81 ROAPAC: Market Size, By Material, 20132020 ($Million)

Table 82 RoW: Cannula Market Size, By Product, 20132020 ($Million)

Table 83 RoW: Cannulas Market Size, By Application, 20132020 ($Million)

Table 84 RoW: Market Size, By End User, 20132020 ($Million)

Table 85 RoW: Market Size, By Material, 20132020 ($Million)

Table 86 Partnerships, Collaborations and Agreements, 20112014

List of Figures (52 Figures)

Figure 1 Research Methodology

Figure 2 Market Size Estimation

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Data Triangulation Methodology for Cannula

Figure 5 Market Snapshot (2015 vs. 2020): Dermatology Cannula Expected to Be the Fastest-Growing Segment in Next Five Years

Figure 6 Cosmetic/Plastic Surgery Expected to Be Fastest-Growing Application Segment in the Forecast Period

Figure 7 Asia-Pacific Expected to Be the Fastest-Growing Market During the Forecast Period

Figure 8 Plastic-Based Cannula to Dominate the Market in the Forecast Period

Figure 9 Hospital

Figure 10 Market Growth Will Be Driven By Increasing Number of Surgeries Globally

Figure 11 Cardiovascular Surgery Segment Held the Largest Market Share

Figure 12 Dermatology Cannula Segment to Grow at the Highest Rate During the Forecast Period

Figure 13 Asia-Pacific to Witness the Highest Grow Rate of Cannula From 2015 to 2020

Figure 14 Hospitals Commanded the Largest Share of the Market of Cannula in 2014

Figure 15 Silicone Segment to Grow at the Highest Rate

Figure 16 Asia-Pacific Holds Lucrative Growth Opportunities of Cannula

Figure 17 Market: Drivers, Restraints, Opportunities, and Challenges for Cannula

Figure 18 Strategic Benchmarking: Key Players Adopted Organic Growth Strategies to Enhance Their Product Portfolios

Figure 19 Cardiovascular Surgery to Dominate the Cannula Applications Market (2014)

Figure 20 North America Dominated the Market for Cardiovascular Surgery

Figure 21 Asia-Pacific Expected to Be the Fastest-Growing Market for Cosmetic/Plastic Surgery

Figure 22 Asia-Pacific Expected to Be the Fastest-Growing Market for Other Applications

Figure 23 Cardiac Cannula Dominated the MIS Product Segment

Figure 24 North America Dominated the Cardiac Cannula Market in 2014

Figure 25 Asia-Pacific Expected to Be the Fastest-Growing Market for Nasal Cannula During the Forecast Period

Figure 26 Asia-Pacific Expected to Be the Fastest-Growing Market for Dermatology Cannula During the Forecast Period

Figure 27 Plastic Cannula Held the Largest Market Share in 2014

Figure 28 Asia-Pacific to Witness the Highest Growth in the Plastic Cannula Market

Figure 29 Silicone Cannulas Market to Witness Highest Growth in the Asia-Pacific Region

Figure 30 North America Dominated the Metal Cannulas Market in 2014

Figure 31 Global Cannula Market, By End User

Figure 32 Hospitals End-User Segment Held the Largest Share of the Cannulas Market in 2014

Figure 33 North America Dominated the Hospitals Segment in 2014

Figure 34 North America to Hold the Largest Share of the Ambulatory Surgical Centers in Forecast Period

Figure 35 Asia-Pacific End-Users Market Expected to Show the Highest Growth in the Forecast Period

Figure 36 Geographic Snapshot (2014): Cannulas Market in Asia-Pacific to Witness Highest Growth in the Forecast Period

Figure 37 Asia-Pacific: an Attractive Destination for Cannulas Market

Figure 38 North American Market Snapshot: Increasing Number of Surgeries Among Elderly Patients to Drive Demand for Cannula

Figure 39 Cosmetic/Plastic Surgery Segment Expected to Grow at Highest Growth Rate By 2020

Figure 40 New Product Launches, the Key Growth Strategy Adopted By Market Players in the Last Three Years

Figure 41 Battle for Market Share: New Product Launches Was the Key Strategy

Figure 42 Geographic Revenue Mix of Top Market Players

Figure 43 Medtronic PLC: Company Snapshot

Figure 44 Edward Lifescience Corporation: Company Snapshot

Figure 45 Terumo Corporation: Company Snapshot

Figure 46 Sorin Group: Company Snapshot

Figure 47 Smith & Nephew PLC: Company Snapshot

Figure 48 Conmed Corporation: Company Snapshot

Figure 49 Smiths Medical: Company Snapshot

Figure 50 Teleflex Incorporated: Company Snapshot

Figure 51 Maquet Holding B.V. & Co. KG.: Company Snapshot

Figure 52 Boston Scientific Corporation: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cannula Market