Capacitive Sensor Market by Sensor Type (Touch Sensor (Displays & Input Devices), Motion Sensor (Accelerometer, Gyroscope & Magnetometer), Position Sensor (Displacement & Proximity Sensor)), Industry, and Geography - Global Forecast to 2022

The capacitive sensor market is estimated to reach USD 31.79 Billion by 2022, at a CAGR of 5.4% during the forecast period. The capacitive sensor market size, in terms of volume, is estimated to register a shipment of 21.14 Billion units by 2022, at a CAGR of 9.3% during the forecast period. The base year considered for study is 2015, and the forecast period considered is between 2016 and 2022. This report provides a detailed analysis of the market based on type of sensor, industry, and region. It has been estimated that the touch sensor market would hold a large share of the capacitive sensor market during the forecast period. The capacitive sensor market, by industry, includes consumer electronics, food & beverages, oil & gas, healthcare, automotive, defense, and industrial manufacturing among others. Consumer electronics industry contributes maximum in the capacitive sensor market. The capacitive sensor market for the automotive industry is expected to grow in the coming years because the automotive industry has recently been experiencing rapid changes in manufacturing technology; the capacitive sensor market for automotive industry is expected to grow at a high CAGR between 2016 and 2022.

The capacitive sensor market is estimated to reach USD 31.79 Billion by 2022, at a CAGR of 5.4% during the forecast period. The capacitive sensor market size, in terms volume, is estimated to register a shipment of 21.14 Billion units by 2022, at a CAGR of 9.3% during the forecast period. Growing preference for capacitive touch sensors in majority of the consumer electronic products such as multi touchscreens, touchpads, sliders, TV controls, smartphones, multi-media players, tablets, kiosks, and gaming consoles among others, is expected to fuel the demand for the capacitive sensor market.

The market for capacitive position sensors is expected to grow at the highest rate during the forecast period due to its increasing demand in industries, ranging from automotive to manufacturing to consumer electronics, healthcare, and others.

The capacitive sensor market for the automotive industry is expected to grow at a high CAGR during the forecast period. There is a great scope for capacitive sensors in manufacturing and supplying companies in all the nations since capacitive sensors are in high demand in all the manufacturing units of the automotive industry for almost all processing machines and other supporting functions.

The capacitive sensor market in APAC is expected to grow at the highest CAGR during the forecast period. Factors such as rising automotive sales, growing need for automatization in industries, increasing security concerns, and ongoing technological developments in consumer electronics in countries such as India, South Korea and Japan in the APAC region are expected to drive the growth of the market in this region.

Declining demand for all-in-one PCs and short supply of indium tin oxide are the key factors restraining the growth of the capacitive sensor market. In addition, lack of universal standards makes it difficult to predict the performance of a sensor from a set of specifications, thus acting as a challenge for the capacitive sensor market.

Key players in this market are focused on strategic partnerships, collaborations, agreements, and new product launches to increase their revenue. Synaptics Inc. (U.S.) is a leading player in the capacitive sensor market. The company focuses more on organic growth strategies such as new product launches and expansions to sustain in the capacitive sensor market. Its recent product launch was in March 2016; the company launched a family of touch controllers, named S788x, which caters to the safety needs of the automotive market. Apart from new product launches, the company has also been entering into collaborations. For instance, in February 2016, Synaptics collaborated with Valeo (U.S.) to develop an automotive touchscreen that combines capacitive touch, the ClearForce sensing technology, and haptic feedback.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

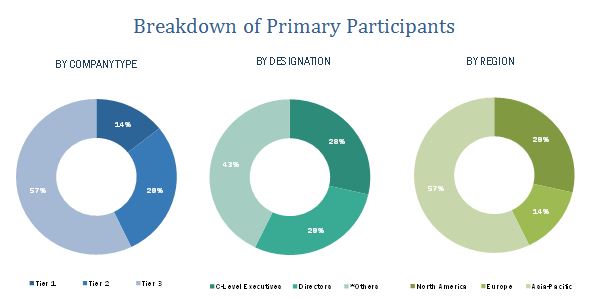

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insight (Page No. - 33)

4.1 Increasing Opportunites in Automotive Expected to Drive the Capacitive Sensor Market During the Forecast Period

4.2 India & South Korea to Be Emerging Markets in the Forecasted Period for Capacitive Sensor Market

4.3 China Dominated the Overall Capacitive Sensor Market in 2015

4.4 Capacitive Motion Sensor Market, By Application

4.5 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 38)

5.1 Market Segmentation

5.1.1 Capacitive Sensor Market, By Sensor Type

5.1.2 Capacitive Sensor Market, By Industry

5.1.3 Capacitive Sensor Market, By Geography

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Consumer Electronics Industry Across the World

5.2.1.2 Growing Trend of Miniaturization of Sensors

5.2.1.3 Increasing Use of Scratch-Resistant Non-Glass Surfaces in Electronics

5.2.2 Restraints

5.2.2.1 Declining Demand for All-In-One PCS

5.2.2.2 Short Supply of Indium Tin Oxide

5.2.3 Opportunities

5.2.3.1 Growth Opportunity of Capacitive Sensors in Dynamic Interactive Display Market

5.2.4 Challenges

5.2.4.1 Lack of Proper Guidelines to Measure Performance Standards

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

7 Capacitive Sensor Market, By Sensor Type (Page No. - 56)

7.1 Introduction

7.2 Touch Sensors

7.2.1 Capacitive Touch Sensor Market, By Application

7.2.1.1 Displays

7.2.1.1.1 Single Touchscreen

7.2.1.1.2 Multi Touchscreen

7.2.1.2 Input Devices

7.2.1.2.1 Buttons

7.2.1.2.2 Sliders

7.2.1.2.3 Trackpads

7.2.2 Capacitive Touch Sensor Market, By Technology

7.2.2.1 Surface Capacitance

7.2.2.2 Projected Capacitance

7.2.2.2.1 Self-Capacitance

7.2.2.2.2 Mutual-Capacitance

7.2.3 Comparison Between Resistive & Capacitive Sensors

7.2.4 Touch Sensor Market, By Surface Type

7.2.4.1 Glass-Based Surface

7.2.4.2 Non-Glass–Based Surface

7.2.4.2.1 Market for Non-Glass Surface, By Type

7.2.4.2.2 Plastic/Polymer

7.2.4.2.2.1 PMMA

7.2.4.2.2.2 Polycarbonates

7.2.4.2.2.3 Pet and Petg

7.2.4.2.2.4 Others

7.2.4.2.3 Sapphire

7.3 Motion Sensors

7.3.1 Accelerometers

7.3.2 Magnetometers

7.3.3 Gyroscopes

7.4 Position Sensors

7.4.1 Displacement Sensors

7.4.1.1 Linear Position

7.4.1.2 Rotary Position

7.4.2 Proximity Sensors

7.5 Others

7.5.1 Pressure Sensors

7.5.2 Level Sensors

8 Capacitive Sensor Market, By Industry (Page No. - 91)

8.1 Introduction

8.2 Consumer Electronics

8.2.1 Smartphones

8.2.2 Laptops & Tablets

8.2.3 Wearable Devices

8.2.4 Interactive Monitors

8.2.5 Others

8.2.6 Market for Capacitive Sensor in Consumer Electronics Industry, By Type of Sensor

8.3 Food & Beverages

8.3.1 Market for Capacitive Sensor in Food & Beverages Industry, By Type of Sensor

8.4 Oil & Gas

8.4.1 Market for Capacitive Sensor in Oil & Gas Industry, By Type of Sensor

8.5 Healthcare

8.5.1 Market for Capacitive Sensor in Healthcare Industry, By Type of Sensor

8.6 Automotive

8.6.1 Market for Capacitive Sensor in Automotive Industry, By Type of Sensor

8.7 Defense

8.7.1 Market for Capacitive Sensor in Defense Industry, By Type of Sensor

8.8 Industrial Manufacturing

8.8.1 Market for Capacitive Sensor in Industrial Manufacturing Industry, By Type of Sensor

8.9 Others

8.9.1 Market for Capacitive Sensor in Others Industry, By Type of Sensor

9 Geographic Analysis (Page No. - 105)

9.1 Introduction

9.2 Americas

9.2.1 North America

9.2.1.1 Initiatives Taken By Arr Act to Boost the Healthcare Sector in North America

9.2.1.2 U.S.

9.2.1.2.1 an Ideal Environment for Innovation That Facilitated Massive Advancements in the Capacitive Sensor Market

9.2.1.3 Canada

9.2.1.3.1 Demand for Capacitive Sensors Expected to Grow With the Increase in Canada‘S Healthcare Spending

9.2.1.4 Mexico

9.2.1.4.1 Necessary Steps Taken Up By the Government of Mexico in the Healthcare Field

9.2.2 South America

9.2.2.1 South America: Increase in the Sale of Automobiles and Expanding Scope of Applications Across Different Industry

9.2.2.2 Brazil

9.2.2.2.1 Emerging Major Automobile Manufacturing Region in South America

9.2.2.3 Rest of South America

9.3 Europe

9.3.1 Presence of Dominant Industries Such as Industrial Manufacturing and Automotive to Drive the European Market

9.3.2 U.K.

9.3.2.1 Increasing Integration of Miniature Capacitive Sensors Into U.K.’S Power Industry

9.3.3 Germany

9.3.3.1 Established Healthcare and Automotive Industries to Drive the German Market

9.3.4 France

9.3.4.1 Potential for Development of Capacitive Sensors in the Power Sector

9.3.5 Italy

9.3.5.1 Notable Advancement in Italy’s Cancer Research in Spite of Recent Cuts in Funding

9.3.6 Rest of Europe

9.4 APAC

9.4.1 Prosperous Growth Curve in Region in Terms of Consumption of Capacitive Sensors for Various Applications

9.4.2 China

9.4.2.1 Leading Contributor in the Global Capacitive Sensor Market

9.4.3 Japan

9.4.3.1 Japan: Largest Consumer Electronics Industry in the World

9.4.4 India

9.4.4.1 Fastest-Growing Market for Capacitive Sensors

9.4.5 South Korea

9.4.5.1 Market Driven By Electronics and Automotive Industry

9.4.6 Rest of APAC

9.5 RoW

9.5.1 Middle East

9.5.1.1 Better Opportunities for Capacitive Pressure Sensor Manufacturers

9.5.2 Africa

9.5.2.1 Weak Industrial Policies Expected to Impact the Capacitive Sensor Market

10 Competitive Landscape (Page No. - 127)

10.1 Overview

10.2 Market Ranking for Capacitive Sensor Market

10.3 Competitive Scenario

10.4 Recent Developments

10.4.1 New Product Launches

10.4.2 Mergers & Acquisitions

10.4.3 Expansions

10.4.4 Partnerships/Joint Ventures/Collaborations

11 Company Profiles (Page No. - 133)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Introduction

11.2 Synaptics Inc.

11.3 Microchip Technology, Inc.

11.4 Cypress Semiconductor Corp.

11.5 Stmicroelectronics N.V.

11.6 NXP Semiconductors N.V.

11.7 Texas Instruments, Inc.

11.8 Renesas Electronics Corp.

11.9 Infineon Technologies AG

11.10 Analog Devices, Inc.

11.11 Cirque Corp.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 158)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (69 Tables)

Table 1 Growing Trend of Miniaturization of Sensors Propels the Growth of the Capacitive Sensor Market

Table 2 Declining Demand for All-In-One PCS Acts as A Restraint in the Capacitive Sensors Market

Table 3 Capacitive Sensors in Interactive Display Products Posea Huge Opportunity for the Market

Table 4 Capacitive Sensors in Interactive Display Products Posea Huge Opportunity for the Market

Table 5 Porter’s Five Forces Analysis: Threat of Substitutes Likely to Have A Low Impact on the Overall Market During the Forecast Period

Table 6 Capacitive Sensor Market, By Sensor Type, 2013–2022 (USD Billion)

Table 7 Capacitive Sensor Market, By Sensor Type, 2013–2022 (Million Units)

Table 8 Capacitive Touch Sensor Market, By Industry, 2013–2022 (USD Million)

Table 9 Capacitive Touch Sensor Market, By Region, 2013–2022 (USD Million)

Table 10 Capacitive Touch Sensor Market, By Application, 2013–2022 (USD Million)

Table 11 Capacitive Touch Sensor Market, By Application, 2013–2022 (Million Units)

Table 12 Capacitive Touch Sensor Market, By Display Type, 2013–2022 (USD Million)

Table 13 Capacitive Touch Sensor Market for Display Types, By Region, 2013–2022 (USD Million)

Table 14 Capacitive Touch Sensor Market, By Input Device, 2013–2022 (USD Million)

Table 15 Capacitive Touch Sensor Market, By Input Device, 2013–2022 (Million Units)

Table 16 Captacitive Sensor Market for Input Devices, By Region, 2013–2022 (USD Million)

Table 17 Capacitive Touch Sensor Market, By Technology, 2013–2022 (USD Million)

Table 18 Capacitive Touch Sensor Market, By Projected Capacitance Technology, 2013–2022 (USD Million)

Table 19 Capacitive Touch Sensor Market, By Surface Type, 2013–2022 (USD Million)

Table 20 Capacitive Touch Sensor Market, By Surface Type, 2013–2022 (Million Units)

Table 21 Capacitive Touch Sensor Market, By Non-Glass–Based Surface Type, 2013–2022 (USD Million)

Table 22 Capacitive Touch Sensor Market, By Plastic- & Polymer-Based Surface Type, 2013–2022 (USD Million)

Table 23 Capacitive Motion Sensor Market, By Industry, 2013–2022 (USD Million)

Table 24 Capacitive Motion Sensor Market, By Region, 2013–2022 (USD Million)

Table 25 Capacitive Motion Sensor Market, By Application, 2013–2022 (USD Million)

Table 26 Capacitive Motion Sensor Market, By Application, 2013–2022 (Million Units)

Table 27 Capacitive Motion Sensor Market for Accelerometers, By Region, 2013–2022 (USD Million)

Table 28 Capacitive Motion Sensor Market for Magnetometers, By Region, 2013–2022 (USD Million)

Table 29 Capacitive Motion Sensor Market for Gyroscopes, By Region, 2013–2022 (USD Million)

Table 30 Capacitive Position Sensor Market, By Application, 2013–2022 (USD Million)

Table 31 Capacitive Position Sensor Market, By Application, 2013–2022 (Million Units)

Table 32 Capacitive Position Sensor Market, By Industry, 2013–2022 (USD Million)

Table 33 Capacitive Position Sensor Market, By Region, 2013–2022 (USD Million)

Table 34 Capacitive Position Sensor Market, By Displacement Sensor Type, 2013–2022 (USD Million)

Table 35 Capacitive Displacement Sensor Market, By Region, 2013–2022 (USD Million)

Table 36 Capacitive Proximity Sensor Market, By Region, 2013–2022 (USD Million)

Table 37 Other Capacitive Sensors Market, By Application, 2013–2022 (USD Million)

Table 38 Other Capacitive Sensors Market, By Application, 2013–2022 (Million Units)

Table 39 Other Capacitive Sensors Market, By Industry, 2013–2022 (USD Million)

Table 40 Other Capacitive Sensors Market, By Region, 2013–2022 (USD Million)

Table 41 Capacitive Pressure Sensor Market, By Region, 2013–2022 (USD Million)

Table 42 Capacitive Level Sensor Market, By Region, 2013–2022 (USD Million)

Table 43 Capacitive Sensor Market, By Industry, 2013–2022 (USD Million)

Table 44 Capacitive Sensor Market, By Consumer Electronic Device, 2013–2022 (USD Million)

Table 45 Capacitive Sensor Market for Consumer Electronics Industry, By Sensor Type, 2013–2022 (USD Million)

Table 46 Capacitive Senosr Maket for Food & Beverages Industry, By Sensor Type, 2013–2022 (USD Million)

Table 47 Capacitive Sensor Market for Oil & Gas Industry, By Sensor Type, 2013–2022 (USD Million)

Table 48 Capacitive Sensor Market for Healthcare Industry, By Sensor Type, 2013–2022 (USD Million)

Table 49 Capacitive Sensor Market for Automotive Industry, By Sensor Type, 2013–2022 (USD Million)

Table 50 Capacitive Sensor Market for Defense Industry, By Sensor Type, 2013–2022 (USD Million)

Table 51 Capacitive Sensor Market for Industrial Manufacturing Industry, By Sensor Type, 2013–2022 (USD Million)

Table 52 Capacitive Sensor Market for Other Industries, By Sensor Type, 2013–2022 (USD Million)

Table 53 Capacitive Sensor Market, By Region, 2013–2022 (USD Million)

Table 54 Capacitive Sensor Market in Americas, By Sensor Type, 2013–2022 (USD Million)

Table 55 Capacitive Sensor Market in Americas, By Region, 2013–2022 (USD Million)

Table 56 Capacitive Sensor Market in North America, By Sensor Type, 2013–2022 (USD Million)

Table 57 Capacitive Sensor Market in North America, By Country, 2013–2022 (USD Million)

Table 58 Capacitive Sensor Market in South America, By Sensor Type, 2013–2022 (USD Million)

Table 59 Capacitive Sensor Market in South America, By Country, 2013–2022 USD Million

Table 60 Capacitive Sensor Market in Europe, By Sensor Type, 2013–2022 (USD Million)

Table 61 Capacitive Sensor Market in Europe, By Country, 2013–2022 (USD Million)

Table 62 Capacitive Sensor Market in APAC, By Sensor Type, 2013–2022 (USD Million)

Table 63 Capacitive Sensor Market in APAC, By Country, 2013–2022 (USD Million)

Table 64 Capacitive Sensor Market in RoW, By Sensor Type, 2013–2022 (USD Million)

Table 65 Capacitive Sensor Market in RoW, By Region, 2013–2022 (USD Million)

Table 66 New Product Launches, 2013–2016

Table 67 Mergers & Acquisitions, 2014–2016

Table 68 Expansions, 2015

Table 69 Partnerships/Joint Ventures/Collaborations, 2016

List of Figures (81 Figures)

Figure 1 Capacitive Sensor Market: Segmentation

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown & Data Triangulation

Figure 6 Global Capacitive Sensor Market Expected to Grow at A Moderate Rate During the Forecast Period

Figure 7 Touch Sensors Expected to Hold the Largest Size of the Capacitive Sensor Market During the Forecast Period

Figure 8 Capacitive Sensor Market for Automotive Industry Expected to Grow at the Highest Rate During the Forecast Period

Figure 9 Capacitive Sensors in Wearables Market is Expected to Grow at the Highest Rate During the Forecast Period

Figure 10 Capacitive Sensor Market in APAC Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 11 Increasing Demand for Capacitive Sensors in Automotive Industry

Figure 12 India Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 13 Touch Sensors Held the Largest Share of the Capacitive Sensor Market in APAC in 2015

Figure 14 Magnetometer Market Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 15 Capacitive Sensor Market in APAC is Currently at the Growth Stage

Figure 16 Geographical Segmentation of the Capacitive Sensor Market

Figure 17 Rising Consumer Electronics Industry Expected to Spur the Growth of the Capacitive Sensor Market

Figure 18 Increasing Sales for Touch Panels in the Consumer Electronics Market, 2012–2016

Figure 19 World-Wide All-In-One Computers Decline in Shipment, 2011–2016

Figure 20 Position Sensors Witnesses Growth Opportunities in Capacitive Sensor Market

Figure 21 Major Value is Added During the Device Integration Phase

Figure 22 Impact of Intensity of Competitive Rivalry Was Moderate in the Capacitive Sensor Market in 2015

Figure 23 Capacitive Sensor Market: Porter’s Five Forces Analysis

Figure 24 Intensity of Competitive Rivalry: Moderate Competition in the Market Owing to the Presence of A Large Number of Players

Figure 25 Threat of Substitutes: Impact Likely to Remain Low During the Forecast Period

Figure 26 Bargaining Power of Buyers: Impact Likely to Be High During the Forecast Period Due to the Availability of A Large Number of Suppliers

Figure 27 Bargaining Power of Suppliers: Impact Likely to Be Medium During the Forecast Period Due to Low Product Differentiation

Figure 28 Threat of New Entrants: Impact Likely to Be Medium During the Forecast Period Due to Moderate Capital Requirement

Figure 29 Capacitive Sensor Market Segmentation: By Sensor Type

Figure 30 Market for Position Sensors Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 31 Capacitive Touch Sensor Market Segmentation: By Application

Figure 32 Capacitive Touch Sensor Market Segmentation: By Display

Figure 33 Market for Displays Expected to Grow at A Higher Rate Compared to Input Devices During the Forecast Period

Figure 34 Capacitive Touch Sensor Market Segmentation: By Input Device

Figure 35 Capacitive Touch Sensor Market Segmentation: By Technology

Figure 36 Capacitive Touch Sensor Market Segmentation: By Projected Capacitance

Figure 37 Capacitive Touch Sensor Market Segmentation: By Surface Type

Figure 38 Capacitive Touch Sensor Market Segmentation: By Non-Glass–Based Surface Type

Figure 39 Capacitive Touch Sensor Market Segmentation: By Plastic/Polymer-Based Surface Type

Figure 40 Capacitive Motion Sensor Market: By Application

Figure 41 Capacitive Motion Sensor Market for Magnetometers Expected to Grow at the Highest Rate During the Forecast Period

Figure 42 Capacitive Position Sensor Market: By Application

Figure 43 Capacitive Displacement Sensor Market: By Type

Figure 44 Other Capacitive Sensors Market: By Application

Figure 45 The Automotive Industry Expected to Lead the Market for Other Capacitive Sensors During the Forecast Period

Figure 46 Capacitive Sensor Market Segmentation: By Industry

Figure 47 Automotive Industry Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 48 Consumer Electronics Market Segmentation: By Device

Figure 49 Position Sensor Market for Consumer Electronics Industry Expected to Grow at the Highest Rate During the Forecast Period

Figure 50 Position Sensor Market for Healthcare Industry Expected to Grow at the Highest Rate During the Forecast Period

Figure 51 Position Sensor Market for Industrial Manufacturing Industry Expected to Grow at the Highest Rate During the Forecast Period

Figure 52 Capacitive Sensor Market, By Geography

Figure 53 Geographic Snapshot: APAC Expected to Register the Highest Growth Rate During the Forecast Period

Figure 54 Capacitive Sensor Market in India Estimated to Grow at the Highest Rate Between 2016 and 2022

Figure 55 The Capacitive Sensor Market Segmentation in Americas

Figure 56 Increased Use of Capacitive Sensors for Commercial Applications Expected to Drive the Market in the Americas During the Forecast Period

Figure 57 North American Capacitive Sensor Market, By Country, 2015

Figure 58 The Capacitive Sensor Market Segmentation in Europe

Figure 59 The Capacitive Sensor Market Segmentation in APAC

Figure 60 Presence of Prominent Consumer Electronics Companies & System Suppliers Expected to Drive the Growth of the Market in APAC

Figure 61 The Capacitive Sensor Market Segmentation in RoW

Figure 62 Key Growth Strategies Adopted By the Top Companies, 2013–2016

Figure 63 Synaptics Exhibited the Highest Growth Rate Between 2013 and 2015

Figure 64 Market Ranking of the Top 5 Players in the Capacitive Sensor Market, 2015

Figure 65 Market Evaluation Framework – Partnerships/ Agreements/ Joint Ventures Fuelled Growth and Innovation Between 2013 and 2015

Figure 66 Battle for Market Share: New Product Launch Was the Key Strategy, Between 2013 and 2015

Figure 67 Geographic Revenue Mix of the Top 5 Market Players

Figure 68 Synaptics Inc.: Company Snapshot

Figure 69 Synaptics Inc.: SWOT Analysis

Figure 70 Microchip Technology, Inc.: Company Snapshot

Figure 71 Microchip Technology, Inc.: SWOT Analysis

Figure 72 Cypress Semiconductor Corp.: Company Snapshot

Figure 73 Cypress Semiconductor Corp.: SWOT Analysis

Figure 74 Stmicroelectronics N.V.: Company Snapshot

Figure 75 Stmicroelectronics N.V.: SWOT Analysis

Figure 76 NXP Semiconductors N.V.: Company Snapshot

Figure 77 NXP Semiconductors N.V.: SWOT Analysis

Figure 78 Texas Instruments, Inc.: Company Snapshot

Figure 79 Renesas Electronics Corp.: Company Snapshot

Figure 80 Infineon Technologies AG: Company Snapshot

Figure 81 Analog Devices, Inc.: Company Snapshot

The research methodology used to estimate and forecast the capacitive sensor market begins with obtaining data on key vendor revenues and market shipment through secondary research. The vendor offerings have also been taken into consideration to determine the market segmentation. The top-down procedure has been employed to arrive at the overall market size of the global capacitive sensor market from the number of units of sensors shipped worldwide and the average selling price of each sensor in USD/unit. After arriving at the overall market size, the total market has been split into several segments and subsegments, which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. This data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

This report provides valuable insights regarding the ecosystem of this market such as raw material suppliers; integrated device manufacturers (IDMs); original device manufacturers (ODMs); original equipment manufacturers (OEMs); assembly, testing, & packaging vendors; and sensors chip traders; & distributors. This study also answers several questions for the stakeholders such as which market segments to focus on in the next two to five years for prioritizing the efforts and investments. Some of the key players operating in this market are Synaptics Inc. (U.S.), Microchip Technology, Inc. (U.S.), Cypress Semiconductor Corp. (U.S.), and STMicroelectronics N.V. (Switzerland) among others.

Target Audience:

- Raw material suppliers

- Electronic design automation (EDA) & design tool vendors

- Fabrication, wafer, & foundry process equipment vendors

- Integrated device manufacturers (IDMs)

- Fabless vendors, fabrication players

- Intellectual property vendors

- Original device manufacturers (ODMs)

- Original equipment manufacturers (OEMs)

- Assembly, testing, & packaging vendors

- Sensors chip traders & distributors

Scope of the Report:

This research report categorizes the global capacitive sensor market based on the type of sensor, industry, and region.

Global Capacitive Sensor Market, by Sensor Type

- Touch Sensors

- Motion Sensors

- Position Sensors

- Others (Capacitive Pressure And Level Sensors)

Global Capacitive Sensor Market, by Industry

- Consumer Electronics

- Food & Beverages

- Oil & Gas

- Healthcare

- Automotive

- Defense

- Industrial Manufacturing

- Others (Entertainment, Retail, and Hospitality Industries)

Global Capacitive Sensor Market, by Region

- Americas

- Europe

- APAC

- RoW

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

- Geographic Analysis

- Comprehensive coverage of regulations followed in each region (the Americas, APAC, and Europe)

- Company Information

- Detailed analysis and profiling of additional market players (upto five)

Growth opportunities and latent adjacency in Capacitive Sensor Market

Looking for information relating specifically to capacitive touch sensor overall market value by mobile, wearables, and durable (industrial) industries from 2015-2020.

I am specifically interested in touch buttons for keypads, keyboards, control interface/panel etc. Top two technologies for these are membrane and capacitive for touch buttons.