Carboxymethyl Cellulose Market

Carboxymethyl Cellulose Market by Application (Industrial, Pharmaceutical, Personal Care, Food & Beverage, Other Applications) and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

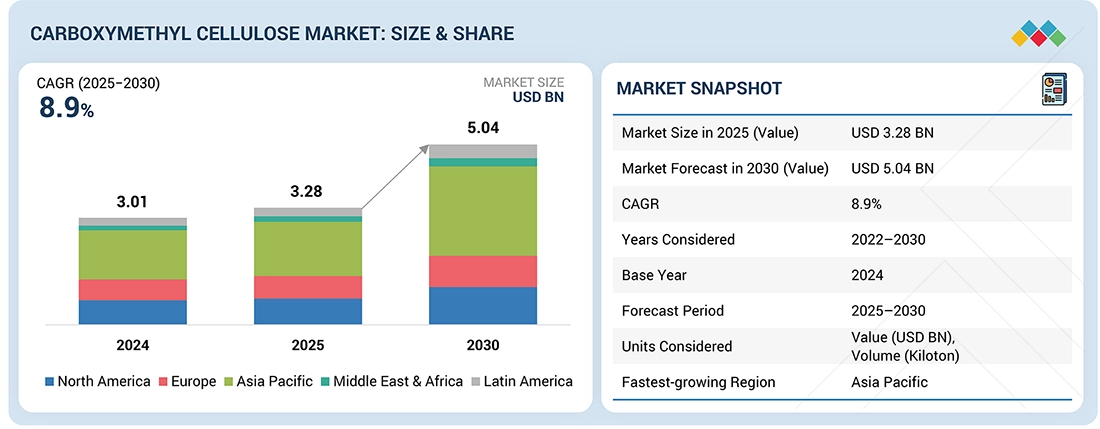

The carboxymethyl cellulose market size is valued at USD 3.28 billion in 2025 and is expected to reach USD 5.04 billion by 2030, at a CAGR of 8.9% during the forecast period. The market is growing due to the increased demand from the food & beverage, pharmaceutical, and personal care sectors, which depend on carboxymethyl cellulose for functions such as thickening, stabilizing, and binding. The use of carboxymethyl cellulose in various industrial applications, including oil & gas drilling, detergents, paper processing, and construction, is increasing. The shift towards bio-based and sustainable ingredients is also increasing the demand for carboxymethyl cellulose. The continuous development of production capacities in the Asian region also supports the overall market growth.

KEY TAKEAWAYS

-

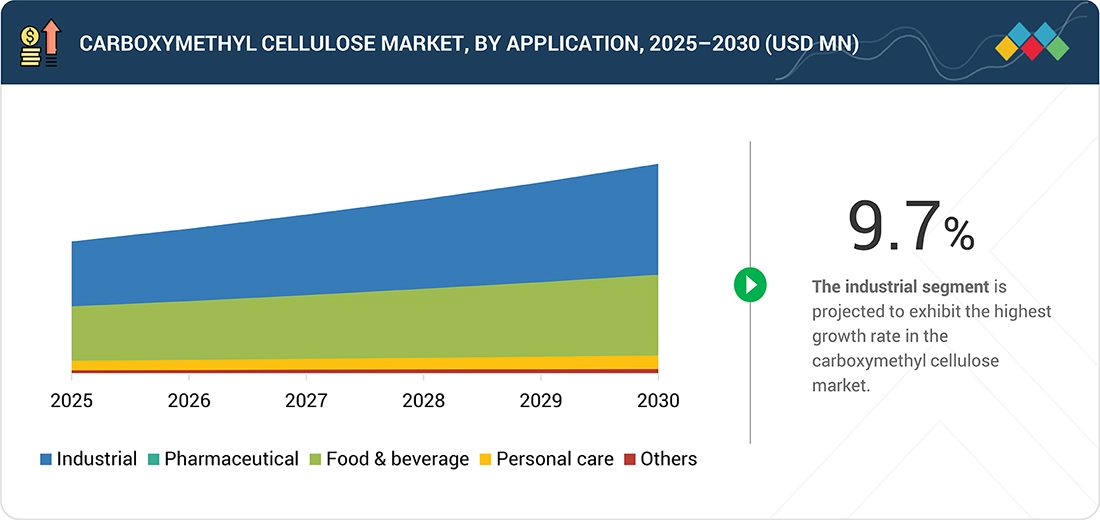

By ApplicationBy application, the Industrial segment is projected to register the highest CAGR of 9.7% in the carboxymethyl cellulose market during the forecast period.

-

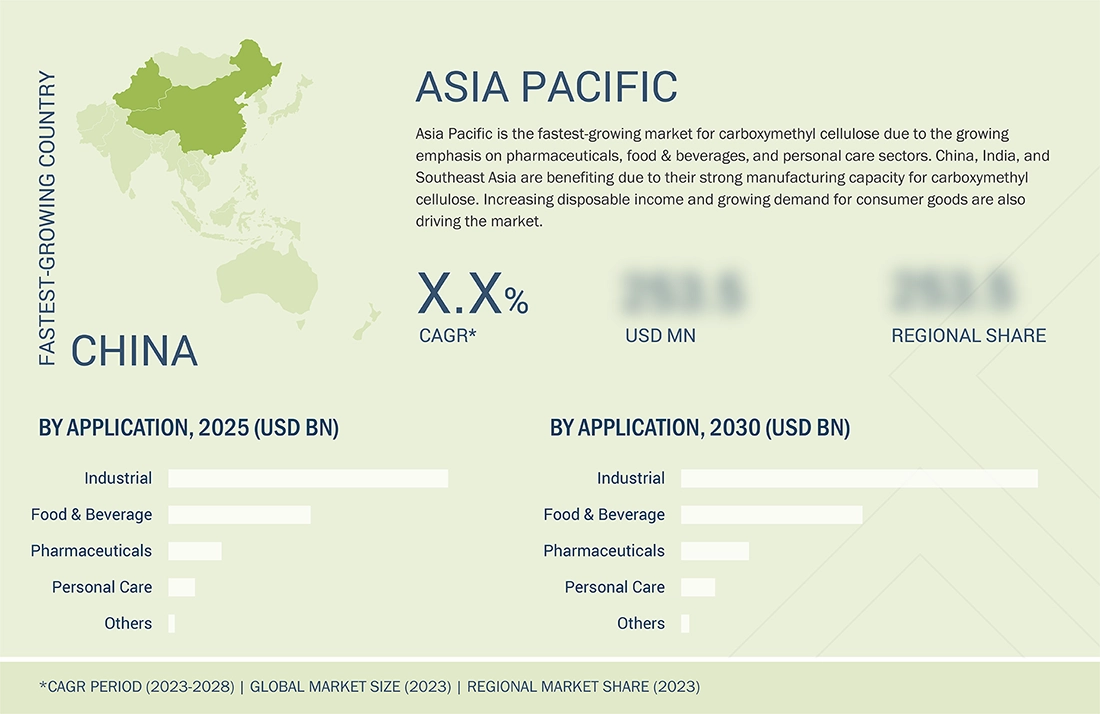

By RegionBy region, Asia Pacific is projected to register the highest CAGR of 10.5% in the global carboxymethyl cellulose market during the forecast period.

-

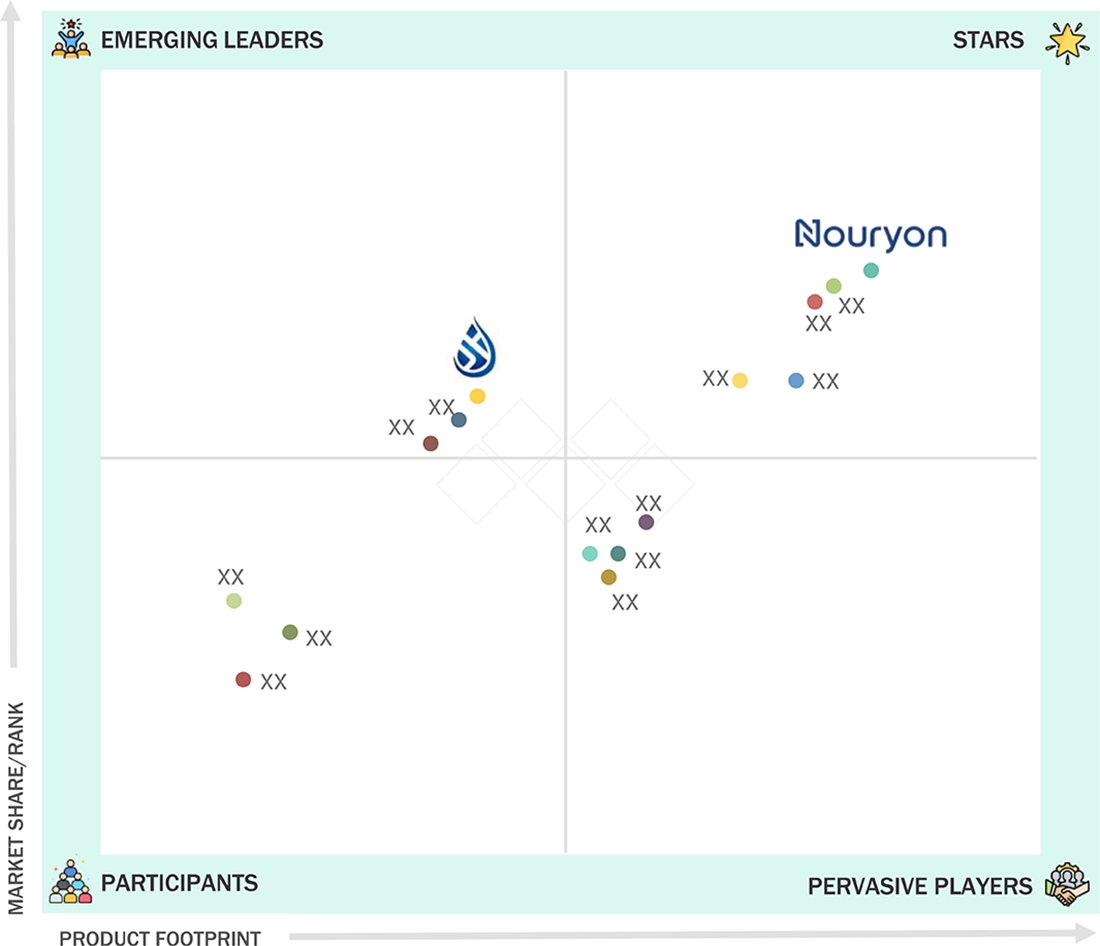

Competitive Landscape-Key PlayersAKKIM (Turkey), Ashland Global Holdings, Inc. (US), Nouryon Chemicals Holding B.V. (Netherlands), Shandong Head Co., Ltd. (China), Hebei Jiahua Cellulose Co., Ltd. (China), Nippon Paper Industries Co., Ltd. (Japan), Daicel Corporation (Japan), and DKS Co., Ltd. (Japan) are star players in the carboxymethyl cellulose market, given their broad industry coverage and strong operational & financial strength.

-

Competitive Landscape- StartupsPatel Chemical Specalities, Henan Botai Chemical Building Material Co., Ltd., Celotech Chemical Co., Ltd., Zhejiang Kehong Chemical Co., Ltd., and Pioma Chemicals have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios.

The carboxymethyl cellulose market's growth is driven by the increasing demand for performance-enhancing ingredients in various end-use Industries. Carboxymethyl cellulose is used due to its controlled viscosity, improved texture, enhanced water retention, and improved stability, which makes it indispensable in food processing, pharmaceuticals, cosmetics, and industrial applications. Furthermore, the shift towards more economical and plant-based additives is driving the adoption of carboxymethyl cellulose. The boom in oilfield activities, growth of the detergent and paper industries, and the growing demands for formulations in personal care and healthcare are all contributing to the increasing application of carboxymethyl cellulose.

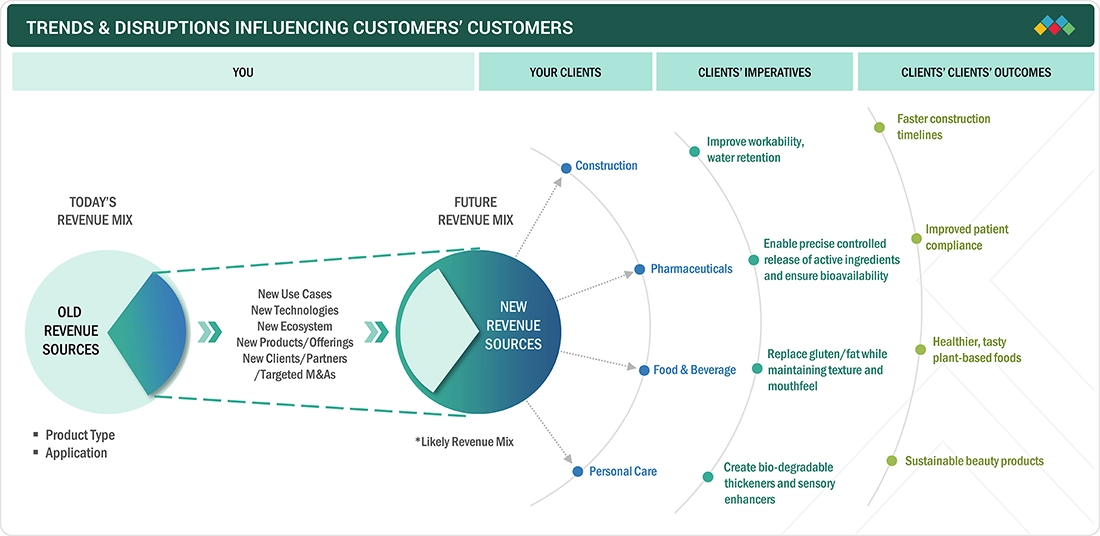

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions affect consumers' businesses. These shifts influence the revenues of end users. As a result, the revenue changes for end users are likely to impact the revenues of carboxymethyl cellulose suppliers, which in turn affect the revenues of carboxymethyl cellulose manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand across food, pharmaceutical, and personal care sectors

-

Expansion of industrial applications, including oil & gas, detergents, and paper processing

Level

-

Volatility in raw material prices and supply fluctuations

-

Strict regulatory standards in food and pharmaceutical applications

Level

-

Rising focus on bio-based and sustainable ingredients

-

Growing applications in emerging technologies and advanced materials

Level

-

Competition from regional manufacturers

-

Availability of alternative polymers and substitutes

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand across food, pharmaceutical, and personal care sectors

The?????? carboxymethyl cellulose market has experienced accelerated growth. Carboxymethyl cellulose is no longer just a mixing agent. It adjusts the consistency, prevents particles from settling, enhances the sensory aspect of the product, and extends freshness, particularly in baked goods, milk substitutes, dressings, beverages, and gluten-free products. Pharmaceutical companies are using more carboxymethyl cellulose due to their increased production and smarter formulations. Carboxymethyl cellulose is used in lotions, shampoos, creams, and toothpaste to thicken the mixtures, stabilize the blends, and enhance the product's performance.

Restraint: Volatility in raw material prices and supply fluctuations

The production of carboxymethyl cellulose is highly reliant on a limited number of key raw materials, namely cellulose (from wood pulp or cotton linters), caustic soda, and monochloroacetic acid. Disruption in the supply chain of such inputs due to environmental regulations on forestry, global chemical supply limitations, changing agricultural production, and geopolitical instability can cause significant price fluctuations for manufacturers. The significantly higher production costs resulting from these fluctuations make it difficult for manufacturers to maintain consistent pricing for their customers. In addition, if a manufacturer experiences an unexpected shortage of chemicals used in etherification, it would cause a delay in production cycles, which in turn would result in delayed delivery times and reduced supply reliability. These fluctuations in the availability and price of chemicals significantly reduce profit margins for both manufacturers and end-users of carboxymethyl cellulose, creating substantial challenges for long-term planning among these stakeholders. Smaller manufacturers are particularly affected by this volatility, as they lack the same procurement advantages and storage capabilities as larger manufacturers.

Opportunity: Growing applications in emerging technologies and advanced materials

Due to its unique properties of film formation, dissolving in water, having great adhesion characteristics, and controlling rheological (viscosity) properties of other materials, carboxymethyl cellulose is well positioned to be utilized in many burgeoning technology sectors. Carboxymethyl cellulose is used as a binder for the anodes of lithium-ion batteries, serving as an alternative to petroleum-based binders. This allows electrodes to be produced in a safer and more sustainable manner. With the rapid growth of electric vehicle adoption globally, the demand for battery-grade carboxymethyl cellulose is expected to increase significantly in the coming years. Similarly, the field of 3D printing will benefit from the use of carboxymethyl cellulose to control the viscosity and improve the extrusion functionality of bio-ink and specialized material formulations. In addition to its applications in the manufacturing of nanocomposites, membranes for water purification, and controlled release systems, carboxymethyl cellulose is likely to continue growing in importance as new advanced material developments take place globally.

Challenge: Competition from regional manufacturers

Competition in the carboxymethyl cellulose market varies regionally due to the increased presence of smaller manufacturers in Asia Pacific that are providing competitively priced products to consumers who have lower price sensitivity. Smaller manufacturers typically have lower overall production costs, which enables them to provide market access to customers through more flexible pricing options. This creates disadvantages for larger, higher-overhead-costing companies that are unable to sustain their market share in this environment. Consequently, the competitive nature of this environment may lead to price wars, decreased margins, and increased difficulty for established players to compete on points of differentiation based solely on product performance. Moreover, regional competitors can react to customer preferences more quickly than larger manufacturers. Therefore, larger manufacturers need to implement strategies that focus on product innovation, quality standardization, and forming strategic partnerships to remain competitive.

CARBOXYMETHYL CELLULOSE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The company uses carboxymethyl cellulose in industrial applications, such as in oil & gas drilling fluids for viscosity control and fluid-loss reduction. | Increased efficiency of drilling, fluid loss minimized, wellbore stability enhanced, and more reliable rheological performance during drilling process |

|

The company incorporates carboxymethyl cellulose as stabilizer and thickener in processed foods. | Longer shelf life, improved food quality, and improved texture in product quality |

|

The company applies carboxymethyl cellulose as anti-redeposition agent in detergents. | Enhanced detergent stability, improved cleaning performance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

This?????? ecosystem reveals every level of the value chain for the carboxymethyl cellulose market, starting with raw material suppliers like WestRock, Daicel, Kemira, and Sappi, who supply cellulose that is necessary for production. Manufacturers such as Nouryon, DKS, and Ashland transform these materials into carboxymethyl cellulose, which is utilized in various industries. Distributors like DKSH, Redox, and Megachem are the ones who bring the product to the global markets. End users such as Dr. Reddy's, L'Oreal, Saint-Gobain, Bayer, Nestlé, and Unilever utilize carboxymethyl cellulose in pharmaceuticals, cosmetics, construction, food, and household products.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Carboxymethyl Cellulose Market, By Application

The?????? industrial segment is the fastest-growing application of carboxymethyl cellulose. Carboxymethyl cellulose is used as a thickener, binder, and water-retention agent to enhance product durability in various industries, including construction, paper, textiles, detergents, and ceramics. The growing infrastructure development in the Asia Pacific region is boosting the demand for cement, gypsum boards, and adhesives, which improve workability and crack resistance. Moreover, sustainability initiatives driven by regulatory authorities are ??????rapidly accelerating the growth of the carboxymethyl cellulose market.

REGION

Asia Pacific to be fastest-growing region in carboxymethyl cellulose market during forecast period

Cost-efficient?????? production, ease of raw material availability, and large-scale industrialization contribute to the rapid expansion of the carboxymethyl cellulose market in Asia Pacific. China is at the forefront of this growth due to its extensive chemical manufacturing capabilities, large domestic consumption, low production costs, and increasing use of carboxymethyl cellulose in advanced sectors such as batteries and specialty materials.

CARBOXYMETHYL CELLULOSE MARKET: COMPANY EVALUATION MATRIX

In the carboxymethyl cellulose market matrix, Nouryon Chemicals Holding BV (Star) leads with a strong market share and extensive product footprint, which are widely adopted in the industrial, pharmaceutical, personal care, and food & beverage industries. Hebei Jiahua Cellulose Co., Ltd. (Emerging Leader) is gaining visibility as it focuses on innovation and backs this with high-performance cellulose for tile adhesives, drymix mortars, coatings, and food applications. While Nouryon Chemicals Holding BV dominates through scale and a diverse portfolio, Hebei Jiahua Cellulose Co., Ltd. shows significant potential to move toward the leaders’ quadrant as demand for carboxymethyl cellulose continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Amtex (Uruguay)

- AKKIM (Turkey)

- Ashland Global Holdings, Inc. (US)

- PAC & CMC Manufacturing Co., Ltd. (China)

- Nippon Paper Industries Co., Ltd (Japan)

- Shandong Head Co., Ltd. (China)

- Nouryon Chemicals Holding B.V. (Netherlands)

- Daicel Corporation (Japan)

- KIMA CHEMICAL CO., LTD. (China)

- Pioma Chemicals (India)

- YuCMC Co., Ltd. (China)

- Hubei Jiahua Cellulose Co., Ltd. (China)

- DKS Co. Ltd. (Japan)

- Lamberti S.P.A (Italy)

- Zibo Hailan Chemical Co., Ltd. (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 3.28 Billion |

| Market Forecast in 2030 (Value) | USD 5.04 Billion |

| Growth Rate | CAGR of 8.9% from 2025 to 2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Application: Industrial, Pharmaceutical, Personal Care, Food & Beverage, Other Applications |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

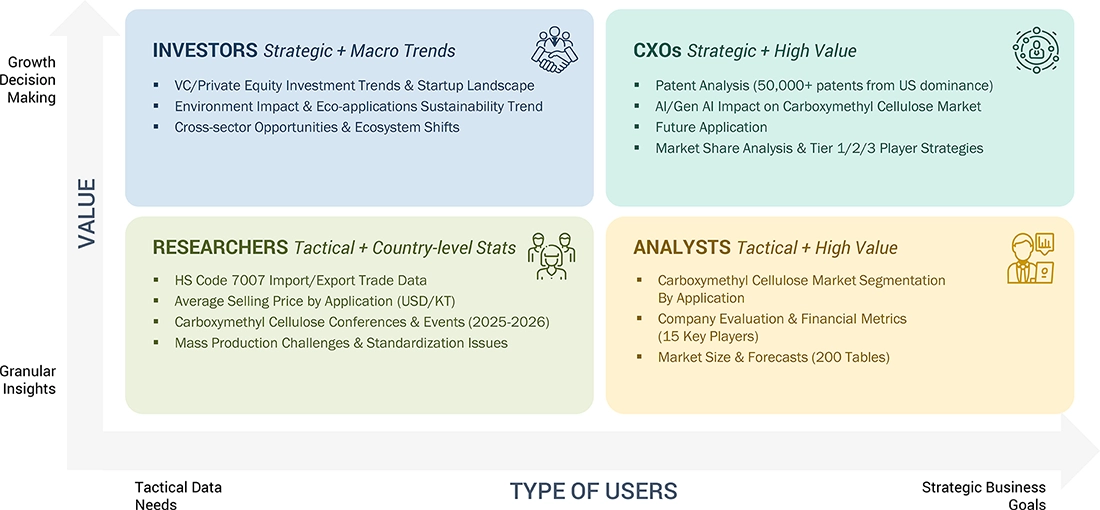

WHAT IS IN IT FOR YOU: CARBOXYMETHYL CELLULOSE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Carboxymethyl Cellulose Manufacturer (Food, Pharma, Personal Care & Industrial Grades) |

|

|

| Carboxymethyl Cellulose Formulator / Compounder (Food, Personal Care, Detergents & Industrial Applications) |

|

|

| Raw Material Supplier (Wood Pulp / Cotton Linter / Chemical Intermediates for Carboxymethyl Cellulose Production) |

|

|

| Construction Chemicals & Industrial Formulations Using Carboxymethyl Cellulose (Cement Additives, Drilling Fluids, Coatings, Paper Processing) |

|

|

RECENT DEVELOPMENTS

- January 2022 : Ashland Global Holding, Inc. announced plans to increase production capacity of Natrosol HEC at its plant in Virginia, US.

- April 2022 : Bermocoll FLOW is a sustainable and innovative product that combines the leveling and flow properties of associative synthetic thickeners, along with the stability properties of cellulose thickener.

- January 2020 : J.M. Huber Corporation signed a definitive agreement to sell its carboxymethyl cellulose business (CMC) to Nouryon, a global specialty chemicals company.

Table of Contents

Methodology

The study involved four major activities in estimating the current market size of nanocellulose. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of nanocellulose through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the market's segments and sub-segments.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, notifications by regulatory bodies, trade directories, and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The nanocellulose market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the development of pulp & paper, composites, biomedical & pharmaceutical, paints & Coatings, electronics & sensors, and other applications. Advancements in technology characterize the supply side. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the nanocellulose market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the industrial evaporators market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides in the pulp & paper, composites, paints & coatings, biomedical & pharmaceuticals, electronic & sensors, and other industries.

Market Definition

Nanocellulose is a bio-based nanomaterial also called nanostructured cellulose. This pseudoplastic material acts like certain gels or fluids thick or viscous in normal conditions but thin out or flow over time. The main types of nanocellulose include microfibrillated cellulose (MFC), nanofibrillated cellulose (NFC), and crystalline nanocellulose or nanocrystalline cellulose (CNC/NCC). Other types of nanocellulose include bacterial nanocellulose and cellulose filaments. Nanocellulose has the potential to take the place of or add to plastic and parts of oil and fracking drilling fluids and emulsifiers.

Key Stakeholder

- Manufacturers of dimethyl carbonate

- Traders, distributors, and suppliers of nanocellulose

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environment support agencies

- Investment banks and private equity firms

Report Objectives:

- To analyze and forecast the nanocellulose market by type, raw material, and application in terms of value and volume.

- To forecast the market size for various segments concerning four main regions: Asia Pacific, Europe, North America, Rest of the World, along with their key countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the nanocellulose market

- To strategically analyze the micromarkets1 concerning individual growth trends, growth prospects, and their contribution to the overall market

- To benchmark players within the market using competitive leadership mapping, which analyses market players on various parameters within the broad categories of business and product strategies.

- To map the competitive intelligence based on company profiles, key player strategies, and game-changing developments, such as product launches and developments, expansions, mergers and acquisitions, and contracts and agreements

- To strategically profile the key players and analyze their market shares and core competencies2.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

- Additional country-level analysis of the dimethyl carbonate market

- Profiling of additional market players (up to 5)

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Carboxymethyl Cellulose Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Carboxymethyl Cellulose Market