Hydrocolloids Market Size, Share, Industry Growth, Trends, Overview by Type (Gelatin, Pectin, Carrageenan, Xanthan gum, Agar, Gum Arabic, Alginates, Guar gum, MCC), Source (Botanical, Microbial, Animal, Seaweed, Synthetic), Function, Application and Region - Global Forecast to 2028

Hydrocolloids Market Growth Analysis, 2028

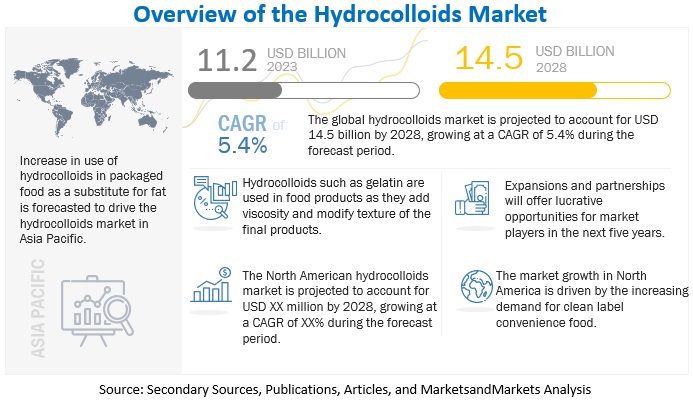

The global hydrocolloids market size was valued at USD 11.2 billion in 2023 and is poised to reach USD 14.5 billion by 2028, growing at a CAGR of 5.4% from 2023–2028.

One of the most often utilized additives in the food sector is hydrocolloid. In addition to serving as gelling agent, thickener,emulsifier, fat substitute, and stabilizer, it is also used as flocculating agent, clarifying agent, whipping agent, and clouding agent.

Moreover, hydrocolloids are used to create edible films, encapsulate flavors, and inhibit crystallization. Also, it is now known that hydrocolloids have a wide range of functions in the field of health, including the provision of dietary fiber with less calories. Foods with superior texture, taste, and other organoleptic features have always been desired by consumers. Consumers who are concerned about their health are now demanding more natural and nutritious food products. And it turned into one of the key factors that fueled the growth of the hydrocolloids industry.

The need for fat substitutes is rising since there is more emphasis placed on nutrition and health, particularly the need to stop the growth of diabetes, obesity, and food allergies. The demand for stabilisers has increased as a result of the development of numerous stabilisers that are used only as emulsifiers and texturizers. Xanthan gum is used to thicken Italian dressings, while light mayonnaise uses guar and xanthan gum as fat replacements to increase viscosity.

To know about the assumptions considered for the study, Request for Free Sample Report

Hydrocolloids Market Growth Insights

Drivers: Multifunctionality of hydrocolloids to lead to wide range of applications

Among various biopolymers, hydrocolloids are widely utilized in food technology. To increase quality and shelf life, hydrocolloids are frequently employed in food formulations. In a variety of food products, including soups, salad dressings, gravies, toppings, sauces, jellies, jam, restructured foods, marmalade, and low-sugar per calorie gels, hydrocolloids have been widely employed. They can also be used to prevent the production of sugar and ice crystals in ice cream and to manage the flavur release. These substances aid in enhancing food texture and moisture retention in the baking sector, which helps to delay starch retrogradation and, therefore, raises the overall quality of the items during storage.

Recently, some hydrocolloids are being used due to their polymeric structure as fat replacers to obtain low-calorie products. Hydrocolloid additions enhance the production of gluten-free bakery products by giving the dough better texture, thickening, and water retention. When xanthan gum is employed in gluten-free bread made using a starch mixture of rice flour, corn starch, and sodium caseinate, the desired results on rheological testing are obtained. Thus, during the review period, the increasing demand for gluten-free bakery products is anticipated to further drive the demand for hydrocolloids in food.

Restraints: Stringent regulations and international quality standards

It is observed that there are no clear universal guidelines regarding the usage of individual ingredients in the end products. Regulations and guidelines vary from region to region. This has resulted in additional costs for production for manufacturing region-specific ingredients. Furthermore, the amount of hydrocolloids that can be used in food items is rigorously controlled. The health of people may be negatively impacted by excessive hydrocolloids. The way hydrocolloids are used in food will affect health. Each hydrocolloid makes a relatively minor contribution, and the health advantages of these substances cannot be distinguished from those of other non-digestible carbohydrates. Manufacturers may be constrained by a variety of rules. The most recent regulations, directives, as well as any other applicable national laws and regulations of that country, must be checked in order to have a complete understanding of the approved and prohibited hydrocolloids, as well as the precise approved applications, dosage, and conditions of use in a given country.

Opportunities: Emerging markets in Asia Pacific and Africa

The production, exploitation, and upkeep of precious resources are under increased pressure from the expanding world population. Low-income customers are being impacted by high food prices as a result of high energy prices and growing raw material costs. Water scarcities are adding to the pressure on food supplies, especially in Africa and Northern Asia. Large-scale production of hydrocolloids in the region, coupled with advances in science and technology, helping in extending the shelf life of foods, may provide a suitable option for small and medium-scale food & beverage manufacturers for integrating clean label ingredients in their products. This is anticipated to help in augmenting the hydrocolloids market size.

Challenges: Intense competition and product rivalry due to similar products

The hydrocolloid market is highly competitive, comprising a significant number of leading and small players. A majority of the emerging players in the market are located in the Asia Pacific region and offer a variety of products. With the increase in demand for natural, clean-labeled food and cosmetic products, key players in the market are focusing on R&D investments to launch different hydrocolloids, which would cater to the requirements of the customers. For instance, in October 2022, Nexira announced the launch of native locust bean gum texturizing range. These products can be used in non-dairy formulations to fulfill consumer expectations for sensory experiences and clean-label plant-based foods and beverages.

Type Insights

By type, gelatin is projected to gain largest share in the hydrocolloids market during the study period

The gelatin segment is projected to dominate the market. Still, as people's awareness of their health and the environment is growing, they are gradually turning towards hydrocolloids made from plants. One notable influencing element that is predicted to considerably affect the hydrocolloids in food market size throughout the projected period is the sharp growth in the overweight and obese population, across the globe. Food products with lower fat, sugar, and salt contents not having any negative affects on food's texture, flavor, or aroma are in higher demand on the market.

Application Insights

By application, food & beverages is forecasted to account for the largest share in the market during the research period

Hydrocolloids enhance the cooking yield, texture, and slice qualities of beef and poultry products. To preserve moisture and natural textural qualities of meat and poultry products as well as to increase viscosity, carrageenan is utilised in food items. In contrast, agar assists in the lowering of fat content in meat products. While xanthan gum is frequently used as a thickening and stabiliser in meat products, gelatin is also used to enhance the look of meat products and gel the fluids in processed hams. The use of alginate in meat products improves texture and quality. Pectin and locust bean gum work as fat replacers in meat & poultry products, whereas guar gum can be utilised as a binder and lubricant in many meat products.

Source Insights

By source, animal segment is anticipated to occupy major share in the market during the study period

In hydrocolloids market growth by source, animal segment is forecasted to account the largest market share during the forecast period. Yet, as environmental concerns grow, the demand for hydrocolloids derived from plants is rising quickly. The food industry has access to a wide variety of hydrocolloids, and the list keeps expanding as new sources are discovered in streams of by-products or natural resources. Conventional hydrocolloids include exudate gums like gum Arabic, gum ghatti, and tragacanth, as well as substances derived from plants including pectin, modified starches, modified celluloses, guar gum, and locust bean gum. In the food sector, hydrocolloids made from algae are frequently employed as thickening, emulsifying, and gelling agents. Examples include carrageenan, agar, and alginate.

Function Insights

By function, stabilizers is forecasted to gain the major share in the hydrocolloids market during the research period

Hydrocolloids are regarded as the most significant group of substances used to stabilise and protect flavours in beverage emulsions since emulsions are thermodynamically unstable systems that have a propensity to separate into two immiscible liquids. The most often used emulsifiers and stabilisers in beverage emulsions are gum arabic and modified starches; other hydrocolloid stabilisers include xanthan, carrageenan, pectin, cellulose derivatives, and alginates. The physicochemical and textural characteristics of beverage emulsions can be influenced by the distinct functional characteristics of each of these hydrocolloids.

To know about the assumptions considered for the study, download the pdf brochure

Regional Insights

North America is projected to gain the largest market share in the global hydrocolloids market. Given the nation's food habits and eating habits, there is a special demand for the ingredient that reduces oil and fat in US. It serves as a barrier for the oil and fat found in the widely consumed breaded and fried cuisine in the country. It is possible to substitute calorie-dense fat and oil with what is essentially structured water by employing hydrocolloids. Customers prefer foods that are low in oil and fat, which is attainable with the right use of hydrocolloids. The hydrocolloids industry in the nation is anticipated to grow further as a result of the huge rise in the number of health-conscious consumers.

The main hydrocolloids that are accessible and used in the US include pectin, gellan gum, guar gum, xanthan gum, and locust bean gum. The food sector has access to a variety of hydrocolloids, including biopolymers, carrageenan, and pectin, due to US based firms like Cargill, Incorporated (US), Ingredion (US), Darling Ingredients Inc. (US), among others. These hydrocolloids are employed in numerous pharmaceutical and cosmetic products as well as in the food industry.

Key Players:

Key players in this market include International Flavors & Fragrances Inc. (US), Ingredion (US), Cargill, Incorporated (US), Kerry Group plc (Ireland), Associated Archer Daniels Midland Company (US), Palsgaard A/S (Denmark), Darling Ingredients Inc. (US), DSM (Netherlands), Ashland (US), Tate & Lyle (UK), CP Kelco U.S., Inc. (US), Nexira (France), Deosen Biochemical (Ordos) Ltd. (China), Fufeng Group (China), and BASF SE (Germany).

Hydrocolloids Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 11.2 billion |

|

Revenue Forecast in 2028 |

USD 14.5 billion |

|

Growth Rate |

CAGR of 5.4% |

|

Forecast period considered |

2023–2028 |

|

Key Companies studied |

|

Hydrocolloids Market Segmentation:

|

Segment |

Subsegment |

|

Market By Type |

|

|

Market By Application |

|

|

Market By Function |

|

|

Market By Source |

|

|

Market By Region |

|

Frequently Asked Questions (FAQ):

How big is the market for hydrocolloids?

The global hydrocolloids market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2028 to reach USD 14.5 billion by 2028.

What is the estimated growth rate (CAGR) of the global Hydrocolloids Market for the next five years?

The global hydrocolloids market is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2028.

What are the major revenue pockets in the Hydrocolloids Industry currently?

North America is projected to gain the largest market share in the global hydrocolloids industry. Given the nation's food habits and eating habits, there is a special demand for the ingredient that reduces oil and fat in US. It serves as a barrier for the oil and fat found in the widely consumed breaded and fried cuisine in the country. It is possible to substitute calorie-dense fat and oil with what is essentially structured water by employing hydrocolloids.

What are the factors driving the Hydrocolloids Market?

Processed foods are often high in hydrocolloids, which are used to improve their texture, stability, and shelf life. The increasing demand for processed foods is therefore driving the demand for hydrocolloids.

Which players are involved in manufacturing of hydrocolloids market?

Key players in this market include International Flavors & Fragrances Inc. (US), Ingredion (US), Cargill, Incorporated (US), Kerry Group plc (Ireland), Associated Archer Daniels Midland Company (US), Palsgaard A/S (Denmark), Darling Ingredients Inc. (US), DSM (Netherlands), Ashland (US), Tate & Lyle (UK), CP Kelco U.S., Inc. (US), Nexira (France), Deosen Biochemical (Ordos) Ltd. (China), Fufeng Group (China), and BASF SE (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Multifunctionality of hydrocolloids to lead to wide range of applications- Rise in demand for clean-label products due to rise in health and wellness trend- Expansion of ready meal and convenience food industry to catalyze demandRESTRAINTS- Stringent regulations and international quality standards- Inadequate supply of raw materials and price fluctuationOPPORTUNITIES- Emerging markets in Asia pacific and Africa- Hydrocolloids to replace and reduce other ingredients in food products- Increase in investments in R&DCHALLENGES- Intense competition and product rivalry due to similar products- Unclear labeling to lead to ambiguity and uncertainty

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY ANALYSISPROTEIN HYDROLYSISALCOHOL PRECIPITATIONCROSSLINKING OF POLYSACCHARIDESCO-GELATION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 SUPPLY CHAIN

-

6.5 ECOSYSTEMUPSTREAMDOWNSTREAM

-

6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

6.7 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.8 PRICE TREND ANALYSISAVERAGE SELLING PRICES, BY KEY TYPE

-

6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES AND EVENTS

-

6.11 CASE STUDIESCASE STUDY 1CASE STUDY 2

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.13 TRADE ANALYSIS

- 7.1 INTRODUCTION

- 7.2 CODEX ALIMENTARIUS

- 7.3 EUROPEAN COMMISSION

- 8.1 INTRODUCTION

-

8.2 GELATINWIDE USE OF GELATIN IN FOOD APPLICATION

-

8.3 XANTHAN GUMXANTHAN GUM’S WIDE USAGE AS THICKENER IN DIFFERENT INDUSTRIES

-

8.4 CARRAGEENANUSAGE OF CARRAGEENAN AS GELATIN ALTERNATIVE IN JELLY-BASED PRODUCTS

-

8.5 ALGINATESAPPLICATION OF ALGINATE TO COAT FRUITS AND VEGETABLES AS MICROBIAL AND VIRAL PROTECTION PRODUCTS

-

8.6 AGARPREFERENCE OF AGAR OVER SYNTHETIC MATERIALS AS ALTERNATIVE SOURCE OF RAW MATERIALS FOR PHARMACEUTICAL APPLICATIONS

-

8.7 PECTINUSAGE OF PECTIN AS VISCOSITY ENHANCER DUE TO GELLING ABILITY

-

8.8 GUAR GUMUSE OF GUAR GUM IN DIFFERENT INDUSTRIES AS STABILIZER

-

8.9 LOCUST BEAN GUMLOCUST BEAN GUM TO DECREASE BLOOD SUGAR AND BLOOD FAT LEVELS

-

8.10 GUM ARABICGUM ARABIC ACTS AS STABILIZER TO EXTEND PRODUCT’S SHELF LIFE

-

8.11 CARBOXYMETHYL CELLULOSE (CMC)USAGE OF CMC AS THICKENER AND STABILIZER IN FOOD PRODUCTS

-

8.12 MICROCRYSTALLINE CELLULOSE (MCC)APPLICATION OF MCC AS CELLULOSE DERIVATIVE IN FOOD INDUSTRY

- 9.1 INTRODUCTION

-

9.2 BOTANICALBOTANICAL HYDROCOLLOIDS CONSIDERED AS ‘CLEAN LABEL’ AND SAFE OPTION AGAINST SYNTHETIC ADDITIVES

-

9.3 MICROBIALWIDE USAGE OF MICROBIAL-SOURCED HYDROCOLLOIDS SUCH AS XANTHAN GUM

-

9.4 ANIMALANIMAL-DERIVED GELATIN TO OCCUPY MAJOR MARKET SHARE

-

9.5 SEAWEEDAPPLICATION OF HIGH-VALUE SEAWEED HYDROCOLLOIDS AS THICKENING AGENTS IN PHARMACEUTICALS AND BIOTECHNOLOGICAL APPLICATIONS

-

9.6 SYNTHETICRESISTANCE TO MICROBIAL DEGRADATION TO BE MAJOR ADVANTAGE OF SYNTHETIC HYDROCOLLOIDS OVER NATURAL HYDROCOLLOIDS

- 10.1 INTRODUCTION

-

10.2 THICKENERSAPPLICATION OF THICKENING AGENTS IN SOUPS, SALAD DRESSINGS, GRAVIES, SAUCES, AND TOPPINGS

-

10.3 STABILIZERSHYDROCOLLOIDS ACT AS STABILIZERS IN DAIRY PRODUCTS, BEVERAGES, AND DESSERTS

-

10.4 GELLING AGENTSUSAGE OF HYDROCOLLOID GELATION IN VARIOUS FOOD APPLICATIONS

-

10.5 FAT REPLACERSPREFERENCE OF CONSUMERS OF REDUCED-FAT PRODUCTS IN THEIR ROUTINE DIET

-

10.6 COATING MATERIALSUSAGE OF HYDROCOLLOIDS IN EDIBLE FILM-FORMING FUNCTIONS

-

10.7 OTHER FUNCTIONSHYDROCOLLOIDS TO GAIN POPULARITY AS EMULSIFIERS AND MOISTURE-BINDING AGENTS

- 11.1 INTRODUCTION

-

11.2 FOOD & BEVERAGESHYDROCOLLOIDS TO REPLACE FAT BY USING STARCHES SOLUBLE IN WATERBAKERY & CONFECTIONERY- Hydrocolloids to improve quality of bakery products by providing texture, stability, and extended shelf-lifeMEAT & POULTRY PRODUCTS- Hydrocolloids to improve cooking yield, texture, and slice characteristicsSAUCES & DRESSINGS- Hydrocolloids to be used in sauces and dressing applicationsDAIRY PRODUCTS- Food hydrocolloids used as stabilizers, thickeners, and gelling agentsOTHERS

-

11.3 COSMETICS & PERSONAL CARE PRODUCTSUSE OF HYDROCOLLOIDS AS VISCOSITY CONTROL AGENTS DUE TO THEIR THICKENING AND GELLING PROPERTIES

-

11.4 PHARMACEUTICALSPOTENTIAL OF NATURALLY OCCURRING HYDROCOLLOIDS IN DRUG FORMULATION DUE TO EXTENSIVE APPLICATION AS FOOD ADDITIVES

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICARECESSION IMPACT ANALYSISUS- Higher demand for low-fat food products to drive market growthCANADA- Substantial growth of functional food segment to trigger demand for different hydrocolloidsMEXICO- Rise in consumption of dairy products to drive market growth

-

12.3 EUROPERECESSION IMPACT ANALYSISGERMANY- Increase in consumption of different baked goods to drive marketUK- Presence of large food sector as well as cosmetic industry to propel market growthFRANCE- High consumption of confectionery products to drive marketITALY- Wide presence of dairy sector and increased production of ice cream to increase use of hydrocolloidsSPAIN- Demand for healthier processed food to increase demand for natural hydrocolloidsREST OF EUROPE

-

12.4 ASIA PACIFICRECESSION IMPACT ANALYSISCHINA- Rise in demand for healthy beverages and dairy products to drive market growthJAPAN- Demand for variety of Japanese beverages to drive marketAUSTRALIA & NEW ZEALAND- Consumption of beverages to increase demand for different preservative manufacturersINDIA- Increase in demand for healthy processed food products to increase demand for hydrocolloidsREST OF ASIA PACIFIC

-

12.5 REST OF THE WORLD (ROW)RECESSION IMPACT ANALYSISMIDDLE EAST & AFRICA- Rising demand for nutritional labeling to increase demand for natural hydrocolloidsSOUTH AMERICA- Gradual increase in purchasing power of Argentinians and Brazilians to increase consumption of convenience food

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 MARKET SHARE ANALYSIS

- 13.4 REVENUE SHARE ANALYSIS OF KEY PLAYERS

-

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 13.6 PRODUCT FOOTPRINT

-

13.7 STARTUP/SME EVALUATION QUADRANT (OTHER PLAYERS)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF OTHER PLAYERS

-

13.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY PLAYERSINTERNATIONAL FLAVORS & FRAGRANCES INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINGREDION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCARGILL, INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKERRY GROUP PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARCHER DANIELS MIDLAND COMPANY (ADM)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDARLING INGREDIENTS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDSM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewASHLAND- Business overview- Products/Solutions/Services offered- MnM viewTATE & LYLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFUFENG GROUP- Business overview- Products/Solutions/Services offered- MnM viewPALSGAARD A/S- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCP KELCO U.S., INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEXIRA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDEOSEN BIOCHEMICAL (ORDOS) LTD.- Business overview- Products/Solutions/Services offered- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- MnM View

-

14.2 OTHER PLAYERSEST-AGAR AS- Business overview- Products/Solutions/Services offeredEXANDAL USA CORP.- Business Overview- Products/Solutions/Services offeredINDIAN HYDROCOLLOIDS- Business Overview- Products/Solutions/Services offeredLUCID COLLOIDS LTD- Business Overview- Products/Solutions/Services offeredSUNITA HYDROCOLLOIDS PVT LTD- Business Overview- Products/Solutions/Services offeredBHANSALI INTERNATIONALB & V SRLALTRAFINE GUMSAGARMEXAGAR DEL PACIFICO S.A.

- 15.1 INTRODUCTION

- 15.2 STUDY LIMITATIONS

-

15.3 FOOD EMULSIFIERS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

15.4 PECTIN MARKETMARKET DEFINITIONMARKET OVERVIEW

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

- TABLE 2 HYDROCOLLOIDS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 APPLICATIONS AND FUNCTIONALITIES OF VARIOUS HYDROCOLLOIDS

- TABLE 4 HYDROCOLLOIDS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 GELATIN: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

- TABLE 6 PECTIN: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

- TABLE 7 CMC: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

- TABLE 8 KEY PATENTS PERTAINING TO HYDROCOLLOIDS, 2013–2022

- TABLE 9 KEY CONFERENCES AND EVENTS IN HYDROCOLLOIDS MARKET, 2023

- TABLE 10 FOOD HYDROCOLLOID BATCH-TO-BATCH VARIATION (USA)

- TABLE 11 ASSESSMENT OF NOVEL FAT REPLACER

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 TOP 10 IMPORTERS AND EXPORTERS, 2021

- TABLE 17 TOP 10 IMPORTERS AND EXPORTERS, 2020

- TABLE 18 TOP 10 IMPORTERS AND EXPORTERS, 2019

- TABLE 19 TOP 10 IMPORTERS AND EXPORTERS, 2018

- TABLE 20 LIST OF HYDROCOLLOIDS USED IN FOOD INDUSTRY

- TABLE 21 HYDROCOLLOIDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 22 HYDROCOLLOIDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 HYDROCOLLOIDS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 24 HYDROCOLLOIDS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 25 GELATIN: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 GELATIN: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 GELATIN: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 28 GELATIN: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 29 XANTHAN GUM: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 XANTHAN GUM: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 XANTHAN GUM: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 32 XANTHAN GUM: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 33 CARRAGEENAN: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 CARRAGEENAN: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 CARRAGEENAN: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 36 CARRAGEENAN: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 37 ALGINATES: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 ALGINATES: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 ALGINATES: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 40 ALGINATES: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 41 AGAR: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 AGAR: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 AGAR: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 44 AGAR: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 45 PECTIN: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 PECTIN: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 PECTIN: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 48 PECTIN: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 49 GUAR GUM: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 GUAR GUM: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 GUAR GUM: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 52 GUAR GUM: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 53 LBG: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 LBG: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 LBG: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 56 LBG: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 57 GUM ARABIC: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 GUM ARABIC: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 GUM ARABIC: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 60 GUM ARABIC: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 61 CMC: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 CMC: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 CMC: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 64 CMC: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 65 MCC: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 MCC: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 MCC: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 68 MCC: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 69 HYDROCOLLOIDS MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 70 HYDROCOLLOIDS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 71 BOTANICAL: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 72 BOTANICAL: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 MICROBIAL: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 MICROBIAL: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 ANIMAL: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 76 ANIMAL: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 SEAWEED: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 SEAWEED: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 SYNTHETIC: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 80 SYNTHETIC: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 HYDROCOLLOIDS MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 82 HYDROCOLLOIDS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 83 HYDROCOLLOIDS USED AS THICKENING AGENTS

- TABLE 84 THICKENERS: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 85 THICKENERS: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 STABILIZERS: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 87 STABILIZERS: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 HYDROCOLLOIDS USED AS GELLING AGENTS

- TABLE 89 GELLING AGENTS: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 90 GELLING AGENTS: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 FAT REPLACERS: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 92 FAT REPLACERS: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 COATING MATERIALS: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 94 COATING MATERIALS: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 OTHER FUNCTIONS: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 96 OTHER FUNCTIONS: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 98 HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 FOOD & BEVERAGES: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 100 FOOD & BEVERAGES: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 COSMETICS & PERSONAL CARE PRODUCTS: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 102 COSMETICS & PERSONAL CARE PRODUCTS: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 PHARMACEUTICALS: HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 104 PHARMACEUTICALS: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 106 HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 HYDROCOLLOIDS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 108 HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 109 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 114 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 115 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 116 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 120 NORTH AMERICA: HYDROCOLLOIDS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 121 US: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 122 US: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 CANADA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 124 CANADA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 125 MEXICO: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 126 MEXICO: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 EUROPE: HYDROCOLLOIDS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 128 EUROPE: HYDROCOLLOIDS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 129 EUROPE: HYDROCOLLOIDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 130 EUROPE: HYDROCOLLOIDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 131 EUROPE: HYDROCOLLOIDS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 132 EUROPE: HYDROCOLLOIDS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 133 EUROPE: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 134 EUROPE: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 EUROPE: HYDROCOLLOIDS MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 136 EUROPE: HYDROCOLLOIDS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 137 EUROPE: HYDROCOLLOIDS MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 138 EUROPE: HYDROCOLLOIDS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 139 GERMANY: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 140 GERMANY: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 141 UK: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 142 UK: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 143 FRANCE: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 144 FRANCE: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 145 ITALY: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 146 ITALY: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 147 SPAIN: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 148 SPAIN: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 149 REST OF EUROPE: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 150 REST OF EUROPE: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 154 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 155 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 156 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 157 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 158 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 159 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 160 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 161 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 162 ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 163 CHINA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 164 CHINA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 165 JAPAN: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 166 JAPAN: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 167 AUSTRALIA & NEW ZEALAND: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 168 AUSTRALIA & NEW ZEALAND: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 169 INDIA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 170 INDIA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 173 ROW: HYDROCOLLOIDS MARKET, BY SUB-REGION, 2018–2022 (USD MILLION)

- TABLE 174 ROW: HYDROCOLLOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 175 ROW: HYDROCOLLOIDS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 176 ROW HYDROCOLLOIDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 177 ROW: HYDROCOLLOIDS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 178 ROW: HYDROCOLLOIDS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 179 ROW: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 180 ROW: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 181 ROW: HYDROCOLLOIDS MARKET, BY SOURCE, 2018–2022 (USD MILLION)

- TABLE 182 ROW: HYDROCOLLOIDS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 183 ROW: HYDROCOLLOIDS MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 184 ROW: HYDROCOLLOIDS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 187 SOUTH AMERICA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 188 SOUTH AMERICA: HYDROCOLLOIDS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 189 STRATEGIES ADOPTED BY KEY PLAYERS IN HYDROCOLLOIDS MARKET

- TABLE 190 GLOBAL HYDROCOLLOIDS MARKET: DEGREE OF COMPETITION

- TABLE 191 COMPANY PRODUCT FOOTPRINT, BY APPLICATION

- TABLE 192 COMPANY PRODUCT FOOTPRINT, BY REGION

- TABLE 193 OVERALL COMPANY PRODUCT FOOTPRINT

- TABLE 194 DETAILED LIST OF OTHER PLAYERS

- TABLE 195 COMPETITIVE BENCHMARKING (OTHER PLAYERS), 2021

- TABLE 196 HYDROCOLLOIDS MARKET: NEW PRODUCT LAUNCHES, 2018–2022

- TABLE 197 HYDROCOLLOIDS MARKET: DEALS, 2018–2022

- TABLE 198 HYDROCOLLOIDS MARKET: OTHERS, 2018–2022

- TABLE 199 INTERNATIONAL FLAVORS & FRAGRANCES INC.- BUSINESS OVERVIEW

- TABLE 200 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCT LAUNCHES

- TABLE 201 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- TABLE 202 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHERS

- TABLE 203 INGREDION: BUSINESS OVERVIEW

- TABLE 204 INGREDION: PRODUCT LAUNCHES

- TABLE 205 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 206 CARGILL, INCORPORATED: OTHERS

- TABLE 207 KERRY GROUP PLC: BUSINESS OVERVIEW

- TABLE 208 KERRY GROUP PLC: OTHERS

- TABLE 209 ARCHER DANIELS MIDLAND COMPANY - BUSINESS OVERVIEW

- TABLE 210 ARCHER DANIELS MIDLAND COMPANY: DEALS

- TABLE 211 ARCHER DANIELS MIDLAND COMPANY: OTHERS

- TABLE 212 DARLING INGREDIENTS INC.: BUSINESS OVERVIEW

- TABLE 213 DARLING INGREDIENTS INC.: NEW PRODUCT LAUNCHES

- TABLE 214 DSM: BUSINESS OVERVIEW

- TABLE 215 DSM: PRODUCT LAUNCHES

- TABLE 216 DSM: OTHERS

- TABLE 217 ASHLAND - BUSINESS OVERVIEW

- TABLE 218 TATE & LYLE: BUSINESS OVERVIEW

- TABLE 219 TATE & LYLE: OTHERS

- TABLE 220 FUFENG GROUP - BUSINESS OVERVIEW

- TABLE 221 PALSGAARD A/S: BUSINESS OVERVIEW

- TABLE 222 PALSGAARD A/S: DEALS

- TABLE 223 PALSGAARD: OTHERS

- TABLE 224 CP KELCO U.S., INC. – BUSINESS OVERVIEW

- TABLE 225 CP KELCO U.S., INC.: PRODUCT LAUNCHES

- TABLE 226 CP KELCO U.S., INC.: DEALS

- TABLE 227 CP KELCO U.S., INC.: OTHERS

- TABLE 228 NEXIRA - BUSINESS OVERVIEW

- TABLE 229 NEXIRA: PRODUCT LAUNCHES

- TABLE 230 NEXIRA: DEALS

- TABLE 231 DEOSEN BIOCHEMICAL (ORDOS) LTD. - BUSINESS OVERVIEW

- TABLE 232 BASF SE: BUSINESS OVERVIEW

- TABLE 233 EST-AGAR AS - BUSINESS OVERVIEW

- TABLE 234 EXANDAL USA CORP.- BUSINESS OVERVIEW

- TABLE 235 INDIAN HYDROCOLLOIDS - BUSINESS OVERVIEW

- TABLE 236 LUCID COLLOIDS LTD - BUSINESS OVERVIEW

- TABLE 237 SUNITA HYDROCOLLOIDS PVT LTD - BUSINESS OVERVIEW

- TABLE 238 ADJACENT MARKETS TO HYDROCOLLOIDS MARKET

- TABLE 239 FOOD EMULSIFIERS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

- TABLE 240 PECTIN MARKET SIZE, BY TYPE, 2017–2025 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 HYDROCOLLOIDS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 HYDROCOLLOIDS MARKET SIZE ESTIMATION: SUPPLY SIDE (1/2)

- FIGURE 5 HYDROCOLLOIDS MARKET SIZE ESTIMATION: SUPPLY SIDE (2/2)

- FIGURE 6 HYDROCOLLOIDS MARKET SIZE ESTIMATION: DEMAND SIDE

- FIGURE 7 HYDROCOLLOIDS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 8 HYDROCOLLOIDS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 HYDROCOLLOIDS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 HYDROCOLLOIDS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 HYDROCOLLOIDS MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 HYDROCOLLOIDS MARKET SIZE, BY FUNCTION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 HYDROCOLLOIDS MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 15 NORTH AMERICA TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 16 FRANCE AND THICKENERS SEGMENTS ACCOUNTED FOR LARGEST RESPECTIVE SHARES IN 2022

- FIGURE 17 GELATIN TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 ANIMAL SOURCE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 STABILIZERS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 20 FOOD & BEVERAGES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 21 NORTH AMERICA AND FOOD & BEVERAGES TO DOMINATE DURING FORECAST PERIOD

- FIGURE 22 MARKET DYNAMICS: HYDROCOLLOIDS MARKET

- FIGURE 23 HYDROCOLLOIDS MARKET: VALUE CHAIN

- FIGURE 24 PRODUCT DEVELOPMENT AND DISTRIBUTION TO ADD VALUE TO SUPPLY CHAIN FOR HYDROCOLLOIDS

- FIGURE 25 HYDROCOLLOIDS MARKET: ECOSYSTEM MAP

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

- FIGURE 27 GLOBAL AVERAGE SELLING PRICES, BY KEY TYPE

- FIGURE 28 PATENTS GRANTED FOR HYDROCOLLOIDS MARKET, 2013–2022

- FIGURE 29 REGIONAL ANALYSIS OF PATENTS GRANTED FOR HYDROCOLLOIDS MARKET, 2013–2022

- FIGURE 30 GELATIN TO LEAD HYDROCOLLOIDS MARKET DURING FORECAST PERIOD (USD MILLION)

- FIGURE 31 ANIMAL HYDROCOLLOIDS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

- FIGURE 32 STABILIZERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

- FIGURE 33 FOOD & BEVERAGES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 34 HYDROCOLLOIDS MARKET GROWTH RATE, BY KEY COUNTRY, 2023–2028

- FIGURE 35 NORTH AMERICA: HYDROCOLLOIDS MARKET SNAPSHOT

- FIGURE 36 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 37 EUROPE: HYDROCOLLOIDS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 38 ASIA PACIFIC HYDROCOLLOIDS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 39 ROW: HYDROCOLLOIDS MARKET SNAPSHOT

- FIGURE 40 ROW HYDROCOLLOIDS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS, 2019–2021 (USD BILLION)

- FIGURE 42 HYDROCOLLOIDS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- FIGURE 43 HYDROCOLLOIDS MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- FIGURE 44 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 45 INGREDION: COMPANY SNAPSHOT

- FIGURE 46 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 47 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 48 ARCHER DANIELS MIDLAND COMPANY: COMPANY SNAPSHOT

- FIGURE 49 DARLING INGREDIENTS INC.: COMPANY SNAPSHOT

- FIGURE 50 DSM: COMPANY SNAPSHOT

- FIGURE 51 ASHLAND: COMPANY SNAPSHOT

- FIGURE 52 TATE & LYLE: COMPANY SNAPSHOT

- FIGURE 53 FUFENG GROUP: COMPANY SNAPSHOT

- FIGURE 54 BASF SE: COMPANY SNAPSHOT

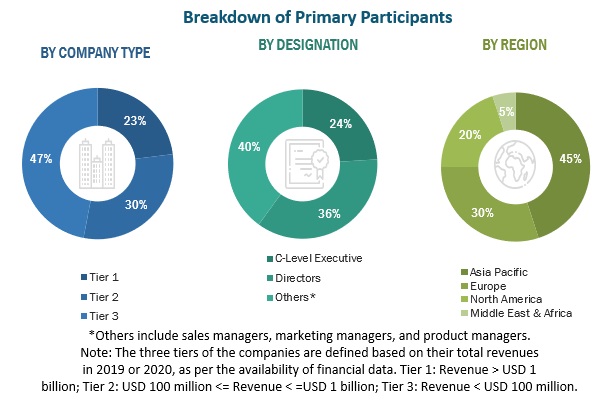

This research study involved the extensive use of secondary sources directories and databases such as Bloomberg Businessweek and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the hydrocolloids market report. In-depth interviews were conducted with various primary respondents such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

In the secondary research process, various secondary sources such as the Food and Agriculture organization (FAO), United States Department of Agriculture (USDA), European Commission, Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, food safety organizations, regulatory bodies, and trade directories.

Primary Research

The hydrocolloids market comprises several stakeholders such as in the Supply-side: hydrocolloids producers, suppliers, distributors, importers, and exporters, and in the Demand-side: processed food product manufacturers, food and beverage manufacturers, cosmetic producing companies, and research organizations. Regulatory-side: Related government authorities, commercial research & development (R&D) institutions, FDA, EFSA, USDA, FSANZ, EUFIC government agencies & NGOs, and other regulatory bodies, Food product consumers, Regulatory bodies, including government agencies and NGOs, Commercial research & development (R&D) institutions and financial institutions, Government and research organizations

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Hydrocolloids Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the hydrocolloid market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To determine and project the size of the hydrocolloids market with respect to type, source, function, application, and region

- To identify the attractive opportunities in the market by determining the largest and fastest growing

- segments across regions

- To provide detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To provide the regulatory framework for major countries related to the market

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To understand the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- To analyze the value chain and products across the key regions and their impact on the prominent market players

- To provide insights on key product innovations and investments in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Geographic Analysis

- A further breakdown of the Rest of Europe Hydrocolloids Market Report, by key countries such as Denmark, Belgium, Switzerland, Ireland, the Netherlands.

- A further breakdown of the Rest of Asia Pacific Market, by key countries such as Vietnam, Malaysia, Thailand, and Indonesia.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydrocolloids Market