Cardiac Surgery Instruments Market by Product (Clamps, Forceps, Scalpel, Scissors, Needle Holder), Application (Coronary Artery Bypass Graft, Heart Valve Surgery, Pediatric Surgery, Heart Transplant), & End User (Hospital, ASC) - Global Forecast to 2022

[150 Pages Report] The overall cardiac surgery instruments market is expected to reach USD 1.63 Billion by 2022 from USD 1.16 Billion in 2017 at a CAGR of 7.1%. Major factors driving the growth of this market include growing prevalence of cardiac conditions and the subsequent increase in the number of surgical procedures, rising geriatric population, and growing investments, funds, and grants by government bodies worldwide. However, adoption of alternative surgical methods and lack of Medicare payments may restrain the growth of this market.

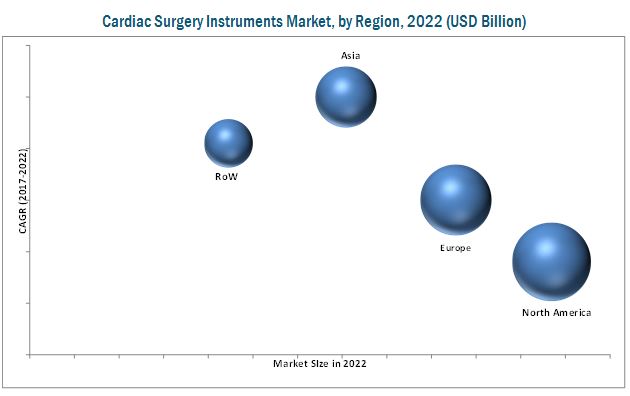

North America dominated the global cardiac surgery instruments market in 2017, with the U.S. accounting for a major share of this regional market. Factors such as high incidence of cardiac diseases, rising awareness programs and increased funding for research projects are likely to drive the growth of the North American market.

Followed by North America, Europe dominated the global market in 2017. The European market is mainly driven by increasing adoption of surgical procedures in cardiology, growth in European healthcare sector, and awareness programs. However, the Asian market is slated to grow at the highest CAGR owing to the increasing government and private sector investments in healthcare, growing purchasing power and high incidence of cardiac diseases. Some prominent markets in Asia include China, India, and Japan.

The market is fragmented with several global as well as local players. Players offer several products across different subsegments of this market. Key players in this market include Becton, Dickinson and Company (U.S.), B. Braun Melsungen AG (Germany), Teleflex Incorporated (U.S.), Medline Industries, Inc. (U.S.), KLS Martin Group (U.S.), STILLE (Sweden), Sklar Surgical Instruments (U.S.), Symmetry Surgical Inc. (U.S.), Delacroix-Chevalier (France), Wexler Surgical (U.S.), Surgins (U.K.), Surtex Instruments Ltd. (U.K.), Cardivon Surgical Inc. (China), Rumex International Corporation (U.S.), and Scanlan International (U.S.).

Target Audience:

- Hospitals and private clinics

- Cardiac centers

- Ambulatory surgery centers (ASCs)

- Academic institutes

- Medical research institutes

- Market research and consulting firms

- Venture capitalists

- Suppliers and distributors of cardiac surgery instruments

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report

This report categorizes the cardiac surgery instruments market into the following segments and subsegments.

Cardiac Surgery Instruments Market, by Product

- Forceps

- Vascular Forceps

- Grasping Forceps

- Other Forceps

- Needle Holders

- Scissors

- Clamps

- Other Cardiac Surgical Instruments

Note: Other cardiac surgical instruments include scalpels, suction tube, and retractors.

Cardiac Surgery Instruments Market, by Application

- Coronary Artery Bypass Graft (CABG)

- Heart Valve Surgery

- Pediatric Cardiac Surgery

- Other Applications

Note: Other applications include heart transplant and cardiomyoplasty.

Cardiac Surgery Instruments Market, by End User

- Hospitals and Cardiac Centers

- Ambulatory Surgery Centers

Cardiac Surgery Instruments Market, by Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- U.K.

- France

- RoE

- Asia

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs.

The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to 5)

The cardiac surgery market is mainly driven by factors such as high incidence of cardiac diseases, growing prevalence of cardiac conditions and the subsequent increase in the number of surgical procedures, rising geriatric population, and growing investments, funds, and grants by government bodies worldwide.

The market in this report is segmented on the basis of products, applications, end users, and regions. Based on product, the market is segmented into forceps, scissors, needle holders, clamps, and other cardiac surgery instruments. The forceps segment dominated the market in 2017, and it is also projected to experience the highest growth during the forecast period. The high growth in this segment is attributed to the increase in the number of cardiac surgeries and the repeated use of forceps in most cardiac procedures.

Based on application, the market is further divided into coronary artery bypass graft (CABG), heart valve surgery, pediatric cardiac surgery, and other applications. CABG forms the largest and fastest-growing application segment of the global market. This is mainly attributed to the high incidence of cardiac diseases and the resulting increase in the number of surgical procedures. Heart valve surgery forms the second largest segment.

Based on the end user, the market is segmented into hospitals and cardiac centers, and ambulatory surgery centers. The hospitals and cardiac centers segment is expected to dominate the market for cardiac surgery instruments. Growth in this end-user segment can be attributed to the increasing incidence of cardiac and heart valve diseases and the subsequent increase in the number of cardiac surgery procedures.

The global cardiac surgery equipment market is dominated by North America, followed by Europe. The market in Asia is expected to grow at the highest CAGR during the forecast period. Factors such as increasing awareness programs, high incidence of cardiac diseases, rising number of hospitals, increased cardiac research funding, and improvements in the healthcare sector of Asian countries contribute to the growth of the market in that region.

Key market players are Becton, Dickinson and Company (U.S.), B. Braun Melsungen AG (Germany), Teleflex Incorporated (U.S.), Medline Industries, Inc. (U.S.), KLS Martin Group (U.S.), STILLE (Sweden), Sklar Surgical Instruments (U.S.), Symmetry Surgical Inc. (U.S.), Delacroix-Chevalier (France), Wexler Surgical (U.S.), Surgins (U.K.), Surtex Instruments Ltd. (U.K.), Cardivon Surgical Inc. (China), Rumex International Corporation (U.S.), and Scanlan International (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Approach

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Global Cardiac Surgery Instruments: Market Overview

4.2 Global Market Size, By Product, 2017 - 2022

4.3 Geographic Analysis: Market, By Application (2017)

4.4 Global Market, By End User

4.5 Geographic Snapshot of the Global Market

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Prevalence of Cardiac Conditions and Subsequent Increase in the Number of Surgical Procedures

5.2.1.2 Rising Geriatric Population

5.2.1.3 Growing Investments, Funds, and Grants By Government Bodies

5.2.2 Restraints

5.2.2.1 Adoption of Alternative Surgical Methods

5.2.2.2 Reduction in Medicare Payments to Healthcare Providers in the U.S.

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Free-Trade Agreements

5.2.4 Challenges

5.2.4.1 Shortage of Cardiac Surgeons

6 Cardiac Surgery Instruments Market, By Product (Page No. - 39)

6.1 Introduction

6.2 Forceps

6.2.1 Vascular Forceps

6.2.2 Grasping Forceps

6.2.3 Other Forceps

6.3 Needle Holders

6.4 Scissors

6.5 Clamps

6.6 Other Cardiac Surgery Instruments

7 Cardiac Surgery Instruments Market, By Application (Page No. - 50)

7.1 Introduction

7.2 Coronary Artery Bypass Grafting

7.3 Heart Valve Surgery

7.4 Pediatric Cardiac Surgery

7.5 Other Applications

8 Cardiac Surgery Instruments Market, By End User (Page No. - 58)

8.1 Introduction

8.2 Hospitals and Cardiac Centers

8.3 Ambulatory Surgery Centers

9 Cardiac Surgery Instruments Market, By Region (Page No. - 64)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 U.K.

9.3.4 Rest of Europe

9.4 Asia

9.5 Rest of the World (RoW)

10 Competitive Landscape (Page No. - 91)

10.1 Overview

10.2 Key Players in Cardiac Surgery Instruments Market

10.3 Vendor Dive Overview

10.3.1 Vanguards

10.3.2 Dynamic Players

10.3.3 Innovators

10.3.4 Emerging Players

10.4 Competitive Benchmarking

10.4.1 Product Offerings (For All 25 Players)

10.4.2 Business Strategy (For All 25 Players)

*Top 25 Companies Analyzed for This Study are - Becton, Dickinson and Company (U.S.), B. Braun Melsungen AG (Germany), Teleflex Incorporated (U.S.), Medline Industries, Inc. (U.S.), KLS Martin Group (U.S.), Sklar Surgical Instruments (U.S.), Scanlan International (U.S.), Stille (Sweden), Sontec Instruments (U.S.), Rumex International Corporation (U.S.), Surgins (U.K.), Surtex Instruments Ltd. (U.K.), Fehling Surgical Instruments, Inc (Germany), Geister Medizintechnik GmbH (Germany), Symmetry Surgical Inc. (U.S.), Cardivon Surgical Inc. (China), Delacroix-Chevalier (France), Wexler Surgical Inc. (U.S.), Jj International Instruments (India), Judd Medical (U.K.), Accurate Surgical & Scientific Instruments Corp. (Assi) (U.S.), Boss Instruments, Ltd. (U.S.), Hebson Surgical Company (India), Taurus (Germany), Medicon Eg (Germany)

11 Company Profiles (Page No. - 97)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Becton, Dickinson and Company

11.2 B. Braun Melsungen AG

11.3 Teleflex Incorporated

11.4 Stille

11.5 KLS Martin Group

11.6 Medline Industries, Inc.

11.7 Sklar Surgical Instruments

11.8 Symmetry Surgical Inc.

11.9 Delacroix-Chevalier

11.10 Wexler Surgical Inc.

11.11 Surgins

11.12 Surtex Instruments Limited

11.13 Cardivon Surgical Inc.

11.14 Rumex International Corporation

11.15 Scanlan International

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 142)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (82 Tables)

Table 1 Projected Increase in the Global Population Between 2005 and 2030, By Age

Table 2 Prominent Free-Trade Agreements

Table 3 Global Market Size, By Product, 2015–2022 (USD Million)

Table 4 Global Cardiac Surgery Forceps Market Size, By Region, 2015–2022 (USD Million)

Table 5 Cardiac Surgery Forceps Market Size, By Type, 2015–2022 (USD Million)

Table 6 North America: Cardiac Surgery Forceps Market Size, By Country, 2014–2021 (USD Million)

Table 7 Europe: Cardiac Surgery Forceps Market Size, By Country, 2015–2022 (USD Million)

Table 8 Vascular Forceps Market Size, By Region, 2015–2022 (USD Million)

Table 9 Global Grasping Forceps Market Size, By Region, 2015–2022 (USD Million)

Table 10 Global Other Forceps Market Size, By Region, 2015–2022 (USD Million)

Table 11 Global Cardiac Surgery Needle Holders Market Size, By Region, 2015–2022 (USD Million)

Table 12 North America: Cardiac Surgery Needle Holders Market Size, By Country, 2015–2022 (USD Million)

Table 13 Europe: Cardiac Surgery Needle Holders Market Size, By Country, 2015–2022 (USD Million)

Table 14 Global Cardiac Surgery Scissors Market Size, By Region, 2015–2022 (USD Million)

Table 15 North America: Cardiac Surgery Scissors Market Size, By Country, 2015–2022 (USD Million)

Table 16 Europe: Cardiac Surgery Scissors Market Size, By Country, 2015–2022 (USD Million)

Table 17 Global Cardiac Surgery Clamps Market Size, By Region, 2015–2022 (USD Million)

Table 18 North America: Cardiac Surgery Clamps Market Size, By Country, 2015–2022 (USD Million)

Table 19 Europe: Cardiac Surgery Clamps Market Size, By Country, 2015–2022 (USD Million)

Table 20 Other Cardiac Surgery Instruments Market Size, By Region, 2015–2022 (USD Million)

Table 21 North America: Other Cardiac Surgery Equipment MarketSize, By Country, 2015–2022 (USD Million)

Table 22 Europe: Other Cardiac Surgery Instruments Market Size, By Country, 2015–2022 (USD Million)

Table 23 Global Market Size, By Application, 2015–2022 (USD Million)

Table 24 Global Market Size for CABG, By Region, 2015–2022 (USD Million)

Table 25 North America: cardiac surgery equipment market Size for CABG, By Country, 2015–2022 (USD Million)

Table 26 Europe: cardiac surgery equipment market Size for CABG, By Country, 2015–2022 (USD Million)

Table 27 Global Market Size for Heart Valve Surgery, By Region, 2015–2022 (USD Million)

Table 28 Cardiac Surgery Instruments North America Market Size for Heart Valve Surgery, By Country, 2015–2022 (USD Million)

Table 29 Cardiac Surgery Instruments Europe Market Size for Heart Valve Surgery, By Country, 2015–2022 (USD Million)

Table 30 Global Market Size for Pediatric Cardiac Surgery, By Region, 2015–2022 (USD Million)

Table 31 North America: Cardiac Surgery Equipment Market Size for Pediatric Cardiac Surgery, By Country, 2015–2022 (USD Million)

Table 32 Europe: Cardiac Surgery Instruments Market Size for Pediatric Cardiac Surgery, By Country, 2015–2022 (USD Million)

Table 33 Global Market Size for Other Applications, By Region, 2015–2022 (USD Million)

Table 34 North America: Cardiac Surgery Instruments Market Size for Other Applications, By Country, 2015–2022 (USD Million)

Table 35 Cardiac Surgery Instruments Europe Market Size for Other Applications, By Country, 2015–2022 (USD Million)

Table 36 Global Cardiac Surgery Instruments Market Size, By End User, 2015–2022 (USD Million)

Table 37 Global Market Size for Hospitals and Cardiac Centers, By Region, 2015–2022 (USD Million)

Table 38 North America: Cardiac Surgery Equipment Market Size for Hospitals and Cardiac Centers, By Country, 2015–2022 (USD Million)

Table 39 Europe: Cardiac Surgery Equipment Market Size for Hospitals and Cardiac Centers, By Country, 2015–2022 (USD Million)

Table 40 Global Market Size for Ambulatory Surgery Centers, By Region, 2015–2022 (USD Million)

Table 41 North America: Cardiac Surgery Equipment Market Size for Ambulatory Surgery Centers, By Country, 2015–2022 (USD Million)

Table 42 Europe: Cardiac Surgery Instruments Market Size for Ambulatory Surgery Centers, By Country, 2015–2022 (USD Million)

Table 43 Cardiac Surgery Market Size, By Region, 2015–2022 (USD Million)

Table 44 Cardiac Surgery Instruments North America Market Size, By Country, 2015–2022 (USD Million)

Table 45 Cardiac Surgery Instruments North America Market Size, By Product, 2015–2022 (USD Million)

Table 46 North America: Cardiac Surgery Forceps Market Size, By Type, 2015–2022 (USD Million)

Table 47 Cardiac Surgery Instruments North America Market Size, By Application, 2015–2022 (USD Million)

Table 48 Cardiac Surgery Instruments North America Market Size, By End User, 2015–2022 (USD Million)

Table 49 U.S.: Cardiac Surgery Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 50 U.S.: Cardiac Surgery Instruments Market Size, By Application, 2015–2022 (USD Million)

Table 51 U.S.: Cardiac Surgery Equipment Market Size, By End User, 2015–2022 (USD Million)

Table 52 Canada: Cardiac Surgery Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 53 Canada: Cardiac Surgery Equipment MarketSize, By Application, 2015–2022 (USD Million)

Table 54 Canada: Cardiac Surgery Instruments Market Size, By End User, 2015–2022 (USD Million)

Table 55 Europe: Cardiac Surgery Equipment Market Size, By Country, 2015–2022 (USD Million)

Table 56 Europe: Cardiac Surgery Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 57 Europe: Cardiac Surgery Forceps Market Size, By Type, 2015–2022 (USD Million)

Table 58 Europe: Cardiac Surgery Equipment Market Size, By Application, 2015–2022 (USD Million)

Table 59 Europe: Cardiac Surgery Equipment Market Size, By End User, 2015–2022 (USD Million)

Table 60 Germany: Cardiac Surgery Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 61 Germany: Cardiac Surgery Instruments Market Size, By Application, 2015–2022 (USD Million)

Table 62 Germany: Cardiac Surgery Equipment Market Size, By End User, 2015–2022 (USD Million)

Table 63 Cardiac Surgery Instruments France Market Size, By Product, 2015–2022 (USD Million)

Table 64 Cardiac Surgery Instruments France Market Size, By Application, 2015–2022 (USD Million)

Table 65 Cardiac Surgery Instruments France Market Size, By End User, 2015–2022 (USD Million)

Table 66 Cardiac Surgery Instruments U.K. Market Size, By Product, 2015–2022 (USD Million)

Table 67 Cardiac Surgery Instruments U.K. Market Size, By Application, 2015–2022 (USD Million)

Table 68 Cardiac Surgery Instruments U.K. Market Size, By End User, 2015–2022 (USD Million)

Table 69 RoE: Healthcare Expenditure, By Country, 2007 vs 2014 (% of GDP)

Table 70 RoE: Cardiac Surgery Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 71 RoE: Cardiac Surgery Instruments Market Size, By Application, 2015–2022 (USD Million)

Table 72 RoE: Cardiac Surgery Equipment Market Size, By End User, 2015–2022 (USD Million)

Table 73 Asia: Cardiac Surgery Equipment Market Size, By Product, 2015–2022 (USD Million)

Table 74 Asia: Cardiac Surgery Forceps Market Size, By Type, 2015–2022 (USD Million)

Table 75 Asia: Cardiac Surgery Equipment Market Size, By Application, 2015–2022 (USD Million)

Table 76 Asia: Cardiac Surgery Equipment Market Size, By End User, 2015–2022 (USD Million)

Table 77 Cardiovascular Disease Death Rate Per 100,000 People, 2014 (Age 35 to 74 Years)

Table 78 RoW: Cardiac Surgery Instruments Market Size, By Product, 2015–2022 (USD Million)

Table 79 RoW: Cardiac Surgery Forceps Market Size, By Type, 2015–2022 (USD Million)

Table 80 RoW: Cardiac Surgery Equipment Market Size, By Application, 2015–2022 (USD Million)

Table 81 RoW: Cardiac Surgery Equipment Market Size, By End User, 2015–2022 (USD Million)

Table 82 Top 3 Players in the Cardiac Surgery Instruments Market

List of Figures (34 Figures)

Figure 1 Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Data Triangulation Methodology

Figure 6 Key Data From Secondary Sources

Figure 7 Key Data From Primary Sources

Figure 8 Global Size, By Product, 2017 vs 2022 (USD Million)

Figure 9 Global Cardiac Surgery Instruments Market for Forceps, By Type, 2017 vs 2022 (USD Million)

Figure 10 Global Market Size, By Application, 2017 vs 2022 (USD Million)

Figure 11 Global Market Size, By End User, 2017 vs 2022 (USD Million)

Figure 12 North America to Dominate the Cardiac Surgery Instruments Market During the Forecast Period

Figure 13 Emerging Asian Markets to Offer Growth Opportunities in the Forecast Period

Figure 14 Forceps to Account for the Largest Share of the Cardiac Surgery Equipment Market During the Forecast Period

Figure 15 CABG to Command the Largest Share of the Cardiac Surgery Equipment Market in 2017

Figure 16 Hospitals & Cardiac Centers to Register the Highest CAGR Between 2017 & 2022

Figure 17 Asia Projected to Witness the Highest CAGR During the Forecast Period

Figure 18 Global Market: Key Drivers, Restraints, Opportunities, and Challenges

Figure 19 Global Geriatric Population Aged 65 and Above (In Millions)

Figure 20 Global Prevalence of Coronary Heart Disease By Age and Sex (2009–2012)

Figure 21 Forceps to Dominate the Cardiac Surgery Instruments Market During the Forecast Period

Figure 22 Vascular Forceps to Dominate the Cardiac Surgery Forceps Market During the Forecast Period

Figure 23 CABG—The Key Application Segment in the Cardiac Surgery Equipment Market

Figure 24 Hospitals and Cardiac Centers to Dominate the Cardiac Surgery Instruments Market During the Forecast Period

Figure 25 North America Will Continue to Dominate the Cardiac Surgery Equipment Market in 2022

Figure 26 North America: Cardiac Surgery Equipment Market Snapshot

Figure 27 Europe: Cardiac Surgery Equipment Market Snapshot

Figure 28 Asia: Cardiac Surgery Instruments Market Snapshot

Figure 29 RoW: Cardiac Surgery Equipment Market Snapshot

Figure 30 MnM Dive – Vendor Comparison Matrix

Figure 31 Becton, Dickinson and Company: Company Snapshot (2016)

Figure 32 B. Braun Melsungen AG: Company Snapshot (2016)

Figure 33 Teleflex Incorporated: Company Snapshot (2016)

Figure 34 Stille: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cardiac Surgery Instruments Market