Cargo Shipping Market by Cargo Type (Liquid, Dry, General, Container), Industry Type (Food, Electrical/Electronics, Mineral Fuels & Oils, Manufacturing), Trade Routes, Infrastructure, Regulations, and by Freight Forwarding - Global Trends and Forecast to 2021

[118 Pages Report] Cargo shipping market is projected to reach 12.52 billion tons at CAGR of 3.5% from 2016 to 2021. The global market is estimated to gain momentum from 2018 onwards after years of sluggish growth. Global economic growth, rise in the global commodity demand that results in increased seaborne trade that ultimately act as key drivers of the growth of global cargo shipping trade. The study segments the cargo shipping trends on the basis of cargo type, industry type, and major trade routes. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 to 2021.

Market Dynamics

Drivers

- Rise in global seaborne trade at the global level

- Growing imports and exports of liquid, dry, general, and container cargo trade in Asia Pacific & the Middle East countries

- Noteworthy growth in pharmaceutical, industrial, agricultural, petrochemical, and automtive industry

Restraints

- Cargo transport duration

Opportunities

- Port Infrastructure Development

- Inland marine cargo transport

Challenges

- Ongoing & upcoming rigorous environmental & safety regulatory compliances across different regions

Rise in global seaborne trade in order to meet the consumer demand would drive the cargo shipping

As per the United Nations Conference on Trade and Development (UNCTAD), the global seaborne trade volume touched 10 billion tons in 2015, which included exports and imports of dry cargo including bulk commodities and containerized trade. The constantly increasing containerized trade coupled with the rising trend of port automation to cope up with the increased demand has led to growing size of port terminals to accommodate the goods, which, in turn, is driving the demand for cargo shipping globally.

The following are key objectives of the study

- To analyse the global marine cargo industry, by region, in terms of geo-politics

- To define and analyse the global marine cargo markets by cargo type - liquid cargo, dry bulk, general cargo, container cargo

- To define and analyse the global marine cargo by trade routes - Suez Canal, Panama Canal, Straits of Malacca & Singapore and Strait of Hormuz with trade lanes

- To define, describe and analyse current and future trends in global cargo shipping industry

- To define and describe the global industrial, agricultural, petrochemical cargo shipping market by value.

- To define and describe the regulatory framework and challenges in the global cargo shipping industry

- To geo-politically analyze the global cargo shipping industry by region

The research methodology used in the report involves various secondary sources, including paid databases and directories. Experts from related industries and suppliers have been interviewed to understand the future trends in the global market. The bottom-up approach has been used to estimate the market size, wherein country-wise trade statistics have been taken into account. All major shipping trade routes have been considered while estimating the global cargo shipping industry. Major infrastructure initiatives based on development of new ports and expansion of existing ports have analyzed in the report. Cargo movement in major industries like food, electronics and electrical goods, manufacturing and mineral oil and fuels have been tracked in the report. Cargo handled by all major shipping companies has taken into consideration. Regional and global trade is quantified on country level

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the cargo shipping industry consists of shipping companies such as A.P. Moller Maersk (Denmark), CMA CGM SA (France), and Mediterranean Shipping Company S.A (Switzerland). Freight forwarders such as DHL Global Forwarding (Germany), Panalpina (Switzerland), Ceva Logistics (Netherlands), DB Schenker (Gemany) are also vital part of ecosystem. Shipbuilding and shipping containers manufacturers are also part of cargo shipping ecosystem. There are few trade statistical portals such as the International Trade Centre (ITC), and United Nations Conference on Trade and Development (UNCTAD) among others.

Major Developments in Market

- In May 2016, Maersk Line launched its new AC1 service, connecting the West Coast of Latin America with Asia. This new service will optimize its Asia to Central America network which will add a third loop to the AC network. The new service is expected to provide Maersk Line’s customers with reduced transit times and greater port coverage on certain corridors while maintaining the network’s stability

- In April 2016, COSCO Container Lines, CMA CGM, Evergreen Line and Orient Overseas Container Line signed a Memorandum of Understanding to form a new alliance. The new alliance offers competitive products and comprehensive service networks across the globe

- In December 2015, MSC has entered in a new vessel sharing agreement with Hapag-Lloyd, Hamburg Süd, CMA CGM, China Shipping and Hyundai. This new agreement ensures that MSC customers will get wider port coverage and faster transit times. The number of weekly sailings available to customers will increase from one per week to three. Additionally, there would be a notable improvement in transit times.

Target Audience

- Shipping Companies

- Shipbuilding Companies

- Customers

- Downstream stakeholders

- Government regulatory authorities

- Investment firms.

- Equity research firms.

- Private equity firms.

Scope of the Report

-

By Cargo Infrastructure

- Port Developments in Asia

- Port Developments in Europe

- Port Developments in North America

- Port Developments in South America

- Port Developments in Africa

-

By Cargo Type

- Container Cargo

- Bulk Cargo

- General Cargo

- Oil & Gas

-

By Industry Type

- Food, Manufacturing

- Oil & Ores

- Electrical & Electronics

-

By Region

- Middle East & Africa

- Asia-Pacific

- Europe

- Rest of the World

Available Customizations

MarketsandMarkets offers the following customizations for this market:

- Regional Shipping Analysis, By Cargo Type

- Detailed analysis and profiling of additional market players (up to 3)

The cargo shipping market is projected to grow at a CAGR of 3.50% from 2016 to 2021. The global market is estimated to gain momentum after fiscal year 2018 after years of sluggish growth. The market growth is majorly attributed to growth in container transportation within growing developing and developed economies.

General cargo is estimated to leads this market, by cargo type. The factors that drivers the growth of this market are improving economic conditions of the European nations, trade agreements being formed between major developing and developed countries. With the improving economic conditions, the import & export trade of goods and products becomes more prominent for which general cargo would provide significant transportation model. Advantages such as individual transport of commodities that help in reduced ship time at port terminals, and enhanced utilisation of ship space. All of these factors would prompt the demand of General cargo in coming years.

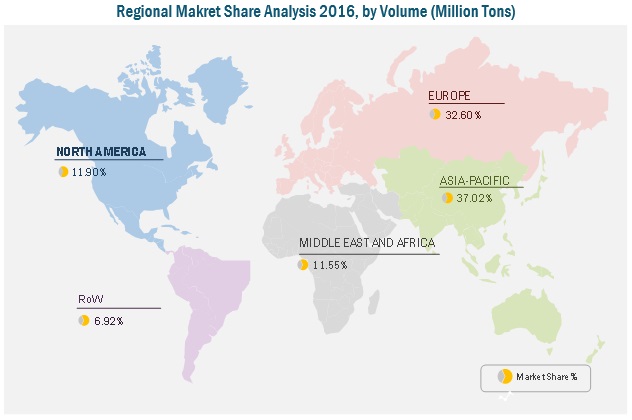

Asia-Pacific is projected to lead this market during the period of 2016 to 2021. The growth of the cargo market is primarily triggered by the increasing population, infrastructural development and manufacturing activities. Furthermore, rising trend of globalization and demographic changes are also few other key drivers for Asia-Pacific. The Shanghai Port (China), Shenzhen Port (China), Hong Kong, S.A.R.(China), and Ningbo-Zhoushan, China), Singapore Port & Keihin Port (Japan) are some port terminals that handles millions of TEU annually that subsequently drive the growth of in Asia Pacific market.

Rising infrastructural development at the port terminals to accommodate the growing demand of cargo Shipping

The increasing investment in port infrastructure, global supply & demand cycle are also key driving factors for cargo shipping industry. Expansion of trade passages such as Panama Canal and Suez Canal increases waterways’ capacity and allow the passage of larger vessels is beneficial for cargo shipping. Increasing number of countries forging free trade agreements will boost the cargo shipping industry. Further, different free trade agreements such has NAFTA, AFTA, TPSEP, and others have helped countries significantly towards strengthening their economies. These agreements not only are responsible for the growth in trade between nations but also have direct impact on the shipping industry. Also, the developing country in past years are driving the economic growth. The improved specialization in the supply chain for marine trade has gathered huge development as developing countries continue to gain greater market share in the cargo shipping business.

Critical questions the report answers:

- Where will be the technological developments are being taking place at the port terminals to automate the cargo handling process at port terminals?

- Which all industries are majorly contributing to the global cargo handling and what are the upcoming trends that further drive this market?

Cargo shipping industry is facing environmental challenges as well as challenges emerging from changing dynamics of geopolitics. These challenges are restraining the growth of industry. Along with these challenges, high cost of buying new bigger container ships and competition to fill them in saturated market has started consolidation in the shipping industry. The industry players are fighting for market share which is giving rise to pricing at their marginal cost. Shipping industry can overcome these restrains by increasing productivity in operations, and improvement in network and fleet.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Scope

1.3.1 Markets Covered

1.4 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.2 Secondary Data

2.3 Key Data From Secondary Sources

2.4 Primary Data

2.4.1 Research Techniques & Data Collection Methods

2.4.2 Primary Participants

3 Executive Summary (Page No. - 18)

4 Cargo Shiping Market , By Cargo Type (Page No. - 23)

4.1 Cargo Shiping Market, By Cargo Type

4.1.1 Liquid Cargo

4.1.2 Dry Bulk

4.1.3 General Cargo

4.1.4 Container Cargo

4.2 International Seaborne Trade, By Cargo Type

4.3 Middle East& Africa Seaborne Trade, By Cargo Type

4.4 North America Seaborne Trade, By Cargo Type

4.5 Asia-Pacific Seaborne Trade, By Cargo Type

4.6 Europe Seaborne Trade, By Cargo Type

4.7 RoW Seaborne Trade, By Cargo Type

5 Cargo Shiping Trends, By Industry Type (Page No. - 27)

5.1 Introduction

5.2 North America Cargo Shiping Trends

5.2.1 North America Food Industry Cargo Shiping Trends, By Country

5.2.2 North America Electric/ Electronics Industry Cargo Shiping Trends, By Country

5.2.3 North America Mineral Fuels, Oils Industry Cargo Shiping Trends, By Country

5.2.4 North America Manufacturing Industry Cargo Shiping Trends, By Country

5.3 Europe Cargo Shiping Trends

5.3.1 Europe Food Industry Cargo Shiping Trends, By Country

5.3.2 Europe Electrical/ Electronics Industry Cargo Shiping Trends, By Country

5.3.3 Europe Mineral Fuels& Oils Industry Cargo Shiping Trends, By Country

5.3.4 Europe Manufacturing Industry Cargo Shiping Trends, By Country

5.4 Asia-Pacific Market Cargo Shiping Trends

5.4.1 Asia-Pacific Food Industry Cargo Shiping Trends, By Country

5.4.2 Asia-Pacificelectrical/ Electronics Industry Cargo Shiping Trends, By Country

5.4.3 Asia-Pacific Manufacturing Industry Cargo Shiping Trends, By Country

5.4.4 Asia-Pacific Mineral Fuels, Oils Industry Cargo Shiping Trends, By Country

5.5 Middle East & Africa Cargo Shiping Trends

5.5.1 Food Industry Cargo Shiping Trends, By Country

5.5.2 Middle East & Africa Electricals & Electronics Industry Cargo Shiping Trends, By Country

5.5.3 Middle East & Africa Minerals, Fuels& Oils Industry Cargo Shiping Trends, By Country

5.5.4 Middle East & Africa Manufacturing Industry Cargo Shiping Trends, By Country

5.6 Rest of the World (RoW)

5.6.1 Rest of the World Food Industry Cargo Shiping Trends, By Country

5.6.2 Rest of the World Electrical/ Electronics Industry Cargo Shiping Trends, By Country

5.6.3 Rest of the World Manufacturing Industry Cargo Shiping Trends, By Country

5.6.4 Rest of the World Minerals Fuels & Oils Industry Cargo Shiping Trends, By Country

6 Global Cargo Shiping Market, By Trade Route (Page No. - 39)

6.1 Suez Canal

6.1.1 Importance of the Suez Canal:

6.1.2 Advantages of the Suez Canal:

6.1.3 Suez Canal Traffic By Ship Type

6.2 Panama Canal

6.2.1 Panama Canal Expansion Project

6.2.2 Panama Canal Traffic, By Vessel Type

6.3 Straits of Malacca and Singapore

6.4 Strait of Hormuz

6.5 Container Shipping Routes

6.5.1 East-West Trade Route

6.5.1.1 East-West Trade Route

6.5.1.2 Trans-Pacific

6.5.1.3 Europe-Asia

6.5.1.4 Transatlantic

6.5.2 North-South Trade Route:

6.5.3 Distribution of Global Containerized Trade By Route

7 Regulatory Framework and Challenges (Page No. - 45)

7.1 Regulatory Framework

7.1.1 Cargo Shiping - Environmental Regulations

7.1.2 Cargo Shiping: Safety Regulations

7.1.3 Cargo Shiping: Regulations for Preventing Collisions at Sea

7.1.4 Cargo Shiping: Other Important International Regulations

7.1.5 Cargo Shiping: Regional Conventions (From 1978 to 2000)

7.1.6 Cargo Shiping: Recent & Upcoming Regulations (From 2016 to 2018)

7.2 Challenges

7.2.1 Piracy

7.2.2 Piracy In Southeast Asia:

7.2.3 Piracy In Africa:

7.2.4 Anti-Piracy Measures & Organizations:

7.2.5 Oil Spills

7.2.5.1 Oil Cleanup Technologies

7.3 Air Pollution

7.4 Ballast Water Discharge

7.5 Biofouling

7.5.1 The Adverse Effects of Ship Hull Biofouling Include:

8 Cargo Shiping Infrastructure (Page No. - 60)

8.1 Port Developments, By Region

8.1.1 Existing Ports (Terminal Expansion, Capacity Expansion)

8.1.1.1 Developments of Ports In Asia

8.1.1.2 Developments of Ports In Europe

8.1.1.3 Developments of Ports In North America

8.1.1.4 Developments of Ports In South America

8.1.1.5 Developments of Ports In Africa

8.1.2 Upcoming Ports (Terminals Planned, Capacity Planned, Cargo Type Planned to Handle)

9 Current and Future Trends Impacting Global Cargo Shiping Market (Page No. - 68)

9.1 Trends By Cargo Type

9.1.1 Bulk Cargo

9.1.2 Oil & Gas

9.1.3 General Cargo

9.1.4 Container Transport

9.2 Trends By Region & Industry Type

9.2.1 Europe

9.2.2 North America

9.2.3 Asia-Pacific

9.2.4 Middle East and Africa

9.2.5 RoW

10 Geopolitical Analysis By Region (Page No. - 72)

10.1 Geopolitical Analysis of Middle East & Africa

10.1.1 Iran

10.1.1.1 Iran & Saudi Arabia Conflict

10.1.2 Libya & Yemen Crisis

10.2 Geopolitical Analysis of Europe

10.2.1 Mediterranean Migrant Crisis

10.2.2 Baltic Sea

10.3 Geopolitical Analysis of Asia-Pacific

10.3.1 South China Sea Conflict

10.4 Geopolitical Analysis of Rest of the World

10.4.1 Nicaragua’s Canal Project

11 Regional Shipping Import-Export Data (Page No. - 76)

11.1 Regional Shipping Exports Data

11.2 Regional Shipping Import Data

12 Trends In Freight Forwarding (Page No. - 80)

12.1 Consolidations and Acquisitions

12.2 Providing Value Added Services

12.3 Near-Sourcing

12.4 Regionalization

12.5 Adaption of Information Technology

13 Competitive Landscape (Page No. - 82)

13.1 Competitive Situation & Trends

13.2 Battle for Market Share: New Service Launch Was the Key Strategy

13.3 New Service Launches

13.4 Mergers & Acquisitions and Other Developments

13.5 Agreements/Joint Ventures/Supply Contracts/Partnerships

13.6 Expansions

14 Competitive Landscape (Page No. - 88)

14.1 Competitive Situation & Trends

14.2 New Service Launches

14.3 Expansions

14.4 Agreements/Joint Ventures/Supply Contracts/Partnerships

14.5 Mergers & Acquisitions and Other Developments

15 Company Profiles (Page No. - 93)

(Company at A Glance, Business Overview, Products Offered, Key Strategy, Recent Developments, SWOT Analysis & MnM View)*

15.1 Introduction

15.2 A.P. Møller – Mærsk A/S

15.3 Mediterranean Shipping Company Sa

15.4 China Cosco Holdings Company Limited

15.5 CMA CGM S.A

15.6 Hapag-Lloyd AG

15.7 Deutsche Post DHL Group

15.8 Ceva Logistics

15.9 Panalpina Welttransport (Holding) AG

15.10 Deutsche Bahn AG

15.11 Nippon Express Co. Ltd.

*Details on Company at A Glance, Recent Financials, Products Offered, Strategies & Insights, & Recent Developments Might Not Be Captured In Case of Unlisted Companies.

List of Tables (57 Tables)

Table 1 International Seaborne Trade, By Cargo Type, 2012-2021 (Million Tons)

Table 2 Middle East& Africa Seaborne Trade, By Cargo Type, 2012-2021 (Million Tons)

Table 3 North America Seaborne Trade, By Cargo Type, 2012-2021, (Million Tons)

Table 4 Asia-Pacific Seaborne Trade, By Cargo Type, 2012-2021, (Million Tons)

Table 5 Europe Seaborne Trade, By Cargo Type, 2012-2021, (Million Tons

Table 6 RoW Seaborne Trade, By Cargo Type, 2012 -2021, (Million Tons)

Table 7 North America Food Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 8 North America Electric/ Electronics Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 9 North America Mineral Fuels, Oils Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 10 North America Manufacturing Industry Cargo Shiping Trends, By Country, 2014 – 2021 (USD Million)

Table 11 Europe Food Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 12 Europe Electrical/ Electronics Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 13 Europe Mineral Fuels& Oils Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 14 Europe Manufacturing Industry Cargo Shiping Trends, By Country, 2014 – 2021 (USD Million)

Table 15 Asia-Pacific Food Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 16 Asia-Pacificelectrical/ Electronics Industry Cargo Shiping Trends, By Country, 2014 – 2021 (USD Million)

Table 17 Asia-Pacific Manufacturing Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 18 Asia-Pacific Mineral Fuels, Oils Industry Cargo Shiping Trends, By Country, 2014 – 2021 (USD Million)

Table 19 Food Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 20 Middle East & Africa Electricals & Electronics Industry Cargo Shiping Trends, By Country, 2014 – 2021 (USD Million)

Table 21 Middle East & Africa Minerals, Fuels& Oils Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 22 Middle East & Africa Manufacturing Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 23 Rest of the World Food Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 24 Rest of the World Electrical/ Electronics Industry Cargo Shiping Trends, By Country, 2014 – 2021 (USD Million)

Table 25 Rest of the World Manufacturing Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 26 Rest of the World Minerals Fuels & Oils Industry Cargo Shiping Trends, By Country, 2014 - 2021 (USD Million)

Table 27 Suez Canal Traffic By Ship Type (‘000 Tons)

Table 28 Panama Canal Traffic By Market Segment

Table 29 Estimated Containerized Cargo Flows on Major East-West Container Trade Routes, 2009-2014

Table 30 Cargo Shiping: Environmental Regulations (1983 – 2005)

Table 31 Cargo Shiping: Safety Regulations ( 1980 – 2017)

Table 32 Cargo Shiping: Regulations for Preventing Collisions at Sea (1977)

Table 33 Other Important International Regulations for Cargo Shiping

Table 34 Regional Conventions of Cargo Shiping From 1978 to 2000

Table 35 Cargo Shiping Recent & Upcoming Regulations From 2016 to 2018

Table 36 Developments of Ports In Asia

Table 37 Developments of Ports In Europe

Table 38 Developments of Ports In North America

Table 39 Developments of Ports In South America

Table 40 Developments of Ports In Africa

Table 41 Upcoming Ports (Terminals Planned, Capacity Planned, Cargo Type Planned to Handle)

Table 42 North America Shipping Export, By Country, 2014-2021, (USD Billion)

Table 43 Europe Shipping Export Data, By Country, 2014-2021, (USD Billion)

Table 44 Asia-Pacific Shipping Export Data, By Country, 2014-2021, (USD Billion)

Table 45 Africa and Middle East Shipping Export Data, By Country, 2014-2021, (USD Billion)

Table 46 North America Shipping Import Data, By Country, 2014-2021, (USD Billion)

Table 47 Europe Shipping Import Data, 2014-2021, By Country, (USD Billion)

Table 48 Asia-Pacific Shipping Import Data, By Country, 2014-2021, (USD Billion)

Table 49 Africa and Middle East Shipping Import Data, By Country, 2014-2021, (USD Billion)

Table 50 New Service Launches, 2016

Table 51 Mergers & Acquisitions and Other Developments, 2016

Table 52 Agreements/Joint Ventures/Supply Contracts/Partnerships, 2014–2016

Table 53 Expansions, 2015–2016

Table 54 New Service Launches, 2014–2016

Table 55 Expansions, 2014–2016

Table 56 Agreements/Joint Ventures/Supply Contracts/Partnerships, 2013–2014

Table 57 Mergers & Acquisitions and Other Developments, 2015

List of Figures (29 Figures)

Figure 1 International Seaborne Trade, By Volume, 2011—2015

Figure 2 Cargo Shiping Market Segmentation

Figure 3 Research Design (Will Update Later)

Figure 4 Research Methodology Model

Figure 5 Breakdown of Primary Interviews: By Stakeholder Type, Designation, & Region ( In Progress)

Figure 6 Cargo Shiping Industry Snapshot (2016)

Figure 7 Cargo Shiping Industry Size, By Cargo Type,By Volume 2016 vs 2021

Figure 8 Cargo Shiping Market Share, By Cargo Type, By Region, 2016

Figure 9 Asia-Pacific is the Largest Contributor to the Cargo Industry By Volume

Figure 10 Distribution of Global Containerized Trade By Route, 2014 (Percentage Share of Global Trade In Ted)

Figure 11 Companies Adopted New Service Launch as the Key Growth Strategy From 2013 to 2016

Figure 12 Market Evaluation Framework: Agreements/Joint Ventures/Supply Contracts/Partnerships Fuelled the Growth of the Cargo Shiping Shipping Market From 2013 to 2016

Figure 13 Companies Adopted Agreements/Joint Ventures/Supply Contracts/Partnerships as the Key Growth Strategy From 2012 to 2016

Figure 14 Market Evaluation Framework: Agreements/Joint Ventures/Supply Contracts/Partnerships Fuelled the Demand for Marine Freight Forwarding From 2013 to 2016

Figure 15 Battle for Market Share: New Service Launch Was the Key Strategy

Figure 16 A.P. Møller – Mærsk A/S: Business Overview

Figure 17 A.P. Møller – Mærsk A/S: SWOT Analysis

Figure 18 Mediterranean Shipping Company Sa: SWOT Analysis

Figure 19 China Cosco Holdings Company Limited : Business Overview

Figure 20 China Cosco Holdings Company Limited: SWOT Analysis

Figure 21 CMA CGM : Business Overview

Figure 22 CMA CGM S.A: SWOT Analysis

Figure 23 Hapag-Lloyd AG: Business Overview

Figure 24 Hapag Lloyd AG: SWOT Analysis

Figure 25 Deutsche Post DHL Group: Business Overview

Figure 26 Ceva Logistics: Company Snapshot

Figure 27 Panalpina Welttransport (Holding) AG

Figure 28 Deutsche Bahn AG : Business Overview

Figure 29 Nippon Express Co., Ltd Business Overview

Growth opportunities and latent adjacency in Cargo Shipping Market