Catheter Stabilization Devices Market by Product ((Arterial, CVS (Portal, Femoral), Chest, Epidural, Peripheral (Nasogastric, Endotracheal, Foley)), Application (Cardiovascular, Respiratory), End User - Global Forecasts to 2025

Market Growth Outlook Summary

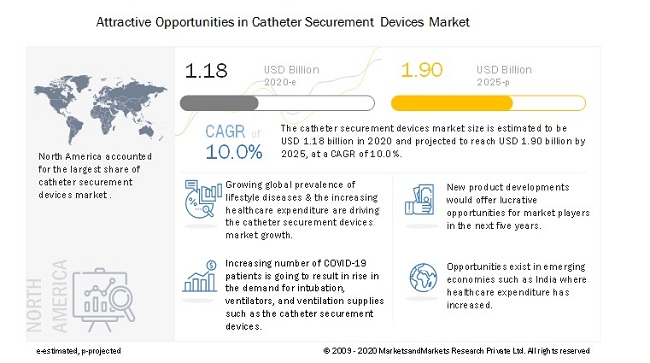

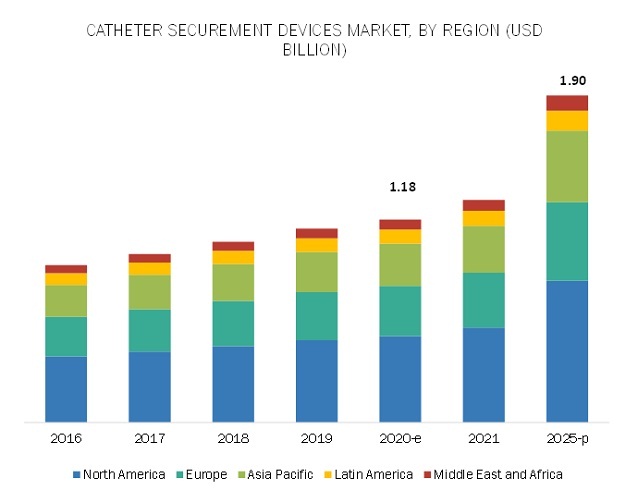

The global catheter stabilization devices market growth forecasted to transform from $1.18 billion in 2020 to $1.90 billion by 2025, driven by a CAGR of 10.0%. The emerging economies such as India and China are expected to provide a wide range of growth opportunities for players in the market which is driven by growing incidences of heart and other life style diseases.

Peripheral securement devices segment is expected to hold the largest share of the market in 2020

The catheter securement devices market, based on type, is segmented into peripheral, arterial, central, chest drainage, abdominal drainage, epidural, and all-site securement devices. The peripheral catheter securement devices segment dominated this market in 2019. The peripheral catheters are the most widely used products and thus the use of securement devices for these catheters is significant.

Increasing use of catheter securement devices in cardiovascular and respiratory procedures in 2019

Based on application, the catheter securement devices market is segmented into respiratory procedures, cardiovascular procedures, gastric and oropharyngeal procedures, general surgery, radiology, urological procedures, and other applications. In 2019, the cardiovascular procedures segment accounted for the largest market share owing to the fact that several CVD and heart diseases are on the rise and have prevalence in developing as well as developed markets.

North America is expected to hold the highest share in 2020

The catheter securement devices market in North America is expected to grow at a steady pace in the coming years. There has been a tremendous increase in the use of these devices in routine operating procedures. Placed of catheters for fluid transmissions requires the need for securement devices to avoid infections. Increasing investment in healthcare in the developing economies such as India is also creating opportunities for market players to enter into these markets.

Key Market Players

The major players operating in the catheter securement devices market include 3M (US), C.R. Bard, Inc. (US), ConvaTec Group plc (UK), Merit Medical Systems (US), B. Braun Melsungen AG (Germany), DeRoyal Industries, Inc. (US), Cardinal Health (US), Baxter International Inc. (US), Smiths Medical (US), Centurion Medical Products (US), M.C. Johnson Company, Inc. (US), Dale Medical Products, Inc. (US), TIDI Products, LLC (US), BioDerm Inc. (US), Starboard Medical, Inc. (US), Pepper Medical (US), Adhezion Biomedical LLC (US), Marpac (US), Cryo-Push Medical Technology Co., Ltd. (China), MERMAID MEDICAL A/S (Denmark), Interrad Medical (US), Owens & Minor, Inc. (US), and Bird & Cronin Inc. (US).

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2016–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By type, applications, end user, and region |

|

Geographies Covered |

North America (US, Canada), Europe (Germany, France, UK, and the RoE), APAC (Japan, China, India, and the RoAPAC), Latin America, and the Middle East & Africa |

|

Companies Covered |

3M (US), C.R. Bard, Inc. (US), ConvaTec Group plc (UK), Merit Medical Systems (US), B. Braun Melsungen AG (Germany), DeRoyal Industries, Inc. (US), Cardinal Health (US), Baxter International Inc. (US), Smiths Medical (US), Centurion Medical Products (US), M.C. Johnson Company, Inc. (US), Dale Medical Products, Inc. (US), TIDI Products, LLC (US), BioDerm Inc. (US), Starboard Medical, Inc. (US), Pepper Medical (US), Adhezion Biomedical LLC (US), Marpac (US), Cryo-Push Medical Technology Co., Ltd. (China), MERMAID MEDICAL A/S (Denmark), Interrad Medical (US), Owens & Minor, Inc. (US), and Bird & Cronin Inc. (US). |

This research report categorizes the catheter securement devices market into the following segments and subsegments:

Catheter securement devices market, by Type

-

Peripheral Securement Devices

- Foley Catheter Securement Devices

- Nasogastric Tubes Securement Devices

- Endotracheal Tube Securement Devices

- Midlines Securement Devices

- Ventriculoperitoneal Securement Devices

-

Continuous Nerve Block Catheter Securement Devices

- Central Venous Catheter Securement Devices

- Portal Securement Devices

- PICC Securement Devices

- Subclavian Securement Devices

- Femoral Securement Devices

- Jugular Securement Devices

- Arterial Securement Devices

- Chest Drainage Tube Securement Devices

-

Abdominal Drainage Tube Securement Devices

- Percutaneous Endoscopic Gastrostomy Securement Devices

- Jejunal Catheter Securement Devices

- Umbilical Catheter Securement Devices

- Epidural Securement Devices

- All-Site Securement Devices

Catheter securement devices market, by Application

- Cardiovascular Procedures

- Respiratory Procedures

- Gastric and Oropharangeal Procedures

- General Surgery

- Urological Procedures

- Radiology

- Other Applications

Catheter securement devices market, by End User

- Hospitals

- Home Care Settings

- Emergency Clinics

- Diagnostic Imaging Centers

Catheter securement devices market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent developments:

- In 2019, Dale Medical Products, Inc. (US) introduced Hold-n-Place Catheter Securement Products, which are engineered stabilization devices (ESD) and feature a soft, comfortable, & a flexible design.

- In 2019, 3M (US) acquired Acelity Inc. (US). This acquisition will further accelerate 3M as a leader in advanced wound care and specialty surgical applications.

- In 2018, 3M (US) introduced PICC/CVC securement device + CHG Dressing.

- In 2018, Medline (US) acquired Centurion Medical Products (US).

Key Questions Addressed in the Report:

- What are the growth opportunities in the catheter securement devices market across major regions in the future?

- Emerging countries have immense opportunities for the growth and adoption of catheter securement products. Will this scenario continue during the next five years?

- Where will all the advancements in products offered by various companies take the industry in the mid- to long-term?

- What are the various catheter securement product types and their respective market shares in the overall market?

- What are the new trends and advancements in the catheter securement devices market?

- What is the impact of COVID-19 on catheter securement devices market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 CATHETER SECUREMENT DEVICES MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2.2.1 Key data from primary sources

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 CATHETER SECUREMENT DEVICES MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 CATHETER SECUREMENT DEVICES MARKET: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 7 CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 9 CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 10 CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 CATHETER SECUREMENT DEVICES MARKET OVERVIEW

FIGURE 11 RISING GLOBAL INCIDENCE OF LIFESTYLE DISEASES TO DRIVE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 CATHETER SECUREMENT DEVICES MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 12 PERIPHERAL CATHETER SECUREMENT DEVICES SEGMENT TO DOMINATE THE MARKET IN 2020

4.3 CATHETER SECUREMENT DEVICES MARKET SHARE, BY END USER, 2020 VS. 2025

FIGURE 13 HOSPITALS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CATHETER SECUREMENT DEVICES MARKET IN 2020

4.4 CATHETER SECUREMENT DEVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 14 ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH RATE IN THE CATHETER SECUREMENT DEVICES MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 CATHETER SECUREMENT DEVICES MARKET: DRIVERS, RESTRAINTS, AND OPPORTUNITIES

5.2.1 DRIVERS

5.2.1.1 Increasing prevalence of lifestyle diseases

FIGURE 16 RISING GERIATRIC POPULATION (AGED ABOVE 60 YEARS), BY REGION, 2017 VS. 2050

5.2.1.2 Cost-benefits of securement devices

5.2.2 RESTRAINTS

5.2.2.1 Availability of alternative products

5.2.2.2 Delay in non-urgent treatments and surgical procedures due to COVID-19

5.2.3 OPPORTUNITIES

5.2.3.1 Growth potential in emerging economies

5.3 COVID-19 IMPACT ON THE CATHETER SECUREMENT DEVICES MARKET

5.4 ADJACENT MARKETS TO THE CATHETER SECUREMENT DEVICES MARKET

6 CATHETER SECUREMENT DEVICES MARKET, BY TYPE (Page No. - 53)

6.1 INTRODUCTION

TABLE 1 CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 2 CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

6.2 PERIPHERAL CATHETER SECUREMENT DEVICES

6.2.1 PERIPHERAL CATHETER SECUREMENT DEVICES HOLD THE LARGEST MARKET SHARE DUE TO THE LARGE NUMBER OF PERIPHERAL CATHETERS USED

IN SURGERIES 55

TABLE 3 PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 4 PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 5 PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 6 PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

6.2.1.1 Foley catheter securement devices

TABLE 7 FOLEY CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 8 FOLEY CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.2.1.2 Nasogastric tube securement devices

TABLE 9 NASOGASTRIC TUBE SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 10 NASOGASTRIC TUBE SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.2.1.3 Endotracheal tube securement devices

TABLE 11 ENDOTRACHEAL TUBE SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 ENDOTRACHEAL TUBE SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.2.1.4 Midlines securement devices

TABLE 13 MIDLINES SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 MIDLINES SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.2.1.5 Ventriculoperitoneal securement devices

TABLE 15 VENTRICULOPERITONEAL SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 VENTRICULOPERITONEAL SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.2.1.6 Continuous nerve block catheter securement devices

TABLE 17 CONTINUOUS NERVE BLOCK CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 CONTINUOUS NERVE BLOCK CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.3 CENTRAL VENOUS CATHETER SECUREMENT DEVICES

6.3.1 CENTRAL VENOUS CATHETER SECUREMENT DEVICES ARE REPLACING SUTURES DUE TO THEIR EASE OF USE AND LOWER CHANCES OF INFECTIONS

TABLE 19 CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 21 CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 22 CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

6.3.1.1 Portal securement devices

TABLE 23 PORTAL SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 PORTAL SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.3.1.2 PICC securement devices

TABLE 25 PICC SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 PICC SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.3.1.3 Subclavian securement devices

TABLE 27 SUBCLAVIAN SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 SUBCLAVIAN SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.3.1.4 Femoral securement devices

TABLE 29 FEMORAL SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 FEMORAL SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.3.1.5 Jugular securement devices

TABLE 31 JUGULAR SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 JUGULAR SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.4 ARTERIAL CATHETER SECUREMENT DEVICES

6.4.1 ARTERIAL SECUREMENT DEVICES ARE USED FOR REDUCING INFECTIONS AT THE ARTERIAL CATHETER INSERTION SITES

TABLE 33 ARTERIAL CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 ARTERIAL CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.5 CHEST DRAINAGE TUBE SECUREMENT DEVICES

6.5.1 CHEST DRAINAGE TUBE SECUREMENT DEVICES ARE NECESSARY FOR AVOIDING COMPLICATIONS IN LUNG CONDITIONS

TABLE 35 CHEST DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 CHEST DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.6 ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES

6.6.1 LOW POPULARITY OF PROPHYLACTIC DRAINAGE PROCESS HAS HINDERED THE OVERALL USE OF RELATED SECUREMENT DEVICES

TABLE 37 ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 39 ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 40 ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

6.6.1.1 Percutaneous endoscopic gastrostomy securement devices

TABLE 41 PERCUTANEOUS ENDOSCOPIC GASTROSTOMY SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 PERCUTANEOUS ENDOSCOPIC GASTROSTOMY SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.6.1.2 Jejunal catheter securement devices

TABLE 43 JEJUNAL CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 JEJUNAL CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.6.1.3 Umbilical catheter securement devices

TABLE 45 UMBILICAL CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 46 UMBILICAL CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.7 EPIDURAL SECUREMENT DEVICES

6.7.1 EPIDURAL SECUREMENT DEVICES ARE USED TO AVOID COMPLICATIONS IN C-SECTION PROCEDURES

TABLE 47 EPIDURAL SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 48 EPIDURAL SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

6.8 ALL-SITE SECUREMENT DEVICES

6.8.1 FLEXIBILITY OF FUNCTION ALLOWS FOR WIDE APPLICATIONS OF ALL-SITE SECUREMENT DEVICES

TABLE 49 ALL-SITE SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 50 ALL-SITE SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

7 CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION (Page No. - 80)

7.1 INTRODUCTION

TABLE 51 CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 52 CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

7.2 CARDIOVASCULAR PROCEDURES

7.2.1 INCREASING PREVALENCE OF CARDIOVASCULAR DISEASES WILL DRIVE MARKET GROWTH

TABLE 53 CATHETER SECUREMENT DEVICES MARKET FOR CARDIOVASCULAR PROCEDURES, BY REGION, 2016–2019 (USD MILLION)

TABLE 54 CATHETER SECUREMENT DEVICES MARKET FOR CARDIOVASCULAR PROCEDURES, BY REGION, 2020–2025 (USD MILLION)

7.3 RESPIRATORY PROCEDURES

7.3.1 INCREASING PREVALENCE OF RESPIRATORY DISEASES WILL DRIVE THE DEMAND FOR SECUREMENT DEVICES

TABLE 55 CATHETER SECUREMENT DEVICES MARKET FOR RESPIRATORY PROCEDURES, BY REGION, 2016–2019 (USD MILLION)

TABLE 56 CATHETER SECUREMENT DEVICES MARKET FOR RESPIRATORY PROCEDURES, BY REGION, 2020–2025 (USD MILLION)

7.4 GASTRIC AND OROPHARYNGEAL PROCEDURES

7.4.1 GROWING GERIATRIC POPULATION AND INCREASE IN THE PREVALENCE OF GASTRIC DISEASES WILL DRIVE MARKET GROWTH

TABLE 57 CATHETER SECUREMENT DEVICES MARKET FOR GASTRIC AND OROPHARYNGEAL PROCEDURES, BY REGION, 2016–2019 (USD MILLION)

TABLE 58 CATHETER SECUREMENT DEVICES MARKET FOR GASTRIC AND OROPHARYNGEAL PROCEDURES, BY REGION, 2020–2025 (USD MILLION)

7.5 GENERAL SURGERY

7.5.1 MOST GENERAL SURGERIES ARE PERFORMED IN HOSPITAL SETTINGS

TABLE 59 CATHETER SECUREMENT DEVICES MARKET FOR GENERAL SURGERY, BY REGION, 2016–2019 (USD MILLION)

TABLE 60 CATHETER SECUREMENT DEVICES MARKET FOR GENERAL SURGERY, BY REGION, 2020–2025 (USD MILLION)

7.6 UROLOGICAL PROCEDURES

7.6.1 HIGH PREVALENCE OF UROLOGICAL DISEASES WILL INCREASE THE DEMAND FOR CATHETER SECUREMENT DEVICES

TABLE 61 CATHETER SECUREMENT DEVICES MARKET FOR UROLOGICAL PROCEDURES, BY REGION, 2016–2019 (USD MILLION)

TABLE 62 CATHETER SECUREMENT DEVICES MARKET FOR UROLOGICAL PROCEDURES, BY REGION, 2020–2025 (USD MILLION)

7.7 RADIOLOGY

7.7.1 INTERVENTIONAL RADIOLOGY PROCEDURES REQUIRE MULTIPLE CATHETERS AND SECUREMENT DEVICES

TABLE 63 CATHETER SECUREMENT DEVICES MARKET FOR RADIOLOGY, BY REGION, 2016–2019 (USD MILLION)

TABLE 64 CATHETER SECUREMENT DEVICES MARKET FOR RADIOLOGY, BY REGION, 2020–2025 (USD MILLION)

7.8 OTHER APPLICATIONS

TABLE 65 CATHETER SECUREMENT DEVICES MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 66 CATHETER SECUREMENT DEVICES MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

8 CATHETER SECUREMENT DEVICES MARKET, BY END USER (Page No. - 90)

8.1 INTRODUCTION

TABLE 67 CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 68 CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2020–2025 (USD MILLION)

8.2 HOSPITALS

8.2.1 HIGH VOLUME OF SURGERIES TO DRIVE THE DEMAND FOR CATHETER SECUREMENT DEVICES IN HOSPITALS

TABLE 69 CATHETER SECUREMENT DEVICES MARKET FOR HOSPITALS, BY REGION, 2016–2019 (USD MILLION)

TABLE 70 CATHETER SECUREMENT DEVICES MARKET FOR HOSPITALS, BY REGION, 2020–2025 (USD MILLION)

8.3 HOMECARE SETTINGS

8.3.1 GROWING DEMAND FOR LONG-TERM CARE IN HOMECARE SETTINGS TO SUPPORT THE GROWTH OF THIS END-USER SEGMENT

TABLE 71 CATHETER SECUREMENT DEVICES MARKET FOR HOMECARE SETTINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 72 CATHETER SECUREMENT DEVICES MARKET FOR HOMECARE SETTINGS, BY REGION, 2020–2025 (USD MILLION)

8.4 EMERGENCY CLINICS

8.4.1 RISING PATIENT VOLUME IN EMERGENCY CLINICS TO SUPPORT THE GROWTH OF THIS END-USER SEGMENT

TABLE 73 CATHETER SECUREMENT DEVICES MARKET FOR EMERGENCY CLINICS, BY REGION, 2016–2019 (USD MILLION)

TABLE 74 CATHETER SECUREMENT DEVICES MARKET FOR EMERGENCY CLINICS, BY REGION, 2020–2025 (USD MILLION)

8.5 DIAGNOSTIC IMAGING CENTERS

8.5.1 INCREASING DEMAND FOR PREVENTIVE IMAGING PROCEDURES TO DRIVE THE GROWTH OF THIS END-USER SEGMENT

TABLE 75 CATHETER SECUREMENT DEVICES MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 76 CATHETER SECUREMENT DEVICES MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2020–2025 (USD MILLION)

9 CATHETER SECUREMENT DEVICES MARKET, BY REGION (Page No. - 96)

9.1 INTRODUCTION

TABLE 77 CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 78 CATHETER SECUREMENT DEVICES MARKET, BY REGION, 2020–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 17 NORTH AMERICA: CATHETER SECUREMENT DEVICES MARKET SNAPSHOT

TABLE 79 NORTH AMERICA: CATHETER SECUREMENT DEVICES MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 80 NORTH AMERICA: CATHETER SECUREMENT DEVICES MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 81 NORTH AMERICA: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 82 NORTH AMERICA: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 83 NORTH AMERICA: CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 84 NORTH AMERICA: CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 85 NORTH AMERICA: PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 86 NORTH AMERICA: PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 87 NORTH AMERICA: ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 88 NORTH AMERICA: ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 89 NORTH AMERICA: CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 90 NORTH AMERICA: CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 91 NORTH AMERICA: CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 92 NORTH AMERICA: CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2020–2025 (USD MILLION)

9.2.1 US

9.2.1.1 US dominates the North American catheter securement devices market

FIGURE 18 POPULATION GROWTH IN THE US, 2016–2060

TABLE 93 US: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 94 US: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Increasing awareness of CVD will drive market growth in Canada

TABLE 95 CANADA: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 96 CANADA: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.3 EUROPE

TABLE 97 EUROPE: CATHETER SECUREMENT DEVICES MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 98 EUROPE: CATHETER SECUREMENT DEVICES MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 99 EUROPE: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 100 EUROPE: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 101 EUROPE: CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 102 EUROPE: CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 103 EUROPE: PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 104 EUROPE: PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 105 EUROPE: ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 106 EUROPE: ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 107 EUROPE: CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 108 EUROPE: CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 109 EUROPE: CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 110 EUROPE: CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2020–2025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany dominates the European catheter securement devices market

TABLE 111 GERMANY: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 112 GERMANY: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.3.2 UK

9.3.2.1 CVD is the second-most-common cause of death in the UK

TABLE 113 UK: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 114 UK: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Favorable demographics will support the adoption of catheter securement devices in France

TABLE 115 FRANCE: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 116 FRANCE: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.3.4 REST OF EUROPE

TABLE 117 ROE: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 118 ROE: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 19 APAC: CATHETER SECUREMENT DEVICES MARKET SNAPSHOT

TABLE 119 APAC: CATHETER SECUREMENT DEVICES MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 120 APAC: CATHETER SECUREMENT DEVICES MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 121 APAC: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 122 APAC: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 123 APAC: CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 124 APAC: CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 125 APAC: PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 126 APAC: PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 127 APAC: ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 128 APAC: ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 129 APAC: CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 130 APAC: CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 131 APAC: CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 132 APAC: CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2020–2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China accounts for the largest share of the APAC market

TABLE 133 CHINA: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 134 CHINA: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Well-developed healthcare system and universal healthcare reimbursement policy are expected to drive market growth

TABLE 135 JAPAN: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 136 JAPAN: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Increasing incidence of CVD is driving market growth

TABLE 137 INDIA: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 138 INDIA: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.4.4 REST OF APAC

TABLE 139 ROAPAC: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 140 ROAPAC: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.5 LATIN AMERICA

TABLE 141 LATAM: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 142 LATAM: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 143 LATAM: CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 144 LATAM: CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 145 LATAM: PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 146 LATAM: PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 147 LATAM: ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 148 LATAM: ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 149 LATAM: CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 150 LATAM: CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 151 LATAM: CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 152 LATAM: CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2020–2025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

TABLE 153 MIDDLE EAST & AFRICA: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: CENTRAL VENOUS CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 157 MIDDLE EAST & AFRICA: PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: PERIPHERAL CATHETER SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 160 MIDDLE EAST & AFRICA: ABDOMINAL DRAINAGE TUBE SECUREMENT DEVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 161 MIDDLE EAST & AFRICA: CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: CATHETER SECUREMENT DEVICES MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 163 MIDDLE EAST & AFRICA: CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 164 MIDDLE EAST & AFRICA: CATHETER SECUREMENT DEVICES MARKET, BY END USER, 2020–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 143)

10.1 OVERVIEW

FIGURE 20 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE CATHETER SECUREMENT DEVICES MARKET

10.2 MARKET SHARE ANALYSIS, 2019

FIGURE 21 CATHETER SECUREMENT DEVICES MARKET SHARE, BY KEY PLAYER, 2019

10.3 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

10.4 VENDOR INCLUSION CRITERIA

10.5 VENDOR DIVE

10.5.1 VISIONARY LEADERS

10.5.2 INNOVATORS

10.5.3 DYNAMIC DIFFERENTIATORS

10.5.4 EMERGING COMPANIES

FIGURE 22 GLOBAL CATHETER SECUREMENT DEVICES MARKET: COMPETITIVE LEADERSHIP MAPPING (2019)

10.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS (2019)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 23 MNM DIVE-VENDOR COMPARISON MATRIX FOR START-UPS: CATHETER SECUREMENT DEVICES MARKET

10.7 COMPETITIVE SCENARIO

10.7.1 PRODUCT LAUNCHES

10.7.2 PARTNERSHIPS

10.7.3 ACQUISITIONS

10.7.4 EXPANSIONS

10.7.5 AGREEMENTS

11 COMPANY PROFILES (Page No. - 153)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

11.1 3M

FIGURE 24 3M: COMPANY SNAPSHOT (2019)

11.2 B. BRAUN MELSUNGEN AG

FIGURE 25 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2019)

11.3 BAXTER INTERNATIONAL

FIGURE 26 BAXTER INTERNATIONAL: COMPANY SNAPSHOT (2019)

11.4 C.R. BARD (BECTON, DICKINSON AND COMPANY)

FIGURE 27 BD: COMPANY SNAPSHOT (2019)

11.5 CONVATEC GROUP PLC

FIGURE 28 CONVATEC GROUP PLC: COMPANY SNAPSHOT (2019)

11.6 CENTURION MEDICAL PRODUCTS (MEDLINE INDUSTRIES, INC.)

11.7 CARDINAL HEALTH

FIGURE 29 CARDINAL HEALTH: COMPANY SNAPSHOT (2019)

11.8 MERIT MEDICAL SYSTEMS

FIGURE 30 MERIT MEDICAL SYSTEMS: COMPANY SNAPSHOT (2019)

11.9 OWENS & MINOR, INC.

FIGURE 31 OWENS & MINOR, INC.: COMPANY SNAPSHOT (2019)

11.10 M.C. JOHNSON COMPANY INC.

11.11 SMITHS MEDICAL

11.12 DALE MEDICAL PRODUCTS, INC.

11.13 TIDI PRODUCTS, LLC

11.14 DEROYAL INDUSTRIES, INC.

11.15 BIODERM INC.

11.16 STARBOARD MEDICAL, INC.

11.17 PEPPER MEDICAL

11.18 ADHEZION BIOMEDICAL, LLC

11.19 MARPAC

11.20 CHENGDU CRYO-PUSH MEDICAL TECHNOLOGY CO., LTD.

11.21 MERMAID MEDICAL A/S

11.22 INTERRAD MEDICAL

11.23 BIRD & CRONIN, INC.

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

12 ADJACENT/RELATED MARKETS - CATHETERS MARKET (Page No. - 187)

12.1 INTRODUCTION

12.2 CATHETERS MARKET

12.2.1 MARKET DEFINITION

12.2.2 LIMITATIONS

12.2.3 MARKET OVERVIEW

12.3 CATHETERS MARKET, BY REGION

TABLE 165 CATHETERS MARKET, BY REGION, 2018–2025 (USD MILLION)

12.4 CATHETERS MARKET, BY TYPE

TABLE 166 CATHETERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.1 CARDIOVASCULAR CATHETERS

TABLE 167 CARDIOVASCULAR CATHETERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.2 INTRAVENOUS CATHETERS

TABLE 168 INTRAVENOUS CATHETERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.2.1 Central venous catheters

TABLE 169 CENTRAL VENOUS CATHETERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.3 UROLOGICAL CATHETERS

TABLE 170 UROLOGICAL CATHETERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.3.1 Urinary catheters

TABLE 171 URINARY CATHETERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 172 URINARY CATHETERS MARKET, BY TYPE, 2018–2025 (MILLION UNITS)

12.4.3.2 Dialysis catheters

TABLE 173 DIALYSIS CATHETERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.4.4 SPECIALTY CATHETERS

TABLE 174 SPECIALTY CATHETERS MARKET, BY TYPE, 2018–2025 (USD MILLION)

12.5 CATHETERS MARKET, BY END USER

TABLE 175 CATHETERS MARKET, BY END USER, 2018–2025 (USD MILLION)

12.5.1 HOSPITALS

TABLE 176 CATHETERS MARKET FOR HOSPITALS, BY REGION, 2018–2025 (USD MILLION)

12.5.2 LONG-TERM CARE FACILITIES

TABLE 177 CATHETERS MARKET FOR LONG-TERM CARE FACILITIES, BY REGION, 2018–2025 (USD MILLION)

12.5.3 DIAGNOSTIC IMAGING CENTERS

TABLE 178 CATHETERS MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2018–2025 (USD MILLION)

12.5.4 OTHER END USERS

TABLE 179 CATHETERS MARKET FOR OTHER END USERS, BY REGION, 2018–2025 (USD MILLION)

13 APPENDIX (Page No. - 196)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

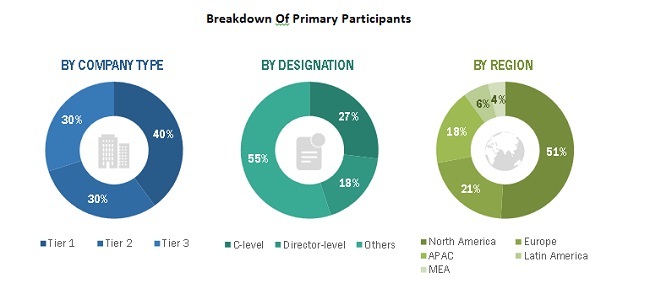

The study involved four major activities to estimate the current size of the catheter securement devices market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

Several stakeholders such as catheter securement device manufacturers, vendors, distributors and scientists, researchers, laboratory technicians, and doctors from hospitals and clinics were consulted for this report. The demand side of this market is characterized by significant use of catheter securement devices due to increasing cancer, diabetes, chronic wounds, musculoskeletal disorders and the growing aging population across the globe. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the catheter securement devices market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the catheter securement devices industry.

Report Objectives

- To define, describe, and forecast the catheter securement devices market on the basis of type, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, and opportunities)

- To strategically analyse micromarkets with respect to individual growth trends, prospects, and contributions to the overall catheter securement devices market

- To analyse market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in five geographical regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyse their product portfolios, market positions, and core competencies

- To track and analyse competitive developments such as product launches, partnerships, expansions, and acquisitions in the catheter securement devices market

Available Customizations:

Product Analysis:

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Geographic Analysis:

- Further breakdown of the European, Asia Pacific, Latin America, and the Middle East & African segments into their respective countries for this market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Volume Data:

- Customization options for volume data (number of units sold) and customization options for volume data (number of tests)

Opportunities Assessment:

- A detailed report underlining the various growth opportunities presented in the market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Catheter Stabilization Devices Market