Centrifuge Market

Centrifuge Market by Type (Laboratory, Industrial), Rotor Type (Fixed-Angle, Swinging Bucket), Application (Fluid Clarification, Dewatering), End-use Industry (Pharmaceutical, Food & Beverage), Speed, Capacity, & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The centrifuge market is projected to reach USD 0.63 billion by 2030 from USD 0.50 billion in 2025, at a CAGR of 4.7% during the forecast period. The centrifuge market is witnessing strong growth, fueled by its diverse applications across industries such as pharmaceuticals, biotechnology, food and beverages, chemicals, mining, and wastewater treatment. Centrifuges play a critical role in solid-liquid separation, fluid clarification, and product purification, making them indispensable for both industrial and laboratory use. In the pharmaceutical and biotechnology sectors, growing demand for biologics, vaccines, and cell-based therapies is driving the adoption of advanced high-speed and ultracentrifuges for precision separation. Meanwhile, industrial segments rely heavily on centrifuges for wastewater management, sludge dewatering, and resource recovery, aligning with global sustainability initiatives and stringent environmental regulations.

KEY TAKEAWAYS

-

BY TYPEThe centrifuge market is segmented by type into laboratory centrifuges, industrial centrifuges, decanter centrifuges, high-speed separators, and other types. Laboratory centrifuges dominate the market due to their widespread use in research, diagnostics, and biotechnology applications. Industrial centrifuges are gaining traction in large-scale manufacturing processes. Decanter centrifuges are preferred for solid-liquid separation in wastewater treatment and mining. High-speed separators are crucial for precise separations in pharmaceuticals and food processing. Other types include specialized centrifuges for niche applications like blood separation in healthcare.

-

BY APPLICATIONKey applications include solid control, mud cleaning, dewatering, fluid clarification, and other applications. Solid control holds a significant share, driven by oil and gas drilling operations. Mud cleaning is essential in mining and construction. Dewatering applications are prominent in wastewater management and sludge processing. Fluid clarification is vital in beverage production and chemical processing. Other applications encompass biofuel production and pharmaceutical purification, contributing to market diversity.

-

BY SPEEDThe market is divided into medium speed, low speed, and high speed centrifuges. High-speed centrifuges lead the segment owing to their efficiency in separating fine particles and use in advanced research. Low-speed centrifuges are commonly used in clinical settings for basic separations. Medium-speed centrifuges bridge the gap, offering versatility for industrial and laboratory uses.

-

BY END-USE INDUSTRYMajor end-use industries include pharmaceutical, food & beverages, oil & gas, chemicals, water & wastewater treatment, and other end-use industries. The pharmaceutical sector dominates due to stringent purity requirements and bioprocessing needs. Food & beverages rely on centrifuges for clarification and separation processes. Oil & gas uses them for drilling fluid management. Chemicals and water & wastewater treatment segments are growing with increasing environmental regulations. Other industries include mining and biotechnology.

-

BY ROTOR TYPEThe centrifuge market is segmented into fixed-angle rotor centrifuges, swinging bucket centrifuges, vertical & horizontal centrifuges, and other rotor types. Fixed-angle rotor centrifuges hold the largest share due to their superior efficiency, versatility, and widespread applicability across laboratory, industrial, and research settings.

-

BY CAPACITYThe market is segmented by capacity into small-capacity, medium-capacity, and large-capacity centrifuges. Large-capacity centrifuges dominate industrial applications like wastewater treatment and oil refining, handling high volumes. Medium-capacity is suitable for mid-scale operations in food processing and chemicals. Small-capacity centrifuges are prevalent in laboratories and small-scale production.

-

BY REGIONThe market spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads with advanced technological adoption and a strong pharmaceutical presence. Asia Pacific is the fastest-growing region, driven by industrialization in China and India. Europe emphasizes environmental compliance, boosting wastewater applications. Latin America and the Middle East & Africa are emerging with investments in oil & gas and mining.

-

COMPETITIVE LANDSCAPEMajor players include Alfa Laval, GEA Group, Andritz, FLSmidth A/S, and KUBOTA Corporation. Companies are focusing on innovation, such as energy-efficient and automated centrifuges. Strategic acquisitions and partnerships are common to expand market reach. The landscape is competitive with emphasis on R&D for customized solutions and sustainability.

Technological advancements, such as automated, continuous, and energy-efficient centrifuges, are enhancing operational efficiency, reducing costs, and expanding market appeal. The food and beverage industry is increasingly deploying centrifuges for dairy processing, beverage clarification, and edible oil refining. Additionally, rising investments in infrastructure and healthcare in emerging markets, particularly in the Asia Pacific, are creating significant growth opportunities. However, high initial costs, energy consumption, and maintenance requirements remain key challenges. Overall, with its vital role in industrial efficiency, healthcare innovation, and sustainable practices, the centrifuge market is positioned for consistent expansion, supported by ongoing R&D and the shift toward smarter, more sustainable separation technologies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The centrifuge market is undergoing significant trends and disruptions driven by technological innovation and shifting industry demands. One major trend is the rise of continuous and automated centrifuges, which improve throughput and reduce labor dependency compared to traditional batch systems. Integration of IoT and AI for predictive maintenance and performance monitoring is disrupting equipment management, minimizing downtime, and optimizing efficiency. In pharmaceuticals and biotechnology, the surge in biologics, vaccines, and cell therapies is fueling demand for advanced high-speed and single-use centrifuge systems, while in industrial sectors, stricter environmental regulations are pushing adoption in wastewater treatment and resource recovery. Another disruptive factor is the development of energy-efficient and compact centrifuge designs, catering to sustainability goals and reducing operational costs. Additionally, the growing presence of emerging markets in the Asia Pacific is reshaping competitive dynamics. Collectively, these trends highlight a shift toward smarter, more sustainable, and application-specific centrifuge solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Critical role in enhancing efficiency, productivity, and quality across sectors

-

•Intensive oil & gas exploration

Level

-

•Environmental concerns related to waste disposal

-

•High capital & maintenance cost

Level

-

•Growth of pharmaceutical and biotechnology sectors

Level

-

•Increasing competition from alternative technologies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Critical role in enhancing efficiency, productivity, and quality across sectors

Centrifuges play a pivotal role in boosting operational efficiency, productivity, and product quality in diverse industries, serving as a primary driver for market growth. In sectors like pharmaceuticals, food and beverages, chemicals, oil and gas, and wastewater treatment, these machines enable precise solid-liquid separation, fluid clarification, dewatering, and purification processes that are essential for maintaining high standards and regulatory compliance. For instance, in pharmaceutical manufacturing, centrifuges facilitate bioprocessing of biologics and vaccines, ensuring purity and scalability amid rising healthcare demands and advancements in personalized medicine. Similarly, in oil and gas, they manage drilling fluids and separate oil-water mixtures, enhancing recovery rates and reducing downtime. Rapid industrialization in emerging economies, coupled with stringent environmental and quality regulations, further amplifies demand for advanced, automated centrifuges that offer higher throughput, energy efficiency, and reliability. Technological innovations, such as high-speed and refrigerated models, support applications in biotechnology research, renewable energy, and mineral recovery, driving consistent performance across large-scale operations.

Restraint: Environmental concerns related to waste disposal

Environmental concerns surrounding waste disposal represent a significant restraint on the centrifuge market, as operations often generate sludge, effluents, and hazardous byproducts that require careful management to comply with regulations. In industries like wastewater treatment, chemicals, and oil and gas, the separation processes produce concentrated waste that, if not handled properly, can lead to soil and water contamination, prompting stricter disposal guidelines from bodies like the EPA and EU directives. This increases operational costs for safe disposal, recycling, or treatment, particularly for small and medium enterprises in cost-sensitive regions. Additionally, biosafety regulations demand features like aerosol-tight designs to prevent environmental release of biohazards in laboratory settings, adding to equipment complexity and expenses. Noise emissions and energy consumption during high-speed operations also raise sustainability issues, with tightening standards pushing manufacturers toward eco-friendly innovations but slowing adoption due to higher upfront investments. In decanter centrifuge applications for municipal wastewater, improper waste handling can exacerbate pollution concerns, limiting market expansion in environmentally regulated areas. These factors, combined with the long lifespan of equipment reducing replacement needs, contribute to moderated growth despite the market's overall upward trajectory

Opportunity: Growth of pharmaceutical and biotechnology sectors

The expansion of the pharmaceutical and biotechnology sectors presents substantial opportunities for the centrifuge market, driven by surging demands for advanced drug development, biologics, and vaccine production. With increasing investments in R&D, particularly post-pandemic, centrifuges are crucial for processes like cell harvesting, viral vector purification, and bioprocessing in cell and gene therapies, where precision and contamination-free operations are paramount. The rise in chronic diseases and personalized medicine further amplifies the need for high-throughput, GMP-compliant systems in labs and manufacturing facilities. In the Asia Pacific, rapid growth in these sectors, supported by government policies in China and India, opens avenues for market penetration with automated and refrigerated models. Opportunities also lie in single-cell analytics and CAR-T workflows, where gentle centrifugation enhances efficiency. Sustainability trends encourage energy-efficient designs, aligning with EU procurement policies for eco-friendly equipment.

Challenge: Increasing competition from alternative technologies

Increasing competition from alternative technologies poses a formidable challenge to the centrifuge market, as options like membrane filtration, hydrocyclones, sedimentation, and decantation offer cost-effective, low-maintenance alternatives for separation tasks. These methods often require less energy and skilled labor, appealing to industries with tight margins, such as wastewater treatment and food processing, where centrifuges' high capital and operational costs can deter adoption. For example, membrane filtration provides high efficiency without moving parts, reducing wear and downtime, while hydrocyclones excel in large-volume applications like mining and oil recovery. Advancements in these technologies, including compact designs and improved sustainability, intensify pressure on centrifuge manufacturers to differentiate through innovation, such as automated, energy-efficient models. In laboratory settings, outsourced services further erode demand for in-house equipment. Regulatory compliance for biosafety and noise adds complexity, challenging smaller players in a consolidated landscape dominated by firms like Thermo Fisher and Alfa Laval.

Centrifuge Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Industrial centrifuges for dairy, food, and beverage processing to separate cream, whey, and impurities | Higher product purity, improved processing efficiency, and compliance with food safety standards |

|

Decanter centrifuges for wastewater treatment in municipal and industrial plants | Reduced sludge volume, lower disposal costs, and sustainability in water management |

|

Benchtop centrifuges for biotechnology labs handling cell cultures and protein separation | Increased lab productivity, precise separations, and support for advanced biotech research |

|

Centrifuges for chemical and mining industries to clarify liquids and recover valuable solids | Resource efficiency, reduced waste, and stable production processes |

|

Solid-liquid separation centrifuges for pulp & paper and chemical processing plants | Improved throughput, lower energy consumption, and sustainable manufacturing |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The centrifuge market ecosystem consists of a diverse network of stakeholders spanning technology, manufacturing, distribution, and end-use industries. Raw material and component suppliers provide motors, rotors, and control systems essential for equipment design. Manufacturers such as GEA, Alfa Laval, and Thermo Fisher develop laboratory, industrial, and high-speed centrifuges tailored to sector-specific needs. Distributors and service providers ensure global reach, after-sales support, and maintenance. End users include pharmaceuticals, biotechnology, food & beverage, chemicals, mining, and wastewater treatment industries. Additionally, regulatory bodies and research institutions influence standards, innovation, and compliance. Together, this interconnected ecosystem drives innovation, adoption, and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Centrifuge Market, by Type

Industrial centrifuges hold the largest share of the centrifuge market due to their extensive use across a wide range of high-volume, continuous processing industries. They are essential in sectors such as chemical processing, oil and gas, food and beverage, mining, wastewater treatment, and pharmaceuticals, where large-scale separation, clarification, and dewatering are critical to operational efficiency. Industrial centrifuges are designed for durability, high throughput, and the ability to handle challenging materials, including abrasive slurries and high-solid-content mixtures, making them indispensable for bulk processing. Their versatility allows them to process diverse feedstocks while meeting stringent quality and environmental standards. Growing global industrialization, infrastructure development, and environmental regulations drive demand for efficient separation technologies in manufacturing and resource-processing facilities. Additionally, the expansion of energy exploration, particularly in oil, gas, and renewable biofuels, further boosts adoption. Unlike laboratory centrifuges, which serve niche, small-scale applications, industrial centrifuges are integral to core production lines, directly impacting productivity and profitability. Continuous advancements, such as automation, energy efficiency improvements, and integration with process control systems, enhance their performance and ROI, reinforcing their dominance in the market. As industries increasingly seek cost-effective, high-capacity separation solutions, industrial centrifuges remain the preferred choice, sustaining their leading market position.

Centrifuge Market, by Capacity

The medium-capacity segment (10–50 m³/hour) holds the largest share of the centrifuge market due to its optimal balance between processing capability, operational flexibility, and cost-efficiency, making it the preferred choice across multiple industries. Medium-capacity centrifuges are widely used in pharmaceuticals, biotechnology, food and beverage, chemical processing, oil and gas, and municipal wastewater treatment plants, where they can efficiently handle moderate-to-high volumes without the excessive capital and maintenance costs associated with large-capacity systems. They are versatile enough to manage diverse feed materials, from liquid-solid slurries in chemical manufacturing to biomass separation in bioprocessing, enabling consistent throughput and product quality. These centrifuges are also more adaptable to space-constrained facilities compared to their larger counterparts, making them suitable for both new installations and retrofits in existing plants. Their processing range aligns well with the needs of mid-sized production facilities and specialized industrial applications, offering the scalability to increase output without overinvesting in capacity that may go underutilized. Furthermore, medium-capacity units often incorporate advanced features such as automated controls, energy-efficient drives, and CIP (clean-in-place) systems, ensuring regulatory compliance and reducing downtime. The segment benefits from strong demand in emerging markets, where mid-scale manufacturing and municipal infrastructure projects are expanding rapidly. Additionally, industries transitioning from manual or batch separation methods to automated continuous operations often select medium-capacity centrifuges as a cost-effective entry point, delivering quick ROI while improving operational reliability. Unlike small-capacity centrifuges that are limited to niche or laboratory-scale applications, and large-capacity units that cater to heavy-duty, specialized industries, medium-capacity centrifuges serve a broad spectrum of customers seeking high efficiency, flexibility, and lower lifecycle costs. This versatility, combined with growing adoption in both developed and developing regions, ensures that the medium-capacity segment continues to dominate the centrifuge market in terms of both volume and revenue share.

Centrifuge Market, by Speed

The medium-speed segment (5,000–20,000 RPM) accounts for the largest share of the centrifuge market owing to its broad applicability, optimal balance between separation efficiency and operational safety, and cost-effectiveness across diverse industries. Medium speed centrifuges are extensively used in pharmaceuticals, biotechnology, food and beverage, chemical processing, wastewater treatment, and oil and gas, as they provide sufficient centrifugal force for efficient separation of solids and liquids without the extreme wear, noise, or higher maintenance demands often associated with high-speed units. They can handle a wide range of feed materials, from biological samples and fermentation broths to industrial slurries, making them suitable for both continuous and batch operations. Their performance range enables precise separation while maintaining energy efficiency and mechanical durability, which is critical for long-term operation in industrial environments. Moreover, medium-speed centrifuges are less prone to heat generation compared to high-speed models, making them ideal for temperature-sensitive applications such as biomolecule purification and dairy product processing. They also tend to have lower acquisition and operating costs, which appeals to both mid-sized manufacturers and large-scale plants aiming to optimize capital expenditure. Technological advancements, including automated control systems, variable frequency drives, and vibration monitoring, have enhanced their reliability and ease of operation, further driving adoption. The segment benefits from significant demand in emerging economies, where industries require robust, multipurpose separation equipment that can handle moderate to high volumes with consistent performance. Unlike low-speed centrifuges, which are typically limited to basic clarification tasks, and high-speed centrifuges, which are often specialized for niche, high-purity applications, medium-speed units strike the ideal middle ground, delivering strong throughput, versatility, and cost efficiency. This balance ensures they remain the preferred choice for a wide spectrum of industries, solidifying their dominant position in the global centrifuge market

Centrifuge Market, by Rotor Type

Fixed-angle rotor centrifuges hold the largest share of the centrifuge market due to their superior efficiency, versatility, and widespread applicability across laboratory, industrial, and research settings. In a fixed angle rotor, samples are held at a constant angle, typically between 25° and 40° allowing particles to sediment quickly along the tube wall and pellet firmly at the bottom. This design minimizes run times while maximizing separation efficiency, making them ideal for high-throughput operations. Fixed angle rotor centrifuges can operate at a broad range of speeds, from low to ultra-high, enabling their use in diverse applications such as cell harvesting, protein purification, nucleic acid extraction, and industrial-scale clarification processes. Their structural simplicity, compared to swinging bucket or complex vertical rotor systems, enhances mechanical stability, reduces maintenance needs, and improves durability under repeated use. The rigid rotor design also supports higher g-forces without compromising safety, which is particularly valuable in industries and research where precise separation is critical. Moreover, they accommodate a wide variety of tube sizes and materials, increasing flexibility in handling different sample volumes and types. Fixed angle rotors are also more cost-effective over their lifecycle, as they are less prone to mechanical wear and require fewer replacement parts than swinging bucket systems. This cost efficiency, coupled with consistent, reproducible results, drives strong adoption across both developed and emerging markets. In industrial applications, fixed angle rotor centrifuges are favored for their robustness and ability to handle challenging materials in continuous or batch modes. Their dominance is further supported by technological enhancements such as advanced balancing systems, digital controls, and corrosion-resistant materials, which improve operational safety and extend service life. By combining speed, accuracy, adaptability, and cost-effectiveness, fixed angle rotor centrifuges have become the preferred choice for a broad spectrum of separation needs, ensuring their leadership in the global centrifuge market.

Centrifuge Market, by Application

Fluid clarification holds the largest share of the centrifuge market because it is a critical requirement across a wide range of industries, ensuring product quality, process efficiency, and regulatory compliance. The process involves removing fine suspended solids from liquids to achieve a clarified, contaminant-free fluid, which is essential in sectors such as food and beverage, pharmaceuticals, biotechnology, chemicals, wastewater treatment, and oil and gas. In the food and beverage industry, fluid clarification is vital for producing clear juices, wines, and dairy products, while in pharmaceuticals and biotech, it ensures the purity of vaccines, biologics, and other formulations. Industrial operations, including chemical manufacturing and petrochemicals, rely on clarification to maintain product consistency and prevent downstream equipment fouling. Wastewater treatment plants use centrifuge-based clarification to meet environmental discharge regulations, reducing turbidity and improving water reuse potential. Centrifuges are preferred for fluid clarification due to their high throughput, precision, and ability to handle varying feed conditions without requiring large filter media replacements, unlike traditional filtration methods. Medium- and high-speed centrifuges are particularly effective in separating micron-sized particles, delivering consistent performance even with variable solid loads. Moreover, advancements in automated controls, continuous operation capabilities, and CIP (clean-in-place) systems have made centrifuge-based clarification more efficient, hygienic, and cost-effective. The versatility of clarification applications—ranging from large-scale industrial processing to specialized high-purity laboratory requirements—ensures continuous demand in both developed and emerging markets. As industries increasingly focus on quality assurance, sustainable operations, and meeting strict regulatory standards, the role of centrifuge-based fluid clarification becomes even more significant. Its broad applicability, ability to integrate seamlessly into existing production lines, and consistent return on investment reinforce fluid clarification’s dominance as the largest application segment in the global centrifuge market, ensuring steady growth and widespread adoption across diverse end-use sectors.

Centrifuge Market, by End-use Industry

The pharmaceutical industry holds the largest share of the centrifuge market due to its critical reliance on precise, high-quality separation processes in drug manufacturing, biotechnology, and vaccine production. Centrifuges are indispensable in pharmaceutical operations for applications such as cell harvesting, protein purification, plasma separation, vaccine clarification, and removal of impurities from active pharmaceutical ingredients (APIs). The rise of biologics, biosimilars, and personalized medicines has further intensified the need for advanced centrifuge systems capable of handling sensitive biological materials while maintaining sterility and compliance with stringent Good Manufacturing Practices (GMP) and regulatory standards from agencies like the FDA and EMA. The sector’s rapid growth, fueled by increasing global healthcare demand, an aging population, and expanding R&D investments, continues to drive the adoption of centrifuge technologies. Moreover, post-pandemic expansion in vaccine manufacturing and therapeutic biologics has significantly boosted demand for high-throughput, automated, and contamination-free centrifuge solutions. Pharmaceutical companies prioritize equipment that ensures reproducibility, scalability, and ease of cleaning, making centrifuges with features such as clean-in-place (CIP) systems, automated controls, and robust safety mechanisms particularly attractive. Compared to other industries, pharmaceuticals require the highest degree of precision, sterility, and regulatory compliance, which elevates the importance of centrifuge technology in their manufacturing workflows. Additionally, continuous innovation in downstream processing, coupled with the industry’s ongoing shift toward single-use and modular systems, creates opportunities for centrifuge manufacturers to deliver tailored solutions. While food & beverage, chemicals, oil & gas, and wastewater sectors also rely heavily on centrifuges, the pharmaceutical industry’s consistent demand, higher value-added applications, and willingness to invest in cutting-edge separation technologies ensure it remains the dominant end-use segment in terms of revenue share. This combination of stringent quality requirements, market growth drivers, and technological alignment firmly establishes pharmaceuticals as the largest contributor to the global centrifuge market.

REGION

Asia Pacific to be fastest-growing region in global centrifuge market during forecast period

Asia Pacific holds the largest share of the centrifuge market due to rapid industrialization, expanding manufacturing capabilities, and strong growth across key end-use industries such as pharmaceuticals, biotechnology, food and beverage, chemicals, and wastewater treatment. Countries like China, India, Japan, and South Korea are major hubs for pharmaceutical production, vaccine manufacturing, and biotech research, driving significant demand for advanced centrifuge technologies. Rising healthcare investments, coupled with government initiatives to strengthen domestic drug manufacturing and water treatment infrastructure, further boost adoption. The region’s rapidly growing population and urbanization create substantial demand for clean water, processed foods, and healthcare services, all of which rely on centrifuge-based separation processes. Additionally, Asia Pacific is witnessing significant oil and gas exploration, petrochemical processing, and mining activities, further increasing industrial centrifuge usage. Lower manufacturing costs, availability of skilled labor, and strong supply chain networks make the region a preferred location for global centrifuge producers to set up production and distribution facilities. Technological advancements and increasing adoption of automation in process industries also enhance market penetration. This combination of diverse industrial demand, favorable economic conditions, and strategic manufacturing advantages ensures Asia Pacific’s leading position in the global centrifuge market, with continued strong growth potential in the coming years.

Centrifuge Market: COMPANY EVALUATION MATRIX

The centrifuge market is characterized by a mix of stars, emerging leaders, participants, and pervasive players. The chart highlights Alfa Laval as a strong market leader in terms of both market share and product footprint, occupying the "Stars" quadrant. Several smaller players cluster in the "Participants" and "Emerging Leaders" zones, reflecting niche positioning or early-stage growth potential, with SPX Flow positioned as a notable emerging leader due to its focus on high-value process solutions and expanding presence in food, beverage, and industrial applications. Overall, market dynamics suggest strong competition, with global giants driving innovation while smaller companies strive for differentiation and market penetration.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.48 Billion |

| Market Forecast in 2030 (Value) | USD 0.63 Billion |

| Growth Rate | 4.7% |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, South America, Europe, Asia Pacific, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Centrifuge Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Centrifuge Manufacturer | Competitor profiles (financials, R&D focus, product portfolios: primary equipment, secondary equipment, tertiary equipment), Customer landscape mapping by end-use (residential, commercial, industrial), Partnership ecosystem analysis | Identify supply chain blind spots - Detect customer migration to alternative suppliers - Highlight untapped customer clusters for market entry - Strengthening forward integration with advanced treatment technologies |

| Water Recycle and Reuse Equipment Supplier | Benchmarking global & regional installed treatment capacities - Regulatory & sustainability policies specific to end-users - Processing & manufacturing constraints | Pinpoint high-value opportunities in centrifuge applications - Enable targeting of Tier-1 customers with tailored equipment |

RECENT DEVELOPMENTS

- March 2025 : GEA entered a technology partnership with Rock Tech Lithium Inc. to supply centrifuge-based crystallization and zero-liquid discharge systems for a lithium converter in Guben, Germany. The agreement followed successful test work, paving the way for the procurement of decanters to support lithium processing for battery production. This partnership expands GEA’s centrifuge applications into the chemical and energy storage sectors, leveraging its separation technology expertise.

- March 2024 : GEA launched the ecoclear i bacteria removal separator, a skid-mounted centrifuge designed for small to medium-sized dairies. This separator efficiently removes bacteria and spores from milk, ensuring product safety and quality with low energy consumption. Its compact design allows seamless integration into existing dairy processes, supporting sustainable production by minimizing waste. The launch underscores GEA’s commitment to innovative, eco-friendly centrifuge solutions tailored to the food and beverage industry.

- July 2023 : Andritz introduces decanter centrifuges tailored to challenging industrial oil recovery. These three-phase decanter centrifuges can separate liquids from solids and liquids with different densities of oil and water. These robust machines are designed for use in both ATEX Zone 1 and 2 areas.

- January 2023 : Alfa Laval has developed new biofuel-ready separators for the marine industry that effectively clean biofuels such as HVO (hydrotreated vegetable oil) and FAME (fatty acid methyl ester). These separators help prevent performance issues and costly engine wear. Additionally, the company is introducing guided vehicles (AGVs) that offer improved durability, performance, and static dissipation.

Table of Contents

Methodology

The study involved four major activities in estimating the size of the centrifuge market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The centrifuge market comprises several stakeholders in the value chain, including raw material suppliers, manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the centrifuge market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the centrifuge market industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, speed, rotor type, capacity, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of centrifuge and future outlook of their business which will affect the overall market.

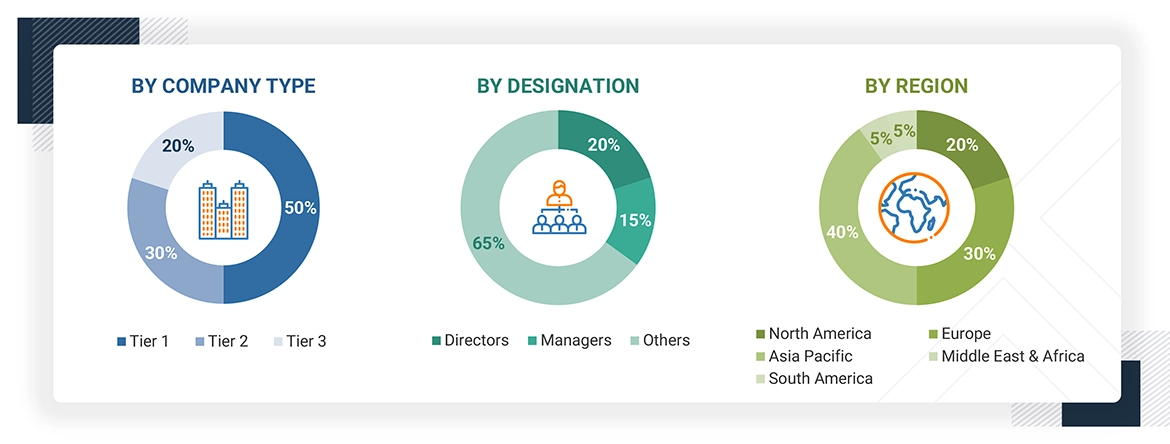

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for the centrifuge market. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research

- The supply chain of the industry has been determined through primary and secondary research

- All percentage shares, splits, and breakdowns based on type, speed, rotor type, capacity, application, end-use industry, and region were determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis, and presented in this report

Data Triangulation

After arriving at the total market size from the estimation process above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources: the top-down approach, the bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The centrifuge market encompasses the global industry involved in the design, manufacturing, distribution, and servicing of equipment that uses centrifugal force to separate substances of different densities, typically solids from liquids or liquids of varying densities. Centrifuges are widely used in industries such as pharmaceuticals, biotechnology, food and beverage, chemicals, oil and gas, and wastewater treatment. Market offerings range from laboratory-scale units for research and diagnostics to large industrial systems for high-volume processing. Growth is driven by increasing demand for efficient separation processes, technological advancements, regulatory compliance needs, and expanding applications across both developed and emerging economies.

Stakeholders

- Centrifuge Manufacturers

- Centrifuge Traders, Distributors, and Suppliers

- Raw Material Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the centrifuge market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, speed, rotor type, capacity, application, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as product launches, expansions, investments, collaborations, partnerships, and announcements in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What are the factors influencing the growth of the centrifuge market?

The centrifuge market is propelled by increasing demand for centrifuges in processing industries, intensive exploration of oil & gas, and increased deployment of advanced technologies in centrifuges.

What are centrifuges?

The centrifuge market encompasses the global industry involved in the design, manufacturing, distribution, and servicing of equipment that uses centrifugal force to separate substances of different densities. Applications span pharmaceuticals, biotechnology, food and beverage, chemicals, oil and gas, and wastewater treatment. Growth drivers include demand for efficient separation, technological advances, and expanding industrial applications.

Which region is expected to have the largest market share in the centrifuge market?

The Asia Pacific region accounts for the largest share of the centrifuge market during the forecast period.

Who are the key market players covered in the report?

The key players in this market are ALFA LAVAL (Sweden), GEA Group Aktiengesellschaft (Germany), ANDRITZ (Austria), FLSmidth A/S (Denmark), KUBOTA Corporation (Japan), Flottweg SE (Germany), SPX FLOW, Inc. (US), Mitsubishi Kakoki Kaisha, Ltd. (Japan), Ferrum AG (Switzerland), and SIEBTECHNIK GmbH (Germany).

What is the size of the centrifuge market?

The centrifuge market is projected to grow from USD 0.50 billion in 2025 to USD 0.63 billion by 2030, at a CAGR of 4.7%.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Centrifuge Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Centrifuge Market