Ceramic Tube Market by Material Type (Alumina and Zirconia), Application (Electronics and Electrical and Medical and Healthcare), and Region (North America, South America, Asia-Pacific, Middle East and Africa, and Europe) - Global Forecast to 2022

[157 Pages Report] The global ceramic tube market is estimated to be USD 641.2 Million in 2016 and is expected to grow at a CAGR of 7.52%, from 2017 to 2022. This growth can be attributed to the increased demand for electrical transmission and distribution equipment and the replacement and refurbishment of existing power infrastructure.

The years considered for the study are as follows:

- Base Year: 2016

- Estimated Year: 2017

- Projected Year: 2022

- Forecast Period: 2017 to 2022

The base year considered for company profiles is 2016. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, describe, and forecast the global ceramic tube market by material type, application type, and region

- To provide detailed information regarding the major factors influencing the growth of the ceramic tube market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future prospects, and contribution of each segment to the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as contracts & agreements, partnerships, and collaborations in the market

Research Methodology

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global ceramic tube market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, standards and certification organizations of companies, and organizations related to all the segments of this industry’s value chain. The research methodology has been explained below.

- Study of annual revenues and market developments of the major players that provide ceramic tube

- Analysis of the major raw materials providers for ceramic tube

- Assessment of future trends and growth of end-users in the ceramic tube market

- Assessment of the market

- with respect to the type of ceramic tube used by various end-users in various applications

- Study of the market trends in various regions or countries supported by the type of ceramic tube

- Study of contracts & developments related to the market by key players across different regions

- Finalization of the overall market sizes by triangulating the supply-side data, which includes product developments, supply chain, and annual revenues of companies manufacturing ceramic tube across the globe

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below illustrates the breakdown of primaries conducted during the research study on the basis of company type, designation, and region

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

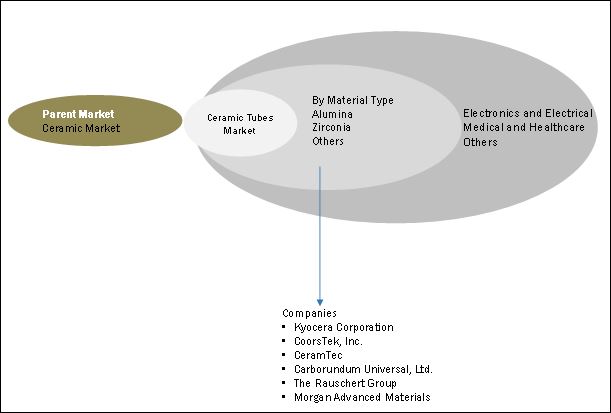

The ecosystem of ceramic tube market starts with the parent ceramic market which is further categorized, by shape, into the ceramic tube market, ceramic plate market, and others. The market is segmented, by material type, into alumina, zirconia, and others. It has been further categorized into the metallized alumina and zirconia ceramic tube subsegment and the non-metallized alumina and zirconia tubes subsegment. These tubes are mainly used as the enveloping material for vacuum interrupters, power grid tubes, X-ray tubes, thermocouple insulators, and spark plugs, among others.

Target Audience:

The report’s target audience includes:

- Ceramic tube manufacturing companies

- Raw material suppliers

- Institutional investors

- Associations

- Government and research organizations

- National and local government organizations

Scope of the Report:

The market has been segmented as follows.

On the basis of Material Type

- Alumina

- Zirconia

- Others

On the basis of Application

- Electronics and Electrical

- Medical and Healthcare

- Others

(The report also covers the end-use application of vacuum interrupters)

On the basis of Region

- North America

- South America

- Asia-Pacific

- Middle East & Africa

- Europe

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

Further breakdown of region/country-specific analyses

Company Information

Detailed analyses and profiling of additional market players (up to five)

The global ceramic tube market is expected to grow at a CAGR of 7.52%, from 2017 to 2022, to reach a projected USD 993.3 Million by 2022. The growth will be mainly driven by an increase in the demand for power equipment such as vacuum interrupters and capacitors.

The report segments the ceramic tube market, on the basis of material type, into alumina, zirconia, and others, which includes silicates, aluminum titanate, aluminum nitride, silicon carbide, and boron nitride. The alumina ceramic tube segment led the ceramic tube market, by material type, and is used in electrical and thermal insulation applications such as thermocouples, vacuum interrupters, spark plugs, and capacitors. The alumina tube segment is also the fastest growing market due to the comparatively low-cost and high durability of the tubes. The market, by material type, has also been segmented into metallized and non-metallized. Metallized ceramics are ones that are brazed or joined with metal for strengthening the ceramic tube and are used mainly in electrical power equipment. Non-metalized ceramic tube are not brazed with metal or any other material.

The global ceramic tube market, by application, is segmented into electronic and electrical, medical and healthcare, and other, which includes spark plugs. Electronic and electrical applications include vacuum interrupters, power grid tubes, insulators, and capacitors. The growing demand for renewable energy as well the increasing demand for power transmission and distribution equipment is driving the electronic and electrical segment. The medical and healthcare application segment includes ceramic tube used in X-ray tubes for insulation while the others segment includes spark plugs where ceramic tube are used as insulating envelopes.

The report further segments the electronic and electrical applications segment into the end-use of vacuum interrupters in various power equipment. The vacuum interrupter segment has been segmented, by end-use, into circuit breakers, contactors, re-closers, load break switches, and tap changers. The market for ceramic tube for vacuum interrupter is mainly driven by the growing demand for power equipment, especially in countries such as China, India, and the U.S. The re-closers and circuit breakers markets are expected to grow at a relatively high CAGR from 2017 to 2022. The stringent environmental norms for SF6 -based circuit breakers is one of the primary factors that are expected to drive the vacuum interrupter-based circuit breakers market, from 2017 to 2022.

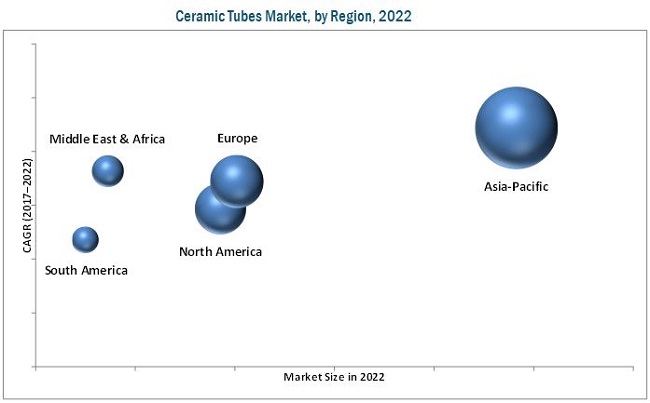

The market in Asia-Pacific is the largest, by size, and is estimated to grow at the highest rate due to rapid demand for power transmission and distribution equipment in China. Increased investments in the manufacturing sector combined with power generation infrastructure in China, India, and other fast-growing emerging economies in the region, such as Indonesia, has led to a surge in the demand for vacuum interrupters, capacitors, and insulators, thus, driving the ceramic tube market in the region. Increased investments in the manufacturing of automotive parts such as spark plugs in China, Japan, and India is further expected to drive the market for ceramic tube.

The major factor restraining the growth of the ceramic tube market is the rising energy costs associated with the manufacture of ceramic tube. The ceramic industry is an energy-intensive industry and energy costs contribute to nearly a third of the manufacturing costs. A majority of the ceramic tube manufacturers rely on natural gas as the main energy source and the high volatility in natural gas prices has become a major restraining factor affecting the growth of the market.

The market is dominated by a few international players that hold a major share of the global ceramic tube market. The major suppliers of ceramic tube include Kyocera Corporation (Japan), CeramTec GmbH (Germany), CoorsTek, Inc. (U.S.), Morgan Advanced Materials (U.K.), and Carborundum Universal, Ltd. (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Countries Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approcah

2.2.2 Top-Down Approcah

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Ceramic Tube Market Overview

4.2 Ceramic Tube Market, By Application

4.3 Ceramic Tube Market, By Application & Region

4.4 Ceramic Tube Market, By Material Type

5 Market Overview (Page No. - 34)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Increasing Demand for Power Transmission and Distribution Equipment

5.1.1.2 Replacement and Refurbishment of Existing Power Infrastructure

5.1.1.3 Stringent Environmental Norms for Sf6-Based Circuit Breakers

5.1.2 Restraints

5.1.2.1 Rising Energy Costs for Ceramic Manufacturing

5.1.2.2 Availability of Raw Materials and Volatility of Prices

5.1.3 Opportunities

5.1.3.1 Increasing Share of Renewable Energy

5.1.4 Challenges

5.1.4.1 Low-Cost Competition From Emerging Markets

6 Ceramic Tube Market, By Material Type (Page No. - 40)

6.1 Introduction

6.2 Alumina

6.3 Zirconia

6.4 Other Material Types

7 Ceramic Tube Market, By Application (Page No. - 45)

7.1 Introduction

7.2 Ceramic Tube Market for Electronic and Electrical

7.3 Ceramic Tube Market for Medical & Healthcare

7.4 Ceramic Tube Market for Others

8 Ceramic Tube for Vacuum Interrupter Market, By End-Use (Page No. - 50)

8.1 Introduction

8.2 Circuit Breakers: Ceramic Tube Market for Vacuum Interrupter

8.3 Contactors: Ceramic Tube Market for Vacuum Interrupter

8.4 Re-Closers: Ceramic Tube Market for Vacuum Interrupter

8.5 Load Break Switches: Ceramic Tube Market for Vacuum Interrupter

8.6 Tap Changers: Ceramic Tube Market for Vacuum Interrupter

9 Ceramic Tube Market, By Region (Page No. - 57)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 By Material Type

9.2.2 By Application

9.2.3 By End-Use, Vacuum Interrupters

9.2.4 By Country

9.2.4.1 China

9.2.4.2 Japan

9.2.4.3 South Korea

9.2.4.4 India

9.2.4.5 Rest of Asia-Pacific

9.3 Europe

9.3.1 By Material Type

9.3.2 By Application

9.3.3 By End-Use, Vacuum Interrupters

9.3.4 By Country

9.3.4.1 Germany

9.3.4.2 U.K.

9.3.4.3 France

9.3.4.4 Russia

9.3.4.5 Italy

9.3.4.6 Rest of Europe

9.4 North America

9.4.1 By Material Type

9.4.2 By Application

9.4.3 By End-Use, Vacuum Interrupters

9.4.4 By Country

9.4.4.1 U.S.

9.4.4.2 Canada

9.4.4.3 Mexico

9.5 The Middle East & Africa

9.5.1 By Material Type

9.5.2 By Application

9.5.3 By End-Use, Vacuum Interrupters

9.5.4 By Country

9.5.4.1 South Africa

9.5.4.2 Saudi Arabia

9.5.4.3 United Arab Emirates (U.A.E.)

9.5.4.4 Rest of the Middle East & Africa

9.6 South America

9.6.1 By Material Type

9.6.2 By Application

9.6.3 By End-Use, Vacuum Interrupters

9.6.4 By Country

9.6.4.1 Brazil

9.6.4.2 Argentina

9.6.4.3 Rest of South America

10 Competitive Landscape (Page No. - 84)

10.1 Overview

10.2 Market Ranking, 2016

10.3 Competitive Situation & Trends

10.3.1 Competitive Leadership Mapping

10.3.2 Visionary Leaders

10.3.3 Innovators

10.3.4 Dynamic Differentiators

10.3.5 Emerging Companies

10.4 Strength of Product Portfolio (For All 25 Players)

10.5 Interviews, and Marketsandmarkets Analysisbusiness Strategy Excellence (For All 25 Players)

11 Company Profiles (Page No. - 92)

(Overview, Strength of Product Portfolio , Business Strategy Excellence , Products Offering, Recent Development’s, Business Strategy)*

11.1 Morgan Advanced Materials

11.2 Kyocera Corporation

11.3 Carborundum Universal, Ltd.

11.4 NGK Spark Plug Co., Ltd.

11.5 Ceramtec

11.6 HP Technical Ceramics

11.7 Coorstek, Inc.

11.8 Xiamen Innovacera Advanced Materials Co., Ltd.

11.9 Texers Technical Ceramics

11.10 Precision Ceramics

11.11 TQ Abrasive Machining

11.12 The Rauschert Group

11.13 Mantec Technical Ceramics

11.14 International Syalons

11.15 C-Mac International, LLC

11.16 Ortech Advanced Ceramics

11.17 Mcdanel Advanced Ceramic Technologies, LLC

11.18 LSP Industrial Ceramics, Inc.

11.19 Insaco, Inc.

11.20 China Southern Advanced Ceramic Technology Co., Ltd.

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Products Offering, Recent Development’s, Business Strategy Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 148)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (60 Tables)

Table 1 Global Ceramic Tube Market Snapshot

Table 2 Ceramic Tube Market, By Material Type, 2015–2022 (USD Million)

Table 3 Alumina Market, By Region, 2015–2022 (USD Million)

Table 4 Alumina Market, By Type, 2015–2022 (USD Million)

Table 5 Zirconia Market, By Region, 2015–2022 (USD Million)

Table 6 Zirconia Market, By Type, 2015–2022 (USD Million)

Table 7 Other Material Types Market, By Region, 2015–2022 (USD Million)

Table 8 Ceramic Tube Market, By Application, 2015–2022 (USD Million)

Table 9 Electrical & Electronic: Ceramic Tube Market Size, By Equipment, 2015–2022 (USD Million)

Table 10 Electrical & Electronic: Ceramic Tube Market Size, By Region, 2015–2022 (USD Million)

Table 11 Medical & Healthcare: Market Size, By Region, 2015–2022 (USD Million)

Table 12 Others: Market Size, By Region, 2015–2022 (USD Million)

Table 13 Ceramic Tube Market for Vacuum Interrupter, Market Size, By End-Use, 2015–2022 (USD Million)

Table 14 Circuit Breaker: Market for Vacuum Interrupter, Market Size, By Region, 2015–2022 (USD Million)

Table 15 Contactors: Market for Vacuum Interrupter, Market Size, By Region, 2015–2022 (USD Million)

Table 16 Re-Closers: Market for Vacuum Interrupter, Market Size, By Region, 2015–2022 (USD Million)

Table 17 Load Break Switches: Market for Vacuum Interrupter, Market Size, By Region, 2015–2022 (USD Million)

Table 18 Tap Changers: Market for Vacuum Interrupter, Market Size, By Region, 2015–2022 (USD Million)

Table 19 Ceramic Tube Market Size, By Region, 2015–2022 (USD Million)

Table 20 Asia-Pacific: Ceramic Tube Market Size, By Material Type, 2015–2022 (USD Million)

Table 21 Asia-Pacific: By Market Size, By Application, 2015–2022 (USD Million)

Table 22 Asia-Pacific: By Market for Vacuum Interrupters, Market Size, By End-Use, , 2015–2022 (USD Million)

Table 23 Asia-Pacific: By Market Size, By Country, 2015–2022 (USD Million)

Table 24 China: Ceramic Tube Market Size, By Application, 2015–2022

Table 25 Japan: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 26 South Korea: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 27 India: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 28 Rest of Asia-Pacific: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 29 Europe: Ceramic Tube Market Size, By Material Type, 2015–2022 (USD Million)

Table 30 Europe: By Market Size, By Application, 2015–2022 (USD Million)

Table 31 Europe: By Market for Vacuum Interrupters, Market Size, By End-Use, , 2015–2022 (USD Million)

Table 32 Europe: By Market Size, By Country, 2015–2022 (USD Million)

Table 33 Germany: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 34 U.K.: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 35 France: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 36 Russia: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 37 Italy: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 38 Rest of Europe: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 39 North America: Ceramic Tube Market Size, By Material Type, 2015–2022 (USD Million)

Table 40 North America: By Market Size, By Application, 2015–2022 (USD Million)

Table 41 North America: By Market for Vacuum Interrupters, Market Size, By End-Use, 2015–2022 (USD Million)

Table 42 North America: Ceramic Tube Market Size, By Country, 2015–2022 (USD Million)

Table 43 U.S.: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 44 Canada: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 45 Mexico: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 46 The Middle East & Africa: Ceramic Tube Market Size, By Material Type, 2015–2022 (USD Million)

Table 47 The Middle East & Africa: By Market Size, By Application, 2015–2022 (USD Million)

Table 48 Middle East & Africa: Ceramic Tube Market for Vacuum Interrupters, Market Size, By End-Use, 2015–2022 (USD Million)

Table 49 The Middle East & Africa: Ceramic Tube Market Size, By Country, 2015–2022 (USD Million)

Table 50 South Africa: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 51 Saudi Arabia: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 52 U.A.E.: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 53 Rest of the Middle East & Africa: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 54 South America: Ceramic Tube Market Size, By Material Type, 2015–2022 (USD Million)

Table 55 South America: By Market Size, By Application, 2015–2022 (USD Million)

Table 56 South America: By Market for Vacuum Interrupters, Market Size, By End-Use, 2015–2022 (USD Million)

Table 57 South America: By Market Size, By Country, 2015–2022 (USD Million)

Table 58 Brazil: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 59 Argentina: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

Table 60 Rest of South America: Ceramic Tube Market Size, By Application, 2015–2022 (USD Million)

List of Figures (30 Figures)

Figure 1 Ceramic Tube Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Ceramic Tube Market in Asia-Pacific is Expected to Grow With Highest CAGR During the Forecast Period

Figure 7 Alumina is Projected to Dominate the Ceramic Tube Market During the Forecast Period

Figure 8 Increasing Investment in Transmission & Distribution Network is Expected to Drive the Ceramic Tube Market

Figure 9 Electronic & Electrical Segment is Expected to Lead the Ceramic Tube Market

Figure 10 Asia-Pacific Accounted for the Highest Market Share in 2016 & is Expected to Grow With the Highest CAGR During the Forecast Period

Figure 11 Alumina is Dominating the Global Ceramic Tube Market, By Material Type (2016)

Figure 12 The U.S.: Investments in Power Transmission, 2010–2016

Figure 13 U.S.: Investments in Power Transmission, 2010–2016

Figure 14 Investments in Renewable Energy, 2012–2016

Figure 15 Ceramic Tube Market, By Material Type, 2017 & 2022 (USD Million)

Figure 16 Ceramic Tube Market, By Application, 2017 & 2022 (USD Million)

Figure 17 Ceramic Tube Market for Vacuum Interrupter, By End-Use, 2017 & 2022 (USD Million)

Figure 18 Asia-Pacific is Estimated to Hold the Lion’s Share of the Ceramic Tube Market in 2017

Figure 19 Regional Snapshot: Asia-Pacific Offered Attractive Market Opportunities in 2016

Figure 20 Regional Snapshot: Europe Offered Attractive Market Opportunities in 2016

Figure 21 Companies Adopted Expansions & Investments and Mergers & Acquisitions as Key Growth Strategy 2014–2017

Figure 22 Market Ranking for Ceramic Tube , 2016

Figure 23 Market Evaluation Framework, 2014–2017

Figure 24 Battle for Market Share (2014–2017): Expansions & Investments Was the Key Strategy Adopted By the Players in the Ceramic Tube Market

Figure 25 Competitive Leadership Mapping: Ceramic Tube Market

Figure 26 Morgan Advanced Materials: Company Snapshot

Figure 27 Kyocera Corporation: Company Snapshot

Figure 28 Carborundum Universal, Ltd.: Company Snapshot

Figure 29 NGK Spark Plug Co., Ltd.: Company Snapshot

Figure 30 Ceramtec: Company Snapshot

Growth opportunities and latent adjacency in Ceramic Tube Market