Chlor-Alkali Market by Type (Caustic Soda (Alumina, Chemicals, Textiles, Soaps & Detergents), Chlorine (EDC/PVC, Isocyanates, Propylene Oxide, C1/C2 Aromatics), Soda Ash (Glass, Water Treatment, Metallurgy, Pulp & Paper)), Region - Global Forecast to 2026

Updated on : August 07, 2024

Chlor-Alkali Market

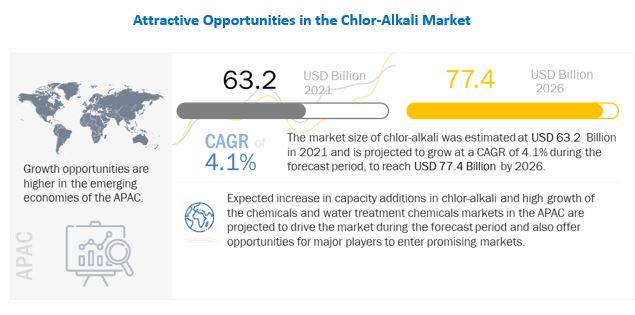

Chlor-alkali market was valued at USD 63.2 billion in 2021 and is projected to reach USD 77.4 billion by 2026, growing at a cagr 4.1% from 2021 to 2026. The rising demand for organic and inorganic chemicals and increasing manufacturing sector output is leading to the growth of the APAC chlor-alkali market. Moreover, increasing investments for the expansion of production facilities in China, India, and ASEAN countries are expected to, in turn, drive demand in the chlor-alkali market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global Chlor-Alkali market

In 2020, the Chlor-Alkali market saw a dip in growth rate due to COVID-19 and the consequent lockdown across the world. The COVID-19 pandemic has severely impacted North American and European countries. Several manufacturing activities have been suspended as a preventive measure. Disruptions in supply chains impacted the chlor-alkali and other end-use industries, and demand declined by over 5% in a majority of the applications. Several expansion projects across the globe have been suspended, which has resulted in a decline in demand for chlor-alkali. The demand for the chemicals, organic, and inorganic chemicals declined significantly across the globe. To mitigate the impact, several chemical companies in North America and Europe are channelizing focus on operational efficiency, cost management, and asset optimization. Key players are also focusing on long-term opportunities such as emerging applications, investing in innovations, studying customer buying behavior patterns, and adopting new business models that help generate sustained growth, among others. Due to the pandemic, various building construction and infrastructural projects were suspended or postponed across the globe. Therefore, the demand for PVC declined across the globe, which, in turn, impacted the chlorine market. Decline in automotive industry further reduced the demand for glass and polymers. Moreover, water treatment projects were either rescheduled or suspended, which, in turn, will have a significant impact on the market.

Chlor-Alkali Market Dynamics

Driver: Steady Growth of Chemical industry across the globe to drive demand

Chlor-alkali products such as chlorine, caustic soda, and soda ash play a vital role in the chemical industry. These products are necessary raw materials in major bulk chemical industries and utilized in various industrial and manufacturing value chains. The products are used in different applications such as plastics, alumina, paper & pulp, and others and find applications in diverse end-use industries (construction, automotive, and others). Thus, rising chemical output and strong economic conditions in emerging countries are expected to drive the growth of the chlor-alkali market.

According to the European Chemical Industry Council (Cefic), in 2019, the global sale of chemicals was worth USD 4,108 billion. China dominates the sales of chemicals, followed by the European Union and the US. The sales of chemicals are expected to reach USD 6.9 trillion by 2030. Chlor-alkali products being one of the key raw materials for various products in the chemical industry, high demand is expected to further drive demand.

- According to PlasticsEurope, global plastic production in 2019 was 368 million tons. APAC dominated the market accounting for 51% of the global production.

- PVC is utilized in the construction, electronics, healthcare, automotive, packaging, and other end-use industries. Its low cost and desirable physical & mechanical properties make it a suitable material was various applications. In 2019, the demand for PVC in Europe was approximately five million tons, which accounted for 10% of the overall production of plastic in Europe.

- There is high growth in the construction sector in the US, China, and India. In 2019, the contribution of construction to the GDP of India, the US, and China was approximately 9%, 6%, and 7% respectively.

- Recovery of the automotive sector is expected to drive the demand for PVC, aluminum, and other materials in the automotive industry which is expected to further drive the market for chlor-alkali products

Restraints: Environmental impact of chlor-alkali products

Environmental impact of the chlor-alkali industry is one of the restraining factors for the market. As chlorine is highly toxic, its leakage and discharge in the environment are closely monitored. The presence of dioxin in pulp- and paper-based products and chlorinated organic compounds in pulp mill effluents are serious concerns for environmental safety. Chlorine derivatives also have harmful effects as these are responsible for ozone layer depletion and thus utilization is being restricted. The mercury cell process, if used for the manufacture of chlorine and caustic soda, emits mercury through the discharge, which, if not treated before disposing to the environment, can poison freshwater resources. According to Euro Chlor, European chlor-alkali industries phased out the mercury cell process by 2019, which is expected to lead to some capacity shutdowns.

Another issue is observed in the use of asbestos as a separator material in the diaphragm cell technology, which causes lung cancer. The USEPA has imposed a ban on the use of asbestos-based separators in the diaphragm cell technology due to this threat. High concentration of caustic soda in water bodies has a negative impact on aquatic life. The United States Environmental Protection Agency (EPA), REACH, and other regulating bodies regulate the production and utilization of these products. The synthetic soda ash manufacturing process leads to environmental issues because of the effluents discharged, which contain highly visible pollutants. All these aforesaid concerns act as restraints for the growth of the chlor-alkali market.

Opportunity: Emerging countries offer significant growth opportunities

The growing industrialization in emerging economies such as China, India, South Korea, Indonesia, Thailand, Taiwan, Mexico, Brazil, and Argentina is expected to drive the chlor-alkali market during the next five years. The high demand from the packaging, building & construction, consumer goods, and automotive applications in these countries increases the need for plastics, aluminum, and others used in these applications. Government policies supporting the growth of industries, low labor costs, skilled workforces, availability of raw materials, and increasing urbanization have enabled domestic and foreign companies to establish their facilities in these countries. The growth of the manufacturing industry in Malaysia, Vietnam, Colombia, and Chile is also expected to fuel market growth.

The market for plastics is dominated by the US, China, India, and Germany, among others. Brazil, China, South Africa, and Argentina, among other emerging countries, offer significant growth opportunities for the chlor-alkali market. Increasing economic activities such as rapid industrialization and urbanization are driving the demand for plastics in emerging countries. For instance, the construction industry contributes 10.0% to India’s GDP. End-use industries including automobile, construction, packaging, consumer goods, and medical & pharmaceutical are rapidly growing in these countries.

The GDP of these emerging economies acts as a major indicator for the growth of the chlor-alkali market, as it represents the growth of the economy and per capita consumption. Due to the increase in GDP, the per capita income and spending power of the population also increases, which results in higher per capita plastic consumption in these countries. Thus, the growth of the demand for chlor-alkali can be attributed to the increasing per capita plastic consumption, which, in turn, is providing opportunities to market players in these countries.

In recent years, the chemical industry has witnessed high growth in emerging regions and steady growth in developed/mature markets. Industry participants are keen on addressing the needs/demands of growing economies. Global players have adopted expansion strategies to enhance their production capacities. Key market players are adopting expansions and joint ventures strategies to enhance their market competitiveness and increase penetration in different regions. Chemical industries in the US and Europe are mature and their growth is largely influenced by the GDP growth of these regions. The trend in rapid industrialization, supported by strong demand due to improving standards of living, significant population base, and available pools of workforces in the APAC, Middle East & Africa, and South America has led companies to establish their facilities in these regions and cater to regional demands.

Challenges: Transportation and storage of chlorine

Chlorine is a highly toxic chemical which causes irritation in the respiratory system if inhaled. Exposure to concentrated amounts causes eye irritation, vomiting, coughing, choking sensation, and lung irritation. Prolonged chlorine exposure can also lead to acute respiratory distress syndrome, inflammation of the lungs from breathing in chemical fumes, and even death. It is a strong oxidizer which may react with flammable materials. Chlorine has to be converted into liquid under pressure for transportation; even a small puncture can cost lives because of the above-mentioned properties. To avoid transportation issues, market players are establishing integrated chlor-alkali facilities.

EDC/PVC application in Chlorine account for the largest share.

The EDC/PVC is the largest segment by applications for the Chlorine in Chlor-alkali market. Ethylene dichloride (EDC) is produced by the catalyzed chlorination of ethylene in the presence of ferric chloride (FeCl3) as the catalyst. Vinyl chloride monomer, along with anhydrous hydrochloric acid, is produced by the decomposition of ethylene dichloride at high temperatures. Vinyl chloride is an intermediate in the vinyl chain which is highly toxic and cannot be used in its monomer form. It has to be converted into a polymer. This vinyl chloride monomer is fed into polymerization reactors, wherein the polymerization reaction takes place to provide polyvinyl chloride (PVC). The PVC industry finds major applications in the construction, electronics, healthcare, automotive, packaging, and other end-use industries. Its low cost and desirable physical & mechanical properties make it a suitable material was various applications. Growth in PVC industry further expects to drive the demand for chlorine in chlor-alkali market.

Alumina application in Caustic Soda account for the largest share

The alumina is the largest segment by applications for the Caustic Soda in Chlor-alkali market. Caustic soda is used in the process for the extraction of aluminum from bauxite ore. It dissolves the bauxite ore which is the raw material in the production of aluminum. In this process, pure alumina is separated from the bauxite ore. The alumina collected is further subjected to calcination. APAC dominates the market, followed by North America and Europe. The demand for caustic soda is projected to be driven by the shifting base of industrial production to the APAC, the increasing population, and the rising demand for infrastructure.

Glass application in Soda Ash accounts for the largest share

The glass is the largest segment by applications for the Soda Ash in Chlor-alkali market. Soda ash is an essential component in the manufacture of glass. Glass is produced by melting silica soda ash (approximately 15% of the total weight of the glass) and calcium compounds along with coloring agents and metallic oxides. Various types of glass are available such as flat glass (including sheet glass, float glass, figured & wired glass, safety glass, and mirror), glass hollow wares & containers, vacuum flasks, laboratory glassware, and fiberglass. Glass products are widely used in the construction, automotive, packaging, household, laboratory, and other industrial applications. APAC is projected to drive the demand for soda ash in the glass application due to the high demand from emerging economies such as India, Indonesia, and Thailand where the construction and automotive sectors are growing.

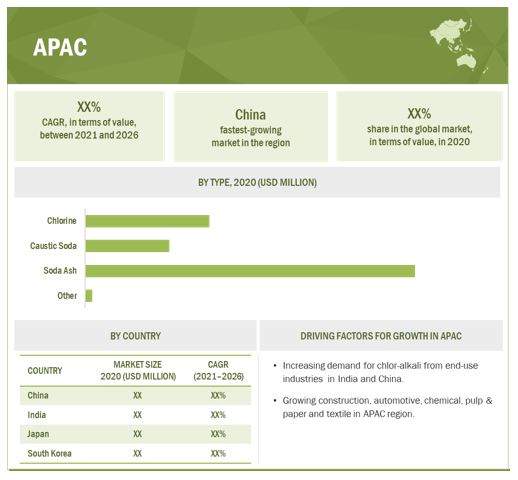

APAC is estimated to be the largest market for Chlor-Alkali.

APAC accounted for the largest share of the Chlor-Alkali market in 2020, followed by Europe and North America.

Growth is led by rapid industrialization, rising demand from various applications, and increasing government spending. Different industries are focusing on these emerging markets and increasing their footprints by setting up manufacturing facilities, distribution centers, and research & development centers. The APAC chlor-alkali market is expected to see a rising demand from the chemical, water treatment, PVC, glass, metallurgy, and soap & detergents, among other sectors. Chlor-Alkali manufacturer in the APAC region include Tata Chemicals Limited (India), Formosa Plastics Corporation (Taiwan), Tosoh Corporation (Japan), Hanwha Solutions Corporation (South Korea), Nirma Limited (India), AGC, Inc. (Japan), Xinjiang Zhongtai Chemical Co. Ltd. (China), and others.

Chlor-Alkali Market Players

The leading players in the Chlor-Alkali market are Olin Corporation(US), Westlake Chemical Corporation (US), Tata Chemicals Limited (India), Occidental Petroleum Corporation (US), Formosa Plastics Corporation (Taiwan), Solvay SA (Belgium), Tosoh Corporation (Japan), Hanwha Solutions Corporation (South Korea), Nirma Limited (India), AGC, Inc. (Japan), Dow Inc. (US), Xinjiang Zhongtai Chemical Co. Ltd. (China), INOVYN (UK), Ciner Resources Corporation (US), Wanhua-Borsodchem (Hungary), and others.

Read More: Chlor-Alkali Companies

Recent Developments

- In July 2021, Olin Corporation entered into an agreement with ASHTA Chemicals, Inc. (US) to buy and sell chlorine which is produced at ASHTA's Ohio facility in the US.

- In January 2021, Formosa Plastic Corporation announced the expansion of production facilities based in the US, Taiwan, and China.

- In December 2019, Tata Chemicals acquired 25% partnership interest in Tata Chemicals (Soda Ash) Partners Holdings from The Andover Group, Inc., a subsidiary of Owens-Illinois Inc. for USD 195 million. Through this, the company gained full ownership of Tata Chemicals (Soda Ash).

- In November 2018, Tata Chemicals announced an investment worth USD 350 million for the de-bottlenecking of the Mithapur facility which is expected to help increase the production capacity by 150 KT soda ash and 400 KT salt and help reduce the carbon footprint.

- In September 2018, AGC, Inc. planned to expand its chlor-alkali business in Thailand by increasing production capacity.

- In September 2018, AGC, Inc. planned to expand the PVC capacity for P.T. Asahimas Chemical (Indonesia), one of its subsidiaries to 750,000 tons.

- In February 2018, Westlake Chemical Corporation planned to expand the production capacities of chlor-alkali, PVC, and VCM at its facility in Germany and Louisiana, US.

Key Questions addressed by the report

- What was the market size of Chlor-Alkali and the estimated share of each region in 2021, in terms of volume and value?

- What will be the CAGR of the Chlor-Alkali market in all the key regions during the forecast period?

- What is the estimated demand for Chlor-Alkali in the various applications?

- Who are the major players in the market region-wise?

- What is the impact of the COVID-19 pandemic on the Chlor-Alkali market?

Chlor-Alkali Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 63.2 billion |

|

Revenue Forecast in 2026 |

USD 77.4 billion |

|

CAGR |

4.1% |

|

Years Considered |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Unit considered |

Value (USD Million), Volume (Kilotons) |

|

Segments |

Type, Application and Region |

|

Regions |

APAC, North America, Europe, Middle East & Africa and South America |

|

Companies |

The major players are, Olin Corporation(US), Westlake Chemical Corporation (US), Tata Chemicals Limited (India), Occidental Petroleum Corporation (US), Formosa Plastics Corporation (Taiwan), Solvay SA (Belgium), Tosoh Corporation (Japan), Hanwha Solutions Corporation (South Korea), Nirma Limited (India), AGC, Inc. (Japan), Dow Inc. (US), Xinjiang Zhongtai Chemical Co. Ltd. (China), INOVYN (UK), Ciner Resources Corporation (US), Wanhua-Borsodchem (Hungary), and others are covered in the Chlor-Alkali market. |

This research report categorizes the global Chlor-Alkali market on the basis of Type, Application, and Region.

On the basis of Type

-

Caustic Soda Market

- Alumina

- Inorganic Chemicals

- Organic Chemicals

- Food And Pulp & Paper

- Soaps & Detergents

- Textile

- Water Treatment

- Steel/Metallurgy - Sintering

- Others

-

Chlorine Market

- EDC/PVC

- Organic Chemicals

- Inorganic Chemicals

- Isocyanates

- Chlorinated Intermediates

- Propylene Oxide

- Pulp & Paper

- C1/C2 Aromatics

- Water Treatment

- Others

-

Soda Ash Market

- Glass

- Soaps & Detergents

- Chemicals

- Metallurgy

- Water Treatment

- Pulp & Paper

- Others

- Others (HCL)

On the basis of region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

- South America

The market has been further analyzed for the key countries in each of these regions.

Frequently Asked Questions (FAQ):

What is the major driver influencing the growth of the Chlor-Alkali market?

The major driver influencing the growth of Chlor-Alkali is the steady growth of Chemical industry across the globe.

How is the Chlor-Alkali market segmented by type?

The Chlor-Alkali market is segmented into Chlorine, Caustic Soda, Soda Ash, and others by type.

What is the major challenge in the Chlor-Alkali market?

Transportation and storage of chlorine is a major challenge in the Chlor-Alkali market.

How is the Chlroine market segmented by the application?

By application Chlorine market is segmented to EDC/PVC, Organic Chemicals, Inorganic Chemicals, Isocyanates, Chlorinated Intermediates, Propylene Oxide, Pulp & Paper, C1/C2/ Aromatics, Water Treatment, and Others.

What are the major opportunities in the Chlor-Alkali market?

Emerging countries offer significant growth opportunities is an opportunity for the Chlor-Alkali market.

How is the Caustic Soda market is segmented by applications?

By Application the Caustic Soda market is segmented into Alumina, Inorganic Chemicals, Organic Chemicals, Food and Pulp & Paper, Soaps & Detergents, Textiles, Water Treatment, Steel/Metallurgy – Sintering, and Others.

Which region has the largest market for Chlor-alkali?

APAC has the largest market for Chlor-Alkali owing to the increase in demand from India, China, and ASEAN countries.

How is the Soda Ash market is segmented by applications?

By Application the Soda Ash market is segmented into Glass, Soaps & Detergents, Chemicals, Metallurgy, Water Treatment, Pulp & Paper, and Others.

How market is segment for Chlor-Alkali by region?

On the basis of region the market is segmented into North America, Europe, APAC, Middle East & Africa and South America

What are Chlor-alkali manufacturing process?

Chlor-alkali products (caustic soda and chlorine) are manufactured majorly by using one of the three technologies—mercury cell, membrane, and diaphragm cell.

Who are the major manufacturers of Chlor-alkali?

The major manufacturers of Chlor-Alkali are Olin Corporation (US), Westlake Chemical Corporation (US), Tata Chemicals Limited (India), Occidental Petroleum Corporation (US), Formosa Plastics Corporation (Taiwan), Solvay SA (Belgium), Tosoh Corporation (Japan), Hanwha Solutions Corporation (South Korea), Nirma Limited (India), AGC, Inc. (Japan), Dow Inc. (US), Xinjiang Zhongtai Chemical Co. Ltd. (China), INOVYN (UK), Ciner Resources Corporation (US), Wanhua-Borsodchem (Hungary), and others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS IN REPORT

1.3 MARKET SCOPE

FIGURE 1 CHLOR-ALKALI MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

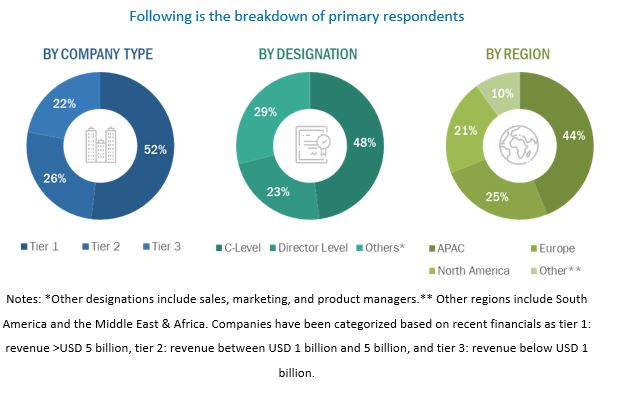

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 2 CHLOR-ALKALI MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.1.2.5 List of participant industry experts

2.2 MARKET SIZE ESTIMATION APPROACH

2.2.1 BOTTOM-UP MARKET SIZE ESTIMATION: MARKET SIZE OF SEVERAL COUNTRIES AND ASCERTAINING THEIR SHARE TO ESTIMATE THE OVERALL DEMAND

FIGURE 3 MARKET SIZE ESTIMATION – DEMAND SIDE

2.2.2 ESTIMATING THE CHLOR-ALKALI MARKET SIZE FROM THE KEY SUPPLIERS’ MARKET SHARE

FIGURE 4 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 5 SPECIALTY CHLOR-ALKALI MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 6 CAUSTIC SODA SEGMENT ACCOUNTED FOR THE LARGEST SHARE IN 2020

FIGURE 7 EDC/PVC APPLICATION IN CHLORINE ACCOUNTED FOR THE LARGEST SHARE IN 2020

FIGURE 8 GLASS APPLICATION IN SODA ASH ACCOUNTED FOR THE LARGEST SHARE IN 2020

FIGURE 9 ALUMINA APPLICATION IN CAUSTIC SODA ACCOUNTED FOR THE LARGEST SHARE IN 2020

FIGURE 10 MARKET IN APAC PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CHLOR-ALKALI MARKET

FIGURE 11 GROWTH OF CHEMICAL AND MANUFACTURING INDUSTRIES IN EMERGING ECONOMIES EXPECTED TO DRIVE DEMAND FOR CHLOR-ALKALI

4.2 CHLOR-ALKALI MARKET IN APAC, BY PRODUCT TYPE AND COUNTRY

FIGURE 12 CHINA IS EXPECTED TO MAINTAIN ASCENDENCY IN THE APAC CHLOR-ALKALI MARKET

4.3 CHLOR-ALKALI MARKET, BY COUNTRY

FIGURE 13 INDIA AND CHINA TO GROW AT THE HIGHEST RATES DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE CHLOR-ALKALI MARKET

5.2.1 DRIVERS

5.2.1.1 Steady growth of chemical industry across the globe to drive demand

TABLE 2 APPLICATIONS OF CHLORINE AND CAUSTIC SODA CHEMICAL PRODUCTS IN VARIOUS SECTORS

5.2.1.2 Increased demand for water & wastewater treatment in various end-use industries

TABLE 3 INDUSTRIAL DEMAND FOR WATER, BY CONTINENT

5.2.2 RESTRAINTS

5.2.2.1 Environmental impact of chlor-alkali products

5.2.2.2 Energy-intensive operations

5.2.2.3 Economic slowdown and impact of COVID-19 on the manufacturing sector

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging countries offer significant growth opportunities

5.2.3.2 Steady recovery of the automotive sector

5.2.4 CHALLENGES

5.2.4.1 Transportation and storage of chlorine

5.2.4.2 Impact of increased prices of natural gas

5.2.4.3 Imbalances in the demand and supply of chlor-alkali products

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 CHLOR-ALKALI MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 INTENSITY OF COMPETITIVE RIVALRY

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 THREAT OF SUBSTITUTES

TABLE 4 CHLOR-ALKALI MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 ROLE IN THE ECOSYSTEM

5.4 TECHNOLOGY ANALYSIS

5.4.1 MERCURY CELL

5.4.2 DIAPHRAGM CELL

5.4.3 MEMBRANE CELL

5.5 REGULATORY LANDSCAPE

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 16 SUPPLY CHAIN OF THE CHLOR-ALKALI MARKET

5.7 YC AND YCC SHIFT

FIGURE 17 INCREASING DEMAND FOR WATER TREATMENT AND HEALTHY GROWTH OF MANUFACTURING INDUSTRY TO BRING CHANGE IN FUTURE REVENUE MIX

5.7.1 YC SHIFT

5.7.2 YCC SHIFT

5.8 CHLOR-ALKALI PATENT ANALYSIS

5.8.1 INTRODUCTION

5.8.2 METHODOLOGY

5.8.3 DOCUMENT TYPE

FIGURE 18 GRANTED PATENTS SHARE TILL MARCH 2021

FIGURE 19 PUBLICATION TRENDS - LAST TEN YEARS

5.8.4 INSIGHT

FIGURE 20 JURISDICTION ANALYSIS

5.8.5 TOP COMPANIES/APPLICANTS

TABLE 6 LIST OF PATENTS BY TAIKO PHARMACEUTICAL CO LTD.

TABLE 7 LIST OF PATENTS BY SUMITOMO CHEMICAL CO

TABLE 8 LIST OF PATENTS BY BASF SE

TABLE 9 LIST OF PATENTS BY BASF SE

TABLE 10 TOP TEN PATENT OWNERS (US) DURING THE LAST TEN YEARS

5.9 FACTORS FOR FORECASTING AND IMPACT OF COVID-19

5.9.1 IMPACT ON THE GLOBAL CHEMICAL INDUSTRY

FIGURE 21 GLOBAL CHEMICAL INDUSTRY OVERVIEW (USD BILLION), 2019 & 2024

5.9.2 IMPACT ON GLOBAL PVC INDUSTRY AND ITS OUTLOOK

FIGURE 22 GLOBAL PVC INDUSTRY OVERVIEW IN VOLUME (MILLION TON), 2019 & 2024

5.9.3 GLOBAL ALUMINA PRODUCTION

TABLE 11 GLOBAL ALUMINA PRODUCTION (‘000 TON), 2018 - 2020

5.10 RANGE SCENARIO OF CHLOR-ALKALI MARKET

FIGURE 23 CHLOR-ALKALI MARKET, RANGE SCENARIO, 2019–2026

5.11 ECOSYSTEM OF CHLOR-ALKALI MARKET

FIGURE 24 ECOSYSTEM OF CHLOR-ALKALI MARKET

5.12 PRICING ANALYSIS

TABLE 12 PRICES OF CHLOR-ALKALI PRODUCTS (USD/TON), 2020

5.13 KEY EXPORTING AND IMPORTING COUNTRIES

TABLE 13 GLOBAL EXPORT AND IMPORT SCENARIO OF CHLOR-ALKALI PRODUCTS, BY VOLUME (TON), 2018-2020

TABLE 14 TOP FIVE SODA ASH AND CHLORINE EXPORTING AND IMPORTING COUNTRIES, BY VOLUME (TON), 2018-2020

5.14 MACROECONOMIC INDICATORS

5.14.1 GLOBAL GDP OUTLOOK

TABLE 15 WORLD GDP GROWTH PROJECTIONS

5.15 ADJACENT AND RELATED MARKETS

5.15.1 INTRODUCTION

5.15.2 LIMITATIONS

5.15.3 COMMODITY PLASTICS MARKET

5.15.3.1 Market definition

5.15.3.2 Commodity plastics market, by type

TABLE 16 COMMODITY PLASTICS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 17 COMMODITY PLASTICS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

5.15.3.3 Commodity plastics market, by region

TABLE 18 COMMODITY PLASTICS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 COMMODITY PLASTICS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

5.15.4 WATER TREATMENT CHEMICALS MARKET

5.15.4.1 Market definition

5.15.4.2 Water treatment chemicals market, by type

TABLE 20 WATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 21 WATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

5.16 CASE STUDY

6 CHLOR-ALKALI MARKET, BY TYPE (Page No. - 97)

6.1 INTRODUCTION

FIGURE 25 CAUSTIC SODA SEGMENT PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 22 CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 23 CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 24 CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 25 CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

6.2 CAUSTIC SODA

TABLE 26 CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 27 CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 28 CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 29 CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

6.2.1 ALUMINA

6.2.1.1 Growing manufacturing sector to fuel demand for alumina

TABLE 30 CAUSTIC SODA MARKET SIZE FOR ALUMINA, BY REGION, 2016–2018 (KILOTON)

TABLE 31 CAUSTIC SODA MARKET SIZE FOR ALUMINA, BY REGION, 2016–2018 (USD MILLION)

TABLE 32 CAUSTIC SODA MARKET SIZE FOR ALUMINA, BY REGION, 2019–2026 (KILOTON)

TABLE 33 CAUSTIC SODA MARKET SIZE FOR ALUMINA, BY REGION, 2019–2026 (USD MILLION)

6.2.2 INORGANIC CHEMICALS

6.2.2.1 Caustic soda utilized in the production of other chlor-alkali products

TABLE 34 CAUSTIC SODA MARKET SIZE FOR INORGANIC CHEMICALS, BY REGION, 2016–2018 (KILOTON)

TABLE 35 CAUSTIC SODA MARKET SIZE FOR INORGANIC CHEMICALS, BY REGION, 2016–2018 (USD MILLION)

TABLE 36 CAUSTIC SODA MARKET SIZE FOR INORGANIC CHEMICALS, BY REGION, 2019–2026 (KILOTON)

TABLE 37 CAUSTIC SODA MARKET SIZE FOR INORGANIC CHEMICALS, BY REGION, 2019–2026 (USD MILLION)

6.2.3 ORGANIC CHEMICALS

6.2.3.1 Caustic soda is one of the key raw materials for the commercial production of various organic chemicals

TABLE 38 CAUSTIC SODA MARKET SIZE FOR ORGANIC CHEMICALS, BY REGION, 2016–2018 (KILOTON)

TABLE 39 CAUSTIC SODA MARKET SIZE FOR ORGANIC CHEMICALS, BY REGION, 2016–2018 (USD MILLION)

TABLE 40 CAUSTIC SODA MARKET SIZE FOR ORGANIC CHEMICALS, BY REGION, 2019–2026 (KILOTON)

TABLE 41 CAUSTIC SODA MARKET SIZE FOR ORGANIC CHEMICALS, BY REGION, 2019–2026 (USD MILLION)

6.2.4 FOOD AND PULP & PAPER

6.2.4.1 Industrialization and urbanization in emerging countries promote growth

TABLE 42 CAUSTIC SODA MARKET SIZE FOR FOOD AND PULP & PAPER, BY REGION, 2016–2018 (KILOTON)

TABLE 43 CAUSTIC SODA MARKET SIZE FOR FOOD AND PULP & PAPER, BY REGION, 2016–2018 (USD MILLION)

TABLE 44 CAUSTIC SODA MARKET SIZE FOR FOOD AND PULP & PAPER, BY REGION, 2019–2026 (KILOTON)

TABLE 45 CAUSTIC SODA MARKET SIZE FOR FOOD AND PULP & PAPER, BY REGION, 2019–2026 (USD MILLION)

6.2.5 SOAPS & DETERGENTS

6.2.5.1 Increase in per-capita income in emerging countries to fuel demand

TABLE 46 CAUSTIC SODA MARKET SIZE FOR SOAPS & DETERGENTS, BY REGION, 2016–2018 (KILOTON)

TABLE 47 CAUSTIC SODA MARKET SIZE FOR SOAPS & DETERGENTS, BY REGION, 2016–2018 (USD MILLION)

TABLE 48 CAUSTIC SODA MARKET SIZE FOR SOAPS & DETERGENTS, BY REGION, 2019–2026 (KILOTON)

TABLE 49 CAUSTIC SODA MARKET SIZE FOR SOAPS & DETERGENTS, BY REGION, 2019–2026 (USD MILLION)

6.2.6 TEXTILES

6.2.6.1 Growth of the textile industry in the APAC to drive demand

TABLE 50 CAUSTIC SODA MARKET SIZE FOR TEXTILES, BY REGION, 2016–2018 (KILOTON)

TABLE 51 CAUSTIC SODA MARKET SIZE FOR TEXTILES, BY REGION, 2016–2018 (USD MILLION)

TABLE 52 CAUSTIC SODA MARKET SIZE FOR TEXTILES, BY REGION, 2019–2026 (KILOTON)

TABLE 53 CAUSTIC SODA MARKET SIZE FOR TEXTILES, BY REGION, 2019–2026 (USD MILLION)

6.2.7 WATER TREATMENT

6.2.7.1 Caustic soda is a cost-effective method to control the acidity of water

TABLE 54 CAUSTIC SODA MARKET SIZE FOR WATER TREATMENT, BY REGION, 2016–2018 (KILOTON)

TABLE 55 CAUSTIC SODA MARKET SIZE FOR WATER TREATMENT, BY REGION, 2016–2018 (USD MILLION)

TABLE 56 CAUSTIC SODA MARKET SIZE FOR WATER TREATMENT, BY REGION, 2019–2026 (KILOTON)

TABLE 57 CAUSTIC SODA MARKET SIZE FOR WATER TREATMENT, BY REGION, 2019–2026 (USD MILLION)

6.2.8 STEEL/METALLURGY – SINTERING

6.2.8.1 Rising demand from APAC to promote growth in sintering industry

TABLE 58 CAUSTIC SODA MARKET SIZE FOR STEEL/METALLURGY - SINTERING, BY REGION, 2016–2018 (KILOTON)

TABLE 59 CAUSTIC SODA MARKET SIZE FOR STEEL/METALLURGY - SINTERING, BY REGION, 2016–2018 (USD MILLION)

TABLE 60 CAUSTIC SODA MARKET SIZE FOR STEEL/METALLURGY - SINTERING, BY REGION, 2019–2026 (KILOTON)

TABLE 61 CAUSTIC SODA MARKET SIZE FOR STEEL/METALLURGY - SINTERING, BY REGION, 2019–2026 (USD MILLION)

6.2.9 OTHERS

TABLE 62 CAUSTIC SODA MARKET SIZE FOR OTHERS, BY REGION, 2016–2018 (KILOTON)

TABLE 63 CAUSTIC SODA MARKET SIZE FOR OTHERS, BY REGION, 2016–2018 (USD MILLION)

TABLE 64 CAUSTIC SODA MARKET SIZE FOR OTHERS, BY REGION, 2019–2026 (KILOTON)

TABLE 65 CAUSTIC SODA MARKET SIZE FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

6.3 CHLORINE

TABLE 66 CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 67 CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 68 CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 69 CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

6.3.1 EDC/PVC

6.3.1.1 Growth in construction industry to drive demand for PVC applications

TABLE 70 CHLORINE MARKET SIZE FOR EDC/PVC, BY REGION, 2016–2018 (KILOTON)

TABLE 71 CHLORINE MARKET SIZE FOR EDC/PVC, BY REGION, 2016–2018 (USD MILLION)

TABLE 72 CHLORINE MARKET SIZE FOR EDC/PVC, BY REGION, 2019–2026 (KILOTON)

TABLE 73 CHLORINE MARKET SIZE FOR EDC/PVC, BY REGION, 2019–2026 (USD MILLION)

6.3.2 ORGANIC CHEMICALS

6.3.2.1 Growing chemical industry increases the demand for chlorine as feedstock chemical

TABLE 74 CHLORINE MARKET SIZE FOR ORGANIC CHEMICALS, BY REGION, 2016–2018 (KILOTON)

TABLE 75 CHLORINE MARKET SIZE FOR ORGANIC CHEMICALS, BY REGION, 2016–2018 (USD MILLION)

TABLE 76 CHLORINE MARKET SIZE FOR ORGANIC CHEMICALS, BY REGION, 2019–2026 (KILOTON)

TABLE 77 CHLORINE MARKET SIZE FOR ORGANIC CHEMICALS, BY REGION, 2019–2026 (USD MILLION)

6.3.3 INORGANIC CHEMICALS

6.3.3.1 Rising demand for disinfectants to lead to market growth of inorganic chemicals

TABLE 78 CHLORINE MARKET SIZE FOR INORGANIC CHEMICALS, BY REGION,2016–2018 (KILOTON)

TABLE 79 CHLORINE MARKET SIZE FOR INORGANIC CHEMICALS, BY REGION, 2016–2018 (USD MILLION)

TABLE 80 CHLORINE MARKET SIZE FOR INORGANIC CHEMICALS, BY REGION, 2019–2026 (KILOTON)

TABLE 81 CHLORINE MARKET SIZE FOR INORGANIC CHEMICALS, BY REGION, 2019–2026 (USD MILLION)

6.3.4 ISOCYANATES

6.3.4.1 Rising demand for isocyanates in the APAC region due to the growth of the construction industry

TABLE 82 CHLORINE MARKET SIZE FOR ISOCYANATES, BY REGION, 2016–2018 (KILOTON)

TABLE 83 CHLORINE MARKET SIZE FOR ISOCYANATES, BY REGION, 2016–2018 (USD MILLION)

TABLE 84 CHLORINE MARKET SIZE FOR ISOCYANATES, BY REGION, 2019–2026 (KILOTON)

TABLE 85 CHLORINE MARKET SIZE FOR ISOCYANATES, BY REGION, 2019–2026 (USD MILLION)

6.3.5 CHLORINATED INTERMEDIATES

6.3.5.1 Rising demand for titanium dioxide and related chemicals to fuel growth

TABLE 86 CHLORINE MARKET SIZE FOR CHLORINATED INTERMEDIATES, BY REGION, 2016–2018 (KILOTON)

TABLE 87 CHLORINE MARKET SIZE FOR CHLORINATED INTERMEDIATES, BY REGION, 2016–2018 (USD MILLION)

TABLE 88 CHLORINE MARKET SIZE FOR CHLORINATED INTERMEDIATES, BY REGION, 2019–2026 (KILOTON)

TABLE 89 CHLORINE MARKET SIZE FOR CHLORINATED INTERMEDIATES, BY REGION, 2019–2026 (USD MILLION)

6.3.6 PROPYLENE OXIDE

6.3.6.1 Growing construction and automotive industries fuel the demand for polyurethane plastics

TABLE 90 CHLORINE MARKET SIZE FOR PROPYLENE OXIDE, BY REGION, 2016–2018 (KILOTON)

TABLE 91 CHLORINE MARKET SIZE FOR PROPYLENE OXIDE, BY REGION, 2016–2018 (USD MILLION)

TABLE 92 CHLORINE MARKET SIZE FOR PROPYLENE OXIDE, BY REGION, 2019–2026 (KILOTON)

TABLE 93 CHLORINE MARKET SIZE FOR PROPYLENE OXIDE, BY REGION, 2019–2026 (USD MILLION)

6.3.7 PULP & PAPER

6.3.7.1 Preference for chlorine as a bleaching agent to drive demand in the pulp & paper application

TABLE 94 CHLORINE MARKET SIZE FOR PULP & PAPER, BY REGION, 2016–2018 (KILOTON)

TABLE 95 CHLORINE MARKET SIZE FOR PULP & PAPER, BY REGION, 2016–2018 (USD MILLION)

TABLE 96 CHLORINE MARKET SIZE FOR PULP & PAPER, BY REGION, 2019–2026 (KILOTON)

TABLE 97 CHLORINE MARKET SIZE FOR PULP & PAPER, BY REGION, 2019–2026 (USD MILLION)

6.3.8 C1/C2, AROMATICS

6.3.8.1 Utilization of chlorine in various industrial processes for the commercial production of chemicals

TABLE 98 CHLORINE MARKET SIZE FOR C1/C2, AROMATICS, BY REGION, 2016–2018 (KILOTON)

TABLE 99 CHLORINE MARKET SIZE FOR C1/C2, AROMATICS, BY REGION, 2016–2018 (USD MILLION)

TABLE 100 CHLORINE MARKET SIZE FOR C1/C2, AROMATICS, BY REGION, 2019–2026 (KILOTON)

TABLE 101 CHLORINE MARKET SIZE FOR C1/C2, AROMATICS, BY REGION, 2019–2026 (USD MILLION)

6.3.9 WATER TREATMENT

6.3.9.1 Inexpensive water treatment with the use of chlorine compared to other methods promotes growth

TABLE 102 CHLORINE MARKET SIZE FOR WATER TREATMENT, BY REGION, 2016–2018 (KILOTON)

TABLE 103 CHLORINE MARKET SIZE FOR WATER TREATMENT, BY REGION, 2016–2018 (USD MILLION)

TABLE 104 CHLORINE MARKET SIZE FOR WATER TREATMENT, BY REGION, 2019–2026 (KILOTON)

TABLE 105 CHLORINE MARKET SIZE FOR WATER TREATMENT, BY REGION, 2019–2026 (USD MILLION)

6.3.10 OTHERS

TABLE 106 CHLORINE MARKET SIZE FOR OTHERS, BY REGION, 2016–2018 (KILOTON)

TABLE 107 CHLORINE MARKET SIZE FOR OTHERS, BY REGION, 2016–2018 (USD MILLION)

TABLE 108 CHLORINE MARKET SIZE FOR OTHERS, BY REGION, 2019–2026 (KILOTON)

TABLE 109 CHLORINE MARKET SIZE FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

6.4 SODA ASH

TABLE 110 SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 111 SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 112 SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 113 SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

6.4.1 GLASS

6.4.1.1 Growth in end-use industries to drive demand

TABLE 114 SODA ASH MARKET SIZE FOR GLASS, BY REGION, 2016–2018 (KILOTON)

TABLE 115 SODA ASH MARKET SIZE FOR GLASS, BY REGION, 2016–2018 (USD MILLION)

TABLE 116 SODA ASH MARKET SIZE FOR GLASS, BY REGION, 2019–2026 (KILOTON)

TABLE 117 SODA ASH MARKET SIZE FOR GLASS, BY REGION, 2019–2026 (USD MILLION)

6.4.2 SOAPS & DETERGENTS

6.4.2.1 Increasing population and rising per capita income to drive demand

TABLE 118 SODA ASH MARKET SIZE FOR SOAPS & DETERGENTS, BY REGION, 2016–2018 (KILOTON)

TABLE 119 SODA ASH MARKET SIZE FOR SOAPS & DETERGENTS, BY REGION, 2016–2018 (USD MILLION)

TABLE 120 SODA ASH MARKET SIZE FOR SOAPS & DETERGENTS, BY REGION, 2019–2026 (KILOTON)

TABLE 121 SODA ASH MARKET SIZE FOR SOAPS & DETERGENTS, BY REGION, 2019–2026 (USD MILLION)

6.4.3 CHEMICALS

6.4.3.1 Soda ash is vital for the production of sodium compounds

TABLE 122 SODA ASH MARKET SIZE FOR CHEMICALS, BY REGION, 2016–2018 (KILOTON)

TABLE 123 SODA ASH MARKET SIZE FOR CHEMICALS, BY REGION, 2016–2018 (USD MILLION)

TABLE 124 SODA ASH MARKET SIZE FOR CHEMICALS, BY REGION, 2019–2026 (KILOTON)

TABLE 125 SODA ASH MARKET SIZE FOR CHEMICALS, BY REGION, 2019–2026 (USD MILLION)

6.4.4 METALLURGY

6.4.4.1 Rising demand from end-use industries to drive demand

TABLE 126 SODA ASH MARKET SIZE FOR METALLURGY, BY REGION, 2016–2018 (KILOTON)

TABLE 127 SODA ASH MARKET SIZE FOR METALLURGY, BY REGION, 2016–2018 (USD MILLION)

TABLE 128 SODA ASH MARKET SIZE FOR METALLURGY, BY REGION, 2019–2026 (KILOTON)

TABLE 129 SODA ASH MARKET SIZE FOR METALLURGY, BY REGION, 2019–2026 (USD MILLION)

6.4.5 WATER TREATMENT

6.4.5.1 Increase in awareness and regulations regarding water & wastewater treatment promotes growth

TABLE 130 SODA ASH MARKET SIZE FOR WATER TREATMENT, BY REGION, 2016–2018 (KILOTON)

TABLE 131 SODA ASH MARKET SIZE FOR WATER TREATMENT, BY REGION, 2016–2018 (USD MILLION)

TABLE 132 SODA ASH MARKET SIZE FOR WATER TREATMENT, BY REGION, 2019–2026 (KILOTON)

TABLE 133 SODA ASH MARKET SIZE FOR WATER TREATMENT, BY REGION, 2019–2026 (USD MILLION)

6.4.6 PULP & PAPER

6.4.6.1 Growth in end-use industries to drive demand

TABLE 134 SODA ASH MARKET SIZE FOR PULP & PAPER, BY REGION, 2016–2018 (KILOTON)

TABLE 135 SODA ASH MARKET SIZE FOR PULP & PAPER, BY REGION, 2016–2018 (USD MILLION)

TABLE 136 SODA ASH MARKET SIZE FOR PULP & PAPER, BY REGION, 2019–2026 (KILOTON)

TABLE 137 SODA ASH MARKET SIZE FOR PULP & PAPER, BY REGION,2019–2026 (USD MILLION)

6.4.7 OTHERS

TABLE 138 SODA ASH MARKET SIZE FOR OTHERS, BY REGION, 2016–2018 (KILOTON)

TABLE 139 SODA ASH MARKET SIZE FOR OTHERS, BY REGION, 2016–2018 (USD MILLION)

TABLE 140 SODA ASH MARKET SIZE FOR OTHERS, BY REGION, 2019–2026 (KILOTON)

TABLE 141 SODA ASH MARKET SIZE FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

6.5 OTHERS

TABLE 142 CHLOR-ALKALI MARKET SIZE FOR OTHERS, BY REGION, 2016–2018 (KILOTON)

TABLE 143 CHLOR-ALKALI MARKET SIZE FOR OTHERS, BY REGION, 2016–2018 (USD MILLION)

TABLE 144 CHLOR-ALKALI MARKET SIZE FOR OTHERS, BY REGION, 2019–2026 (KILOTON)

TABLE 145 CHLOR-ALKALI MARKET SIZE FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

7 CHLOR-ALKALI MARKET, BY REGION (Page No. - 149)

7.1 INTRODUCTION

FIGURE 26 CHINA TO BE THE FASTEST-GROWING CHLOR-ALKALI MARKET

7.2 ASIA PACIFIC

FIGURE 27 ASIA PACIFIC: CHLOR-ALKALI MARKET SNAPSHOT

TABLE 146 APAC: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2016–2018 (KILOTON)

TABLE 147 APAC: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 148 APAC: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 149 APAC: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 150 APAC: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 151 APAC: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 152 APAC: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 153 APAC: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 APAC: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 155 APAC: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 156 APAC: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 157 APAC: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 158 APAC: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 159 APAC: CAUSTIC SODA MARKET SIZE, BY APPLICATION,2016–2018 (USD MILLION)

TABLE 160 APAC: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 161 APAC: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 162 APAC: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 163 APAC: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 164 APAC: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 165 APAC: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.2.1 CHINA

7.2.1.1 Strong recovery from the repercussions of the COVID-19 pandemic expected to support market growth

TABLE 166 CHINA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 167 CHINA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 168 CHINA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 169 CHINA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 CHINA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 171 CHINA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 172 CHINA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 173 CHINA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 174 CHINA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 175 CHINA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 176 CHINA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 177 CHINA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 178 CHINA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 179 CHINA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 180 CHINA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 181 CHINA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.2.2 INDIA

7.2.2.1 Increasing FDI investments in the manufacturing industry expected to support market growth

TABLE 182 INDIA CHLOR-ALKALI PRODUCTS PRODUCTION CAPACITY AND PRODUCTION

TABLE 183 INDIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 184 INDIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 185 INDIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 186 INDIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 187 INDIA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 188 INDIA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 189 INDIA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 190 INDIA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 191 INDIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 192 INDIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 193 INDIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 194 INDIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 195 INDIA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 196 INDIA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 197 INDIA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 198 INDIA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.2.3 JAPAN

7.2.3.1 Growth in end-use industries to augment market growth

TABLE 199 CHLOR-ALKALI PRODUCTS, PRODUCTION, 2018–2020 (TON)

TABLE 200 JAPAN: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 201 JAPAN: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 202 JAPAN: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 203 JAPAN: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 204 JAPAN: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 205 JAPAN: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 206 JAPAN: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 207 JAPAN: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 208 JAPAN: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 209 JAPAN: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 210 JAPAN: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 211 JAPAN: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 212 JAPAN: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 213 JAPAN: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 214 JAPAN: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 215 JAPAN: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.2.4 SOUTH KOREA

7.2.4.1 Government investments in manufacturing sector to drive demand

TABLE 216 SOUTH KOREA: CHLOR-ALKALI PRODUCTION, 2018-2020 (TON)

TABLE 217 SOUTH KOREA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 218 SOUTH KOREA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 219 SOUTH KOREA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 220 SOUTH KOREA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 221 SOUTH KOREA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 222 SOUTH KOREA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 223 SOUTH KOREA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 224 SOUTH KOREA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 225 SOUTH KOREA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 226 SOUTH KOREA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 227 SOUTH KOREA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 228 SOUTH KOREA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 229 SOUTH KOREA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 230 SOUTH KOREA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 231 SOUTH KOREA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 232 SOUTH KOREA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.2.5 ASEAN

7.2.5.1 Growing manufacturing sector to promote demand for chlor-alkali products in various end-use industries

TABLE 233 ASEAN: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 234 ASEAN: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 235 ASEAN: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 236 ASEAN: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 237 ASEAN: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 238 ASEAN: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 239 ASEAN: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 240 ASEAN: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 241 ASEAN: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 242 ASEAN: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 243 ASEAN: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 244 ASEAN: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 245 ASEAN: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 246 ASEAN: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 247 ASEAN: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 248 ASEAN: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.2.6 REST OF APAC

TABLE 249 REST OF APAC: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 250 REST OF APAC: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 251 REST OF APAC: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 252 REST OF APAC: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 253 REST OF APAC: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 254 REST OF APAC: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 255 REST OF APAC: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 256 REST OF APAC: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 257 REST OF APAC: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 258 REST OF APAC: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 259 REST OF APAC: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 260 REST OF APAC: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 261 REST OF APAC: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 262 REST OF APAC: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 263 REST OF APAC: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 264 REST OF APAC: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.3 NORTH AMERICA

FIGURE 28 NORTH AMERICA: CHLOR-ALKALI MARKET SNAPSHOT

TABLE 265 NORTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY COUNTRY,2016–2018 (KILOTON)

TABLE 266 NORTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 267 NORTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 268 NORTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 269 NORTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 270 NORTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 271 NORTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 272 NORTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 273 NORTH AMERICA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 274 NORTH AMERICA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 275 NORTH AMERICA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 276 NORTH AMERICA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 277 NORTH AMERICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 278 NORTH AMERICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 279 NORTH AMERICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 280 NORTH AMERICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 281 NORTH AMERICA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 282 NORTH AMERICA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 283 NORTH AMERICA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 284 NORTH AMERICA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.3.1 US

7.3.1.1 Steady growth in demand from several industrial applications to drive the market

FIGURE 29 US: CHEMICAL AND MATERIALS PRODUCTION GROWTH OUTLOOK, 2018 - 2022

FIGURE 30 SODA ASH PRODUCTION IN US (KILOTON), 2016-2020

TABLE 285 US: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 286 US: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 287 US: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 288 US: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 289 US: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 290 US: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 291 US: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 292 US: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 293 US: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 294 US: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 295 US: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 296 US: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 297 US: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 298 US: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 299 US: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 300 US: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.3.2 CANADA

7.3.2.1 Uncertainty regarding the end-use industry growth to impact the market in the future

TABLE 301 CANADA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 302 CANADA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 303 CANADA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 304 CANADA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 305 CANADA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 306 CANADA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 307 CANADA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 308 CANADA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 309 CANADA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 310 CANADA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 311 CANADA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 312 CANADA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 313 CANADA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 314 CANADA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 315 CANADA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 316 CANADA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.3.3 MEXICO

7.3.3.1 Expected recovery from the repercussions of the COVID-19 pandemic to support the market growth

TABLE 317 MEXICO: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 318 MEXICO: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 319 MEXICO: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 320 MEXICO: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 321 MEXICO: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 322 MEXICO: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 323 MEXICO: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 324 MEXICO: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 325 MEXICO: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 326 MEXICO: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 327 MEXICO: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 328 MEXICO: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 329 MEXICO: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 330 MEXICO: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 331 MEXICO: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 332 MEXICO: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.4 EUROPE

TABLE 333 EUROPE: CHLORINE PRODUCTION CAPACITY, BY COUNTRY, 2020 (KILOTON)

TABLE 334 EUROPE: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2016–2018 (KILOTON)

TABLE 335 EUROPE: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 336 EUROPE: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 337 EUROPE: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 338 EUROPE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 339 EUROPE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 340 EUROPE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 341 EUROPE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 342 EUROPE: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 343 EUROPE: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 344 EUROPE: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 345 EUROPE: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 346 EUROPE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 347 EUROPE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 348 EUROPE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 349 EUROPE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 350 EUROPE: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 351 EUROPE: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 352 EUROPE: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 353 EUROPE: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.4.1 GERMANY

7.4.1.1 Favorable economic environment for construction and chemical sectors to foster market growth

TABLE 354 GERMANY: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 355 GERMANY: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 356 GERMANY: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 357 GERMANY: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 358 GERMANY: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 359 GERMANY: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 360 GERMANY: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 361 GERMANY: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 362 GERMANY: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 363 GERMANY: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 364 GERMANY: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 365 GERMANY: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 366 GERMANY: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 367 GERMANY: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 368 GERMANY: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 369 GERMANY: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.4.2 FRANCE

7.4.2.1 Growth in the plastics industry to fuel the demand for chlor-alkali products

TABLE 370 FRANCE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 371 FRANCE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 372 FRANCE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 373 FRANCE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 374 FRANCE: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 375 FRANCE: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 376 FRANCE: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 377 FRANCE: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 378 FRANCE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 379 FRANCE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 380 FRANCE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 381 FRANCE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 382 FRANCE: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 383 FRANCE: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 384 FRANCE: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 385 FRANCE: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.4.3 UK

7.4.3.1 Steady increase in construction and chemical sectors to fuel demand for chlor-alkali products

TABLE 386 UK: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 387 UK: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 388 UK: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 389 UK: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 390 UK: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 391 UK: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 392 UK: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 393 UK: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 394 UK: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 395 UK: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 396 UK: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 397 UK: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 398 UK: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 399 UK: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 400 UK: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 401 UK: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.4.4 RUSSIA

7.4.4.1 Steady development in pulp & paper sector to support chlor-alkali market growth

TABLE 402 RUSSIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 403 RUSSIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 404 RUSSIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 405 RUSSIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 406 RUSSIA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 407 RUSSIA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 408 RUSSIA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 409 RUSSIA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 410 RUSSIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 411 RUSSIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 412 RUSSIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 413 RUSSIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 414 RUSSIA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 415 RUSSIA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 416 RUSSIA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 417 RUSSIA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.4.5 REST OF EUROPE

TABLE 418 REST OF EUROPE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 419 REST OF EUROPE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 420 REST OF EUROPE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 421 REST OF EUROPE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 422 REST OF EUROPE: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 423 REST OF EUROPE: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 424 REST OF EUROPE: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 425 REST OF EUROPE: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 426 REST OF EUROPE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 427 REST OF EUROPE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 428 REST OF EUROPE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 429 REST OF EUROPE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 430 REST OF EUROPE: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 431 REST OF EUROPE: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 432 REST OF EUROPE: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 433 REST OF EUROPE: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.5 MIDDLE EAST & AFRICA

TABLE 434 MIDDLE EAST & AFRICA: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2016–2018 (KILOTON)

TABLE 435 MIDDLE EAST & AFRICA: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 436 MIDDLE EAST & AFRICA: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 437 MIDDLE EAST & AFRICA: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 438 MIDDLE EAST & AFRICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 439 MIDDLE EAST & AFRICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 440 MIDDLE EAST & AFRICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 441 MIDDLE EAST & AFRICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 442 MIDDLE EAST & AFRICA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 443 MIDDLE EAST & AFRICA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 444 MIDDLE EAST & AFRICA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 445 MIDDLE EAST & AFRICA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 446 MIDDLE EAST & AFRICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 447 MIDDLE EAST & AFRICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 448 MIDDLE EAST & AFRICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 449 MIDDLE EAST & AFRICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 450 MIDDLE EAST & AFRICA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 451 MIDDLE EAST & AFRICA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 452 MIDDLE EAST & AFRICA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 453 MIDDLE EAST & AFRICA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.5.1 SAUDI ARABIA

7.5.1.1 Growing investment in the expansion of desalination capacity and building & construction industry supports the market growth

TABLE 454 SAUDI ARABIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 455 SAUDI ARABIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 456 SAUDI ARABIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 457 SAUDI ARABIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 458 SAUDI ARABIA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 459 SAUDI ARABIA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 460 SAUDI ARABIA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 461 SAUDI ARABIA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 462 SAUDI ARABIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 463 SAUDI ARABIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 464 SAUDI ARABIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 465 SAUDI ARABIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 466 SAUDI ARABIA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 467 SAUDI ARABIA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 468 SAUDI ARABIA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 469 SAUDI ARABIA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.5.2 UAE

7.5.2.1 Steady recovery of several end-use industries from COVID-19 impact to support market growth

TABLE 470 UAE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 471 UAE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 472 UAE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 473 UAE: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 474 UAE: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 475 UAE: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 476 UAE: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 477 UAE: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 478 UAE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 479 UAE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 480 UAE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 481 UAE: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 482 UAE: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 483 UAE: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 484 UAE: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 485 UAE: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.5.3 SOUTH AFRICA

7.5.3.1 Growth in the end-use industries such as chemicals and automotive to drive the market

TABLE 486 SOUTH AFRICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 487 SOUTH AFRICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 488 SOUTH AFRICA: CHLOR-ALKALI MARKET SIZE, BY TYPE,2019–2026 (KILOTON)

TABLE 489 SOUTH AFRICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 490 SOUTH AFRICA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 491 SOUTH AFRICA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 492 SOUTH AFRICA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 493 SOUTH AFRICA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 494 SOUTH AFRICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 495 SOUTH AFRICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 496 SOUTH AFRICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 497 SOUTH AFRICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 498 SOUTH AFRICA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 499 SOUTH AFRICA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 500 SOUTH AFRICA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 501 SOUTH AFRICA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.5.4 NIGERIA

7.5.4.1 Paper & packaging, chemical, and automotive industries to drive the market

TABLE 502 NIGERIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 503 NIGERIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 504 NIGERIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 505 NIGERIA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 506 NIGERIA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 507 NIGERIA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 508 NIGERIA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 509 NIGERIA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 510 NIGERIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 511 NIGERIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 512 NIGERIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 513 NIGERIA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 514 NIGERIA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 515 NIGERIA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 516 NIGERIA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 517 NIGERIA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 518 REST OF MIDDLE EAST & AFRICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 519 REST OF MIDDLE EAST & AFRICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 520 REST OF MIDDLE EAST & AFRICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 521 REST OF MIDDLE EAST & AFRICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 522 REST OF MIDDLE EAST & AFRICA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 523 REST OF MIDDLE EAST & AFRICA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 524 REST OF MIDDLE EAST & AFRICA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 525 REST OF MIDDLE EAST & AFRICA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 526 REST OF MIDDLE EAST & AFRICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 527 REST OF MIDDLE EAST & AFRICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 528 REST OF MIDDLE EAST & AFRICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 529 REST OF MIDDLE EAST & AFRICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 530 REST OF MIDDLE EAST & AFRICA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 531 REST OF MIDDLE EAST & AFRICA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 532 REST OF MIDDLE EAST & AFRICA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 533 REST OF MIDDLE EAST & AFRICA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

7.6 SOUTH AMERICA

TABLE 534 SOUTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2016–2018 (KILOTON)

TABLE 535 SOUTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2016–2018 (USD MILLION)

TABLE 536 SOUTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 537 SOUTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 538 SOUTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (KILOTON)

TABLE 539 SOUTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2016–2018 (USD MILLION)

TABLE 540 SOUTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 541 SOUTH AMERICA: CHLOR-ALKALI MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 542 SOUTH AMERICA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 543 SOUTH AMERICA: CHLORINE MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 544 SOUTH AMERICA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 545 SOUTH AMERICA: CHLORINE MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 546 SOUTH AMERICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 547 SOUTH AMERICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 548 SOUTH AMERICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 549 SOUTH AMERICA: CAUSTIC SODA MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 550 SOUTH AMERICA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (KILOTON)

TABLE 551 SOUTH AMERICA: SODA ASH MARKET SIZE, BY APPLICATION, 2016–2018 (USD MILLION)

TABLE 552 SOUTH AMERICA: SODA ASH MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)