Clinical Chemistry Analyzers Market Size, Growth, Share & Trends Analysis

Clinical Chemistry Analyzers Market by Product [Analyzers (Fully Automated, PoC, Semi-automated), Reagents], Test Type [Lipid Profile, Liver, Basic Metabolic Panels], End User [Hospitals & Clinics, Research, Labs], Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

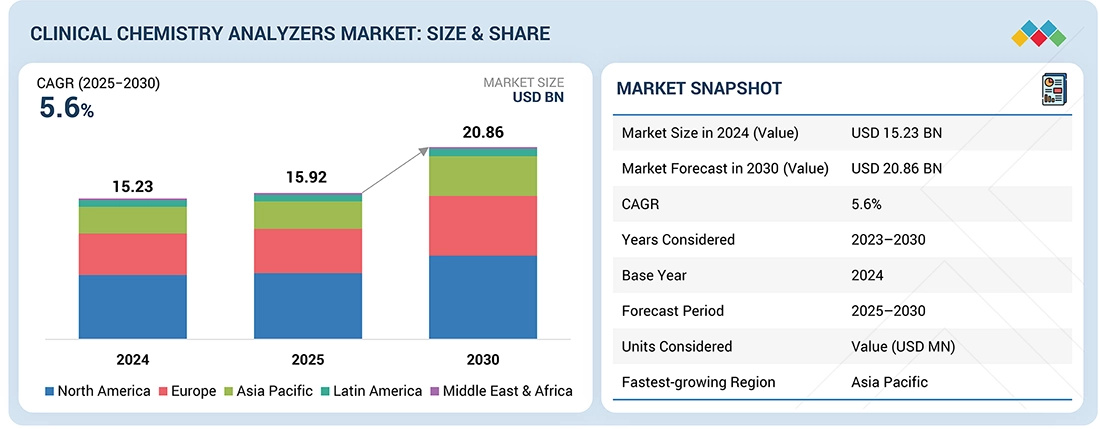

The global clinical chemistry analyzers market is expected to grow from USD 15.92 billion in 2025 to USD 20.86 billion by 2030, at a CAGR of 5.6% during the forecast period. The market growth is driven by increasing demand for routine and specialized diagnostic testing, the rising prevalence of chronic and lifestyle-related diseases, and continuous advancements in analyzer technologies that improve efficiency, accuracy, and throughput in clinical laboratories. The growing adoption of point-of-care testing and laboratory automation is also supporting market expansion across healthcare settings.

KEY TAKEAWAYS

-

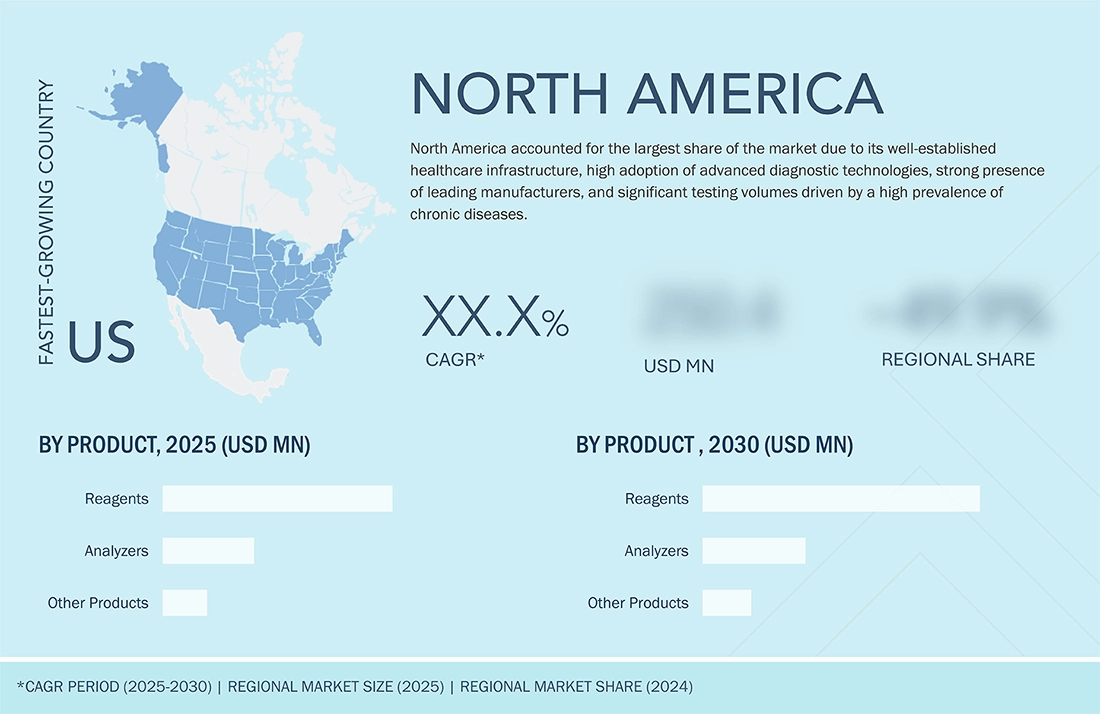

By RegionThe North America clinical chemistry analyzers market dominated in 2024, backed by strong healthcare infrastructure, high technology adoption, leading manufacturer presence, and large testing volumes.

-

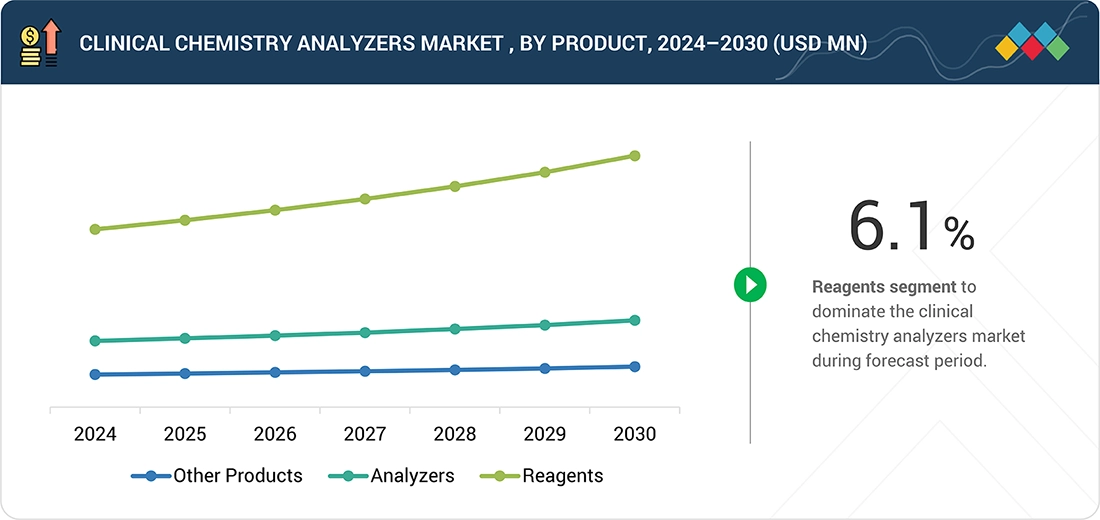

BY PRODUCTIn the clinical chemistry analyzers market, by product type, the reagents segment is expected to register the highest CAGR of 6.1%.

-

BY TEST TYPEBy test type, the basic metabolic panels segment accounted for the largest share in 2024, driven by its extensive use in routine health assessments and rising emphasis on preventive healthcare.

-

BY END USERBy end user, the hospitals & clinics segment held the largest share in 2024, driven by high patient load and the need for timely diagnostics.

-

Competitive LandscapeAbbott, F. Hoffmann-La Roche Ltd., and Siemens Healthineers AG were identified as some of the star players in the global clinical chemistry analyzers market, supported by their strong market presence and extensive product portfolios.

-

Competitive LandscapeCompanies EKF Diagnostics Holdings plc, and Teco Diagnostic, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The clinical chemistry analyzers market is poised for significant growth in the coming years, driven by the increasing focus on preventive healthcare and early disease detection. Ongoing advancements in automation, digital integration, and diagnostic technologies are enhancing laboratory efficiency and accuracy, thereby encouraging the broader adoption of analyzers. Furthermore, the expansion of healthcare infrastructure, rising patient awareness, and the increasing prevalence of chronic and lifestyle-related diseases are expected to support sustained market growth throughout the forecast period.

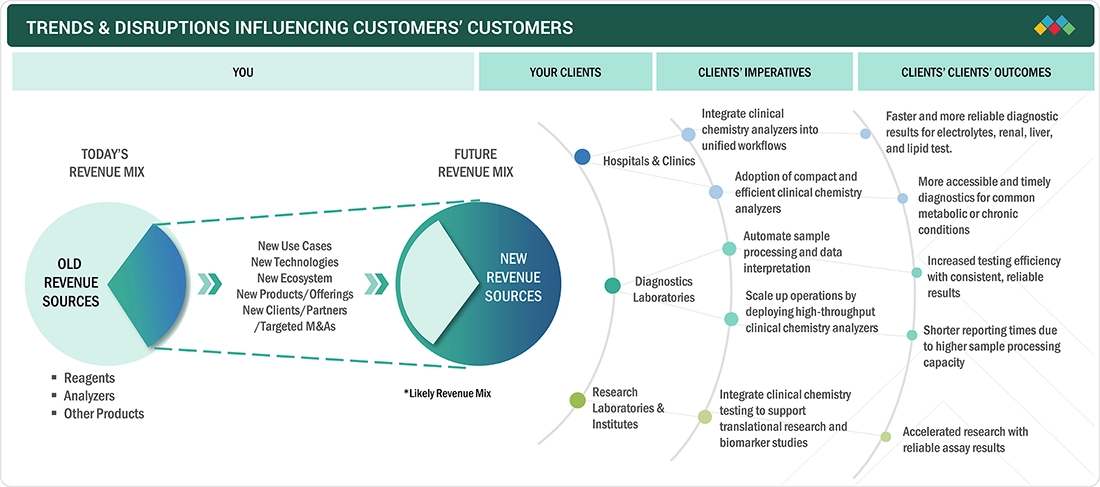

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The clinical chemistry analyzers market is being shaped by several key trends that influence laboratory operations and investment decisions. Healthcare providers are increasingly adopting analyzers with advanced automation and integration capabilities to improve testing efficiency, minimize errors, and manage growing patient volumes. There is also a rising emphasis on preventive healthcare and routine monitoring, which is driving higher demand for a broad range of diagnostic tests. In addition, laboratories are focusing on solutions that enhance workflow efficiency, reduce turnaround times, and provide accurate, reliable results to support clinical decision-making. Collectively, these trends are pushing healthcare facilities toward more efficient, technologically advanced, and patient-centric diagnostic practices, supporting sustained growth in the clinical chemistry analyzers market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising geriatric population and increasing prevalence of chronic & lifestyle diseases

-

Growing adoption of point-of-care testing devices

Level

-

Requirement for high capital investments and shortage of skilled laboratory technicians

-

Availability of refurbished analyzers

Level

-

Increasing government initiatives and funding for preventive care

-

Growth opportunities in emerging economies

Level

-

Increasing regulatory requirements

-

High degree of consolidation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising geriatric population and increasing prevalence of chronic & lifestyle diseases

The rising geriatric population and the increasing prevalence of chronic and lifestyle-related diseases are driving the clinical chemistry analyzers market. Older populations are more prone to conditions such as diabetes, cardiovascular disorders, and metabolic imbalances, which require regular diagnostic testing. This growing patient base, coupled with the heightened focus on preventive healthcare, is fueling the demand for clinical chemistry analyzers across hospitals, clinics, and diagnostic laboratories

Restraint: Availability of refurbished analyzers

The availability of refurbished clinical chemistry analyzers acts as a restraint on market growth. Refurbished systems are often offered at lower prices compared to new analyzers, which can lead healthcare facilities, particularly in cost-sensitive regions, to opt for these alternatives. This limits the potential for new analyzers and may slow the adoption of the latest technologies.

Opportunity: Growth opportunities in emerging economies

Emerging economies present significant growth opportunities for the clinical chemistry analyzers market. Rapidly developing healthcare infrastructure, increasing healthcare expenditure, and growing awareness of preventive diagnostics in these regions are creating a favorable environment for market expansion. Companies can leverage these trends by introducing cost-effective and scalable analyzer solutions tailored to the needs of emerging markets.

Challenge: Increasing regulatory requirements

Increasing regulatory requirements pose a challenge for the clinical chemistry analyzers market. Manufacturers must comply with stringent quality, safety, and performance standards across different regions, which can result in higher development costs and longer product approval timelines. These regulatory hurdles can slow product launches and limit market entry, particularly for smaller companies seeking to expand globally.

clinical-chemistry-analyzer-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers clinical chemistry analyzers through Alinity c and ARCHITECT systems for hospitals and diagnostic laboratories. | Delivers accurate testing, reduces turnaround times, and integrates with laboratory information systems to streamline lab operations. |

|

Offers clinical chemistry analyzers through the cobas series, serving hospitals, reference labs, and specialty diagnostic centers. | Provides accurate and reliable test results, supports high-throughput testing for efficient workflows. |

|

Provides analyzers such as Atellica CH and ADVIA Chemistry for hospitals, reference labs, and specialty testing centers. | Enables precise and rapid testing, integrates with laboratory automation systems, and improves operational efficiency. |

|

Supplies clinical chemistry analyzers such as the AU series and DxC series, used in hospital labs and reference laboratories. | Ensures precise results, enables scalable testing volumes, and supports automated laboratory workflows and data management. |

|

Provides clinical chemistry analyzers and associated reagents for hospitals and diagnostic labs, including compact and specialty systems. | Supports reliable testing, facilitates medium- to high-throughput workflows. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The clinical chemistry analyzers market ecosystem comprises manufacturers that design, develop, and produce a broad range of analyzers, reagents, and related products. These companies manage the full value chain, from product research and design to manufacturing and commercialization. Distributors, wholesalers, and e-commerce platforms act as key channels, facilitating the promotion and delivery of analyzers to healthcare facilities. End users, including hospitals, clinics, diagnostic laboratories, research institutes, and other healthcare providers, significantly influence demand patterns and purchasing decisions. Additionally, investors and health regulatory authorities shape the market by supporting innovation, ensuring compliance with regulations, and guiding strategic growth initiatives.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Clinical Chemistry Analyzers Market, By Product

The clinical chemistry analyzers market, by product, includes analyzers, reagents, and other products. Among these, the reagents segment accounted for the largest share in 2024, driven by their recurring demand in routine diagnostic testing. Laboratories require a continuous supply of reagents to perform accurate and timely tests, making them a critical and high-volume component of clinical chemistry operations.

Clinical Chemistry Analyzers Market, By Test Type

Based on test type, the market includes basic metabolic panels, liver function panels, lipid profiles, renal function panels, thyroid function panels, electrolyte panels, and specialty chemical tests. Basic metabolic panels led the market in 2024, reflecting their widespread use in routine health assessments and monitoring of essential metabolic parameters. Increasing attention to preventive healthcare and early detection of chronic conditions has contributed to the high adoption of these panels in clinical practice

Clinical Chemistry Analyzers Market, By End User

The clinical chemistry analyzers market, by end user, includes hospitals & clinics, diagnostic laboratories, research laboratories and institutes, and other end users. Hospitals & clinics accounted for the largest share in 2024, driven by high patient volumes and the need for timely and accurate diagnostic results. The adoption of advanced analyzers in these settings has improved operational efficiency, reduced turnaround times, and supported effective patient management, making hospitals & clinics the most significant contributors to market demand.

REGION

North America accounted for the largest share of the clinical chemistry analyzers market during the forecast period.

North America accounted for the largest share of the market due to its well-established healthcare infrastructure, high adoption of advanced diagnostic technologies, strong presence of leading manufacturers, and significant testing volumes driven by a high prevalence of chronic diseases.

clinical-chemistry-analyzer-market: COMPANY EVALUATION MATRIX

Abbott is a leading player in the clinical chemistry analyzers market, supported by its broad product range and sustained investment in research and development. The company has a wide geographical presence through its network of subsidiaries and operates across both the pharmaceutical and diagnostic segments, providing diversified exposure within the healthcare industry. Its established market position, comprehensive portfolio, and continuous product development activities contribute to its role as a leading provider in the clinical chemistry analyzers market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 15.23 Billion |

| Revenue Forecast in 2030 | USD 20.86 Billion |

| Growth Rate | CAGR of 5.6% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America and Middle East & Africa |

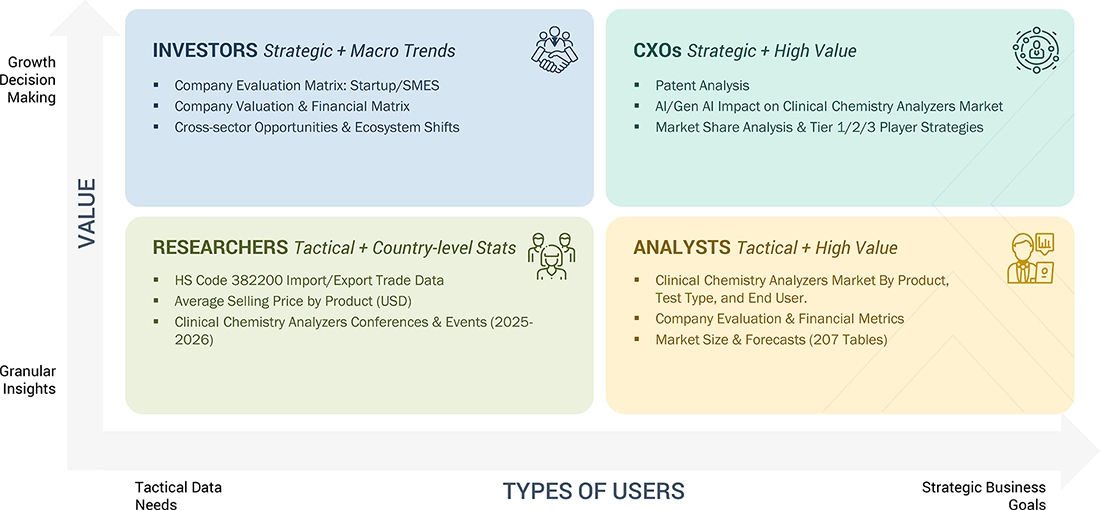

WHAT IS IN IT FOR YOU: clinical-chemistry-analyzer-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Product matrix, which provides a detailed comparison of the product portfolio of each company in the clinical chemitsry anayzers market. | Enables easy comparison of competitors’ offerings, helping identify gaps, overlaps, and differentiation opportunities. |

| Company Information | Additional five company profiles of players operating in the clinical chemitsry anayzers market. | Provides insights into competitors’ strategies, innovation focus, and partnerships, supporting strategic planning. |

| Geographic Analysis | Additional country-level analysis of the clinical chemitsry anayzers market. | Guides market entry, localization, and targeted launch strategies by highlighting regional demand and opportunities. |

RECENT DEVELOPMENTS

- March 2025 : Danaher Corporation (US) received 510(k) clearance from the US FDA for its DxC 500i Clinical Analyzer, an integrated clinical chemistry and immunoassay system. The DxC 500i offers up to 800 chemistry tests and 100 immunoassay tests per hour, combining advanced technology with an intuitive interface to deliver fast, reliable results for laboratories of all sizes.

- June 2024 : F. Hoffmann-La Roche Ltd. (Switzerland) launched the cobas c 703 and cobas ISE neo analytical units for the cobas pro integrated solutions in CE-mark markets. The cobas c 703 delivers up to 2,000 tests per hour with 70 reagent positions, doubling the platform’s clinical chemistry throughput. The cobas ISE neo improves ISE testing efficiency by automating maintenance and reducing hands-on time

- July 2023 : Siemens Healthineers AG (Germany) launched the Atellica CI Analyzer, a compact system designed for immunoassay and clinical chemistry testing. The analyzer aims to help laboratories address workforce shortages, support revenue growth, and improve operational flexibility while maintaining consistent performance and clinical accuracy.

- February 2023 : HORIBA Ltd. (Japan) received CE IVDR registration of three new Yumizen C clinical chemistry analyzers offering new levels of instrument and reagent synergy.

- February 2021 : Thermo Fisher Scientific Inc. (US) entered into a partnership with Mindray Medical International Ltd. (China), a global manufacturer and supplier of medical devices, to offer two clinical chemistry analyzers in the US and Canada. These systems are intended for use in drug screening across clinical laboratories and drug court testing facilities

Table of Contents

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising geriatric population and increasing prevalence of chronic & lifestyle diseases- Growing adoption of point-of-care testing devices- Increasing demand for laboratory automationRESTRAINTS- Requirement for high capital investments and shortage of skilled laboratory technicians- Availability of refurbished analyzersOPPORTUNITIES- Increasing government initiatives and funding for preventive care- Growth opportunities in emerging economiesCHALLENGES- Increasing regulatory requirements- High degree of consolidation

- 5.3 PRICING ANALYSIS

-

5.4 PATENT ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSIS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.9 PESTLE ANALYSIS

-

5.10 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- China- Japan- IndiaLATIN AMERICA- Brazil- MexicoMIDDLE EASTAFRICA

- 5.11 TRADE ANALYSIS

- 6.1 INTRODUCTION

-

6.2 REAGENTSRECURRENT PURCHASE REQUIREMENT OF REAGENTS TO DRIVE MARKET

-

6.3 ANALYZERSSEMI-AUTOMATIC ANALYZERS- Cost-effectiveness of semi-automatic analyzers to propel segment growthFULLY AUTOMATIC ANALYZERS- Rapid sample processing and reduction of turnaround times to boost marketPOINT-OF-CARE ANALYZERS- Increasing adoption of PoC technologies to drive segment growth

- 6.4 OTHER PRODUCTS

- 7.1 INTRODUCTION

-

7.2 BASIC METABOLIC PANELRISING INCIDENCE OF DIABETES AND OTHER CHRONIC DISEASES TO DRIVE MARKET

-

7.3 LIVER PANELINCREASE IN LIVER-RELATED DISEASES TO DRIVE MARKET

-

7.4 RENAL PROFILERISING INCIDENCE OF ESRD PATIENTS TO PROPEL GROWTH OF RENAL PROFILE TESTING MARKET

-

7.5 LIPID PROFILERAPID RISE IN OBESITY RATES TO PROPEL MARKET GROWTH

-

7.6 THYROID FUNCTION PANELSPIKE IN INCIDENCE OF THYROID-RELATED DISORDERS TO DRIVE MARKET

-

7.7 ELECTROLYTE PANELINCREASING PREVALENCE OF HYPERTENSION AND KIDNEY DISEASES TO DRIVE GROWTH

-

7.8 SPECIALTY CHEMICAL TESTSSPECIALTY CHEMICAL TESTS SEGMENT TO GROW AT LOWEST CAGR DURING FORECAST PERIOD

- 8.1 INTRODUCTION

-

8.2 HOSPITALS & CLINICSINCREASE IN DISEASES & DISORDERS TO PROPEL MARKET GROWTH

-

8.3 DIAGNOSTIC LABORATORIESRISE IN OUTSOURCING ACTIVITIES TO DIAGNOSTIC LABORATORIES AT REDUCED COSTS TO DRIVE MARKET

-

8.4 RESEARCH LABORATORIES & INSTITUTESGROWTH IN FUNDING FOR LIFE SCIENCE RESEARCH TO BOOST MARKET

- 8.5 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Increasing cases of diabetes & obesity-related diseases to boost marketCANADA- Spike in prevalence of chronic & lifestyle diseases to drive market growth in Canada

-

9.3 EUROPEGERMANY- Increasing healthcare expenditure to drive market growth in GermanyUK- Growing number of accredited clinical laboratories to propel market growthFRANCE- Rising R&D expenditure in France to boost marketITALY- Age-related chronic conditions owing to large geriatric population to drive market growthSPAIN- Increasing prevalence of age-associated disorders to drive market growthRUSSIA- Increasing access to quality healthcare to support market growth in RussiaREST OF EUROPE

-

9.4 ASIA PACIFICCHINA- Increasing awareness of preventive care to drive demand for clinical chemistry analyzersJAPAN- Favorable regulatory framework to drive market growth in JapanINDIA- Increasing private & public investments to propel market growthREST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 10.1 OVERVIEW

-

10.2 STRATEGIES ADOPTED BY KEY PLAYERSRIGHT-TO-WIN APPROACHES ADOPTED BY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY EVALUATION QUADRANTLIST OF EVALUATED VENDORSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPANY EVALUATION QUADRANT FOR START-UPS (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

10.7 COMPETITIVE SCENARIOPRODUCT LAUNCHES & APPROVALSDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSF. HOFFMANN-LA ROCHE LTD.- Business overview- Products offered- Recent developments- MnM viewDANAHER CORPORATION- Business overview- Products offered- Recent developments- MnM viewABBOTT LABORATORIES- Business overview- Products offered- MnM viewSIEMENS HEALTHCARE GMBH- Business overview- Products offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC INC.- Business overview- Products offered- Recent developments- MnM viewHORIBA, LTD.- Business overview- Products offered- Recent developmentsSYSMEX CORPORATION- Business overview- Products offered- Recent developmentsEKF DIAGNOSTICS- Business overview- Products offered- Recent developmentsQUIDELORTHO CORPORATION- Business overview- Products offered- Recent developmentsHITACHI LTD.- Business overview- Products offered

-

11.2 OTHER PLAYERSMINDRAY MEDICAL INTERNATIONAL LTD.ELITECH GROUPBIOBASE GROUPSFRITRIVITRON HEALTHCARE PVT. LTD.RANDOX LABORATORIES LTD.MEDICA CORPORATIONMERIL LIFE SCIENCES PVT. LTD.ERBA MANNHEIMGENRUI BIOTECH CO., LTD.DIRUITECO DIAGNOSTICSBALIO DIAGNOSTICSSNIBE CO. LTD.AMS ALLIANCE

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 CLINICAL CHEMISTRY ANALYZERS MARKET: RISK ASSESSMENT

- TABLE 2 PERCENTAGE OF POPULATION AGED 65 YEARS OR ABOVE, BY REGION (2022–2050)

- TABLE 3 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT

- TABLE 4 CLINICAL CHEMISTRY ANALYZERS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 6 EXPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 7 CLINICAL CHEMISTRY REAGENTS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 8 KEY PRODUCTS IN CLINICAL CHEMISTRY ANALYZERS REAGENTS MARKET

- TABLE 9 CLINICAL CHEMISTRY REAGENTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 10 CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 11 CLINICAL CHEMISTRY ANALYZERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 12 KEY PRODUCTS IN SEMI-AUTOMATIC CLINICAL CHEMISTRY ANALYZERS MARKET

- TABLE 13 SEMI-AUTOMATIC ANALYZERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 KEY PRODUCTS IN FULLY AUTOMATIC CLINICAL CHEMISTRY ANALYZERS MARKET

- TABLE 15 FULLY AUTOMATIC ANALYZERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 16 KEY PRODUCTS IN POINT-OF-CARE CLINICAL CHEMISTRY ANALYZERS MARKET

- TABLE 17 POINT-OF-CARE ANALYZERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 CLINICAL CHEMISTRY ANALYZERS FOR OTHER PRODUCTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 20 CLINICAL CHEMISTRY BASIC METABOLIC PANEL TESTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 CLINICAL CHEMISTRY LIVER PANEL TESTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 CLINICAL CHEMISTRY RENAL PROFILE TESTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 CLINICAL CHEMISTRY LIPID PROFILE TESTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 CLINICAL CHEMISTRY THYROID FUNCTION PANEL TESTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 CLINICAL CHEMISTRY ELECTROLYTE PANEL TESTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 CLINICAL CHEMISTRY SPECIALTY CHEMICAL TESTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 28 CLINICAL CHEMISTRY ANALYZERS MARKET FOR HOSPITALS & CLINICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 CLINICAL CHEMISTRY ANALYZERS MARKET FOR DIAGNOSTIC LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 CLINICAL CHEMISTRY ANALYZERS MARKET FOR RESEARCH LABORATORIES & INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 CLINICAL CHEMISTRY ANALYZERS MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 CLINICAL CHEMISTRY ANALYZERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 38 US: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 39 US: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 40 US: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 41 US: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 42 CANADA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 43 CANADA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 44 CANADA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 45 CANADA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 EUROPE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 48 EUROPE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 49 EUROPE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 50 EUROPE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 51 GERMANY: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 52 GERMANY: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 53 GERMANY: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 54 GERMANY: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 55 UK: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 56 UK: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 57 UK: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 58 UK: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 59 FRANCE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 60 FRANCE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 FRANCE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 62 FRANCE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 63 ITALY: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 64 ITALY: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 65 ITALY: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 66 ITALY: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 67 SPAIN: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 68 SPAIN: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 SPAIN: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 70 SPAIN: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 RUSSIA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 72 RUSSIA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 73 RUSSIA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 74 RUSSIA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 75 REST OF EUROPE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 76 REST OF EUROPE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 REST OF EUROPE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 78 REST OF EUROPE: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: CLINICAL CHEMISTRY ANALYZERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 84 CHINA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 85 CHINA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 86 CHINA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 87 CHINA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 88 JAPAN: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 89 JAPAN: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 JAPAN: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 91 JAPAN: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 92 INDIA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 93 INDIA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 INDIA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 95 INDIA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 99 REST OF ASIA PACIFIC: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 100 LATIN AMERICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 101 LATIN AMERICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 LATIN AMERICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 103 LATIN AMERICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 108 CLINICAL CHEMISTRY ANALYZERS MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 109 CLINICAL CHEMISTRY ANALYZERS MARKET: DEGREE OF COMPETITION

- TABLE 110 KEY PRODUCT LAUNCHES & APPROVALS

- TABLE 111 KEY DEALS

- TABLE 112 KEY OTHER DEVELOPMENTS

- TABLE 113 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- TABLE 114 DANAHER CORPORATION: BUSINESS OVERVIEW

- TABLE 115 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- TABLE 116 SIEMENS HEALTHCARE GMBH: BUSINESS OVERVIEW

- TABLE 117 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- TABLE 118 HORIBA, LTD.: BUSINESS OVERVIEW

- TABLE 119 SYSMEX CORPORATION: BUSINESS OVERVIEW

- TABLE 120 EKF DIAGNOSTICS: BUSINESS OVERVIEW

- TABLE 121 QUIDELORTHO CORPORATION: BUSINESS OVERVIEW

- TABLE 122 HITACHI LTD.: BUSINESS OVERVIEW

- FIGURE 1 CLINICAL CHEMISTRY ANALYZERS MARKET SEGMENTATION

- FIGURE 2 CLINICAL CHEMISTRY ANALYZERS MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 7 CLINICAL CHEMISTRY ANALYZERS MARKET: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 CLINICAL CHEMISTRY ANALYZERS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 CLINICAL CHEMISTRY ANALYZERS MARKET, BY ANALYZER TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 CLINICAL CHEMISTRY ANALYZERS MARKET, BY TEST TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 CLINICAL CHEMISTRY ANALYZERS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 CLINICAL CHEMISTRY ANALYZERS MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 RISING ADOPTION OF POC PRODUCTS TO SUPPORT MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 15 REAGENTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 BASIC METABOLIC PANEL SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 17 HOSPITALS & CLINICS SEGMENT TO CONTINUE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC MARKET EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 CLINICAL CHEMISTRY ANALYZERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 PATENT ANALYSIS FOR CLINICAL CHEMISTRY ANALYZERS (JANUARY 2013–DECEMBER 2022)

- FIGURE 21 VALUE CHAIN ANALYSIS OF CLINICAL CHEMISTRY ANALYZERS MARKET

- FIGURE 22 CLINICAL CHEMISTRY ANALYZERS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 CLINICAL CHEMISTRY ANALYZERS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 NORTH AMERICA: CLINICAL CHEMISTRY ANALYZERS MARKET SNAPSHOT

- FIGURE 25 ASIA PACIFIC: CLINICAL CHEMISTRY ANALYZERS MARKET SNAPSHOT

- FIGURE 26 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN CLINICAL CHEMISTRY MARKET (2022)

- FIGURE 27 MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- FIGURE 28 CLINICAL CHEMISTRY ANALYZERS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 29 CLINICAL CHEMISTRY ANALYZERS MARKET: COMPANY EVALUATION MATRIX FOR START-UPS, 2022

- FIGURE 30 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 31 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 32 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- FIGURE 33 SIEMENS HEALTHCARE GMBH: COMPANY SNAPSHOT (2022)

- FIGURE 34 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- FIGURE 35 HORIBA, LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 36 SYSMEX CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 37 EKF DIAGNOSTICS: COMPANY SNAPSHOT (2022)

- FIGURE 38 QUIDELORTHO CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 39 HITACHI LTD.: COMPANY SNAPSHOT (2022)

Methodology

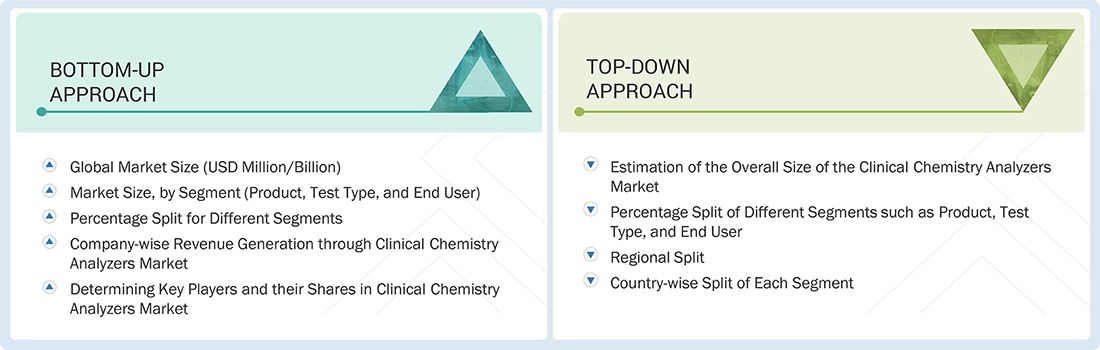

The objective of this study is to analyze the key market dynamics, including drivers, opportunities, restraints, challenges, and key player strategies. To track company developments, such as acquisitions, product launches, expansions, agreements, and partnerships, the competitive landscape of the clinical chemistry analyzers is analyzed to evaluate market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used. The four steps involved in estimating the market size are

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

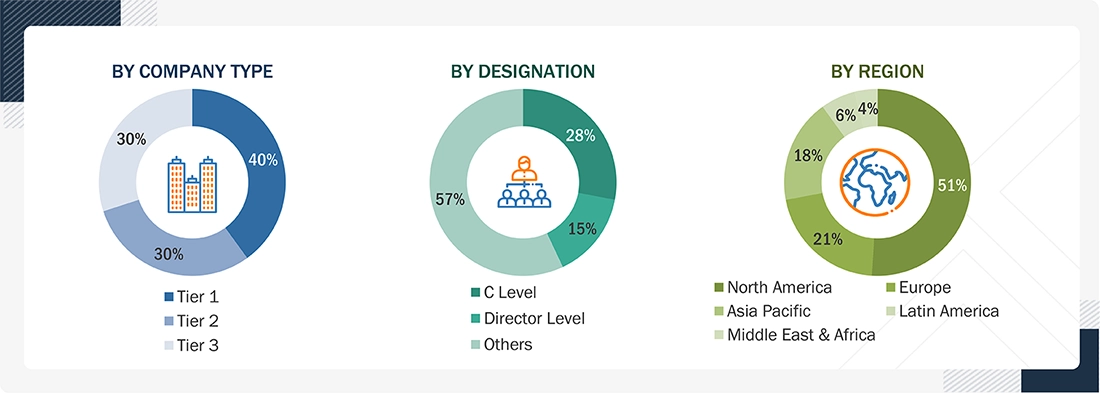

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as assess prospects.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2024, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = USD 10 million.

|

COMPANY NAME |

DESIGNATION |

|

Siemens Healthineers AG |

Regional Sales Head |

|

Thermo Fisher Scientific Inc. |

Business Manager |

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the clinical chemistry analyzer’s total size. These methods were also used extensively to estimate the size of various market segments. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the clinical chemistry analyzers have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Clinical Chemistry Analyzers Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and obtain precise statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, as applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Clinical chemistry analyzers are various types of instruments and reagents used to determine the concentration of specific metabolites, electrolytes, proteins, and/or drugs in samples of serum, plasma, urine, cerebrospinal fluid, and/or other body fluids.

Key Stakeholders

- Manufacturers & distributors of clinical chemistry analyzers, reagents, and consumables

- Data management solutions users and providers

- Associations related to clinical chemistry analyzers

- Hospitals & clinics

- Diagnostic laboratories

- Academic research institutes

- Pharmaceutical and biotechnology companies

- Clinical research organizations (CROs)

Report Objectives

- To define, describe, segment, and forecast the global clinical chemistry analyzers by product, test type, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall clinical chemistry analyzers

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the clinical chemistry analyzers using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Available Customizations

MarketsandMarkets offers the following customizations for this market report.

Country Information

- Additional country-level analysis of clinical chemistry analyzers

Company profiles

- Five additional company profiles of players operating in the clinical chemistry analyzers.

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the clinical chemistry analyzers

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Clinical Chemistry Analyzers Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Clinical Chemistry Analyzers Market