Clinical Trial Services Market Size, Growth, Share & Trends Analysis

Clinical Trial Services Market by Type (Laboratory, Monitoring, Recruitment, PV, Data Management), Phase (I, II, III), Therapy (Oncology, Neurology, Dermatology, CVD), Modality (Biologics, Devices), Delivery Model (FSP, Hybrid) - Global Forecast to 2030

OVERVIEW

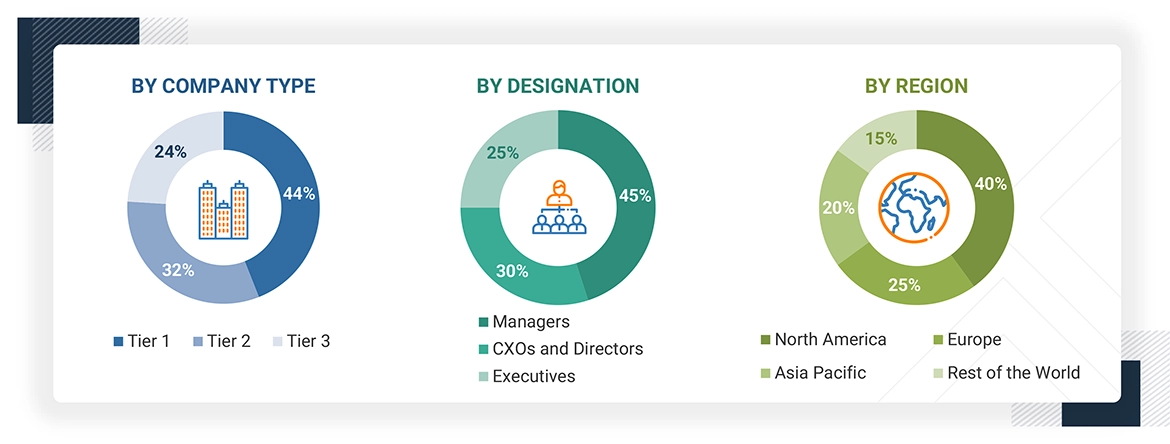

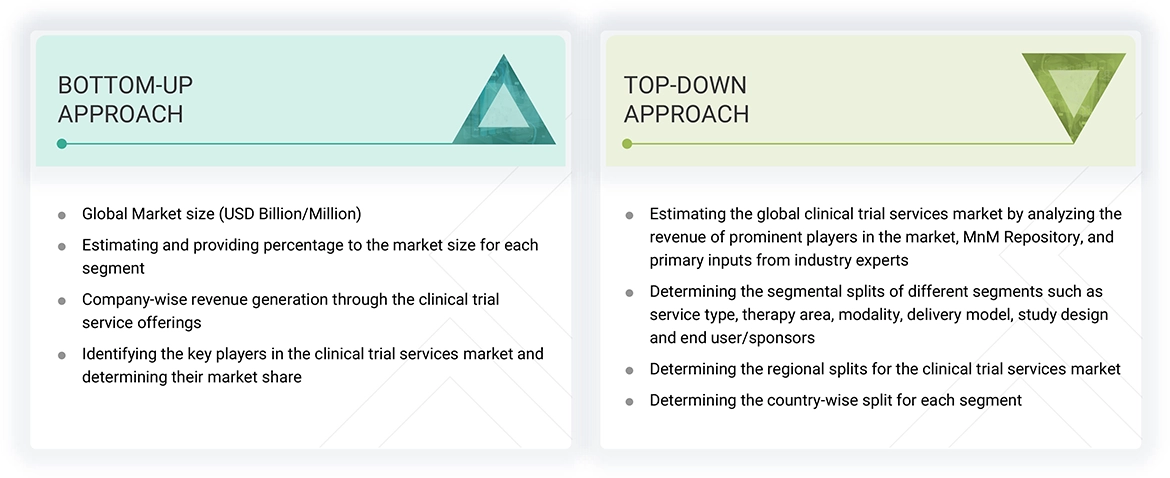

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global clinical trial services market is expected to reach USD 101.86 billion in 2030 from USD 66.59 billion in 2025 at a CAGR of 8.9% during the forecast period. Factors such as the growing focus on patient-centric clinical trials such as Decentralized Clinical trials (DCTs) and the increasing number of clinical trials for precision/personalized medicines are supporting the growth of this market.

KEY TAKEAWAYS

-

By RegionThe North American market accounted for a 45.0% revenue share in 2024. Large share is attributed to the presence of a well-established pharmaceutical industry, the rising number of ongoing clinical trial studies, growing R&D expenditure, and a strong presence of CROs.

-

By ServicesBy services, the patient recruitment & retention segment is expected to register the highest CAGR of 10.7%.

-

By PhaseBy phase, the phase III segment is projected to grow at the fastest rate from 2025 to 2030.

-

By End userBy end user, the Pharmaceutical & Biotpharmaceutical Companies segment accounted for a 70.9% revenue share in 2024. Market growth is driven by the increased investments in drug research and development, expanding R&D pipelines, rising expenditure on novel therapies, and the growing trend of outsourcing clinical and laboratory testing services.

The global clinical trial services market is driven by the increasing adoption of patient-focused approaches, such as decentralized clinical studies (DCTs), and the rising demand for personalized medicine, supported by higher R&D investments.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on business in the clinical trial services market across phases I to IV is shaped by evolving sponsor requirements, technological innovations, and increasing trial complexity. Pharmaceutical, biotechnology, medical device firms, and CROs are primary clients of clinical trial services, relying on specialized providers for crucial functions like trial management, patient recruitment, site monitoring, data analytics, and regulatory compliance. Demand is driven by the rise in advanced and personalized therapies, the globalization of clinical research, and a growing emphasis on patient-centric, decentralized and hybrid clinical trial models.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising R&D investments and patent cliff pressure to support market growth

-

Increasing focus on patient-centric trials (DCT)

Level

-

No restraints

Level

-

Regulatory requirement for increasing diversity in clinical trials

-

Growing role of real-world evidence in drug approvals

Level

-

Cybersecurity or intellectual property concerns

-

Challenge of patient retention

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advancement in Imaging Technology

Major pharmaceutical companies are facing a near patent cliff leading to stiff competition from biosimilars and generics, pressuring these companies to invest substantially towards R&D and increasing the demand for outsourced clinical trial services. According to IQVIA’s R&D Trends Report (2024), pharmaceutical companies raised their R&D spending by 49% from 2018 to 2023, reaching over USD 161 billion. Companies like J&J plan to launch 20 new drugs by 2030 to offset revenue declines. Additionally, rising biosimilar development is driving demand for CRO services, as generic and biosimilar manufacturers require outsourced clinical trials.

Restraint: High costs associated with clinical trial supplies

No restraints

Opportunity: Regulatory requirement for increasing diversity in clinical trials

Regulatory agencies like the FDA and EMA are increasing requirements for diversity in clinical trials to ensure treatments are effective for all populations. The FDA’s 2024 guidelines require trial sponsors to develop Diversity Action Plans (DAPs) to include underrepresented groups, while the EMA’s Clinical Trials Regulation (EU) No. 536/2014 promotes broader participant inclusion. To meet these requirements, pharmaceutical companies are expanding trials to new locations and partnering with local organizations, making trial management more complex. This is driving demand for CROs, which help with logistics, regulatory compliance, and patient recruitment. Many companies are also using decentralized trials and digital tools to improve accessibility.

Challenge: Cybersecurity or intellectual property concerns

Cybersecurity and intellectual property (IP) concerns are major challenges in the outsourced clinical trial market. Clinical trials involve large amounts of sensitive data, including patient information and drug development details. When trials are outsourced, this data is shared across multiple platforms, increasing the risk of cyberattacks, data breaches, and unauthorized access. Ransomware attacks and data leaks have become more common, threatening trial integrity and compliance with regulations. Intellectual property protection is also a concern, as outsourcing involves multiple partners in different countries, each following different data security rules.

clinical-trials-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

ICON plc provided clinical trial services to the Pfizer and BioNTech SE investigational COVID-19 vaccine programme. | Provided high level of remote clinical monitoring and source data verification, safeguarding data quality and integrity in the evolving pandemic environment. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The clinical trial services market ecosystem consists of raw material suppliers (clinical supply vendors, laboratory service providers, data and IT integrators), service and technology providers (CROs, specialized clinical trial management and site support firms), and end users (pharmaceutical and biotechnology sponsors, medical device companies, academic research networks). Key services span from protocol development and site management to patient recruitment, monitoring, biomarker analysis, data management, and regulatory submission, across all study phases (I-IV).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Clinical Trial Services Market, By Services

In 2024, clinical trial management & monitoring services held the largest share of the market owing to the increasing integration of advanced technologies such as AI/ML and wearable devices supporting remote clinical monitoring. These services also help sponsors enhance their site contracting cycle times and site payments by negotiating and managing contracts with clinical trial sites and streamlining the payment process to clinical trial sites.

Clinical Trial Services Market, By Study design

In 2024, interventional studies dominated the clinical trial services market. This large share of this study design segment can be attributed to the rising demand for new drugs and medical devices for various therapy areas such as oncology, and neurology among others leading to an increased demand for interventional trials, as these therapies require stringent testing in controlled environments for approvals by regulatory bodies. Owing to this pharmaceutical companies and CROs invest in these studies to accelerate drug development and bring innovative therapies to market.

Clinical Trial Services Market, By Delivery Model

In 2024, the full-service outsourcing model held the largest share of the clinical trial services market due to the increase in the number of small and mid-size pharmaceutical companies that prefer the FSO service model as they have limited resources and rely on CRO’s expertise for conducting clinical trials. Moreover, large pharmaceutical companies also utilize FSO for late-stage trials, where extensive global site management and regulatory expertise are required.

REGION

Asia Pacific to be fastest-growing region in global clinical trial services market during forecast period

The Asia Pacific region is expected to grow at the highest rate during the forecast period, supported by availability of a diverse and vast patient population for clinical trials, rising government spending, and relatively low manufacturing costs.

clinical-trials-market: COMPANY EVALUATION MATRIX

In the clinical trial services market matrix, IQVIA (Star) leads with a dominant global market share and unmatched breadth of advanced technology, data, and service capabilities. IQVIA drives innovation with its integrated platform for decentralized and hybrid clinical trials, leveraging proprietary analytics, AI-driven trial management, and connected data solutions that help sponsors accelerate drug development, optimize patient recruitment, and ensure regulatory compliance across all phases. Pharmaron (Emerging Leader) is rapidly gaining international visibility by offering comprehensive, flexible clinical development services spanning early to late-stage studies, with a strong reputation in complex and adaptive trial designs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- IQVIA Inc. (US)

- Thermo Fisher Scientific Inc. (US)

- Fortrea (US)

- ICON Plc (Ireland)

- Medpace (US)

- Syneos Health (US)

- Laboratory Corporation of America Holdings (US)

- Wuxi AppTec (China)

- Frontage Labs (US)

- Pharmaron (US)

- Tigermed (China)

- SGS Société Générale De Surveillance SA. (Switzerland)

- Eurofins Scientific (Luxembourg)

- Linical (Japan)

- Parexel International Corporation (US)

- Worldwide Clinical Trials (US)

- Novotech (Australia)

- PSI (Switzerland)

- Allucent (US)

WHAT IS IN IT FOR YOU: clinical-trials-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Competitive Landscape Assessment |

|

|

| End-to-End Outsourcing Strategy |

|

|

RECENT DEVELOPMENTS

- February 2025 : Novotech signed an MOU with Wonju Severance Christian Hospital in South Korea to enhance clinical research and medical innovation by combining its expertise in clinical trial management with the hospital’s strong research capabilities to improve trial quality and patient care.

- Januay 2025 : ICON plc expanded its AI portfolio to improve clinical trial efficiencies, supported by its AI Centre of Excellence and AI Governance Committee. The newly launched AI tools include iSubmit for automating clinical trial document management, Mapi Research Trust COA for real-time updates on Clinical Outcome Assessments, FORWARD+ for resource demand forecasting, Study Startup Site Contracts for streamlining contract drafting, and OMR AI Navigation Assistant for advanced clinical study analytics.

- December 2024 : PPD renewed two contracts with the US National Institutes of Health (NIH) focusing on monitoring clinical trial sites and providing research support for HIV and related diseases.

Table of Contents

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing focus on patient-centric trials (DCTs)- Increasing clinical trials for precision/personalized medicines supporting growth in clinical trial outsourcing- Rising R&D investments and patent cliff pressure driving growth in outsourcing clinical trial activities- Service flexibility offered by CROs for clinical development(FSP, FSO, Hybrid)- Technological integrationsOPPORTUNITIES- Increased focus on pediatric clinical trials- Increasing regulatory requirements for increasing diversity in clinical trials- Growing role of real-world evidence in drug approvals- Expanding drug modalities (such as CGT, Tissue Engineering, Bispecific Abs) in clinical trialsCHALLENGES- Cybersecurity or intellectual property concerns- Challenge of patient retention- Growing market competition

-

5.3 MARKET TRENDSIN SILICO CLINICAL TRIALS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.5 PRICING ANALYSISPRICING ANALYSIS, BY KEY PLAYER (QUALITATIVE)INDICATIVE PRICING ANALYSIS, BY PHASE, 2024INDICATIVE PRICING ANALYSIS, BY THERAPEUTIC AREA, 2024

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

-

5.9 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Clinical trial management system (CTMS)- Electronic data capture (EDC) systems- Randomization and trial supply management (RTSM)COMPLEMENTARY TECHNOLOGIES- Telemedicine and wearable devices- AI and ML integration

- 5.10 KEY CONFERENCES AND EVENTS, 2025–2026

-

5.11 REGULATORY LANDSCAPEREGULATORY FRAMEWORK- North America- Europe- Asia Pacific- RoWREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.14 IMPACT OF AI/GEN AI ON CLINICAL TRIAL SERVICES MARKETINTRODUCTIONMARKET POTENTIAL FOR CLINICAL TRIALSAI USE CASESKEY COMPANIES IMPLEMENTING AIFUTURE OF GENERATIVE AI IN CLINICAL TRIAL ECOSYSTEM

- 6.1 INTRODUCTION

-

6.2 CLINICAL TRIAL MANAGEMENT & MONITORINGRISING ADOPTION OF ADVANCED TECHNOLOGIES SUCH AS ARTIFICIAL INTELLIGENCE AND RISE OF REMOTE CLINICAL MONITORING TO SUPPORT MARKET GROWTH

-

6.3 LABORATORY SERVICESANALYTICAL TESTING SERVICES- Increasing demand for analytical testing for drug development to drive marketBIOANALYTICAL TESTING SERVICES- Rising focus on biologics in advanced therapies to drive market

-

6.4 CLINICAL TRIAL DATA MANAGEMENT SERVICESBIOSTATISTICS- Integration of real-world data (RWD) into statistical analysis to support market growthOTHER DATA MANAGEMENT SERVICES

-

6.5 CLINICAL TRIAL SUPPLY & LOGISTIC SERVICESCOMPLEXITIES ASSOCIATED WITH SUPPLY AND LOGISTICS TO DRIVE MARKET

-

6.6 CONSULTINGINCREASING COMPLEXITIES DURING TRIALS TO DRIVE MARKET

-

6.7 PATIENT RECRUITMENT & RETENTIONINCREASING REQUIREMENT FOR DECENTRALIZED CLINICAL TRIAL SERVICES TO BOOST MARKET GROWTH

-

6.8 MEDICAL WRITINGINCREASED OUTSOURCING OF MEDICAL WRITING SERVICES IN EMERGING ECONOMIES TO DRIVE MARKET

-

6.9 SAFETY & PHARMACOVIGILANCEREGULATORY AND SAFETY MONITORING EXPERTISE OFFERED BY CROS TO SUPPORT MARKET GROWTH

- 6.10 OTHER SERVICE TYPES

- 7.1 INTRODUCTION

-

7.2 PHASE IIIHIGH SIGNIFICANCE OF PHASE III TRIALS TO DRIVE DEMAND FOR OUTSOURCING

-

7.3 PHASE IILONG DURATION OF PHASE II STUDIES TO CREATE GROWTH OPPORTUNITIES FOR CROS

-

7.4 PHASE IDECLINING TRIALS TO POSE CHALLENGE IN MARKET GROWTH

-

7.5 PHASE IVSIGNIFICANCE OF PHASE IV FROM REGULATORY VIEWPOINT TO SUPPORT MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 SMALL MOLECULESEXTENSIVE PIPELINE OF DRUGS IN DEVELOPMENT PHASE AND GROWING INVESTMENTS IN R&D OF SMALL MOLECULES TO BOOST MARKET GROWTH

-

8.3 BIOLOGICSGROWING COLLABORATIONS TO DEVELOP NEW BIOLOGICS AND RISING REGULATORY SUPPORT TO PROPEL DEMAND

-

8.4 MEDICAL DEVICES & IVDSPECIALIZED SERVICES OFFERED BY CROS TO DRIVE DEMAND

- 9.1 INTRODUCTION

-

9.2 ONCOLOGYGROWING DISEASE BURDEN AND FOCUS ON DEVELOPING NOVEL MEDICINES FOR CANCER TO DRIVE MARKET

-

9.3 NEUROLOGYINCREASING R&D INVESTMENTS RELATED TO NEUROLOGICAL DISORDERS TO DRIVE MARKET

-

9.4 RESPIRATORY DISORDERSRISING INCIDENCE OF RESPIRATORY DISORDERS TO SUPPORT MARKET GROWTH

-

9.5 METABOLIC DISORDERS/ENDOCRINOLOGYINCREASING GLOBAL DIABETES POPULATION TO BOOST MARKET GROWTH

-

9.6 CARDIOVASCULAR SYSTEM DISORDERSHIGH FOCUS ON PHARMACEUTICAL R&D ATTRIBUTED TO RISING MORTALITY RATES DUE TO CVD TO DRIVE MARKET

-

9.7 DERMATOLOGYGROWING FOCUS ON DRUG DEVELOPMENT FOR VARIOUS SKIN CONDITIONS TO SUPPORT MARKET GROWTH

-

9.8 GASTROINTESTINAL DISEASESEXPANSION AND DEVELOPMENT OF GASTROINTESTINAL DRUG PRODUCT LINE TO PROPEL MARKET

-

9.9 IMMUNOLOGICAL DISORDERSGROWING CLINICAL RESEARCH FOR IMMUNOLOGICAL DISORDERS TO FUEL MARKET GROWTH

-

9.10 INFECTIOUS DISEASESRISING OUTBREAKS OF INFECTIOUS DISEASES TO INCREASE DRUG DISCOVERY ACTIVITIES AND DRIVE MARKET

-

9.11 PSYCHIATRYGROWING INCIDENCE OF PSYCHIATRIC DISORDERS TO SUPPORT MARKET GROWTH

-

9.12 OPHTHALMOLOGYRISING NUMBER OF OPHTHALMOLOGY PIPELINE DRUGS TO SUPPORT SEGMENT GROWTH

-

9.13 HEMATOLOGYCONSISTENT DRUG DEVELOPMENT EFFORTS FOR HEMATOLOGICAL DISORDERS TO SUPPORT MARKET GROWTH

-

9.14 GENITOURINARY & WOMEN’S HEALTHRISING PREVALENCE OF CHRONIC DISORDERS IN WOMEN TO PROPEL MARKET

- 9.15 OTHER THERAPEUTIC AREAS

- 10.1 INTRODUCTION

-

10.2 FULL-SERVICE OUTSOURCING (FSO) MODELRISE IN NUMBER OF EMERGING BIOPHARMACEUTICAL COMPANIES TO DRIVE MARKET

-

10.3 FUNCTIONAL SERVICE PROVIDER (FSP) MODELGROWING ADOPTION OF FSP SERVICE BY LARGE PHARMACEUTICAL COMPANIES TO FUEL MARKET GROWTH

-

10.4 HYBRID MODELHIGH FLEXIBILITY OFFERED BY HYBRID MODEL TO SUPPORT MARKET GROWTH

- 11.1 INTRODUCTION

-

11.2 INTERVENTIONALMAJOR ROLE OF INTERVENTIONAL TRIALS IN EVALUATING SAFETY AND EFFICACY OF NEW DRUGS AND DEVICES TO DRIVE MARKET

-

11.3 OBSERVATIONALINCREASING RELIANCE ON OBSERVATIONAL STUDIES TO EVALUATE EFFICACY OF DRUGS IN REAL-WORLD SCENARIO TO SUPPORT MARKET GROWTH

- 12.1 INTRODUCTION

-

12.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIESINCREASE IN R&D EXPENDITURE BY PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES TO DRIVE MARKET

-

12.3 MEDICAL DEVICE COMPANIESRISING ACQUISITIONS AND EXPANSIONS OF SERVICE PORTFOLIOS BY MEDICAL DEVICE CRO SERVICE PROVIDERS TO DRIVE MARKET

-

12.4 ACADEMIC INSTITUTESRISING COLLABORATIONS BETWEEN CROS AND ACADEMIA TO DRIVE MARKET

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICAUS- Presence of well-established CROs to drive marketCANADA- Favorable government-led initiatives and rising R&D investments to drive market

-

13.3 EUROPEGERMANY- Growing R&D spending and favorable government policies to propel marketUK- Rising collaborations and improved policies to support marketFRANCE- Government-led support for effective drug research to drive marketITALY- Government-led focus on improving clinical trial regulations to drive marketSPAIN- Rising R&D expenditure to boost market growthREST OF EUROPE

-

13.4 ASIA PACIFICCHINA- Low manufacturing cost and increased establishment of R&D centers to drive marketINDIA- Cost-efficient and innovation-driven approach to propel marketJAPAN- Decline in number of clinical trials to limit marketAUSTRALIA- Favorable tax incentives and cash rebates to pharmaceutical companies to support marketSOUTH KOREA- Favorable government initiatives for drug development to drive marketREST OF ASIA PACIFIC

-

13.5 LATIN AMERICABRAZIL- Government-led support through improved policies in pharmaceutical R&D to drive marketMEXICO- Increasing investments in pharma R&D to drive marketREST OF LATIN AMERICA

-

13.6 MIDDLE EASTGCC COUNTRIES- Saudi Arabia- UAE- Rest of GCC countriesREST OF MIDDLE EASTAFRICA- Expanding pharmaceutical industry to support market growth

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS, 2024

-

14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2024- Company footprint- Region footprint- Service type footprint- Phase footprint

-

14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024- Detailed list of key startups/SMEs- Competitive benchmarking of startups/SMEs

- 14.7 COMPANY VALUATION AND FINANCIAL METRICS

- 14.8 BRAND/SERVICE COMPARISON

-

14.9 COMPETITIVE SCENARIOSERVICE LAUNCHESDEALSEXPANSIONS

-

15.1 KEY PLAYERSIQVIA INC.- Business overview- Services offered- Recent developments- MnM viewICON PLC- Business overview- Services offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC INC.- Business overview- Services offered- Recent developments- MnM viewFORTREA- Business overview- Services offered- Recent developments- MnM viewSYNEOS HEALTH- Business overview- Services offered- Recent developments- MnM viewLABORATORY CORPORATION OF AMERICA HOLDINGS- Business overview- Services offered- Recent developments- MnM viewMEDPACE- Business overview- Services offeredWUXI APPTEC- Business overview- Services offered- Recent developmentsFRONTAGE LABS- Business overview- Services offered- Recent developmentsPHARMARON- Business overview- Services offeredTIGERMED- Business overview- Services offered- Recent developmentsSGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA- Business overview- Services offeredEUROFINS SCIENTIFIC- Business overview- Services offeredLINICAL- Business overview- Services offered- Recent developmentsPAREXEL INTERNATIONAL CORPORATION- Business overview- Services offered- Recent developments

-

15.2 OTHER PLAYERSWORLDWIDE CLINICAL TRIALSPROPHARMANOVOTECHPSIALLUCENTPREMIER RESEARCHCAIDYAERGOMED GROUPCLARIOPRECISION MEDICINE GROUP, LLC.ADVANCED CLINICALEPS HOLDINGS, INC.GUIRES INC. (PEPGRA)KCR S.A.

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 IMPACT ANALYSIS OF SUPPLY- AND DEMAND-SIDE FACTORS

- TABLE 2 RISK ASSESSMENT

- TABLE 3 CLINICAL TRIAL SERVICES MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 4 INDICATIVE PRICING ANALYSIS OF CLINICAL TRIAL SERVICES, BY PHASE, 2024 (USD)

- TABLE 5 INDICATIVE PRICING ANALYSIS OF CLINICAL TRIAL SERVICES, BY THERAPEUTIC AREA, 2024 (USD)

- TABLE 6 CLINICAL TRIAL SERVICES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 CLINICAL TRIAL SERVICES MARKET: KEY CONFERENCES AND EVENTS, 2025–2026

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REGULATORY SCENARIO FOR DRUG APPROVALS AND CGMP PROCEDURES

- TABLE 14 CLINICAL TRIAL SERVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF CLINICAL TRIAL SERVICES FOR END USER

- TABLE 16 BUYING CRITERIA FOR CLINICAL TRIAL SERVICES, BY END USER

- TABLE 17 CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 18 CLINICAL TRIAL MANAGEMENT & MONITORING SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 19 NORTH AMERICA: CLINICAL TRIAL MANAGEMENT & MONITORING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 20 EUROPE: CLINICAL TRIAL MANAGEMENT & MONITORING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 21 ASIA PACIFIC: CLINICAL TRIAL MANAGEMENT & MONITORING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 22 LATIN AMERICA: CLINICAL TRIAL MANAGEMENT & MONITORING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 23 MIDDLE EAST: CLINICAL TRIAL MANAGEMENT & MONITORING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 24 GCC COUNTRIES: CLINICAL TRIAL MANAGEMENT & MONITORING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 25 EXAMPLES OF LABORATORY SERVICES OFFERED BY PROMINENT PLAYERS

- TABLE 26 LABORATORY SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 27 NORTH AMERICA: LABORATORY SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 28 EUROPE: LABORATORY SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 29 ASIA PACIFIC: LABORATORY SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 30 LATIN AMERICA: LABORATORY SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 31 MIDDLE EAST: LABORATORY SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 32 GCC COUNTRIES: LABORATORY SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 33 LABORATORY SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 34 ANALYTICAL TESTING SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: ANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 36 EUROPE: ANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: ANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 38 LATIN AMERICA: ANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 39 MIDDLE EAST: ANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 40 GCC COUNTRIES: ANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 41 BIOANALYTICAL TESTING SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 43 EUROPE: BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 44 ASIA PACIFIC: BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 45 LATIN AMERICA: BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 46 MIDDLE EAST: BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 47 GCC COUNTRIES: BIOANALYTICAL TESTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 48 EXAMPLES OF DATA MANAGEMENT SERVICES OFFERED BY PROMINENT PLAYERS

- TABLE 49 CLINICAL TRIAL DATA MANAGEMENT SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: CLINICAL TRIAL DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 51 EUROPE: CLINICAL TRIAL DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: CLINICAL TRIAL DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 53 LATIN AMERICA: CLINICAL TRIAL DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 54 MIDDLE EAST: CLINICAL TRIAL DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 55 GCC COUNTRIES: CLINICAL TRIAL DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 56 CLINICAL TRIAL DATA MANAGEMENT SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 57 CLINICAL TRIAL DATA MANAGEMENT SERVICES: CLINICAL TRIAL SERVICES MARKET FOR BIOSTATISTICS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR BIOSTATISTICS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 59 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR BIOSTATISTICS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 60 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR BIOSTATISTICS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 61 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR BIOSTATISTICS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 62 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR BIOSTATISTICS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 63 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR BIOSTATISTICS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 64 OTHER DATA MANAGEMENT SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: OTHER DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 66 EUROPE: OTHER DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 67 ASIA PACIFIC: OTHER DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 68 LATIN AMERICA: OTHER DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 69 MIDDLE EAST: OTHER DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 70 GCC COUNTRIES: OTHER DATA MANAGEMENT SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 71 CLINICAL TRIAL SUPPLY & LOGISTIC SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: CLINICAL TRIAL SUPPLY & LOGISTIC SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 73 EUROPE: CLINICAL TRIAL SUPPLY & LOGISTIC SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 74 ASIA PACIFIC: CLINICAL TRIAL SUPPLY & LOGISTIC SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 75 LATIN AMERICA: CLINICAL TRIAL SUPPLY & LOGISTIC SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 76 MIDDLE EAST: CLINICAL TRIAL SUPPLY & LOGISTIC SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 77 GCC COUNTRIES: CLINICAL TRIAL SUPPLY & LOGISTIC SERVICES MARKET,BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 78 CONSULTING SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: CONSULTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 80 EUROPE: CONSULTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: CONSULTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 82 LATIN AMERICA: CONSULTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 83 MIDDLE EAST: CONSULTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 84 GCC COUNTRIES: CONSULTING SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 85 PATIENT RECRUITMENT & RETENTION SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: PATIENT RECRUITMENT & RETENTION SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 87 EUROPE: PATIENT RECRUITMENT & RETENTION SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: PATIENT RECRUITMENT & RETENTION SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION), BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 89 LATIN AMERICA: PATIENT RECRUITMENT & RETENTION SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 90 MIDDLE EAST: PATIENT RECRUITMENT & RETENTION SERVICES MARKET,BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 91 GCC COUNTRIES: PATIENT RECRUITMENT & RETENTION SERVICES MARKET,BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 92 MEDICAL WRITING SERVICE MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: MEDICAL WRITING SERVICE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 94 EUROPE: MEDICAL WRITING SERVICE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MEDICAL WRITING SERVICE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 96 LATIN AMERICA: MEDICAL WRITING SERVICE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 97 MIDDLE EAST: MEDICAL WRITING SERVICE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 98 GCC COUNTRIES: MEDICAL WRITING SERVICE MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 99 SAFETY & PHARMACOVIGILANCE SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: SAFETY & PHARMACOVIGILANCE SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 101 EUROPE: SAFETY & PHARMACOVIGILANCE SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: SAFETY & PHARMACOVIGILANCE SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 103 LATIN AMERICA: SAFETY & PHARMACOVIGILANCE SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 104 MIDDLE EAST: SAFETY & PHARMACOVIGILANCE SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 105 GCC COUNTRIES: SAFETY & PHARMACOVIGILANCE SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 106 OTHER CLINICAL TRIAL SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: OTHER CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 108 EUROPE: OTHER CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: OTHER CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 110 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR LATIN AMERICA, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 111 MIDDLE EAST: OTHER CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 112 GCC COUNTRIES: OTHER CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 113 CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 114 CLINICAL TRIAL SERVICES MARKET FOR PHASE III, BY REGION, 2023–2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR PHASE III, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 116 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR PHASE III, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR PHASE III, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 118 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR PHASE III, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 119 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR PHASE III, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 120 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR PHASE III, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 121 CLINICAL TRIAL SERVICES MARKET FOR PHASE II, BY REGION, 2023–2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR PHASE II, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 123 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR PHASE II, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR PHASE II, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 125 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR PHASE II, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 126 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR PHASE II, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 127 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR PHASE II, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 128 CLINICAL TRIAL SERVICES MARKET FOR PHASE I, BY REGION, 2023–2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR PHASE I, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 130 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR PHASE I, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR PHASE I, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 132 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR PHASE I, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 133 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR PHASE I, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 134 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR PHASE I, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 135 CLINICAL TRIAL SERVICES MARKET FOR PHASE IV, BY REGION, 2023–2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR PHASE IV, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 137 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR PHASE IV, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR PHASE IV, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 139 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR PHASE IV, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 140 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR PHASE IV, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 141 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR PHASE IV, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 142 CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 143 CLINICAL TRIAL SERVICES MARKET FOR SMALL MOLECULES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 144 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR SMALL MOLECULES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 145 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR SMALL MOLECULES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR SMALL MOLECULES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 147 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR SMALL MOLECULES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 148 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR SMALL MOLECULES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 149 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR SMALL MOLECULES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 150 CLINICAL TRIAL SERVICES MARKET FOR BIOLOGICS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 151 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR BIOLOGICS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 152 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR BIOLOGICS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 153 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR BIOLOGICS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 154 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR BIOLOGICS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 155 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR BIOLOGICS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 156 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR BIOLOGICS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 157 CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICES & IVD, BY REGION, 2023–2030 (USD MILLION)

- TABLE 158 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICES & IVD, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 159 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICES & IVD, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICES & IVD, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 161 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICES & IVD, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 162 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICES & IVD, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 163 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICES & IVD, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 164 CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 165 NUMBER OF NEW CANCER CASES, BY TYPE, 2022 VS. 2040

- TABLE 166 CLINICAL TRIAL SERVICES MARKET FOR ONCOLOGY, BY REGION, 2023–2030 (USD MILLION)

- TABLE 167 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 168 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 170 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 171 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 172 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 173 CLINICAL TRIAL SERVICES MARKET FOR NEUROLOGY, BY REGION, 2023–2030 (USD MILLION)

- TABLE 174 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR NEUROLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 175 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR NEUROLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 176 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR NEUROLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR NEUROLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 178 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR NEUROLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 179 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR NEUROLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 180 CLINICAL TRIAL SERVICES MARKET FOR RESPIRATORY DISORDERS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 181 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 182 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 183 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 184 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 185 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 186 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 187 CLINICAL TRIAL SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY REGION, 2023–2030 (USD MILLION)

- TABLE 188 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 189 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 190 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 191 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 192 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 193 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 194 CLINICAL TRIAL SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 195 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 196 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 197 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 198 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 199 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 200 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 201 CLINICAL TRIAL SERVICES MARKET FOR DERMATOLOGY, BY REGION, 2023–2030 (USD MILLION)

- TABLE 202 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR DERMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 203 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR DERMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 204 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR DERMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 205 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR DERMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 206 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR DERMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 207 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR DERMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 208 CLINICAL TRIAL SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 209 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 210 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 211 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 212 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 213 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 214 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 215 CLINICAL TRIAL SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 216 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 217 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 218 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 219 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 220 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 221 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 222 CLINICAL TRIAL SERVICES MARKET FOR INFECTIOUS DISEASES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 223 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 224 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 225 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 226 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 227 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 228 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 229 CLINICAL TRIAL SERVICES MARKET FOR PSYCHIATRY, BY REGION, 2023–2030 (USD MILLION)

- TABLE 230 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR PSYCHIATRY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 231 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR PSYCHIATRY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 232 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR PSYCHIATRY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 233 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR PSYCHIATRY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 234 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR PSYCHIATRY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 235 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR PSYCHIATRY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 236 CLINICAL TRIAL SERVICES MARKET FOR OPHTHALMOLOGY, BY REGION, 2023–2030 (USD MILLION)

- TABLE 237 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 238 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 239 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 240 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 241 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 242 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 243 CLINICAL TRIAL SERVICES MARKET FOR HEMATOLOGY, BY REGION, 2023–2030 (USD MILLION)

- TABLE 244 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR HEMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 245 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR HEMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 246 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR HEMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 247 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR HEMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 248 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR HEMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 249 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR HEMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 250 CLINICAL TRIAL SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY REGION, 2023–2030 (USD MILLION)

- TABLE 251 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 252 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 253 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 254 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 255 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 256 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 257 CLINICAL TRIAL SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 258 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 259 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 260 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 261 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 262 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 263 OTHER THERAPEUTIC AREAS: CLINICAL TRIAL SERVICES MARKET FOR GCC COUNTRIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 264 CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 265 CLINICAL TRIAL SERVICES MARKET FOR FULL-SERVICE OUTSOURCING (FSO) MODEL, BY REGION, 2023–2030 (USD MILLION)

- TABLE 266 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR FULL-SERVICE OUTSOURCING (FSO) MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 267 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR FULL-SERVICE OUTSOURCING (FSO) MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 268 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR FULL-SERVICE OUTSOURCING (FSO) MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 269 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR FULL-SERVICE OUTSOURCING (FSO) MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 270 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR FULL-SERVICE OUTSOURCING (FSO) MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 271 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR FULL-SERVICE OUTSOURCING (FSO) MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 272 CLINICAL TRIAL SERVICES MARKET FOR FUNCTIONAL SERVICE PROVIDER (FSP) MODEL, BY REGION, 2023–2030 (USD MILLION)

- TABLE 273 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR FUNCTIONAL SERVICE PROVIDER (FSP) MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 274 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR FUNCTIONAL SERVICE PROVIDER (FSP) MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 275 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR FUNCTIONAL SERVICE PROVIDER (FSP) MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 276 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR FUNCTIONAL SERVICE PROVIDER (FSP) MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 277 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR FUNCTIONAL SERVICE PROVIDER (FSP) MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 278 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR FUNCTIONAL SERVICE PROVIDER (FSP) MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 279 CLINICAL TRIAL SERVICES MARKET FOR HYBRID MODEL, BY REGION, 2023–2030 (USD MILLION)

- TABLE 280 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR HYBRID MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 281 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR HYBRID MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 282 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR HYBRID MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 283 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR HYBRID MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 284 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR HYBRID MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 285 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR HYBRID MODEL, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 286 CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 287 CLINICAL TRIAL SERVICES MARKET FOR INTERVENTIONAL STUDY DESIGN, BY REGION, 2023–2030 (USD MILLION)

- TABLE 288 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR INTERVENTIONAL STUDY DESIGN, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 289 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR INTERVENTIONAL STUDY DESIGN, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 290 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR INTERVENTIONAL STUDY DESIGN, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 291 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR INTERVENTIONAL STUDY DESIGN, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 292 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR INTERVENTIONAL STUDY DESIGN, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 293 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR INTERVENTIONAL STUDY DESIGN, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 294 CLINICAL TRIAL SERVICES MARKET FOR OBSERVATIONAL STUDY DESIGN, BY REGION, 2023–2030 (USD MILLION)

- TABLE 295 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR OBSERVATIONAL STUDY DESIGN, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 296 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR OBSERVATIONAL STUDY DESIGN, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 297 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR OBSERVATIONAL STUDY DESIGN, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 298 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR OBSERVATIONAL STUDY DESIGN, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 299 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR OBSERVATIONAL STUDY DESIGN, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 300 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR OBSERVATIONAL STUDY DESIGN, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 301 CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 302 CLINICAL TRIAL SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 303 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 304 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 305 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 306 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 307 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 308 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 309 CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 310 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 311 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 312 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 313 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 314 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 315 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 316 CLINICAL TRIAL SERVICES MARKET FOR ACADEMIC INSTITUTES, BY REGION, 2023–2030 (USD MILLION)

- TABLE 317 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 318 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 319 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 320 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 321 MIDDLE EAST: CLINICAL TRIAL SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 322 GCC COUNTRIES: CLINICAL TRIAL SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 323 CLINICAL TRIAL SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 324 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 325 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 326 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 327 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 328 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 329 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 330 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 331 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 332 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 333 NORTH AMERICA: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 334 US: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 335 US: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 336 US: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 337 US: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 338 US: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 339 US: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 340 US: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 341 US: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 342 US: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 343 CANADA: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 344 CANADA: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 345 CANADA: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 346 CANADA: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 347 CANADA: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 348 CANADA: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 349 CANADA: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 350 CANADA: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 351 CANADA: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 352 EUROPE: CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 353 EUROPE: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 354 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 355 EUROPE: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 356 EUROPE: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 357 EUROPE: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 358 EUROPE: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 359 EUROPE: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 360 EUROPE: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 361 EUROPE: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 362 GERMANY: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 363 GERMANY: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 364 GERMANY: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 365 GERMANY: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 366 GERMANY: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 367 GERMANY: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 368 GERMANY: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 369 GERMANY: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 370 GERMANY: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 371 UK: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 372 UK: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 373 UK: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 374 UK: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 375 UK: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 376 UK: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 377 UK: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 378 UK: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 379 UK: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 380 FRANCE: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 381 FRANCE: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES,BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 382 FRANCE: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 383 FRANCE: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 384 FRANCE: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 385 FRANCE: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 386 FRANCE: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 387 FRANCE: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 388 FRANCE: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 389 ITALY: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 390 ITALY: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 391 ITALY: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 392 ITALY: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 393 ITALY: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 394 ITALY: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 395 ITALY: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 396 ITALY: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 397 ITALY: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 398 SPAIN: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 399 SPAIN: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 400 SPAIN: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 401 SPAIN: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 402 SPAIN: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 403 SPAIN: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 404 SPAIN: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 405 SPAIN: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 406 SPAIN: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 407 REST OF EUROPE: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 408 REST OF EUROPE: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 409 REST OF EUROPE: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 410 REST OF EUROPE: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 411 REST OF EUROPE: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 412 REST OF EUROPE: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 413 REST OF EUROPE: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 414 REST OF EUROPE: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 415 REST OF EUROPE: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 416 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 417 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 418 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 419 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 420 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 421 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 422 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 423 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 424 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 425 ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 426 CHINA: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 427 CHINA: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 428 CHINA: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 429 CHINA: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 430 CHINA: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 431 CHINA: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 432 CHINA: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 433 CHINA: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 434 CHINA: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 435 INDIA: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 436 INDIA: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 437 INDIA: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 438 INDIA: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 439 INDIA: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 440 INDIA: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 441 INDIA: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 442 INDIA: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 443 INDIA: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 444 JAPAN: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 445 JAPAN: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 446 JAPAN: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 447 JAPAN: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 448 JAPAN: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 449 JAPAN: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 450 JAPAN: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 451 JAPAN: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 452 JAPAN: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 453 AUSTRALIA: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 454 AUSTRALIA: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 455 AUSTRALIA: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 456 AUSTRALIA: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 457 AUSTRALIA: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 458 AUSTRALIA: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 459 AUSTRALIA: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 460 AUSTRALIA: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 461 AUSTRALIA: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 462 SOUTH KOREA: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 463 SOUTH KOREA: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 464 SOUTH KOREA: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 465 SOUTH KOREA: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 466 SOUTH KOREA: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 467 SOUTH KOREA: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 468 SOUTH KOREA: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 469 SOUTH KOREA: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 470 SOUTH KOREA: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 471 REST OF ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 472 REST OF ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 473 REST OF ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 474 REST OF ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 475 REST OF ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 476 REST OF ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 477 REST OF ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 478 REST OF ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 479 REST OF ASIA PACIFIC: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 480 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 481 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 482 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 483 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 484 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 485 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 486 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 487 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 488 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 489 LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 490 BRAZIL: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 491 BRAZIL: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 492 BRAZIL: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 493 BRAZIL: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 494 BRAZIL: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 495 BRAZIL: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 496 BRAZIL: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 497 BRAZIL: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 498 BRAZIL: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 499 MEXICO: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 500 MEXICO: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 501 MEXICO: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 502 MEXICO: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 503 MEXICO: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

- TABLE 504 MEXICO: CLINICAL TRIAL SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

- TABLE 505 MEXICO: CLINICAL TRIAL SERVICES MARKET, BY DELIVERY MODEL, 2023–2030 (USD MILLION)

- TABLE 506 MEXICO: CLINICAL TRIAL SERVICES MARKET, BY STUDY DESIGN, 2023–2030 (USD MILLION)

- TABLE 507 MEXICO: CLINICAL TRIAL SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 508 REST OF LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 509 REST OF LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR LABORATORY SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 510 REST OF LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY SERVICE TYPE, 2023–2030 (USD MILLION)

- TABLE 511 REST OF LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET, BY PHASE, 2023–2030 (USD MILLION)

- TABLE 512 REST OF LATIN AMERICA: CLINICAL TRIAL SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)