2

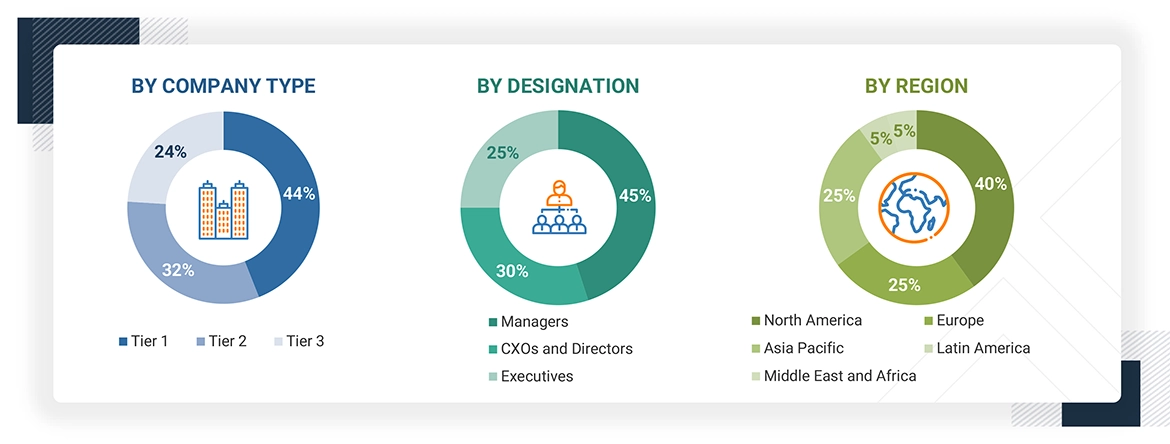

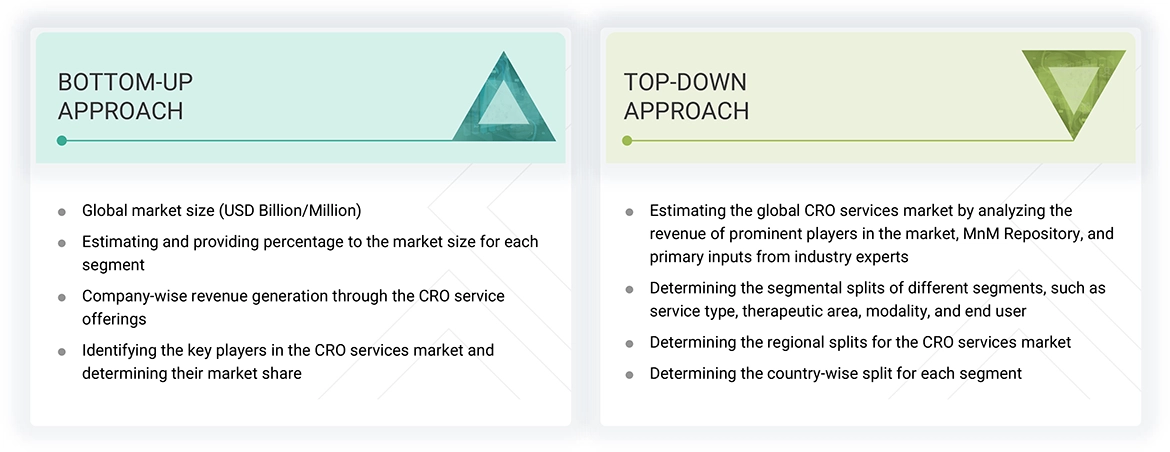

RESEARCH METHODOLOGY

59

5

MARKET OVERVIEW

Decentralized trials and tech integration drive CRO market growth amidst rising protocol complexity.

88

5.2.1.1

RISING CLINICAL TRIAL VOLUME AND ESCALATING PROTOCOL COMPLEXITY

5.2.1.2

GROWING FOCUS ON DECENTRALIZED/PATIENT-CENTRIC TRIALS

5.2.1.3

INCREASING PREFERENCE FOR SERVICE FLEXIBILITY

5.2.1.4

TECHNOLOGICAL INTEGRATION

5.2.1.5

GROWING R&D BUDGETS AND EXPANDING LATE-STAGE PIPELINES

5.2.2.1

SHIFT TOWARD REGULATORY COMPLIANCE

5.2.2.2

GROWING ADOPTION OF RISK-BASED MONITORING

5.2.2.3

FAVORABLE REIMBURSEMENT SCENARIO

5.2.3.1

PATIENT RETENTION

5.2.3.2

CYBERSECURITY AND INTELLECTUAL PROPERTY CHALLENGES

6

INDUSTRY TRENDS

Discover how emerging analytics and technologies are redefining pricing and regulatory landscapes globally.

96

6.1.1

HEALTH ECONOMICS & OUTCOMES RESEARCH AND REAL-WORLD EVIDENCE

6.1.3

SPECIALIZED ANALYTICS FOR EMERGING MODALITIES

6.2

TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6.3.1

INDICATIVE PRICING ANALYSIS, BY SERVICE TYPE

6.3.2

INDICATIVE PRICING ANALYSIS, BY PHASE

6.3.3

INDICATIVE PRICING ANALYSIS, BY REGION

6.6

INVESTMENT/FUNDING ACTIVITY

6.7.1.1

CLINICAL TRIAL MANAGEMENT SYSTEM

6.7.1.2

RANDOMIZATION AND TRIAL SUPPLY MANAGEMENT

6.7.1.3

ELECTRONIC DATA CAPTURE (EDC) SYSTEM

6.7.2

COMPLEMENTARY TECHNOLOGIES

6.7.2.1

MODEL-INFORMED DRUG DEVELOPMENT

6.7.2.2

DATA MANAGEMENT AND INFORMATICS TECHNOLOGIES

6.7.3

ADJACENT TECHNOLOGIES

6.7.3.1

CLINICAL TRIAL SIMULATION TOOLS

6.8

KEY CONFERENCES AND EVENTS

6.9.1

REGULATORY FRAMEWORK

6.9.1.4

REST OF THE WORLD

6.9.2

REGULATORY ANALYSIS

6.9.3

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.9.4

REGULATORY SCENARIO FOR DRUG APPROVALS AND CGMP PROCEDURES

6.10

PORTER’S FIVE FORCES ANALYSIS

6.10.1

BARGAINING POWER OF SUPPLIERS

6.10.2

BARGAINING POWER OF BUYERS

6.10.3

THREAT OF NEW ENTRANTS

6.10.4

THREAT OF SUBSTITUTES

6.10.5

INTENSITY OF COMPETITIVE RIVALRY

6.11

KEY STAKEHOLDERS AND BUYING CRITERIA

6.11.1

KEY STAKEHOLDERS IN BUYING PROCESS

6.12.1

BUDGET ALLOCATION TREND

6.12.2

ADOPTION BARRIER AND INTERNAL FRICTION

6.13

IMPACT OF AI/GEN AI ON CRO SERVICES MARKET

6.13.2

MARKET POTENTIAL ACROSS DRUG DEVELOPMENT STAGES

6.13.4

KEY COMPANIES IMPLEMENTING AI

6.13.5

FUTURE OF GENERATIVE AI IN DRUG DEVELOPMENT ECOSYSTEM

6.14

IMPACT OF 2025 TRUMP TARIFF ON CRO SERVICES MARKET

6.14.3

PRICE IMPACT ANALYSIS

6.14.4

IMPACT ON COUNTRY/REGION

6.14.4.1

NORTH AMERICA (US)

6.14.5

IMPACT ON END-USE INDUSTRIES

6.14.5.1

PHARMACEUTICAL & BIOTECH COMPANIES

6.14.5.2

MEDICAL DEVICE COMPANIES

6.14.5.3

ACADEMIC INSTITUTES

7

CRO SERVICES MARKET, BY TYPE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 164 Data Tables

131

7.2

CLINICAL RESEARCH SERVICES

7.2.1.1

LARGE-SCALE TESTING ABILITY TO ASSESS EFFICACY AND SAFETY OF DRUGS TO AID GROWTH

7.2.2.1

GROWING NUMBER OF PIPELINE PRODUCTS IN PHASE II STUDIES TO DRIVE MARKET

7.2.3.1

ROBUST PIPELINE OF PHARMACEUTICAL AND BIOPHARMACEUTICAL PRODUCTS TO SUPPORT GROWTH

7.2.4.1

STRINGENT GLOBAL REGULATIONS FOR DRUG SAFETY MONITORING TO SPUR GROWTH

7.3

EARLY PHASE DEVELOPMENT SERVICES

7.3.1

CHEMISTRY, MANUFACTURING, AND CONTROL SERVICES

7.3.1.1

GROWING NEED TO MEET REGULATORY NORMS FOR DRUGS TO FUEL MARKET

7.3.2

PRECLINICAL SERVICES

7.3.2.1

PHARMACOKINETICS/PHARMACODYNAMICS

7.3.2.2

TOXICOLOGY TESTING

7.3.2.3

OTHER PRECLINICAL SERVICES

7.3.3.1

INCREASING RELIANCE ON CRO SERVICES FOR TARGET IDENTIFICATION AND VALIDATION TO EXPEDITE GROWTH

7.4.1.1

PHYSICAL CHARACTERIZATION

7.4.1.2

RAW MATERIAL TESTING

7.4.1.3

BATCH-RELEASE TESTING

7.4.1.4

STABILITY TESTING

7.4.1.5

OTHER ANALYTICAL TESTING SERVICES

7.4.2

BIOANALYTICAL TESTING

7.4.2.1

INCREASING OUTSOURCING OF R&D ACTIVITIES TO ACCELERATE GROWTH

7.5.1

GROWING ADOPTION OF CONSULTING SERVICES FOR FASTER REGULATORY APPROVALS TO BOOST MARKET

7.6

DATA MANAGEMENT SERVICES

7.6.1

NEED TO TRACK PROGRESS OF EARLY DRUG DEVELOPMENT TO AUGMENT GROWTH

8

CRO SERVICES MARKET, BY THERAPEUTIC AREA

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 144 Data Tables

213

8.2.1.1

INCREASING CASES AND HIGH SPENDING ON TREATING BREAST CANCER TO SUPPORT GROWTH

8.2.2.1

INCREASING FOCUS ON DEVELOPING DRUGS AGAINST LUNG CANCER TO FOSTER GROWTH

8.2.3.1

INCREASING DRUG DISCOVERY AND DEVELOPMENT EFFORTS AGAINST COLORECTAL CANCER TO AID GROWTH

8.2.4.1

GROWING CLINICAL PIPELINE TO PROPEL MARKET

8.3.1

INCREASING INCIDENCE OF CHRONIC INFECTIONS TO SUPPORT GROWTH

8.4

CARDIOVASCULAR SYSTEM DISORDERS

8.4.1

HIGH MORTALITY RATES DUE TO CARDIOVASCULAR DISEASES TO FUEL MARKET

8.5.1

GROWING INVESTMENTS IN NEUROLOGICAL DISORDER RESEARCH TO DRIVE MARKET

8.6.1

INCREASING FOCUS ON VACCINE DEVELOPMENT TO SPUR GROWTH

8.7

METABOLIC DISORDERS/ENDOCRINOLOGY

8.7.1

INCREASING GLOBAL DIABETES AND OBESITY POPULATION TO PROMOTE GROWTH

8.8

IMMUNOLOGICAL DISORDERS

8.8.1

GROWING CLINICAL RESEARCH FOR IMMUNOLOGICAL DISORDERS TO BOOST MARKET

8.9.1

RISING CASES OF PSYCHIATRIC DISORDERS AND DEPRESSION TO SUSTAIN GROWTH

8.10

RESPIRATORY DISORDERS

8.10.1

RISING INCIDENCE OF CHRONIC RESPIRATORY DISEASE TO FOSTER GROWTH

8.11.1

GROWING FOCUS ON DRUG DEVELOPMENT AGAINST VARIOUS SKIN CONDITIONS TO DRIVE MARKET

8.12.1

GROWTH IN OPHTHALMOLOGY PIPELINE DRUGS TO SUPPORT MARKET

8.13

GASTROINTESTINAL DISEASES

8.13.1

RAPID LIFESTYLE AND DIETARY CHANGES TO AMPLIFY GROWTH

8.14

GENITOURINARY & WOMEN’S HEALTH

8.14.1

RISING AWARENESS ABOUT EARLY DISEASE DIAGNOSIS AND TREATMENT TO BOLSTER GROWTH

8.15.1

INCREASING DRUG APPROVALS FOR DRUGS AGAINST NON-MALIGNANT HEMATOLOGICAL CONDITIONS TO SUPPORT GROWTH

8.16

OTHER THERAPEUTIC AREAS

9

CRO SERVICES MARKET, BY MODALITY

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 87 Data Tables

287

9.2.1

ONGOING SURGE IN PHARMACEUTICAL R&D INVESTMENTS TO SUPPORT GROWTH

9.3.1

MONOCLONAL ANTIBODY

9.3.1.1

SURGING DEMAND FOR TARGETED THERAPIES ACROSS ONCOLOGY, AUTOIMMUNE DISORDERS, AND INFECTIOUS DISEASES TO DRIVE MARKET

9.3.2

CELL & GENE THERAPY

9.3.2.1

ROBUST DRUG PIPELINE AND R&D INITIATIVES TO DRIVE MARKET

9.4.1

RAPID INNOVATIONS IN DIAGNOSTICS, IMPLANTABLE, AND DIGITAL HEALTH TECHNOLOGIES TO FOSTER GROWTH

9.5.1

MONOCLONAL ANTIBODY BIOSIMILARS

9.5.1.1

RISING DEMAND FOR AFFORDABLE THERAPEUTIC OPTIONS TO SUPPORT GROWTH

9.5.2.1

INCREASING PATENT EXPIRATIONS TO CONTRIBUTE TO GROWTH

9.5.3

COLONY STIMULATING FACTOR

9.5.3.1

INCREASING USE OF COLONY STIMULATING FACTOR DURING POST-CHEMOTHERAPY TO AID GROWTH

9.5.4.1

ESSENTIAL ROLE OF ERYTHROPOIETIN IN TREATING ANEMIA TO STIMULATE GROWTH

10

CRO SERVICES MARKET, BY END USER

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 22 Data Tables

328

10.2

PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

10.2.1

INCREASING OUTSOURCING AND PARTNERSHIPS TO ACCELERATE GROWTH

10.3

MEDICAL DEVICE COMPANIES

10.3.1

INCREASING RECOGNITION OF CRO PROVIDERS TO AUGMENT GROWTH

10.4.1

CONSISTENT COLLABORATIONS BETWEEN CROS AND ACADEMIA TO INTENSIFY GROWTH

11

CRO SERVICES MARKET, BY REGION

Comprehensive coverage of 7 Regions with country-level deep-dive of 18 Countries | 347 Data Tables.

342

11.2.1

MACROECONOMIC OUTLOOK FOR NORTH AMERICA

11.2.2.1

INCREASING INCIDENCE OF ONCOLOGY INDICATIONS TO ACCELERATE GROWTH

11.2.3.1

FAVORABLE GOVERNMENT INITIATIVES AND HIGH INVESTMENTS TO SUPPORT GROWTH

11.3.1

MACROECONOMIC OUTLOOK FOR EUROPE

11.3.2.1

PRESENCE OF STRONG PHARMACEUTICAL AND BIOTECHNOLOGY R&D INFRASTRUCTURE TO SPUR GROWTH

11.3.3.1

RISING R&D EXPENDITURE IN PHARMACEUTICAL INDUSTRY TO EXPEDITE GROWTH

11.3.4.1

INCREASING TECHNOLOGICAL ADVANCEMENTS AND FASTER DRUG DISCOVERY AND DEVELOPMENT INITIATIVES TO AID GROWTH

11.3.5.1

SHORT TIMELINE FOR DRUG APPROVALS TO ENCOURAGE GROWTH

11.3.6.1

GROWING INVESTMENT IN PHARMACEUTICAL INDUSTRY TO BOOST MARKET

11.4.1

MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

11.4.2.1

CONTINUED EFFORTS ON IMPROVING LEVEL OF DRUG SAFETY AND SUPPLY TO SPUR GROWTH

11.4.3.1

LARGE POOL OF PATIENTS AND PRESENCE OF HIGHLY SKILLED MEDICAL PROFESSIONALS TO AUGMENT GROWTH

11.4.4.1

GROWING DRUG DEVELOPMENT ACTIVITY TO PROPEL MARKET

11.4.5.1

GROWING FOCUS ON FUNDING OPPORTUNITIES TO BOOST MARKET

11.4.6.1

EMERGING CLINICAL RESEARCH HUB TO SUSTAIN GROWTH

11.4.7

REST OF ASIA PACIFIC

11.5.1

MACROECONOMIC OUTLOOK FOR LATIN AMERICA

11.5.2.1

GROWING FOCUS ON ENHANCING PHARMACEUTICAL RESEARCH AND PRODUCTION TO FUEL MARKET

11.5.3.1

INCREASING INVESTMENTS IN PHARMA R&D TO PROMOTE GROWTH

11.5.4

REST OF LATIN AMERICA

11.6.1

MACROECONOMIC OUTLOOK FOR MIDDLE EAST

11.6.2.1

KINGDOM OF SAUDI ARABIA (KSA)

11.6.2.2

UNITED ARAB EMIRATES (UAE)

11.6.2.3

REST OF MIDDLE EAST

11.7.1

BOOMING PHARMACEUTICAL INDUSTRY TO FACILITATE GROWTH

11.7.2

MACROECONOMIC OUTLOOK FOR AFRICA

12

COMPETITIVE LANDSCAPE

Discover top strategies and market positions defining the CRO services competitive landscape.

501

12.2

KEY PLAYER STRATEGIES/RIGHT TO WIN

12.2.1

OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN CRO SERVICES MARKET

12.3

REVENUE ANALYSIS, 2020–2024

12.4

MARKET SHARE ANALYSIS, 2024

12.5

COMPANY VALUATION AND FINANCIAL METRICS

12.6

BRAND/SERVICE COMPARISON

12.7

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

12.7.5

COMPANY FOOTPRINT: KEY PLAYERS, 2024

12.7.5.1

COMPANY FOOTPRINT

12.7.5.2

REGION FOOTPRINT

12.8

COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

12.8.1

PROGRESSIVE COMPANIES

12.8.2

RESPONSIVE COMPANIES

12.8.5

COMPETITIVE BENCHMARKING

12.8.5.1

DETAILED LIST OF KEY STARTUPS/SMES

12.8.5.2

COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12.9

COMPETITIVE SCENARIO

12.9.1

SERVICE/SOLUTION LAUNCHES AND APPROVALS

13

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

521

13.1.1.1

BUSINESS OVERVIEW

13.1.1.2

SERVICES/SOLUTIONS OFFERED

13.1.1.3

RECENT DEVELOPMENTS

13.1.3

THERMO FISHER SCIENTIFIC INC.

13.1.8

CHARLES RIVER LABORATORIES

13.1.9

PAREXEL INTERNATIONAL CORPORATION

13.1.12

SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA

13.1.14

EUROFINS SCIENTIFIC

13.1.17

BIOAGILE THERAPEUTICS PRIVATE LIMITED

13.1.18

FIRMA CLINICAL RESEARCH

13.1.19

ACCULAB LIFE SCIENCES

13.1.22

ADVANCED CLINICAL

13.2.4

WORLDWIDE CLINICAL TRIALS

13.2.5

CTI CLINICAL TRIAL & CONSULTING

14.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3

CUSTOMIZATION OPTIONS

TABLE 1

CRO SERVICES MARKET: INCLUSIONS AND EXCLUSIONS

TABLE 2

IMPACT ANALYSIS OF SUPPLY- AND DEMAND-SIDE FACTORS

TABLE 3

CRO SERVICES MARKET: RISK ANALYSIS

TABLE 4

CRO SERVICES MARKET: STRATEGIC ANALYSIS OF GROWTH OPPORTUNITIES

TABLE 5

CRO SERVICES MARKET: EMERGING BUSINESS MODELS AND TARGET SEGMENTS

TABLE 6

CRO SERVICES MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

TABLE 7

INDICATIVE PRICING ANALYSIS, BY SERVICE TYPE, 2024 (USD)

TABLE 8

INDICATIVE PRICING ANALYSIS, BY PHASE, 2024 (USD MILLION)

TABLE 9

INDICATIVE PRICING ANALYSIS, BY REGION, 2024 (USD MILLION)

TABLE 10

CRO SERVICES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

TABLE 11

CRO SERVICES MARKET: KEY CONFERENCES AND EVENTS, 2025–2026

TABLE 12

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15

REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16

CRO SERVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 17

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MODALITY

TABLE 18

KEY BUYING CRITERIA, BY END USER

TABLE 19

CRO SERVICES MARKET: ADOPTION BARRIER AND INTERNAL FRICTION

TABLE 20

CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 21

NUMBER OF REGISTERED AND RECRUITING CLINICAL STUDIES AS OF AUGUST 2024, BY LOCATION

TABLE 22

CLINICAL RESEARCH SERVICES OFFERED BY MARKET PLAYERS

TABLE 23

CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 24

CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 25

NORTH AMERICA: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 26

EUROPE: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 27

ASIA PACIFIC: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 28

LATIN AMERICA: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 29

MIDDLE EAST: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 30

GCC COUNTRIES: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 31

CRO SERVICES MARKET FOR PHASE III, BY REGION, 2023–2030 (USD MILLION)

TABLE 32

NORTH AMERICA: CRO SERVICES MARKET FOR PHASE III, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 33

EUROPE: CRO SERVICES MARKET FOR PHASE III, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 34

ASIA PACIFIC: CRO SERVICES MARKET FOR PHASE III, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 35

LATIN AMERICA: CRO SERVICES MARKET FOR PHASE III, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 36

MIDDLE EAST: CRO SERVICES MARKET FOR PHASE III, BY REGION, 2023–2030 (USD MILLION)

TABLE 37

GCC COUNTRIES: CRO SERVICES MARKET FOR PHASE III, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 38

CRO SERVICES MARKET FOR PHASE II, BY REGION, 2023–2030 (USD MILLION)

TABLE 39

NORTH AMERICA: CRO SERVICES MARKET FOR PHASE II, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 40

EUROPE: CRO SERVICES MARKET FOR PHASE II, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 41

ASIA PACIFIC: CRO SERVICES MARKET FOR PHASE II, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 42

LATIN AMERICA: CRO SERVICES MARKET FOR PHASE II, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 43

MIDDLE EAST: CRO SERVICES MARKET FOR PHASE II, BY REGION, 2023–2030 (USD MILLION)

TABLE 44

GCC COUNTRIES: CRO SERVICES MARKET FOR PHASE II, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 45

CRO SERVICES MARKET FOR PHASE I, BY REGION, 2023–2030 (USD MILLION)

TABLE 46

NORTH AMERICA: CRO SERVICES MARKET FOR PHASE I, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 47

EUROPE: CRO SERVICES MARKET FOR PHASE I, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 48

ASIA PACIFIC: CRO SERVICES MARKET FOR PHASE I, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 49

LATIN AMERICA: CRO SERVICES MARKET FOR PHASE I, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 50

MIDDLE EAST: CRO SERVICES MARKET FOR PHASE I, BY REGION, 2023–2030 (USD MILLION)

TABLE 51

GCC COUNTRIES: CRO SERVICES MARKET FOR PHASE I, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 52

CRO SERVICES MARKET FOR PHASE IV, BY REGION, 2023–2030 (USD MILLION)

TABLE 53

NORTH AMERICA: CRO SERVICES MARKET FOR PHASE IV, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 54

EUROPE: CRO SERVICES MARKET FOR PHASE IV, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 55

ASIA PACIFIC: CRO SERVICES MARKET FOR PHASE IV, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 56

LATIN AMERICA: CRO SERVICES MARKET FOR PHASE IV, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 57

MIDDLE EAST: CRO SERVICES MARKET FOR PHASE IV, BY REGION, 2023–2030 (USD MILLION)

TABLE 58

GCC COUNTRIES: CRO SERVICES MARKET FOR PHASE IV, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 59

CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 60

CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 61

NORTH AMERICA: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 62

EUROPE: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 63

ASIA PACIFIC: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 64

LATIN AMERICA: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 65

MIDDLE EAST: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 66

GCC COUNTRIES: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 67

CRO SERVICES MARKET FOR CHEMISTRY, MANUFACTURING, AND CONTROL SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 68

NORTH AMERICA: CRO SERVICES MARKET FOR CHEMISTRY, MANUFACTURING, AND CONTROL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 69

EUROPE: CRO SERVICES MARKET FOR CHEMISTRY, MANUFACTURING, AND CONTROL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 70

ASIA PACIFIC: CRO SERVICES MARKET FOR CHEMISTRY, MANUFACTURING, AND CONTROL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 71

LATIN AMERICA: CRO SERVICES MARKET FOR CHEMISTRY, MANUFACTURING, AND CONTROL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 72

MIDDLE EAST: CRO SERVICES MARKET FOR CHEMISTRY, MANUFACTURING, AND CONTROL SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 73

GCC COUNTRIES: CRO SERVICES MARKET FOR CHEMISTRY, MANUFACTURING, AND CONTROL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 74

CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 75

CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 76

NORTH AMERICA: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 77

EUROPE: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 78

ASIA PACIFIC: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 79

LATIN AMERICA: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 80

MIDDLE EAST: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 81

GCC COUNTRIES: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 82

CRO SERVICES MARKET FOR PHARMACOKINETICS/PHARMACODYNAMICS, BY REGION, 2023–2030 (USD MILLION)

TABLE 83

NORTH AMERICA: CRO SERVICES MARKET FOR PHARMACOKINETICS/PHARMACODYNAMICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 84

EUROPE: CRO SERVICES MARKET FOR PHARMACOKINETICS/PHARMACODYNAMICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 85

ASIA PACIFIC: CRO SERVICES MARKET FOR PHARMACOKINETICS/PHARMACODYNAMICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 86

LATIN AMERICA: CRO SERVICES MARKET FOR PHARMACOKINETICS/PHARMACODYNAMICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 87

MIDDLE EAST: CRO SERVICES MARKET FOR PHARMACOKINETICS/PHARMACODYNAMICS, BY REGION, 2023–2030 (USD MILLION)

TABLE 88

GCC COUNTRIES: CRO SERVICES MARKET FOR PHARMACOKINETICS/PHARMACODYNAMICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 89

CRO SERVICES MARKET FOR TOXICOLOGY TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 90

NORTH AMERICA: CRO SERVICES MARKET FOR TOXICOLOGY TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 91

EUROPE: CRO SERVICES MARKET FOR TOXICOLOGY TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 92

ASIA PACIFIC: CRO SERVICES MARKET FOR TOXICOLOGY TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 93

LATIN AMERICA: CRO SERVICES MARKET FOR TOXICOLOGY TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 94

MIDDLE EAST: CRO SERVICES MARKET FOR TOXICOLOGY TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 95

GCC COUNTRIES: CRO SERVICES MARKET FOR TOXICOLOGY TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 96

CRO SERVICES MARKET FOR OTHER PRECLINICAL SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 97

NORTH AMERICA: CRO SERVICES MARKET FOR OTHER PRECLINICAL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 98

EUROPE: CRO SERVICES MARKET FOR OTHER PRECLINICAL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 99

ASIA PACIFIC: CRO SERVICES MARKET FOR OTHER PRECLINICAL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 100

LATIN AMERICA: CRO SERVICES MARKET FOR OTHER PRECLINICAL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 101

MIDDLE EAST: CRO SERVICES MARKET FOR OTHER PRECLINICAL SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 102

GCC COUNTRIES: CRO SERVICES MARKET FOR OTHER PRECLINICAL SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 103

CRO SERVICES MARKET FOR DISCOVERY STUDIES, BY REGION, 2023–2030 (USD MILLION)

TABLE 104

NORTH AMERICA: CRO SERVICES MARKET FOR DISCOVERY STUDIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 105

EUROPE: CRO SERVICES MARKET FOR DISCOVERY STUDIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 106

ASIA PACIFIC: CRO SERVICES MARKET FOR DISCOVERY STUDIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 107

LATIN AMERICA: CRO SERVICES MARKET FOR DISCOVERY STUDIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 108

MIDDLE EAST: CRO SERVICES MARKET FOR DISCOVERY STUDIES, BY REGION, 2023–2030 (USD MILLION)

TABLE 109

GCC COUNTRIES: CRO SERVICES MARKET FOR DISCOVERY STUDIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 110

LABORATORY SERVICES OFFERED BY KEY PLAYERS

TABLE 111

CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 112

CRO SERVICES MARKET FOR LABORATORY SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 113

NORTH AMERICA: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 114

EUROPE: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 115

ASIA PACIFIC: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 116

LATIN AMERICA: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 117

MIDDLE EAST: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 118

GCC COUNTRIES: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 119

CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 120

CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 121

NORTH AMERICA: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 122

EUROPE: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 123

ASIA PACIFIC: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 124

LATIN AMERICA: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 125

MIDDLE EAST: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 126

GCC COUNTRIES: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 127

CRO SERVICES MARKET FOR PHYSICAL CHARACTERIZATION, BY REGION, 2023–2030 (USD MILLION)

TABLE 128

NORTH AMERICA: CRO SERVICES MARKET FOR PHYSICAL CHARACTERIZATION, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 129

EUROPE: CRO SERVICES MARKET FOR PHYSICAL CHARACTERIZATION, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 130

ASIA PACIFIC: CRO SERVICES MARKET FOR PHYSICAL CHARACTERIZATION, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 131

LATIN AMERICA: CRO SERVICES MARKET FOR PHYSICAL CHARACTERIZATION, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 132

MIDDLE EAST: CRO SERVICES MARKET FOR PHYSICAL CHARACTERIZATION, BY REGION, 2023–2030 (USD MILLION)

TABLE 133

GCC COUNTRIES: CRO SERVICES MARKET FOR PHYSICAL CHARACTERIZATION, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 134

CRO SERVICES MARKET FOR RAW MATERIAL TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 135

NORTH AMERICA: CRO SERVICES MARKET FOR RAW MATERIAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 136

EUROPE: CRO SERVICES MARKET FOR RAW MATERIAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 137

ASIA PACIFIC: CRO SERVICES MARKET FOR RAW MATERIAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 138

LATIN AMERICA: CRO SERVICES MARKET FOR RAW MATERIAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 139

MIDDLE EAST: CRO SERVICES MARKET FOR RAW MATERIAL TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 140

GCC COUNTRIES: CRO SERVICES MARKET FOR RAW MATERIAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 141

CRO SERVICES MARKET FOR BATCH-RELEASE TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 142

NORTH AMERICA: CRO SERVICES MARKET FOR BATCH-RELEASE TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 143

EUROPE: CRO SERVICES MARKET FOR BATCH-RELEASE TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 144

ASIA PACIFIC: CRO SERVICES MARKET FOR BATCH-RELEASE TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 145

LATIN AMERICA: CRO SERVICES MARKET FOR BATCH-RELEASE TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 146

MIDDLE EAST: CRO SERVICES MARKET FOR BATCH-RELEASE TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 147

GCC COUNTRIES: CRO SERVICES MARKET FOR BATCH-RELEASE TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 148

CRO SERVICES MARKET FOR STABILITY TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 149

NORTH AMERICA: CRO SERVICES MARKET FOR STABILITY TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 150

EUROPE: CRO SERVICES MARKET FOR STABILITY TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 151

ASIA PACIFIC: CRO SERVICES MARKET FOR STABILITY TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 152

LATIN AMERICA: CRO SERVICES MARKET FOR STABILITY TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 153

MIDDLE EAST: CRO SERVICES MARKET FOR STABILITY TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 154

GCC COUNTRIES: CRO SERVICES MARKET FOR STABILITY TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 155

CRO SERVICES MARKET FOR OTHER ANALYTICAL TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 156

NORTH AMERICA: CRO SERVICES MARKET FOR OTHER ANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 157

EUROPE: CRO SERVICES MARKET FOR OTHER ANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 158

ASIA PACIFIC: CRO SERVICES MARKET FOR OTHER ANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 159

LATIN AMERICA: CRO SERVICES MARKET FOR OTHER ANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 160

MIDDLE EAST: CRO SERVICES MARKET FOR OTHER ANALYTICAL TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 161

GCC COUNTRIES: CRO SERVICES MARKET FOR OTHER ANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 162

CRO SERVICES MARKET FOR BIOANALYTICAL TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 163

NORTH AMERICA: CRO SERVICES MARKET FOR BIOANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 164

EUROPE: CRO SERVICES MARKET FOR BIOANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 165

ASIA PACIFIC: CRO SERVICES MARKET FOR BIOANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 166

LATIN AMERICA: CRO SERVICES MARKET FOR BIOANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 167

MIDDLE EAST: CRO SERVICES MARKET FOR BIOANALYTICAL TESTING, BY REGION, 2023–2030 (USD MILLION)

TABLE 168

GCC COUNTRIES: CRO SERVICES MARKET FOR BIOANALYTICAL TESTING, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 169

CONSULTING SERVICES OFFERED BY PROMINENT PLAYERS

TABLE 170

CRO SERVICES MARKET FOR CONSULTING SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 171

NORTH AMERICA: CRO SERVICES MARKET FOR CONSULTING SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 172

EUROPE: CRO SERVICES MARKET FOR CONSULTING SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 173

ASIA PACIFIC: CRO SERVICES MARKET FOR CONSULTING SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 174

LATIN AMERICA: CRO SERVICES MARKET FOR CONSULTING SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 175

MIDDLE EAST: CRO SERVICES MARKET FOR CONSULTING SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 176

GCC COUNTRIES: CRO SERVICES MARKET FOR CONSULTING SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 177

CRO SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 178

NORTH AMERICA: CRO SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 179

EUROPE: CRO SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 180

ASIA PACIFIC: CRO SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 181

LATIN AMERICA: CRO SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 182

MIDDLE EAST: CRO SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 183

GCC COUNTRIES: CRO SERVICES MARKET FOR DATA MANAGEMENT SERVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 184

CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 185

NUMBER OF NEW CANCER CASES, BY TYPE, 2020 VS. 2040

TABLE 186

CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 187

CRO SERVICES MARKET FOR ONCOLOGY, BY REGION, 2023–2030 (USD MILLION)

TABLE 188

NORTH AMERICA: CRO SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 189

EUROPE: CRO SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 190

ASIA PACIFIC: CRO SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 191

LATIN AMERICA: CRO SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 192

MIDDLE EAST: CRO SERVICES MARKET FOR ONCOLOGY, BY REGION, 2023–2030 (USD MILLION)

TABLE 193

GCC COUNTRIES: CRO SERVICES MARKET FOR ONCOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 194

CRO SERVICES MARKET FOR BREAST CANCER, BY REGION, 2023–2030 (USD MILLION)

TABLE 195

NORTH AMERICA: CRO SERVICES MARKET FOR BREAST CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 196

EUROPE: CRO SERVICES MARKET FOR BREAST CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 197

ASIA PACIFIC: CRO SERVICES MARKET FOR BREAST CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 198

LATIN AMERICA: CRO SERVICES MARKET FOR BREAST CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 199

MIDDLE EAST: CRO SERVICES MARKET FOR BREAST CANCER, BY REGION, 2023–2030 (USD MILLION)

TABLE 200

GCC COUNTRIES: CRO SERVICES MARKET FOR BREAST CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 201

CRO SERVICES MARKET FOR LUNG CANCER, BY REGION, 2023–2030 (USD MILLION)

TABLE 202

NORTH AMERICA: CRO SERVICES MARKET FOR LUNG CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 203

EUROPE: CRO SERVICES MARKET FOR LUNG CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 204

ASIA PACIFIC: CRO SERVICES MARKET FOR LUNG CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 205

LATIN AMERICA: CRO SERVICES MARKET FOR LUNG CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 206

MIDDLE EAST: CRO SERVICES MARKET FOR LUNG CANCER, BY REGION, 2023–2030 (USD MILLION)

TABLE 207

GCC COUNTRIES: CRO SERVICES MARKET FOR LUNG CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 208

CRO SERVICES MARKET FOR COLORECTAL CANCER, BY REGION, 2023–2030 (USD MILLION)

TABLE 209

NORTH AMERICA: CRO SERVICES MARKET FOR COLORECTAL CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 210

EUROPE: CRO SERVICES MARKET FOR COLORECTAL CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 211

ASIA PACIFIC: CRO SERVICES MARKET FOR COLORECTAL CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 212

LATIN AMERICA: CRO SERVICES MARKET FOR COLORECTAL CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 213

MIDDLE EAST: CRO SERVICES MARKET FOR COLORECTAL CANCER, BY REGION, 2023–2030 (USD MILLION)

TABLE 214

GCC COUNTRIES: CRO SERVICES MARKET FOR COLORECTAL CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 215

CRO SERVICES MARKET FOR PROSTATE CANCER, BY REGION, 2023–2030 (USD MILLION)

TABLE 216

NORTH AMERICA: CRO SERVICES MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 217

EUROPE: CRO SERVICES MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 218

ASIA PACIFIC: CRO SERVICES MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 219

LATIN AMERICA: CRO SERVICES MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 220

MIDDLE EAST: CRO SERVICES MARKET FOR PROSTATE CANCER, BY REGION, 2023–2030 (USD MILLION)

TABLE 221

GCC COUNTRIES: CRO SERVICES MARKET FOR PROSTATE CANCER, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 222

NUMBER OF DRUGS IN R&D PIPELINE FOR OTHER CANCERS, 2023–2024

TABLE 223

CRO SERVICES MARKET FOR OTHER CANCERS, BY REGION, 2023–2030 (USD MILLION)

TABLE 224

NORTH AMERICA: CRO SERVICES MARKET FOR OTHER CANCERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 225

EUROPE: CRO SERVICES MARKET FOR OTHER CANCERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 226

ASIA PACIFIC: CRO SERVICES MARKET FOR OTHER CANCERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 227

LATIN AMERICA: CRO SERVICES MARKET FOR OTHER CANCERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 228

MIDDLE EAST: CRO SERVICES MARKET FOR OTHER CANCERS, BY REGION, 2023–2030 (USD MILLION)

TABLE 229

GCC COUNTRIES: CRO SERVICES MARKET FOR OTHER CANCERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 230

CRO SERVICES MARKET FOR INFECTIOUS DISEASES, BY REGION, 2023–2030 (USD MILLION)

TABLE 231

NORTH AMERICA: CRO SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 232

EUROPE: CRO SERVICES MARKET FOR ONCOLOGY, BY INFECTIOUS DISEASES, 2023–2030 (USD MILLION)

TABLE 233

ASIA PACIFIC: CRO SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 234

LATIN AMERICA: CRO SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 235

MIDDLE EAST: CRO SERVICES MARKET FOR INFECTIOUS DISEASES, BY REGION, 2023–2030 (USD MILLION)

TABLE 236

GCC COUNTRIES: CRO SERVICES MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 237

CRO SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY REGION, 2023–2030 (USD MILLION)

TABLE 238

NORTH AMERICA: CRO SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 239

EUROPE: CRO SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 240

ASIA PACIFIC: CRO SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 241

LATIN AMERICA: CRO SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 242

MIDDLE EAST: CRO SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY REGION, 2023–2030 (USD MILLION)

TABLE 243

GCC COUNTRIES: CRO SERVICES MARKET FOR CARDIOVASCULAR SYSTEM DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 244

CRO SERVICES MARKET FOR NEUROLOGY, BY REGION, 2023–2030 (USD MILLION)

TABLE 245

NORTH AMERICA: CRO SERVICES MARKET FOR NEUROLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 246

EUROPE: CRO SERVICES MARKET FOR NEUROLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 247

ASIA PACIFIC: CRO SERVICES MARKET FOR NEUROLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 248

LATIN AMERICA: CRO SERVICES MARKET FOR NEUROLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 249

MIDDLE EAST: CRO SERVICES MARKET FOR NEUROLOGY, BY REGION, 2023–2030 (USD MILLION)

TABLE 250

GCC COUNTRIES: CRO SERVICES MARKET FOR NEUROLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 251

CRO SERVICES MARKET FOR VACCINES, BY REGION, 2023–2030 (USD MILLION)

TABLE 252

NORTH AMERICA: CRO SERVICES MARKET FOR VACCINES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 253

EUROPE: CRO SERVICES MARKET FOR VACCINES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 254

ASIA PACIFIC: CRO SERVICES MARKET FOR VACCINES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 255

LATIN AMERICA: CRO SERVICES MARKET FOR VACCINES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 256

MIDDLE EAST: CRO SERVICES MARKET FOR VACCINES, BY REGION, 2023–2030 (USD MILLION)

TABLE 257

GCC COUNTRIES: CRO SERVICES MARKET FOR VACCINES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 258

CRO SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY REGION, 2023–2030 (USD MILLION)

TABLE 259

NORTH AMERICA: CRO SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 260

EUROPE: CRO SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 261

ASIA PACIFIC: CRO SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 262

LATIN AMERICA: CRO SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 263

MIDDLE EAST: CRO SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY REGION, 2023–2030 (USD MILLION)

TABLE 264

GCC COUNTRIES: CRO SERVICES MARKET FOR METABOLIC DISORDERS/ENDOCRINOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 265

CRO SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY REGION, 2023–2030 (USD MILLION)

TABLE 266

NORTH AMERICA: CRO SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 267

EUROPE: CRO SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 268

ASIA PACIFIC: CRO SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 269

LATIN AMERICA: CRO SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 270

MIDDLE EAST: CRO SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY REGION, 2023–2030 (USD MILLION)

TABLE 271

GCC COUNTRIES: CRO SERVICES MARKET FOR IMMUNOLOGICAL DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 272

CRO SERVICES MARKET FOR PSYCHIATRY, BY REGION, 2023–2030 (USD MILLION)

TABLE 273

NORTH AMERICA: CRO SERVICES MARKET FOR PSYCHIATRY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 274

EUROPE: CRO SERVICES MARKET FOR PSYCHIATRY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 275

ASIA PACIFIC: CRO SERVICES MARKET FOR PSYCHIATRY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 276

LATIN AMERICA: CRO SERVICES MARKET FOR PSYCHIATRY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 277

MIDDLE EAST: CRO SERVICES MARKET FOR PSYCHIATRY, BY REGION, 2023–2030 (USD MILLION)

TABLE 278

GCC COUNTRIES: CRO SERVICES MARKET FOR PSYCHIATRY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 279

CRO SERVICES MARKET FOR RESPIRATORY DISORDERS, BY REGION, 2023–2030 (USD MILLION)

TABLE 280

NORTH AMERICA: CRO SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 281

EUROPE: CRO SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 282

ASIA PACIFIC: CRO SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 283

LATIN AMERICA: CRO SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 284

MIDDLE EAST: CRO SERVICES MARKET FOR RESPIRATORY DISORDERS, BY REGION, 2023–2030 (USD MILLION)

TABLE 285

GCC COUNTRIES: CRO SERVICES MARKET FOR RESPIRATORY DISORDERS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 286

CRO SERVICES MARKET FOR DERMATOLOGY, BY REGION, 2023–2030 (USD MILLION)

TABLE 287

NORTH AMERICA: CRO SERVICES MARKET FOR DERMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 288

EUROPE: CRO SERVICES MARKET FOR DERMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 289

ASIA PACIFIC: CRO SERVICES MARKET FOR DERMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 290

LATIN AMERICA: CRO SERVICES MARKET FOR DERMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 291

MIDDLE EAST: CRO SERVICES MARKET FOR DERMATOLOGY, BY REGION, 2023–2030 (USD MILLION)

TABLE 292

GCC COUNTRIES: CRO SERVICES MARKET FOR DERMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 293

CRO SERVICES MARKET FOR OPHTHALMOLOGY, BY REGION, 2023–2030 (USD MILLION)

TABLE 294

NORTH AMERICA: CRO SERVICES MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 295

EUROPE: CRO SERVICES MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 296

ASIA PACIFIC: CRO SERVICES MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 297

LATIN AMERICA: CRO SERVICES MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 298

MIDDLE EAST: CRO SERVICES MARKET FOR OPHTHALMOLOGY, BY REGION, 2023–2030 (USD MILLION)

TABLE 299

GCC COUNTRIES: CRO SERVICES MARKET FOR OPHTHALMOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 300

CRO SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY REGION, 2023–2030 (USD MILLION)

TABLE 301

NORTH AMERICA: CRO SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 302

EUROPE: CRO SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 303

ASIA PACIFIC: CRO SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 304

LATIN AMERICA: CRO SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 305

MIDDLE EAST: CRO SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY REGION, 2023–2030 (USD MILLION)

TABLE 306

GCC COUNTRIES: CRO SERVICES MARKET FOR GASTROINTESTINAL DISEASES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 307

CRO SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY REGION, 2023–2030 (USD MILLION)

TABLE 308

NORTH AMERICA: CRO SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 309

EUROPE: CRO SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 310

ASIA PACIFIC: CRO SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 311

LATIN AMERICA: CRO SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 312

MIDDLE EAST: CRO SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY REGION, 2023–2030 (USD MILLION)

TABLE 313

GCC COUNTRIES: CRO SERVICES MARKET FOR GENITOURINARY & WOMEN’S HEALTH, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 314

CRO SERVICES MARKET FOR HEMATOLOGY, BY REGION, 2023–2030 (USD MILLION)

TABLE 315

NORTH AMERICA: CRO SERVICES MARKET FOR HEMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 316

EUROPE: CRO SERVICES MARKET FOR HEMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 317

ASIA PACIFIC: CRO SERVICES MARKET FOR HEMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 318

LATIN AMERICA: CRO SERVICES MARKET FOR HEMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 319

MIDDLE EAST: CRO SERVICES MARKET FOR HEMATOLOGY, BY REGION, 2023–2030 (USD MILLION)

TABLE 320

GCC COUNTRIES: CRO SERVICES MARKET FOR HEMATOLOGY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 321

CRO SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2023–2030 (USD MILLION)

TABLE 322

NORTH AMERICA: CRO SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 323

EUROPE: CRO SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 324

ASIA PACIFIC: CRO SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 325

LATIN AMERICA: CRO SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 326

MIDDLE EAST: CRO SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2023–2030 (USD MILLION)

TABLE 327

GCC COUNTRIES: CRO SERVICES MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 328

CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 329

CRO SERVICES MARKET FOR SMALL MOLECULES, BY REGION, 2023–2030 (USD MILLION)

TABLE 330

NORTH AMERICA: CRO SERVICES MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 331

EUROPE: CRO SERVICES MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 332

ASIA PACIFIC: CRO SERVICES MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 333

LATIN AMERICA: CRO SERVICES MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 334

MIDDLE EAST: CRO SERVICES MARKET FOR SMALL MOLECULES, BY REGION, 2023–2030 (USD MILLION)

TABLE 335

GCC COUNTRIES: CRO SERVICES MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 336

CRO SERVICES MARKET FOR BIOLOGICS, BY REGION, 2023–2030 (USD MILLION)

TABLE 337

NORTH AMERICA: CRO SERVICES MARKET FOR BIOLOGICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 338

EUROPE: CRO SERVICES MARKET FOR BIOLOGICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 339

ASIA PACIFIC: CRO SERVICES MARKET FOR BIOLOGICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 340

LATIN AMERICA: CRO SERVICES MARKET FOR BIOLOGICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 341

MIDDLE EAST: CRO SERVICES MARKET FOR BIOLOGICS, BY REGION, 2023–2030 (USD MILLION)

TABLE 342

GCC COUNTRIES: CRO SERVICES MARKET FOR BIOLOGICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 343

CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 344

CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY, BY REGION, 2023–2030 (USD MILLION)

TABLE 345

NORTH AMERICA: CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 346

EUROPE: CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 347

ASIA PACIFIC: CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 348

LATIN AMERICA: CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 349

MIDDLE EAST: CRO SERVICES BIOLOGICS MARKET FOR MONOCLONAL ANTIBODY, BY REGION, 2023–2030 (USD MILLION)

TABLE 350

GCC COUNTRIES: CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 351

CRO SERVICES MARKET FOR CELL & GENE THERAPY, BY REGION, 2023–2030 (USD MILLION)

TABLE 352

NORTH AMERICA: CRO SERVICES MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 353

EUROPE: CRO SERVICES MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 354

ASIA PACIFIC: CRO SERVICES MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 355

LATIN AMERICA: CRO SERVICES MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 356

MIDDLE EAST: CRO SERVICES MARKET FOR CELL & GENE THERAPY, BY REGION, 2023–2030 (USD MILLION)

TABLE 357

GCC COUNTRIES: CRO SERVICES MARKET FOR CELL & GENE THERAPY, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 358

CRO SERVICES MARKET FOR OTHER BIOLOGICS, BY REGION, 2023–2030 (USD MILLION)

TABLE 359

NORTH AMERICA: CRO SERVICES MARKET FOR OTHER BIOLOGICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 360

EUROPE: CRO SERVICES MARKET FOR OTHER BIOLOGICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 361

ASIA PACIFIC: CRO SERVICES MARKET FOR OTHER BIOLOGICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 362

LATIN AMERICA: CRO SERVICES MARKET FOR OTHER BIOLOGICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 363

MIDDLE EAST: CRO SERVICES MARKET FOR OTHER BIOLOGICS, BY REGION, 2023–2030 (USD MILLION)

TABLE 364

GCC COUNTRIES: CRO SERVICES MARKET FOR OTHER BIOLOGICS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 365

CRO SERVICES MARKET FOR MEDICAL DEVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 366

NORTH AMERICA: CRO SERVICES MARKET FOR MEDICAL DEVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 367

EUROPE: CRO SERVICES MARKET FOR MEDICAL DEVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 368

ASIA PACIFIC: CRO SERVICES MARKET FOR MEDICAL DEVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 369

LATIN AMERICA: CRO SERVICES MARKET FOR MEDICAL DEVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 370

MIDDLE EAST: CRO SERVICES MARKET FOR MEDICAL DEVICES, BY REGION, 2023–2030 (USD MILLION)

TABLE 371

GCC COUNTRIES: CRO SERVICES MARKET FOR MEDICAL DEVICES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 372

CRO SERVICES MARKET FOR BIOSIMILARS, BY REGION, 2023–2030 (USD MILLION)

TABLE 373

NORTH AMERICA: CRO SERVICES MARKET FOR BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 374

EUROPE: CRO SERVICES MARKET FOR BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 375

ASIA PACIFIC: CRO SERVICES MARKET FOR BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 376

LATIN AMERICA: CRO SERVICES MARKET FOR BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 377

MIDDLE EAST: CRO SERVICES MARKET FOR BIOSIMILARS, BY REGION, 2023–2030 (USD MILLION)

TABLE 378

GCC COUNTRIES: CRO SERVICES MARKET FOR BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 379

CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 380

CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY BIOSIMILARS, BY REGION, 2023–2030 (USD MILLION)

TABLE 381

NORTH AMERICA: CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 382

EUROPE: CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 383

ASIA PACIFIC: CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 384

LATIN AMERICA: CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 385

MIDDLE EAST: CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY BIOSIMILARS, BY REGION, 2023–2030 (USD MILLION)

TABLE 386

GCC COUNTRIES: CRO SERVICES MARKET FOR MONOCLONAL ANTIBODY BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 387

CRO SERVICES MARKET FOR INSULIN, BY REGION, 2023–2030 (USD MILLION)

TABLE 388

NORTH AMERICA: CRO SERVICES MARKET FOR INSULIN, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 389

EUROPE: CRO SERVICES MARKET FOR INSULIN, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 390

ASIA PACIFIC: CRO SERVICES MARKET FOR INSULIN, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 391

LATIN AMERICA: CRO SERVICES MARKET FOR INSULIN, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 392

MIDDLE EAST: CRO SERVICES MARKET FOR INSULIN, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 393

GCC COUNTRIES: CRO SERVICES MARKET FOR INSULIN, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 394

CRO SERVICES MARKET FOR COLONY STIMULATING FACTOR, BY REGION, 2023–2030 (USD MILLION)

TABLE 395

NORTH AMERICA: CRO SERVICES MARKET FOR COLONY STIMULATING FACTOR, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 396

EUROPE: CRO SERVICES MARKET FOR COLONY STIMULATING FACTOR, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 397

ASIA PACIFIC: CRO SERVICES MARKET FOR COLONY STIMULATING FACTOR, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 398

LATIN AMERICA: CRO SERVICES MARKET FOR COLONY STIMULATING FACTOR, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 399

MIDDLE EAST: CRO SERVICES MARKET FOR COLONY STIMULATING FACTOR, BY REGION, 2023–2030 (USD MILLION)

TABLE 400

GCC COUNTRIES: CRO SERVICES BIOSIMILARS MARKET FOR COLONY STIMULATING FACTOR, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 401

CRO SERVICES MARKET FOR ERYTHROPOIETIN, BY REGION, 2023–2030 (USD MILLION)

TABLE 402

NORTH AMERICA: CRO SERVICES MARKET FOR ERYTHROPOIETIN, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 403

EUROPE: CRO SERVICES MARKET FOR ERYTHROPOIETIN, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 404

ASIA PACIFIC: CRO SERVICES MARKET FOR ERYTHROPOIETIN, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 405

LATIN AMERICA: CRO SERVICES MARKET FOR ERYTHROPOIETIN, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 406

MIDDLE EAST: CRO SERVICES MARKET FOR ERYTHROPOIETIN, BY REGION, 2023–2030 (USD MILLION)

TABLE 407

GCC COUNTRIES: CRO SERVICES MARKET FOR ERYTHROPOIETIN, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 408

CRO SERVICES MARKET FOR OTHER BIOSIMILARS, BY REGION, 2023–2030 (USD MILLION)

TABLE 409

NORTH AMERICA: CRO SERVICES MARKET FOR OTHER BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 410

EUROPE: CRO SERVICES MARKET FOR OTHER BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 411

ASIA PACIFIC: CRO SERVICES MARKET FOR OTHER BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 412

LATIN AMERICA: CRO SERVICES MARKET FOR OTHER BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 413

MIDDLE EAST: CRO SERVICES MARKET FOR OTHER BIOSIMILARS, BY REGION, 2023–2030 (USD MILLION)

TABLE 414

GCC COUNTRIES: CRO SERVICES MARKET FOR OTHER BIOSIMILARS, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 415

CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 416

CRO SERVICES MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY REGION, 2023–2030 (USD MILLION)

TABLE 417

NORTH AMERICA: CRO SERVICES MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 418

EUROPE: CRO SERVICES MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 419

ASIA PACIFIC: CRO SERVICES MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 420

LATIN AMERICA: CRO SERVICES MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 421

MIDDLE EAST: CRO SERVICES MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY REGION, 2023–2030 (USD MILLION)

TABLE 422

GCC COUNTRIES: CRO SERVICES MARKET FOR PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 423

CRO SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY REGION, 2023–2030 (USD MILLION)

TABLE 424

NORTH AMERICA: CRO SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 425

EUROPE: CRO SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 426

ASIA PACIFIC: CRO SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 427

LATIN AMERICA: CRO SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 428

MIDDLE EAST: CRO SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY REGION, 2023–2030 (USD MILLION)

TABLE 429

GCC COUNTRIES: CRO SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 430

CRO SERVICES MARKET FOR ACADEMIC INSTITUTES, BY REGION, 2023–2030 (USD MILLION)

TABLE 431

NORTH AMERICA: CRO SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 432

EUROPE: CRO SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 433

ASIA PACIFIC: CRO SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 434

LATIN AMERICA: CRO SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 435

MIDDLE EAST: CRO SERVICES MARKET FOR ACADEMIC INSTITUTES, BY REGION, 2023–2030 (USD MILLION)

TABLE 436

GCC COUNTRIES: CRO SERVICES MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 437

CRO SERVICES MARKET, BY REGION, 2023–2030 (USD MILLION)

TABLE 438

NORTH AMERICA: CRO SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 439

NORTH AMERICA: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 440

NORTH AMERICA: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 441

NORTH AMERICA: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 442

NORTH AMERICA: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 443

NORTH AMERICA: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 444

NORTH AMERICA: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 445

NORTH AMERICA: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 446

NORTH AMERICA: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 447

NORTH AMERICA: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 448

NORTH AMERICA: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 449

NORTH AMERICA: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 450

NORTH AMERICA: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 451

NORTH AMERICA: KEY MACROECONOMIC INDICATORS

TABLE 452

US: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 453

US: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 454

US: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 455

US: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 456

US: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 457

US: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 458

US: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 459

US: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 460

US: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 461

US: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 462

US: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 463

US: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 464

CANADA: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 465

CANADA: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 466

CANADA: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 467

CANADA: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 468

CANADA: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 469

CANADA: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 470

CANADA: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 471

CANADA: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 472

CANADA: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 473

CANADA: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 474

CANADA: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 475

CANADA: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 476

EUROPE: CRO SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 477

EUROPE: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 478

EUROPE: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 479

EUROPE: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 480

EUROPE: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 481

EUROPE: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 482

EUROPE: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 483

EUROPE: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 484

EUROPE: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 485

EUROPE: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 486

EUROPE: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 487

EUROPE: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 488

EUROPE: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 489

EUROPE: KEY MACROECONOMIC INDICATORS

TABLE 490

GERMANY: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 491

GERMANY: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 492

GERMANY: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 493

GERMANY: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 494

GERMANY: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 495

GERMANY: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 496

GERMANY: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 497

GERMANY: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 498

GERMANY: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 499

GERMANY: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 500

GERMANY: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 501

GERMANY: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 502

UK: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 503

UK: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 504

UK: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 505

UK: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 506

UK: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 507

UK: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 508

UK: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 509

UK: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 510

UK: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 511

UK: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 512

UK: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 513

UK: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 514

FRANCE: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 515

FRANCE: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 516

FRANCE: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 517

FRANCE: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 518

FRANCE: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 519

FRANCE: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 520

FRANCE: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 521

FRANCE: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 522

FRANCE: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 523

FRANCE: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 524

FRANCE: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 525

FRANCE: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 526

ITALY: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 527

ITALY: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 528

ITALY: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 529

ITALY: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 530

ITALY: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 531

ITALY: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 532

ITALY: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 533

ITALY: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 534

ITALY: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 535

ITALY: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 536

ITALY: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 537

ITALY: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 538

SPAIN: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 539

SPAIN: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 540

SPAIN: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 541

SPAIN: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 542

SPAIN: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 543

SPAIN: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 544

SPAIN: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 545

SPAIN: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 546

SPAIN: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 547

SPAIN: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 548

SPAIN: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 549

SPAIN: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 550

REST OF EUROPE: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 551

REST OF EUROPE: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 552

REST OF EUROPE: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 553

REST OF EUROPE: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 554

REST OF EUROPE: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 555

REST OF EUROPE: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 556

REST OF EUROPE: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 557

REST OF EUROPE: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 558

REST OF EUROPE: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 559

REST OF EUROPE: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 560

REST OF EUROPE: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 561

REST OF EUROPE: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 562

ASIA PACIFIC: CRO SERVICES MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

TABLE 563

ASIA PACIFIC: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 564

ASIA PACIFIC: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 565

ASIA PACIFIC: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 566

ASIA PACIFIC: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 567

ASIA PACIFIC: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 568

ASIA PACIFIC: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 569

ASIA PACIFIC: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 570

ASIA PACIFIC: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 571

ASIA PACIFIC: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 572

ASIA PACIFIC: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 573

ASIA PACIFIC: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 574

ASIA PACIFIC: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 575

ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

TABLE 576

CHINA: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 577

CHINA: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 578

CHINA: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 579

CHINA: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 580

CHINA: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 581

CHINA: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 582

CHINA: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 583

CHINA: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 584

CHINA: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 585

CHINA: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 586

CHINA: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 587

CHINA: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 588

INDIA: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 589

INDIA: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 590

INDIA: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 591

INDIA: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 592

INDIA: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 593

INDIA: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 594

INDIA: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 595

INDIA: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 596

INDIA: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 597

INDIA: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 598

INDIA: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 599

INDIA: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 600

JAPAN: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 601

JAPAN: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 602

JAPAN: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 603

JAPAN: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 604

JAPAN: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 605

JAPAN: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)

TABLE 606

JAPAN: CRO SERVICES MARKET, BY MODALITY, 2023–2030 (USD MILLION)

TABLE 607

JAPAN: CRO SERVICES MARKET FOR BIOLOGICS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 608

JAPAN: CRO SERVICES MARKET FOR BIOSIMILARS, BY TYPE, 2023–2030 (USD MILLION)

TABLE 609

JAPAN: CRO SERVICES MARKET, BY THERAPEUTIC AREA, 2023–2030 (USD MILLION)

TABLE 610

JAPAN: CRO SERVICES MARKET FOR ONCOLOGY, BY TYPE, 2023–2030 (USD MILLION)

TABLE 611

JAPAN: CRO SERVICES MARKET, BY END USER, 2023–2030 (USD MILLION)

TABLE 612

AUSTRALIA: CRO SERVICES MARKET, BY TYPE, 2023–2030 (USD MILLION)

TABLE 613

AUSTRALIA: CRO SERVICES MARKET FOR CLINICAL RESEARCH SERVICES, BY PHASE, 2023–2030 (USD MILLION)

TABLE 614

AUSTRALIA: CRO SERVICES MARKET FOR EARLY PHASE DEVELOPMENT SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 615

AUSTRALIA: CRO SERVICES MARKET FOR PRECLINICAL SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 616

AUSTRALIA: CRO SERVICES MARKET FOR LABORATORY SERVICES, BY TYPE, 2023–2030 (USD MILLION)

TABLE 617

AUSTRALIA: CRO SERVICES MARKET FOR ANALYTICAL TESTING, BY TYPE, 2023–2030 (USD MILLION)