Electronics Conformal Coating Market by Material (Acrylic, Silicone, Parylene, Urethane/Polyurethane, Epoxy), Equipment (Curing, Coating), Method (Brush Coating, Dipping), Application and Geography - Global Forecasts to 2020

The Electronics conformal coating market was valued at USD 1.70 Billion in 2014, and it is expected to reach USD 2.41 Billion by 2020, at a CAGR of 5.99% during the forecast period. The base year used for this study is 2014 and the forecast period considered is between 2015 and 2020. This report provides a detailed analysis of the market based on material types, equipment, methods, applications, and regions. The increasing use of automation and adding as well as enhancing features of the end products by Original Equipment Manufacturers (OEMs) has resulted in the increase usage of electronic components which is one of the major drivers for the market. Besides this the conformal coating helps manufacturers to provide end products with higher level of reliability by protecting the electronic components from moisture, chemicals, dirt, temperature extremes, and abrasion. This factor is also fueling the growth of the Electronics conformal coating market.

The research methodology used to estimate and forecast the Electronics conformal coating market begins with capturing data on key vendor revenue through the secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the global conformal coating market from the revenues of key players in the market. After arriving at the overall market size, the total market has been split into several segments and sub-segments, which have been verified through the primary research by conducting extensive interviews of people holding key positions such as CEOs, VPs, directors and executives. These market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The global Electronics conformal coating market size is estimated to grow from USD 1.70 Billion in 2014, and is expected to reach USD 2.41 Billion by 2020, at a CAGR of 5.99% between 2015 and 2020. The growth of this market is being propelled by the increasing usage of electronic components in the end products by OEMs, as well as ability of this coating to help manufacturers to provide end products with higher level of reliability.

The scope of this report covers the Electronics conformal coating market by material, equipment, method, application, and region. The leading conformal coating materials of the conformal coating material market are acrylic followed by silicone. The leading position of the acrylic conformal coating material can be attributed to the fact that among all the materials it is the easiest to re-work on the acrylic material. Besides this, acrylic material is also easy to apply, has low cost, takes less time to cure, and provides good resistance from chemical, moisture, and abrasion.

The Electronics conformal coating market for aerospace & defense application sector is expected to grow at a high CAGR during the forecast period. Companies in the this sector are using conformal coating to provide electrical, physical and mechanical protection to electronics such as radar/detection equipment, power systems, navigation systems, communication systems, and military vehicles.

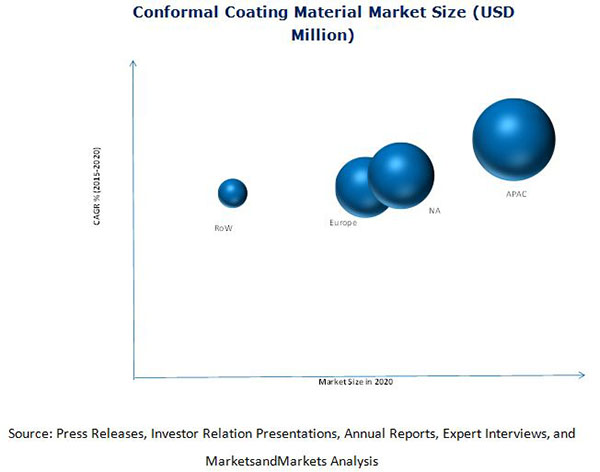

The APAC region held the largest share of the conformal coating material market in 2014, and it is expected to grow at the highest growth rate during the forecast period. The rapid growth of the automotive industry in this region, in addition to the growth of consumer electronics, and aerospace & defense sectors has contributed to the growth of the conformal coating material in the APAC region.

One of the key restraining factors in the Electronics conformal coating market is the decrease in demand for electronic devices and equipment because of economic slowdown. The impact of this restraining factor would decrease with time as the economy in countries recession start to recover. The major players in the conformal coating market include Chase Corporation (U.S.), DOW Corning Corporation (U.S.), Electrolube (U.K.), Nordson Corporation (U.S.), Precision Valve & Automation, Inc. (U.S.), and others. These players adopted various strategies such as new product developments, acquisitions, and business expansion to cater to the needs of the conformal coating market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Year Consideration

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.3.1 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Electronics Conformal Coating Market

4.2 Conformal Coating Material Market, By Application

4.3 Conformal Coating Material Market, By Region (2014-2020)

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Highly Reliable Electronic Devices/Equipment

5.2.1.2 Increasing Use of Automation Across the Industries

5.2.1.3 Growing Demand for Parylene Conformal Coating

5.2.2 Restraint

5.2.2.1 Economic Slowdown

5.2.3 Opportunities

5.2.3.1 Increasing Application Areas

5.2.4 Challenge

5.2.4.1 Lack of Technical Knowledge

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Key Influencers

6.3 Porter’s Five Forces Model

6.3.1 Threats of New Entrants

6.3.2 Threats of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Industry Rivalry

7 Electronics Conformal Coating Market, By Equipment (Page No. - 50)

7.1 Introduction

7.2 Curing System

7.3 Coating & Dispensing System

7.4 Inspection System

7.5 Others

8 Electronics Conformal Coating Market, By Application Method (Page No. - 56)

8.1 Introduction

8.2 Brush Coating

8.3 Dipping

8.4 Spray Coating

8.5 Selective Coating

8.6 Vapor Deposition

9 Electronics Conformal Coating Market, By Material (Page No. - 58)

9.1 Introduction

9.2 Acrylic

9.3 Polyurethane/Urethane

9.4 Silicone

9.5 Epoxy

9.6 Parylene

9.7 Others

10 Electronics Conformal Coating Market, By Application (Page No. - 70)

10.1 Introduction

10.2 Automotive Electronics

10.3 Aerospace & Defense Electronics

10.4 Consumer Electronics

10.5 Medical Electronics

10.6 Others

11 Electronics Conformal Coating Market, By Geography (Page No. - 81)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 U.K.

11.3.2 Germany

11.3.3 France

11.3.4 Spain

11.3.5 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 Japan

11.4.3 South Korea

11.4.4 India

11.4.5 Rest of APAC

11.5 Rest of the World

11.5.1 South America

11.5.2 Middle East & Africa

12 Competitive Landscape (Page No. - 107)

12.1 Overview

12.2 Market Ranking Analysis: Electronics Conformal Coating Market

12.3 Competitive Situation

12.3.1 New Product Launches

12.3.2 Expansions

12.3.3 Acquisitions

13 Company Profile (Page No. - 114)

13.1 Chase Corp.

13.1.1 Business Overview

13.1.2 Products Offered

13.1.3 Recent Developments

13.1.4 MnM View

13.1.4.1 SWOT Analysis

13.2 Nordson Corp.

13.2.1 Business Overview

13.2.2 Products Offered

13.2.3 Recent Developments

13.2.4 MnM View

13.2.4.1 SWOT Analysis

13.3 Precision Valve & Automation, Inc.

13.3.1 Business Overview

13.3.2 Products Offered

13.3.3 Recent Developments

13.3.4 MnM View

13.4 Dow Corning Corp.

13.4.1 Business Overview

13.4.2 Products Offered

13.4.3 MnM View

13.5 Electrolube

13.5.1 Business Overview

13.5.2 Products Offered

13.5.3 Recent Developments

13.5.4 MnM View

13.6 Shin-ETSU Chemical Co., Ltd.

13.6.1 Business Overview

13.6.2 Products Offered

13.6.3 Recent Developments

13.7 Henkel AG & Co. KGAA

13.7.1 Business Overview

13.7.2 Products & Services

13.8 Dymax Corp.

13.8.1 Business Overview

13.8.2 Products Offered

13.8.3 Recent Developments

13.9 Chemtronics

13.9.1 Business Overview

13.9.2 Products Offered

13.10 Peters Group

13.10.1 Business Overview

13.10.2 Products Offered

13.11 Mg Chemicals Ltd.

13.11.1 Business Overview

13.11.2 Products Offered

14 Appendix (Page No. - 134)

14.1 Insights of Industry Experts

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (69 Tables)

Table 1 Driver Analysis

Table 2 Restraint Analysis

Table 3 Opportunity Analysis

Table 4 Challenge Analysis

Table 5 List of Companies Considered in the Study of Conformal Coating Market

Table 6 Equipment: Electronics Conformal Coating Market Size, By Region,2013–2020 (USD Million)

Table 7 Equipment:: Electronics Conformal Coating Market Size in North America, By Country, 2013–2020 (USD Million)

Table 8 Equipment: Electronics Conformal Coating Market Size in Europe, By Country, 2013–2020 (USD Million)

Table 9 Equipment: Conformal Coating Market Size in APAC, By Country,2013–2020 (USD Million)

Table 10 Equipment: Conformal Coating Market Size in RoW, By Region,2013–2020 (USD Million)

Table 11 Equipment: Electronics Conformal Coating Market Size, By Type2013–2020 (USD Million)

Table 12 Equipment: Conformal Coating and Dispensing System Market Size, By Method 2013–2020 (USD Million)

Table 13 Conformal Coating Material Market Size, By Material Type,2013–2020 (USD Million)

Table 14 Acrylic: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 15 Acrylic: Conformal Coating Material Market Size, By Region,2013–2020 (USD Million)

Table 16 Polyurethane/Urethane: Conformal Coating Material Market Size, By Application, 2013–2020 (USD Million)

Table 17 Polyurethane/Urethane: Conformal Coating Material Market Size, By Region, 2013–2020 (USD Million)

Table 18 Silicone: Conformal Coating Material Market Size, By Application, 2013–2020 (USD Million)

Table 19 Silicone: Conformal Coating Material Market Size, By Region,2013–2020 (USD Million)

Table 20 Epoxy: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 21 Epoxy: Conformal Coating Material Market Size, By Region,2013–2020 (USD Million)

Table 22 Parylene: Conformal Coating Material Market Size, By Application, 2013–2020 (USD Million)

Table 23 Parylene: Conformal Coating Material Market Size, By Region,2013–2020 (USD Million)

Table 24 Others: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 25 Others: Conformal Coating Material Market Size, By Region,2013–2020 (USD Million)

Table 26 Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 27 Automotive Electronics: Conformal Coating Material Type Market Size, By Material Type, 2013–2020 (USD Million)

Table 28 Automotive Electronics: Conformal Coating Material Market Size, By Region, 2013–2020 (USD Million)

Table 29 Aerospace & Defense: Conformal Coating Material Type Market Size, By Material Type, 2013–2020 (USD Million)

Table 30 Aerospace & Defense: Conformal Coating Material Market Size, By Region, 2013–2020 (USD Million)

Table 31 Consumer Electronics: Conformal Coating Material Market Size, By Material Type, 2013–2020 (USD Million)

Table 32 Consumer Electronics: Conformal Coating Material Market Size, By Region, 2013–2020 (USD Million)

Table 33 Medical Electronics: Conformal Coating Material Market Size, By Material Type, 2013–2020 (USD Million)

Table 34 Medical Electronics: Conformal Coating Material Market Size, By Region, 2013–2020 (USD Million)

Table 35 Others: Electronics Conformal Coating Market Size, By Material Type,2013–2020 (USD Million)

Table 36 Others: Conformal Coating Material Market Size, By Region,2013–2020 (USD Million)

Table 37 Conformal Coating Material Market Size, By Region,2013–2020 (USD Million)

Table 38 North America: Conformal Coating Material Market Size, By Country, 2013–2020 (USD Million)

Table 39 North America: Conformal Coating Material Market Size, By Application, 2013–2020 (USD Million)

Table 40 North America: Conformal Coating Material Market Size, By Material Type, 2013–2020 (USD Million)

Table 41 U.S.: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 42 Canada: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 43 Mexico: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 44 Europe: Electronics Conformal Coating Market Size, By Country,2013–2020 (USD Million)

Table 45 Europe: Conformal Coating Market Size, By Material Type,2013–2020 (USD Million)

Table 46 Europe: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 47 U.K.: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 48 Germany: Conformal Coating Material Market Size, By Application, 2013–2020 (USD Million)

Table 49 France: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 50 Spain: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 51 Rest of Europe: Conformal Coating Material Market Size, By Application, 2013–2020 (USD Million)

Table 52 APAC: Conformal Coating Material Market Size, By Country,2013–2020 (USD Million)

Table 53 APAC: Conformal Coating Material Market Size, By Material Type,2013–2020 (USD Million)

Table 54 APAC: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 55 China Conformal Coating Market Size, By Application,2013–2020 (USD Million)

Table 56 Japan: Conformal Coating Market Size, By Application,2013–2020 (USD Million)

Table 57 South Korea: Conformal Coating Market Size, By Application,2013–2020 (USD Million)

Table 58 India: Electronics Electronics Conformal Coating Market Size, By Application,2013–2020 (USD Million)

Table 59 Rest of APAC: Electronics Conformal Coating Market Size, By Application,2013–2020 (USD Million)

Table 60 RoW: Conformal Coating Material Market Size, By Region,2013–2020 (USD Million)

Table 61 RoW: Electronics Conformal Coating Market Size, By Material Type,2013–2020 (USD Million)

Table 62 RoW: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million)

Table 63 South America: Conformal Coating Material Market, By Country,2013–2020 (USD Million)

Table 64 Brazil: Conformal Coating Material Market Size, By Application,2013–2020 (USD Million

Table 65 Argentina: Conformal Coating Material Market Size, By Application, 2013–2020 (USD Million)

Table 66 Middle East & Africa: Conformal Coating Material Market Size, By Application, 2013–2020 (USD Million)

Table 67 New Product Launches, 2012–2015

Table 68 Expansions, 2012–2015

Table 69 Acquisitions, 2012–2015

List of Figures (48 Figures)

Figure 1 Market Scope

Figure 2 Years Considered in the Report

Figure 3 Global Electronics Conformal Coating Market: Research Design

Figure 4 Electronics Conformal Coating Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Conformal Coating Market Size Estimation Methodology: Top-Down Approach

Figure 6 Breakdown of Primaries Interviews

Figure 7 Data Triangulation

Figure 8 Assumptions

Figure 9 Conformal Coating: Market Size Analysis (2013–2020)

Figure 10 Conformal Coating Material Market Snapshot: Automotive Sector Expected to Lead During the Forecast Period

Figure 11 APAC Accounted for the Largest Share in the Conformal Coating Equipment Market in 2014

Figure 12 The Conformal Coating Material Market Expected to Grow at A Moderate Growth Rate During the Forecast Period

Figure 13 Aerospace & Defense Expected to Witness Highest Growth Rate During the Forecast Period

Figure 14 The Automotive Electronics Sector Estimated to Hold the Largest Share of the Global Conformal Coating Material in 2015

Figure 15 Growth in APAC Expected to Be Driven By Emerging Markets Such as China and India

Figure 16 APAC Estimated to Hold the Largest Share of the Global Conformal Coating Material Market Segmented on the Basis of Application in 2015

Figure 17 Drivers, Restraints, Opportunities, and Challenges for the Electronics Conformal Coating Market

Figure 18 Value Chain Analysis: Major Value Addition Done During the Manufacturing Phase

Figure 19 Porter’s Five Forces Analysis

Figure 20 Porters Analysis: Conformal Coating

Figure 21 Threats of New Entrants

Figure 22 Threats of Substitutes

Figure 23 Bargaining Power of Suppliers

Figure 24 Bargaining Power of Buyers

Figure 25 Industry Rivalry

Figure 26 APAC Expected to Lead the Conformal Coating Equipment Market in 2015

Figure 27 Conformal Coating Material Market: Segmentation

Figure 28 Parylene Electronics Conformal Coating Market Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 29 Automotive Electronics Segment Expected to Lead the Silicone Conformal Coating Material Market in 2015

Figure 30 Electronics Conformal Coating Market: Segmentation

Figure 31 Automotive Electronics Segment Expected to Lead the Conformal Coating Material Market in 2015

Figure 32 APAC Expected to Witness the Highest Growth Rate During the Forecast Period in the Consumer Electronics Segment of Conformal Coating Material Market

Figure 33 Geographic Snapshot (2014): China and India are Emerging as Potential Markets

Figure 34 APAC Expected to Be the Fastest Growing Region in the Conformal Coating Material Market

Figure 35 Conformal Coating Material Market Snapshot for North America: Demand Expected to Be Driven By the Automotive Electronics Sector During the Forecast Period

Figure 36 Conformal Coating Material Market Snapshot for Europe: Demand Expected to Be Driven By the Automotive Electronics Sector During the Forecast Period

Figure 37 APAC Market Snapshot: Demand Likely to Be Driven By the Automotive Electronics Segment During the Forecast Period

Figure 38 Companies Adopted New Product Launches as the Key Growth Strategy (2012–2015)

Figure 39 Conformal Coating Material Market: Market Ranking Analysis

Figure 40 Conformal Coating Equipment Market: Market Ranking Analysis

Figure 41 Market Evolution Framework-Significant New Product Launches has Fueled Growth and Innovation Between 2012 and 2015

Figure 42 Battle for Market Share: New Product Launches Was the Key Strategy From 2014 and 2015

Figure 43 Chase Corp.: Company Snapshot

Figure 44 Chase Corp.: SWOT Analysis

Figure 45 Nordson Corp.: Company Snapshot

Figure 46 Nordson Corp.: SWOT Analysis

Figure 47 Shin-ETSU Chemical Co., Ltd.: Company Snapshot

Figure 48 Henkel AG & Co. KGAA: Company Snapshot

The conformal coating ecosystem comprises conformal coating material vendors such as Chase Corporation (U.S.), MG Chemicals Ltd. (Canada), DOW Corning Corporation (U.S.), and Chemtronics (U.S.); equipment providers such as Nordson Corporation (U.S.), and Precision Valve & Automation, Inc. (U.S.), and others who sell these products to end users to cater to their unique requirements; end users are from a wide range of applications sectors such as automotive electronics, consumer electronics, medical electronics, and aerospace & defense among others.

The study answers several questions for the target audiences, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments

The target audience:

- Conformal coating material, and equipment providers

- Electronic system designers and manufacturers

- Research organizations and consulting companies

- Associations, forums, and alliances related to conformal coating

- Investors

- Key players

Report Scope:

In this report, the Electronics conformal coating market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

- Market, by Material: acrylic, silicone, polyurethane/urethane, parylene, epoxy, and others.

- Market, by Equipment: coating & dispensing systems, curing systems, and inspection systems

- Market, by Method: brush coating, dipping, spray coating, selective coating, and vapor deposition

- Market, by Application: automotive electronics, aerospace & defense, consumer electronics, medical electronics, and others.

- Market, by Geography: North America (sub-segmented into the U.S., Canada, and Mexico), Europe (sub-segmented into the U.K., Germany, France, Spain, and others), Asia-Pacific (sub-segmented into China, Japan, South Korea, India, and others), and the Rest of the World (sub-segmented into South America and the Middle East and Africa)

- Competitive Landscape: Market ranking analysis.

- Company Profiles: Detailed analysis of the major companies present in the Electronics conformal coating market.

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per a company’s specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Electronics Conformal Coating Market

Just now I am working with electronics protection methodologies and would like to see the picture of the coating applications in the market.

We are interest to know more the details about the Electronics Conformal Coating market sizing of material such as Acrylic, Silicone, and Others.