Connected Mining Market by Offering (Solutions (Asset Tracking and Optimization, Fleet Management) and Services (Professional, Managed)), Mining Type (Surface, Underground), Application, Deployment Mode and Region - Global Forecast to 2028

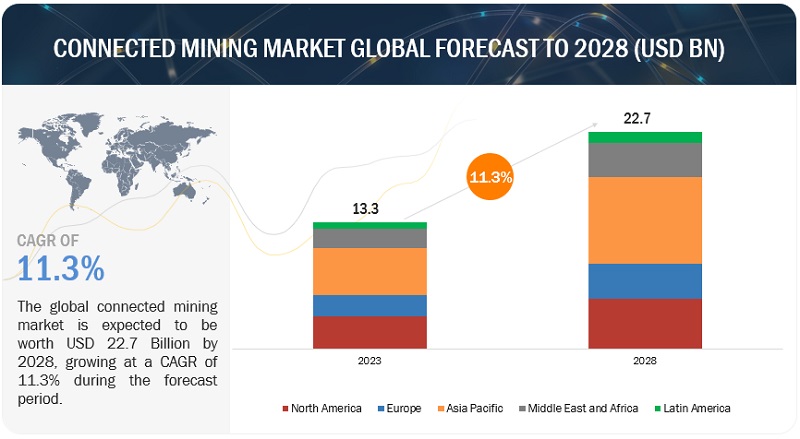

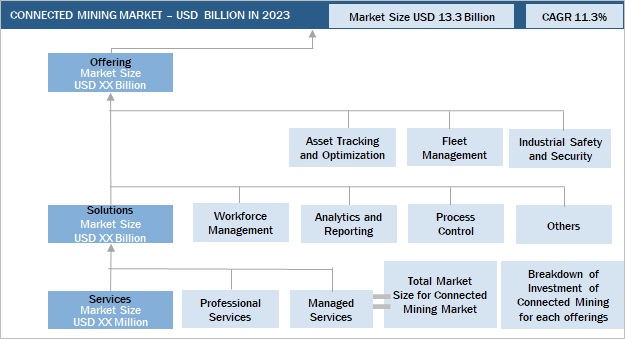

The global connected mining market size was estimated at USD 13.3 billion in 2023 and is projected to reach USD 22.7 billion by 2028, growing at CAGR of 11.3%. Leveraging advanced technologies such as IoT, AI, and data analytics, connected mining enables real-time data collection, analysis, and decision-making, empowering mining companies to optimize their operations, enhance safety measures, and improve overall efficiency. As the mining industry continues to embrace digital transformation, the adoption of connected mining solutions is expected to rise significantly, driving the market’s growth and revolutionizing mining operations worldwide.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Connected Mining Market Dynamics

Driver: Advancing Mining Operations through Connectivity

The increasing complexity and scale of mining operations and the need for streamlined communication and collaboration are driving the adoption of connected mining solutions. Mining companies leverage advanced technologies to connect personnel, equipment, and systems across multiple sites. These solutions enable seamless information exchange, real-time monitoring, and centralized control, enhancing operational efficiency, reducing errors, and improving overall productivity. By harnessing the power of connectivity, connected mining solutions facilitate better coordination, collaboration, and decision-making, enabling mining companies to overcome operational challenges and stay competitive in a rapidly evolving industry.

Restraint: High Initial Implementation Cost and Operational Disruptions

A significant constraint for the connected mining market is the high initial implementation cost. Integrating advanced technologies, establishing communication networks, and deploying IoT devices require substantial upfront investment. Due to these high costs, many mining companies, especially smaller players, might face financial constraints in adopting connected mining solutions. Additionally, the implementation process may involve disruptions to ongoing mining operations and require workforce retraining, further adding to the cost and potential resistance to change.

Opportunity: Leveraging Technological Advancements and Connectivity for Growth

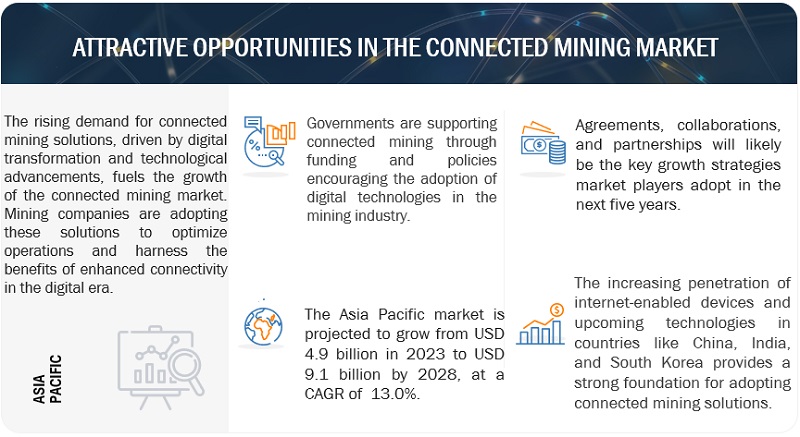

The rapid advancements in digital technologies and the increasing availability of high-speed internet present significant growth opportunities for the connected mining market. With the deployment of 5G networks and the expansion of reliable communication infrastructure, mining companies can leverage real-time data and enhanced connectivity for improved operational efficiency and safety. Furthermore, the integration of connected mining with emerging technologies such as AI, machine learning, and automation opens new possibilities for predictive maintenance, optimized resource management, and autonomous operations.

Challenge: Ensuring Security, Interoperability, and Trust in Connected Mining Solutions

Mining operations deal with sensitive information related to resources, production, and personnel, making them potential targets for cyber threats. Therefore, robust cybersecurity measures and data encryption protocols are essential to safeguarding the integrity and confidentiality of mining data. Standardizing communication protocols and ensuring interoperability among various connected devices and systems also present technical challenges that require careful planning and collaboration among technology providers and mining companies.

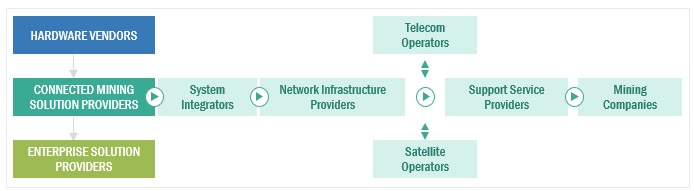

Connected Mining Market Ecosystem

The connected mining market is driven by prominent companies that have established themselves as leaders in the industry. These companies are well-established, financially stable, and have a proven track record in providing innovative solutions and services in the mining sector. Their diverse product portfolio spans infrastructure, solutions, applications, and services, enabling them to cater to the market’s evolving needs. With state-of-the-art technologies and extensive capabilities, these companies are at the forefront of driving the advancement of connected mining technology.

By offering, Services segment to grow at a higher CAGR during the forecast period

During the forecast period, the services segment is poised to witness substantial growth in the connected mining market. As mining companies increasingly adopt connected mining solutions, the demand for specialized services to implement, manage, and optimize these technologies is rising. Service providers are pivotal in guiding mining companies through the complexities of digital transformation, offering tailored solutions to address specific operational challenges and requirements. The services segment’s higher CAGR growth reflects the industry's growing recognition of the importance of professional expertise and support in leveraging the full potential of connected mining technologies.

By mining type, the surface segment is expected to grow at a higher CAGR during the forecast period

The surface segment is expected to experience a higher compound annual growth rate during the forecast period in the connected mining market. Surface mining is becoming a favored method for resource extraction due to its cost-effectiveness and accessibility of mineral deposits near the Earth’s surface. As mining companies seek to enhance productivity and optimize resource management, the adoption of connected mining solutions in surface mining operations is rising. Connected mining technologies offer real-time monitoring, automation, and data analytics, providing valuable insights for better decision-making and operational efficiency in surface mining.

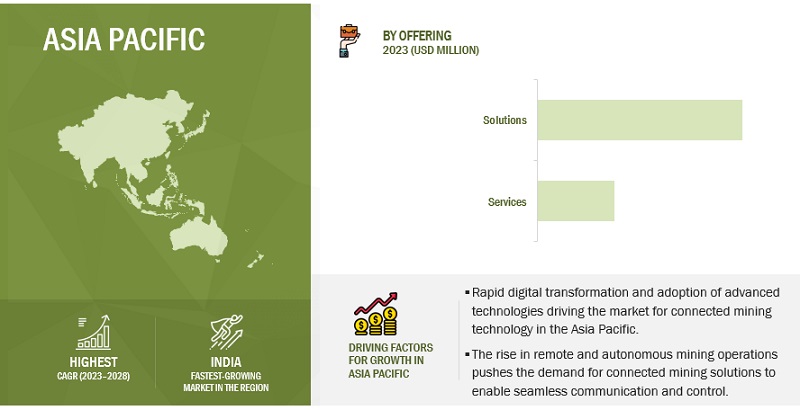

By region, Asia Pacific to grow at a higher CAGR during the forecast period

During the forecast period, Asia Pacific is expected to experience a higher compound annual growth rate in the connected mining market. The region’s thriving mining industry and rapid industrialization and urbanization drive the demand for advanced technologies to enhance operational efficiency and productivity. Additionally, the growing emphasis on safety and environmental sustainability in mining operations encourages mining companies to adopt connected mining solutions. With increasing investments in digital transformation and the deployment of 5G networks in the region, Asia Pacific presents significant growth opportunities for connected mining solution providers.

Market Players:

The major players in the connected mining market are ABB (Switzerland), IBM (US), SAP (Germany), Cisco (US), Schneider Electric (France), Komatsu (Japan), Hexagon (Sweden), Caterpillar (US), Rockwell Automation (US), Trimble (US), Siemens (Germany), Howden (Scotland), Accenture (Ireland), PTC (US), Hitachi (Japan), Eurotech Communication (Israel), Wipro (India), MST Global (US), GE Digital (US), Symboticware (Canada), Getac (Taiwan), IntelliSense.io (UK), Zyfra (Finland), Axora (UK), GroundHog (US), SmartMining SpA (Chile), and Applied Vehicle Analysis (Africa).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2023-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By Component, Solutions, Services, Mining Type, deployment mode, Application, Regions |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

ABB (Switzerland), IBM (US), SAP (Germany), Cisco (US), Schneider Electric (France), Komatsu (Japan), Hexagon (Sweden), Caterpillar (US), Rockwell Automation (US), Trimble (US), Siemens (Germany), Howden (Scotland), Accenture (Ireland), PTC (US), Hitachi (Japan), Eurotech Communication (Israel), Wipro (India), MST Global (US), GE Digital (US), Symboticware (Canada), Getac (Taiwan), IntelliSense.io (UK), Zyfra (Finland), Axora (UK), GroundHog (US), SmartMining SpA (Chile), and Applied Vehicle Analysis (Africa). |

This research report categorizes the connected mining market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

- Solutions

- Services

Based on Solution:

- Asset Tracking and Optimization

- Fleet Management

- Industrial Safety and Security

- Workforce Management

- Analytics and Reporting

- Process Control

- Others(Operational performance, Quality optimization solutions)

Based on Service:

-

Professional Services

- Consulting

- Integration and Deployment

- Support and Maintenance

- Managed Services

Based on Mining Type:

- Surface

- Underground

Based on Deployment Mode:

- On-premises

- Cloud

Based on Application:

- Exploration

- Processing and Refining

- Transportation

Based on Regions:

-

North America

- US

- Canada

-

Europe

- Russia

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Australia

- India

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- June 2022 - Metso Outotec and Dynamox worked together to implement the condition monitoring platform of Dynamox in mining and aggregating operations. The solution is being provided by Metso Outotec to the installed equipment base of the business. Dynamox is a new member of the Metso Outotec partner ecosystem and aids in creating and offering customers simple-to-use digital solutions. The corporation is leveraging analytics and AI to further advance its mining operations.

- November 2021 - Hexagon AB, a market pioneer in virtual reality solutions, introduced the HxGN MineEnterprise Platform in November 2021. This new product is intended to increase real-time data management and analytics for mining operations.

- August 2021 - A cooperation between Caterpillar and BHP, a global mining, oil, and metals corporation, was established. In order to reduce greenhouse gas (GHG) emissions at BHP's mining locations around the world, the alliance planned to build and execute zero-emissions mining vehicles. In order to enable future mine sites and emission-free machinery, the alliance would help shape the processes, infrastructure, and technology needed.

- August 2021 - To improve its position in the connected mining market, Komatsu Ltd., a top manufacturer of mining equipment, said in August 2021 that it had acquired Immersive Technologies, a supplier of training solutions for the mining sector.

Frequently Asked Questions (FAQ):

What is connected mining?

Connected mining refers to integrating advanced digital technologies and communication systems into mining operations to enable real-time data exchange, seamless connectivity, and improved decision-making. It uses Internet of Things (IoT) devices, sensors, data analytics, artificial intelligence, and automation to gather, analyze, and utilize data from various mining processes, including equipment, personnel, and environmental conditions. Connected mining solutions offer mining companies enhanced visibility and control over their operations, leading to increased efficiency, improved safety measures, optimized resource management, and ultimately, higher productivity and profitability. By harnessing the power of connectivity and data-driven insights, connected mining aims to revolutionize the mining industry by fostering smarter, safer, and more sustainable practices.

What is the market size of the connected mining market?

The global connected mining market is expected to be worth USD 22.7 billion by 2028, growing at CAGR of 11.3% during the forecast period.

What are the major drivers in the connected mining market?

Connected mining solutions provide real-time data insights and analytics, allowing mining companies to optimize processes, reduce downtime, and make informed decisions promptly. Safety and worker wellbeing are also significant drivers, as connected mining technologies enable continuous monitoring of personnel and equipment, ensuring a safer working environment and minimizing the risk of accidents. Additionally, the growing focus on sustainable mining practices and environmental compliances drives the implementation of connected solutions that promote resource conservation and minimize the industry's ecological footprint. The integration of IoT, AI, and automation in the connected mining landscape empowers mining companies to enhance overall performance, safety, and sustainability, positioning these drivers at the forefront of the industry's rapid transformation.

Who are the major players operating in the connected mining market?

The major players in the connected mining market are ABB (Switzerland), IBM (US), SAP (Germany), Cisco (US), Schneider Electric (France), Komatsu (Japan), Hexagon (Sweden), Caterpillar (US), Rockwell Automation (US), Trimble (US), Siemens (Germany), Howden (Scotland), Accenture (Ireland), PTC (US), Hitachi (Japan), Eurotech Communication (Israel), Wipro (India), MST Global (US), GE Digital (US), Symboticware (Canada), Getac (Taiwan), IntelliSense.io (UK), Zyfra (Finland), Axora (UK), GroundHog (US), SmartMining SpA (Chile), and Applied Vehicle Analysis (Africa).

Which key technology trends prevail in the connected mining market?

In the connected mining market, several key technology trends are shaping the industry's landscape. Internet of Things (IoT) is playing a pivotal role by enabling the integration of sensors, devices, and equipment to gather real-time data from mining operations. The data-driven approach allows mining companies to monitor equipment health, track assets, and optimize resource utilization. Artificial Intelligence (AI) and machine learning algorithms further revolutionize the industry by analyzing vast amounts of data, identifying patterns, and predicting equipment failures, thus facilitating predictive maintenance. Cloud computing empowers mining companies to store and process massive amounts of data securely, while edge computing brings computing capabilities closer to mining sites, reducing latency and enabling real-time decision-making. Automation and autonomous systems are also gaining traction, improving safety and efficiency in mining operations. Together, these technology trends drive innovation, improve productivity, and transform the connected mining landscape.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Mining 4.0 initiative in industries paving way for connected mining- Usage of sensors to improve operational and automated processes- Greater adoption of IoT to accelerate use of digital solutions in developing connected mines- Provision of ventilation systems in mines to enhance safety and security of workersRESTRAINTS- Depletion of natural resources and increase in populationOPPORTUNITIES- Rise in demand for digitalization- Need for metals and minerals- Emergence of 5G technologyCHALLENGES- Shortage of skilled labor- Differences in standards, models, interfaces, and protocols would impact convergence of IT and OT

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM

-

5.5 PORTER’S FIVE FORCES MODELTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.6 PATENT ANALYSIS

-

5.7 PRICING ANALYSISPRICING, BY INTEGRATED SOLUTIONPRICING, BY STANDALONE SOLUTION

-

5.8 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCEBLOCKCHAININTERNET OF THINGSCLOUD COMPUTINGROBOTICSBIG DATA AND ANALYTICS

- 5.9 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.10 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- Workplace Safety Law- Health and Safety at Work Act- Occupational Safety and Health Act- Small Business Regulatory Enforcement Fairness Act- General Data Protection Regulation- Cloud Standard Customer Council- Health Insurance Portability and Accountability Act- ISO 45001:2018- International Labour Organization- National Institute for Occupational Safety and Health- National Safety Council

-

5.11 CASE STUDY ANALYSISCASE STUDY 1: IMPLEMENTATION OF ACCENTURE LIFE SAFETY SOLUTION TO ACHIEVE OPERATIONAL EFFICIENCYCASE STUDY 2: SHELL AND IBM DEVELOPED OREN TO SUPPORT DIGITAL TRANSFORMATION FOR MINING INDUSTRYCASE STUDY 3: SIGNIFICANT GROWTH IN PRODUCTION CAPACITY OBSERVED WITH HELP OF HITACHI MACHINERYCASE STUDY 4: DEPLOYMENT OF CISCO’S CONNECTED MINING SOLUTIONS TO SUPPORT DIGITAL TRANSFORMATIONCASE STUDY 5: DEPLOYMENT OF VELOCITY EHS TO IMPROVE SAFETY STANDARDSCASE STUDY 6: RIO TINTO CHOSE CATERPILLAR TO CREATE CONNECTED VALUE CHAIN IN GUDAI-DARRI MINE

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.13 EVOLUTION OF CONNECTED MINING TECHNOLOGYEARLY ADOPTERS AND WIRELESS COMMUNICATION (LATE 1990S–EARLY 2000S)SENSOR INTEGRATION AND MONITORING SYSTEMS (EARLY 2000S– MID-2010S)INTERNET OF THINGS (IOT) AND DATA ANALYTICS (MID-2010S–PRESENT)AUTOMATION AND ROBOTICS (LATE 2010S–PRESENT)INTEGRATION WITH CLOUD COMPUTING AND ARTIFICIAL INTELLIGENCE (PRESENT AND FUTURE)EMPHASIS ON SUSTAINABILITY AND ENVIRONMENTAL MONITORING (PRESENT AND FUTURE)

-

5.14 FUTURE DIRECTION OF CONNECTED MINING MARKET LANDSCAPEADVANCED AUTOMATION AND ROBOTICSEDGE COMPUTING AND REAL-TIME ANALYTICSARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGENHANCED SAFETY AND HEALTH MONITORINGSUSTAINABLE MINING PRACTICESINTEGRATION OF BLOCKCHAIN AND SUPPLY CHAIN TRANSPARENCYCOLLABORATIVE ECOSYSTEMS AND DIGITAL TWINS

-

5.15 CONNECTED MINING MARKET: IMPACT ON ADJACENT NICHE TECHNOLOGIESINTERNET OF THINGS (IOT)BIG DATA AND ANALYTICSARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNINGROBOTICS AND AUTOMATIONREMOTE SENSING AND GEOSPATIAL TECHNOLOGIESCOMMUNICATION AND CONNECTIVITY

- 6.1 INTRODUCTION

-

6.2 SOLUTIONSSOLUTIONS: MARKET DRIVERS

-

6.3 SERVICESSERVICES: MARKET DRIVERS

- 7.1 INTRODUCTION

-

7.2 ASSET TRACKING AND OPTIMIZATIONASSET TRACKING & OPTIMIZATION: MARKET DRIVERS

-

7.3 FLEET MANAGEMENTFLEET MANAGEMENT: MARKET DRIVERS

-

7.4 INDUSTRIAL SAFETY & SECURITYINDUSTRIAL SAFETY & SECURITY: CONNECTED MINING MARKET DRIVERS

-

7.5 WORKFORCE MANAGEMENTWORKFORCE MANAGEMENT: MARKET DRIVERS

-

7.6 ANALYTICS AND REPORTINGANALYTICS & REPORTING: MARKET DRIVERS

-

7.7 PROCESS CONTROLPROCESS CONTROL: MARKET DRIVERS

-

7.8 OTHER SOLUTIONSOTHER SOLUTIONS: MARKET DRIVERS

- 8.1 INTRODUCTION

-

8.2 PROFESSIONAL SERVICESPROFESSIONAL SERVICES: MARKET DRIVERSCONSULTINGINTEGRATION & DEPLOYMENTSUPPORT & MAINTENANCE

-

8.3 MANAGED SERVICESMANAGED SERVICES: MARKET DRIVERS

- 9.1 INTRODUCTION

-

9.2 EXPLORATIONEXPLORATION: MARKET DRIVERS

-

9.3 PROCESSING & REFININGPROCESSING & REFINING: MARKET DRIVERS

-

9.4 TRANSPORTATIONTRANSPORTATION: MARKET DRIVERS

- 10.1 INTRODUCTION

-

10.2 ON-PREMISESON-PREMISES: MARKET DRIVERS

-

10.3 CLOUDCLOUD: MARKET DRIVERS

- 11.1 INTRODUCTION

-

11.2 SURFACESURFACE: MARKET DRIVERS

-

11.3 UNDERGROUNDUNDERGROUND: MARKET DRIVERS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY NORMSUNITED STATESCANADA

-

12.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY NORMSRUSSIAUKGERMANYREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: CONNECTED MINING MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY NORMSCHINAAUSTRALIAINDIAREST OF ASIA PACIFIC

-

12.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY NORMSMIDDLE EASTAFRICA

-

12.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY NORMSBRAZILMEXICOREST OF LATIN AMERICA

- 13.1 OVERVIEW

-

13.2 STRATEGIES ADOPTED BY KEY PLAYERSPRODUCT LAUNCHESDEALS

- 13.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

- 13.4 HISTORICAL REVENUE ANALYSIS

-

13.5 COMPANY EVALUATION MATRIX OVERVIEWCOMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 13.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

13.7 COMPANY MARKET RANKING ANALYSISSTARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITION

-

13.8 COMPETITIVE BENCHMARKINGPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

14.1 MAJOR COMPANIESCISCO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewACCENTURE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCATERPILLAR INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewABB LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developmentsSCHNEIDER ELECTRIC- Business overview- Products/Solutions/Services offered- Recent developmentsKOMATSU- Business overview- Products/Solutions/Services offered- Recent developmentsHEXAGON AB- Business overview- Products/Solutions/Services offered- Recent developmentsROCKWELL AUTOMATION, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsTRIMBLE INC.- Business overview- Products/Solutions/Services offered- Recent developmentsHITACHI CONSTRUCTION MACHINERYPTCEUROTECH COMMUNICATIONGETACSIEMENSHOWDENWIPROMST GLOBALGE DIGITAL

-

14.2 STARTUPS/SMESZYFRAAXORAGROUNDHOGSMARTMININGAPPLIED VEHICLE ANALYSISSYMBOTICWAREINTELLISENSE.IO

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

-

15.3 WORKPLACE SAFETY MARKET– GLOBAL FORECAST TO 2025MARKET DEFINITIONMARKET OVERVIEWWORKPLACE SAFETY MARKET, BY COMPONENTWORKPLACE SAFETY MARKET, BY SYSTEMWORKPLACE SAFETY MARKET, BY APPLICATIONWORKPLACE SAFETY MARKET, BY REGION

-

15.4 IOT MARKET – GLOBAL FORECAST TO 2024MARKET DEFINITIONMARKET OVERVIEWIOT MARKET, BY COMPONENTIOT MARKET, BY ORGANIZATION SIZEIOT MARKET, BY REGION

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2019–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 STUDY ASSUMPTIONS

- TABLE 4 CONNECTED MINING MARKET: ECOSYSTEM

- TABLE 5 MARKET: PORTER'S FIVE FORCES

- TABLE 6 TOP TWENTY PATENT OWNERS (US)

- TABLE 7 PRICING, BY INTEGRATED SOLUTION

- TABLE 8 PRICING, BY STANDALONE SOLUTION

- TABLE 9 CONNECTED MINING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 11 KEY BUYING CRITERIA FOR CONNECTED MINING

- TABLE 12 MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 13 CONNECTED MINING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 14 SOLUTIONS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 15 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 17 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 19 CONNECTED MINING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 20 ASSET TRACKING & OPTIMIZATION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 ASSET TRACKING & OPTIMIZATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 FLEET MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 FLEET MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 INDUSTRIAL SAFETY & SECURITY: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 INDUSTRIAL SAFETY & SECURITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 WORKFORCE MANAGEMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 WORKFORCE MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 ANALYTICS & REPORTING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 ANALYTICS & REPORTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 PROCESS CONTROL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 PROCESS CONTROL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 OTHER SOLUTIONS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 OTHER SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 CONNECTED MINING MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 35 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 36 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 37 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 38 PROFESSIONAL SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 CONSULTING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 CONSULTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 INTEGRATION & DEPLOYMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 INTEGRATION & DEPLOYMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 MANAGED SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 CONNECTED MINING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 49 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 EXPLORATION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 EXPLORATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 PROCESSING & REFINING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 PROCESSING & REFINING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 TRANSPORTATION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 TRANSPORTATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 CONNECTED MINING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 57 MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 58 ON-PREMISES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 ON-PREMISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 CLOUD: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 CONNECTED MINING MARKET, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 63 MARKET, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 64 SURFACE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 SURFACE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 UNDERGROUND: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 UNDERGROUND: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: CONNECTED MINING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 UNITED STATES: CONNECTED MINING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 87 UNITED STATES: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 88 UNITED STATES: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 89 UNITED STATES: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 90 UNITED STATES: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 91 UNITED STATES: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 92 UNITED STATES: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 93 UNITED STATES: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 94 UNITED STATES: MARKET, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 95 UNITED STATES: MARKET, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 96 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 97 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 98 UNITED STATES: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 99 UNITED STATES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: CONNECTED MINING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 108 EUROPE: MARKET, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 109 EUROPE: MARKET, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 111 EUROPE: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 113 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 114 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 115 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 RUSSIA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 117 RUSSIA: CONNECTED MINING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 118 RUSSIA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 119 RUSSIA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 120 RUSSIA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 121 RUSSIA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 122 RUSSIA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 123 RUSSIA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 124 RUSSIA: MARKET, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 125 RUSSIA: MARKET, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 126 RUSSIA: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 127 RUSSIA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 128 RUSSIA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 129 RUSSIA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: CONNECTED MINING MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MARKET, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MARKET, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 146 CHINA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 147 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 148 CHINA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 149 CHINA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 150 CHINA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 151 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 152 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 153 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 154 CHINA: MARKET, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 155 CHINA: MARKET, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 156 CHINA: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 157 CHINA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 158 CHINA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 159 CHINA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: CONNECTED MINING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: MARKET, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: CONNECTED MINING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 176 MIDDLE EAST: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 177 MIDDLE EAST: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 178 MIDDLE EAST: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 179 MIDDLE EAST: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 180 MIDDLE EAST: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 181 MIDDLE EAST: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 182 MIDDLE EAST: CONNECTED MINING MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 183 MIDDLE EAST: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 184 MIDDLE EAST: MARKET, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 185 MIDDLE EAST: MARKET, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 186 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 187 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 188 MIDDLE EAST: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 189 MIDDLE EAST: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 190 LATIN AMERICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 191 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 192 LATIN AMERICA: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 193 LATIN AMERICA: CONNECTED MINING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 194 LATIN AMERICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 195 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 196 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 197 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 198 LATIN AMERICA: MARKET, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 199 LATIN AMERICA: MARKET, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 200 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 201 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 202 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 203 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 204 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 205 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 206 BRAZIL: CONNECTED MINING MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 207 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 208 BRAZIL: MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 209 BRAZIL: MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 210 BRAZIL: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 211 BRAZIL: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 212 BRAZIL: CONNECTED MINING MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 213 BRAZIL: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 214 BRAZIL: MARKET, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 215 BRAZIL: MARKET, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 216 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 217 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 218 BRAZIL: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 219 BRAZIL: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 220 CONNECTED MINING MARKET: PRODUCT LAUNCHES, FEBRUARY 2020–JULY 2023

- TABLE 221 MARKET: DEALS, JANUARY 2020–JULY 2023

- TABLE 222 MARKET: DEGREE OF COMPETITION

- TABLE 223 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 224 COMPANY PRODUCT FOOTPRINT

- TABLE 225 COMPANY OFFERING FOOTPRINT

- TABLE 226 COMPANY INDUSTRY FOOTPRINT

- TABLE 227 COMPANY REGION FOOTPRINT

- TABLE 228 CONNECTED MINING: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 229 CONNECTED MINING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

- TABLE 230 CISCO: BUSINESS OVERVIEW

- TABLE 231 CISCO: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 232 CISCO: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 233 CISCO: DEALS

- TABLE 234 IBM: BUSINESS OVERVIEW

- TABLE 235 IBM: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 236 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 IBM: DEALS

- TABLE 238 ACCENTURE: BUSINESS OVERVIEW

- TABLE 239 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 ACCENTURE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 241 ACCENTURE: DEALS

- TABLE 242 CATERPILLAR INC.: BUSINESS OVERVIEW

- TABLE 243 CATERPILLAR INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 CATERPILLAR INC.: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 245 CATERPILLAR INC.: DEALS

- TABLE 246 ABB: BUSINESS OVERVIEW

- TABLE 247 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 ABB: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 249 ABB: DEALS

- TABLE 250 SAP: BUSINESS OVERVIEW

- TABLE 251 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 SAP: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 253 SAP: DEALS

- TABLE 254 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- TABLE 255 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 SCHNEIDER ELECTRIC: DEALS

- TABLE 257 KOMATSU: BUSINESS OVERVIEW

- TABLE 258 KOMATSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 KOMATSU: PRODUCT/SOLUTION/SERVICE LAUNCH

- TABLE 260 KOMATSU: DEALS

- TABLE 261 HEXAGON AB: BUSINESS OVERVIEW

- TABLE 262 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 HEXAGON AB: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 264 HEXAGON AB: DEALS

- TABLE 265 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

- TABLE 266 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 ROCKWELL AUTOMATION: PRODUCT/SOLUTION/SERVICE LAUNCH

- TABLE 268 ROCKWELL AUTOMATION: DEALS

- TABLE 269 TRIMBLE INC.: BUSINESS OVERVIEW

- TABLE 270 TRIMBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 TRIMBLE INC.: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 272 TRIMBLE INC.: DEALS

- TABLE 273 WORKPLACE SAFETY MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

- TABLE 274 WORKPLACE SAFETY MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

- TABLE 275 HARDWARE: WORKPLACE SAFETY MARKET, BY TYPE, 2014–2019 (USD MILLION)

- TABLE 276 HARDWARE: WORKPLACE SAFETY MARKET SHIPMENTS, 2014–2019 (THOUSAND UNITS)

- TABLE 277 HARDWARE: WORKPLACE SAFETY MARKET, BY TYPE, 2019–2025 (USD MILLION)

- TABLE 278 HARDWARE: WORKPLACE SAFETY MARKET SHIPMENTS, 2019–2025 (THOUSAND UNITS)

- TABLE 279 HARDWARE: WORKPLACE SAFETY MARKET, BY REGION, 2014–2019 (USD MILLION)

- TABLE 280 HARDWARE: WORKPLACE SAFETY MARKET, BY REGION, 2019–2025 (USD MILLION)

- TABLE 281 SOFTWARE: WORKPLACE SAFETY MARKET, BY REGION, 2014–2019 (USD MILLION)

- TABLE 282 SOFTWARE: WORKPLACE SAFETY MARKET, BY REGION, 2019–2025 (USD MILLION)

- TABLE 283 SERVICES: WORKPLACE SAFETY MARKET, BY REGION, 2014–2019 (USD MILLION)

- TABLE 284 SERVICES: WORKPLACE SAFETY MARKET, BY REGION, 2019–2025 (USD MILLION)

- TABLE 285 WORKPLACE SAFETY MARKET, BY SYSTEM, 2014–2019 (USD MILLION)

- TABLE 286 WORKPLACE SAFETY MARKET, BY SYSTEM, 2019–2025 (USD MILLION)

- TABLE 287 WORKPLACE SAFETY MARKET, BY APPLICATION, 2014–2019 (USD MILLION)

- TABLE 288 WORKPLACE SAFETY MARKET, BY APPLICATION, 2019–2025 (USD MILLION)

- TABLE 289 WORKPLACE SAFETY MARKET, BY REGION, 2014–2019 (USD MILLION)

- TABLE 290 WORKPLACE SAFETY MARKET, BY REGION, 2019–2025 (USD MILLION)

- TABLE 291 IOT MARKET, BY COMPONENT, 2015–2020 (USD BILLION)

- TABLE 292 IOT MARKET, BY COMPONENT, 2021–2026 (USD BILLION)

- TABLE 293 IOT HARDWARE MARKET, BY REGION, 2015–2020 (USD BILLION)

- TABLE 294 IOT HARDWARE MARKET, BY REGION, 2021–2026 (USD BILLION)

- TABLE 295 IOT SOFTWARE SOLUTIONS MARKET, BY REGION, 2015–2020 (USD BILLION)

- TABLE 296 IOT SOFTWARE SOLUTIONS MARKET, BY REGION, 2021–2026 (USD BILLION)

- TABLE 297 IOT SOFTWARE SOLUTIONS MARKET, BY COMPONENT, 2015–2020 (USD BILLION)

- TABLE 298 IOT SOFTWARE SOLUTIONS MARKET, BY COMPONENT, 2021–2026 (USD BILLION)

- TABLE 299 IOT MARKET, BY ORGANIZATION, 2015–2020 (USD BILLION)

- TABLE 300 IOT MARKET, BY ORGANIZATION, 2021–2026 (USD BILLION)

- TABLE 301 SMALL AND MEDIUM-SIZED ENTERPRISES: IOT MARKET, BY REGION, 2015–2020 (USD BILLION)

- TABLE 302 SMALL AND MEDIUM-SIZED ENTERPRISES: IOT MARKET, BY REGION, 2021–2026 (USD BILLION)

- TABLE 303 LARGE ENTERPRISES: IOT MARKET, BY REGION, 2015–2020 (USD BILLION)

- TABLE 304 LARGE ENTERPRISES: IOT MARKET, BY REGION, 2021–2026 (USD BILLION)

- TABLE 305 IOT MARKET, BY REGION, 2015–2020 (USD BILLION)

- TABLE 306 IOT MARKET, BY REGION, 2021–2026 (USD BILLION)

- FIGURE 1 CONNECTED MINING MARKET: RESEARCH DESIGN

- FIGURE 2 RESEARCH METHODOLOGY: APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY-SIDE): REVENUE OF OFFERINGS IN MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL OFFERINGS IN MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 (DEMAND-SIDE): CONNECTED MINING MARKET

- FIGURE 6 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 7 RECESSION IMPACT: MARKET

- FIGURE 8 CONNECTED MINING MARKET, 2022–2028

- FIGURE 9 LEADING SEGMENTS IN MARKET IN 2023

- FIGURE 10 MARKET: REGIONAL SNAPSHOT

- FIGURE 11 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS DURING 2023–2028

- FIGURE 12 NEED FOR OPERATIONAL EFFICIENCY IN MINING TO IMPACT MARKET GROWTH

- FIGURE 13 NORTH AMERICA: ASSET TRACKING & OPTIMIZATION AND SURFACE SEGMENT TO ACCOUNT FOR LARGEST RESPECTIVE MARKET SHARES

- FIGURE 14 EUROPE: ASSET TRACKING & OPTIMIZATION AND SURFACE MINING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARES

- FIGURE 15 ASIA PACIFIC: ASSET TRACKING & OPTIMIZATION AND SURFACE MINING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARES

- FIGURE 16 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 CONNECTED MINING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- FIGURE 19 NUMBER OF PATENTS GRANTED DURING 2011–2022

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- FIGURE 21 KEY BUYING CRITERIA

- FIGURE 22 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 23 ASSET TRACKING & OPTIMIZATION SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 24 PROFESSIONAL SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 25 INTEGRATION & DEPLOYMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 26 EXPLORATION SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 27 CLOUD SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 SURFACE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 ASIA PACIFIC TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 33 HISTORICAL REVENUE ANALYSIS, 2020–2022

- FIGURE 34 CONNECTED MINING: COMPANY EVALUATION MATRIX, 2023

- FIGURE 35 RANKING OF KEY PLAYERS IN CONNECTED MINING MARKET, 2023

- FIGURE 36 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 37 CONNECTED MINING MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2023

- FIGURE 38 CISCO: COMPANY SNAPSHOT

- FIGURE 39 IBM: COMPANY SNAPSHOT

- FIGURE 40 ACCENTURE: FINANCIAL OVERVIEW

- FIGURE 41 CATERPILLAR: FINANCIAL OVERVIEW

- FIGURE 42 ABB: COMPANY SNAPSHOT

- FIGURE 43 SAP: COMPANY SNAPSHOT

- FIGURE 44 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 45 KOMATSU: FINANCIAL OVERVIEW

- FIGURE 46 HEXAGON AB: FINANCIAL OVERVIEW

- FIGURE 47 ROCKWELL AUTOMATION: FINANCIAL OVERVIEW

- FIGURE 48 TRIMBLE: FINANCIAL OVERVIEW

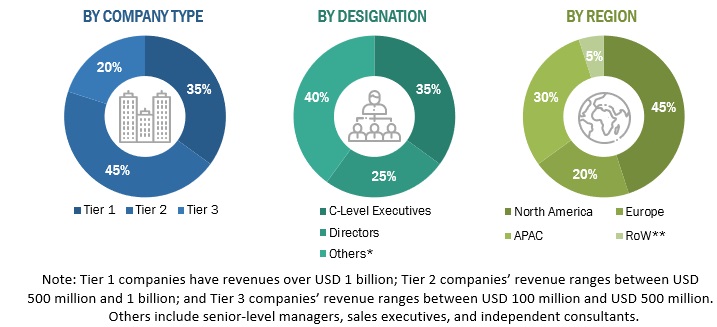

This research study involved extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for this technical, market-oriented, and commercial study of the global connected mining market. The primary sources were several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, Service Providers (SPs), technology developers, alliances, and organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. These included journals, annual reports, press releases, investor presentations of companies and white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the connected mining market. The primary sources from the demand side included consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

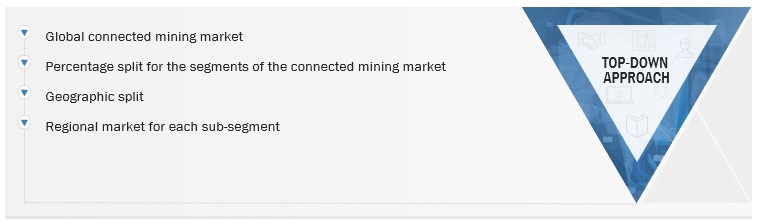

Multiple approaches were adopted to estimate and forecast the connected mining market. The first approach involved estimating the market size by summating companies’ revenue generated through connected mining solutions & services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the connected mining market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Connected Mining Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Connected Mining Market Size: Top-Down Approach

Data Triangulation

The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Connected mining is a technology-driven approach that revolutionizes the mining industry by leveraging advanced technologies such as IoT, cloud computing, and data analytics. It enables mining companies to optimize operations, enhance safety measures, and improve overall efficiency. Connected mining solutions facilitate real-time equipment monitoring, enable remote collaboration, and provide actionable insights for informed decision-making. Connecting mining transforms traditional mining practices by leveraging connectivity and digitalization, driving productivity and sustainability. This approach empowers mining companies to streamline their operations, reduce downtime, and maximize resource utilization, leading to improved profitability and competitiveness in the industry.

Key Stakeholders

- Mining Companies

- Technology Providers

- Equipment Manufacturers

- Service Providers

- Regulatory Bodies

- Industry Associations and Research Organizations

- Investors and Financial Institutions

Report Objectives

- To define, describe, and forecast the connected mining market based on segments based on offering, solutions, services, mining type, deployment mode, and application, with regions covered.

- To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information on the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the connected mining market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global connected mining market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global connected mining market.

- To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, product offerings, and business strategies; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Connected Mining Market