Cosmetic Packaging Market by Type, Material (Glass, Metal, Rigid plastic, Paper-based, Flexible packaging), Application (Skin care, Hair care, Oral care, Sun care, Color cosmetic, Fragrance & perfume), and Region - Global Forecast to 2025

Updated on : June 18, 2024

Cosmetic Packaging Market

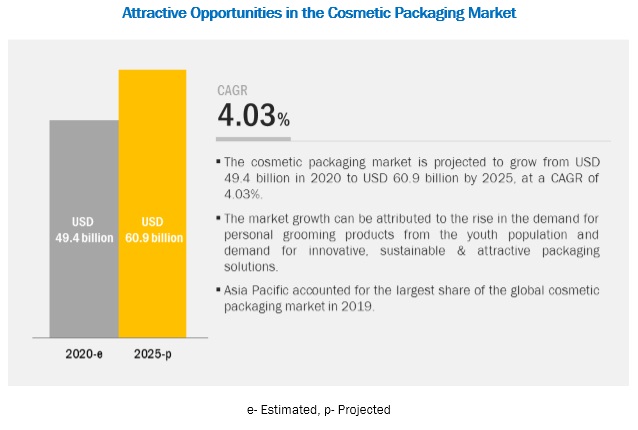

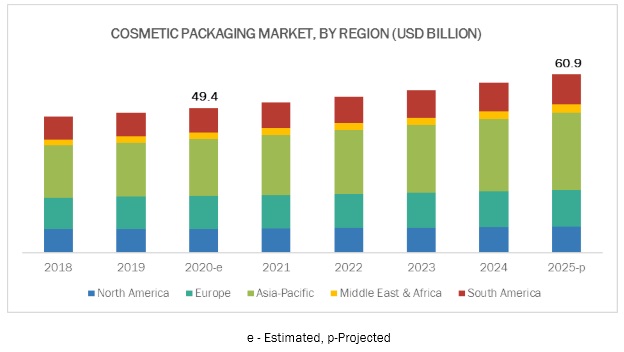

The global cosmetic packaging market was valued at USD 49.4 billion in 2020 and is projected to reach USD 60.9 billion by 2025, growing at 4.03% cagr from 2020 to 2025. The interest for cosmetic packaging can be credited to the high development and expansion of cosmetic items across the globe. Factors, for example, appeal from cosmetic brands for inventive, alluring and sustainable packaging across the globe are driving the interest for cosmetic packaging.

As far as worth and volume is concerned, the bottles segment is projected to lead the cosmetic packaging market from 2020 to 2025.

Considering type, the bottles segment is projected to be the biggest market for cosmetic packaging. The prevailing market position of the bottles can be ascribed to its sturdiness. Plastic jugs / bottles are generally liked as these are light in weight (which makes them simple to carry) and are not easily breakable. Besides, the interest of bottles for scents and aromas is quickly expanding due to the alluring and premium look of the glass bottles.

As far as worth and volume is concerned, the paper-based segment of the cosmetic packaging market is projected to develop at the most elevated CAGR during the conjecture time frame.

Considering material, the paper-based segment is projected to be the quickest developing section in the cosmetic packaging market. Factors like recyclability, maintainability, and the utilization of eco-friendly materials for the development of packaging items make it a broadly sought-after material for the packaging of cosmetics.

As far as worth and volume is concerned, the skin care segment of the cosmetic packaging market is projected to be the biggest market.

By application, the skin care segment is projected to be the biggest portion in the cosmetic packaging market. This predominant market position is owing to the dramatic development sought after for personal care & grooming items across the globe. With the adjustment of the way of life and purchasing behaviours, the interest in health, grooming and personal care items has additionally gone up (particularly the young and male populace), which has set out an opportunity for the skin care segment.

As far as both worth as well as volume, the Asia Pacific region is assessed to represent the most noteworthy share in the worldwide cosmetic packaging market during the estimate time frame

The Asia Pacific area represented the biggest market share in 2019. The expansion sought after in the region for cosmetic packaging can be generally credited to the developing populace, urbanization and discretionary cashflow of the populace. Moreover, there are less severe standards and norms for the utilization of raw materials or manufacturing of packaging items, alongside the simple accessibility of modest work, which is drawing in the central parts to extend their activities in the region. Moreover, the expansion popular for cosmetics from the arising economies of Asia Pacific is supposed to help the market for cosmetic packaging also.

Cosmetic Packaging Market Players

Key players, such as Amcor PLC (Australia), Berry Global Inc. (US), Sonoco (US), Albea SA (France), HCP Packaging (China), AptarGroup, Inc. (US), and Huhtamaki Oyj (Finland) have adopted these strategies to strengthen their product portfolios, expand their market presence, and enhance their growth prospects in the cosmetic packaging market.

Amcor, formerly known as APM-Australian Paper Manufacturers, is a global packaging manufacturer that offers innovative packaging solutions to the customers. Amcor designs highly versatile packaging solutions which are innovative, available with a one-way integrated valve, and offer ease of disposal. Innovation, excellence in manufacturing, and a broad range of technologies are the key strengths of the company. The company is one of the key leaders in the cosmetic packaging market; faces strong competition from the global as well as the regional players.

Cosmetic Packaging Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) and Volume (Million Unit) |

|

Segments covered |

Type, Material, Application, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

|

Companies covered |

Amcor PLC (Australia), Berry Global Inc. (US), Sonoco (US), Huhtamaki Oyj (Finland), Albea SA (France), HCP Packaging (China), TriMas Corporation (US), AptarGroup, Inc. (US), Gerresheimer AG (Germany), DS Smith PLC (UK), World Wide Packaging LLC (US), Graham Packaging International (France), and Libo Cosmetics Co., Ltd. (China) |

This research report categorizes the cosmetic packaging market based on type, material, application, and region.

Cosmetic packaging market on the basis of type:

- Bottles

- Tubes

- Jars

- Containers

- Blister & strip packs

- Aerosol cans

- Folding cartons

- Flexible plastics

- Others (includes tins, liquid cartons, and flexible paper)

Cosmetic packaging market on the basis of material:

- Glass

- Metal

- Paper-based

- Rigid plastic

- Flexible packaging

Cosmetic packaging market on the basis of application:

- Skin care

- Hair care

- Color cosmetic

- Sun care

- Oral care

- Fragrances & perfumes

Cosmetic packaging market on the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In January 2020, Albea SA opened a new plant for the manufacturing of metal parts for its skincare and cosmetic packaging Huai’an (China). The operations in the plant are expected to start in 2020.

- In December 2019, AptarGroup opened a new sales office in Dubai. This sales office will be operated for all the three segments of the company namely, beauty & home, food & beverage and pharma. With this expansion, the company aims to target the customers of several countries in the Middle East.

- In December 2019, Huhtamaki acquired complete ownership of the joint venture company Laminor S.A. (Brazil), which was established in 2002 as a 50/50 joint venture with Bemis Company (now part of Amcor). Laminor S.A. was specialized in manufacturing tube laminates, particularly for oral care applications. This acquisition is expected to expand Huhtamaki’s tube laminate business and further its flexible packaging product portfolio.

Key Questions Addressed by the Report:

- What are the global trends in the cosmetic packaging market? Would the market witness an increase or decline in the demand in the coming years?

- What is the estimated demand for different types of cosmetic packaging?

- Where will the strategic developments take the industry in the mid to long-term?

- What are the upcoming industry applications and trends for cosmetic packaging?

- Who are the major players in the cosmetic packaging market globally?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.3.2 REGIONS COVERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 29)

3.1 INTRODUCTION

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 EMERGING ECONOMIES TO WITNESS A RELATIVELY HIGHER DEMAND FOR COSMETIC PACKAGING

4.2 APAC: COSMETIC PACKAGING MARKET, BY TYPE AND COUNTRY

4.3 COSMETIC PACKAGING MARKET, BY TYPE

4.4 COSMETIC PACKAGING MARKET, BY MATERIAL

4.5 COSMETIC PACKAGING MARKET, BY APPLICATION

4.6 COSMETIC PACKAGING MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising penetration of cosmetics in the developing economies

5.2.1.2 Need for innovative, customized, and premium packaging from the cosmetic industry

5.2.1.3 Role of cosmetic packaging in the marketing of cosmetic products

5.2.2 RESTRAINTS

5.2.2.1 Government regulations or restrictions regarding the application of a few ingredients or raw materials in cosmetic packaging

5.2.2.2 Fluctuating raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Development of new & innovative packaging material

5.2.3.2 Increase in demand for the use of sustainable & environmentally-friendly packaging

5.2.4 CHALLENGES

5.2.4.1 Risk of counterfeit packaging for cosmetics

6 COSMETIC PACKAGING MARKET, BY TYPE (Page No. - 41)

6.1 INTRODUCTION

6.1.1 COSMETIC PACKAGING MARKET, BY TYPE

6.2 BOTTLES

6.3 TUBES

6.4 JARS

6.5 CONTAINERS

6.6 BLISTER & STRIP PACKS

6.7 FOLDING CARTONS

6.8 AEROSOL CANS

6.9 FLEXIBLE PLASTICS

6.1 OTHERS

7 COSMETIC PACKAGING MARKET, BY MATERIAL (Page No. - 46)

7.1 INTRODUCTION

7.1.1 COSMETIC PACKAGING MARKET, BY MATERIAL

7.2 GLASS

7.3 PAPER-BASED

7.4 METAL

7.5 FLEXIBLE PACKAGING

7.6 RIGID PLASTICS

8 COSMETIC PACKAGING MARKET, BY APPLICATION (Page No. - 50)

8.1 INTRODUCTION

8.1.1 COSMETIC PACKAGING MARKET, BY APPLICATION

8.2 SKIN CARE

8.3 HAIR CARE

8.4 COLOR COSMETIC

8.5 SUN CARE

8.6 ORAL CARE

8.7 FRAGRANCE & PERFUME

9 COSMETIC PACKAGING MARKET, BY REGION (Page No. - 54)

9.1 INTRODUCTION

9.2 APAC

9.2.1 CHINA

9.2.1.1 China to be the largest market for cosmetic packaging in APAC

9.2.2 JAPAN

9.2.2.1 Japan to be the second-largest market in APAC for cosmetic packaging

9.2.3 INDIA

9.2.3.1 India to be the fastest-growing country in the global cosmetic packaging market

9.2.4 AUSTRALIA

9.2.4.1 Rise in demand for grooming products by men is expected to boost the Australian cosmetic packaging market

9.2.5 REST OF APAC

9.2.5.1 Skin care to be the largest segment for cosmetic packaging in the Rest of APAC

9.3 EUROPE

9.3.1 GERMANY

9.3.1.1 Germany to be the largest market for cosmetic packaging in Europe by 2025

9.3.2 UK

9.3.2.1 The UK to be the third-largest cosmetic packaging market in Europe in 2019

9.3.3 FRANCE

9.3.3.1 Hair care to be the largest segment in the French cosmetic packaging market by 2025

9.3.4 RUSSIA

9.3.4.1 Increase in demand for skin care and color cosmetic products to drive the Russian cosmetic packaging market

9.3.5 SPAIN

9.3.5.1 Spain to be the fastest-growing country in the European cosmetic packaging market

9.3.6 ITALY

9.3.6.1 Rise in demand for beauty & personal care products to boost the market for cosmetic packaging in Italy

9.3.7 REST OF EUROPE

9.3.7.1 Hair care is projected to be the largest segment in Rest of Europe by 2025

9.4 NORTH AMERICA

9.4.1 US

9.4.1.1 The US to be the largest market for cosmetic packaging in North America

9.4.2 CANADA

9.4.2.1 Canada to be the second-fastest-growing cosmetic packaging market in North America

9.4.3 MEXICO

9.4.3.1 Mexico to be the fastest-growing cosmetic packaging market in North America by 2025

9.5 SOUTH AMERICA

9.5.1 BRAZIL

9.5.1.1 Brazil to account for the largest share in the South American cosmetic packaging market

9.5.2 ARGENTINA

9.5.2.1 Color cosmetic to be the fastest-growing segment of the cosmetic packaging market in Argentina

9.5.3 REST OF SOUTH AMERICA

9.5.3.1 Rigid plastic is projected to remain the largest consumed material type in Rest of South America

9.6 MIDDLE EAST & AFRICA

9.6.1 UAE

9.6.1.1 The UAE to be the second-largest cosmetic packaging market in the Middle East & Africa in 2019

9.6.2 SAUDI ARABIA

9.6.2.1 Saudi Arabia to be the largest market for cosmetic packaging in the Middle East & Africa

9.6.3 SOUTH AFRICA

9.6.3.1 South Africa to be the fastest-growing cosmetic packaging market in the Middle East & Africa by 2025, in terms of volume

9.6.4 TURKEY

9.6.4.1 Rigid plastic to be the largest segment of the Turkish cosmetic packaging market in 2019

9.6.5 REST OF MIDDLE EAST & AFRICA

9.6.5.1 Rest of Middle East & Africa has a high potential for growth in the cosmetic packaging market

10 COMPETITIVE LANDSCAPE (Page No. - 117)

10.1 OVERVIEW

10.2 MICROQUADRANT FOR COSMETIC PACKAGING MANUFACTURER

10.2.1 VISIONARY LEADERS

10.2.2 INNOVATORS

10.2.3 DYNAMIC DIFFERENTIATORS

10.2.4 EMERGING COMPANIES

10.3 COSMETIC PACKAGING MARKET (GLOBAL)

10.3.1 STRENGTH OF PRODUCT PORTFOLIO

10.3.2 BUSINESS STRATEGY EXCELLENCE

10.4 COMPETITIVE SCENARIO

10.4.1 ACQUISITION

10.4.2 EXPANSION

10.4.3 NEW PRODUCT DEVELOPMENT

11 COMPANY PROFILES (Page No. - 125)

(Business Overview, Financial Assessment, Operational Assessment, Amcor Plc’s Segment Information, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right To Win)*

11.1 AMCOR PLC

11.2 BERRY GLOBAL INC.

11.3 DS SMITH PLC

11.4 SONOCO

11.5 HUHTAMAKI OYJ

11.6 APTARGROUP, INC.

11.7 SILGAN HOLDINGS INC.

11.8 GERRESHEIMER AG

11.9 TRIMAS CORPORATION

11.10 ALBEA SA

11.11 HCP PACKAGING

11.12 OTHER PLAYERS

11.12.1 QUADPACK INDUSTRIES SA

11.12.2 GRAHAM PACKAGING INTERNATIONAL

11.12.3 LIBO COSMETIC CO., LTD.

11.12.4 BRIMAR PACKAGING USA

11.12.5 COSMOPAK USA LLC

11.12.6 APC PACKAGING

11.12.7 WORLD WIDE PACKAGING LLC

11.12.8 FUSION PACKAGING SOLUTIONS

11.12.9 RAEPAK LTD.

*Details on Business Overview, Financial Assessment, Operational Assessment, Amcor Plc’s Segment Information, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right To Win might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 173)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (144 Tables)

TABLE 1 COSMETIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 2 COSMETIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNIT)

TABLE 3 COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 4 COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 5 DIFFERENT RIGID PLASTIC RESINS AND THEIR APPLICATIONS

TABLE 6 COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 7 COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 8 COSMETIC PACKAGING MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 COSMETIC PACKAGING MARKET SIZE, BY REGION, 2018–2025 (MILLION UNIT)

TABLE 10 APAC: COSMETIC PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 11 APAC: COSMETIC PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION UNIT)

TABLE 12 APAC: COSMETIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 13 APAC: COSMETIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNIT)

TABLE 14 APAC: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 15 APAC: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 16 APAC: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 17 APAC: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 18 CHINA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 19 CHINA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 20 CHINA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 21 CHINA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 22 JAPAN: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 23 JAPAN: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 24 JAPAN: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 25 JAPAN: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 26 INDIA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 27 INDIA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 28 INDIA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 29 INDIA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 30 AUSTRALIA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 31 AUSTRALIA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 32 AUSTRALIA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 33 AUSTRALIA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 34 REST OF APAC: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 35 REST OF APAC: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 36 REST OF APAC: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 37 REST OF APAC: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 38 EUROPE: COSMETIC PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 EUROPE: COSMETIC PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION UNIT)

TABLE 40 EUROPE: COSMETIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 41 EUROPE: COSMETIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNIT)

TABLE 42 EUROPE: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 43 EUROPE: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 44 EUROPE: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 45 EUROPE: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 46 GERMANY: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 47 GERMANY: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 48 GERMANY: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 49 GERMANY: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 50 UK: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 51 UK: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 52 UK: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 53 UK: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 54 FRANCE: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 55 FRANCE: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 56 FRANCE: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 57 FRANCE: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 58 RUSSIA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 59 RUSSIA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 60 RUSSIA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 61 RUSSIA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 62 SPAIN: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 63 SPAIN: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 64 SPAIN: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 65 SPAIN: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 66 ITALY: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 67 ITALY: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 68 ITALY: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 69 ITALY: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 70 REST OF EUROPE: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 71 REST OF EUROPE: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 72 REST OF EUROPE: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 73 REST OF EUROPE: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 74 NORTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION UNIT)

TABLE 76 NORTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 NORTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNIT)

TABLE 78 NORTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 79 NORTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 80 NORTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 81 NORTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 82 US: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 83 US: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 84 US: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 85 US: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 86 CANADA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 87 CANADA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 88 CANADA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 89 CANADA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 90 MEXICO: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 91 MEXICO: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 92 MEXICO: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 93 MEXICO: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 94 SOUTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 95 SOUTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION UNIT)

TABLE 96 SOUTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 97 SOUTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNIT)

TABLE 98 SOUTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 99 SOUTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 100 SOUTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 101 SOUTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 102 BRAZIL: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 103 BRAZIL: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 104 BRAZIL: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 105 BRAZIL: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 106 ARGENTINA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 107 ARGENTINA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 108 ARGENTINA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 109 ARGENTINA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 110 REST OF SOUTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 111 REST OF SOUTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 112 REST OF SOUTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 113 REST OF SOUTH AMERICA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 114 MIDDLE EAST & AFRICA: COSMETIC PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 115 MIDDLE EAST & AFRICA: COSMETIC PACKAGING MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION UNIT)

TABLE 116 MIDDLE EAST & AFRICA: COSMETIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 117 MIDDLE EAST & AFRICA: COSMETIC PACKAGING MARKET SIZE, BY TYPE, 2018–2025 (MILLION UNIT)

TABLE 118 MIDDLE EAST & AFRICA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 119 MIDDLE EAST & AFRICA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 120 MIDDLE EAST & AFRICA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 121 MIDDLE EAST & AFRICA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 122 UAE: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 123 UAE: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 124 UAE: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 125 UAE: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 126 SAUDI ARABIA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 127 SAUDI ARABIA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 128 SAUDI ARABIA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 129 SAUDI ARABIA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 130 SOUTH AFRICA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 131 SOUTH AFRICA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 132 SOUTH AFRICA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 133 SOUTH AFRICA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 134 TURKEY: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 135 TURKEY: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 136 TURKEY: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 137 TURKEY: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 138 REST OF MIDDLE EAST & AFRICA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 139 REST OF MIDDLE EAST & AFRICA: COSMETIC PACKAGING MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION UNIT)

TABLE 140 REST OF MIDDLE EAST & AFRICA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 141 REST OF MIDDLE EAST & AFRICA: COSMETIC PACKAGING MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION UNIT)

TABLE 142 ACQUISITION

TABLE 143 EXPANSION

TABLE 144 NEW PRODUCT DEVELOPMENT

LIST OF FIGURES (43 Figures)

FIGURE 1 COSMETIC PACKAGING MARKET SEGMENTATION

FIGURE 2 APPROACH 1 (BASED ON COSMETIC MARKET)

FIGURE 3 APPROACH 2 (BASED ON COSMETIC COMPANIES’ MARKET SHARE, BY REGION)

FIGURE 4 COSMETIC PACKAGING MARKET: DATA TRIANGULATION

FIGURE 5 KEY MARKET INSIGHTS

FIGURE 6 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 7 FOLDING CARTONS TO BE THE FASTEST-GROWING TYPE SEGMENT IN THE COSMETIC PACKAGING MARKET IN TERMS OF VALUE

FIGURE 8 PAPER-BASED TO BE THE FASTEST-GROWING MATERIAL SEGMENT IN THE COSMETIC PACKAGING MARKET DURING THE FORECAST PERIOD

FIGURE 9 SKIN CARE TO BE THE LARGEST APPLICATION SEGMENT IN THE COSMETIC PACKAGING MARKET DURING THE FORECAST PERIOD

FIGURE 10 APAC LED THE COSMETIC PACKAGING MARKET IN 2019

FIGURE 11 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN THE COSMETIC PACKAGING MARKET DURING THE FORECAST PERIOD

FIGURE 12 CHINA WAS THE LARGEST MARKET FOR COSMETIC PACKAGING IN APAC IN 2019

FIGURE 13 BOTTLES TO LEAD THE COSMETIC PACKAGING MARKET DURING THE FORECAST PERIOD

FIGURE 14 PAPER-BASED TO BE THE FASTEST-GROWING SEGMENT IN THE COSMETIC PACKAGING MARKET

FIGURE 15 SKIN CARE IS PROJECTED TO BE THE LARGEST MARKET FOR THE GLOBAL COSMETIC PACKAGING MARKET BY 2025

FIGURE 16 THE COSMETIC PACKAGING MARKET IN INDIA IS PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

FIGURE 17 COSMETIC PACKAGING MARKET DYNAMICS

FIGURE 18 YC, YCC DRIVERS

FIGURE 19 BOTTLES TO BE THE LARGEST SEGMENT OF THE COSMETIC PACKAGING MARKET BY 2025

FIGURE 20 RIGID PLASTIC TO LEAD THE COSMETIC PACKAGING MARKET TILL 2025

FIGURE 21 SKIN CARE SEGMENT TO DOMINATE THE COSMETIC PACKAGING MARKET DURING THE FORECAST PERIOD

FIGURE 22 INDIA IS PROJECTED TO BE THE FASTEST-GROWING COUNTRY-LEVEL MARKET, 2020–2025

FIGURE 23 APAC: COSMETIC PACKAGING MARKET SNAPSHOT

FIGURE 24 COMPANIES ADOPTED ACQUISITION AS THE KEY GROWTH STRATEGY BETWEEN 2016 AND 2019

FIGURE 25 COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 26 AMCOR PLC: COMPANY SNAPSHOT

FIGURE 27 AMCOR PLC: SWOT ANALYSIS

FIGURE 28 WINNING IMPERATIVES: AMCOR PLC

FIGURE 29 BERRY GLOBAL INC.: COMPANY SNAPSHOT

FIGURE 30 BERRY GLOBAL INC.: SWOT ANALYSIS

FIGURE 31 WINNING IMPERATIVES: BERRY GLOBAL INC.

FIGURE 32 DS SMITH PLC: COMPANY SNAPSHOT

FIGURE 33 DS SMITH PLC: SWOT ANALYSIS

FIGURE 34 WINNING IMPERATIVES: DS SMITH PLC

FIGURE 35 SONOCO: COMPANY SNAPSHOT

FIGURE 36 SONOCO: SWOT ANALYSIS

FIGURE 37 WINNING IMPERATIVES: SONOCO

FIGURE 38 HUHTAMAKI OYJ: COMPANY SNAPSHOT

FIGURE 39 HUHTAMAKI OYJ: SWOT ANALYSIS

FIGURE 40 WINNING IMPERATIVES: HUHTAMAKI OYJ

FIGURE 41 APTARGROUP, INC.: COMPANY SNAPSHOT

FIGURE 42 GERRESHEIMER AG: COMPANY SNAPSHOT

FIGURE 43 TRIMAS CORPORATION: COMPANY SNAPSHOT

The study involved four major activities for estimating the current global size of the cosmetic packaging market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of cosmetic packaging through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the cosmetic packaging market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the cosmetic packaging market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

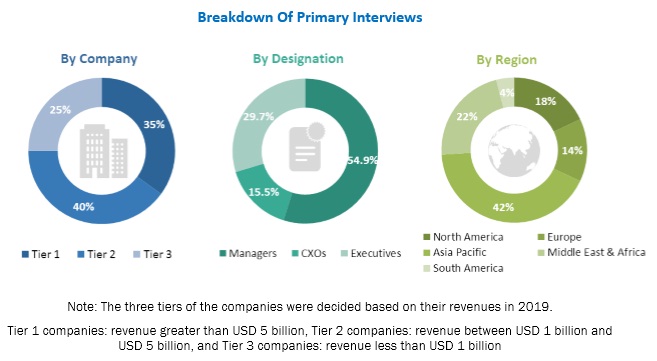

Primary Research

Various primary sources from both the supply and demand sides of the cosmetic packaging market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the cosmetic packaging industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the cosmetic packaging market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the cosmetic packaging market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Research Objectives

- To define, analyze, and project the size of the cosmetic packaging market in terms of value and volume based on type, material, application, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the cosmetic packaging market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the cosmetic packaging report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the cosmetic packaging market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Cosmetic Packaging Market