Crew Management Systems Market by Application (Crew Planning, Crew Services, Crew Training, Crew Operations), System (On-Cloud, Server Based), Device (Smartphones, PCS, Tablets), and Region - Global Forecast to 2022

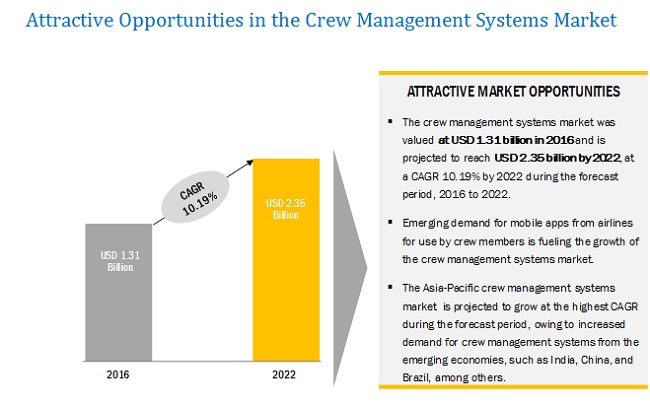

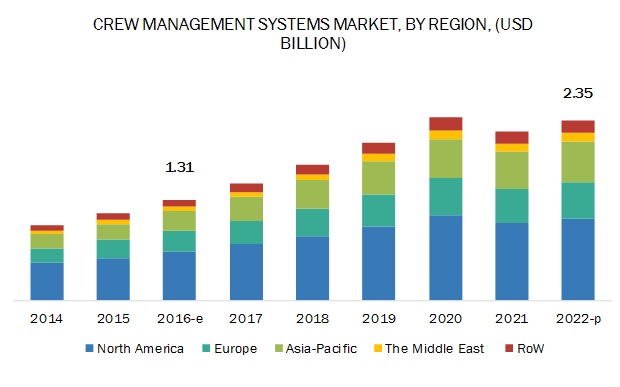

[146 Pages Report] The crew management systems market is estimated to grow from USD 1.31 billion in 2016 to USD 2.35 billion by 2022, at a CAGR of 10.19% from 2016 to 2022. The objectives of this study are to analyze the crew management system market, along with the statistics from 2016 to 2022 as well as to define, describe, and forecast the crew management systems market on the basis of application, system, device, and region. The year 2015 has been considered to be the base year, whereas, 2016 to 2022 has been considered as the forecast period for the market study. Factors such as growing focus on the safety of flights and continuous growth in air traffic across the globe are some of the factors driving the growth of this market.

Based on system, the on-cloud segment is projected to lead the crew management systems market during the forecast period

On the basis of system, the on-cloud segment is estimated to lead the crew management systems market during the forecast period. It is evident that more and more airlines are adapting to the cloud technology to obtain the ease of operations and excellence in client servicing. Cloud software has quickly become an integral part in everyday operations of flight crew. Online airline services for cabin crew, such as e-ticketing, accommodation arrangements, flight schedules, and climatic condition forecasts, among many others.

Based on device, the tablets segment is estimated to grow at the highest CAGR during the forecast period

On the basis of device, the tablet segment of the crew management systems market is anticipated to grow at the highest CAGR during the forecast period. This is attributed towards to introduce tablets for cabin crew to reduce complicated paper-based/manual operations in performing their day-to-day functions like meal distribution and passenger management.

Based on application, the crew operations segment is estimated to grow at the highest CAGR during the forecast period

Among application, the crew operations segment of the crew management systems market is projected to grow at the highest CAGR during the forecast period. This application of the crew management system is responsible for combining crew schedules with real-time flight data to facilitate the controllers to concentrate at the specific areas such as delay in flight due to bad weather conditions.

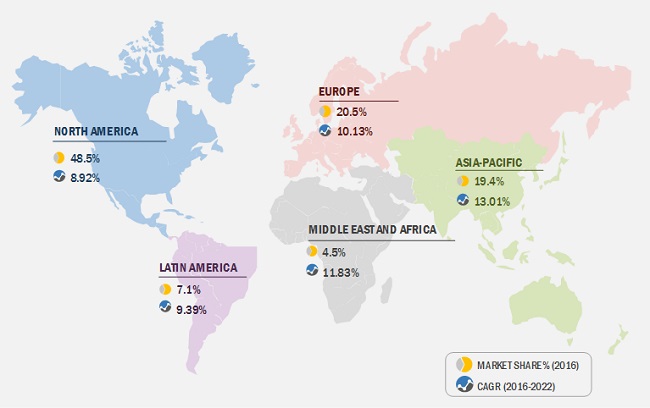

North American region is estimated to lead the crew management systems market during the forecast period

North America is estimated to lead the crew management systems market during the forecast period. The growth of the crew management market in North America is expected to be driven by the increase in the number of airlines entering the market. The North American region is expected to have the highest demand for crew management systems providers, owing to the existence of world’s leading airliners including American Airlines, Delta Air Lines, and Southwest Airlines among others.

Asia-Pacific region is estimated to grow at the highest CAGR during the forecast period

The Asia-Pacific crew management systems market is projected to grow at the highest CAGR from 2016 to 2022. Growth in passenger traffic has resulted in increased demand for new aircraft in the region, which is anticipated to boost the market during the forecast period.

Market Dynamics: Crew Management Systems Market

Driver: Growing focus on the safety of flights

Crew management systems are important for ensuring safe flight operations. The need and importance of these systems as well as their efficacy to ensure safe and efficient aircraft operations are recognized across the globe. As such, airlines are increasingly deploying these systems to ensure sufficient rest time for crew members between two flights to reduce fatigue in them. Moreover, these systems also provide situational awareness to crew members and help them in problem solving, decision-making, and carrying out teamwork for safe flight operations during the time of any onboard failures.

Opportunity: Entry of new airlines in developed countries

Entry of new airlines in developed countries presents the most attractive opportunity for the key players operating in the aviation sector. The cost of employment is high in developed countries, such as the U.S., the U.K., Canada, and Germany, among others. There are various airlines, which are entering the aviation industry in these developed countries. Thus, crew management systems are required by these airlines to ensure the most efficient utilization of crew members, thereby resulting in the reduction of the cost incurred by crew.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2014-2022 |

|

Base year considered |

2015 |

|

Forecast period |

2016-2022 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Application, System, Device |

|

Geographies covered |

North America, Europe, Asia-Pacific, Middle East, and Rest of the World |

|

Companies covered |

Airline software solutions providers such as Sabre Airline Solutions (U.S.), Lufthansa Systems (Germany), Jeppesen (U.S.), Hexaware Technologies (India), IBS Software Services (India), among others, and component manufacturers such as Fujitsu (Japan), Intelisys Aviation (Canada), AIMS, Inc. (U.S.), Blue One Software (Brussels), PDC Aviation (U.K.), Aviolinx (Sweden), and Sheorey Digital Systems Pvt Ltd (India), among others. |

This research report categorizes the crew management systems market into the following segments:

By Application

- Crew Planning

- Crew Training

- Crew Services

- Crew Operations

By System

- On-Cloud

- Server Based

By Device

- Smartphones

- Personal Computers (PCs)

- Tablets

By Region

- North America

- Europe

- Asia-Pacific

- Middle East

- Rest of the World

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of the World market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Players

The crew management systems ecosystem comprises airline software solutions providers such as Sabre Airline Solutions (U.S.), Lufthansa Systems (Germany), Jeppesen (U.S.), Hexaware Technologies (India), and Fujitsu (Japan), among others.

Recent Developments

- In 2015, Sabre Airline Solutions signed an agreement with Alaska Airlines to provide technology solutions which are able to track and monitor inventory of ancillary products.

- In 2016, Lufthansa Systems signed a ten-year contract with IBS Software Services to replace its legacy Unisys based Crew Management techniques. This contract will help to modernize their crew management system.

- In 2015, Fujitsu entered into a strategic partnership with Australian-based Constraint Technologies Incorporated to offer network operations, crew planning, tracking, and management for the airline industry.

- In 2017, Jeppesen signed a three-year contract with Swiss International Air Lines to optimize crew planning.

Key Questions addressed by the report

- What is the impact of upcoming disruptive technologies on the Crew Management Systems Market?

- Which systems have increasing demand in the Crew Management Systems Market?

- How are the market players in the industry addressing challenges in the Crew Management Systems Market?

- How are the changing demands of customers impacting the competitive landscape?

- What will impact the leading market players’ wallet share upto 2022?

- What is helping the top players in the market to sustain and grow their market share?

- How will the impact on the global economy affect the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Crew Management Systems Market From 2016 to 2022

4.2 Crew Management System Market, By Application

4.3 Crew Management System Market, By System

4.4 Crew Management System Market, By Device

4.5 Crew Management System Market, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Crew Management System Market, By Application

5.2.2 Crew Management System Market, By System

5.2.3 Crew Management System Market, By Device

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Stringent Regulations Pertaining to Working Hours of Crew Members Onboard

5.3.1.2 Cost Reduction Through Optimized Utilization of Crew Members

5.3.1.3 Growing Focus on the Safety of Flights

5.3.1.4 Continuous Growth in Air Traffic Across the Globe

5.3.2 Restraints

5.3.2.1 Inability of the Crew Management Systems to Consider Various Human Factors

5.3.3 Opportunities

5.3.3.1 Entry of New Airlines in Developed Countries

5.3.4 Challenges

5.3.4.1 Development of Crew Management Systems to Meet Specific Requirements of the Airlines

5.3.4.2 Change in the Work Plan of Crew Members Due to Unforeseen Situations

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Technology Trends

6.3 Technological Evolution

6.3.1 Fifth Generation of Crew Management Systems Was for Management and Avoidance of Errors That Occurred in Crew Planning for Maximum Utilization of Crew

6.4 New Trends and Technologies

6.4.1 Use of Mobile Applications in Crew Management Systems

6.4.2 Cloud-Based Services (SaaS)

6.5 Manpower Planning

6.5.1 Includes Crew Pairing, Crew Rostering, Crew Training, and Arrangement for Crew Traveling

6.6 Crew Pairing

6.6.1 Includes Crew Tracking, Sending of Alerts and Notifications, and Crew Pay Generation

6.7 Crew Rostering

6.7.1 Enables Crew Members to have Easy Access to Their Work Schedules. It Also Provides Flexible Bidding Options to Them

6.8 Crew Control

6.8.1 Keeps Track of the Level of Impact of the Training on the Crew Members

6.9 Key Trend Analysis in the Market

7 Crew Management Systems Market, By Application (Page No. - 50)

7.1 Introduction

7.2 Crew Planning

7.2.1 Ensures and Includes Crew Rescheduling in Case of Any Disruptions and Flight Delays

7.3 Crew Training

7.3.1 Ensure the Positive Outcome of the Funds Being Spent on Training and That These are Being Efficiently Utilized

7.4 Crew Services

7.4.1 Ensures the Optimum Usage of the Available Human Resources

7.5 Crew Operations

7.5.1 Reduces the Required Time for Rescheduling, in Case of Any Changes in the Previous Plans Through System Generated Alerts

8 Crew Management Systems Market, By System (Page No. - 55)

8.1 Introduction

8.2 On-Cloud

8.2.1 Airlines are Adapting to the Cloud Technology to Obtain Ease of Operations and Excellence in Client Servicing

8.3 Server Based

8.3.1 Allows Access on One Particular Location

9 Crew Management Systems Market, By Device (Page No. - 61)

9.1 Introduction

9.2 Smartphones

9.2.1 Offers Personalized Options Before and During Travel

9.3 Personal Computers (PCS)

9.3.1 Provides Airlines the Ability to Deploy the System on Standard Personal Computers

9.4 Tablets

9.4.1 Reduce Complicated Paper-Based/Manual Operations

10 Regional Analysis (Page No. - 65)

10.1 Introduction

10.2 North America

10.2.1 By Application

10.2.2 By System

10.2.3 By Device

10.2.4 By Country

10.2.4.1 U.S.

10.2.4.1.1 By Application

10.2.4.1.2 By System

10.2.4.1.3 By Device

10.2.4.2 Canada

10.2.4.2.1 By Application

10.2.4.2.2 By System

10.2.4.2.3 By Device

10.3 Europe

10.3.1 By Application

10.3.2 By System

10.3.3 By Device

10.3.4 By Country

10.3.4.1 Ireland

10.3.4.1.1 By Application

10.3.4.1.2 By System

10.3.4.1.3 By Device

10.3.4.2 U.K.

10.3.4.2.1 By Application

10.3.4.2.2 By System

10.3.4.2.3 By Device

10.3.4.3 Germany

10.3.4.3.1 By Application

10.3.4.3.2 By System

10.3.4.3.3 By Device

10.3.4.4 Spain

10.3.4.4.1 By Application

10.3.4.4.2 By System

10.3.4.4.3 By Device

10.3.4.5 Rest of Europe

10.3.4.5.1 By Application

10.3.4.5.2 By System

10.3.4.5.3 By Device

10.4 Asia-Pacific

10.4.1 By Application

10.4.2 By System

10.4.3 By Device

10.4.4 By Country

10.4.4.1 China

10.4.4.1.1 By Application

10.4.4.1.2 By System

10.4.4.1.3 By Device

10.4.4.2 India

10.4.4.2.1 By Application

10.4.4.2.2 By System

10.4.4.2.3 By Device

10.4.4.3 Japan

10.4.4.3.1 By Application

10.4.4.3.2 By System

10.4.4.3.3 By Device

10.4.4.4 Rest of Asia-Pacific

10.4.4.4.1 By Application

10.4.4.4.2 By System

10.4.4.4.3 By Device

10.5 Middle East

10.5.1 By Application

10.5.2 By System

10.5.3 By Device

10.5.4 By Country

10.5.4.1 U.A.E.

10.5.4.1.1 By Application

10.5.4.1.2 By System

10.5.4.1.3 By Device

10.5.4.2 Saudi Arabia

10.5.4.2.1 By Application

10.5.4.2.2 By System

10.5.4.2.3 By Device

10.5.4.3 Rest of the Middle East

10.5.4.3.1 By Application

10.5.4.3.2 By System

10.5.4.3.3 By Device

10.6 Rest of the World

10.6.1 By Application

10.6.2 By System

10.6.3 By Device

11 Competitive Landscape (Page No. - 102)

11.1 Introduction

11.2 Dive Chart Overview

11.2.1 Vanguards

11.2.2 Innovators

11.2.3 Dynamic

11.2.4 Emerging

11.3 Competitive Benchmarking

11.3.1 Product Offerings (For All 12 Companies)

11.3.2 Business Strategy (For All 12 Companies)

*Top 12 Companies Analyzed for This Study are - Sabre Airline Solutions (U.S.); Lufthansa Systems (Germany); Fujitsu (Japan); Hexaware Technologies (India); Jeppesen (U.S.); IBS Software Services (India); Intelisys Aviation Services (Canada); AIMS, Inc. (U.S.); Blueone Software (Belgium); PDC Aviation (U.K.); Aviolinx (Sweden); Sheorey Digital Systems Pvt LTD (India)

12 Company Profiles (Page No. - 106)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Sabre Airline Solutions

12.1.1 Business Overview

12.1.2 Company Scorecard

12.1.3 Product Offerings

12.1.4 Business Strategy

12.1.5 Recent Developments

12.2 Lufthansa Systems

12.2.1 Business Overview

12.2.2 Company Scorecard

12.2.3 Product Offerings

12.2.4 Business Strategy

12.2.5 Recent Developments

12.3 Fujitsu

12.3.1 Business Overview

12.3.2 Company Scorecard

12.3.3 Product Offerings

12.3.4 Business Strategy

12.3.5 Recent Developments

12.4 Jeppesen

12.4.1 Business Overview

12.4.2 Company Scorecard

12.4.3 Product Offerings

12.4.4 Business Strategy

12.4.5 Recent Developments

12.5 IBS Software Services Pvt LTD

12.5.1 Business Overview

12.5.2 Company Scorecard

12.5.3 Product Offerings

12.5.4 Business Strategy

12.5.5 Recent Developments

12.6 AIMS, Inc.

12.6.1 Business Overview

12.6.2 Company Scorecard

12.6.3 Product Offerings

12.6.4 Business Strategy

12.6.5 Recent Developments

12.7 Blue One Management Sa/Nv

12.7.1 Business Overview

12.7.2 Company Scorecard

12.7.3 Product Offerings

12.7.4 Business Strategy

12.8 Intelisys Aviation Systems

12.8.1 Business Overview

12.8.2 Company Scorecard

12.8.3 Product Offerings

12.8.4 Business Strategy

12.9 PDC Aviation

12.9.1 Business Overview

12.9.2 Company Scorecard

12.9.3 Product Offerings

12.9.4 Business Strategy

12.10 Aviolinx

12.10.1 Business Overview

12.10.2 Company Scorecard

12.10.3 Product Offerings

12.10.4 Business Strategy

12.11 Hexaware Technologies

12.11.1 Business Overview

12.11.2 Company Scorecard

12.11.3 Product Offerings

12.11.4 Business Strategy

12.12 Sheorey Digital Systems Pvt. LTD.

12.12.1 Business Overview

12.12.2 Company Scorecard

12.12.3 Product Offerings

12.12.4 Business Strategy

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 136)

13.1 Discussion Guide: Crew Management Systems Market

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (78 Tables)

Table 1 Crew Management Systems Market, By Application

Table 2 Crew Management System Market, By System

Table 3 International Operation Standards for Flight Crew (Upto 11 Hours of Flight Time)

Table 4 List of Airlines Entering Developed Countries

Table 5 Crew Management Systems Market Size, By Application, 2014-2022 (USD Million)

Table 6 Crew Planning: Crew Management System Market, By Region, 2014-2022 (USD Million)

Table 7 Crew Training: Market, By Region, 2014-2022 (USD Million)

Table 8 Crew Services: Market, By Region, 2014-2022 (USD Million)

Table 9 Crew Operations: Crew Management System Market, By Region, 2014-2022 (USD Million)

Table 10 Market Size, By System, 2014-2022 (USD Million)

Table 11 On-Cloud: Market Size, By Region, 2014-2022 (USD Million)

Table 12 Server Based: Market Size, By Region, 2014-2022 (USD Million)

Table 13 Crew Management Systems Market, By Device, 2014-2022 (USD Million)

Table 14 Smartphones: Market, By Region, 2014-2022 (USD Million)

Table 15 PCS: Crew Management System Market, By Region, 2014-2022 (USD Million)

Table 16 Tablets: Market, By Region, 2014-2022 (USD Million)

Table 17 Market Size, By Region, 2014-2022 (USD Million)

Table 18 North America: Crew Management System Market Size, By Application, 2014-2022 (USD Million)

Table 19 North America: Market Size, By System, 2014-2022 (USD Million)

Table 20 North America: Market Size, By Device, 2014-2022 (USD Million)

Table 21 North America: Market Size, By Country, 2014-2022 (USD Million)

Table 22 U.S.: Market Size, By Application, 2014-2022 (USD Million)

Table 23 U.S.: Market Size, By System, 2014-2022 (USD Million)

Table 24 U.S.: Market Size, By Device, 2014-2022 (USD Million)

Table 25 Canada: Crew Management System Market Size, By Application, 2014-2022 (USD Million)

Table 26 Canada: Market Size, By System, 2014-2022 (USD Million)

Table 27 Canada: Market Size, By Device, 2014-2022 (USD Million)

Table 28 Europe: Crew Management System Market Size, By Application, 2014-2022 (USD Million)

Table 29 Europe: Market Size, By System, 2014-2022 (USD Million)

Table 30 Europe: Market Size, By Device, 2014-2022 (USD Million)

Table 31 Europe: Market Size, By Country, 2014-2022 (USD Million)

Table 32 Ireland: Market Size, By Application, 2014-2022 (USD Million)

Table 33 Ireland: Market Size, By System, 2014-2022 (USD Million)

Table 34 Ireland: Market Size, By Device, 2014-2022 (USD Million)

Table 35 U.K.: Crew Management System Market Size, By Application, 2014-2022 (USD Million)

Table 36 U.K.: Market Size, By System, 2014-2022 (USD Million)

Table 37 U.K.: Market Size, By Device, 2014-2022 (USD Million)

Table 38 Germany: Market Size, By Application, 2014-2022 (USD Million)

Table 39 Germany: Market Size, By System, 2014-2022 (USD Million)

Table 40 Germany: Market Size, By Device, 2014-2022 (USD Million)

Table 41 Spain: Crew Management System Market Size, By Application, 2014-2022 (USD Million)

Table 42 Spain: Market Size, By System, 2014-2022 (USD Million)

Table 43 Spain: Market Size, By Device, 2014-2022 (USD Million)

Table 44 Rest of Europe: Market Size, By Application, 2014-2022 (USD Million)

Table 45 Rest of Europe: Market Size, By System, 2014-2022 (USD Million)

Table 46 Rest of Europe: Market Size, By Device, 2014-2022 (USD Million)

Table 47 Asia-Pacific: Market Size, By Application, 2014-2022 (USD Million)

Table 48 Asia-Pacific: Market Size, By System, 2014-2022 (USD Million)

Table 49 Asia-Pacific: Market Size, By Device, 2014-2022 (USD Million)

Table 50 Asia-Pacific: Market Size, By Country, 2014-2022 (USD Million)

Table 51 China: Crew Management System Market Size, By Application, 2014-2022 (USD Million)

Table 52 China: Market Size, By System, 2014-2022 (USD Million)

Table 53 China: Market Size, By Device, 2014-2022 (USD Million)

Table 54 India: Market Size, By Application, 2014-2022 (USD Million)

Table 55 India: Market Size, By System, 2014-2022 (USD Million)

Table 56 India: Market Size, By Device, 2014-2022 (USD Million)

Table 57 Japan: Market Size, By Application, 2014-2022 (USD Million)

Table 58 Japan: Market Size, By System, 2014-2022 (USD Million)

Table 59 Japan: Market Size, By Device, 2014-2022 (USD Million)

Table 60 Rest of Asia-Pacific: Crew Management System Market Size, By Application, 2014-2022 (USD Million)

Table 61 Rest of Asia-Pacific: Market Size, By System, 2014-2022 (USD Million)

Table 62 Rest of Asia-Pacific: Market Size, By Device, 2014-2022 (USD Million)

Table 63 The Middle East: Market Size, By Application, 2014-2022 (USD Million)

Table 64 The Middle East: Market Size, By System, 2014-2022 (USD Million)

Table 65 The Middle East: Market Size, By Device, 2014-2022 (USD Million)

Table 66 The Middle East: Market Size, By Country, 2014-2022 (USD Million)

Table 67 UAE: Market Size, By Application, 2014-2022 (USD Million)

Table 68 UAE: Market Size, By System, 2014-2022 (USD Million)

Table 69 UAE: Market Size, By Device, 2014-2022 (USD Million)

Table 70 Saudi Arabia: Market Size, By Application, 2014-2022 (USD Million)

Table 71 Saudi Arabia: Market Size, By System, 2014-2022 (USD Million)

Table 72 Saudi Arabia: Market Size, By Device, 2014-2022 (USD Million)

Table 73 Rest of the Middle East: Crew Management System Market Size, By Application, 2014-2022 (USD Million)

Table 74 Rest of the Middle East: Market Size, By System, 2014-2022 (USD Million)

Table 75 Rest of the Middle East: Market Size, By Device, 2014-2022 (USD Million)

Table 76 Rest of the World: Market Size, By Application, 2014-2022 (USD Million)

Table 77 Rest of the World: Market Size, By System, 2014-2022 (USD Million)

Table 78 Rest of the World: Market Size, By Device, 2014-2022 (USD Million)

List of Figures (64 Figures)

Figure 1 Research Process Flow

Figure 2 Research Design: Crew Management Systems Market

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions in the Research Study

Figure 8 The Crew Planning Application Segment is Projected to Lead the Crew Management Systems Market From 2016 to 2022

Figure 9 The on Cloud System Segment Accounted for the Largest Share of the Crew Management System Market in 2016

Figure 10 Crew Management System Market, By Device, 2016 & 2022 (USD Million)

Figure 11 The Asia-Pacific Crew Management System Market to Grow at the Highest Growth CAGR From 2016 to 2022

Figure 12 Agreement/Partnership/Acquisition are the Key Growth Strategies Adopted Between, 2010-2016

Figure 13 Emerging Demand for Mobile Apps From Airlines for Use By Crew Members Services is Expected to Fuel the Growth of the Crew Management System Market During the Forecast Period

Figure 14 The Crew Operations Segment of the Crew Management System Market is Projected to Grow at the Highest CAGR From 2016 to 2022

Figure 15 The on Cloud System Segment is Projected to Lead the Crew Management System Market From 2016 to 2022

Figure 16 The Smartphones Device Segment Led the Crew Management System Market in 2016

Figure 17 The North American Region Accounted for the Largest Share of the Market in 2016

Figure 18 Crew Management System Market, By Application

Figure 19 Market, By System

Figure 20 Market, By Device

Figure 21 Crew Management System Market: Drivers, Restraints, Opportunities, and Challenges

Figure 22 Global Air Passenger Traffic, 200o-2015 (Billion)

Figure 23 Technological Advancements are A Growing Trend in the Crew Management Systems Market

Figure 24 Technological Evolution of Crew Management Systems

Figure 25 Assessing Capabilities of Crew Management Systems By Their Functional Features

Figure 26 Basic Functional Features of Crew Management Systems

Figure 27 Crew Operations Estimated to Grow at A Highest Rate During the Forecast Period

Figure 28 Basic Functional Features of TCS Crewcollab

Figure 29 Basic Functional Features of AIMS Crew Management Systems

Figure 30 The Tablets Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 31 Regional Snapshot: 2016-2022

Figure 32 North America Snapshot: U.S. to Lead Crew Management Systems Market During the Forecast Period

Figure 33 Europe Snapshot: Ireland to Lead the Market During the Forecast Period

Figure 34 Asia-Pacific Snapshot: China to Lead the Market During the Forecast Period

Figure 35 Middle East Snapshot: UAE Expected to Lead the Market During the Forecast Period

Figure 36 Dive Chart

Figure 37 Sabre Airline Solutions: Company Snapshot (2016)

Figure 38 Sabre Airline Solutions: Product Offering

Figure 39 Sabre Airline Solutions: Business Strategy

Figure 40 Lufthansa Systems: Company Snapshot (2015)

Figure 41 Lufthansa Systems: Product Offering

Figure 42 Lufthansa Systems: Business Strategy

Figure 43 Fujitsu: Company Snapshot (2015)

Figure 44 Fujitsu: Product Offering

Figure 45 Fujitsu: Business Strategy

Figure 46 Jeppesen: Product Offering

Figure 47 Jeppesen: Business Strategy

Figure 48 IBS Software Services: Product Offering

Figure 49 IBS Software Services: Business Strategy

Figure 50 AIMS, Inc.: Product Offering

Figure 51 AIMS, Inc. : Business Strategy

Figure 52 Blue One Management SA/NV: Product Offering

Figure 53 Blue One Management SA/NV: Business Strategy

Figure 54 Intelisys Aviation Systems: Product Offering

Figure 55 Intelisys Aviation Systems: Business Strategy

Figure 56 PDC Aviation: Product Offering

Figure 57 PDC Aviation: Business Strategy

Figure 58 Aviolinx: Product Offering

Figure 59 Aviolinx: Business Strategy

Figure 60 Hexaware Technologies: Company Snapshot (2015)

Figure 61 Hexaware Technologies: Product Offering

Figure 62 Hexaware Technologies: Business Strategy

Figure 63 Sheorey Digital Systems Pvt. LTD.: Product Offering

Figure 64 Sheorey Digital Systems Pvt. LTD.: Business Strategy

Growth opportunities and latent adjacency in Crew Management Systems Market