Data Center Power Market

Data Center Power Market by Electrical Solution (UPS, Power Distribution Unit, Generators & Energy Storage, Power Management Software & DCIM), Data Center Size (Power Capacity), Data Center Type (Colocation, Cloud/Hyperscale, Enterprises) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interview with Experts, MarketsandMarkets Analysis

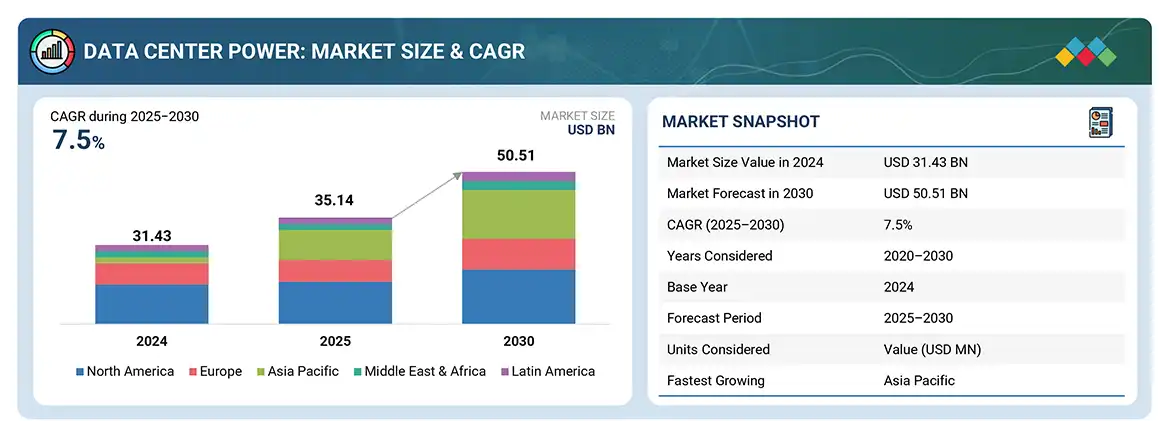

The global data center power market is expected to grow substantially, projected to rise from USD 35.14 billion in 2025 to USD 50.51 billion by 2030, reflecting a CAGR of 7.5%. Data center power systems ensure reliable, continuous electricity for critical operations, enabling high-capacity computing, cloud services, and IT infrastructure. The market for these systems is expanding rapidly due to growing AI and cloud workloads, stricter energy efficiency regulations, and the increasing need for data centers to maintain operational continuity while reducing carbon footprint and managing energy costs.

KEY TAKEAWAYS

-

BY COMPONENTUPS, PDUs, and energy storage systems drive the data center power market by ensuring reliable, continuous, and scalable power for uninterrupted operations.

-

BY TIER TYPEHigher-tier data centers, such as Tier III and IV, are driving the market by offering greater redundancy and uptime, supporting mission-critical operations, and attracting enterprises requiring maximum reliability.

-

BY DATA CENTER SIZE (POWER CAPACITY)Large, mega, and massive data centers are gaining traction due to their ability to support high-density workloads, hyperscale cloud operations, and AI/ML processing, leading to increased demand for robust power infrastructure.

-

BY DATA CENTER TYPE

- Cloud/Hyperscale facilities are expanding rapidly due to scalability, global reach, and cost-efficiency.

- Colocation centers remain preferred for multi-tenant environments.

- Enterprise data centers continue to ensure control over critical internal IT systems.

-

BY ENTERPRISE VERTICALBFSI and telecommunications are expected to hold significant market share, leveraging advanced power solutions for real-time operations, regulatory compliance, high-performance computing, and continuous connectivity, driving the adoption of reliable and scalable data center power infrastructure.

-

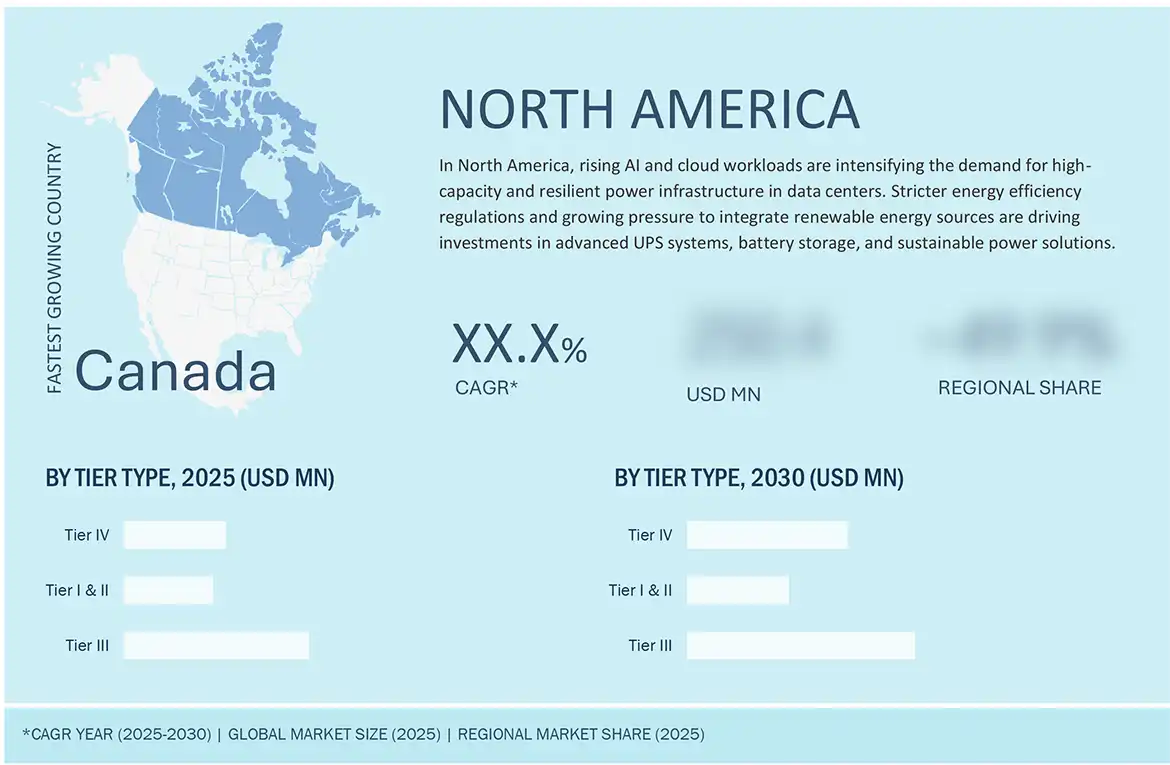

BY REGIONNorth America is expected to lead in 2025, driven by investments in hyperscale and enterprise data centers, advanced power solutions, and renewable energy integration, ensuring reliable and efficient operations. The US drives growth with widespread adoption of advanced, reliable, and scalable data center power infrastructure.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including partnerships, collaborations, and investments. For instance, Schneider Electric (France), Vertiv (US), and ABB (Switzerland) have entered into multiple alliances and agreements to expand their data center power offerings, enhance technological capabilities, and meet the growing demand for reliable electrical solutions across data center types worldwide.

Reliable and resilient power is critical for modern data centers to maintain uninterrupted operations. Advanced UPS, switchgear, and energy storage systems monitor load distribution, detect anomalies, and coordinate backup power, ensuring compliance with energy efficiency standards while supporting high-performance computing and large-scale cloud workloads. By automatically adjusting power allocation, balancing peak demand, and integrating renewable and stored energy sources, these systems optimize energy usage and protect critical infrastructure, enhancing operational resilience, minimizing downtime, and strengthening overall reliability.

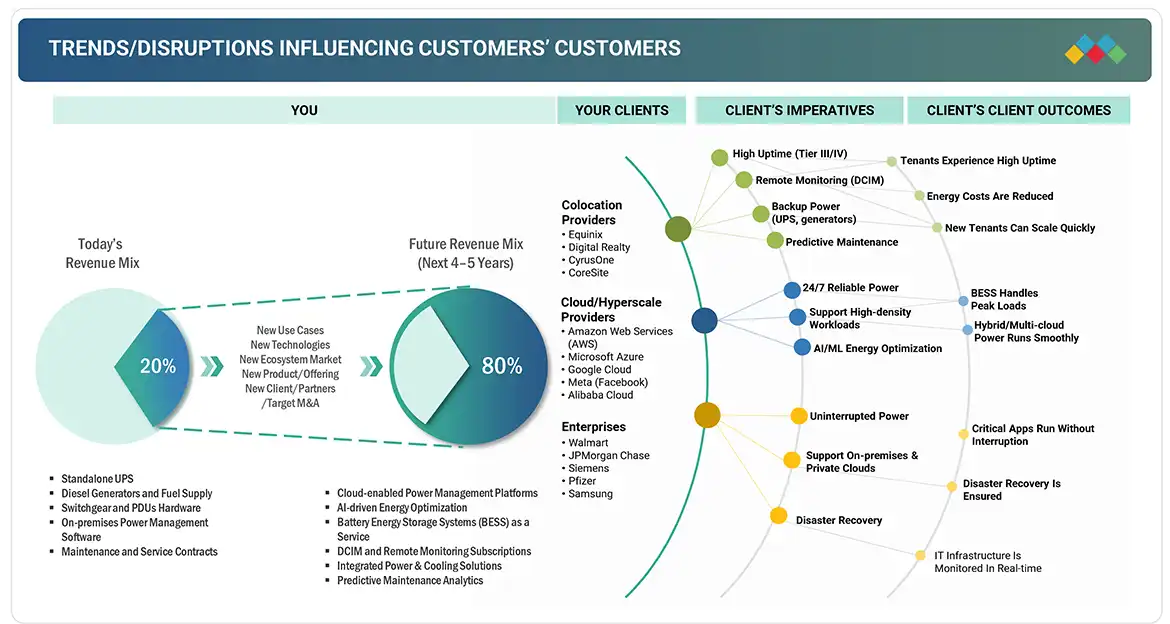

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMER'S BUSINESS

Changes in power demands impact clients’ operations. Data centers rely on modular UPS, standby generators, switchgear, battery storage, smart power management, and predictive analytics to maintain continuous operations and flexible capacity. These solutions help tenants reduce energy costs, scale quickly, run critical applications smoothly, and ensure disaster recovery. Changes in energy availability, reliability, or regulatory requirements directly affect these outcomes and influence growth for data center power providers.

Source: Secondary Research, Interview with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in Data Centers Worldwide

-

Rising AI Workloads Escalating Energy Consumption and Grid Pressure

Level

-

Water Scarcity and Localized Resource Risks Restrain Data Center Growth

Level

-

Nuclear Energy Drives High-capacity, Low-emission Power Solutions for Data Centers

-

Geothermal Energy Enhances Sustainable and Reliable Power for Data Centers

Level

-

Power Challenges Threatening Data Center Growth

Source: Secondary Research, Interview with Experts, MarketsandMarkets Analysis

Driver: Rise in data centers worldwide

The increasing growth of data centers worldwide is driving demand for scalable and energy-efficient power solutions. Rising workloads, adoption of high-performance servers, and advanced cooling needs are encouraging operators to invest in intelligent distribution systems, high-density UPS, and modular renewable infrastructure. As of March 2024, there were approximately 11,800 data centers across the globe (Visual Capitalist). Looking ahead, hyperscale and colocation projects are expected to add nearly 10 GW of new capacity in 2025, with another 7 GW set to be completed—representing about USD 170 billion in asset value requiring financing (JLL). With data centers already accounting for around 1% of global electricity use, and 2–4% in major economies, efficient and resilient power systems are critical for cost-effective and reliable operations.

Restraint: Water Scarcity and Localized Resource Risks Restrain Data Center Growth

Water scarcity and localized resource risks are increasingly restraining the data center power market, particularly as high-performance computing workloads grow. AI data centers could push global water consumption to around 1,068 billion liters annually by 2028, an 11-fold increase from 2024, with much of the strain concentrated in regions already facing water stress. Examples include Australia, where major data centers could use nearly 2% of Sydney’s supply, and Central Texas, where large facilities consume millions of liters daily. These issues are forcing operators to adopt water-efficient cooling, alternative sources, or relocate, increasing costs and operational complexity.

Opportunity: Nuclear Energy Drives High-capacity, Low-emission Power Solutions for Data Centers

Nuclear energy, through small modular reactors (SMRs) and advanced microreactors, offers a major opportunity to supply high-capacity, low-emission power for data centers. Providing stable, round-the-clock electricity, these solutions meet the continuous energy demands of data centers while reducing carbon footprints. Projects in the UK, such as Holtec, EDF, and Tritax’s SMR-powered facility in Nottinghamshire, and initiatives in the US with X-energy, Last Energy, and TerraPower demonstrate nuclear’s ability to deliver predictable, grid-independent power. This trend creates opportunities for vendors across reactor technology, engineering services, fuel supply, and long-term operational support.

Challenge: Power Challenges Threatening Data Center Growth

The rapid rise in AI, cloud, and digital services is fueling unprecedented demand for data centers, yet the sector faces a critical obstacle: limited access to power. Vacancy rates in top US markets have dropped to record lows, but construction and expansion are increasingly constrained by grid delays, high energy costs, and slow permitting. These challenges not only create supply bottlenecks but also raise operational risks and costs for developers and operators. To mitigate the impact, industry players must prioritize power as a core element of strategy. This includes investing in renewable and on-site generation, adopting energy-efficient cooling technologies, and working closely with utilities and regulators to fast-track interconnections. Forward-looking planning, including accurate demand forecasting and preleasing, will be essential. Without decisive action, power constraints risk becoming the single biggest barrier to sustaining data center growth in an era of record demand.

Data center power market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | BENEFITS USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Modular UPS deployment ensured reliable, scalable, and efficient power for a growing data center. Hot-swappable modules reduced downtime, and renewable integration boosted sustainability. | Reliable, uninterrupted power Lower costs with efficiency and renewables Scalable infrastructure for future growth |

|

A modular UPS with lithium-ion batteries enabled reliable, space-efficient, and scalable power for a new data center facing space and redundancy challenges. | 70% smaller footprint Longer battery lifespan Flexible expansion with modular design |

|

Standby power for a data center expansion was designed to align with sustainability goals while ensuring full reliability. Since traditional diesel systems conflicted with decarbonization targets, renewable fuel-based generators were implemented, maintaining performance while reducing emissions. | Standby systems fully operated on renewable fuel Up to 40% reduction in lifecycle emissions Reliable backup with no performance loss Support for long-term carbon neutrality goals |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent data center power market players operate across UPS, PDU, switchgear, on-site power generation and energy storage, BESS, and power management software & DCIM. These companies deliver scalable, high-density, and energy-efficient solutions via modular, cloud-connected, and on-premises models, supported by advanced technologies such as AI-driven power optimization, predictive maintenance, real-time monitoring, and automated fault detection, along with operational expertise and global service networks to help data centers ensure uninterrupted performance, optimize energy use, and maintain reliability at scale.

Source: Secondary Research, Interview with Experts, MarketsandMarkets Analysis

MARKET SEGMENTS

Source: Secondary Research, Interview with Experts, MarketsandMarkets Analysis

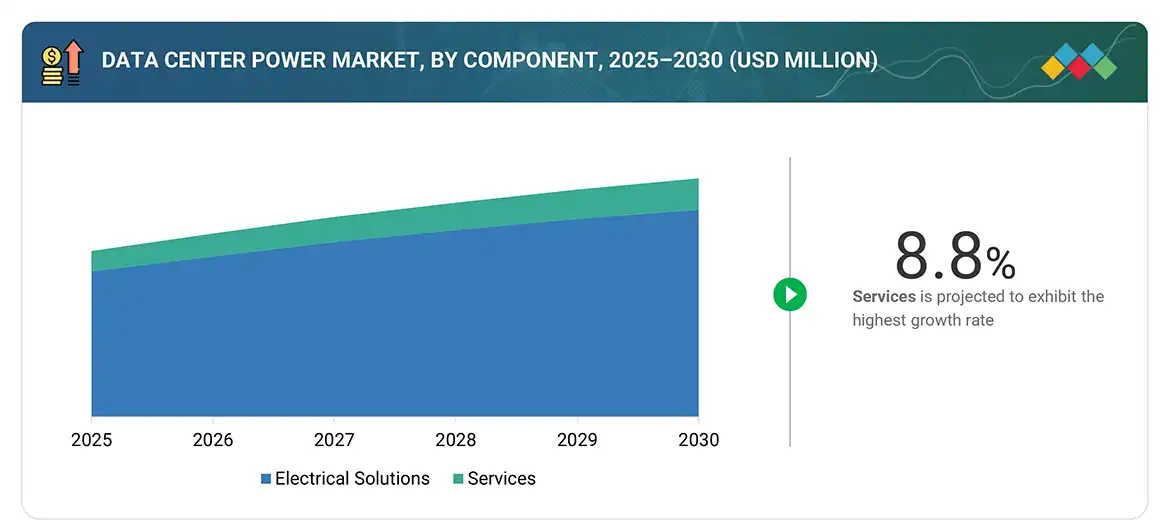

Data Center Power Market, By Component

The electrical solutions segment is expected to hold the largest market share throughout the forecast period. These solutions provide data centers with end-to-end capabilities to ensure reliable power distribution, continuous uptime, and energy efficiency. Leveraging advanced technologies such as high-density UPS, intelligent PDUs, switchgear automation, and predictive maintenance, they optimize power usage, minimize downtime, and support rapid scaling. Integrated with monitoring and DCIM platforms, these solutions enable real-time visibility, fault detection, and efficient load management, ensuring resilient operations for high-performance, power-intensive data center workloads.

Data Center Power Market, By Data Center Size (Power Capacity)

The mega-sized data center segment (10 MW to 100 MW) is expected to hold the largest market share during the forecast period. These high-capacity facilities require robust power solutions to ensure uninterrupted operations and efficient energy management. Vendors provide integrated electrical systems, including high-density UPS, combined with advanced power management software and DCIM platforms. By monitoring power usage, optimizing load distribution, and enabling predictive maintenance, these solutions support reliable, scalable, and energy-efficient operations for mega-sized, power-intensive data centers.

Data Center Power Market, By Data Center Type

Cloud and hyperscale data centers are expected to grow at the highest CAGR. These facilities demand highly scalable, resilient, and energy-efficient power solutions to support massive workloads and rapid expansion. By leveraging modular UPS, intelligent PDUs, on-site generation, BESS, and advanced power management software, operators optimize energy use, ensure uninterrupted performance, and enable remote monitoring. Cloud-connected power infrastructure allows real-time visibility, predictive maintenance, and seamless integration with IT systems, supporting global operations, reducing operational costs, and aligning with sustainability and efficiency goals.

Data Center Power Market, By Enterprise Vertical

The healthcare and life sciences segment is expected to have the highest CAGR during the forecast period. Data centers in this vertical require highly reliable, energy-efficient, and secure power solutions to support critical applications, large-scale data storage, and regulatory compliance. Vendors provide integrated electrical systems with advanced monitoring, predictive maintenance, and real-time analytics, ensuring uninterrupted operations and optimal energy management. These solutions help healthcare and life sciences organizations protect sensitive data, maintain high availability for patient care and research, and scale efficiently as workloads grow.

REGION

North America is expected to hold the largest market share in the data center power market during the forecast period.

North America is expected to hold the largest market share in the data center power market during the forecast period, led by the US and its hyperscale developments. Rapid expansion of data centers, driven by AWS, Google, and Microsoft, is fueling demand for resilient, scalable, and energy-efficient power infrastructure. In August 2024, CBRE reported a 10% increase in data center capacity, a record-low 2.8% availability of space, and a 69% rise in under-construction activity, highlighting the growing need for reliable power systems. Integration of renewables, hybrid solutions, and advanced cooling further strengthens the region’s leadership globally.

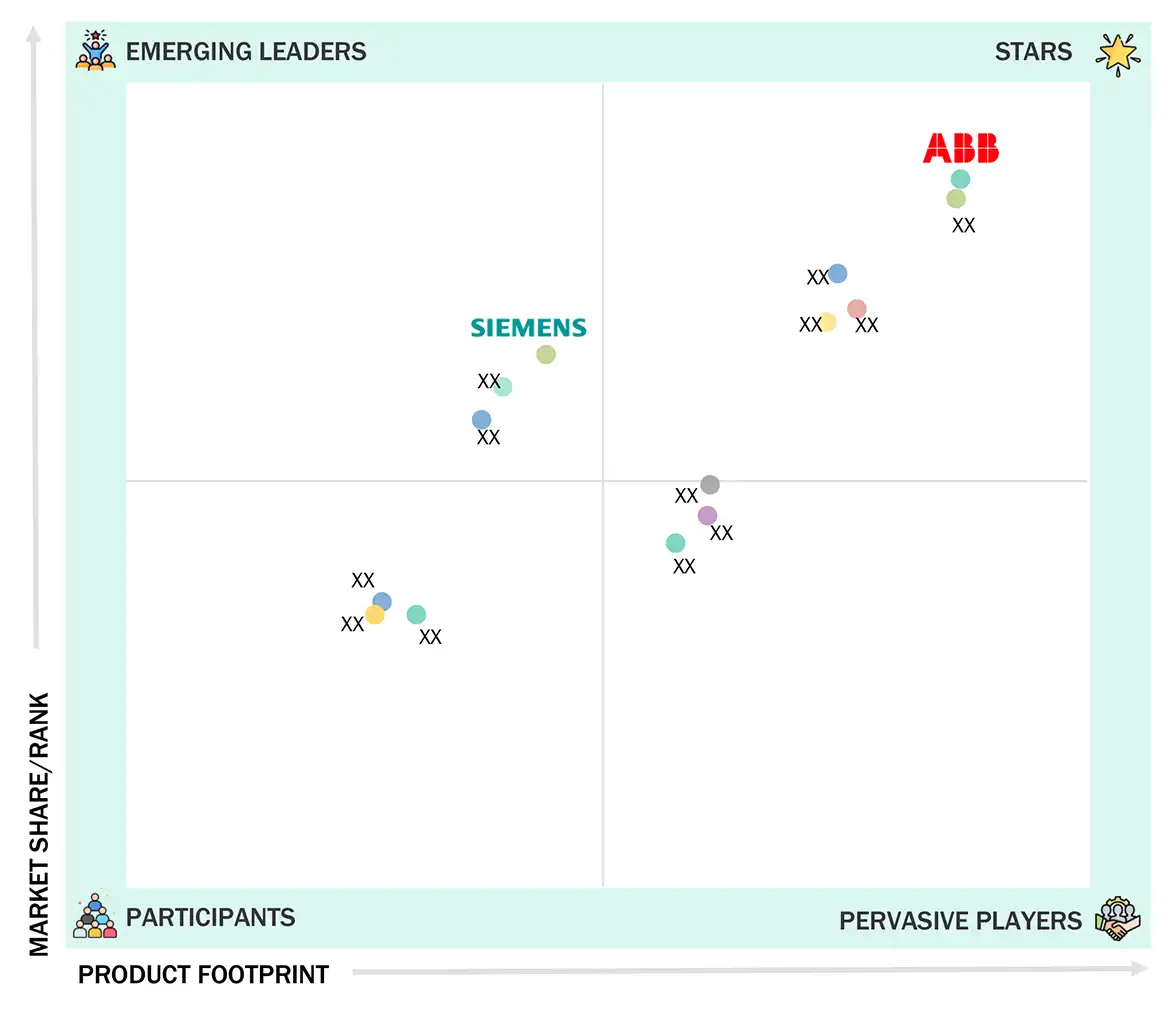

Data center power market: COMPANY EVALUATION MATRIX

In the data center power market matrix, ABB (star) leads with a strong market presence and comprehensive solutions spanning UPS, PDUs, switchgear, on-site generation, and advanced power management, driving widespread adoption across hyperscale, cloud, and enterprise data centers. Siemens (emerging player) is gaining traction with innovative, energy-efficient, and modular power solutions tailored for high-density and mission-critical deployments. While ABB dominates with scale, global reach, and established customer deployments, Siemens demonstrates strong growth potential to move toward the leaders’ quadrant with its technology-driven approach and sustainability focus.

Source: Secondary Research, Interview with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 31.43 Billion |

| Revenue Forecast in 2030 | USD 50.51 Billion |

| Growth Rate | CAGR of 7.5% from 2025-2030 |

| Actual data | 2020-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

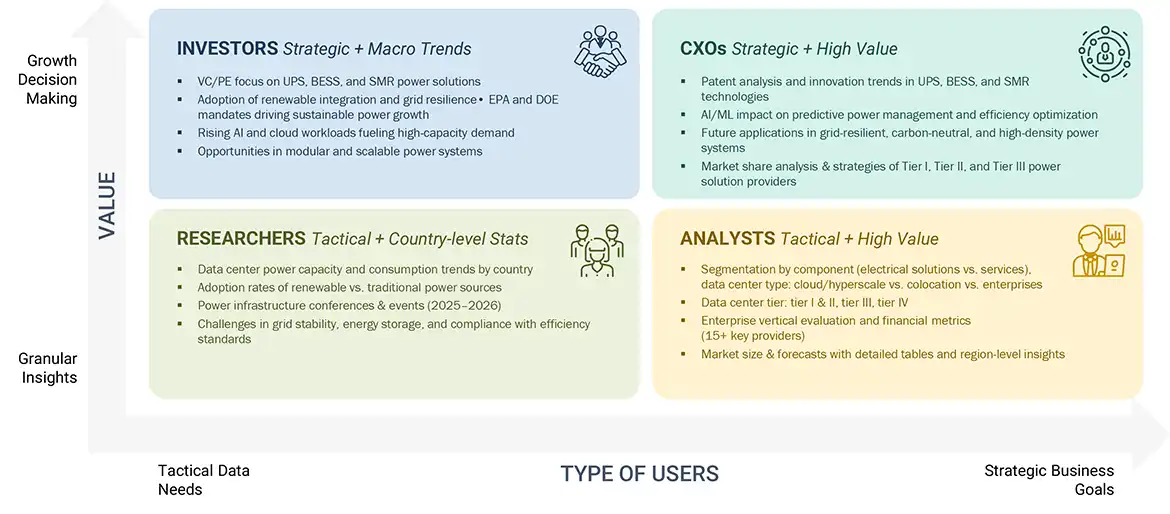

WHAT IS IN IT FOR YOU: Data center power market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the deep dive customization for players like you-

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- July 2025 : ABB launched the SACE Emax 3, a next-generation air circuit breaker for data centers and critical infrastructure. It features advanced sensing, predictive maintenance, arc flash detection, and the world’s first SL2 cybersecurity certification, enhancing energy resilience, reliability, and operational intelligence.

- July 2025 : Eaton partnered with NVIDIA to advance high-voltage direct current (HVDC) power infrastructure for AI data centers, providing grid-to-chip power management, reference architectures, and solutions that optimize energy, support high-density GPU racks, and accelerate next-generation AI infrastructure deployment.

- June 2025 : Schneider Electric launched new EcoStruxure Pod Data Centre and Rack Solutions to support AI and HPC workloads. The prefabricated, scalable systems integrate liquid cooling, high-power distribution, and advanced racks, enabling rapid deployment, high-density scaling, and efficient thermal management for AI clusters.

- May 2025 : Delta launched AI-ready, green data center solutions at COMPUTEX 2025. These solutions feature containerized data centers, 800V HVDC power, advanced liquid cooling, and certified in-rack CDUs for NVIDIA GB200 NVL72. The solutions enhance efficiency, resilience, and sustainability to support next-generation AI infrastructure.

- May 2025 : Schneider Electric acquired a 75% stake in Motivair to enhance liquid cooling solutions for AI and high-performance computing data centers in Saudi Arabia. This will support Vision 2030, carbon-neutral operations, and energy-efficient, sustainable digital infrastructure across the Kingdom.

Table of Contents

Methodology

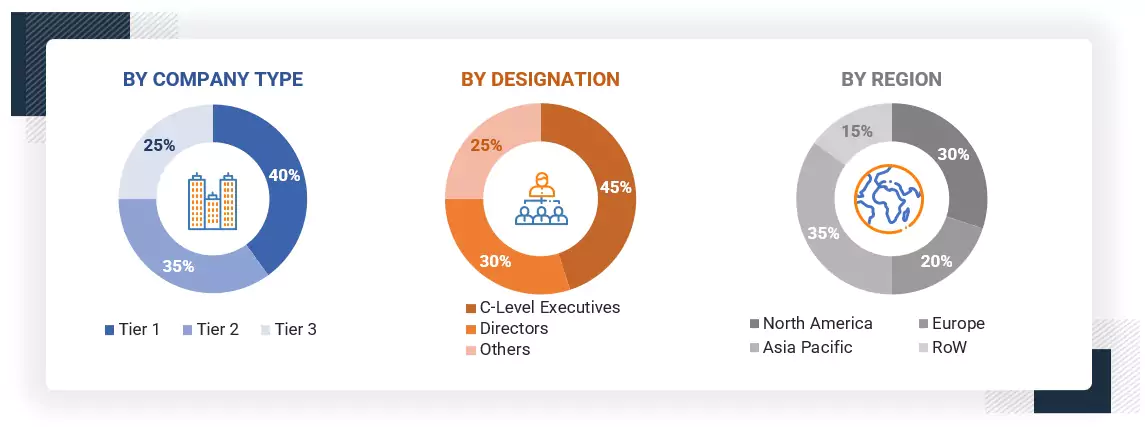

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information for a technical, market-oriented, and commercial study of the global data center power market. A few other market-related reports and analyses published by various industry associations, such as the National Security Agency (NSA) and SC Magazine, were considered while doing the extensive secondary research. The primary sources were mainly the industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, and technologists from companies and organizations related to all segments of this industry's value chain.

In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information and assess the prospects. The market has been estimated by analyzing various driving factors, such as improving organizational compliance requirements, enhancing operational efficiency, and simplifying workflows to eliminate bottlenecks.

Secondary Research

The market size of companies offering data center power was derived based on secondary data available through paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and rating the companies based on their product capabilities and business strategies.

Various sources were referenced in the secondary research process to identify and collect information for the study. These sources included annual reports, press releases, investor presentations of companies, product data sheets, white papers, journals, certified publications, and articles from recognized authors, government websites, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the data center power market.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology-related trends, segmentation types, industry trends, and regions.

Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), installation teams of governments and end users who utilize data center power, and digital initiatives project teams, were interviewed to understand the buyers’ perspectives on suppliers, products, service providers, and their current use of services, which would influence the overall data center power market.

Note 1: Tier 1 companies have revenues greater than USD 10 billion; tier 2 companies’ revenues range

between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and 1 billion.

Note 2: Others include sales, marketing, and product managers.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

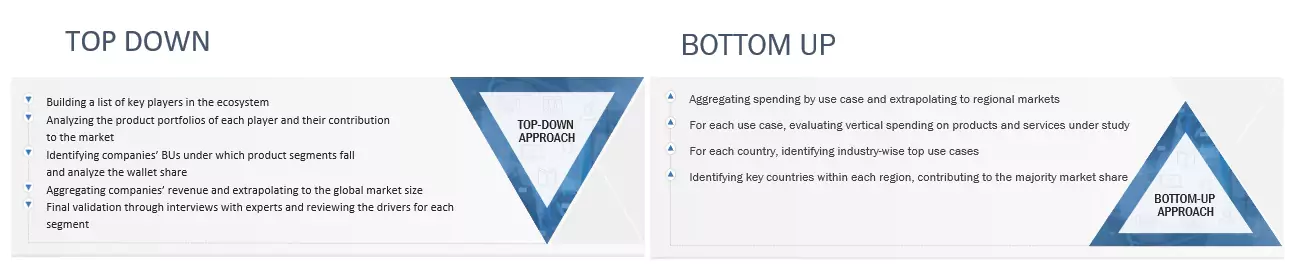

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the data center power market. The first approach involved estimating the market size by summing up the companies’ revenue generated through the sale of services.

The research methodology used to estimate the market size included the following:

- Primary and secondary research was conducted to assess the revenue contributions of major market participants in each country, with secondary research identifying these participants.

- Critical insights were obtained by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- Primary sources were used to verify all percentage splits and breakups, which we calculated using secondary sources.

Data Center Power Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from the government entities’ supply and demand sides.

Market Definition

According to MarketsandMarkets, “Data center power refers to the electrical infrastructure that supplies, distributes, and manages electricity within a data center to ensure the continuous operation of servers, networking, and cooling systems. It includes components such as UPS, PDUs, generators, transformers, and backup systems designed for reliability and redundancy. Modern data center power solutions also focus on efficiency, scalability, and integration of renewable energy to support growing workloads and sustainability goals.”

Stakeholders

- UPS system providers (modular, monolithic, lithium-ion, lead-acid)

- Generator manufacturers (diesel, gas, hybrid)

- PDU and switchgear suppliers

- Battery Energy Storage System (BESS) providers

- Data Center Infrastructure Management (DCIM) vendors

- Power monitoring and optimization software providers

- Smart grid and energy management solution developers

- Hyperscale cloud providers

- Colocation providers

- Enterprise data center operators

- Grid electricity suppliers

- Renewable energy providers (solar, wind, hydro integration for data centers)

Report Objectives

- To define, describe, and forecast the data center power market based on component, tier type, data center size, data center type, enterprise vertical, and region

- To forecast the market size of five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micromarkets with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents, innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/generative AI on the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments such as mergers & acquisitions, product launches, and partnerships & collaborations in the market

Available Customizations

MarketsandMarkets provides customizations based on the company’s unique requirements using market data. The following customization options are available for the report.

Product Analysis

- The product matrix provides a detailed comparison of each company’s portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the data center power market

Company Information

- Detailed analysis and profiling of five additional market players

Key Questions Addressed by the Report

What is the current market size of the Data Center Power market?

The global Data Center Power market was valued at USD 35.14 billion in 2025 and is projected to reach USD 50.51 billion by 2030, growing at a CAGR of 7.5% from 2025 to 2030.

Which region leads the market?

North America leads the Data Center Power market, followed by Europe and Asia Pacific, with Asia Pacific advancing fastest due to rapid expansion of cloud computing, hyperscale data centers, and digital transformation initiatives across countries in the region.

What are the emerging trends in the Data Center Power market?

Key emerging trends in the Data Center Power market include the growing adoption of AI-driven energy management, liquid cooling, and modular UPS systems to enhance efficiency and sustainability. Additionally, the integration of renewable energy sources and advanced battery storage is driving greener, more resilient data center operations.

Who are the key companies in this market?

Leading players in the market include ABB (Switzerland), Schnieder Electric (France), Vertiv (US), Eaton (Ireland), and Delta Electronics (Taiwan).

What factors are driving market growth?

The data center power market is driven by rise in data center around the world. High-performance computing driving ultra-dense power requirements. Rising AI Workloads Escalating Energy Consumption and Grid Pressure

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center Power Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center Power Market