The study involved four major activities in estimating the Modular Data Center market. We conducted secondary research to gather information on the market, competitors, and parent market. The next stage was to validate these findings and assumptions and size them with industry professionals across the value chain using primary research. Top-down and bottom-up methodologies were used to determine the total market size. We used the market breakup and data triangulation techniques to estimate the market size of the modular data center market segments.

Secondary Research

Multiple sources were utilized to find and gather data for this research project in the secondary research phase. Other sources used were annual reports, press releases, investor presentations, white papers, journals, publications, and articles from reputable sources, directories, and databases. Information was also collected from additional secondary sources like academic journals, official government sites, blogs, and online platforms of vendors.

Primary Research

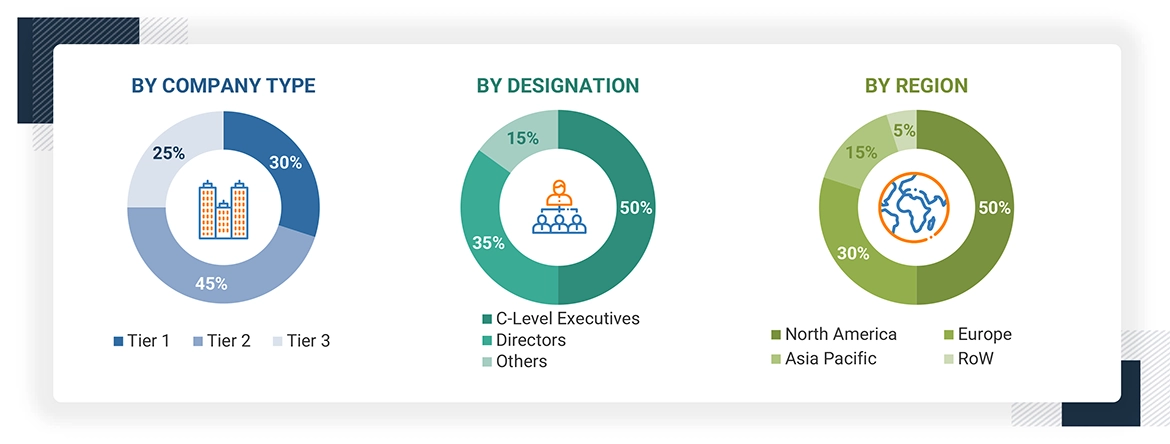

Primary sources included industry experts from the core and associated industries, preferred software suppliers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations representing all parts of the industry's value chain. In-depth interviews were conducted with primary respondents, including major industry participants, subject-matter experts, C-level executives of important market companies, and industry consultants, to acquire and verify critical qualitative and quantitative data and analyze the market's potential.

We performed primary interviews to gain insights such as market statistics, the current trends disrupting the industry, new use cases applied, revenue data collected from products and services, market breakdowns, market size projections, market predictions, and data triangulation. Primary research has helped us grasp different technology trends, segmentation types, industry trends, and geographies. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs); installation teams of governments/end users using modular data center solutions and services; and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which will affect the overall modular data center market.

*Others include sales managers, marketing managers, and product managers

Note: Tier 1 – recorded overall annual revenues of more than USD 10 billion; Tier 2 company – USD 1–10

billion; and Tier 3 company – USD 500 million – 1 billion of the overall revenues

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We estimated and forecasted the Modular Data Management market. And other related submarkets using top-down and bottom-up methodologies. We used a bottom-up approach to calculate the overall market size by analyzing the revenues and offerings of significant market players. This study used data triangulation methods and validation through primary interviews to determine and confirm the precise worth of the whole parent market. We used the overall market size in the top-down process to estimate the size of other particular markets using percentage splits of market segments.

We used top-down and bottom-up approaches to estimate and validate the Modular Data Center market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

-

We identified key players in the market through secondary research. We then determined their revenue contributions in the respective countries through primary and secondary research.

-

This procedure included studying top market player’s annual and financial reports and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

-

All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Using top-down and bottom-up methodologies, we estimated and forecasted the Modular Data Center market and related submarkets. We used a bottom-up approach to calculate the overall market size by analyzing the revenues and offerings of significant market players. This study used data triangulation methods and validation through primary interviews to determine and confirm the precise worth of the whole parent market. We used the overall market size in the top-down process to estimate the size of other particular markets using percentage splits of market segments.

Modular Data Center Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the market was divided into segments and subsegments using the previously described market size estimating techniques. Where applicable, data triangulation and market breakup methods were used to complete the whole market engineering process and ascertain the exact numbers for each market segment and subsegment. The data was triangulated by evaluating many elements and trends on the demand and supply sides of the Modular Data Center market.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines Modular Data Center as “references a deployment method and engineered solution for assembling a portable data center out of prefabricated modular components (commonly ISO standard container dimensions) that enable scalability and a rapid delivery schedule. Characteristics of modular data centers include standardization, rapid time to market, multiple power and cooling options, ease of deployment, greater reliability, location flexibility, smaller footprint, minimal construction dependencies, ease of scale, reduced stranded capacity and lower cost among others

Stakeholders

-

Cloud Service Providers (CSPs)

-

Original Equipment Manufacturers (OEMs)

-

Data Center Equipment Suppliers

-

Colocation Providers

-

Technology Services Providers

-

Data Center Managed Services Providers

-

Government Organizations

-

Networking Companies

-

Consultants/Consultancies/Advisory Firms

-

Support and Maintenance Service Providers

-

Telecom Service Providers

-

Information Technology (IT) Infrastructure Providers

-

System Integrators (SIs)

-

Regional Associations

-

Independent Software Vendors

-

Value-added Resellers and Distributors

Report Objectives

-

To define, describe, and forecast the Modular Data Center market based on component, form factor, deployment type, build type, data center size, end user, and region

-

To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

-

To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

-

To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To strategically analyze macro and micro markets with respect to growth trends, prospects, and their contribution to the overall market

-

To analyze industry trends, patents and innovations, and pricing data related to the market

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

-

To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

-

To track and analyze competitive developments, such as mergers & acquisitions, product developments, and partnerships & collaborations in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

-

The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis as per Feasibility

-

Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

-

Further breakup of the North American market into countries contributing 75% to the regional market size

-

Further breakup of the Latin American market into countries contributing 75% to the regional market size

-

Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

-

Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Modular Data Center Market